Today’s number: $12.7 billion

Monday, Dec 22, 2014 - Posted by Rich Miller

* From the Center for Tax and Budget Accountability…

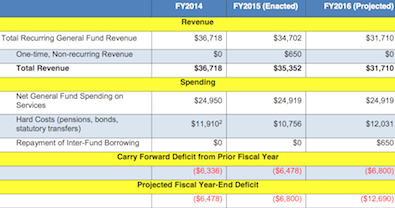

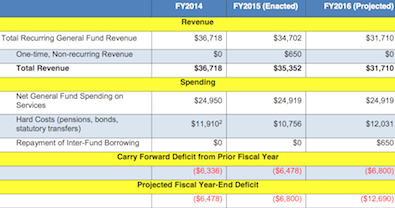

CTBA’s issue brief, The Pending FY2016 Fiscal Cliff details the significant—potentially over $12 billion— fiscal shortfall facing the next General Assembly and Governor-elect Bruce Rauner as they work to craft a General Fund budget for Fiscal Year 2016. The issue brief delineates the amount of recurring income tax revenue the state stands to lose when the temporary income tax increases under the Taxpayer Accountability and Budget Stabilization Act of 2011 phase down on January 1, 2015, as well as the worsening of other fiscal pressures that are projected to occur under current law.

Assuming no tax policy changes, if spending on services in FY2016 is held constant in nominal, non-inflation adjusted dollars at FY2015 levels, the state’s accumulated deficit in its General Fund will almost double, increasing from an estimated $6.8 billion in FY2015, to $12.7 billion by the end of FY2016.

The full report is here.

* From the report…

- Ducky LaMoore - Monday, Dec 22, 14 @ 11:57 am:

Hey, just cut the income tax again, and the economic growth that will cascade from it will solve our massive budget problems. I mean, it’s worked absolutely everywhere it’s been tried, right?

- anon - Monday, Dec 22, 14 @ 12:02 pm:

A $12 billion shortfall can’t be eliminated with gimmicks or wished away. And most Republicans would not vote for a budget that slashed spending by $12 billion.

That means Rauner and his party will have to bring up the T word. The one that they have been insisting kills jobs, chases away employers, and hurts the economy.

- Ghost - Monday, Dec 22, 14 @ 12:03 pm:

I can recover 8 billion of that.

Over 2 billion in pension payments is a legislative obligation formpaying dow te shortfalls. Itnis close to 3billion. Thisnis in top of the regualt pension playment for current employees. Redo the legislation and reduce the extra pament by 2 billion. Designate all fracking revenuse to go tomoaying down the shorted fund from the past and keep the extra payment from grf low or eliminate. Reduction 2 billion

Restore the tax increase and phasnit out a quarter percent. Reduction 5 billion

Make the 650 million fund sweep permanent. Savings 650 million. Convert the 500+ special interet funds to all grf, and run the services they rpovide without special funds catering to the lovvyists for those groups. This will add at least 350 million each year. Sontotla of at least 1 billion.

That leavrs 4 billion shortfall, which is bills we keep passing forward. Bond this down to 0. The annual bond patment on 4 billion will be a lot

Lower the. 4 billion

When the 10 billion retirment bond isnpaid use thos funds to pay down pension hole. As other bonds are paid use a portuon of that expense to build an emergency fund that can be be accessed with out a supermajority, and a note from everyones moms approving the use.

- Ghost - Monday, Dec 22, 14 @ 12:04 pm:

Hmm just horrible typing…where is the edit box….

- Sir Reel - Monday, Dec 22, 14 @ 12:16 pm:

Ghost, when you and others say use special funds, do you know where the revenues that go into special funds comes from?

In some cases they come from something akin to general taxes like GRF. But in many cases they come from specific fees charged to specific groups (who often asked for the fees to support programs they wanted). For example, hunters pay for licenses, permits, etc. for programs they want.

Is it fair to take “their” money for GRF? To in effect make them pay extra taxes (their hands everyone else) for regular State needs?

This raiding of special funds has gone on for too long. Groups like hunters would be better served to repeal their licenses, permits, etc. than see the revenues used like you suggest.

- Sue - Monday, Dec 22, 14 @ 12:16 pm:

When history looks back on the last six years the verdict will be that the state lost six years under Pat Quinn. Nice guy and he had all the goodwill in the world following Blagojevich but he just wasn’t competent and Illinois fell further behind as is clear by these numbers

- Sir Reel - Monday, Dec 22, 14 @ 12:18 pm:

Oops meant to say, “more than everyone else.”

- Bill White - Monday, Dec 22, 14 @ 12:19 pm:

Sue, if the income tax had remained at 5% these numbers would look much better.

- CircularFiringSquad - Monday, Dec 22, 14 @ 12:24 pm:

Waz with all this number nonsense? Its Christmas week. Shut it down send the workforce out for lunch help the soon to be bounced find new spots

- Shark Sandwich - Monday, Dec 22, 14 @ 12:28 pm:

“When history looks back on the last six years the verdict will be that the state lost six years under Pat Quinn.”

The comments on this site are full of valid complaints about PQ, but we didn’t lose time under him. He paid the pension payment. Every. Year. That’s not lost time, it’s an investment in the future that we won’t have to pay later. The one thing that ‘great’ governors of times past couldn’t do, he did.

- archimedes - Monday, Dec 22, 14 @ 12:28 pm:

The phase back of the income tax to 3.75% costs the State $5 billion. It would be better to phase it out as revenue changes offset it (ex., sales tax on services, etc.) - not arbitrarily reduce it to 3.75%.

Also, budgets were balanced in the past with a 3% tax for one simple reason - we weren’t paying the pension (neither the current cost nor the debt built up over the years).

The current cost is about $1.5 billion (and goes down every year even with SB1 thrown out) - but the debt on 50 years of short payments is $6 billion a year and building (since our repayment on the debt is structured to increase each year).

That pension debt repayment (not the pensions themselves) is the issue - and the simple solution is to pay it.

- Precinct Captain - Monday, Dec 22, 14 @ 12:41 pm:

I’ll save Arizona Bob the time: eliminate collective bargaining for teachers the $13 billion hole will disappear.

- Arizona Bob - Monday, Dec 22, 14 @ 12:41 pm:

@ archimedes

=The phase back of the income tax to 3.75% costs the State $5 billion=

Nope. The state had no right to that money, so it didn’t “cost” the state anything. OTOH, if the GA had passed another increase to 5%, that WOULD have cost Illinois taxpayers another $5 billion that they now couldn’t spend housing, clothing and feeding their families, and maybe taking a vacation like the public employees they’re funding enjoy at all too early an age.

It’s not the state’s money, arch. It’s the people’s, and they spend it to better effect for the state than Springfield does.

- anon - Monday, Dec 22, 14 @ 12:47 pm:

== it would be better to phase out == the income tax hike than to drop it all at once to 3.75%.

Of course that would require Gov. Rauner to propose jacking the rate back up from 3.75% to something higher. Following the way Republicans did the math on the Quinn hike (67%), the hike would have to be calculated as a percent increase over the 3.75 rate, not merely as a 1 point rate hike. By my calculation, a one point rate hike would be a whopping 26% tax increase! In total new revenues, it would amount to one of the biggest tax hikes in state history. I can’t wait.

- Arizona Bob - Monday, Dec 22, 14 @ 12:48 pm:

@Precinct Captain

=I’ll save Arizona Bob the time: eliminate collective bargaining for teachers the $13 billion hole will disappear.=

Don’t eliminate collective bargaining, just the “right” to strike. The spending problem we have in Illinois wasn’t created over night, and it won’t be solved overnight. I believe there will be some increased revenue required to get past this mess. The “temporary” 5% increase was supposed to give time for the GA to do that. They didn’t.

The GA and guv have to show they’re willing to only fund “needs” and forget about the “wants” for a few years. Once they do that

(don’t hold your breath), perhaps they’ll have earned the trust of the people to give more of their hard earned dollars to SOLVE the problems rather than just sustaining the dysfunction.

How far are the “takers” willing to go to earn that trust, PC?

- Ghost - Monday, Dec 22, 14 @ 1:09 pm:

Sir reel yes, most of those fees should mot be “special”. When i pay fees and taxes it goes into grf. Why shoukd other fees be held seperate and not used cormoperating the State.

The hunting fees should cover state police, crime labs, dot, and on and on as eahc of those agencies provides services which benefit hunting. The same for every special fund. The state operations directly or indirectly benefit that grp; but they only want to cover specific direct costs. Put it all in the kitty.

- Sue - Monday, Dec 22, 14 @ 1:13 pm:

Bill-exactly. Quinn failed in his efforts on the tax rate and virtually everything else over the past 6 years. Nice guy who was an absolute failure in terms of leadership and practicality. Now he will also be remembered for the cronyism during his remaining brief tenure

- Robert the Bruce - Monday, Dec 22, 14 @ 1:15 pm:

Excellent CTBA analysis. For those of you who didn’t click through to the study, the income tax rollback accounts for $5 billion of the shortfall.

- Ghost - Monday, Dec 22, 14 @ 1:16 pm:

We had an edit button for a short period of time. I named it bob. I miss bob…..

- AC - Monday, Dec 22, 14 @ 1:27 pm:

State financial troubles make it more difficult for individuals and businesses to plan. Making realistic projections over the next 10 years, and making adjustments to spending and taxes would do far more than lowering the tax rate and hoping for increases economic activity. The lack of any sort of plan from the governor elect increases uncertainty in the state economy. Playing political poker instead of beginning the conversation by proposing potential solutions will only make things worse.

- From the 'Dale to HP - Monday, Dec 22, 14 @ 1:49 pm:

@AZBob “It’s not the state’s money, arch. It’s the people’s, and they spend it to better effect for the state than Springfield does.”

But people want services, thus the state has to hire labor to provide those services. So the state has to raise revenue in order to pay the labor who provide those services which the people want. Therefore, the state’s just doing what the people want for the most part.

- Wordslinger - Monday, Dec 22, 14 @ 1:49 pm:

Ghost, I wouldn’t count on any fracking revenues anytime soon.

Start ups need about $70 to $80 a barrel to break even. Price today is $55 to $60 a barrel. Those with options will leave it in the ground for the time being.

Sue, making full pension payments and paying down bills was a failure?

- steve schnorf - Monday, Dec 22, 14 @ 1:58 pm:

Full disclosure: I am a CTBA board member. Now, think about what the report says, in round numbers. One, we don’t have an operating budget shortfall of $12B, our expenses in FY16 will exceed our revenue by $6B. Expenses in FY15 will exceed revenues by more than one billion, if the Governor-elect does nothing to reduce spending the remainder of this year, and that won’t be the case. All reductions this year reduce the deficit for next year.

- anon - Monday, Dec 22, 14 @ 2:02 pm:

== put all the fees in the GRF kitty ==

Various special fees were enacted based upon the promise they would be used exclusively to promote hunting, to regulate nursing, and so on. Based upon the promise in the law, various groups supported the special fees that their members pay. To permanently move those revenues to GRF would entail collecting fees under false pretenses.

- Demoralized - Monday, Dec 22, 14 @ 2:09 pm:

==Nope. The state had no right to that money, so it didn’t “cost” the state anything. ==

Um, Bob, when the tax rate goes down it does in fact cost the state lost revenue. So, you may believe in the new math but I don’t.

==How far are the “takers” willing to go==

Can we please move past this nutty talking point.

- Arizona Bob - Monday, Dec 22, 14 @ 2:16 pm:

@steveSchnorf

=Full disclosure: I am a CTBA board member=

So you’re their “token” Republican so that they can claim bipartisanship, but not political impartiality?

Tell me Steve, when will CTBA be coming up with a list of proposed spending reductions which would be least painful to the taxpayers of Illinois? Isn’t that part of “Tax and Budget Accountability”?

I’m sure we’d all love that as a Christmas present!

- Demoralized - Monday, Dec 22, 14 @ 2:19 pm:

==when will CTBA be coming up with a list of proposed spending reductions which would be least painful to the taxpayers of Illinois==

Bob, when you are talking about these numbers there are no such cuts. I know in your fantasyland such cuts exist but for the rest of the sane world there are no such options.

- Arizona Bob - Monday, Dec 22, 14 @ 2:22 pm:

@Dem

=Um, Bob, when the tax rate goes down it does in fact cost the state lost revenue. So, you may believe in the new math but I don’t.=

Except the tax rate ISN’T going down. It’s proceeding as scheduled. The GA had a 1.25% windfall for a few years. That’s over. Move on.

=Can we please move past this nutty talking point.=

Sure. As soon as you can get past the “nutty” talking point that there’s no way we can reduce what we pay towards pensions, there’s no strategy for having the lcoals who bloated salaries and gave the end of career bumps that casued much of the problem to deal with it by cost shifting and adjusting their salary and benfit schedules accordingly, and there’s no way the capital budget can be reduced if we funded “needs” for safety maintenance and eschewed low value “wants” that benefit the juiced in contractors and unions more than the taxpayers of Illinois.

We got a deal?

- Demoralized - Monday, Dec 22, 14 @ 2:29 pm:

==Except the tax rate ISN’T going down.==

Math not your friend Bob? 3.75% is less than 5% last time I checked. I was just working with my 7 year old on her less than and more than math. She gets it.

==there’s no way we can reduce what we pay towards pensions==

Well, I think the Court so far has said when it comes to state employees that there isn’t a way to do that. I guess we’ll see what the big guys at the Supreme Court say. I’m guessing they’ll say the same thing.

As for the local issue, I suppose your idea is fine. But taxes are going to go up one way or the other. Either at the state or local level. Take your pick. Cost shifts don’t solve that problem.

- steve schnorf - Monday, Dec 22, 14 @ 2:30 pm:

Bob, the honest answer is “Never”. I’ve asked that question at Board meetings, and that’s just not the organizations goal nor the way the staff think. The organization is overall more liberal than I, a moderate, am comfortable with, and the organization is broadening the scope of its interest to areas not related to the state budget and Illinois taxation, and I’m uncomfortable with that.

But, CTBA’s research is, I believe, very close to the gold standard. It is apolitical, non-biased, data-based, and subject to rigorous scrutiny, including peer review. When I first joined 10 years ago they were almost the lone voice, and certainly the most data-based and articulate, calling for an increase in state revenues.

As to the issue of never supporting reductions in spending, they told me, and I now challenge you, Bob: show me legitimate, research based and apolitical studies or data that show the State of Illinois spends or taxes too much. Not BS anecdotal stuff like the stuff we frequently hear, but real solid science that shows Illinois is out of line with its peers and the nation in its tax burden or its spending.

Come on, Bob. Man up. Let’s see it, because I can’t find it.

- Robert the Bruce - Monday, Dec 22, 14 @ 2:46 pm:

@steve schnorf, Thanks for the response to Bob’s question.

Is there any significant ongoing revenue to be found from taking surplus funds from the special interest funds Ghost describes? (ignoring for a second the argument that those are supposed to be used for a specific purpose)

- AC - Monday, Dec 22, 14 @ 2:49 pm:

If a scheduled reduction in the tax rate isn’t a reduction, would a scheduled increase not be an increase?

- VanillaMan - Monday, Dec 22, 14 @ 2:49 pm:

Gee Steve,

Besides Max your dog, what else do you do up there above Whoville on Mt. Crumpet?

- fed up - Monday, Dec 22, 14 @ 3:07 pm:

I hate the way Quinn lied to the state to get the tax increase and the way it was written was beyong assinine but it becomes more and more obvious everyday the increease was and still is needed.

- JS Mill - Monday, Dec 22, 14 @ 3:09 pm:

@AZ “career bumps that casued much of the problem” Any data to support that? Eric Madair is noted for what may be the most exhaustive study on the causal factors for the pension debt. End of career “bumps” was attributable for 6%-7% of the total outstanding debt if memory serves. Nothing to sneeze at but not “much”of the problem. Even a failed educator like yourself can recognize that math. Right?

- Sue - Monday, Dec 22, 14 @ 3:23 pm:

All the 5 percent did was lessen the short term deficits. Any honest assessment recognizes the state is in worse shape today then when the tax increase went into effect. Clearly the rate needs to stay at 5 but absent meaningful pension reform the state is doomed. Even with haing made the actuarial recommended payments the unfounded liability has significantly increased since 2009(despite substantial market gains). The three percent cola is a burden illinois cannot afford whether the income tax rate is 5, 6 or 7 percent. This year the TRS unfounded liability was up nearly 8 billion. The Supreme Court given the health insurance decision for which there was no lawful basis has already telegraphed its pension ruling. The reality is at some point the funds will run out of money to pay benefits at which point the whole mess will be in the court of claims. The supremes may not offer the necessary relief but the court cannot force a legislative tax increase and does anyone think the legislature will raise rates above 5? Like it or not but at some point the pension beneficiaries will get a haircut. Unfortunately, the unions leading the charge insist on asserting the impairment clause rather then recognizing the ability to pay is becoming more and more of the issue. The typical nonsense of a millionaires tax and whatever else the unions raise fails to recognize that the unfounded liability has gotten too large to be resolved in any politically saleable way

- Gubment - Monday, Dec 22, 14 @ 3:36 pm:

Anyone else tired with dealing with this same problem year after year?

- archimedes - Monday, Dec 22, 14 @ 3:37 pm:

Sue - the State has NOT made the actuarial recommended payments. The State HAS made the 1995 ramp payments - but those payments, by design, continue to increase the unfunded liability until 2030.

The 5% income tax is sufficient to pay the pension debt using the 1995 Ramp payment plan. If you want to pay actuarial recommended rates (so that the unfunded liability does not increase at all) you would need less than $2 billion more per year - which is about another 0.5% on the income tax.

So - for 5.5% income tax you can pay full actuarial rates and start reducing the unfunded liability.

Or for 5% income tax - you can stay on the path set by the 1995 pension ramp.

Do the math before saying the 3% COLA is a burden Illinois cannot afford with 5%, 6%, or 7% tax. LOL - a 7% tax rate would bring in another $10 billion!

- Waffle Fries - Monday, Dec 22, 14 @ 3:39 pm:

@steve schnorf

“Expenses in FY15 will exceed revenues by more than one billion, if the Governor-elect does nothing to reduce spending the remainder of this year, and that won’t be the case…”

Are you saying Governor-elect Rauner will propose spending reductions for FY15 or will he merely let the year go by with no supplemental request?

- IllinoisO'Malley - Monday, Dec 22, 14 @ 3:43 pm:

@Sue, please produce evidence that shows a 7% income tax rate would not cover the pension payments.

- IllinoisO'Malley - Monday, Dec 22, 14 @ 3:45 pm:

I think Sue is drinking the Quinn-Hate flavored Kool-Aid.

- Federalist - Monday, Dec 22, 14 @ 3:48 pm:

Sue,

It is interesting to see that you attribute the ‘problem’ as being exclusively the fault of pensions and retiree health insurance.

That is the typical PC response of both Dems and Repubs these days. When you see it that often from two different groups who have been in charge of the budget mess for several decades you know you are NOT on to something. It is the same ole, same ole.

Try expanding your critique to the rest of the budget and see what you come up with.

- walker - Monday, Dec 22, 14 @ 3:55 pm:

We can argue all day long about our pet economic theories. But if we want real numbers to work with, CBTA is the best place to start.

- anon - Monday, Dec 22, 14 @ 4:17 pm:

== Any honest assessment recognizes that the state is in worse shape today than it was when the tax hike went into effect.==

The deficit was about $10 million when the rate was raised. Had the 5% rate been continued as Quinn wanted, the deficit would be half of what it was.

== Like it or not, but at some point the pension beneficiaries will get a haircut. ==

If the state can’t pay its bills, then bond holders and vendors would also “get a haircut.”

- Sue - Monday, Dec 22, 14 @ 4:21 pm:

Folks-what are you all missing-during the five years the five percent was applicable and Quinn made the full pension payments-the unfunded liability has exploded

- walker - Monday, Dec 22, 14 @ 4:26 pm:

The reality appears to be “all of the above” needs to be done if we are to be fiscally healthy in the next twenty or so years.

That would include:

-continued cuts to discretionary spending

-hard total spending caps

-some way to tamp down the growth in pension obligations, until the Tier 2 changes have more impact

-income tax rates maintained at least where they are in 2014

-service tax rates added to the mix

-removal of a substantial number of corporate tax benefits

-some movement of future teacher pension obligations to local districts

-continued closing of state facilities

-restructuring debt to pay down accounts payable

Short of shutting down major pieces of government and defaulting on bonds, or of another 1.5% rise in tax rates, all of the above are needed. No easy trade-offs. No easy political options. Work with real numbers, and fact-based forecasts, not mythical outcomes that have never occurred in the real world.

Time for all, in both parties to realize this. There’s no: “If you give me this, we won’t have to take that.”

All of the above.

Or prove otherwise, with real numbers.

- Rich Miller - Monday, Dec 22, 14 @ 4:28 pm:

Sue, get a freaking clue.

- archimedes - Monday, Dec 22, 14 @ 4:40 pm:

Sue - not missing a thing. The pension payments made while the 5% income tax was in place were not full actuarial payments. The Unfunded Liability was supposed to increase.

The 5% income tax allowed the State to make the 1995 Ramp payments - but these fall well short of the full ARC (Actuarial Required Contribution). The 1995 Ramp structure required the State to make annual payments that would “ramp up” to a constant % of payroll by 2010 - then maintain this % of payroll through 2045 when the systems would be 90% funded.

The Unfunded Liability will continue to go up until the State is paying at least 7.5% (the systems discount cost) interest on the unfunded liability in addition to the annual normal cost.

This isn’t scheduled to happen (under the 1995 pension ramp law) until 2030.

The annual cost of the pension debt, in addition to the normal cost (the cost of benefits earned in the current year) is about 20% of the State GRF budget. Assuming the budget increases 2.5% a year, it will continue to be about 20% of the State budget until 2045.

Then the debt will only be 7.5% of about $35 billion (we will be at 90% funding level - in order to maintain that level you have to pay the interest on the unfunded liability each year). The annual payment will drop to about $2.6 billion a year for the unfunded liability debt service and the normal cost of about $.8 billion a year = a total of about $3.4 billion or about 4.3% of GRF budget.

- Federalist - Monday, Dec 22, 14 @ 4:44 pm:

anon,

Explain in more detail how pensioners will get a haircut. What will be the legal procedure and what distinctions, if any, would be made among the different pensioners new hires, current employees, those retired)?

- Robert the Bruce - Monday, Dec 22, 14 @ 5:23 pm:

excellent post, walker.

my fear is that both parties will ignore what you describe and figure out a way to privatize a state asset for a short-run budget fix that puts us in a bigger hole in the future (sorta like Daley’s parking meter deal).

- CapnCrunch - Monday, Dec 22, 14 @ 5:25 pm:

“It is interesting to see that you attribute the ‘problem’ as being exclusively the fault of pensions and retiree health insurance.”…..

If the ‘problem’ is not the spending of 20% of the budget on “pills and pensions” what is the problem?

- steve schnorf - Monday, Dec 22, 14 @ 5:59 pm:

VM, I don’t understand your post. I’m dense sometimes

- steve schnorf - Monday, Dec 22, 14 @ 6:04 pm:

the Bruce, I believe if you tried to sweep $650M a year, some of the funds would quickly go bankrupt, most others would eventually go bankrupt. That’s why the sweeps are usually referred to as “one time” sources

- archimedes - Monday, Dec 22, 14 @ 6:36 pm:

To blame retirees, or workers for the pension debt is the same as blaming all those vendors for the State’s $6 billion outstanding payable debt.

The State bought goods and services from those vendors and have racked up a $6 billion (used to be closer to $10 billion) IOU. Same thing with the pension debt. For 50 years the State had people work for them without paying the full compensation (salary and benefits earned for that year) - now it owes $110 billion.

Now you have to pay it. The good news is, unlike the $6 billion the vendors are owed right now, the $110 billion can be paid over 30 years.

- PublicServant - Monday, Dec 22, 14 @ 7:51 pm:

===The Unfunded Liability will continue to go up until the State is paying at least 7.5% (the systems discount cost) interest on the unfunded liability in addition to the annual normal cost.===

Maybe the state, realizing the discount cost of the pensions is 7.5%, might seek to reduce that interest on the debt by purchasing POBs at about 60% less interest, now that the courts are ruling that the pipe dream of unilaterally reducing pension benefits Is not an option, might be considered a fiscally responsible way of drastically reducing the pension liability. Or are we still going to assume that pension debt is, somehow, different than other bond debt?

- Anyone Remember - Monday, Dec 22, 14 @ 8:15 pm:

Ghost

Rod Blagojevich and John Filan called - they want the credit for the idea of fund sweeps.

http://illinoisissues-archive.uis.edu/state/budget.html

- cover - Monday, Dec 22, 14 @ 8:42 pm:

= Rod Blagojevich and John Filan called - they want the credit for the idea of fund sweeps. =

That linked story mentions that fund sweeps also occurred under GOP governors, though I think that Edgar (FY 1992) and Ryan (FY 2003) each did it only once [Thompson was before my time]. Blago used it routinely. Quinn also only did sweeps once (FY 2010), then did inter-fund borrowing in FY 2011.

Both this analysis by CTBA and that one-pager that Rauner had earlier this month show the value of inter-fund borrowing in the FY 2015 revenues and the need to pay it back, but is that going to be necessary? Quinn has the authority this year but hasn’t used it yet, as far as I’m aware, and I doubt that Rauner would do so since he’s calling it a gimmick.

- Rich Miller - Monday, Dec 22, 14 @ 9:23 pm:

===they want the credit for the idea of fund sweeps===

Meh. They stole that from Ryan.

- Anyone Remember - Monday, Dec 22, 14 @ 9:38 pm:

cover & Rich Miller

The first fund sweep, as Cover noted, was Jim Edgar’s 1992 sweep (Thompson didn’t do sweeps). He was a piker compared to Blagojevich / Filan. This link says it was $10 million for FY 1993.

http://www.lib.niu.edu/1992/ii920839.html

This link says it was $60 million for FY 1992

http://www.lib.niu.edu/1991/ii910814.html

but the IOC 1992 CAFR put out by then Comptroller Dawn Clark Netsch said: “ordered the transfer of up to

$50 million from various funds in the State treasury into the General Fund;” (page viii - no, it’s not available online).

- Anyone Remember - Monday, Dec 22, 14 @ 9:38 pm:

The first was FY 1992, not CY 1992.

- Soccertease - Monday, Dec 22, 14 @ 9:48 pm:

@Rich: “Meh. They stole that from Ryan”. But Blago/Ryan took it to another level-they doubled fees (e.g., CPA licensure fees), then swept the money. Still burns my axx to this day.

- Soccertease - Monday, Dec 22, 14 @ 9:56 pm:

Meant to say “Blago/Filan took it to another level”.

- steve schnorf - Monday, Dec 22, 14 @ 10:47 pm:

PS, remember, PoBs are taxable, don’t think we could hit 3 unless fairly short term

- Ghost - Monday, Dec 22, 14 @ 11:22 pm:

I think it was ryan where the comptroller refused to do the fund sweep, so they had to write into the bimp and the statutes that the comptroller was required to do it.

- Enviro - Monday, Dec 22, 14 @ 11:28 pm:

For Sue @ 3:23pm - Reality check:

TRS funds have improved over the past year. Funding of TRS at end of FY 2013 - $39.4 billion and at end of FY 2014 45.3 billion.

For more information on the TRS pension fund:

http://trs.illinois.gov/press/2014/august26_14.pdf

- PublicServant - Tuesday, Dec 23, 14 @ 3:30 am:

Steve, the bottom line is that we should try to get that rate, but whatever rate we end up with will provide a lot of savings over the 7.5% interest on the debt that we’re currently paying. It’s a no-brainer, really.

- PublicServant - Tuesday, Dec 23, 14 @ 4:45 am:

Frankly, since the courts are in the process of ruling that pension debt is debt, period, I don’t see why the bonding mechanism needs to be a PoB anyway.

- LaJuice - Tuesday, Dec 23, 14 @ 6:36 am:

Not a partisan statement on this end, but Sue, doesn’t the legislature enact/authorize the spending proposals and the Governor executes them? In my opinion, both the Legislature and Governor bear varying degrees of the responsibility, but the legislature bears more.

- Anyone Remember - Tuesday, Dec 23, 14 @ 9:21 am:

LaJuice -

The General Assembly may enact spending proposals, but the Governor introduces the budget for all of state government, both revenues and expenditures, with the Annual Budget Submission.

- steve schnorf - Tuesday, Dec 23, 14 @ 11:23 am:

PS, because of the IRS code

- LaJuice - Tuesday, Dec 23, 14 @ 12:20 pm:

Anyone, thanks for the note, but I would assume the Governor’s budget is a guideline/starting point for legislative deliberations, correct? The legislature sets the final amounts? I’m not suggesting the Governor(s) doesn’t bear some of the responsibility, but it was my understanding that the legislature actually enacts the spending (then the responsibility goes back to the Governor to oversee it…or hopefully find ways to reduce it)