Poll: No cost shift, but reform pensions

Monday, Jun 25, 2012 - Posted by Rich Miller

* Crain’s has a new poll. Here’s one of the results for the hot-button issue that’s supposedly holding up pension reform talks…

Asked whether teacher pensions should be paid for through state taxes, equalizing the pension bill everywhere, or through raising local taxes so that each school district pays only for its own teachers, 45 percent back the current state system, with 28 percent preferring a switch to local funding. A relatively high 28 percent say they don’t know what to do or have no opinion.

Crain’s didn’t publish its exact questions, but a phrase like “equalizing the pension bill everywhere” could easily lead respondents into being for the status quo. It’s also not true. “Everywhere” in Illinois would necessarily include Chicago. And the state doesn’t currently pick up Chicago’s share of the employer pension contribution.

It also appears that lots of people just don’t understand this situation. It hasn’t been debated nearly as much as most other pension issues, mainly because nobody ever talked about the fact that Chicago pays its employer share into its pension fund, while the state picks up the employer share for suburban and Downstate schools.

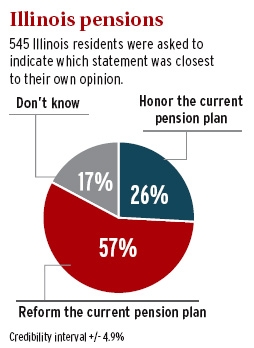

* Overall, though, Illinoisans want to reform the current pension program, according to the poll…

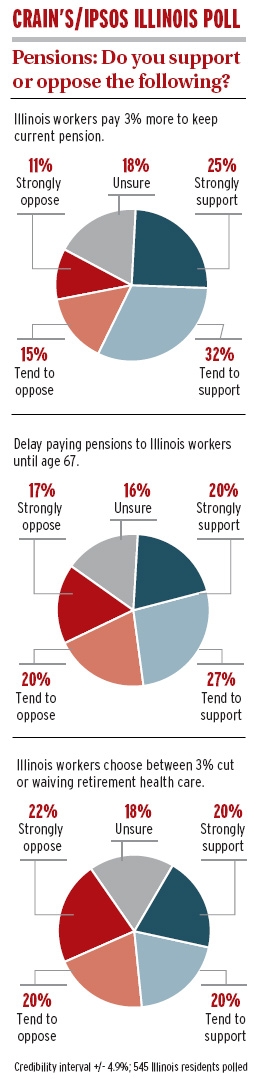

* They do disagree somewhat on the details…

* From Crain’s…

Presented with four options that lawmakers have discussed to offset the pension plans’ collective $83 billion in unfunded liabilities, survey respondents give majority support to only one, with 57 percent saying that workers should have to contribute 3 percent more from their paychecks to keep their current pension benefits; 26 percent say no.

But pushing back the retirement age to 67 draws only 47 percent support (with 20 percent strongly backing that option) and 37 percent opposed. And asked whether workers should be forced to choose between paying 3 percent more or losing their state-provided retirement health care, Illinois residents are split 42 percent against and 40 percent in favor. The difference is well within the poll’s credibility interval of plus or minus 4.9 percent.

Similarly, those surveyed reject a measure now pending in pension talks in Springfield that would require local school districts and taxpayers to pick up teacher retirement costs that now are funded by the state.

Discuss.

- Anyone Remember? - Monday, Jun 25, 12 @ 12:26 pm:

All those in favor of being “served” by a 67 year old fire fighter / police officer, please leave a placard to that effect on the door of your residence … .

- Reality Check - Monday, Jun 25, 12 @ 12:27 pm:

It’s all in the way the question is asked.

The headline response - “57% say reform pensions” - would have been very different if it was worded differently (like, say, CUT pensions).

Crain’s should release their survey. Apparently they didn’t poll the only thing in the most recent bill, slashing the COLA. Why not?

Did they measure what people actually know about the facts around pension issues? Did their script inform or lead respondents?

How about age, gender and demographic crosstabs? Unless we see the survey questions and order we don’t know much about the depth and strength of voter sentiment.

- Teamster - Monday, Jun 25, 12 @ 12:33 pm:

Again and again the State of Illinois and City of Chicago failed to make the contractual pension contributions on behalf of the employees.They should all be indicted for fraud and placed in jail! Quit placating to Chicago Tonite, Laurence Msall, City Club, Civic Federation and Chicago Tribune and take the workers side because last time I checked we pay taxes too. Not only do state workers pay into their pensions they also pay into social security and receive a reduced benefit of only 60% because they receive a pension. Double taxation whitout representation. REGING A BELL!!!!

- Mouthy - Monday, Jun 25, 12 @ 12:34 pm:

Lets see. A Chicago Business magazine’s sample of “545 representative adults” with a plus/minus spread of 4.9% should be taken as credible? Where was the sample group, the Chicago Commercial Club? Anything, real or not, for a negative headline against the Public Sector Employee…. Geez….

- Palos Park Bob - Monday, Jun 25, 12 @ 12:36 pm:

When I taught high school physics, every semester I’d ask a question before we started a section on a subject that was counterintuitive, such as general relativity.

I’d ask for a show of hands of who thought that time slows down when we increase the speed of an object (it does), or if time can pass differently for different objects in the universe(it can be).

Almost everyone voted that time is a constant, except for few students who figured it was a trick question or had read ahead.

After the vote, I told the students that more often than not uninformed voters make the wrong decisions, and that often the “majority” is dead wrong. That’s why they should do their homework before voting in elections, and listen to both sides of an issue.

When I see polls like this, I always wonder what the opinions would be if those being polled actually had a sound knowledge of the issue.

Is the purpose of this kind of polling to give pols an idea of how to pander to a majority of voters, or that they need to educate the public on the issue?

My guess is that it’s more of the former than the latter.

- Palos Park Bob - Monday, Jun 25, 12 @ 12:41 pm:

=All those in favor of being “served” by a 67 year old fire fighter / police officer, please leave a placard to that effect on the door of your residence=

All those in favor of paying for a teacher, administrator or custiodian to retire with full benefits (plus sudsidized health care) at age 55, at least a decade before they can no longer perform their jobs, and bankrupt the state while paying for it, put THAT placard on your door!

- Tom B. - Monday, Jun 25, 12 @ 12:44 pm:

That article says the poll was conducted online. How did they draw the sample and was any dialing done at all? Because an online only sample is not at all representative of citizenry or electorate.

- Shore - Monday, Jun 25, 12 @ 12:44 pm:

To Mouthy, in case you missed it, this has been a deep blue state for 10 years. If they polled for president in that survey obama is probably up 15-19 points. Taxpayers want the people getting the pensions and benefits to pick up more of the tab. Period. A lot of those chicago commercial club members-that name by the way sounds ridiculously pretentious to the point of absurdity by the way, probably donated to rahm/daley/obama/durbin.

As for people paying attention, my experience is that most people in the chicagoland area don’t really care about springfield and really don’t pay attention particularly on something like this in a presidential year during the summer and spring. People that read this blog care, some partisans care, but your average voter probably could not pick madigan or cullerton out of a police lineup.

- lincolnlover - Monday, Jun 25, 12 @ 12:45 pm:

I’m with you, Mouthy. Lets see a poll of 545 representative adults conducted by AFSCME. Think the results would be the same?

- huggybunny - Monday, Jun 25, 12 @ 12:56 pm:

Sorry for the snark, but does it really matter what the taxpayers want? Doesn’t it all come down to what the State can legally do with the pensions? If they have to change the constitution to modify the benefits, then quit talking about it and do..not to be overly dramatic, but lives are on hold while they are spinning in place trying to decide what they can legally do.

- Newsclown - Monday, Jun 25, 12 @ 12:58 pm:

I tend to agree with Palos Bob that the polls come out different if the subjects are at all educated on the subject. I did a rough poll on this in the street a couple weeks ago with a crew, and 90 percent of the people I polled admitted they didn’t know enough about the issue, but if pressed, they felt there should be some compromise on the worker’s side regarding pensions. Pressed further for detail, they ALL back-tracked on their initial statement about workers giving ground, and said workers deserved everything they were promised. What they really meant, it appears, is that they were for a new 2-tier plan for new hires that’s less generous than the old plan, but they don’t think retirees should be victimized after the fact.

What this poll is showing is mostly the uninformed respondent’s reactions to knee-jerk, dog-whistle slogans for one side or the other, not anything actually about policy. They answer based on how you frame the question, not on what they actually know, which is painfully little.

- Raising Kane - Monday, Jun 25, 12 @ 1:03 pm:

hunnybunny, they cant change the constitution to take away benefits after the fact. And, it doesn’t matter for new employees because tier 2 employees pay more than normal cost (which also isn’t legal) so there are no savings to be had on new employees. There is no doubt whatever passes is headed to court.

- Mouthy - Monday, Jun 25, 12 @ 1:12 pm:

@Shore. I wasn’t hired by the taxpayers. I was hired by the politicians the taxpayers hired. These politicians, took the money to fund the pension funds and spent it elsewhere. Now, when questions have arisen on future funding these politicians, to stave off accusations of thievery and gross neglect, have manufactured a narrative

depicting public sector workers as greedy, overpaid, and undeserving of the pensions we’ve earned. This “suspect” poll is just another salvo against perpetrating these connived perceptions.

What’s that have to do with whether or not this is a blue state? I do kind of agree with one of your points though: ” my experience is that most people in the chicagoland area don’t really care about Springfield”…… In my years of experience I have doubt that most people in Chicago could find Springfield on a map.

- Cassiopeia - Monday, Jun 25, 12 @ 1:13 pm:

Having a state pension does not reduce your social security benefits because most state employees pay social security taxes on their state salaries

The following is for the Social Security Administration website:

If your pension is from work where you paid Social Security taxes, it will not affect the amount of your Social Security benefit. However, if any part of your pension is from work where you did not pay Social Security taxes, it could affect the amount of your Social Security benefit.

- JimBob - Monday, Jun 25, 12 @ 1:19 pm:

Chicago teacher pension does get some state funds. Check their website.

- Reality Check - Monday, Jun 25, 12 @ 1:20 pm:

The Crain’s “poll” should be taken with a plateful of salt. The universe is only 545 people, and as Tom B notes above, it appears to be a self-selected click poll (thus unscientific). Plus they’re not sharing their survey instrument, toplines or analysis from the pollster. Why not?

On the other hand, there is a larger sample, scientific poll on this very issue from Hart Research. It found that by 60-34 Illinois voters believe public employees should receive the pension they were promised.

It also found that 49% of voters believe public employees’ pensions are about right or not generous enough, versus just 39% who thought they were too generous.

The Hart poll informed voters about the funding shortfall, so the support for public employees and pensions remained even despite that fact.

The poll also revealed very low information among voters, such as 48% didn’t know that public employees pay toward their own pension and only 29% knew that pensions for new hires had already been cut.

Support for public employees and their pensions increases as knowledge of the facts increases (pensions are modest, public employees pay, most don’t have Social Security, politicians skipping payments caused the debt).

Here’s the poll memo: http://www.weareoneillinois.org/documents/il-pensions-polling-memo.pdf

Toplines: http://capitolfax.com/ILUNIONToplines.pdf

- JimBob - Monday, Jun 25, 12 @ 1:26 pm:

The solutions are a shell game.

1. Teacher paying more will result in higher salary demands and increases taxes (probably local).

2. Increased retirement age means paying high salaries long and increased medical costs for aging teachers. Also more sick days for which subs have to be paid. More local taxes.

3. Keeping aging teachers cuts job opportunities for young people, and keeps pension payments tied, up in investments, rather than being spent in the economy. It is a double whammy for the economy.

4. Local funding, if done should be in the manner that IMRF is funded by school districts - a separate levy.

I agree that Crain’s “research” is questionable. The sample is too small and we no nothing of the sampling technique. It is just yellow journalism.

- huggybunny - Monday, Jun 25, 12 @ 1:51 pm:

@Cassiopeia, not all State workers pay into Social Security…from the SURS site: You will not pay into Social Security during your employment with a SURS-covered employer, so you are not eligible for Social Security coverage based on this employment. You will pay Medicare taxes of 1.45% of your gross earnings. If you have Social

Security benefits from a previous employer, those benefits may be reduced. The reduction in benefits falls under the S.S. Windfall Elimination Provision: http://www.socialsecurity.gov/pubs/10045.pdf

It’s my understanding that State workers have to have over 30 years of substantial earnings to not have any S.S. benefits they have earned reduced.

- Original Rambler - Monday, Jun 25, 12 @ 1:55 pm:

As to Rich’s first point, if the leaders can’t agree on some way to move the cost of non-Chicago teacher pensions to the school districts, then I would like to see Rahm introduce legislation to give us Chicago residents an income tax credit as an offset.

- Bill - Monday, Jun 25, 12 @ 2:06 pm:

==All those in favor of paying for a teacher, administrator or custiodian to retire with full benefits (plus sudsidized health care) at age 55==

That’s just not true,PPBob. But then you already knew that. Is that how you are gonna run your campaign, lying to the voters? If you get 25% I’ll buy you dinner.

- Katiedid - Monday, Jun 25, 12 @ 2:16 pm:

==All those in favor of paying for a teacher, administrator or custiodian to retire with full benefits (plus sudsidized health care) at age 55…==

Actually, the custodian wouldn’t be in the state plan anyway. Only certified school positions are eligible for TRS. The custodians, secretaries, teacher’s aides, etc. would be in IMRF. And, their pensions get reduced if they go at 55 and IMRF retirees don’t get any healthcare subsidies. The state also wouldn’t be paying anything toward their costs; the school pays all of the employer costs for IMRF members.

- CircularFiringSquad - Monday, Jun 25, 12 @ 2:18 pm:

Since we know there will no need for the prop. tax increase in nearly every school district because they can spend interest earnings on reserve to pay for the phase in… maybe the Crainiacs can we poll.

- Kid Kansas - Monday, Jun 25, 12 @ 2:19 pm:

Poll, schmoll! I’m banking of the Constitution: SECTION 5. PENSION AND RETIREMENT RIGHTS

Membership in any pension or retirement system of the

State, any unit of local government or school district, or

any agency or instrumentality thereof, shall be an

enforceable contractual relationship, the benefits of which

shall not be diminished or impaired.

(Source: Illinois Constitution.)

- Honestly - Monday, Jun 25, 12 @ 2:21 pm:

@ Palos Park Bob=”All those in favor of paying for a teacher, administrator or custiodian to retire with full benefits (plus sudsidized health care) at age 55, at least a decade before they can no longer perform their jobs, and bankrupt the state while paying for it, put THAT placard on your door!”=

The above statement is an proof that the misinformation peddled by Tribbies and other deadbeat millionaires clubs has unhelpful.

In spite of virulent popular belief, there’s no evidence that benefit payments have caused the current underfunding.

- Jechislo - Monday, Jun 25, 12 @ 3:30 pm:

Crain should have asked the question: Do you agree or disagree that the State of Illinois should follow the Illinois Constitution when attempting to reduce pension benefits.

This is getting ridiculous. The legislature is going to make a decision based on polls or the Commercial Club of Chicago which will eventually be ruled unconstitutional which will cost the Illinois taxpayers millions - and the State will lose. Then they’ll all just put their heads together to try to pull another stunt.

The State should quit posturing and pandering and pass something that will stand up in court.

- Palos Park Bob - Monday, Jun 25, 12 @ 3:35 pm:

“If you get 25% I’ll buy you dinner”

Bill,is that a bribe?LOL

- Rod - Monday, Jun 25, 12 @ 3:36 pm:

Now we have Laurence Msall from the Civic Federation telling the General Assembly that they have to get over the cost shifting issue this morning and get on with the pension reforms [WBEZ radio]. We also have Republican Senate Leader Radogno asking for a study on the “pots of money” available to the Chicago schools not available to suburban and downstate schools.

Of course one of those treasure troves of dollars is for students with disabilities in Chicago, apparently Radogno would like CPS to take a hit on special education funding to the tune of about $200 million a year, or at least that was ISBE’s last estimate on what it would cost CPS to get their special ed dollars in the same way as the rest of the state.

Possibly Senator Radogno thinks some of that money will make its way to Lemont and District 113A where the district is spending about $1.5 million a year on special education, or 7.8% of the district’s total yearly expenditures. Of this cost, an amazing 97% in FY 2012 came from state and federal funds. [ http://www.sd113a.org/pages/uploaded_files/DB2012FORM0902011REVISEDfor9.2.0.11BOEMeeting-locked-executed.pdf]

The CPS by comparison spent in FY2012 about $911.5 million on special education and it composed about 16.51% of all non capital appropriations for CPS. CPS gets about 75% of its special education funding from federal and state sources. [http://www.cps.edu/About_CPS/Financial_information/Pages/FYBudget2012.aspx]

The Governor has apparently told Radogno she will get the study in about five weeks which I suspect he ordered ISBE to conduct with no additional funding. Really the lady doth protest too much, methinks - as Shakespare once said. I still find it amazing that cut it to the bone Msall is now willing to allow suburban and downstate schools to keep getting their free ride.

- Bill - Monday, Jun 25, 12 @ 3:44 pm:

No,Bob. I’ll make sure to put it on my D-2.

- RNUG - Monday, Jun 25, 12 @ 3:56 pm:

Cassiopeia @ 1:13 pm:

That is true for most SERS employees but not most ’state’ employees. The vast majority of ’state” employees are in the SURS and TRS systems, which do not pay in to SS. In a lot of cases, they get $0 from SS even if they did pay in to it. The offset rules get fairly complicated and there are a whole bunch of “gotyas” in there.

For example, even though my mom, a SERS retiree would normally be entitled to my deceased father’s SS, she gets nothing because she receives a state only ‘non-coordinated’ pension and the offset rules prevent her from collecting SS. In addition, she was one of the SS ‘gap’ generation that also had a different, additional offset rule applied.

- RNUG - Monday, Jun 25, 12 @ 4:22 pm:

Wonder what the poll results would have been if (a) it was explained the State has underfunded the pensions for 40+ years, (b) that the 1970 IL Constitution protects pensions and (c) that IL SC had already ruled in various cases (IL Fed Teachers 1975, etc.) that the State must pay the pensions even if the pension funds go insolvent?

Of course, once you explain those facts, about all you have left to poll is how should the State get the revenue to pay?

- Arthur Andersen - Monday, Jun 25, 12 @ 5:34 pm:

RNUG, I think you got something backwards in your first post. The majority of State employees as commonly defined are members of SERS. Reasonable people can debate about whether or not State University employees participating in SURS are “State employees,” but most would agree that community college SURSers are not. Almost all TRS members are employed by school districts, not the State.

- Liberty_First - Monday, Jun 25, 12 @ 6:41 pm:

How about the following wording:

Should employees pay for the missed pension payments by the state for 30 years or should the state pay?

- Inquiring Mind - Monday, Jun 25, 12 @ 7:34 pm:

While we’re asking questions, someone should ask former State workers Fahner and Msall if they have taken refunds or are planning to collect an excessive State pension and extravagant healthcare.

- RNUG - Monday, Jun 25, 12 @ 8:02 pm:

Arthur Anderson,

You’ll notice I put the term state employees in quotes. I also went on to distinguish between SERS, TRS and SURS.

When talking about the pension problem, if the State has to pay for them, then they are ’state employees’.

- steve schnorf - Monday, Jun 25, 12 @ 8:17 pm:

AA, I THINK (memory getting worse and worse) that state university employees get their paychecks from the Comptroller like SERS members, CC employees don’t

- steve schnorf - Monday, Jun 25, 12 @ 8:38 pm:

RNUG, I fear I disagree with you on the status of various pensioners. In my mind public school teachers are employees of local tax-levying government bodies, as are community college staff. I think the primary difference can be seen in the retiree health plans. CC and public school teachers (downstate) retirees already pay a portion of their health insurance premium, as does their district. Public university employees get the same health benefits, both active and retired, as SERS employees/retirees.

- Yellow Dog Democrat - Monday, Jun 25, 12 @ 9:38 pm:

As I said before, touching retirees’ health care ain’t gonna go over too well in Voterland.

- Arthur Andersen - Monday, Jun 25, 12 @ 9:43 pm:

Steve, thanks as always for helping to clarify. I can’t remember either, but I thought SURS did their own payroll. It’s always hard to recall all the accomplishments over there under Messrs. Spice and Hacking.

RNUG, thanks for the explanation. .

- RNUG - Monday, Jun 25, 12 @ 11:50 pm:

Steve, AA, et al,

I agree the actual employer is the local school district, etc. for most of the teachers.

In fact, I’ve always thought the State pickup of the TRS pension funding was the screwiest way possible to handle it. I’ve always thought the State should send their (pick a percentage) portion of education funding to the school and then the school would place it in a statewide TRS fund. But taht would be way too logical …

- Flan - Wednesday, Jun 27, 12 @ 7:36 am:

Try this poll again with the phrase “Reduce pensions for working people” and see the numbers. All about the wording…