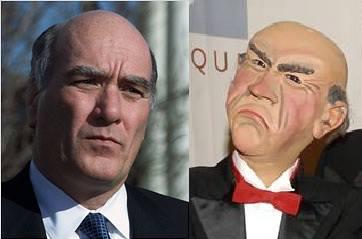

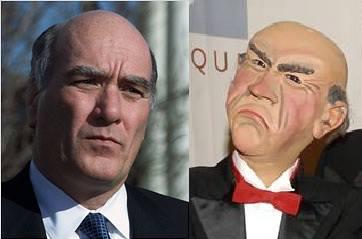

Separated at birth?

Monday, Jul 22, 2013 - Posted by Rich Miller

* Via a Facebook friend, here’s Bill Daley and Edgar Bergen’s Charlie McCarthy Jeff Dunham’s Walter…

Discuss.

42 Comments

|

Question of the day

Monday, Jul 22, 2013 - Posted by Rich Miller

* The AP looks at the graduated tax hike proposals…

Influential Democrats sponsoring legislation in Springfield say the graduated tax — a system used by the federal government and 34 of 41 other states that charge an income tax — is the fairest form of taxation. They say a majority of Illinoisans would get a tax cut from the current rate, but the financially struggling state would take in more money because the wealthiest earners would pay more.

“We hear it said that Illinois is a wealthy state, and it is, but there’s also this great disparity,” said Rep. Naomi Jakobsson, a Democrat from Champaign who’s sponsoring the measure in the Illinois House. “We should have done this a long time ago.”

But Republicans say it’s a tax increase in disguise and accuse Democrats of going back on their word that the 2011 income tax hike would be temporary. They note Democrats’ promises that the 2011 increase — from 3 percent to 5 percent for individuals — would help Illinois out of its financial crisis, yet two and a half years later, the budget has grown and the state still has a multibillion-dollar backlog of bills.

I didn’t realize that Rep. Jakobsson was so influential. Also, the budget has grown mainly because the state is finally making its full pension payments. And the bill backlog has been shrunk, but not mentioned is that there was a provision in the tax hike bill earmarking some of the new revenues to make payments on a bond to pay off the backlog. That bill didn’t pass because it required a three-fifths majority in both houses.

Also, keep in mind that a constitutional amendment for a graduated income tax will require a three-fifths vote in both chambers. It can probably clear the Senate, but the House is a far different story as long as the Republicans remain opposed.

* Jim Nowlan…

The Center for Tax and Budget Accountability in Chicago has a mission of putting a few more bucks in the pockets of the working poor. It is a good-hearted group, and I helped found it. The Center has proposed a state income tax that would be graduated from 5 percent to 11 percent, the highest rate for those with incomes over $1 million.

The Center claims that under their proposal 94 percent of Illinois workers would actually pay less in taxes, because of liberal individual exemptions from the tax, while the rich would share more of the burden

We do need to figure out how to rebuild a middle class that has eroded into working poor status in recent decades. The Center points out that between 1979 and 2010, inflation-adjusted wages for the bottom 60 percent of workers actually dropped while for the top ten percent wages went up 23 percent.

The big trouble is the CTBA proposed rates aren’t in either of the two proposed constitutional amendments. The rates would be set by statute, and they could be anything.

And the Constitution’s cap on corporate income tax rates (currently an 8-5 ratio between corporate and personal rates) would be eliminated.

* Minnesota’s recent enactment of higher progressive rates has been met with pretty strong public approval…

An income tax increase on the wealthiest Minnesotans, the centerpiece of Gov. Mark Dayton’s budget, is supported by 58 percent of those polled, compared with 36 percent opposed. […]

(T)he Legislature created a new tax rate of 9.85 percent for adjusted gross income above $250,000 for couples and above $150,000 for individuals. Income below those levels will continue to be taxed at existing rates. Dayton has said the increase applies to about 2 percent of all taxpayers.

* The Question: Should the General Assembly approve a public constitutional referendum for a graduated income tax? Take the poll and then explain your answer in comments, please. Also, “explain” doesn’t mean that you repeat somebody else’s talking points.

web polls

153 Comments

|

Obamacare rollout begins here

Monday, Jul 22, 2013 - Posted by Rich Miller

* From a press release…

Governor Pat Quinn today signed legislation that enacts a critical part of President Obama’s Affordable Care Act (ACA) by making Medicaid coverage available to all low-income adults in Illinois. Today’s action delivers on a major priority announced by Governor Quinn in his 2013 State of the State address and is part of his agenda to improve the health of the people of Illinois and increase access to quality health care. […]

Sponsored by State Senator Heather Steans (D-Chicago) and State Representative Sara Feigenholtz (D-Chicago), Senate Bill 26 will make Medicaid coverage available to adults with annual income below 138 percent of the federal poverty line, which is $15,860 for individuals and $21,408 for couples. The measure is expected to enroll 342,000 people by 2017. Currently, Medicaid is only available to children, their parents or guardians, adults with disabilities or seniors. Enrollment for the newly eligible population will begin Oct. 1 with coverage starting on Jan. 1.

Under the ACA, for the first three years, coverage of newly eligible adults will be 100 percent federally funded. The reimbursement rate will phase down to 90 percent by 2020. State officials estimate this will bring more than $12 billion in new federal funding to support the state’s health care system from 2014 to 2020. […]

Under Governor Quinn’s leadership, Illinois is also increasing access to health coverage through the Illinois Health Insurance Marketplace, another major feature of the ACA. The Marketplace, which also launches enrollment Oct. 1 with coverage starting Jan. 1, will be accessed through a user-friendly website where individuals, families and small businesses will be able to compare health care policies and premiums and purchase comprehensive health coverage. Those with income between 138 percent and 400 percent of the federal poverty level will receive subsidies on a sliding scale if they obtain coverage through the marketplace.

Discuss.

…Adding… From state Sen. Heather Steans…

Illinois’ share of the costs will total approximately $100 million per year in 2017-2019 and about $200 million in 2020 and each year thereafter.

19 Comments

|

* I asked the comptroller’s office last week to explain the state’s pile of unpaid bills. This is most of what I received via e-mail on July 18th…

(W)e have a General Funds backlog here of $5 billion and we estimate there is another $1.8 billion in the HIRF. So the overall backlog has actually had an uptick to around $6.8 billion.

When the Comptroller gives backlog estimates, she is talking about the unpaid bills being held by the state - not using a technical term “past-due.”

We started the day with unpaid vouchers totaling $3.829 billion in the General Revenue Fund.

In addition to the $3.829 billion backlog in the General Revenue Fund, there is another $1.1170 billion in the School Funds for a total General Funds Backlog of $4.999 billion.

Our oldest regular voucher is 25 June 2013, those vouchers are 16 working days in arrears.

Our oldest medical voucher is 17 June 2013, those vouchers are 21 working days in arrears.

I was also told last week that “Nothing in GRF is older than 30 days.”

* But here’s an example of how the official backlog doesn’t mean that there are no extremely past-due obligations…

Though state aid to the public school system has dwindled in recent years, that alone does not paint the whole picture of districts’ financial woes. Some school districts are waiting on grant money that is in some cases is six months late.

Grants and other “categorical” funds for school functions such as transportation and special education are a part of the $6.8 billion backlog of unpaid bills in Illinois. Without the funds, districts are being forced to tap into other funds and put an even larger strain on their tax levies.

* Meanwhile, this is from a recent Washington Post editorial…

A new survey by scholars at Boston College finds that state and local pension plans have $3.8 trillion in unfunded liabilities, even assuming strong rates of return.

That sentence was eventually corrected…

A new survey by scholars at Boston College finds that state and local pension plans have $3.8 trillion in liabilities, $1 trillion of which is unfunded.

* The mistake was initially caught by Dean Baker at the Center for Economic and Policy Research, which puts the problem into perspective…

)(T)o put this in terms that may be understandable to Post readers, the unfunded liabilities are 0.22 percent of projected GDP over the next 30 years. And, as I noted in my earlier post, most state and local governments are already funding at levels that are consistent with making up this shortfall so there will no required tax increases or spending cuts to meet these future obligations.

* Paul Krugman added his two cents…

But how big is that $1 trillion anyway? It still sounds like a big number, doesn’t it? Dean tries to compare it with projected GDP, which is one way to scale it. Here’s another.

You see, the Boston College study doesn’t just estimate assets and liabilities; it also estimates the Annual Required Contribution, defined as

normal cost – the present value of the benefits accrued in a given year – plus a payment to amortize the unfunded liability

And it compares the ARC with actual contributions.

According to the survey, the ARC is currently about 15 percent of payroll; in reality, state and local governments are making only about 80 percent of the required contributions, so there’s a shortfall of 3 percent of payroll. Total state and local payroll, in turn, is about $70 billion per month, or $850 billion per year. So, nationwide, governments are underfunding their pensions by around 3 percent of $850 billion, or around $25 billion a year.

A $25 billion shortfall in a $16 trillion economy. We’re doomed!

OK, there are some questions about the accounting, mainly coming down to whether pension funds are assuming too high a rate of return on their investments. But even if the shortfall is several times as big as the initial estimate, which seems unlikely, this is just not a major national issue.

* It’s still obviously a local issue, however. But the constant comparisons between Detroit and Chicago/Illinois need to stop…

Elizabeth Foos, municipal credit analyst at Morningstar Inc., said Chicago is seeing a job rebound in areas such as a banking, financial services, transportation and health care.

By some gauges, Detroit barely functions. Foos said 40 percent of the city’s streetlights don’t work and more than half of property owners didn’t pay taxes owed in 2011.

Debt levels: Chicago’s property and sales tax revenues are improving with the economy and the city’s debt load is manageable. Foos has published reports on both cities indicating that if their debts are compared to the taxable value of their property, Detroit’s burden is more than twice that of Chicago.

Population: Detroit has lost 60 percent of its population since its 1950s peak. For the first decade of the 21st century, Detroit was down 25 percent. For the same time periods, Chicago lost 25 percent and 7 percent of its population.

* In other news, this is from a press release…

Illinois Department of Human Services (IDHS) Secretary Michelle R.B. Saddler today announced that the state was awarded a $4.1 million bonus for its effective administration of the Supplemental Food and Nutrition Program (SNAP). Illinois was recognized for its accuracy rate of 98.3 percent, which ranked sixth in the nation in fiscal year 2012.

That’s a pretty darned high accuracy rate, but not good enough for some folks…

Since Illinois has seen an explosion in the number of people receiving food stamps, even a slight error costs taxpayers millions.

In this instance, a mistake rate of less than 2 percent means $50 million is misspent.

That’s the hard truth behind the press release lauding Illinois for having a 98.3 percent accuracy rate for its Supplemental Nutritional Assistance Program. […]

“The more people you add and the bigger the program gets, the more cumbersome it gets. The more difficult it gets to manage. And you have money being given away that shouldn’t be given away,” said Ted Dabrowski, vice President of policy for the Illinois Policy Institute.

Dabrowski’s point doesn’t make a whole lot of sense. The state has a pretty darned high accuracy rate as the program increases in size.

* Related…

* Illinois Comptroller Talks to Not-For-Profits About Budget: “We have taken all of our not for profits and we’ve moved them up. So when it comes to money in the till we’re going to pay you first,’ said the Comptroller.

* Sole buyer in state vendor program says business is good: Although VAP has been in the program since its inception, Reape said it has only really ramped up in the past six months. He said the company has purchased about $130 million worth of receivables from more than 100 vendors.

16 Comments

|

* Another senseless death…

The brother-in-law of State Senator Napoleon Harris was murdered on Chicago’s South Side Thursday night.

Police say someone fired several shots at Andre Bunton as he sat in his car in the South Loop.

At least one hit him in the chest, killing him.

Friends say Bunton was driving a brand-new Mustang, and someone may have tried to carjack him.

* Sun-Times…

Sean Rogers, 36, Bunton’s friend for about 15 years, and Jonathan Harris said Bunton had been in Chicago visiting friends. He’d had dinner near where he was shot, both men said. Just before he was shot, Bunton was on the phone and the person he was speaking with heard a commotion and then the sound of gunfire, Jonathan Harris and Rogers said.

Jonathan Harris said Bunton had a brand new Mustang convertible and had the top down to enjoy the summer night.

“We think maybe somebody just tried to carjack him,” Jonathan Harris, 31, said. “He wasn’t the type of guy to be getting into it with people.”

Friends and family said they were shocked by what they called “senseless violence” and the death of a man soon to be a new father.

“Now you can’t even feel comfortable and safe anywhere,” Jonathan Harris said

It’s just heartbreaking.

* Luckily, nobody was seriously hurt during a Michigan Ave robbery….

Two visitors to Chicago received a rude welcome to the city Friday when one was robbed by a group of city teens and the other was punched while trying to help, officials said.

The two visitors – a 15-year-old Florida girl and a 51-year-old Michigan woman – were both walking on the Mag Mile Friday evening when the older woman was robbed of her iPhone by a group of eight juveniles, officials said. […]

They were about 15 feet behind when they noticed three boys “creeping toward” the women, and one of the boys appeared to gesture to someone else, said the 15-year-old Florida girl.

“All of a sudden seven more teens came and got close to the women,'’ she said.

Then she noticed one of the boys ripping an iPhone from a pocket of one of the three women, so forcefully that the victim said: “Give it back,'’ but they denied they had it, said the girl.

“The rest of them swarmed around her to disorient her,'’ and began to become more physical and push the women against a small metal fence around some shrubs, the girl said.

With a rush of adrenaline, the Florida girl said she decided to step in, against her mother’s wishes.”

* Meanwhile, Sen. Kirk backed off his mass arrest proposal…

Illinois U.S. Sen. Kirk made headlines at the end of May when he proposed arresting 18,000 members of the gangster disciples.

Representative Bobby Rush responded by telling the Chicago Sun-Times Kirk’s idea was “headline grabbing” and an “upper-middle-class, elitist white boy solution to a problem he knows nothing about.”

In the wake of the heated exchange of words, Kirk and Rush met and Kirk has pulled away from his anti-gang proposal.

“Bobby Rush has been somewhat correct in his criticism of me that a mass arrest all at once is not actually that practical,” Kirk said Thursday in an interview with WBEZ.

* Related…

* 4 dead, 9 wounded in city shootings

* The data behind Chicago’s gun crimes: While automatic and assault rifles have been the focus of federal legislative efforts, Chicago largely has a handgun problem. And that handgun problem goes well beyond the homicide numbers. Last year’s homicides totaled 516, with 441 of those resulting in a death by gunshot. There were still 11,886 gun related crimes in Chicago that didn’t end in a homicide.

* Some Municipalities Race To Pass Gun Bans As Deadline Looms

* By deadline, few Illinois towns pass assault weapons bans

34 Comments

|

Who’s stunting now?

Monday, Jul 22, 2013 - Posted by Rich Miller

* For a guy who constantly accuses Gov. Pat Quinn of staging political stunts, this sure looks like a stunt to me. AP…

Former White House Chief of Staff Bill Daley is calling on Gov. Pat Quinn to hold around-the-clock talks to resolve the state’s $97 billion pension shortfall.

Daley will hold a news conference in Chicago on Monday to urge the governor to get more aggressive in trying to solve the worst-in-the-nation crisis. […]

Daley campaign spokesman Pete Giangreco told The Associated Press on Monday that “a confluence of issues” in the last week has increased the urgency for Illinois lawmakers to solve the state’s pension problem.

Giangreco says that includes the lowering of Chicago’s bond rate, Detroit’s bankruptcy and a higher Illinois unemployment rate.

Tossing in Detroit sure makes this look like a stunt to me.

* From last week…

After a bill-signing Thursday, Governor Pat Quinn would not comment on pensions. But his democratic primary opponent Bill Daley wants the governor to convene a 24-7, as-long-as-it-takes legislative leaders meeting.

“I mean, he’s got a big house in Springfield, the mansion. They could all just stay in there and just pound this thing out,” gubernatorial candidate William Daley said.

Apparently, Daley has not faith in the pension reform conference committee. I actually think they’re making some real progress. This issue needed to be taken away from the leaders’ direct control after the disastrous session-ending stalemate. Not that the leaders aren’t controlling things behind the scenes, mind you. I just think that the committee allows for a compromise that the tops couldn’t have agreed to during the spring session, due to the numerous personal and political conflicts between the leaders.

40 Comments

|

Collins backs out of Metra probe

Monday, Jul 22, 2013 - Posted by Rich Miller

* NBC 5…

The former federal prosecutor set to be appointed Monday to investigate allegations of wrongdoing at Metra has backed out, officials announced.

Metra’s board members said Friday it would bring in former Assistant U.S. Attorney Patrick Collins to investigate a scandal that centers around ousted Metra CEO Alex Clifford, but transit officials said Collins declined the job late Sunday.

“I am personally disappointed that Patrick Collins cannot undertake this endeavor,” Chairman Brad O’Halloran said in a statement. “I felt he would have done an excellent job. I remain committed to interviewing other lawyers with outstanding reputations and investigative skills, and to once again ask the board for its approval.”

* Tribune…

Late Sunday, Perkins Coie, Collins’ law firm, told Metra it had a “potential conflict” and that Collins, a partner, could not take on the case, according to a statement by Metra.

Metra’s board of directors was to have met this morning to discuss and potentially approve Collins’ hiring to conduct an investigation into the allegations raised by former Metra CEO Alex Clifford in an April 3 memo and at a July 17 Regional Transportation Authority meeting.

The statement did not specify what the conflict was.

In an e-mail to Metra from Collins quoted in the statement, Collins said that an “initial conflict check” last week came back clear, but that subsequently, Perkins Coie was “made aware of additional conflict issues.”

12 Comments

|

Quinn isn’t the only one with serious baggage

Monday, Jul 22, 2013 - Posted by Rich Miller

* From the New York Times’ national political correspondent on the day that Lisa Madigan announced she wouldn’t be running for governor…

On the surface, it sure looks that way. Gov. Quinn’s poll numbers are not good at all. But it’s not like he’s gonna just roll over and die for Daley. I wanted to see how vulnerable Daley could be to a full-on assault. So, we ran a poll.

* My weekly syndicated newspaper column…

Gov. Pat Quinn is leading his sole Democratic primary rival, and challenger Bill Daley will have some serious problems with his blue chip résumé, according to a new Capitol Fax/We Ask America poll.

The poll of 1,394 likely Democratic primary voters found Quinn leading Daley by five points, 38-33. That’s exactly where the two stood in a January poll. A June poll had Daley leading Quinn by a point, 38-37, but since then Quinn has made some popular moves, including vetoing legislative salaries out of the budget and using his veto powers to rewrite the concealed carry bill.

The most recent poll was taken July 17th, a day after Attorney General Lisa Madigan shook up the race by announcing her decision not to run for governor. It had a margin of error of +/- 2.62 percent. Cellphones made up 28 percent of those called.

28 percent of likely primary voters were undecided, suggesting that there is plenty of room for movement by either man and possibly an opening for someone else to enter the race.

According to the poll, Quinn leads among women by seven points, 38-31 and among men by two points, 40-38. Quinn has a huge 47-27 lead among African-Americans and a 45-36 lead among Latinos. Daley leads 37-35 with white Democrats. Daley leads by only a point in the suburban collar counties and by six points Downstate. Quinn has a 15-point lead in Chicago and a 9-point lead in Cook County.

But a question crafted to mimic a campaign attack shows a potentially killer Daley weakness. Daley was the Midwest chairman of JPMorgan Chase, a “too big to fail” bank when it received $25 billion in federal bailout money, according to the CNN Money website. The company also agreed to settle with the federal government on federal mortgage fraud and wrongful foreclosure charges.

Because I wanted to see how Democratic voters would react to a likely campaign attack, the question posed to them was neither fair nor balanced. Campaigns do this sort of thing all the time to see where their weaknesses are, so it’s not a radical concept by any means.

Daley has several very big negatives, according to people in both parties who have polled or focus grouped the race. His family’s Chicago legacy is one of Daley’s biggest liabilities and, I’m told, the easiest to understand. His bank’s investment in the hugely controversial Chicago parking meter deal is another big hit. Daley’s lead role in the passage of the North American Free Trade Agreement doesn’t play well with labor union members. But after consulting several political pros, some of whom have been, are or may eventually be involved in attacking Daley, I decided to go with a question about JPMorgan Chase.

It is, as I said, not a fair question, but with Gov. Quinn undoubtedly planning a brutal populist assault on Daley, it’s probably close to something you’ll eventually see in an ad, although I didn’t include the fact that Daley’s bank bought a fleet of new jets a few weeks after receiving its federal bailout, nor could I use faces and voices of Illinoisans who were wrongly foreclosed upon.

“Would you be more likely, or less likely to vote for a Democratic gubernatorial candidate who ran a major bank that received federal bailout money, foreclosed on large numbers of Illinois homeowners and engaged in predatory subprime mortgage lending?” voters were asked.

Unsurprisingly, that question moved the needle in a big way. According to the poll, a whopping 73 percent of Democrats were less likely to vote for the candidate. Results like that indicate the issue has major traction. Just 16 percent said it didn’t make any difference and another 11 percent said it made them more likely (possibly a negative reaction to the harsh nature of a question about a fellow party member).

The question proved “devastatingly effective,” said pollster Gregg Durham. The responses “will certainly give Mr. Quinn a political harpoon that could cause significant damage.”

Yes, Gov. Quinn has serious problems. That’s why the incumbent is only receiving the potential votes of 38 percent of his own party members. The June poll found that a mere 33 percent of Democrats approved of his job performance, for crying out loud.

Incumbents with lousy poll numbers like Quinn have no other choice but to attack, attack, attack. And Daley will definitely provide a target rich environment for the governor.

Subscribers have full crosstabs.

* Of course, Quinn won’t be the only one on the attack…

“On the day after, the unemployment numbers say we’re the second-worst in the country,” Daley said of Quinn’s construction tour. “He can cut all the ribbons and dig all the shovels and govern by press conferences or stunts … but that doesn’t make for a game plan or results.”

Daley said Quinn’s method of operating is familiar. “That’s what you’ve seen in the former governor (Blagojevich), and this governor — press conferences and governing by event and stunts and stuff like that. That’s not how you govern as a governor or as a leader, and that’s why nothing gets done.” […]

“He was (Blagojevich’s) lieutenant governor for six years. He ran for re-election with him. If (Blagojevich) was so evil and bad from a policy perspective and a government perspective and bad on the political perspective … why did he run for re-election with the guy?” Daley asked, adding that Quinn has been part of 12 years of failed leadership atop Illinois government.

In October 2006, months after it was revealed that federal investigators were investigating “endemic hiring fraud” in Blagojevich’s administration, Quinn defended Blagojevich and said the then-governor has “always been a person who’s honest and one of integrity.” […]

Daley said, “(Quinn) didn’t think enough of himself or the people of Illinois to say that this (relationship) isn’t working with this governor, ‘I quit’?”

Discuss.

27 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|