* Today’s Tribune headline…

Illinois budget deficit to hit $8 billion despite tax increase

* Today’s Sun-Times headline…

Watchdog group: State deficit to grow to $5 billion

OK, what’s going on?

* Here’s the actual Civic Federation explanation…

The Institute for Illinois’ Fiscal Sustainability at the Civic Federation released its analysis of the enacted FY2012 State budget today. The report found that the spending plan will increase Illinois’ total general operating deficit to $5.0 billion by June 2012. The shortfall would be even larger if the State had not significantly underfunded Medicaid costs and business tax refunds.

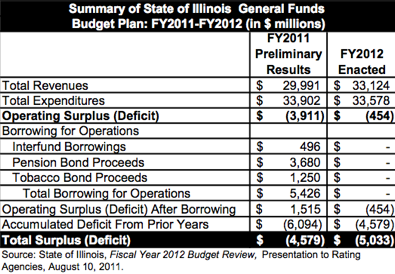

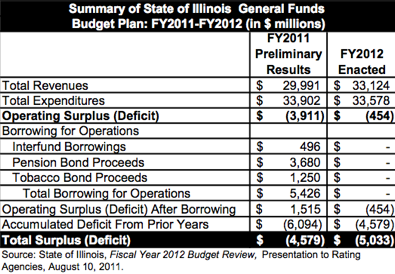

The $5.0 billion projected year-end General Funds deficit includes an accumulated deficit from prior years of $4.6 billion and a FY2012 operating gap between revenues and expenditures of $454 million. However, FY2012 Medicaid costs are underfunded by as much as $1.7 billion. A loophole in the State’s budgetary law allows lawmakers to pay FY2012 Medicaid expenses in FY2013, effectively pushing current year expenditures off into the next fiscal year. The FY2012 budget also does not set aside enough income tax revenue to pay down a backlog of refunds the State owes to businesses, thus boosting the amount of revenue Illinois can spend on its operations.

The State is expected to end FY2012 with $5.5 billion in unpaid bills to vendors and local governments. An additional multi-billion payment backlog exists that is related to business tax refunds, employee and retiree health care and Medicaid. “While the budget process was somewhat improved this year, the Civic Federation cannot say the State of Illinois is better off,” said Laurence Msall, president of the Civic Federation. “By the end of FY2012, the State will have a payment backlog that could require over eight billion dollars in State money to pay off. The State’s finances have not been fixed.”

* It has taken Illinois over a decade to dig itself into this massive budget hole. So, of course, “The State’s finances have not been fixed.” This is a multi-year process to dig ourselves out with a combination of revenue increases and spending cuts. Fiscal year 2012 was just the first step.

* This graphic from the Civic Committee’s own report shows how tough the task is…

The state’s operating deficit is way down, and the state’s end of year balance was cut substantially. But because the state borrowed $5.4 billion last fiscal year (pensions, interfund and tobacco), our bottom line isn’t immediately better. Even so, we’re in far better shape because we didn’t use our “credit card” to pay operating expenses this fiscal year. All told, the state borrowed a whopping $12.1 billion to pay operating expenses between FY09 and FY11.

So, what the state did this year is a start, and not a horrible one, despite the gloom and doom from the headline writers. We’ve had a much better start than New Jersey, for instance, which is relying solely on cuts and apparently still has a $10.5 billion operating deficit. That’s double our operating deficit, both as a hard dollar figure and as a percentage of total budget.

* We’re not out of the woods yet, of course. Pension payments and related debt service jumped $562 million this fiscal year, and those payments will rise another $1.5 billion by Fiscal Year 2015 - the same year the income tax hike is scheduled to expire. The General Assembly took the easy way out and simply delayed Medicaid payments rather than cut provider rates (the payment delay was supported by hospitals and others who wanted to forestall any rate cuts). The governor and many legislators haven’t yet appeared to recognize the full extent of the problem (see below). And while the state has pared down the amount of income tax refunds owed to corporations by about $51 million this year, that backlog is still around $600 million.

* Related…

* New IDOT positions duplicate current state jobs: In the midst of the worst budget crisis in Illinois history, the state’s transportation agency has created a new layer of high-paying administrative jobs with duties that are already performed by current workers, according to records obtained by the Post-Dispatch. The 16 new positions offer top salaries of more than $100,000. They were posted in August, less than a month after the current workers officially joined a union over the objections of the agency.

* AG Madigan: Tax fraud among gas station operators is ‘pervasive’: More than one-fourth of Illinois gas station operators have underreported the amount of fuel they sell to the public, allowing them to pocket millions of dollars in sales tax owed to the state. Within the last 18 months, grand juries have indicted 14 Illinois gas station operators on charges of illegally withholding a portion of the sales taxes their customers paid at the pump.

* Rural enrollment decline leveling off: The unsettling trend of declining enrollment in many rural school districts seems to have stabilized this fall in several Central Illinois districts — a development educators hope continues for several reasons, not the least of which is money. More students generally mean more general state aid that is paid per student, and is based on a district’s average daily attendance.

* Support for M’Boro Youth Camp mounting: “Murphysboro Mayor Ron Williams, State Representative Mike Bost, State Representative Brandon Phelps, and State Senator Dave Luechtefeld have all come out in support of keeping this facility open, and these jobs in Murphysboro,” he said.

* Closing JDC would cost Morgan County $47 million, report finds

* Lincoln businesses fear closing of Logan prison

* Betting on Bernanke Returns 28% for Treasuries

- PublicServant - Monday, Sep 26, 11 @ 9:00 am:

* “Pension payments and related debt service jumped $562 million this fiscal year, and those payments will rise another $1.5 billion by Fiscal Year 2015″

Rich, are those pension figures based on the state following the enacted pension rampup?

- Rich Miller - Monday, Sep 26, 11 @ 9:01 am:

Yes. From the Auditor General’s office. I thought I linked it when I did the post. It’s linked now.

- Leave a Light on George - Monday, Sep 26, 11 @ 9:30 am:

= New IDOT positions duplicate current state jobs:=

Other than outright corruption this headlline captures exactly what is wrong with state government in Illinois.

Blago perfected it by letting nearly every employee unionize then putting his inept cronies in as do nothing superviors/administrators.

The fact that Quinn perpetuates the practice is most disappointing.

- JustaJoe - Monday, Sep 26, 11 @ 9:54 am:

= New IDOT Positions =

This is just more of what has been going on during and after Blago, particularly in IDOT Operations. More jobs for patronage cronies. And if anyone checks, I bet the positions ABOVE the new ones will be more senior management jobs that has been absorbed into the union, with the tacit approval of those in political control. How can you have such a structure? It’s a scam. “I will fumigate state government”…..right.

- Bill - Monday, Sep 26, 11 @ 9:56 am:

NJ didn’t rely solely on cuts. They also stiffed their pension plans and they still didn’t come close.

- Bill - Monday, Sep 26, 11 @ 9:57 am:

… and their taxes are higher.

- Anonymous - Monday, Sep 26, 11 @ 10:37 am:

Not really impressed by Civic Federation’s “analysis”. They just cite other people’s work and state the obvious.

- Louis G. Atsaves - Monday, Sep 26, 11 @ 10:45 am:

So by kicking the can down the road to next year on Medicaid payments and on income tax return payments, we are better off right now than last year? I guess that is one way of looking at it. What about next year? What rabbit will be pulled out of the hat during an election year to “fix” our finances?

- Rich Miller - Monday, Sep 26, 11 @ 10:46 am:

Louis, as clearly stated above, we are doing better than last year because we’re finally not selling bonds to pay operating expenses.

If you can’t understand that, I can’t help you.

- wordslinger - Monday, Sep 26, 11 @ 11:11 am:

As I’m sure AG Madigan knows, tax fraud among many businesses that handle a lot of cash is quite pervasive. It’s a little cheekier with gas stations, because they leave quite a paper trail.

A friend of mine who manages a cash-only bar says his boss takes about 25-30% off the top. And if you’ve ever had work done on your house, you know many contractors are very willing to give a cash discount.

- Louis G. Atsaves - Monday, Sep 26, 11 @ 11:21 am:

Rich I didn’t mention the lack of bond sales, which the GOP opposed. My thoughts continue to go to the bills that were incurred this year that were simply put off to next year (Medicaid and tax return funds as mentioned in the report).

It still looks like smoke and mirrors unless someone can clarify it for me. Paying 2011 bills in 2012 does makes the bottom line of 2011 look better, but it doesn’t reflect the true picture of what is going on.

- Angry Chicagoan - Monday, Sep 26, 11 @ 12:06 pm:

Without the borrowing the FY11 deficit would have been $10 billion. The only reason it gets to $5 billion is because of massive borrowing. The FY12 deficit is $5 billion WITHOUT the borrowing. That’s progress. It’s not enough to prevent borrowing entirely, but it’s progress, and it shows the state finances are clearly on the right track.

- Ghost - Monday, Sep 26, 11 @ 12:44 pm:

Borrow the money under a 4 year payback bill which mandates 90% of the tax increase fund the borrowing.

- steve schnorf - Monday, Sep 26, 11 @ 1:50 pm:

AC, you’re leaving out the unfunded liability issue, but yes, even with that, progress has been made, and that’s good. Can they keep it up, and can they make the tax increase permanent? Time will tell.

- Quinn T. Sential - Monday, Sep 26, 11 @ 3:13 pm:

{can they make the tax increase permanent? }

Stop kidding yourself; the income tax increase is permanent.

- Wickedred - Monday, Sep 26, 11 @ 8:04 pm:

On Mabley’s behalf, we have been drumming up all kinds of support. Locally it’s been amazing - people calling from the community offering their services. Signs are going up all over, petitions are being signed. We have the support of our local legislators. It’s not about the jobs, even though closing a center our size in our community would really hurt the area, it’s about how it will hurt the people we serve. Quinn, Palauski, and others have no clue what these PEOPLE will go through it forced out of the only place they know as home.

I am so thankful to have a community rising to the occasion.

- Mary - Tuesday, Sep 27, 11 @ 11:54 am:

Wickreded: funny, I live in the area of Mabley and haven’t seen one sign, nor petition, nor much in the paper. I have asked many workers, though, if they’d be willing to take a pay/bene cut if it would help keep the Center open. To a person, they said NO. So there you have it. Something’s got to give, Wick.

- Wickedred - Tuesday, Sep 27, 11 @ 7:11 pm:

Mary, better start taking another look around. And you should see what we are being given - we aren’t supposed to be talking to anyone, not supposed to be commenting to people about closure, etc. We are in a scary predicament. I’ve been in my position a long time (and have been on and off here for years), and I’m not so scared to voice my opinion outside of work.