Taxi industry suffers twin blows

Monday, Sep 29, 2014 - Posted by Rich Miller

* As noted below, Gov. Quinn celebrated with Uber today as it announced it would add 420 jobs in Chicago…

Uber Technologies Inc., is keeping an informal political deal it had struck with Gov. Pat Quinn and, as a result, Chicago will be getting hundreds of new Midwest headquarters jobs.

The big ride-sharing firm today announced that it will add 420 jobs to its Central Region headquarters in Chicago by the end of 2016, more than quadrupling the number of non-driving staffers it has here now.

Uber had dangled the possibility of such jobs while Mr. Quinn was considering signing a bill that Yellow, Checker and other conventional cab companies had been pushing to impose tighter rules on companies that dispatch vehicles via cell phone apps. And now that Mr. Quinn has done so, the company says it’s moving ahead.

The bill’s sponsor, Rep. Michael Zalewski (D-Riverside), says he has enough votes to override…

Noting that the bill passed the Il. House with 80 votes and got a “substantial” majority in the Senate, Zalewski predicted that the votes will be there for an override.

“This is a public safety issue. You have Uber-X drivers riding all over Northeastern Illinois who are not subject to proper background checks and don’t have enough insurance. We need to make sure riders are safe,” Zalewski said. […]

Zalewski scoffed at the suggestion that an override of the governor’s veto could cost Chicago 420 new jobs.

“Uber is an innovative, strong company that wants to grow in Chicago. They just feel that government regulation will interfere with their business model and make them less successful than they are now. I disagree. They’ll be just fine,” he said.

* But the US Attorney’s office just sent out this press release..

CHICAGO TAXICAB OPERATOR INDICTED AND ARRESTED FOR ALLEGEDLY CONSPIRING TO FALSIFY TITLES OF SALVAGED AND REBUILT TAXIS

CHICAGO ― A Chicago used car broker and taxicab operator was arrested today after being indicted on federal charges for allegedly causing at least 180 vehicles that were salvaged or rebuilt to illegally obtain clean titles from Indiana and Illinois and, as a result, to illegally operate as licensed and registered taxicabs in the City of Chicago.

The defendant, ALEXANDER IGOLNIKOV, 67, of Northbrook, was charged with one count of conspiracy and two counts each of interstate transportation of false automobile titles and possession of false auto titles in a five-count indictment that was returned by a federal grand jury on Aug. 27 and unsealed today following his arrest.

Ignolikov was scheduled to appear at 3 p.m. today before U.S. Magistrate Judge Jeffrey T. Gilbert in Courtroom 1386 in U.S. District Court.

Igolnikov, also known as “Alexandr Igolnikov” and “Alex,” was the owner of Seven Amigos Used Cars and vice president of Chicago Elite Cab Corp., which operated taxis under city taxi medallions managed by Chicago Elite Cab and related entities affiliated with Chicago Carriage Taxi Company. City taxi medallion rules prohibit any vehicle that was ever issued a “salvage” or “rebuilt” title in any state from being used as a taxicab in Chicago.

The indictment alleges that between 2007 and April 2010 Ignolikov conspired with three unnamed auto brokers, two in Indiana and one in Illinois, to purchase vehicles with salvage titles from online auction sites; fraudulently obtain either clean or rebuilt Indiana titles for those vehicles by submitting false paperwork to the Indiana Bureau of Motor Vehicles; and then using those re-issued Indiana titles to obtain clean Illinois titles, concealing that the vehicles were previously issued salvage or rebuilt titles.

According to the indictment, in many instances, Ignolikov agreed with three auto brokers to have the damaged vehicles towed from the online auctions sites’ yards in out-of-state locations to the premises of Seven Amigos and Chicago Carriage near 26th Street and South Wabash Avenue in Chicago, where the vehicles would be repaired.

In addition to submitting false paperwork concealing the vehicles’ history and damage to Indiana authorities, Ignolikov and the brokers also submitted a false affidavit certifying that an Indiana law enforcement officer had personally examined the vehicles and verified certain identifying information, the charges allege. In reality, no officer had examined the vehicle and the affidavit of a police officer was signed by unnamed Officer A for a fee, or unnamed Officer B, or other individuals without any physical inspection, according to the indictment.

In some instances, based on the allegedly false towing paperwork and false police affidavits, the Indiana Bureau of Motor Vehicles issued clean titles to various auto brokers for vehicles that were previously issued salvage titles. In other instances, other individuals obtained Indiana rebuilt titles through fraud and then placed stickers on those titles concealing that the titles identified the vehicles as being rebuilt. After obtaining either a clean or rebuilt Indiana title for the vehicles, Ignolikov purchased the vehicles in the name of Seven Amigos, Chicago Elite Cab, or other businesses and paid a premium above the purchase price in exchange for the brokers’ work in securing the clean or rebuilt Indiana titles, the indictment alleges.

Finally, Ignolikov and his business associates allegedly used the clean and rebuilt Indiana titles to obtain clean Illinois titles for the vehicles, and later concealed from the City of Chicago the fact that the vehicles were previously issued salvage or rebuilt titles, which prohibited them from being used as taxis.

So much for the “public safety” argument.

24 Comments

|

|

Comments Off

|

* From the Rauner campaign…

Taxpayer Red Alert: Quinn Doubles Down on Lame Duck Tax Hike

“Pat Quinn disrespects every Illinois family by pledging to ram an income tax increase down their throats the day after he gets thrown out of office. Bruce Rauner is going to win on November 4th and he’s going to do all he can to stop a lame duck governor and lame duck legislators from raising taxes.” - Rauner campaign spokesperson Mike Schrimpf

Bruce Rauner’s campaign today issued the following statement in response to Pat Quinn’s decision to double down on his pledge to push through a permanent income tax increase during the lame duck session of the General Assembly:

“Pat Quinn disrespects every Illinois family by pledging to ram an income tax increase down their throats the day after he gets thrown out of office,” Rauner campaign spokesperson Mike Schrimpf said. “Bruce Rauner is going to win on November 4th and he’s going to do all he can to stop a lame duck governor and lame duck legislators from raising taxes.”

Quinn’s comments came after Bruce Rauner this morning called on Illinois House Speaker Michael Madigan and Senate President John Cullerton to block any tax votes until the new General Assembly is seated in January.

Um, wait. Didn’t Rauner say earlier today that he could also push for a tax hike?…

Whether it’s “lame ducks” or “new ducklings” voting for the thing, a tax hike is a tax hike, right?

*** UPDATE *** Quinn campaign…

BREAKING: Bruce Rauner’s Conversion on Income Tax Issue is Further Evidence He Can’t Be Trusted

CHICAGO - Billionaire Bruce Rauner, under fire for dodging responsibility for his business failures as a trial targeting his deadly nursing home chain presses on, is now conceding that he also is interested in maintaining the income tax rates.

Rauner now says he’s interested in the “possibility” of retaining income tax levels next year that he previously vowed to eliminate. But his budget plans still don’t add up. Below is the statement of Quinn for Illinois Deputy Press Secretary Izabela Miltko in response:

“Bruce Rauner cannot be trusted. Mr. Rauner is not only changing his story on his involvement with his deadly nursing home chain - now he’s changing his story about his tax plan.

“Mr. Rauner’s tax plan released earlier in the campaign would lay off 1 out of every 6 teachers and deeply reduce vital services protecting the most vulnerable.

“With the people of Illinois onto his game, Bruce Rauner is now acknowledging that he is interested in maintaining the income tax rates next year. Meanwhile, he’s running millions of dollars in negative attack ads to smear the Governor for the exact same position. How dishonest.

“Rauner’s hoax does not change the reality that the rest of his plan is predicated on harming the economic security of the middle class and irreparably damaging our education system over future years all to put millions more dollars in his own pocket.

“Mr. Rauner’s late-hour conversions still fail to provide a long-term solution to the state’s finances, as Governor Quinn has responsibly done.”

45 Comments

|

Question of the day

Monday, Sep 29, 2014 - Posted by Rich Miller

* The Sun-Times has a story about political campaign buttons…

It’s slim pickings this year for Illinois collectors, despite a race for governor and Chicago mayor. Area collectors say they haven’t come across many buttons made by fans of the candidates.

Neither Gov. Pat Quinn nor Mayor Rahm Emanuel’s re-election campaigns are producing buttons. Republican gubernatorial candidate Bruce Rauner’s campaign didn’t respond to button inquiries, and Ald. Robert Fioretti’s (2nd) mayoral campaign hasn’t made any yet. […]

There’s not huge demand for local candidates’ buttons, but collections of Illinois mayoral candidates and gubernatorial candidates do exist. A campaign might make some pins, but collectors say what really fleshes out a cache are buttons made by candidates’ grass-roots supporters.

Marc Sigoloff of Springfield is known among Illinois collectors for his focus on Barack Obama buttons. At about 5,400 buttons, it is the largest Obama collection in existence, he said.

I have a smallish button collection. Nothing fancy. My dad, however, has a huge collection. My personal favorite was my “Honkies for Harold” button from the 1983 mayoral campaign which I somehow lost years ago. I saw it on a TV news story and asked a Chicago friend to get me one.

* The Question: What’s your own favorite political button and why? Bonus points for telling us a little about your own collection.

46 Comments

|

* HuffPo did a big Mike Bost document dump over the weekend…

Illinois state Rep. Mike Bost (R-Murphysboro) has made a name for himself throwing extraordinary tantrums during legislative sessions. But he doesn’t appear to have contained his notorious temper to the statehouse, according to a review of court and police records obtained by The Huffington Post.

* The one I’ve received the most e-mail about…

The earliest episode dates back to 1986, when a neighborhood beagle named Rusty bit Bost’s 4-year-old daughter. The report filed by animal control officials indicates that the girl provoked the attack by chasing the dog. She ultimately had to get 19 stitches on her face.

According to court records, Bost was displeased that authorities would not be able to deal with the 10-year-old dog immediately. So he got his handgun, drove to Rusty’s owner’s home, and shot the dog to death while it was penned in an enclosure.

Neighbors were “very alarmed and disturbed,” according to the police report, but a jury eventually found Bost not guilty of breaking any laws. The local paper reported the case under the headline “Area man acquitted in dog killing trial.”

* More deets ffrom the ever-snarky Wonkette…

The dog was quarantined in a pen at its owner’s home so it could be tested for rabies, but Bost didn’t feel that local authorities were taking quick enough action, so he drove to the trailer park where the dog was and Second-Amendmented the beagle to death, just as Adams and Jefferson would have wanted. According to the police report, neighbors of the dog’s owners were “upset and frightened” by the shooting because it took place within 20 feet of their trailers manufactured housing, as if they didn’t understand that the price of Liberty is eternal ricochets.

Discuss.

* Other stuff…

* Guest view: Bost shouts at rules he helped create

* New NRCC ad hits the 12th CD: Bill Enyart’s been a bust

* Foster, Senger clash on taxes, job creation

* Illinois a congressional battleground state

101 Comments

|

* Agreed…

Huh?

* Yep, it’s true. The press release…

Governor Quinn Announces the Wait is Over for Chicago’s First Olive Garden Restaurant

New Restaurant Bringing 170 Jobs, Never-Ending Pasta Bowl and Unlimited Breadsticks to Help Feed Illinois’ Growing Workforce

CHICAGO – Governor Pat Quinn today was joined by local officials and employees for the opening of a new Olive Garden restaurant on West Addison Street in Chicago. The new restaurant employs 170 people, who join the 13,800 new private sector jobs created throughout Illinois during August. Today’s event is part of the Governor’s agenda to create jobs and drive Illinois’ economy forward.

“Illinois’ restaurant industry is thriving and establishments like Olive Garden are helping drive our economic comeback,” Governor Quinn said. “While we have more work to do, more people are working today than at any time in the past six years. This is good news for people across the state and it is thanks in part to companies like Olive Garden who are employing hardworking residents and growing our workforce.”

The new Chicago restaurant brings 170 new jobs to the community. Olive Garden, owned by Darden Restaurants, Inc., was created in 1982 and has more than 800 restaurants in the United States and Canada. Darden Restaurants has worked to open up an additional 200 restaurant locations across their brands since 2011.

“Olive Garden would like to thank Governor Quinn and the City of Chicago for their outstanding support in helping us open our first restaurant here,” Remoun Abraham, general manager of the Addison Street Olive Garden said. “We’re excited to join this vibrant community and help create local jobs, and look forward to welcoming and serving our guests.”

I’ve asked the governor’s office if any state incentives were used here. I’ll let you know what they say.

*** UPDATE 1 *** Some commenters are making some interesting points about the restaurant chain’s parent company, so I did a little Googling. From February of this year..

Several big restaurant companies — including YUM! Brands, (YUM) which owns Taco Bell, KFC, Pizza Hut; Darden Restaurants (DRI), which owns Olive Garden and Red Lobster; and Cracker Barrel Old Country Store (CBRL) — directly lobbied against a bill to raise the minimum wage last year, according to Senate lobbying reports.

From 2012…

Darden Restaurants Inc, best known for its Olive Garden and Red Lobster chains, was hit with a lawsuit in federal court in Miami on Thursday accusing one of the largest U.S. restaurant operators of violating federal labor laws by underpaying workers at its popular eateries across the country.

The lawsuit accuses the Orlando, Florida-based company of failing to pay federally mandated minimum wages and forcing its waiters and waitresses to work “off-the-clock” before or after their shifts.

Filed under the Fair Labor Standards Act, it also claims many Darden employees have failed to receive appropriate overtime wages for work in excess of 40 hours per week.

Seems like an odd company to be promoting, no?

*** UPDATE 2 *** The governor’s press office says there were no state incentives.

*** UPDATE 3 *** Greg Hinz…

Uber Technologies Inc., is keeping an informal political deal it had struck with Gov. Pat Quinn and, as a result, Chicago will be getting hundreds of new Midwest headquarters jobs.

The big ride-sharing firm today announced that it will add 420 jobs to its Central Region headquarters in Chicago by the end of 2016, more than quadrupling the number of non-driving staffers it has here now.

Uber had dangled the possibility of such jobs while Mr. Quinn was considering signing a bill that Yellow, Checker and other conventional cab companies had been pushing to impose tighter rules on companies that dispatch vehicles via cell phone apps. And now that Mr. Quinn has done so, the company says it’s moving ahead.

“When policy makers do their homework, they soon learn that we offer access to a safer ride for everyone and bring a number of benefits to cities including higher incomes for drivers, service to neighborhoods and taxi companies ignore and fewer drunk driving incidents,” Uber Central Regional Andrew MacDonald said in a joint press conference with a beaming Mr. Quinn.

52 Comments

|

Rauner’s press conference adventures continue

Monday, Sep 29, 2014 - Posted by Rich Miller

* From the twitters…

* And that brings us to my weekly syndicated newspaper column…

Just a quick note to Bruce Rauner: The next time you try to claim that Gov. Pat Quinn is “personally” under federal investigation (an allegation that, as far as anyone can tell, is not true), it’s probably best not to say it while standing next to a different governor who actually is “personally” under federal investigation.

Rauner held a relatively brief press conference last week to talk about Chicago’s violence problem with New Jersey Gov. Chris Christie at his side. Rauner attempted to claim that Quinn was somehow responsible for the murder of a nine year old boy by a convict on probation - even though it appears right now that all state laws and procedures were followed. And not mentioned, of course, is that Newark, NJ has a murder rate almost twice that of Chicago, which sorta undercut Christie’s contention that Gov. Quinn had “failed” to protect Illinois’ public safety.

Rauner was then asked about the growing scandal of an alleged nursing home “bust-out” scheme, which includes the bizarrely sordid story of how the troubled company was sold off to a pathetic old man who thought he was buying computer parts and instead wound up with an empty shell corporation that ended up being responsible for about a billion dollars in wrongful death judgments.

The candidate denied any personal knowledge of the company’s problems (he never seems to know about his companies’ many, many problems), denied “lying” to the Chicago Tribune when he said he had only served on the nursing home company’s board of directors for a year (the Tribune eventually discovered his tenure was four times longer than that) and claimed that Quinn was “trying to create a distraction” by even bringing up the subject. Actually, Quinn running TV ads last week on a different Rauner company in Georgia that was hit with federal Medicaid fraud charges. Perhaps Rauner is confusing his companies. The nursing home story is an issue now because a federal bankruptcy trial, which started last week, is attempting to sort out who is responsible for paying what to the surviving families of dead nursing home residents.

The gubernatorial contender then attempted to turn the tables on Quinn by claiming the governor is personally under federal investigation for that 2010 anti-violence initiative. But Rauner’s campaign has repeatedly pointed to the fact that their candidate was never even deposed in the nursing home bankruptcy proceeding as “proof” that he has no responsibility. Using Rauner’s very own standard, since Quinn’s e-mails haven’t been directly subpoenaed by the feds he can also legitimately claim to be innocent.

And that’s when a reporter pointed out that Gov. Christie (whom Rauner referred to last week as “one of the greatest public servants in America”) is personally under federal investigation for that bridge closing scandal thing. It’s hardly the next Watergate, and appears freakishly overblown to my eyes, but a federal probe is a federal probe, I suppose, so it was a fair point. Rauner refused to respond and Christie gave the reporter the evil eye.

Not all, but most Chicago reporters don’t know much about state governance, and they know even less about state budgeting. So, Rauner has been able to avoid tough questions about things like his “business reforms” that he refuses to detail, or his proposed massive spending hikes coupled with even bigger tax cuts that will produce budget holes in the billions, etc. That’s where his highly polished, tried and true talking points do him the most good - with reporters who don’t understand the details and, for the most part, don’t care anyway.

But that phase of the campaign is now behind us. What’s left is Chicago reporters pushing Rauner to comment on the issues of the day as defined by them. And when he has no poll-tested talking points to rely on, he’s proving to be a sorely inadequate candidate.

Quinn’s campaign often sends out its lt. governor candidate Paul Vallas when it needs an attack dog. Rauner’s running mate Evelyn Sanguinetti, however, is most definitely not capable of handling herself with Chicago’s notoriously aggressive reporters. She’s just not good at it and they’d eat her for lunch. For as lacking as Rauner is, Sanguinetti is just not an option. So the top guy is left to do all the dirty work.

Discuss.

31 Comments

|

|

Comments Off

|

Ballot initiative money starts to flow

Monday, Sep 29, 2014 - Posted by Rich Miller

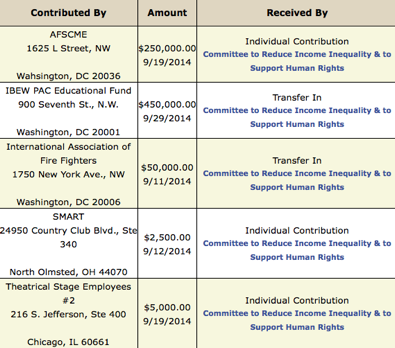

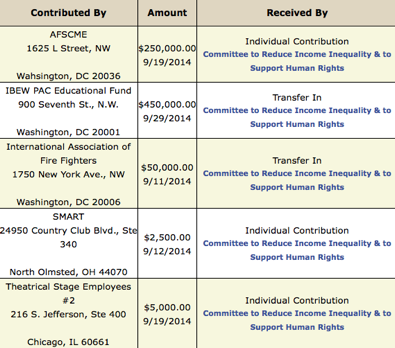

* A new PAC was formed earlier this month called the “Committee to Reduce Income Inequality & to Support Human Rights”…

Purpose: To support proposed constitutional amendments on Crime Victims Bill of Rights & prohibiting election discrimination & to support ballot initiatives on increasing the minimum wage, increasing the income tax on millionaires to fund education

Between Sept.11th and today, it has raised a total of $757,500…

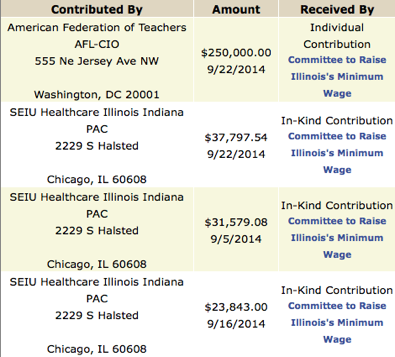

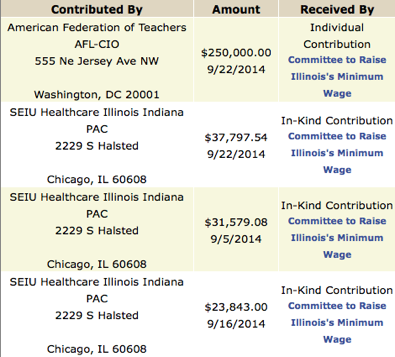

* Since June 20th, the Committee to Raise Illinois’s Minimum Wage has brought in $602,853.41, including these top givers…

* Other ballot initiative committees which haven’t yet started reporting big contributions (although many or even most probably will) include Personal PAC’s Save Birth Control in Illinois committee, Planned Parenthood’s Illinois Votes for Birth Control, SEIU’s Raise Chicago, the IEA’s Fairness for Working Families, Blake Sercye’s Committee to Protect Illinois Voting Rights and the Marsy’s Law for IL Committee.

11 Comments

|

*** UPDATE *** As far as I can tell, the Rauner campaign is right about the first point in its brief response…

The Quinn campaign is essentially double and triple counting the same shares of stock.

The SEC’s rules for determining “beneficial ownership” of stock state that a parent company is deemed to have “beneficial ownership” of any stock owned by subsidiaries. So GTCR Golder Rauner, LLC is considered to have “beneficial ownership” of the shares of stock held by its subsidiary, GTCR Partners VII, LP. GTCR Partners VII, LP, in turn, owns two other funds, and is deemed to have “beneficial ownership” of their shares.

GTCR Funds Owned 18.4 Percent Of HomeBanc As Of February 2006. (SEC Schedule 14A, HomeBanc Corp., 4/20/06)

HomeBanc Did Very Little Subprime Lending. “HomeBanc says the concerns about borrowers’ ability to repay, particularly subprime borrowers, hurt the entire industry. And though HomeBanc did little subprime lending — less than 1 percent of the roughly $5 billion in loans it made last year were in that segment — nervous lenders that HomeBanc relied on to fund loans started retrenching. Wall Street investors who purchased pools of loans through the mortgage-backed securities also retreated.” (Peralte C. Paul, “HOMEBANC: Lender Had Little Margin For Error,” Atlanta Journal Constitution, 8/12/07)

[ *** End Of Update *** ]

* If you saw the Bears game yesterday (and my condolences if you did), then you probably saw a new ad from Gov. Pat Quinn’s campaign. From a press release…

A new television ad released today highlights a Bruce Rauner company acquired in 2000 that gave its CEO a massive exit package even as its risky lending practices led it to bankruptcy in 2007.

At HomeBanc Mortgage, Rauner’s hand-picked CEO- a “superstar” still listed on the GTCRauner Web site- was given nearly $5 million. In contrast, the 1,100 laid-off employees were given $20 gift cards to the Publix supermarket, paid for through their own voluntary paycheck deductions.

HomeBanc is just one of at least 12 Rauner firms that declared bankruptcy under his failed leadership, while Rauner and his partners took the money and ran.

Another Rauner failure is TransHealthcare Inc., a chain of deadly nursing homes owned and operated by Rauner and his partners that is facing an ongoing trial in Florida bankruptcy court over more than $1 billion in judgments for 6 wrongful deaths. Rauner has said he wants to run state government like he ran his business.

* The ad…

Whew.

* Script…

“After billionaire Bruce Rauner took millions out of HomeBanc Mortgage, it went bankrupt. Eleven hundred employees lost their jobs. The CEO? He was given a five million dollar bonus to tide him over. The 1,100 employees who lost their jobs? They got a $20 gift card. That’s right, newspapers reported it. And while that may not say everything about Bruce Rauner, it says a lot.”

* The spot generated a furious push-back from the Rauner campaign…

FACT CHECK: PAT QUINN’S MOST DESPERATE FALSE ATTACK YET

“This is Pat Quinn’s most desperate false attack yet and a reminder that Quinn will do or say anything to distract voters from his plan to raise taxes on every Illinois family right after the election. Pat Quinn’s 67% income tax hike already cost us jobs and stole one week of pay from the average Illinois worker. Pat Quinn can’t tell the truth about Bruce and he also can’t wait to raise your taxes.” - Rauner spokesperson Mike Schrimpf

False Quinn Ad Script: “After billionaire Bruce Rauner took millions out of Homebanc Mortgage, it went bankrupt. 1,100 employees lost their jobs. The CEO? He was given a $5 million bonus to tide him over. The 1,100 employees who lost their jobs? They got a $20 gift card. That’s right, newspapers reported it. And while that may not say everything about Bruce Rauner, it says a lot.”

Fact Check Summary: Neither Bruce Rauner nor GTCR ever took millions out of HomeBanc Mortgage. HomeBanc went bankrupt in 2007; the last date a GTCR employee was on its board was 2004. HomeBanc was consistently rated as an excellent place to work and its CEO was terminated with a severance package months before the company went bankrupt. Regardless, neither Rauner nor GTCR had anything to do with HomeBac’s layoffs or employee severance pay.

QUINN LIE

“After billionaire Bruce Rauner took millions out of HomeBanc Mortgage, it went bankrupt.”

THE FACTS

In 2000, GTCR Partnered With Patrick S. Flood To Establish HomeBanc Mortgage. “First Tennessee National Corporation (FTNC)(NYSE:FTN) announced today that its mortgage banking affiliate First Horizon Home Loan Corporation (FHHLC) signed and closed the sale of its HomeBanc Mortgage division to an investor group led by GTCR Golder Rauner LLC of Chicago and Patrick S. Flood, HomeBanc president.” (Press Release, “First Tennessee Sells HomeBanc Mortgage Division,” Press Release, 5/1/00)

GTCR And Flood Grew HomeBanc Into A Thriving Business, And Took The Company Public In 2004. “The parade of mortgage companies looking to become real estate investment trusts is growing. The latest entrant is HomeBanc Mortgage Corp. here. But unlike the predominantly subprime companies that announced they are converting or looking to convert, HomeBanc has more in common with New York Mortgage Corp., which is another privately held company that is going public by converting to a REIT. In a statement issued by HomeBanc, the new REIT will be called HomeBanc Corp., and the public offering of stock will take place in the late spring or early summer.” (Brad Finkelstein, “Retail Lender HomeBanc To Become REIT,” American Banker, 4/04)

GTCR Did Not Take “Millions Out Of HomeBanc”

From 2000 To 2004, HomeBanc Paid GTCR A $8,333 Monthly Management Fee - An Aggregate Total Of $425,000. “Prior to our initial public offering, GTCR was the majority owner of HBMC Holdings, and as part of its investment in HBMC, we agreed to pay a monthly management fee of $8,333 for management, advice and consulting, including attendance by GTCR representatives at our board meetings, and strategic, operating and financial advice to HBMC. We used approximately $425,000 of the net proceeds from our initial public offering to pay all outstanding accrued management consulting fees due to GTCR.” (SEC Form S-11, HomeBanc Corp, 1/7/05)

Following HomeBanc’s Public Offering, GTCR Was No Longer The Majority Shareholder And Ceased Receiving Management Fees. “As the result of our initial public offering and our related reorganization, GTCR no longer holds a majority interest of our organization, and we no longer accrue or pay any management fees to GTCR.” (SEC Form S-11, HomeBanc Corp, 1/7/05)

HomeBanc Went Bankrupt In 2007, Three Years After It Became A Publicly-Traded Company And Was Out Of GTCR’s Control

HomeBanc Filed For Chapter 11 Bankruptcy In August Of 2007. “Regional mortgage lender HomeBanc Corp has filed for bankruptcy protection, the latest casualty of a housing market that continues to weaken. The Atlanta-based company filed a Chapter 11 petition dated Thursday in U.S. Bankruptcy Court in Delaware. In the filing, the company checked off a box listing estimated assets and liabilities of more than $100 million each.” (”Mortgage Lender Homebanc Files For Chapter 11,” The Associated Press, 8/10/07)

GTCR Stopped Having Representation On HomeBanc’s Board In 2005

The Last Time GTCR Employees Appeared On HomeBanc’s Board Of Directors Was In HomeBanc’s 2004 Yearly SEC Report, Which Was Filed On March 31, 2005. ” (SEC Form 10-K, HomeBanc Corp, 3/31/05)

QUINN LIE

“1,100 employees lost their jobs. The CEO? He was given a $5 million bonus to tide him over. The 1,100 employees who lost their jobs? They got a $20 gift card.”

THE FACTS

Homebanc’s CEO Was Not Given A $5 Million “Bonus” After HomeBanc’s Bankruptcy

Patrick Flood, HomeBanc’s Original CEO, Was Fired By The HomeBanc Board In January Of 2007 - Seven Months Before HomeBan’s Bankruptcy.”HomeBanc replaced its longtime CEO on Tuesday and said it is embarking on a turnaround plan that will restore profitability this year. The Atlanta-based real estate investment trust, like many other companies dependent on the mortgage business, has faced a challenging environment in the last two years. And like some of those companies, including NetBank, the Alpharetta-based Internet bank, HomeBanc is making some dramatic moves. Chief among them: the departure of Patrick S. Flood, who in many ways was the face of HomeBanc, serving as its chief executive and chairman since 2000. Flood had been with HomeBanc and its predecessor companies since 1985. He is being replaced with Kevin D. Race, who had been HomeBanc’s president, chief operating officer and chief financial officer.” (Peralte C. Paul, “HomeBanc Replaces CEO,”Atlanta Journal-Constitution, 1/17/07)

HomeBanc’s Board Gave Flood A $5 Million Severance Package. “Patrick S. Flood, the HomeBanc Corp. CEO who abruptly left his post last week, will receive an exit package valued at $4.98 million. The board of directors at the Atlanta-based mortgage company opted to replace Flood, HomeBanc’s founder and a fixture there since 1985, with Kevin D. Race, whom Flood brought into the company four years ago.” (Peralte C. Paul, “Exit Deal Totals $4.98 Million,” Atlanta Journal-Constitution, 1/23/07)

· GTCR Did Not Have Any Employees On HomeBanc’s Board Of Directors In 2007. (SEC Form 10-K, HomeBanc Corp, 3/31/05)

HomeBanc Filed For Chapter 11 Bankruptcy In August Of 2007 - Seven Months After Flood’s Ouster. “Regional mortgage lender HomeBanc Corp has filed for bankruptcy protection, the latest casualty of a housing market that continues to weaken. The Atlanta-based company filed a Chapter 11 petition dated Thursday in U.S. Bankruptcy Court in Delaware. In the filing, the company checked off a box listing estimated assets and liabilities of more than $100 million each.” (”Mortgage Lender Homebanc Files For Chapter 11,” The Associated Press, 8/10/07)

GTCR Had Nothing To Do With The HomeBanc Layoffs Or The Employee Severance Pay

GTCR Did Not Have Any Employees On HomeBanc’s Board Of Directors In 2007. (SEC Form 10-K, HomeBanc Corp, 3/31/05)

HomeBanc Was Consistently Regarded As An Excellent Place To Work

HomeBanc Was Consistently Named By Fortune Magazine As One Of The Best Companies To Work For In America. “Still, the unraveling of HomeBanc, consistently named by Fortune magazine as one of the best companies to work for in America, was dramatic in its speed.”(Peralte C. Paul, “HOMEBANC: Lender Had Little Margin For Error,” Atlanta Journal Constitution, 8/12/07)

HomeBanc Was Noted For Generous Employee Benefits, Including 20 Hours Of Paid Leave, In Addition To Normal Vacation Time, To Allow Employees To Participate In Family And Community Activities. “Flood, who took the new company’s reins, was hailed as a different kind of chief executive, garnering praise for a faith-based management style that put employees above everything else. ‘I focused on the real value in the organization, and that is the people,’ Flood said in an interview last week. Flood was with HomeBanc and its predecessor companies from 1985 to his firing in January. ‘My focus was always on investing in the people and instructing them to do their best work every day.’ For example, workers were given 20 hours of paid leave called “being there” time to attend their children’s school activities or to volunteer and participate in other family or community events.” (Peralte C. Paul, “HOMEBANC: Lender Had Little Margin For Error,” Atlanta Journal Constitution, 8/12/07)

* While they do make some valuable points, there are some holes in their push-back. From the Quinn campaign…

GTCRauner was in the driver’s seat. Team Rauner mentions an SEC filing - yet conveniently leaves out this SEC filing from more than a year after that point which shows GTCR funds owned 54.9% of the common stock as of the beginning of 2006 [HomeBanc, SEC form 14-A, filed 4/20/06]

Also interesting that they completely ignore what fueled the company’s growth and led to its collapse due to their leadership - risky subprime lending to people who couldn’t afford it. They lit the match and walked away

Also - since their newest “i’m not responsible for anything” excuse is that once they stopped receiving management fees, they weren’t “managing” it anymore– does that mean they finally admit to “managing” the nursing homes?

* More deets from the Quinnsters…

The Business of Bruce Rauner: Homebanc - “It was greed.”

CHICAGO-Bruce Rauner’s Homebanc, which was part of the nation’s lending bubble that burst, positioned itself as a business inspired by values. In fact, it fell victim to greed.

After giving Rauner’s handpicked CEO, Patrick Flood, a $4.98 million exit package, Homebanc went on to lay-off most of its 1,100 employees and, on their way out the door, gave them $20 gift cards for a local supermarket Publix as their severance. Flood is still listed on the GTCRauner Web page.

The company, operating mainly in the Southeast, preyed on people with lower incomes and offered subprime and “interest-only” loans, risky vehicles that yielded unsustainable profits. That became clear when Rauner’s firm filed for Chapter 11 bankruptcy in 2007, one of 12 Rauner bankruptcies to occur under his watch.

The firm’s CEO, who received the five million dollar gift out the door, had lobbied against predatory lending protections that would have forbidden many of the types of loans that took Homebanc into bankruptcy-and led to massive layoffs.

One of Bruce Rauner’s chief lieutenants, Edgar Jannotta, who currently is testifying in Florida at a trial of Rauner-controlled nursing home chains liable for wrongful deaths, also served on Homebanc’s board of directors as did Rauner.

Key quotes:

“They would laugh at us and say the free market will take care of it.” - William Brennan, Atlanta Legal Aid Home Defense Program, who opposed Homebanc’s efforts to gut Georgia predatory lending protections.

“…Government pressure to lend to poor people didn’t cause lenders to make cold calls to hundreds of homeowners or to team up with home repair firms and persuade elderly property owners to refinance homes to patch up their roofs. It was greed.” [Atlanta Journal-Constitution Editorial Board, 10/3/2008]

Timeline:

Apr. 6, 2000: GTCRauner acquires Homebanc [GTCR.com, accessed 9/27/2014]

2002: Homebanc appoints a prominent minister to head its HR department at a time it embarked on a massive expansion. After the company folded, it was revealed that “Most of HomeBanc’s 450 loan officers had no prior experience in the business. Many were local church leaders or family members and friends referred by HomeBanc staff.” [PR Newswire, 4/4/2002] [Wall Street Journal, 8/13/2007]

2002: Georgia passes predatory lending protections. [Georgia Report, 4/22/2002]

January 2003: CEO Patrick Flood writes an op-ed criticizing the new law. [PR Newswire, 1/21/03]

May 2003: Under lobbying by Homebanc, Georgia guts the predatory lending law. [New York Times, 5/07/2003]

2004: GTCR takes Homebanc public. As majority owner, GTCR held 4.25 million shares after the IPO. [National Mortgage News, 05/02/04]

2004: Homebanc expands into risky loans at a period in which the traditional loan pool had been exhausted. These “nontraditional” loans, extended to low-credit customers, will be part of the germ seed for the Great Recession. [American Banker, 8/27/2004]

February 2006: GTCR funds own 54.9% of HomeBanc’s common stock. [HomeBanc, SEC form 14-A, filed 4/20/06]

September 2006: GTCR sells its remaining Homebanc stock. [Homebanc, SEC form 13-D, filed 9/5/2006]

Jan. 16, 2007: Flood is fired, and given a $4.98 million exit package. [Homebanc, SEC form 8-K, filed 1/12/2007]

Aug. 3, 2007: The New York Stock Exchange delists HomeBanc shares. [New York Stock Exchange press release, 8/3/2007]

Aug. 9, 2007: Homebanc files for chapter 11 bankruptcy. [Reuters, August 10, 2007]

Aug, 10, 2007: The firm’s 1,100 employees are laid off, and given well wishes and $20 gift cards from the Publix supermarket chain, funded from voluntary paycheck deductions. [Atlanta Journal Constitution, September 2, 2007] [Wall Street Journal, 8/13/2007]

63 Comments

|

Why, thank you, spammers!

Monday, Sep 29, 2014 - Posted by Rich Miller

* Via my Akismet spam filter (which over the years has blocked 9.8 million spam comments on this blog alone, and yet charges no fee, prompting me to wonder who or what is behind it and why… but I digress) comes this gem from “vedic maths tricks”…

Helloo I am so glad I fouhd your blog page, I really found you by accident, while

I was researching on Yahoo for somethingg else, Anyhow I am here now and would just like to

saay cheers for a fantastic post and a all round interdsting

blog (I also love the theme/design), I don’t have time to read it all at the moment but I have bookmarked it and also added

in your RSS feeds, so when I ave timme I will

be back to read a great deal more, Please do keep up the superb work.

Yes, my 2004 design is so ancien that it’s once again become très chic. Cheers.

* Here’s “Nathan”…

I loved as much as you’ll receive carried out right here.

The sketch is tasteful, your authored subject matter stylish.

nonetheless, you command get got an nervousness over that you wish be delivering the following.

unwell unquestionably come further formerly again as exactly the same nearly very often inside case you shield this increase.

That was either written by a bot or by a Colorado resident.

* From a spammer with the handle “https://www.facebook.com/”…

Howdy would you mind stating which blog platform you’re using?

I’m going to start my own blog soon but I’m having a difficult time deciding between BlogEngine/Wordpress/B2evolution and Drupal.

The reason I ask is because your design and style

seems different then most blogs and I’m looking for something unique.

P.S My apologies for getting off-topic but I had to

ask!

I use WordPress. Thanks for asking. And thanks for appreciating our unique sense of style. Yep, we’re definitely the avant-garde of the blog world.

* And from “velour”…

Howdy! I’m at work surfing around your blog from my new iphone 4!

Just wanted to say I love reading through your blog and look forward

to all your posts! Carry on the superb work!

I actually know that guy. He’s a state worker.

* The above Akimsmet-blocked spam posts all occurred during an hour and a half period Sunday evening, along with eleven others, most of which looked like this one from “fifa 15 coins”…

fifa 15 coins…

What is that guy?…

I’m not sure how to answer that one.

12 Comments

|

“Brookport”

Monday, Sep 29, 2014 - Posted by Rich Miller

* I believe this could very well be the strongest positive ad of the gubernatorial campaign to date…

* Script…

John Barr, Brookport Chief of Police: The city of Brookport was devastated by a F-4 tornado.

John Klaffer, Mayor of Brookport: There was 92 residences that were wiped out at our little town of 452 residences.

Tom Souders, Former Chairman of Massac County Republicans: The town most likely would have perished.

John Klaffer, Mayor of Brookport: I didn’t really know what I was going to do. Never been through anything like this. Nothing had happened yet. It was in the wee hours of the morning. And my phone rang. Governor Quinn, he saved this town. That is not rhetoric, that’s a fact. God bless him.

Tom Souders, Former Chairman of Massac County Republicans: This is one Republican that’s going to be voting for him come this next election.

This is a really good ad all around. The mayor, of course, is simply outstanding. The former GOP chairman is completely believable when he says he’ll be voting for Quinn. That’s not aimed at Republicans, by the way, it’s aimed at indies. And the photo of Quinn looking like he’d been up all night adds immense credibility to the spot’s claims.

We’ll get to Quinn’s new negative ad in a bit.

47 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|