* Ben Polak, chairman of the economics department at Yale University, and Peter K. Schott, professor of economics at the Yale School of Management…

There is something historically different about this recession and its aftermath: in the past, local government employment has been almost recession-proof. This time it’s not. Going back as long as the data have been collected (1955), with the one exception of the 1981 recession, local government employment continued to grow almost every month regardless of what the economy threw at it. But since the latest recession began, local government employment has fallen by 3 percent, and is still falling. In the equivalent period following the 1990 and 2001 recessions, local government employment grew 7.7 and 5.2 percent. Even following the 1981 recession, by this stage local government employment was up by 1.4 percent…

Without this hidden austerity program, the economy would look very different. If state and local governments had followed the pattern of the previous two recessions, they would have added 1.4 million to 1.9 million jobs and overall unemployment would be 7.0 to 7.3 percent instead of 8.2 percent.

* Ezra Klein…

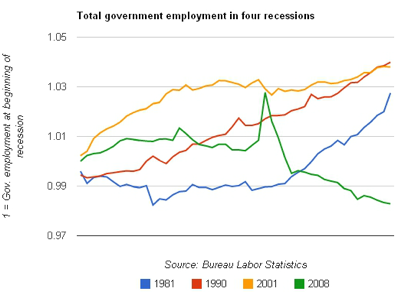

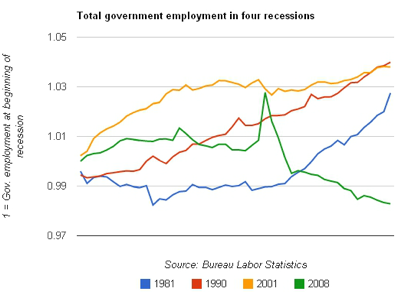

In the graph atop this post, I ran the numbers on total government employment after the 1981, 1990, 2001 and 2008 recessions. I made government employment on the eve of the recession equal to “1,” so what you’re seeing is total change in the ensuing 54 months, which is how much time has elapsed since the start of this recession.

As you can see, government employment tends to rise during recessions, helping to cushion their impact. But with the exception of a spike when we hired temporary workers for the decennial census, it’s fallen sharply during this recession.

Note that a Republican was president after the 1981, 1990 and 2000 recessions. Public-sector austerity looks a lot better to conservatives when they’re out of power than when they’re in it.

* The graph…

Discuss.

- bored now - Tuesday, Jun 12, 12 @ 9:50 am:

back in the 80s, when i was working for an investment bank, we’d tell the rust belt cities that came to us that they needed to develop local economies around three different sectors of the economy (instead of the typical one they were used to) in the belief that local governments stood as the fourth leg of the economic stool. i suppose now that, in order to have a strong economy, you have to broaden that to four different sectors of the economy, since local governments no longer serve as an economic stabilizing to local economies…

- Reality Check - Tuesday, Jun 12, 12 @ 9:53 am:

The GA passed a budget that allows Gov. Quinn to rescind his threats to close state prisons, halfway houses, psychiatric hospitals and homes for individuals with developmental disabilities, avoiding the vast majority of the 3,000 layoffs in his proposed budget.

It’s time for the governor to announce he will not only protect those services but preserve the jobs of the men and women who provide them. A glance at this graph shows how important it is for our economy.

- Joshua - Tuesday, Jun 12, 12 @ 9:55 am:

That graph would be useful if it listed a measure of debt (perhaps as a % of something?) at those same points in time.

i.e. Is the government in more debt now that it was in 1981, 1990 or 2000? Maybe we are nearing the limit of our debt and need to take different actions than we did then?

I know I treated my 1st month of unemployment much different than I did my 36th.

- Anonymous - Tuesday, Jun 12, 12 @ 9:56 am:

Without the context of the federal deficit and debt load, this chart is meaningless.

- RNUG - Tuesday, Jun 12, 12 @ 9:58 am:

Joshua,

My thought exactly. I went off and looked at the referenced articles but didn’t find any data on debt levels or revenue levels. Needs to be put in some kind of economic context.

- Team Sleep - Tuesday, Jun 12, 12 @ 10:02 am:

One of my biggest dings against President Bush was that he and the Congressional and Senate GOP caucuses never seemed willing to cut the size of the federal government. They controlled the Presidency, the House and the Senate for four straight years and did nothing to make government payrolls and spending leaner or at least mired.

The graph does not take into account total government debt or the added cost to continue employing said workers and provide them with fringe benefits.

- Another View - Tuesday, Jun 12, 12 @ 10:03 am:

This is far from the whole picture. Government employment is not the only measure of government activity. So the question should be about overall spending.

Almost everyone believes that investing in road projects is a good stimulus. That results in few government jobs as the money is given to private contractors.

I also agree with the point about indebtedness raised above. The fact that the pension crisis is coming to a head in so many places has limited spending by the state governments in some areas. But that doesn’t mean that their overall spending is down. It just means that it’s going to retirees instead of services.

The Klein article is disingenous. What he’s saying is that if a family fires their maid and then takes a lavish three month vacation in Europe, they’re practicing austerity. After all, their payroll has gone down.

- Rich Miller - Tuesday, Jun 12, 12 @ 10:11 am:

===What he’s saying is that if a family fires their maid and then takes a lavish three month vacation in Europe, they’re practicing austerity. After all, their payroll has gone down.===

Yeah, that’s what he’s saying. Right.

Sheesh.

- Another View - Tuesday, Jun 12, 12 @ 10:16 am:

Did you read the Klein article at all? He claims that there is public sector austerity. Those are his words. He uses one measurement. Employees. There is not a single mention of the overall budget. None.

What honest person would use only that as a measurement of austerity?

This is why these problems are so intractable. When disingenuous crap like this is being published in a major paper.

- Shore - Tuesday, Jun 12, 12 @ 10:16 am:

team sleep-what the media lost in their coverage of bush in 2000 was that he was a big government conservative in texas. Rove had him run a 4 part platform and one of them was spending on education. The “compassionate conservatism” thing was about spending on social stuff-he also boosted aid to africa-to soften the “harsh edges” of abortion ect.

The city of chicago today fired its “fashion programming director”. This is why people have a tough time buying the “we need more bureaucrats” line.

http://chicago.racked.com/archives/2012/06/12/kiran-advani-gives-25-weeks-notice-as-fashion-programming-director-at-the-chicago-office-of-tourism.php

- Aaron - Tuesday, Jun 12, 12 @ 10:18 am:

Nothing that anyone has said changes the facts of the articles, which claim that total government employment is down, which makes the unemployment rate higher.

Debt and deficits have nothing to do with it.

- Madison - Tuesday, Jun 12, 12 @ 10:19 am:

The fundamental problem with our economy is lack of demand. Lack of demand relies on the consumers “marginal propensity to consume” (MPC) to alleviate it. In whatever sector that loses jobs, the MPC takes a hit, and in my opinion, simply shifts the production of a worker from some level of production to unemployment…no production. Simply shifting costs is in the long term a fools errand and short- sighted public policy. Now…we can as a society invest in infrastructure or pay unemployment with the same money folks. Which would you rather have?

- Reality Check - Tuesday, Jun 12, 12 @ 10:21 am:

I would say people need to study simple economics, but it’s not even that complicated. The professors and Klein are noting that employment has not rebounded after 4.5 years of recession as in previous troughs — and one big reason is that local, state and the federal government have cut jobs. If instead they had added jobs at the same rate as in the wake of past recessions, unemployment would be significantly lower today. Period. Your comments about debt are irrelevant to this fact.

- wordslinger - Tuesday, Jun 12, 12 @ 10:23 am:

The dismal tide continues.

Locals are tapped, can’t borrow for operating costs and there will be no more help from the federales with this Congress.

Local governments kept growing during recessions from 1955 on because of the rise of the suburbs and the Baby Boomers moving through the education system.

Interest rates are nil and big business profits are at record levels. But small business profits, wages, employment levels and home values are stuck in the mud.

The last time things were this bad for so long it took an attack on Pearl Harbor and massive government spending and employment to set off an unprecedented period of economic growth.

Too bad the Dems screwed around with healthcare in Obama’s first two years. That was the time for real, long-term, government investment in the economic infrastructure.

They won’t get another chance barring a massive change in Congress.

- Another View - Tuesday, Jun 12, 12 @ 10:30 am:

No reality. It’s not that simple. If they had not cut the jobs, it’s possible that they would have cut other things that would have taken jobs out of the “doing fine” private sector.

- Ahoy! - Tuesday, Jun 12, 12 @ 10:32 am:

I also wonder how local pension obligations are playing a role in the decline of employment. In Springfield the police and fire pension payments alone make up about $17 million annually (around 15% of the general fund budget (that does not include any other pension payment or any payroll). When that much money is going to just two pension funds positions need to go unfilled.

I know this is just a Springfield synopsis, but I can’t believe this is only happening in Springfield.

- wordslinger - Tuesday, Jun 12, 12 @ 10:35 am:

Big business has been doing just fine.

–The new figures indicate that corporate profits accounted for 14 percent of the total national income in 2010, the highest proportion ever recorded. The previous peak, of 13.6 percent, was set in 1942 when the need for war materials filled the order books of companies at the same time as the government imposed wage and price controls, holding down the costs companies had to pay.

–In the first quarter of 2011, the latest figures available, the new estimates indicate corporate profits accounted for 14.2 percent of national income, well above the 13.1 percent that had previously been estimated. –

http://www.nytimes.com/2011/08/06/business/workers-wages-chasing-corporate-profits-off-the-charts.html

- Patience - Tuesday, Jun 12, 12 @ 10:38 am:

“Nothing that anyone has said changes the facts of the articles, which claim that total government employment is down, which makes the unemployment rate higher.”

Agreed. And going by facts alone, I cannot conclude whether or not this is a good thing or a bad thing.

It’s just a bunch of stuff that happened.

- Demoralized - Tuesday, Jun 12, 12 @ 10:39 am:

Another View:

Apparently you still fail to grasp the basic concept that is being put forth here, which is that government jobs (and YES government jobs are part of the overall economy) are on the decline. Your arguments are pure nonsense and irrelevant as it relates to this topic. You are apparently one of those misinformed who don’t realize that any job counts as a job. Doesn’t have to be private sector. Understand yet????

- Demoralized - Tuesday, Jun 12, 12 @ 10:40 am:

Patience:

Yes, it’s always a good thing when people are losing their jobs . . . sheesh.

- Plutocrat03 - Tuesday, Jun 12, 12 @ 10:41 am:

There is a vast difference between what the wage/benefit packages cost the taxpayer in ‘55, ‘81 and ‘01 and now. When you consider the number of dollars it costs to hire a worker these days it is easy to understand why the cost/benefit ratio discourages more government hiring.

Using headcount alone is not an accurate measure. You must add the percentage of the country’s revenue that is dedicated to governmental purposes. Staffing may be down, but the governments consuming too much of the GDP

- Demoralized - Tuesday, Jun 12, 12 @ 10:43 am:

Pluto:

And there is also a vast difference in the private sector. What exactly is your point? More irrelevant nonsense.

- the Other Anonymous - Tuesday, Jun 12, 12 @ 10:47 am:

To the folks that say the graph is inaccurate because it doesn’t show debt as well: short term, government debt is not the problem. How do we know this? Because the Treasury has no problem selling bonds, and interest on US government bonds is extremely low. In other words, the market is telling us that (at least short-term) debt is not a problem.

Moreover, we’re not going to reduce the deficit (and hence debt) until the economy recovers. So if you delay recovery by engaging in austerity policies, you paradoxically have made the debt problem harder to solve.

Last, several commenters make the point that a drop in state and local head counts does not equal a drop in spending. I refer them to the chart accompanying this article.

- 47th Ward - Tuesday, Jun 12, 12 @ 10:57 am:

If you put this study in the context of the latest Obama-Romney ad battle, this study supports Obama’s remark that “the private sector is doing fine,” and confirms that Romney is a lying fool (not that we needed more confirmation of that).

Romney’s insistance that he’d fire more teachers, cops and firefighters while simultansously attacking Obama for the weak employment numbers is the height of political double talk. Either Romney is stupid or he thinks the voters are stupid.

The fact remains, and is confirmed by this report, if public employment had remained at historic staffing levels, the unemployment rate would be lower than it is today. Of course, that would be a benefit to the President, so the GOP would rather keep Americans unemployed than give the President a victory he clearly deserves.

To heck with the country, if high unemployment helps the GOP, that’s what they’ll support. It’s pathetic. Why do they hate America?

- wishbone - Tuesday, Jun 12, 12 @ 10:57 am:

Of course, when the President mentions this obviously true fact everyone jumps all over him. As Jack Nicholson observed they can’t handle the truth.

- mark walker - Tuesday, Jun 12, 12 @ 10:59 am:

The “economic context” is already reflected in this chart. It says what it says, and is an irrefutable argument against two political claims, that government itself is still growing, and that this growth has had a direct impact on higher unemployment during this recovery. The opposite is true.

The “fiscal environment”, regarding deficits and debt, is a separate argument about what tactics were reasonable, and does not add or detract from this chart or its conclusion.

- Burning Down da House - Tuesday, Jun 12, 12 @ 11:00 am:

More smoke and mirrors from the bearded dark overlord as he panders to his cloven-hooved AFSME minions…

- Judgment Day - Tuesday, Jun 12, 12 @ 11:04 am:

Local governments aren’t just tapped out, they actively have to start reducing staff, and eventually programs.

There still is some overall revenue growth, but it’s most likely no more than 1.5% (maybe a little bit higher in some places).

But the problem is that even a ‘no growth’ budget still has a overall increase just due to retirement obligations, health care, insurance and licensing requirements, and all those other little items.

The facts are that to stay at ‘even dollars’, cuts in staff are required - and will be for the next several years. Expect that the 2012-2013 FY budgets will tell the tale for a lot of local governments. Many places have made cuts up to now, but they have been ‘limited’, and in some cases weren’t really hard cuts.

The 2012-2013 FY budgets will be for many tax districts the first real budget where they see the full effects of the collapse of the real estate market and the corresponding impact on local real estate taxes.

IMO, the cuts in services and staff at local government levels are just starting. For a lot of local governments, the increases in IMRF (pension costs for Counties, municipalities, townships, etc.) are killers.

If you are a municipality that buys lake water from the City of Chicago, those cost increases are brutal. As I remember, it’s 25% increase the first year, and an additional 15% for each of the next 3 years. In most places, that’s a direct pass-through to the citizens. But it’s still a budgeted item.

Ezra Kline is just a shill - if he ever had to assist in preparing a budget and making the hard calls, it would be his first time.

- Another View - Tuesday, Jun 12, 12 @ 11:05 am:

“If you put this study in the context of the latest Obama-Romney ad battle, this study supports Obama’s remark that “the private sector is doing fine,”

This article says nothing about private sector employment. Nothing. Amazing that you would try to use it to prove that the private sector is doing fine.

Additionally, it almost sounds as if people want to brag about a woulda coulda been 7.3 rate. That would be higher than any rate during the Bush years.

- Rich Miller - Tuesday, Jun 12, 12 @ 11:07 am:

It never ceases to amaze me how idealogues can reject even the simplest of facts.

- Yellow Dog Democrat - Tuesday, Jun 12, 12 @ 11:08 am:

Denial isn’t just a River in Egypt.

For months on end, “Conservatives” have been railing against the White House about lingering unemployment.

Now that the undisputed numbers show that government austerity measures are contributing mightily to unemployment, they want to change the subject.

“Please, ignore the fact that Republican presidents responded to recessions by increasing the number of government jobs.”

“Look at the debt.”

Yeah. Okay. Let’s looks at the debt.

From Wikipedia:

“Economist Mike Kimel notes that the five former Democratic Presidents (Bill Clinton, Jimmy Carter, Lyndon B. Johnson, John F. Kennedy, and Harry S. Truman) all reduced public debt as a share of GDP, while the last four Republican Presidents (George W. Bush, George H. W. Bush, Ronald Reagan, and Gerald Ford) all oversaw an increase in the country’s indebtedness.”

Ah, you say. But maybe we’ve reached a tipping point — thanks to all of that Republican borrowing — where we just can’t borrow any more.

Fine. You want to blame Republicans for getting us into this mess. Go ahead. Just don’t dare argue they are going to get us out of this mess based on their track record.

- wishbone - Tuesday, Jun 12, 12 @ 11:11 am:

Madison wrote: “The fundamental problem with our economy is lack of demand.”

Bingo! And the marginal propensity to consume (MPC) of the 1% super rich who now have 40% of the nation’s wealth is very low so they just sock it away and don’t create demand with it. Why more economists aren’t pointing this out is depressing.

- mark walker - Tuesday, Jun 12, 12 @ 11:13 am:

It remains a proven fact in the real world, and we have shown it again recently in Europe and most US states, that the most effective way to slow an economic recovery is to focus on lowering debt and deficits, rather than making investments. Those who claim otherwise are engaging in myth-based economics.

Whether we had any reasonable option, given the cumulative results of choices made in the past, is the only legitimate public policy argument.

- Another View - Tuesday, Jun 12, 12 @ 11:16 am:

Well, Rich, if you are talking about me I’ll say that I accept the fact that public sector employment is down. What’s amazing to me is that ideologues would suggest that public sector employment is the measure of austerity. It’s a specious argument and I’m pretty confident Klein knows it and probably a number of people here know it.

I find it amazing that so many people here have figured out all these “simple” things but that the Democrats couldn’t figure it out when they were running Congress and the White House for two years.

- Grandson of Man - Tuesday, Jun 12, 12 @ 11:18 am:

I heard some conservative economist say recently that government is redistributive, taking money from one and giving to another. Wow, I thought I’ve been working all these years as a government employee, but it turns out that I’ve been getting a handout.

- 47th Ward - Tuesday, Jun 12, 12 @ 11:22 am:

===What’s amazing to me is that ideologues would suggest that public sector employment is the measure of austerity.===

AV, so cuts in state and local spending that result in layoffs are not a measure of austerity? Please enlighten us, how would you measure austerity?

- Grandson of Man - Tuesday, Jun 12, 12 @ 11:28 am:

Some Republicans are coming around to the idea of closing tax loopholes or raising taxes. Jeb Bush said he supports this. It seems like a ploy to me. If Republicans support a debt/deficit deal that is 10-1 in favor of cuts over raising taxes, it gives the impression that they are compromising. U.S. Congress has very low approval ratings, and a miniscule compromise would probably be played up.

- Another View - Tuesday, Jun 12, 12 @ 11:29 am:

“AV, so cuts in state and local spending that result in layoffs are not a measure of austerity? Please enlighten us, how would you measure austerity? ”

I would measure it just as I said in my first post. “So the question should be about overall spending. ”

That’s how pretty much anyone would measure austerity. It’s probably how Ezra Klein would measure austerity in his own household. The chart does not prove anything beyond what the chart shows, which is that local and state government employment is down. It certainly is valuable information but it in no way proves that point it claims to prove.

- jeff__ing in Chicago - Tuesday, Jun 12, 12 @ 11:30 am:

If all of the public employees took a 5% pretax pay cut how many of their coworkers could we hire back? Wouldn’t that be good for the economy?Before you jump on me my family’s income is down 25% from 2003-2007 average.

- Judgment Day - Tuesday, Jun 12, 12 @ 11:35 am:

If you really want to make things work better at the local level, stop with the ‘zero sum’ ideological battles.

Here’s a relatively simple step that would make everybody’s lives easier:

1> Too many programs/issues are addressed by making specific units of local government responsible for resolving/inspecting those areas.

For example (an ultra tiny example): State of IL designates that larvacide can only be placed in water retention ponds by licensed, trained staff from health departments or units of local government (municipalities/counties).

Why? Why don’t we expand the eligibility to including the ability to outsource to private vendors who would have to have the same level of training and qualifications?

And apply this same principle to a whole myriad of different inspections (tanning; cross connection, private sewage, etc., etc.).

Ex.: Why do we require plumbers who are licensed plumbers and have taken and passed the 5 day state certification and training for cross connections to also have a Contractor’s license? They’re just inspecting the backflow/RPZ protectors, not fixing them. If they work for a municipality, no problem. But otherwise, they have to have the dreaded contractor’s license.

But as a result, costs go skyrocketing, and people who are currently not working and are extremely qualified are having to sit around because legislatively we can’t get our act together.

You’d make a whole lots of counties and municipalities really, really happy by allowing professional outsourcing services because all the sudden you’ve given the units of local government an option to still address the issue without having to bust their budgets.

- 47th Ward - Tuesday, Jun 12, 12 @ 11:41 am:

===“So the question should be about overall spending.”===

According to this site, total state and local spending since 2010 has been flat or declining, due in large part to reduced public employment.

So unemployment numbers are higher than they otherwise would be because state and local governments have been implementing austerity budgets. Therefore, the drag on employment, and thus consumer demand, is being caused by state and local governments.

If I’m selling cars, I don’t care if my customer is employed in the private sector or the public sector. I just want more customers and people who have jobs are more likely to buy cars than people without jobs.

- 47th Ward - Tuesday, Jun 12, 12 @ 11:42 am:

Sorry, here is the link:

http://www.usgovernmentspending.com/state_chart_gallery

- Rob - Tuesday, Jun 12, 12 @ 11:42 am:

“Yes, it’s always a good thing when people are losing their jobs . . . sheesh. ”

How many jobs were saved by laying people off? Or do you not care about THOSE jobs? Sheesh, indeed.

- lake county democrat - Tuesday, Jun 12, 12 @ 11:45 am:

Rich, I think a lot of this misses the bigger picture - read the CIA-funded 2020 report (issued in 2005) predicting longterm global economic and political trends for background. Also see a 2010 Atlantic cover study on how even America’s best schools are slipping and, more importantly, we’re losing our longtime edge in college/university superiority (and a strangely excellent summary of wast in government funding of scientific research by the late thriller writer Michael Crichton which appears as an appendix to the otherwise crappy State of Fear (I think that was the title)).

Yes, the Bush presidency looted the future to fund two wars, give regressive tax breaks (save the progressive $300 tax rebates), etc. and the stimulus needed to be bigger to account for state government cutbacks but EVENTUALLY economies make short term recoveries (look at Japan in the last decade and a half). We’re heading towards an ever-shrinking pie. It’s not just public sector spending but how public money is spent and what, public OR private, we focus our attention on. One of the tragedies of the Obama stimulus wasn’t the size, but that so much of it was doled out in blind blocks to states to divie up patronage projects and blindly keep public employees on the payrolls. There’s far more accountability on federal spending than there is on local and there was much the stimulus could have done to help expand the economy long-term.

To end my rant, let me note this: amazing how few people pay attention to what the economists who predicted the Great Recession are saying today, with the partial exception of Paul Krugman (who not only got the GR right but also predicted the failure of the stimulus and resulting political inability to do a second stimulus with frightening precision). It’s like sports writer Joe Crowley - doesn’t matter how wrong you are in the past, if you’re entertaining people pay attention to you!

- Another View - Tuesday, Jun 12, 12 @ 12:04 pm:

47th, I found that site as well, which suggests flat spending in the last couple years preceded by a couple years of increases totaling about 10%. I don’t see flat spending as “austerity”.

And yes, the car salesman wants more people employed but they also have to have sufficient income to purchase the vehicles. That’s why this simplistic chart fails so badly.

If locals had 10% salary cuts across the board, that would certainly qualify as austerity to some. The same number of people would be employed, but there would be huge hits on discretionary spending. Many people would delay their next car purchase, for example. That dynamic wouldn’t be reflected in Klein’s chart.

- vole - Tuesday, Jun 12, 12 @ 12:07 pm:

1. The spike in gov. employment caused by Obama’s stimulus is clear. No one can deny this.

2. There was a big stimulus impact from federal spending following 9/11 on local government hiring related to national security and anti terrorist measures.

3. If I am not mistaken, Clinton had the 100,000 cop hiring deal.

4. Someone can help me here, but at least in the early part of Reagan’s first term, federal revenue sharing was still intact.

5. I estimate that at least one private sector job has been lost for every lost public sector job that is directly related to reduced governmental spending at the local and state level. We have certainly seen this in Illinois.

- Cincinnatus - Tuesday, Jun 12, 12 @ 12:10 pm:

This chart assumes that at the start of the measuring time, we are at an amount of government employment we want to use as a measure (hence the 1.0). The chart says nothing about if that is the right amount of employees to begin with, and if the market in government employees is at it optimal level.

This chart is only a comparison to past performances, and NOTHING should be read into other than that.

- Shemp - Tuesday, Jun 12, 12 @ 12:20 pm:

“There is a vast difference between what the wage/benefit packages cost the taxpayer in ‘55, ‘81 and ‘01 and now. When you consider the number of dollars it costs to hire a worker these days it is easy to understand why the cost/benefit ratio discourages more government hiring.”

Bingo! Positions are left vacant because the total cost is growing. The cost to hire a firefighter isn’t $35k or $45k, it’s easily double that with pension contributions, liability insurance, work comp insurance, family health insurance, required training and required testing. When salary has become half the cost of keeping someone employed in the public safety sector, it’s no wonder the numbers are down. Those aren’t the same costs faced in the last recessions by locals.

- Chris - Tuesday, Jun 12, 12 @ 12:20 pm:

” The spike in gov. employment caused by Obama’s stimulus is clear.”

Are you talking about the census blip?

Or are you calling a short-term 1% increase a “spike”?

- 47th Ward - Tuesday, Jun 12, 12 @ 12:27 pm:

===I don’t see flat spending as “austerity”.===

AV, most economists would disagree with you on that.

Cinci, what I was reading into this chart was that it supported Obama’s full remark about the private sector (which was grossly twisted by Romney and Fox News et al):

“We’ve created 4.3 million jobs over the last 27 months. Over 800,000 this year alone. The private sector is doing fine. Where we’re seeing weaknesses in our economy have to do with state and local government — oftentimes cuts initiated by governors or mayors who are not getting the kind of help they have in the past from the federal government…if Republicans want to be helpful, if they really want to move forward and put people back to work, what they should be thinking about is, how do we help state and local governments…the recipes that they’re promoting … would add weakness to the economy … and would result, most economists estimate, in lower growth, and fewer jobs. Not more.”

So what we can read into this is that the GOP Congress is keeping unemployment higher than necessary for political purposes.

- Anonymous - Tuesday, Jun 12, 12 @ 12:31 pm:

-If instead they had added jobs at the same rate as in the wake of past recessions, unemployment would be significantly lower today.-

Seems pretty basic, but wouldn’t there be more tax revenue from income taxes if there were more jobs in the US? Resources overseas don’t pay US taxes or various benefits that the unemployed and “once middle class” receive. Do corporations who offshore make up for that lost revenue?

- Allen Skillicorn - Tuesday, Jun 12, 12 @ 12:34 pm:

Great talking point, but this doesn’t pass the political or economic sniff test. Keynesian economics died in the 70’s and voters aren’t that fickle.

If the Left is pinning their hopes on “We need more gov’t jobs”, I suspect 2012 will be another 2010.

- Anonymous - Tuesday, Jun 12, 12 @ 12:35 pm:

-So what we can read into this is that the GOP Congress is keeping unemployment higher than necessary for political purposes.-

No, I don’t think it’s strictly a GOP thing. The GOP used to like our Corporations and DIDN’T like sharing our Nation’s wealth with others unless it benefitted the US. It’s a “global village” thing.

- Anonymous - Tuesday, Jun 12, 12 @ 1:03 pm:

Furthermore, to assume that the GOP are in that much control seems silly, because then they’d be able to turn it all around again. At this point, I’m not sure anyone knows how to turn this around anymore.

If you were once a US Corporation in say, manufacturing, and you began off-shoring and building your state-of-the art plants overseas, what incentives do you have to tear those down to rebuild them here, and will the “host” government even allow it without hefty fines in the form of pensions plans, etc? (And I don’t believe that saying THEY are not practicing “protectionsim” is a valid argument.)

What about skills in e.g., both the manufacturing and IT sectors? It’s the resources overseas who have been, and are continuing to be, trained in the new techologies–usually on-the-job now.

I guess all those lies about US workers no longer having the necessary skills; interest; or more recently, the “educational background” in manufacturing, IT, call center, etc. jobs, has finally become true.

- Madison - Tuesday, Jun 12, 12 @ 1:23 pm:

Wishbone and I are on the same track. The idealogues will disagree but debt is not the problem, and almost irrelevant under these market conditions. Poor people spend money, and rich people bank it. Money is a commodity. If you want to stimulate the economy, it must be done by putting money in the hands of those that will spend it. That is stimulus or jobs or unemployment. That creates demand, which puts money in the system, which in turn can be used to hire, and then to pay off debt or pay taxes with. We need spending not austerity. look what happened during the depression!

- Give Me A Break - Tuesday, Jun 12, 12 @ 1:28 pm:

“If the Left is pinning their hopes on “We need more gov’t jobs”, I suspect 2012 will be another 2010.”

Well it was not the left at the COGFA Hearings screaming about closures, it was McCann, Watson, John Jones, Cavaletto along with a few other members of the “reduce Big Govt. caucus screaming (Forby and Phelps also).

- Quinn T. Sential - Tuesday, Jun 12, 12 @ 1:31 pm:

Joshua:

He who laughs last is Laffer. This might help to put things into better perspective:

The numbers are mind boggling. From the second quarter of 2007, i.e., the first full quarter of a Pelosi-Reid dominated Congress and a politically weakened President Bush, to the second quarter of 2009 when President Obama assumed office, government spending skyrocketed to 27.3% of GDP from 21.4%. It was the largest peacetime expansion of government spending in U.S. history.

After taking office in 2009, with spending and debt already at record high levels and the deficit headed to $1 trillion, President Obama proceeded to pass his own $830 billion stimulus, auto bailouts, mortgage relief plans, the Dodd-Frank financial reforms and the $1.7 trillion ObamaCare entitlement (which isn’t even accounted for in the chart). While spending did come down in 2010, it wasn’t the result of spending cuts but rather because TARP loans began to be repaid, and that cash was counted against spending.

http://online.wsj.com/article/SB10001424052702303753904577450910257188398.html

- reformer - Tuesday, Jun 12, 12 @ 1:31 pm:

another View

== I find it amazing that so many people here have figured out all these “simple” things but that the Democrats couldn’t figure it out when they were running Congress and the White House for two years.==

Looking back at the graph, I notice a brief spike upward in government employment. I wonder if that wasn’t the Obama stimulus package, which helped state and locales avoid layoffs?

- Cincinnatus - Tuesday, Jun 12, 12 @ 1:32 pm:

47th-

I don’t draw that conclusion at all. Let’s say that on day one, you are overstaffed by 50%. Using the methodology on this chart, if you bring your staffing level down to what you really need, you would show a “negative” on this chart, in more ways than one. So while you can make a relative statement, “Staffing is cut by X%” you cannot say anything about whether the cuts are good, bad or indifferent. The chart is meaningless. I feel the best metric to use is the total number in the workforce from time A to time B.

- reformer - Tuesday, Jun 12, 12 @ 1:36 pm:

Quinn T. Sential

Do you deny that since Obama came into office federal spending has grown at a much slower pace than it did under his predecessor? And that the Obama spending growth rate is the slowest since Ike?

- Quinn T. Sential - Tuesday, Jun 12, 12 @ 1:41 pm:

Reformer:

Is that water in the desert you see in the rearview mirror, or was just a mirage?

{While spending did come down in 2010, it wasn’t the result of spending cuts but rather because TARP loans began to be repaid, and that cash was counted against spending.}

- Anonymous - Tuesday, Jun 12, 12 @ 1:43 pm:

Either way, if this is the GOP’s (some members’) strategy to decrease both taxation and spending AND to become “global” humanitarians with the taxpayers’ money by giving away our jobs, I do not believe it is working.

(Based on stereotypes, the “humanitarian” part and pining for “buy in” and acceptance by cultures other than our own might apply to the left as well.)

- wordslinger - Tuesday, Jun 12, 12 @ 1:47 pm:

–Keynesian economics died in the 70’s and voters aren’t that fickle.–

Did it? With whom and how? Nixon’s wage and price controls?

Been asleep, Rip?

I seem to recall unprecedented peacetime deficit spending in the 1980s (Reagan) leading us out of the recession, followed by paydowns through growth in the 90s (Clinton).

The T-Bond pit at CBOT actually went dark after the government stopped issuing the long bond in 1997, as annual budgets were in surplus.

The long bond was offered again starting in October 2001.

Stimulative deficits followed by paydowns through growth. They are two sides of the coin.

- Anonymous - Tuesday, Jun 12, 12 @ 1:47 pm:

Ha! I just came up with a funny:

Q: How do some fiscal conservatives cut taxes and spending?

A: By encouraging off-shoring, of course.

(Maybe that wasn’t so funny. *shakes head*)

- Anonymous - Tuesday, Jun 12, 12 @ 1:59 pm:

Q: How do they cut borrowing from China to keep our government–and theirs!–running?

A: By cutting taxes and spending…oh, wait!

(That wasn’t funny either.)

- Grandson of Man - Tuesday, Jun 12, 12 @ 2:15 pm:

The U.S. has high income inequality as well as massive budget deficits. I hate to use this cliche, but incomes for the top 1% have shot up from 1979-2007, much more than everyone else’s. I’m sure there are complex causes.

We also have massive budget deficits that need to be addressed, and people are feeling the pain, as are the people getting cuts in Illinois.

Isn’t there a middle ground somewhere between cuts and tax increases? On the national level, why is one party ready to compromise and the other not?

- wishbone - Tuesday, Jun 12, 12 @ 2:20 pm:

“we have shown it again recently in Europe and most US states, that the most effective way to slow an economic recovery is to focus on lowering debt and deficits”

Exactly. Unemployment in Europe is soaring as government spending drops. The time to cut government spending is in good times not a worldwide depression. The focus should be on reducing entitlements in the long term not slashing spending when times are bad.

- wordslinger - Tuesday, Jun 12, 12 @ 2:22 pm:

–Isn’t there a middle ground somewhere between cuts and tax increases?–

Ask Jeb Bush.

- Anonymous - Tuesday, Jun 12, 12 @ 2:33 pm:

-The focus should be on reducing entitlements in the long term not slashing spending when times are bad.-

It’d be interesting to look at some studies on how much “pain” a country (one that was once prosperous) can tolerate, and for how long, until it gets really, really angry? (Workers in India running out at lunch time to throw sticks and stones at the police doesn’t count.)

- 47th Ward - Tuesday, Jun 12, 12 @ 2:38 pm:

===It’d be interesting to look at some studies on how much “pain” a country (one that was once prosperous) can tolerate, and for how long, until it gets really, really angry?===

Depending upon the outcome of next week’s referendum in Greece, I think you may get a chance to see exactly what this looks like. Capital contols are rarely popular and the barter economy isn’t terribly practical in 2012.

If Europe implodes financially, the German bankers will have accomplished what the German army tried and failed to do twice in the last century. And the result will be a pretty strong backlash. I hope Romney has a plan for that if he wins because it’s going to take a heck of a lot more than business experience to manage that mess of global financial and political armageddon.

- Anonymous - Tuesday, Jun 12, 12 @ 2:50 pm:

I think you’re right, 47th. Maybe Romney–or anyone else–will talk to their “US” Corporation CEO buddies to see whether they can help them by sending some of our jobs to them, too.

- Yellow Dog Democrat - Tuesday, Jun 12, 12 @ 2:53 pm:

Darn Yale liberals.

- Anonymous - Tuesday, Jun 12, 12 @ 2:56 pm:

Heh. As with any school, there are some good ones, and some not so good ones. Too bad that most of the really good ones are gone now. I can say with quite a bit of confidence though, that the latter are rolling in their graves.

- johhnypizza - Tuesday, Jun 12, 12 @ 3:01 pm:

According to world renowned statistician Todd Snider 98.6% of all statistics are made up on the spot, and 68.7% of us believe them whether they are accurate or not. I think the same may be said about referenceless graphs.

- Anonymous - Tuesday, Jun 12, 12 @ 3:05 pm:

Just a quick follow-up to my last comment. It’s been a while since we’ve focused on selling redundant and obsolete cast-offs to “our friends” at absolutely ridiculous premiumm rates. We don’t seen to even know who those friends are anymore.

- Anonymous - Tuesday, Jun 12, 12 @ 3:07 pm:

johnnypizza, step out of your house and go talk to a few Americans. REAL Americans. You’ll find out more than any study could ever tell you.

- reformer - Tuesday, Jun 12, 12 @ 3:10 pm:

QTS

Look at the rate of spending increase in Obama’s budgets compared to those of his predecessor. The inconvenient truth is the rate of growth has been much lower under Obama than under Bush 43.

- western illinois - Tuesday, Jun 12, 12 @ 3:41 pm:

http://www.nakedcapitalism.com/2012/06/tom-ferguson-how-wall-street-hustles-americas-cities-and-states-out-of-billions.html

It doesnt help that Wall Street views the loacls as their latest muppets…These Swaps are contracts and wall street would sue if you want out

- Cincinnatus - Tuesday, Jun 12, 12 @ 3:42 pm:

The reason jobs and capital flee is that they go to the place where they are economically best done.

- Quinn T. Sential - Tuesday, Jun 12, 12 @ 3:45 pm:

Reformer:

First, spending on its own has less relevance than when spending is analyzed as a functions of GDP.

Second, spending in the last two years of the Bush presidency (with a Democratic controlled Congress) was attrocious and inexcusable in large measure. Part of that was lame duck syndrome, and part of that was an effrot to provide the Heimllich maneuver to the credit markets before current and prospective borrowers choked to death.

With respect to O’Bama however; as Laffer points out, the spending rates and growth levels are illusory because TARPrepayments served to mitgate total spending when offset by debt repaytments, and yet no real GDP growth was occurring.

If you look at the continuum of spending in the first four years of GB 43, compared to the first four year term for O’Bama, you’ll get a better picture.

- Anonymous - Tuesday, Jun 12, 12 @ 4:16 pm:

=The reason jobs and capital flee is that they go to the place where they are economically best done.=

U-huh. And the previous generation of CEOs who did not off-shore were unaware of the cheap labor sitting overseas even back then? It took this generation’s CEOs and MBAs to figure that out?

The previous generation were more in tune with the details of what was going on in more countries–and here, in the United States, than you’ve probably ever heard of, Cincy. They, too, had bean counters who could crunch numbers and quality experts who could assess capabilities.

But funny how they focused on innovation to increase standing and profits–and actually enjoyed blasting their overseas competition out of the water instead of “giving the store away.”

Different values back then, I suppose.

- wordslinger - Tuesday, Jun 12, 12 @ 4:32 pm:

–The reason jobs and capital flee is that they go to the place where they are economically best done. –

I’m curious as to what that is supposed to mean in present context, both conceptually and grammatically.

You were around in 2008 when Lehman went down, weren’t you, and we discovered the world financial system was a house built on sand, predicated on never-ending rises in housing prices, and lending the same sub-prime MBS buck 30 to 50 times over?

It was quite a party before then. Everyone had a good time, but not everyone stuck around to clean up.

I don’t know what you mean about capital flight. Capital continues to pour into the United States, and interest rates are at historic lows.

But, according to the Fed, nearly 40% of household capital has simply disappeared since 2007 due to the housing crash.

That’s a big problem because consumer spending and housing are the drivers in the economy. You buy a house, you buy junk for the house, you spend to fix it up, you build equity, you move up the ladder, and it’s money, money, money churning and growing everywhere.

Now, four years after the crash, 30% of mortgages are still underwater. You don’t spend a lot fixing up a house that’s worth less than you owe on it, unless you’re out of you’re mind. And you’ve lost most of your net worth in equity, so you’re still not going to spend.

People don’t spend, less demand. Less demand for goods and services, less demand for labor. Fewer jobs, less spending, more demand for government services. A vicious cycle that the Econ 101 Comic Book doesn’t address.

http://www.bloomberg.com/news/2012-06-11/fed-says-family-wealth-plunged-38-8-in-2007-2010-on-home-values.html

- Anonymous - Tuesday, Jun 12, 12 @ 4:35 pm:

What are all the factors, Cincy, that a company has to consider if it goes overseas to open a plant and then later decides to shut it down because of quality issues (that might literally kill people) or if they don’t like their profit margins after a year or so because a bait-and-switch was pulled on them? Or what if your trade secrets and data are being stolen left and right and there’s not much you can do to stop it besides sink more money into a corrupt government and attorneys? What about your company’s reputation when some “silly” middle-managers who were just visiting and being wined and dined by their hosts get into trouble? (It happens more often than you’d like to think, Cincy, and has a tendency to bring in even more jobs.)

Still dealing with the US government, Cincy, who allows you to do pretty much anything you want when it comes to business? And, if you don’t get your way, are you going to jump up and down screaming that you’re a mighty US Capitalist while pointing frantically at your spreadsheets?

How enticing all that cheap labor and fewer or no regs are at first glance. So enticing that few seem to bother to develop even a high-level exist strategy…just in case. And then something happens, and reality hits.

- Anonymous - Tuesday, Jun 12, 12 @ 4:39 pm:

That obviously should read: “So enticing that few seem to bother to develop even a high-level EXIT strategy…just in case.”

- Grandson of Man - Tuesday, Jun 12, 12 @ 4:41 pm:

“Now, four years after the crash, 30% of mortgages are still underwater.”

Romney wants the market to work its magic, for people to foreclose without government help and have investors buy up their homes and rent them out.

- mark walker - Tuesday, Jun 12, 12 @ 4:43 pm:

@Cinci: Jobs and capital have flowed most to China. That’s the economic environment you want to tout?

- Quinn T. Sential - Tuesday, Jun 12, 12 @ 4:47 pm:

Let’s re-adjust the Ritalin dosage and bring the focus of the discussion back to public sector employment.

Reducing the number of laborers on a garbage truck crew from 3 to 2, or not replacing street sweepers or to truck drivers that retire is not resulting in shifting garbage collection or street maintenance overseas.

- Anonymous - Tuesday, Jun 12, 12 @ 4:50 pm:

Nicely explained, word.

- Madison - Tuesday, Jun 12, 12 @ 4:56 pm:

We have to either tax the ultra rich and move that money, or offer incentives to recycle it. Otherwise, the money sits doing nothing. Think of money as the ultimate commodity. If all the wheat is in storage bins, there will be no bread for anyone, no?

- Anonymous - Tuesday, Jun 12, 12 @ 5:08 pm:

Ritalin, Quinn?

- wordslinger - Tuesday, Jun 12, 12 @ 5:11 pm:

Just to be clear, there is no capital flight from the United States.

The world isn’t buying those T-bonds, munis, utilities, stocks and futures with Green Stamps.

The current Prime Rate is 3.25%. The Federal Discount Rate is 0.75% (sweet spread, by the way). I’m guessing if there was capital flight, rates might be wee bit higher.

If you’re talking about a net trade deficit, that’s something else.

- Plutocrat03 - Tuesday, Jun 12, 12 @ 5:46 pm:

More irrelevant nonsense…

In ‘55 public workers were arguably paid less than the average private sector worker. Today the latest statistics show government workers earn more than 30% more than the private sector and the government accounts for 10% more of the GDP. We simply do not have the money to spike the employment levels.

- Plutocrat03 - Tuesday, Jun 12, 12 @ 5:50 pm:

no capital flight from the United States

The would was also buying bonds from Greece, Spain, Ireland and Italy until recently. Banks do not want to lend money to business for expansion and operation. These are not normal times.

On would have to be blind to believe the State and Feds can spend money indefinitely without consequences

- wordslinger - Tuesday, Jun 12, 12 @ 6:11 pm:

–The would was also buying bonds from Greece, Spain, Ireland and Italy until recently. Banks do not want to lend money to business for expansion and operation.–

Interesting statement. Are you comparing those countries to the United States as to capital formation? I think a little market and economic history would be in order.

–On would have to be blind to believe the State and Feds can spend money indefinitely without consequences–

A truer truism was never written. One would have to be psychic to know what you’re trying to say with it.

- steve schnorf - Tuesday, Jun 12, 12 @ 6:18 pm:

P3, blindness affects one’s ability to see not reason

- western illinois - Tuesday, Jun 12, 12 @ 9:50 pm:

Actually because of Capital Flight from Europe some of our interest rates have turned negative alos pointed out by Ezra Klien So indeed we could spend indefinatly. If it extended to Illinois which it isnt we could too. But regardless of downgrades our rates are very very low

- Yellow Dog Democrat - Tuesday, Jun 12, 12 @ 10:30 pm:

Plutocrat03:

To quote my grandfather:

“I keep cutting this board and cuttin’ it, an it’s still too short.”

You would have to be deaf to think that you can lower unemployment simply by firing people.

- Sox fan - Tuesday, Jun 12, 12 @ 11:53 pm:

Remember, this is the tail-end of the “Great” Recession, not some regular, old recession. EVERYONE was affected to some degree by this latest downturn — whether it was Wall Street bankers not getting their usual bonus, teens not being able to find a job, or baby boomers involuntarily entering retirement. All these factors do not make for a strong economy. That’s the main reason we’re struggling economically right now…well, that and some political oneupsmanship on both sides of the aisle.

The U.S. created this mess — not Europe, not Japan — and we are bringing down the world economy. For better or worse (we’re in the “worse” phase now), the U.S, remains the world’s ecomonic leader.

If the Repubs were in power, they would have complained the stimulus was too small, while the Dems complained the fat cats were getting all the money.

So the time has come to put political labels aside and do what’s best for the economy. And that’s to throw money at ALL sectors of the economy — rich, middle class, and poor should all get more than just a “taste” of stimulus funds.

Isn’t that what government is supposed to do during an economic downturn — drive the economy toward a recovery by throwing out a life preserver?

The previous round of stimulus funds was way too small and politically driven. It’s time for the U.S. to stop staring at the rest of the world, and literally take the bull by the horns. Once we do that, guess what? U.S. consumers start spending money again, and suddenly the European and Japanese markets start humming again too.

- VanillaMan - Wednesday, Jun 13, 12 @ 12:08 am:

Mr. Klein’s thinking is obsolete.

We are not billions in debt. Billions, we can handle. We are trillions in debt. The 20th Century economic fixes are complete useless as we face a 16 trillion dollar debt. We don’t build microcomputers with leather and iron. We can’t fix a multi-trillion dollar debt with crap we were taught in government economic classes in the 20th.

There isn’t enough profits earned by all the Fortune 500 corporations, enough wealth earned by the 1%, enough future wage earners to use as collateral by Chinese bankers to pay for ONE YEAR OF FEDERAL SPENDING.

You thought a trillion in debt was insane? How about over a trillion in debt EVERY YEAR for the past four years?

Honestly, no matter how good a liar we can be, bankrolling a government that promises to repay what you give it two generations from now - just won’t fly anymore. The assumption of economic growth, the assumption of profits to pay for future American workers, the assumption of the value of American assets - those graphical lines are not longer promising repayment of the government debts being generated.

Someone has to have money to tax in substantial enough amounts, to pay for government spending that already occurred. Jacking government spending higher is completely foolish when there is no excess funds to take in government taxes.

When you have ten folks, of whom nine are government workers, the last guy’s salary isn’t enough to tax in order to pay for the other nine. The moment government workers end up with more than the non-government workers is the beginning of the end. Hiring more government workers, or making the last guy a government worker, leave no one else to pay for all the government workers.

Somehow, someone got the idea that government spending is equal to private spending. It isn’t. There isn’t any money available for government spending when there isn’t any private spending.

During a recession, there is less private spending. In earlier recessions there was enough credible loans available for government borrowing to bridge over the lapse in private spending. Today, there isn’t enough. Debt financing has taken all the available money to borrow. Today we have reached the ceiling.

You cannot raise the water level of a swimming pool by taking buckets of water out of the deep end, and pouring them into the shallow end. You might cause waves and ripples across the pool surface, but the water level won’t go up. You need more water from another source to add to the pool. In today’s economy, we can’t raise the economy by taking more money out of it via government taxes, in order to put it back into the economy. There needs to be another source of unused money to take.

Since 2007, there isn’t any.

This isn’t the same kind of recession as we’ve seen in the past, because in the past we had the fiscal credit and the pools of available cash to make available in the economy.

So, please shut the hell up about governments borrowing more to employ more. That is only digging the hole deeper.

- Anonymous - Wednesday, Jun 13, 12 @ 1:03 am:

Wow. Wall Street bankers who didn’t get their usual bonuses, their teens who were unable to get summers jobs, and the baby boomers who are now involuntarily entering a slightly uncomfortable retirement, but are looking forward to buying up all the foreclosed homes in their towns?

Really going for the “pity factor” to drive your point home, huh, Sox fan?

- Anonymous - Wednesday, Jun 13, 12 @ 1:06 am:

And, of course, the completely “deny all personal responsibility” catch-all: “The US created this mess.”

- Quinn T. Sential - Wednesday, Jun 13, 12 @ 6:44 am:

SOX Fan:

That is rediculous! The U.S. is not responsible for the socialistic policies of Greece, Ireland and France, to name just a few.

Indiscriminantly spending money when you are already bleeding red ink by the barrel makes a great deal of sense too, if you want to hasten your own demise.

Why not just pump gasoline from the fire hydrants and that will solve a lot of problems too.

I would like to nominate you to a position of authority……

Running the Cubs!

- 47th Ward - Wednesday, Jun 13, 12 @ 11:16 am:

Thanks for joining this discussion VM. It’s now too late to respond to most of your jibberish, but I did want to respond to this:

===So, please shut the hell up about governments borrowing more to employ more. ===

I’ll shut the hell up about that when the Paul Ryan/GOP nihilists shut the hell up about governments borrowing to pay for more tax cuts for businesses and millionaires.

- wordslinger - Wednesday, Jun 13, 12 @ 1:04 pm:

very interesting, VM.

Who pays your check, again?