Myths vs. Facts on SB1652

Thursday, Oct 20, 2011 - Posted by Advertising Department

[The following is a paid advertisement.]

ComEd/Ameren: “SB1652 has consumer protections like a 2.5% rate cap.”

SB1652: The cap applies to a customer’s entire bill (generally comprised of 70% energy costs and 30% delivery costs). With energy costs expected to decline over the next two years, ComEd and Ameren will have more room to increase the delivery charge and still remain under the cap. (Pages 101-103)

ComEd/Ameren: “SB1652 does not guarantee utility profits.”

SB1652: The utilities’ profits are tied to an automatic formula that is based on 30-year Treasury bonds which are at historic lows. As Treasury bonds increase, so do ComEd and Ameren’s allowed profits. (Page 82)

ComEd/Ameren: “SB1652 will create jobs.”

SB1652: ComEd and Ameren may charge ratepayers millions in severance costs for laying off workers. (Page 83)

ComEd/Ameren: “SB1652 will hold the utilities accountable for their performance during extreme weather events.”

SB1652: ComEd and Ameren may each exclude 90 of the worst storms over the ten year program when calculating performance. (Page 97)

ComEd/Ameren: “SB1652 is about smart grid.”

SB1652: The utilities may recover money from ratepayers that has nothing to do with smart grid including executive bonuses, pension packages, workforce reduction costs, and storm expenses. (Pages 82-87).

Comments Off

|

Behind the gaming bill

Thursday, Oct 20, 2011 - Posted by Rich Miller

* This is from yesterday’s coverage of Gov. Pat Quinn’s gaming expansion press conference…

The five new ones would operate in Chicago, South Cook County, North Suburban Lake County, Rockford and Danville. The governor said the ultimate locations should be determined by the Illinois Gaming Board, not by the General Assembly.

As a commenter pointed out last night, how can the governor insist that the Gaming Board should be the one to pick all the new locations and in the same breath say he wants to specifically name Danville and Rockford in the expansion legislation? And, of course, he’s OK with naming Chicago in the bill, too. There was no specification of the location of the south suburban casino, other than it had to be in the south suburbs, so there’d be no change if a Quinn-approved bill actually became law.

That just leaves the proposed Park City casino in Lake County, which is specified in the bill. Is the governor being hypocritical here? Or, maybe he’s just taking a not so subtle shot at Sen. Terry Link, who has been tied to a potential Park City casino owner. I’m betting he’s taking the shot while hoping nobody notices the hypocrisy.

* The Illinois Radio Network has a story about Gov. Quinn’s top priorities for the veto session. Number one is killing the legislative scholarship program, two is addressing the Smart Grid issue and here’s number three…

Quinn said lawmakers must come up with a gambling expansion plan. While there is legislation to expand gambling that passed in the House and the Senate, Quinn says if it makes it to his desk in its current form, he’ll veto it.

It literally took the General Assembly decade to devise the current plan, which Quinn has vowed to veto. Crafting and then finding the votes to pass a new plan without slots at tracks, that requires local “opt-in” for video gaming, bans campaign contributions from the gaming industry, etc. all within the next three weeks is gonna require a legislative miracle.

* The strain is really starting to show…

What Link and Lang may end up doing in the alternative is to write a “trailer bill” that would address some of Quinn’s concerns of about industry oversight, while keeping intact the slots-at-the-tracks provisions, and pass that along to Quinn. (Or, as Lang put it just now, “ram it down his throat.” Yes, things are getting a little tense here.)

A more polite approach…

[State Sen. Dave Koehler, D-Peoria] said he also is concerned that Quinn had not fully engaged with lawmakers to find an acceptable compromise bill that could be passed.

That alone could mean that things are “back to square one,” said state Rep. David Leitch, R-Peoria.

* Meanwhile, Quinn’s action produced a sigh of relief in Iowa…

[Tim Bollman, general manager of Wild Rose Casino and Resort] had some good news to report. Illinois Governor Pat Quinn announced he would not support a bill that would expand gambling in Illinois without significant changes. Quinn said that certain bill provisions, such as allowing slot machines at race venues, would have to be removed under threat of veto.

Bollman said that adding slot machines to race tracks in border cities could potentially lure a percentage of the Wild Rose’s client base away.

* But the Illinois attorney general is supportive…

Attorney General Lisa Madigan said she was concerned from the beginning about the “enormous expansion” of gambling in Illinois.

“In order to expand gaming at any point you have to make sure you have the resources and the structure in place to ensure that you’re not ending up with a greater criminal element involved and that’s always been a priority of mine and I’m glad the governor took the time to look at this,” Madigan said.

* If Illinois ever could get its act together, then Indiana would have a right to be worried…

Indiana’s reliance on casino gambling might not be so apparent in northeast Indiana, but it goes far beyond the service-sector jobs in communities where Indiana’s 13 casinos are found. Casinos generated more than $860 million in tax revenue last year, about 5 percent of all state tax revenue.

Five percent of all state revenues? That’s huge. By contrast, Illinois casinos comprise a little over 1 percent of state revenues. And a very big percentage of that Indiana money is coming across state lines from Illinois.

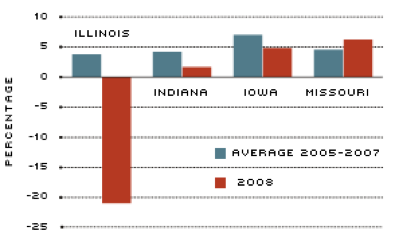

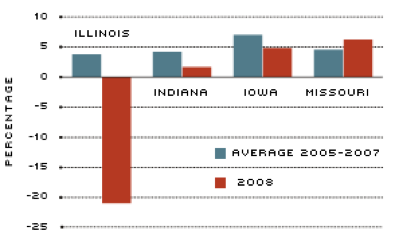

* Illinois wouldn’t keep all that money home, however, even if it somehow does manage to build Chicago and south suburban casinos. Gamblers like to smoke. Look at what happened in Illinois after the smoking ban took effect compared to surrounding states…

Phil Kadner quotes COGFA…

“In the Chicago region, Illinois’ four riverboats (aggregate gross revenue) totals have fallen a combined $472.5 million,” or a minus 35.5 percent since the state passed a ban on cigarette smoking, “while Indiana’s four Chicago-area riverboats have actually increased by $6.6 million or 0.6 percent during this same time frame,” according to the report.

10 Comments

|

* 12:18 pm - From an Illinois Department of Employment Security press release…

The September seasonally adjusted unemployment rate in Illinois ticked up to 10 percent despite the addition of +1,600 new jobs, according to preliminary data released today by the U.S. Bureau of Labor Statistics and the Illinois Department of Employment Security (IDES). […]

In September 2011, unemployed individuals increased +10,500 (1.6 percent) to 663,300 compared to August. Total unemployed has declined -76,800 (-10.4 percent) since January 2010 when the state unemployment rate peaked at 11.2 percent.

* Unlike the rest of this year, government layoffs weren’t much of a factor. According to IDES, the same number of people were employed by state and local governments in September as in August. The year-over-year numbers are pretty astounding, however. Government employment is down 13,200 when compared to September of last year, far more than the 2nd place category, “Information,” which is off by 4,300.

The biggest month-to-month drops were in construction (3,000), financial activities (1,800) and information (1,200).

16 Comments

|

Message received?

Thursday, Oct 20, 2011 - Posted by Rich Miller

* After more than a few backfire moments from their star witness Stu Levine, federal prosecutors lowered the boom on Bill Cellini in court today…

A Hollywood producer testified in federal court Thursday morning that a Springfield power broker told him his business with the state had been put on hold because he hadn’t contributed to then-Gov. Rod Blagojevich’s campaign fund.

Producer and businessman Tom Rosenberg said his firm, Capri Capital, did not initially get the $220 million in state teachers’ pension fund business it was slotted to get.

When he asked Springfield millionaire William Cellini about it, Cellini told him he had angered Blagojevich fund-raisers Tony Rezko and Chris Kelly by not kicking in to the then-governor’s campaign fund, he said.

“Bill told me that Rezko and Kelly said it would not go forward until Capri made the appropriate (contribution),” Rosenberg testified. “He was telling me why it was stopped and it would be stopped until money was contributed to (Rod) Blagojevich.” […]

The testimony combats Cellini’s contention that he was an unwitting participant, or “the ham in the ham sandwich” in the alleged extortion scheme. Cellini is on trial, accused of conspiring with board member Stuart Levine, Rezko and Kelly to extort Rosenberg.

More…

Assistant U.S. Attorney Christopher Niewoehner then asked Rosenberg how Cellini reacted to his ire.

“He was nervous,” Rosenberg quickly responded over the objection of Cellini’s attorney but then was allowed to continue. “I interpreted his voice as nervous.”

Stu Levine has testified that he asked Cellini to deliver a message to Rosenberg about the planned shakedown, and then Rosenberg essentially testified today that he got that message. The defense is cross-examining Rosenberg as I write this, but they’d better poke some big holes in Rosenberg’s story or Cellini could very well be doomed. I’ll let you know what happens.

* From yesterday’s proceedings, which were not witnessed by the jury…

Prior to the start of the direct examination of Rosenberg, Terry Gillespie (of Gillespie and Genson) questioned Rosenberg out of the presence of the jury, a practice Judge Zagel employs frequently to decide whether and how to limit testimony of witnesses, in accord with the Federal Rules of Evidence.

Tom Rosenberg was questioned by Gillespie with regard to six telephone conversations Rosenberg had with Bill Cellini, which were the only communications the two had during the relevant time period [2004]. Rosenberg testified that at the time of each call he never felt that Cellini was trying to cause him economic harm. Gillespie will not be able to ask that type of question, which calls for a legal conclusion, in front of the jury this morning. However, he may be able to come close. If Gillespie succeeds in asking similar questions and getting similar answers, the result may be “game, set and match,” for Mr. Cellini.

* But Judge Zagel has limited the defense’s questions to the extent that Cellini’s lawyers asked for a mistrial yesterday…

Cellini’s lead lawyer, Dan Webb, asked for a mistrial after U.S. Judge James Zagel refused to allow Webb to question Levine about statements Levine made in the Rezko trial.

Federal prosecutors contend Cellini relayed to Rosenberg that he would be expected to make a campaign contribution in order to get TRS funds to invest.

Webb said he believed Levine had contradicted himself in Cellini’s trial compared with testimony Levine gave in Rezko’s trial. Webb said Levine told the jury in Rezko’s trial that no one, including Cellini, directly asked Rosenberg for a $1.5 million political contribution to then-Gov. Rod Blagojevich in May 2004, when the conspiracy was being hatched. […]

“Their (the prosecution’s) theory is that Cellini’s purpose was to deliver … a message … that I would characterize as a ‘that day will come’ message,” Zagel said. “You can argue about whether he delivered the ‘that day will come’ message.”

Whether Cellini thought he delivered the message or not, today’s testimony indicates that Rosenberg received it.

Stay tuned.

…Adding… Let’s do the ScribbleLive thing to keep us updated as it goes along. As always, BlackBerry users click here. Everybody else can kick back and watch…

12 Comments

|

Deal may be close, but what about the budget?

Thursday, Oct 20, 2011 - Posted by Rich Miller

* Negotiations are proceeding on tax breaks for CME Group and CBOE, which have both repeatedly threatened to move operations out of state…

The proposal, which leaders want to push during the veto session that starts Tuesday, would rewrite state law to tax the exchanges only on trades or sales that occur in Illinois, said Senate President John Cullerton. Today, they must pay taxes on all trades, regardless of where the seller or buyer is located. The proposal thus would exclude the many electronic trades that pass through the exchanges from out-of-state parties.

“We’re close,” Mr. Cullerton, a Democrat from Chicago, said in an interview. “They make a strong argument for a correction. Now, it’s just a matter of it’s highly technical and we’re just trying to figure out a way to attribute the sales.”

Nonetheless, Mr. Cullerton said that there’s no agreement with CME yet because it’s not clear yet what the amount of the tax reduction might be.

CME Executive Chairman Terrence Duffy has contended his company pays more in Illinois corporate taxes than any other, including larger ones such as McDonald’s Corp. and Boeing Co., shouldering a disproportionate 6% share of total receipts. The issue came to a head when the state increased the corporate tax rate earlier this year to 7% from 4.8%, boosting CME’s annual expense by $50 million, he said.

The other question would be how this impacts the state budget, which is in better shape than last year, but still far from great. Then again, if CME and CBOE did follow through on their threats, the budgetary impact would be traumatic. Still, are the companies going to make any new Illinois investments in exchange for a break? That’s usually part of any deal.

* Of course, it would also help if the governor and the mayor were on better terms. For instance…

They’re at it again.

After United Auto Workers announced Tuesday that employees nationwide had outvoted local workers and approved a new Ford Motor Co. contract, Mayor Rahm Emanuel and Gov. Pat Quinn staked their claim to the resulting 1,200 jobs in Chicago — in separate statements. […]

When the Ford jobs initially were on the table before workers ratified the deal, Quinn appeared cool to Emanuel’s celebration. Quinn publically said it wasn’t a big deal who gets credit, but his staff clearly wasn’t thrilled that Emanuel jumped out in front of the news.

And…

A carpenters’ union has a tentative accord with the city of Chicago over labor reforms at McCormick Place, but no deal has yet been struck with Gov. Pat Quinn.

“We have an agreement with the city of Chicago and Mayor Emanuel, and we continue our discussions with Gov. Quinn,” a spokesman for the Chicago Regional Council of Carpenters confirmed Wednesday.

Mr. Quinn’s office was not immediately available to comment..

* In a related story, despite Sears’ well-known financial problems, the company claims that at least 15 states besides Illinois have offered incentives to move its headquarters and its 6,000 jobs from Hoffman Estates. And the company is pushing back against the naysayers…

Sears insisted that its balance sheet is strong and it generates significant cash. As with most retailers, an overwhelming bulk of its business happens in the fourth quarter, Brathwaite said. […]

Despite its financial problems, Sears Holdings still ranks No. 52 on the Fortune 500 with more than $43 billion in revenues reported in fiscal year 2010. Sears employs about 6,100 people at its Hoffman Estates headquarters and 20,000 statewide. Its 1992 relocation invested about $200 million into local infrastructure and aided in the development of the Prairie Stone region, Brathwaite said.

Sears also is a major taxpayer in Illinois, to the tune of about $213 million last year and billions over the last 20 years, Brathwaite said.

“We’re an economic development engine for local businesses, with 9,000 in-state vendors, 30,000 hotel nights and meals, and 18,000 plane tickets in and out of O’Hare (International Airport) for visiting associates alone, with 100,000 people visiting our campus every year,” Brathwaite said.

* But the Tribune wants the state to slow down a bit…

Illinois hasn’t exactly encouraged its employers to stay home. An income tax hike and an appalling failure to deal with the state’s massive debt — starting with its pension obligations — make moving a more attractive option. Sears is going to weigh its costs. One factor in Illinois’ favor is that Sears, like any business, will calculate the cost of business interruption and attrition of its talented workforce against the benefits of incentives being dangled by other states. There is a home field advantage.

Sears says it must know soon where Illinois stands. We understand that. This competition will move forward, with or without Illinois. The local governments should be negotiating with the state and each other on the terms of a new EDA. This matter can’t drag.

Don’t ram this down the throat of the local schools, though. That’s hardly the neighborly thing to do.

* Speaking of the locals, this court ruling is sure to send shivers down the spines of a whole lot of not-for-profit operators here…

The Illinois Supreme Court let stand a decision by the Quinn administration to take away the property tax exemption of the Downstate retirement community affiliated with a Lutheran social services agency.

In a little-noticed case, the court has declined to hear the appeal of Meridian Village Assn., a 100-unit development that opened in 1999 in Glen Carbon, about 20 miles east of St. Louis.

Meridian, which was seeking to avoid paying about $161,000 in property taxes in 2000, provided just $30,000 in financial assistance to residents, according to an order issued earlier this year by Illinois Appellate Court in Mount Vernon. The appellate court ruled that the development was not entitled to tax-exempt status either as a charitable or a religious institution, upholding the position of the Illinois Department of Revenue.

The case is another example of how the department — and local officials — are taking a hard-nosed approach to property tax exemptions for non-profits. Operations providing minimal charity are especially vulnerable to losing their tax-exempt status. The state supreme court’s decision is particularly a warning to non-profit hospitals and other health care providers, which are battling in the courts and in the Illinois General Assembly to maintain the long-held benefit, which is possibly worth millions of dollars a year.

* Related…

* North Chicago mayor hopes Abbott breakup isn’t another Hospira: North Chicago Mayor Leon Rockingham Jr. said he hopes a split doesn’t mean that one company will leave, recalling that Hospira Inc. took its operation, along with hundreds of jobs, to Lake Forest after it spun off from Abbott in 2004.

* Ford deal OK’d that brings 2,000 jobs to Chicago

* Existing home and condo sales up, prices down in Chicago area - Median prices decline 8.6% to $160K outside of Chicago. Chicago prices climb 5.6% to $190K

* Leading indicators rise modest amount in September

* Tribune bankruptcy judge ‘days’ from deciding case: report

* Groupon to scale back IPO

32 Comments

|

A modest proposal

Thursday, Oct 20, 2011 - Posted by Rich Miller

* The AP’s series on the state’s overdue bills continues today…

The Illinois Department of Corrections insists its failure to pay its bills on time isn’t creating any safety concerns inside state prisons. But documents show a department executive warned of “a big problem looming” if a food supplier halted deliveries.

“I am fearful at some locations we won’t be able to meet the food needs of the population. To an inmate, food is the most important part of the day, so this obviously would create huge security concerns,” Bryan Gleckler, the department’s chief financial officer, wrote in a June letter that was obtained through the Freedom of Information Act.

The state soon coughed up part of the $2.5 million it owed the supplier, MJ Kellner Co. of Springfield, and Gleckler now plays down the safety concerns. He said the department tries to keep enough food on hand to keep providing meals even if deliveries are cut off.

As of Sept. 8th, the Illinois comptroller’s office had $39.3 million in Corrections-related bills that it hadn’t yet paid. That’s bad enough, but check out this item on the list…

Interest on overdue bills: $2.3 million (5.8 percent [of total])

We’re even late on paying the interest on overdue bills?

Sheesh.

* Quad Cities Online has a handy tool for taking a look at Illinois’ list of overdue bills. The state has 166,002 overdue bills for about $4.9 billion, according to the site. I broke that down by amount owed out of curiosity.

There are, for instance, about 169,000 overdue bills on the books for less than a million dollars. Total all of them up, and you get $1.8 billion.

By contrast, there are 620 records of overdue bills exceeding a million dollars, for a total of about $3.1 billion. Using the SJ-R’s past due bills site, I discovered that almost a third of that $3.1 billion, about $1.4 billion, is owed to state agencies via interfund cash transfers. Here’s a list of the other top bills by vendor…

REGIONAL TRANS AUTHORITY… $306,335,651.20

UNIVERSITY OF ILLINOIS… $298,713,296.07

CHICAGO DIST 299… $245,231,291.81

TEACHERS RETIREMENT SYSTEM SPRINGFIELD… $180,810,081.30

STATE UNIVERSITIES RETIREMENT… $109,707,083.00

STATE EMPLOYEE RETIREMENT SYST… $74,970,220.00

SIU CARBONDALE - PAYROLL CLEAR… $55,605,902.76

CHICAGO CITY TREASURER … $50,027,005.73

HELP AT HOME INC… $48,101,966.81

Help at Home, Inc. isn’t the only business on the bigtime past due bills list. Addus Healthcare is owed $34 million, for instance, and Harmony Health Plan of IL is owed more than $27 million.

* My point here is that perhaps the state could fashion a borrowing plan to pay off either the smaller bills, which are owed to a lot of not-for-profit service agencies and for-profit companies, or it could design a plan to provide immediate relief to all non-governmental entities. Yes, this would be unfair to the RTA, the U of I, etc., but these overdue bills are a significant drag on the Illinois economy.

Borrowing is not popular, to say the least, but a relatively small borrowing plan to pay off some of the state’s overdue bills coupled with some negotiated budget cuts could do wonders for thousands of Illinois businesses and help boost the economy.

Thoughts?

50 Comments

|

* Oy…

Rep. Bobby Schilling is being asked to “lay low’’ after an online threat that offered a $75,000 reward for his assassination exploded across the Internet, a Quad Cities TV station reported late Wednesday.

The Colona Republican learned about the threat via a Google alert Tuesday night. It’s being investigated by Capitol police and the FBI, WQAD-TV reported.

“I’m supposed to kind of lay low, not really go out in public,” Schilling told the station.

The email states: ‘’I will pay $75,000 for ASSASSINATING Illinois Congresswoman (sic) Bobby Schilling and any US Congressman, US Senator and FBI, CIA and NSA DIRECTORS and their FAMILY MEMBERS regardless of their age.’’

Schilling said he’s been told that the California man making the threat has a history of this type of behavior.

‘’I’m pretty concerned. My wife is very concerned. It’s a general threat to all members of Congress, but they specifically called my name out in the threat,” he told the station.

By using that quote in the article, I was able to find similar online threats made by this nutball. The Schilling threat appears to have been deleted [UPDATE: Here it is], but there are others, including one against Congressman Joe Walsh, which has also been taken down.

* Most of the state’s Republican delegation has been threatened by this guy, using the same, exact message…

I will pay $75,000 for ASSASSINATING Illinois Congresswoman Donald Manzullo

and any US Congressman, any US Senator and FBI, CIA and NSA

DIRECTORS and their FAMILY MEMBERS regardless of their age.

BOMB AMERICAN FEDERAL BUILDINGS, INFRASTRUCTURE and KILL FBI, CIA, DNI and

NSA DIRECTORS

I CHALLENGE all readers to email my THREAT to FBI, CIA, NSA and

Secret Service and get me arrested…….FBI TRANSVESTITES will NOT

arrest me because of this reason.

This is my profile at FBI, CIA and NSA

http://groups.google.com/group/alt.privacy/msg/6212b297461a5bc0?hl=en

You MORONS………just listen to me…….Everything mentioned in the

following document is REAL and FBI, CIA and NSA had this technology for more

than 20 years……..

TORTURE BIBLE of FBI, CIA and NSA

Covert Operations of NSA- Mind Control and Directed Energy Weapons

http://www.scribd.com/doc/25664429/Conspiracy-Mind-Control-Covert-Ope…

Congressmen Aaron Schock, John Shimkus and Tim Johnson have also been threatened the same way.

I doubt that any of the congressmen have much to worry about, but it’s unnerving that somebody like this is walking around free. Let’s be careful out there.

…Adding… More searches have turned up additional threats against the rest of the state’s GOP delegation. He’s also threatened lots of others.

32 Comments

|

The Green of Grid Modernization

Thursday, Oct 20, 2011 - Posted by Advertising Department

[The following is a paid advertisement.]

Much of the focus of electric grid modernization has been on jobs and consumer benefits. But did you know that Senate Bill 1652 is also a roadmap for a greener future for Illinois?

Here’s how.

SB 1652…

1. Increases energy efficiency resources available to consumers.

Today, energy efficiency programs save residential customers $95 million annually. SB 1652 will increase those programs by at least another 10 percent.

2. Creates incentives for small-scale generation.

Today, owners of small-scale solar generating systems are unable to bid their power back into the electric grid. SB 1652 changes this by carving out 1% of the existing 6% state solar requirement for small scale generation. This improves the economics for rooftop or other types of consumer-driven solar generation.

3. Provides the platform necessary for the coming electric vehicle revolution.

Widespread use of electric vehicles simply can’t happen without a modern electric infrastructure.

4. Creates a Science and Energy Innovation Trust.

SB 1652 requires the utilities to contribute $20 million for the creation of Science and Energy Innovation Trust, which supports green energy efficiency-based technology startup companies.

For more information on all the benefits of grid modernization through SB 1652, visit www.SmartEnergyIL.com.

Comments Off

|

Simon Institute begins rollout of annual poll

Thursday, Oct 20, 2011 - Posted by Rich Miller

* The Paul Simon Public Policy Institute at SIU has some new statewide poll results. They poll every year. Let’s start with right track, wrong track…

Fewer than one in five voters in the Simon Poll (19.2%) said they thought things in the country were going in the right direction, down significantly from the three in ten (30.2%) who said so in 2010.

Perception of the direction of the state may have bottomed out. Only 14.9% said Illinois was heading in the right direction, statistically equivalent with last year’s 12.2% “right direction” response.

Interesting that national right track has cratered here while state right track has risen ever so slightly. Back in 2008, for instance, the Institute’s poll showed state right track at 12.4 percent.

You might think the national right track decline could be the result of President Barack Obama’s decline. Obama’s Illinois job approval rating is 51.8 percent, essentially identical to his Illinois approval rating in the Institute’s poll a year ago. That’s pretty much the same as a We Ask America poll taken a few weeks ago.

* Gov. Pat Quinn’s approval rating is 35.5 percent. That’s more than 5 points higher than the recent We Ask America poll, which had him slightly below 30 percent, but still close enough to essentially validate both results. The Institute didn’t poll Quinn’s job approval last fall, so there’s no way to measure his change over time in this particular category. But 35.5 percent is about where everybody has had Quinn for well over a year. Quinn’s approval rating in the Institute’s October, 2009 poll was 66.5 percent.

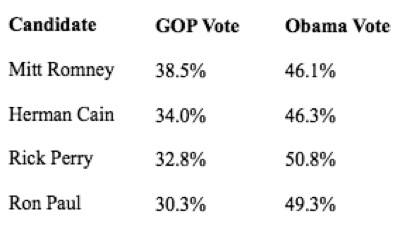

* Now, as you know, I don’t usually do national stuff, but I thought you’d like to see the rest of these numbers. As always, do your very best to avoid bumper sticker slogans and, please, eschew regurgitated DC talking points in comments. Presidential head-to-heads…

From the Institute…

“You could look at this as being uncomfortably close for the president in his home state,” said Simon Institute Director David Yepsen. “On the other hand you could say Obama is holding up fairly well in Illinois, given the difficult year he has had politically and the continued poor performance of the economy.”

* Compare those results to a recent We Ask America poll and there are some differences…

[Obama had] 50 percent vs. former Massachusetts Gov. Mitt Romney’s 35 percent. Other match-ups look similar: Obama 52 percent vs. Texas Gov. Rick Perry’s 30 percent; Obama 53 percent vs. businessman Herman Cain at 30 percent; and Obama 53 percent vs. New Jersey Gov. Chris Christie at 34 percent.

The We Ask America poll was conducted September 28 and Oct. 2. The Simon Institute poll was conducted Oct. 11-16. The Institute’s poll has apparently captured the national Cain surge. However, the Institute’s poll has Obama doing worse against the Republicans than he WAA’s poll. He’s under 50 in all but one Institute poll, and over 50 against everybody in the WAA poll. Then again, the numbers are not hugely different, so we could be looking at noise and methodology differences here. WAA does robopolling, for instance, while the Institute uses humans.

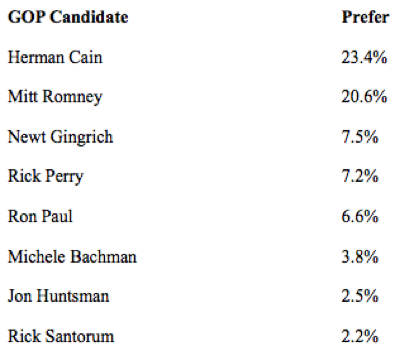

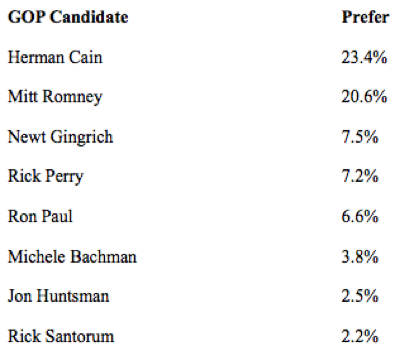

* The Institute also asked Republicans which GOP candidate they preferred…

Keep in mind that self-identified Republicans are a fairly small percentage in this state, so the margin of error is going to be quite high for that subset on a total polling universe of 1,000 registered voters.

* Also, in case anybody wants to know, the Simon Institute didn’t use taxpayer dollars to conduct this poll.

29 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|