|

*** UPDATED x2 *** Not a big deal at all, but it’s probably time to delegate a bit more

Thursday, May 10, 2012 - Posted by Rich Miller *** UPDATE 1 *** I had asked Quinn’s press office if the governor made “a small goof” on his tax return. This is the reply…

*** UPDATE 2 *** The governor’s tax returns have been pulled offline. I saved a copy, however. You can view the returns by clicking here. * Gov. Pat Quinn released his income tax returns to the public this week. From a press release…

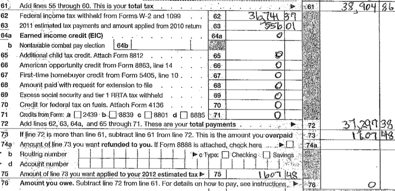

* The full return is here. [Updated link.] With a big hat tip to a reader, check this out. Click the pic for a better view…  OK, we’re going to do a little math here, but stick with me anyway. The federal tax he reported paying was actually $1,607.48 less than the tax he reported owing. But he looks like he reversed the numbers. Instead of subtracting what he owed from what he paid, which would have given him a negative result, he subtracted what he paid from what he owed, and then asked for a $1,607.48 refund when he actually appears to owe that amount. * This is really no big deal. Mistakes happen all the time. And he can probably clean this up by filing an amended return. But it looks like he did his own taxes. Perhaps he needs to realize that he’s just too busy being governor to do this stuff by himself. I asked the governor’s office for a response and haven’t yet heard back. * By the way, the income tax hike he signed into law hit Quinn but good…

Discuss.

|

|

|

|

- Dirty Red - Thursday, May 10, 12 @ 10:07 am:

Let’s give the man a little credit. He did NOT draw a smiley face inside the zeroes.

- Irish - Thursday, May 10, 12 @ 10:11 am:

The Gov agreed to donate to charity the amount he would have received if he took the same furlough days he forced state workers to take, since by law he can’t be paid less than his published salary. Did that charitable deduction reduce his taxes owed? And if it did he should also donate that gain if he wants to really ” be one of the guys”.

- wordslinger - Thursday, May 10, 12 @ 10:13 am:

If the math mistake works, perhaps he could apply his skills to the backlog of bills.

- Champaign - Thursday, May 10, 12 @ 10:13 am:

This mistake, and the fact that he did his own taxes, makes me like him more.

- thechampaignlife - Thursday, May 10, 12 @ 10:18 am:

What, no e-file? That would have saved him from making the mistake and saved the state some money in processing a paper return.

- Ready To Get Out - Thursday, May 10, 12 @ 10:23 am:

And this man is in charge?

- Oswego Willy - Thursday, May 10, 12 @ 10:23 am:

Well, (sniff sniff - stand up, pull up the pants a couple times … sniff, sniff)

What Mr. Quinn needs to do is file a 1040-EJ Niner 604, which would then nullify the mistake, THEN submit a 1060-412 which would allow the IRS to look at the mistake and wait about 30 days for the response back that the IRS got the 1060-412 and is being processed.

In the meantime, Mr. Quinn can send in a 402-Niner 620, which would expedite the process, but the receipt of that form, in triplicate remember, can take an additional 60 to 90 days from the Midwest Section of the IRS auditors.

If all that goes through, and fingers crossed, Mr. quinn than, and quite easily, send the revised 1040 to his assigned Tax Associate, with the 1040-EJ Niner 604, in triplicate, and the 402-Niner 620, in triplicate if the IRS accepts his fast track fix … and if they don’t accept the 402-Niner 620, Mr. Quinn needs to send the 1040-EJ Niner 604, which shows Mr. Quinn will not try to fast track the amendment and will allow the natural process to continue … if Mr. Quinn has the 1040-EJ Niner 604 in triplicate.

In layman’s terms, an easy government fix.

(Sniffs twice, fix my pants and walk away)

- Huggybunny - Thursday, May 10, 12 @ 10:30 am:

I wanted to make a relevant comment, but I can’t stop laughing at how funny this is..this man “was put on earth” to fix our State financial mess, and he screwed up his own tax return…Lord help us!!

- Wensicia - Thursday, May 10, 12 @ 10:31 am:

I can see the press release:

“Governor Quinn graciously submits his erroneous tax return to the public to show why it’s important for Illinois citizens to use e-file with their tax returns.”

- Ahoy! - Thursday, May 10, 12 @ 10:31 am:

they make software for these things now…

- zatoichi - Thursday, May 10, 12 @ 10:40 am:

Ah, Turbo Tax works pretty well.

- Oswego Willy - Thursday, May 10, 12 @ 10:41 am:

A TAXING JOB - QUINN FLUBS OWN RETURN

- Kasich Walker, Jr. - Thursday, May 10, 12 @ 10:44 am:

Time for the Governor to invite all critics to pile on, then, when he is able to crawl out from the pile, stand defiantly, raise his fist, and shout, “I’m gonna do my own taxes again next year, too! And without software!!!!!!!”

- Fed up - Thursday, May 10, 12 @ 10:54 am:

Quinn” I’m The Gov I was told there would be no math. “

- anonymice - Thursday, May 10, 12 @ 10:54 am:

==Did that charitable deduction reduce his taxes owed? And if it did he should also donate that gain if he wants to really ” be one of the guys”.==

“The guys” who took furlough days didn’t pay tax on the lost wages. Getting a deduction for contributing his wages just puts puts the governor on par with them. And he doesn’t get that deduction for state tax purposes, so he’s actually a little worse off than “the guys.”

- Yellow Dog Democrat - Thursday, May 10, 12 @ 10:56 am:

Rich -

The full returns are no longer posted.

Just out of curiosity, what were his charitable deductions?

- Rich Miller - Thursday, May 10, 12 @ 11:01 am:

===The full returns are no longer posted.===

Refresh and check the update.

- Oswego Willy - Thursday, May 10, 12 @ 11:01 am:

“This is the EXACT reason why tax returns are nobody’s business and stuff. Everyone should feel ashamed about making fun of Governor Quinn or whatever.

If Pat Quinn doesn’t show you nuttin’ than he’s all cool and he can fix it with the guy who is on the Monopoly game box,” said Jason Plummer from his “Summer Tree House”…..

- Oswego Willy - Thursday, May 10, 12 @ 11:05 am:

“Dear Rich Miller,

Whew! Thanks for saving those tax returns.

Sincerely,

The Governor’s Office”

- Silent majority - Thursday, May 10, 12 @ 11:07 am:

Agree that he should probably have someone else do his taxes next year, but the fact that he did his own tax returns is endearing.

- RetiredStateEmployee - Thursday, May 10, 12 @ 11:17 am:

More than whether or not he should do his own taxes, it does give you some insight into how the governor operates. I can’t believe someone didn’t catch this before it was made public. Doesn’t it make you wonder if anyone in the governor’s office checks anything? Is that why to no backup was provided as to the pension plan savings? Would we find errors in that calculation as well?

- Soccertease - Thursday, May 10, 12 @ 11:44 am:

Granted, this is a relatively minor error (that he will be charged penalty and interest on by the IRS) I find it alarming that our governor lacks the common sense to buy a cheap software package that would prevent errors and embarassment. It’s not so much the error as the judgment.

- Only in Illinois - Thursday, May 10, 12 @ 12:19 pm:

New meaning to fuzzy math. Makes you to want to double/triple check any numbers the Gov’s office puts out.

- Foxfire - Thursday, May 10, 12 @ 12:37 pm:

It was reported that someone in the Governor’s Office screamed “MILLER!” at about 9 am this morning. Shortly thereafter, the returns were pulled. At 11:02 am, another scream of “MILLER!” was heard from the Governor’s Office.

- Irish - Thursday, May 10, 12 @ 12:55 pm:

anonymice 10:54 am: - The Governor can’t lose his wages for the furlough days so he promised to donate his fair share to charity so he would equally share in the sacrifice.

The employees got nothing for the furlough days. Therefore if the Governor used his charitable donation as a tax deduction and paid less taxes as a result he got something. If it is an equal sacrifice both sides should be equal.

Employees-nothing does not equal Governor-something.

It’s not a big amount but it is the principle.

- Plutocrat03 - Thursday, May 10, 12 @ 1:10 pm:

A mistake on a tax return, as complicated as these things get, is no big deal.

What caught my eye is that the man who is supposed to lead Illinois through a disastrous budget/pension debacle reports nearly no income outside his salary. Most people report more interest income from their checking accounts as PQ reported on all of his non-retirement income?

Spooky

- Demoralized - Thursday, May 10, 12 @ 1:31 pm:

Pluto:

Apparently I need your checking account. I have no other income besides salary.

- david starrett - Thursday, May 10, 12 @ 2:09 pm:

He might want to be considering TurboTax, but at least give him credit for walking the populist walk and not having anything so complex that only a tax attorney could figure it out.

- amalia - Thursday, May 10, 12 @ 2:24 pm:

glad he made a mistake and found it, and whatever… and hope he does not use TurboTax, which has problems too.

- anonymice - Thursday, May 10, 12 @ 2:29 pm:

Irish @ 12:55 ==It’s not a big amount but it is the principle.==

It’s a zero amount. Salary of $150, lose $10 to furlough, pay tax on $140. Salary of $150, give $10 to charity, claim the deduction, pay tax on $140. Even the governor could do that math.

- jeff__ing in Chicago - Thursday, May 10, 12 @ 4:51 pm:

Reading this and doing the math I understand why PQ may think I do not pay enough in taxes. His total Federal, state and property taxes are 50,000 ~35% of his gross income.

I too live in Chicago. 2 working parents similar income and very similar Federal and state taxes. My property tax bill is $6000 more than his and we pay 4.25 FICA plus Medicare. Cook County property taxes are lower than Dupage and Lake County. I am hard sell in believing over 40% in taxes is undertaxed

- sal-says - Thursday, May 10, 12 @ 6:37 pm:

Ugh.

‘Not a big deal at all’ ?????

Not a big deal.

Quinn is CEO of a 12 million person business.

Quinn is responsible for about 40,000 staff.

Quinn is responsible for about a $25 BILLION budget.

And HE, does his tax return himself - by hand! Isn’t THAT cool?

Forget the software; forget the tax attorney. He could EASILY hire a CPA for about 0.1% of his gross income; hand the CPA a box of records and be done with this; post it; and have the CPA be accountable for any questions and/or errors.

Like they say: ‘C’mon, man.’ NO QUALITY judgement at all.

As a now retired State worker, I’ve used a CPA to do my tax return for decades. Yes, it costs and I’m responsible, but any IRS questions? Talk to my CPA. That peace of mind is worth the price. Sorry; but this is just dumb.

- Just Me - Thursday, May 10, 12 @ 9:47 pm:

No wonder our state finances are such a mess.

- Yellow Dog Democrat - Thursday, May 10, 12 @ 11:10 pm:

Rich -

I was 99% sure you’d have them downloaded…why anyone else is surprised is beyond me.

Quinn gave roughly 5.5% of his income to charity. Not bad, probably better than a lot of elected officials, but it would be nice to see him hit 10%.

As for the math mistakes, I think you guys are looking at it all wrong. Did he make a mistake? Sure. But he prepared his taxes himself like most families in Illinois. Most Illinoisans don’t have accountants. In fact, Democrats and Republicans alike would be heroes if they could reform the tax code to put the accountants and tax attorneys out of business.

Don’t sweat it, Pat. We all make mistakes. That’s why there’s an eraser on the other end.

- bigdaddygeo - Friday, May 11, 12 @ 7:06 am:

As they say in the software business, “that’s not a defect, it is a feature.” Want tax reform, make every committee chairman, every member of a tax drafting committee do their own taxes by hand. Credit to PQ for doing it on his own - poor judgement for not buying Turbo Tax.

It is too bad though that we found the error. The best part of the process is finding out 2 years from now that the mistake underpaid his 2011 taxes, underpaid his 1st quarter 2012 resulting in underpayment penalties and interest of twice the original tax due.

- bigdaddygeo - Friday, May 11, 12 @ 7:14 am:

Sorry guys, we missed the best part! Let me get this straight, the Governor of Illinois didn’t disclose whether or not he had foreign accounts. This could be one of the biggest hammers the IRS has. I hope he amends his return …

Non willful violations can be fined up to $10,000.

A person who willfully

fails to report an account or account identifying information may be

subject to a civil monetary penalty equal to the greater of $100,000 or

50 percent of the balance in the account at the time of the violation.

- dumb ol country boy - Friday, May 11, 12 @ 7:51 am:

@ Yellow Dog Dem……Yeah and I hope the “Eraser on the other end” comes at polls when Pat Quinn is attempting to get re-elected.

What a joke!