* Greg Hinz reports that Ty Fahner of the Civic Committee will try to work with organized labor on the pension reform issue next spring…

Ty Fahner, president of the Civic Committee of the Commercial Club, said the group will continue to lobby hard for pension reform and continue spending hundreds of thousands of dollars on TV ads demanding change.

But, in a phone interview, Mr. Fahner said the group will wait for a vote next spring — not sooner — and that it will spend the time trying to convince labor groups that reform works for everyone.

* Fahner also says he won’t be spending cash on the upcoming election cycle…

“We’re not going to play the (election) game,” he continued, “Playing the game has got us into (being) the worst financed state in America. . . .We’re not going to play the game of electing the most people, regardless of the cost.”

That’s quite a declaration, and Mr. Fahner said some may consider him “naive.” Even some business leaders tell me privately that they wish the committee would ratchet up pressure on lawmakers, much like school reform groups did in the last election cycle.

The “school reform groups” didn’t put pressure on lawmakers last fall. Stand for Children Illinois found lawmakers who supported its cause and then gave them tons of cash. The groups that pressured legislators were the teachers’ unions, which boycotted funding Speaker Madigan’s campaign funds and wound up on the short end of the stick the following spring.

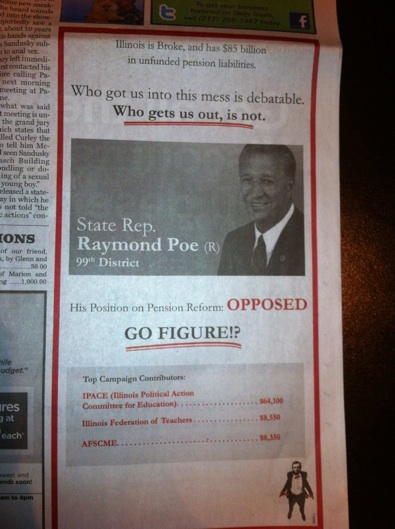

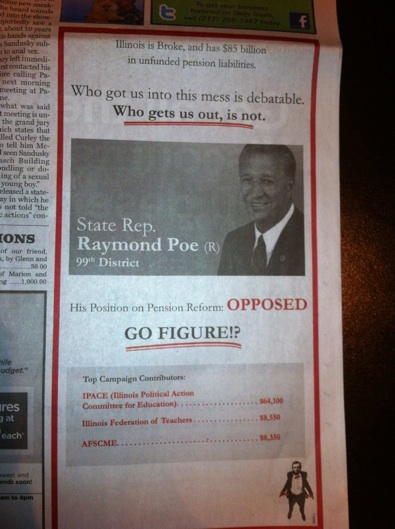

* Despite what Fahner says, you might pardon some legislators for feeling like they’ve already been targeted by Fahner’s group. For instance…

Yeah, that’ll work.

* Meanwhile, Mayor Emanuel is pledging to up the ante…

Confident that the City Council will approve his proposed 2012 budget by a wide margin Wednesday, Rahm Emanuel said he’s already turning his attention to the biggest financial problem facing local taxpayers: the soaring cost of public employee retirement benefits. Even if Chicaqo doubled property taxes, it would still face a pension cost shortfall.

The mayor said he’s told “every leader in Springfield” that he’s willing to take the lead on the issue, “if it’s helpful.” Emanuel even offered to become the first Chicago mayor since Richard J. Daley to address the General Assembly. (Moments after his dramatic appearance, the House approved the bill Daley wanted. But it died later in the Senate.)

Public employee labor unions have blocked proposed legislation to reduce the cost of future benefits for current government workers. Unions argue that it’s unfair to reduce even future benefits that public employes have not earned yet. There’ve been several versions of the proposal. Supporters claim they would help taxpayers not only in Chicago, but also Cook County and the State of Illinois. State pension funds have gobbled up virtually every penny raised by last January’s “temporary” increase in the state income tax.

“In six to seven years, some of these pensions won’t have enough in to pay it. And the taxpayers are on the hook. And I’m not raising property taxes 130 percent, which is what’s required,” Emanuel said. “As I’ve said to every leader, I’m willing to spend my political capital. I’ll get in front of this. I’ll go to your caucuses. I’ll go to the General Assembly. I’ll speak on it. So, if people are looking for political cover, I the mayor will provide that, if it’s helpful.”

* But Steve Schnorf’s comment on a pension post yesterday gives us some hearty food for thought…

Rich, it’s worth reminding people that it is not the cost of the pensions that is breaking the bank. If that’s all we were paying, our payments would go down about 50% this year.

It’s the cost of the debt service on the uncontributed money from past years that is causing the strain. That payment is what is being ramped up, not the normal cost of the pensions, which is a very manageable number. Ever hear the Civic Committee tell you that?

No, I haven’t, Steve.

Schnorf is right about the real problem with the pension payments.

* The Captain’s comment indicates supreme frustration with the entire debate…

Pension payments are governed by something called “the ramp”. The ramp refers to a 1995 law that was passed that laid out a payment plan to get to 90% fully funded pension system in 50 years. The pension systems had been and continue to be woefully underfuned. This plan was designed to correct that. However because of the politics of the time “the ramp” did not call for steady increases in annual pension payments, it continued to call for very low (inadequate) payments in the 1990s and then a very aggressive increase (that’s why they call it the ramp) during our current time period. All the investment losses in 2008 made the situation even worse.

When the Trib and the deities at the Civic Committee whine annually about how each budget fails to fully fund the pension obligation what they mean in each instance is that the annual contribution falls short of what was called for in the 1995 legislation (the ramp). To them the ramp is sacred.

EXCEPT NOW THEY’RE WHINING THAT LAWMAKERS ARE PAYING THE LARGE AMOUNTS THEY ARE SUPPOSED TO UNDER THE SACRED LAW.

Give me a break.

Frankly, I’m starting to think that Illinois ought to stop worshipping at the the ramp’s sacred altar. If we lower the target to 70 percent funded by 2045, those annual payments would be a whole lot more manageable. The ramp isn’t holy writ. It’s a state law that can be changed like any other state law.

- wordslinger - Wednesday, Nov 16, 11 @ 10:34 am:

–Public employee labor unions have blocked proposed legislation to reduce the cost of future benefits for current government workers.–

That’s quite a trick. How did they do that?

- Helm - Wednesday, Nov 16, 11 @ 10:40 am:

I am glad Steve raised the issue of the uncontributed portion by the state and related debt service. Are there any figures showing what the funded ratio would be if the state had funded its portion over the years and then factor in the rate of return during those years, compounding, etc.

While I think that current employees should pay more, why does the Civic Fed, Rahm, etc. conveniently ignore the fact that the employer did not pay its fair share ?

I still cannot understand why the employee has to be responsible for making up this unfunded amount.

- George - Wednesday, Nov 16, 11 @ 10:42 am:

Everyone has known this ramp was coming for 15 years. Heck, changing the ramp-up was talked about for the past 8. But like you said, Rich, the 1995 plan is sacred, and legislators were much more willing to not make the scheduled payment than to change what the payment should have been.

There is no magic about a 90% funded level. And there is no magic about 2045. Further, there is definitely no magic about the 8.5% interest we pay to the pension system.

Time to refinance our debt, change the schedule, and change the goal.

That’s a lot easier than every other plan.

- Michelle Flaherty - Wednesday, Nov 16, 11 @ 10:46 am:

Back in the late 90s when the Illinois revenue structure was generating close to $1 billion in additional revenues, it’s too bad more of it wasn’t used to ramp up contributions. Hindsight 20/20.

If you look at the payment structure of the 1995 plan, there are still several years of the situation getting worse before it gets better.

By that I mean the unfunded liability grows, by design, for the next several years.

From a PR standpoint, it allows the Civic Committee and GOP activists to continue their jihad even as the state follows the very law Republicans put in place to address the funding problem.

And I will acknowledge that the problems were worsened by some Dem-led pension holidays, but it doesn’t change the fact that the 50-year plan was passed knowing full well the people who passed it wouldn’t really have to worry about making any real payments and that would be left for whoever was still around in 15 years.

- Yellow Dog Democrat - Wednesday, Nov 16, 11 @ 10:48 am:

Its also worth noting that as of 1999, our public pensions systems were 89% fully funded.

The collapse of the tech bubble, 9/11, and mortgage crisis — none of which Illinois lawmakers had any control over, all contributed to where we are today.

I think a much more sensible approach than a Ramp would be Stairs: a continuing approp that requires a percentage of all new revenue be added to our pension payments while keeping them flat when revenues are flat.

- Observer - Wednesday, Nov 16, 11 @ 10:56 am:

Forgetting the ramp would be an excellent idea. This would allow the baby boomers to completely trash the pension system for their own benefit and the heck with everyone else. What else is new with the boomers?

- Shemp - Wednesday, Nov 16, 11 @ 10:56 am:

The IAFF and police unions fought like holy heck when IML wanted to go from a 100% funded goal in 2033 to a 90% funded goal in years beyond. Of course, I suppose it’s quite likely the GA is willing to hold itself to a lower standard than it requires its local governments.

Admittedly, I haven’t seen all the State data, but I’ve seen enough of the local pension data to know that some of the public pension plans have huge holes caused by the rules as much as the funding.

Are there more than a handful of state legislators with the guts that Rahm is putting out there? That’s what it’s going to take and I don’t think you’re going to find even a third of the GA with the intestinal fortitude to make hard choices that could jeopardize their reelection, and more importantly, jeopardize their campaign contributions.

And for those saying it’s a funding problem, not a payout problem, if it were so easy to fund the payouts, why hasn’t it been done? If the payouts were properly funded 5, 10, 15, 20 years ago, what would have had to have been cut from the budget in order to make those payments? Would more employees have been axed back then? Would there have been a 100% tax increase a decade ago?

- jeff - Wednesday, Nov 16, 11 @ 11:00 am:

Rich in the past you have posted how pensions were underfunded in the 50s and 60s. The solution then and now is real growth. The underfunding would matter less if Illinois had positive population and employment growth. Without that we are in big trouble.

The trouble is twofold underfunding and rate of return.

Underfunding is a significant problem. Expected rates of return of over 8% is the other. We have underfunded the pensions and they cannot safely return 8% or more. Just because we did earn more in the 90s doesnt mean we can now.

But if you postulated a 4.5% return on investment of pension funds you would run away with your hair on fire. I have a 401k if I could get 8% return for the next 10 years I would have more than enough to live comfortably. Would you take that bet?

If we raise taxes to cover the funding, who would stay? We have to get Illinois growing in a positive way.

- Rich Miller - Wednesday, Nov 16, 11 @ 11:02 am:

===This would allow the baby boomers to completely trash the pension system for their own benefit ===

No, it would be an admission that 90 percent funding is simply too much. It’s unnecessary and unaffordable. Plenty of non baby boomers will be hurt if this ramp continues unabated.

- Reality Check - Wednesday, Nov 16, 11 @ 11:06 am:

The Commercial Club of Chicago’s Civic Committee members are more than a little hypocritical in every respect:

They say they care about the pension funding, except their bill is silent on funding and buts drives up employee contributions and cuts benefits.

They say they should be taken seriously as fiscal stewards but the version of the bill they ran in the spring had a monstrous drafting error that would’ve cost taxpayers $62 billion.

Now they tell Hinz they want to “work with” public employee unions - as long as that means public employees simply agreeing to the CEO-backed bill.

And they say they’re not going to threaten lawmakers, except they’re taking out nasty ads.

Finally, at the precise same time they’re trumpeting the tired line ‘Illinois Is Broke,’ their own members - CME, CBOE, Sears, Motorola - are extorting huge new state tax expenditures.

Sorry if nobody outside of certain editorial boards believes a word they say.

- BigTwich - Wednesday, Nov 16, 11 @ 11:07 am:

–Are there any figures showing what the funded ratio would be if the state had funded its portion over the years and then factor in the rate of return during those years, compounding, etc.–

The Illinois Municipal Retirement System, which mandates annual contributions is funded, if memory serves, around 88%. The State Employees Retirement System, a smiler system with slightly smaller benifits, is funded around 43.5%.

- Question - Wednesday, Nov 16, 11 @ 11:11 am:

It is a given that Chicago homeowners pay some of the lowest property taxes in the nation.

Despite Rahm’s statement, there is plenty of room to raise property taxes to cover some of the shortfall here.

- Yellow Dog Democrat - Wednesday, Nov 16, 11 @ 11:11 am:

Neither the State nor City of Chicago should welch on the promises it made to employees when they hired them.

Telling a police officer or firefighter who has spent 15 years risking their lives for us that we’ve changed our minds is amoral.

Especially if you’re going to treat TIF Funds like a sacred cow.

- Fed up - Wednesday, Nov 16, 11 @ 11:20 am:

I am tired of all the press stating that,private pension plans have taken a hit, so the state employee’s plan should also. That is like my neighbor’s house burned down so I guess mine should also.

- steve schnorf - Wednesday, Nov 16, 11 @ 11:53 am:

jeff, a couple of inconvenient facts. One, Illinois has had positive population growth. Two, the pension systems do average the 8% return you question, and please note, the key word is “average”. They have better years and worse years, but over rolling time periods, they hit their assumption.

If we reduced the assumed actuarial rate of return, we would simply have to pay more up front, and we would end up overfunded, assuming the trustees continued their good work of the past.

- walkinfool - Wednesday, Nov 16, 11 @ 11:55 am:

I have a simpler reason not to believe anything the Civic Committee says. They have been continually and obviously wrong in their financial claims, both about where we are, and what their proposals would produce. When their numbers are always so off, by any resonable accounting and actuarial standards, why should I pay attention to what they propose?

We need to strictly maintain some plan for catch up, though it’s possible that a better plan than the current ramp might work.

- Small Town Liberal - Wednesday, Nov 16, 11 @ 11:57 am:

- Emanuel even offered to become the first Chicago mayor since Richard J. Daley to address the General Assembly. -

I hope he does a better job than he did introducing Todd Snider at Park West last Friday night, seemed a bit off his game:

http://www.youtube.com/watch?v=cda_qKfUBgY

- bigdaddygeo - Wednesday, Nov 16, 11 @ 12:07 pm:

What should the income tax rate be to address the underfunded pension plans? According to Reuters, the increase in tax rates and sales taxes generated increased revenues of $3.4 billion. http://www.reuters.com/article/2011/07/07/us-illinois-tax-hike-idUSTRE7666Y220110707

So does it follow that the “temporary” increase in taxes should go towards paying off old bills and covering the operating deficit with another permanent 2.2% corporate / 2.0% increase go to pensions? The unfunded liability is $80 billion (or $200 billion depending who you ask)). Shouldn’t an additional $3.0 billion per year for 25 years solve the problem?

- sad - Wednesday, Nov 16, 11 @ 12:07 pm:

Stand for Children gives tons of cash and get what they want. Com Ed and Ameren give tons of cash and get what they want. Call me crazy but I see a pattern developing here… There has got to be a better place than this earth, because it sucks.

- Irish - Wednesday, Nov 16, 11 @ 12:12 pm:

Thank you Steve Schnorf!!! And thank you Rich!!!

And Rich I believe you are right regarding scaling back the ramp a little bit. Why is it when our leaders go to work on something it is either all the way one way or all the way the other. Why is it so difficult to come to a reasonable rational solution? Are they really driven so much by the influences of the extremists that they can’t think for themselves?

- Katiedid - Wednesday, Nov 16, 11 @ 12:26 pm:

Considering his constituents, if that ad ran in the SJ-R, then there’s a decent chance that putting in big bold letters that he’s opposed to pension reform might have actually had the opposite effect for Poe and convinced a lot of people in that area to vote *for* him. I do agree with your point, though, Rich, that this doesn’t really show that they aren’t getting involved in elections!

- Yellow Dog Democrat - Wednesday, Nov 16, 11 @ 12:43 pm:

Scaling back the ramp will scale back the problem, but it doesnt solve it.

The economy is cyclical, and every ten years we find ourselves in the position of flat or negative revenue growth. The Ramp, even a ramp that is less steep, pits increased pension payments against increased demand for human services during economic downturns.

Hold the line on pension payments during a recession and hold the line on program expansions during good times and you can basically slalom your way through.

- Cook County Commoner - Wednesday, Nov 16, 11 @ 12:48 pm:

If the push is to move all new government employees onto a 401 plan, are there reliable numbers out there disclosing the projected burn into pension plan investments and income under various scenarios until the last vested pensioner passes?

- jeff - Wednesday, Nov 16, 11 @ 1:31 pm:

Steve our population growth was 3.3% compared to the overall 5.1% growth of the US for 2000 to 2010. You are right, we are growing but are below average. And that growth rate is much lower than previous decades. Low growth should mean fewer taxpayers.

We have hit 8% rates on pensions before. Most state have as well. But as long as the Fed wants to keep interest rates low it will be extremely difficult to do that for awhile. 30 year Tbills at ~3% keep everything low. As my brokers statement reads “Prior performance …”

Do we take more risk to try and get that return?

This is why private businesses dropped defined benefit a long time ago. They could never budget year to year how large their pension payment would have to be.

My opinion is that a defined amount contributed and amounts earned (interest)is what we should be offering our state workers. That way everyone can plan appropriately for their future. My father had his Santa Fe railroad pension whacked 40 years ago. I would not wish that on anyone.

- Just wondering - Wednesday, Nov 16, 11 @ 1:56 pm:

Stand For Children spent all that PAC money to pass legislation that would have eliminated tenure, the right to strike and seniority. The unions protected those things, so how did the teachers come out “on the short end of the stick”?

- Bill - Wednesday, Nov 16, 11 @ 1:59 pm:

==This is why private businesses dropped defined benefit a long time ago.==

“Private business” dropped defined benefit plans so they could keep more of the fruits of their employees labor for their fat cat selves and shareholders. The Civic Committee is motivated by the same greed. Everyone can plan just fine for their future with a constitutionally guaranteed defined benefit plan.

- muon - Wednesday, Nov 16, 11 @ 2:00 pm:

The rate of return on investment is not as good as advertised. Most of the time the quoted averages take in the last 30 years. I don’t think that the 80’s and 90’s are necessarily indicative of returns in the 21st century.

In March 2011 COGFA put out a report on the financial condition of the pension systems. It included the return on investment for each fund for the last ten years. From that report TRS averaged 4.1% over the last 10 years. Even if the terrible losses in FY 2009 are removed the average return was only 7.1% over the remaining 9 years of the last decade.

Other systems were comparable. SERS averaged 2.4% and SURS 3.6% during the period when TRS averaged 4.1%.

- PublicServant - Wednesday, Nov 16, 11 @ 2:00 pm:

Jeff, the pension plans invest in the stock market. See the Average Rate of Return on the Stock market over the last 50 years to determine the approximate pension rate of return on investment.

- just sayin' - Wednesday, Nov 16, 11 @ 2:03 pm:

Ty Fahner is probably a decent guy, but I think we can see why he lost the only election he was ever in (if I’m not mistaken Big Jim appointed him AG and then he lost when up for election).

In any case, pretty sad. How do you beat the unions by surrendering?

- PublicServant - Wednesday, Nov 16, 11 @ 2:04 pm:

Muon, why do you use a 10 year cycle. The pensions invest for the long term. Quit cherry-picking. If you were correct on the avg ror, then you’ve got the actuaries beat, but heck, they’re just math wizzes.

- Original Rambler - Wednesday, Nov 16, 11 @ 2:11 pm:

The Civic Committee wants to work with public employee unions the same way the NBA owners are working with the players’ union!

- Robert - Wednesday, Nov 16, 11 @ 2:51 pm:

Jeff and muon are right about the 8% assumed rate of return being too optimistic. Yes, it is the historic average, but I don’t believe most analysts are predicting 8% for the future. With about 20% in bonds and less risky investments which should return 5-6%, the state needs a greater than 8% return on the 80% that is in domestic and international stocks,hedge funds and private equity. Another danger is that falling short of 8% in a few years could lead to more risk-taking in investments, putting more money into hedge funds/private equity/emerging markets, meaning a greater possibility of a much lower return if things go bad.

Re-do the ramp / lower the target since we’re in a recession does make a lot of sense. But ultimately that just means putting off payments - that combined with the foolish 8% rate of return assumption means we risk more underfunding.

And while it is certainly true that the uncontributed payments from past year is a much greater cost than current/near future obligations, anything that can be done to trim obligations is a real help.

- Rich Miller - Wednesday, Nov 16, 11 @ 2:55 pm:

===but I don’t believe most analysts are predicting 8% for the future. ===

At last check, TRS did solid double-digit returns last year.

- Rich Miller - Wednesday, Nov 16, 11 @ 2:56 pm:

===But ultimately that just means putting off payments===

Only if you think everybody’s gonna retire at once.

- Robert - Wednesday, Nov 16, 11 @ 3:02 pm:

===At last check, TRS did solid double-digit returns last year.===

They sure had a good year. From http://trs.illinois.gov/subsections/investments/investments.htm , TRS return before investments expenses:

1-year return: 24.3%!

3-year return: 3.1%

5-year return: 4.6%

10-year return: 6.4%

- Ahoy - Wednesday, Nov 16, 11 @ 3:03 pm:

I think the Legislature should pass pension reforms on it’s own system and then work on everyone else’s.

- jerry 101 - Wednesday, Nov 16, 11 @ 3:12 pm:

===Frankly, I’m starting to think that Illinois ought to stop worshipping at the the ramp’s sacred altar. If we lower the target to 70 percent funded by 2045, those annual payments would be a whole lot more manageable. The ramp isn’t holy writ. It’s a state law that can be changed like any other state law. ===

I wish people would also realize that the pension “deficit” is an estimate of a long term liability. The actual long-term liability may be very different than what the current liability says. Many things can happen, and those things can cause the long-term deficit to rise, or fall.

It’s an estimate, nothing more, nothing less.

So long as the state/city/county/whatever pays in more than the pension systems pay out in benefits, then the system is reducing our overall future obligations (in comparison to a pay-go system). And that’s what funding future pension obligations really is, an effort to charge future pension benefits to today’s taxpayers, based on the idea that future retirees are currently earning the benefits that they will eventually receive. Which is certainly a good objective - it allows for some predictability and smooths out the cost curve over time - if we had a pay-go system. Plus the workers really are earning their future benefits now, so why shouldn’t current taxpayers be on the hook for those future benefits. It’s the inverse of issuing debt to pay for capital projects - the buildings/roads/schools whatever funded by the debt will be for the benefit of taxpayers in the future, so future taxpayers should pay the costs for the construction.

Anyway, its just an estimate. Change the assumptions, change the inputs, change the expected results, and you change the estimate. Who’s to say what estimate is the right one?

90% funding is absurdly high, and (if we ever reach it) will likely result in OVER funded pensions in a pretty short period - a few years of good investment results, and you’ve got a system that’s, say, 110% funded, maybe more. Why should taxpayers now be on the hook for efforts to overfund the system? A 70% funding objective is much more reasonable. Or, why not have the objective to be that the system needs to be funded annually at a rate of 110% of the current year benefits paid or something on that order, until the system reaches 70%?

There are ways to reduce the pension obligation that don’t involve massive austerity measures.

- muon - Wednesday, Nov 16, 11 @ 3:19 pm:

PublicServant, I used 10 years because that’s the number of years COGFA used in its report earlier this year.

How long the investments will be held in the future is not necessarily the right time scale for determining the time for a rolling average. One has to look at how far back in the past were economic conditions similar to what one expects in the future. For instance the annual rates of inflation in the 1980’s (after 1982) averaged a couple percent higher than the rate in the 90’s and 00’s. Of course there was a much larger inflation effect in the early 80’s. I would not want to average rates of returns from a period of sustained higher inflation, unless I was forecasting a return in the next couple of decades to a similar inflationary period.

In selecting a window for averaging, it might be useful to eliminate rare events. For instance investments in the late 90’s had a very unusual stock bubble, one big enough that the NASDAQ composite is still only about half of it’s peak then. One could also argue that the Great Recession is just as unusual as the dot-com bubble, which is why I also quoted a number without the worst year of that stretch.

- PublicServant - Wednesday, Nov 16, 11 @ 3:34 pm:

Well Muon, if the future is that much different than the past 50 years, then we’ve got much more to worry about then unfunded pension liabilities. Leave the computation of the pension’s ROR to the actuaries that do the estimation for a living based on sound mathamatical formulas.

P.S. Can I borrow your crystal ball after you’re done with it?

- soccermom - Wednesday, Nov 16, 11 @ 3:45 pm:

The ramp was set up arbitrarily. The 2045 target was arbitrary. And heaven knows the GA has been arbitrary about paying their share of the payment. So let’s scrap this broken system and set up something that we can actually live with.

- Peter Snarker - Wednesday, Nov 16, 11 @ 4:22 pm:

Muon -

The best-seller “Black Swan” (written by the guy the media took to calling Dr. Doom a few years ago) clearly and persuasively argued against the folly of “eliminating rare events” - precisely b/c those “rare events” that none of the quants math models and risk models accounted for are, in fact, far from rare, relatively speaking.

Just saying.

- muon - Wednesday, Nov 16, 11 @ 4:50 pm:

PubServ - I think it is safe to say that the next 50 years will look different than the last 50. I don’t think that necessarily changes what worries we carry into that future. As for my numbers, I think I have been completely clear as to the data and assumptions I have made. Actuaries can often be at odds with each other over which assumptions they should make, so their calculations are not set in stone.

PeterS - I have read Black Swan, and I understand Taleb to recommend building financial decisions that are resistant to negative Black Swan events. He does recommend being open to the occurrence of positive Black Swan events, but he doesn’t believe that they are predictable. In the case of our pension systems, that might mean making assumptions that do not include that a tech boom will happen within any given 30-year window.

- PublicServant - Wednesday, Nov 16, 11 @ 6:53 pm:

And I think it’s safe to say that the next 50 years won’t look different from the last 50 in terms of pension portfolio RoR. And while actuaries may differ, they support their differences and reasonable people can then judge for themselves. You, on the other hand, not being an actuary, are blowing smoke, and I’m calling you on it.

This is why I have been saying that reasonable people can get together and discuss this problem, but only with an agreed upon set of facts from experts with credentials that provide weight to their statements. You sir, while you can certainly offer an opinion, are far from an actuarial expert, or am I mistaken? Are you an actuary? Are you involved in any way with public finances? Please don’t throw around numbers otherwise.

- Norseman - Wednesday, Nov 16, 11 @ 8:44 pm:

Compromise with the Civic Committee? As an MC employee with little say as to what the unions should do, I would hope they stand their ground. You can’t compromise with people who have shown bad faith and want to ignore the bad faith that has been shown by the state’s elected leadership regarding the pensions.

The Civic Committee has shown bad faith by not discussing solutions with public employee representatives BEFORE presenting their “reform” to the General Assembly.

Bad faith by vilifying public employees and supportive allies as they try to garner support for their bill.

Bad faith by mistating the facts about the nature of the problem.

Their misinformation campaign conveniently leaves out the decades of state underfunding.

Compromise involves trust that you are being treated in a reasonable manner. There is no trust to be seen here.

Public employees can have little trust that the state will act in a responsible manner when it has historically failed to do so.

I don’t see any possibility of a compromise so long as the Civic Committee and their sycophants insist on violating the constitutional protection of the pensions.

- John - Friday, Nov 18, 11 @ 3:27 pm:

OK, Ty Fahner. And retired folk won’t press until spring either to institute a graduated income tax so that greedy millionaires pay their fair share.