Dancing on a grave that isn’t even a grave

Tuesday, Feb 3, 2015 - Posted by Rich Miller

* From the NRCC…

Hey there,

Remember the unbelievable news that former Lt. Gov. Sheila Simon was reportedly considering a bid for Congress, despite her ties to failed former Governor Pat Quinn?

It turns out, after testing the waters for a few weeks, Simon is not anxious to jump into the race. Today, Roll Call reported that she has rebuffed Democratic recruitment efforts, saying she was “not actively pursuing it.” Simon even went a step further, comparing campaigning to childbirth and that “it’s not something to jump back into right away.”

Simon certainly does not sound like somebody who wants to run. Perhaps Sheila Simon has finally realized that being besties with politically-toxic Pat Quinn will make running for office again a bigger challenge than she ever realized. Then again, Simon must know that in Southern Illinois, being recruited by Nancy Pelosi is just as toxic as being Pat Quinn’s protégé.

NRCC Comment: “Southern Illinois families have had enough of Sheila Simon and Pat Quinn’s failed policies. Democrats will need to step up their recruiting because 12th district voters know better than to send a Pat Quinn protégé to Washington.” – NRCC Spokesman Zach Hunter

That’s really over the top. Apparently, some DC types can’t resist taking shots at people who aren’t even candidates and probably wouldn’t have ever been a candidate.

Sheesh.

42 Comments

|

[The following is a paid advertisement.]

My name is Molly Akers. When a lab switched my biopsy slide with another woman’s, I was misdiagnosed with breast cancer and a doctor needlessly removed my breast.

Real people suffer when such errors occur. I needed several surgeries to fix the preventable mistake and spent countless hours in physical therapy. My young children were terrified to see me in pain while their father washed my hair or helped me out of bed.

Due to no fault of my own I had an unnecessary mastectomy. If powerful corporate interests had their way, my ability to pursue fair compensation for my injuries would have been severely impaired. At best I might have received a token payment.

Our civil justice system protects our constitutional rights, so we can hold wrongdoers responsible. Our courts, funded with our tax dollars, provide accountability and effect changes that reduce the likelihood of serious mistakes reoccurring.

Something terrible happened to me, but it could have been you or someone you love. Please protect open access to Illinois courts.

The Illinois Trial Lawyers Association fights to ensure all citizens get equal footing in the courtroom. To learn more about Molly, click here.

Comments Off

|

Question of the day

Tuesday, Feb 3, 2015 - Posted by Rich Miller

* Tribune…

West suburban lawmakers announced a package of bills Monday aimed at punishing the College of DuPage for giving President Robert Breuder a lucrative severance package and at preventing other taxing bodies from approving similar buyouts. […]

The legislative moves come nearly a week after College of DuPage trustees took an unusual revote to approve a $763,000 severance deal for Breuder, who will retire in March 2016 from the publicly funded community college in Glen Ellyn. The buyout agreement also promises to name the school’s homeland security education center after him.

More than 400 people — including several state lawmakers from the area — attended the revote meeting to denounce the deal, which some trustees now say was done to end Breuder’s current contract early. Breuder, whose total compensation last year was about $484,000, was under contract until 2019, according to an agreement that had been secretly changed by the trustees over the years.

On the severance issue, trustees also were under fire for possibly violating the state’s Open Meetings Act, which requires a public recital of the matter being considered, during an earlier vote.

* The House Republicans summed up the legislative proposals, most of which are still being drafted by LRB…

Representative Batinick is seeking legislation that will provide a recall mechanism for all non-home rule units of government. The legislation includes community college boards of trustees.

Representative Breen is seeking legislation that would cap the amount of allowable severance agreements passed by community college trustees. Breen is seeking to cap such agreements to the equivalent of one year’s salary plus benefits.

Representative Breen is [also] seeking legislation that would bar community colleges from expending state dollars from any state fund, property tax funds or student tuition dollars on severance agreements that exceed the equivalent of one year’s salary plus benefits.

A redraft of HB3289 (Ives, 98th) has been submitted to LRB with additional language pertaining to College of DuPage. Representative Ives has added a 14-day public posting requirement for contracts with salary in excess of $150,000.

HR 55 (Ives) - Directs the Auditor General to conduct a performance audit of the state moneys provided to College of DuPage for FY11 through FY14.

HB 303 - Representative McDermed has introduced legislation that includes severance and settlement agreements that use public funds in the Freedom of Information Act. The legislation is essentially what was introduced in response to the Metra severance scandal in 2013.

Representative Sandack is seeking legislation that will reduce the amount of state money available to community college boards should they take action similar to College of DuPage. If a community college uses state moneys for severance agreements, the community college will have the same amount deducted from the next disbursement by the Comptroller immediately following board action.

Representative Wehrli is seeking legislation to shorten all community college trustee terms to four years from six years. The language will provide that, in order for staggered terms to survive, trustees elected in 2017 will serve two year terms and then trustees elected in 2019 will henceforth serve four year terms. Trustees elected in 2015 will serve until 2021 but then trustees elected in 2021 will henceforth serve four year terms.

* The Question: Which of these proposals do you like? Which ones do you not like? Explain, please.

46 Comments

|

Manar to preview new school bill

Tuesday, Feb 3, 2015 - Posted by Rich Miller

* Sen. Andy Manar is having a press conference today to unveil his revised school funding reform bill. Here’s the media handout…

School Funding Reform Act of 2015

The School Funding Reform Act of 2015 is a reintroduced version of last year’s Senate Bill 16, a proposal to replace Illinois’ dated General State Aid (GSA) formula with a new, need-based system.

Background

Illinois has the second most regressive public school funding system in the country: Districts with significant low-income populations in Illinois get less combined funding from state, local and federal sources than districts with more affluent students. Last year’s proposal passed the Senate and was designed to alleviate this disparity and increase transparency in the system.

The School Funding Reform Act is based on the findings of the bipartisan Education Funding Advisory Committee that was created to study this problem and recommend changes to a funding system that hadn’t been updated or reviewed since 1997.

SB 16 would have:

• Created a single, need-based funding formula (Primary State Aid); replacing GSA and an outdated grant-based system

• Prioritized state resources to help school districts and students who most need them

• Increased transparency by requiring individual schools to account for how they spend state funds, replacing the old district-by-district reports

• Included Chicago in the new, need-based formula—eliminating the Chicago Public Schools block grant

Updates

School Funding Reform Act of 2015 (SB 1) has evolved based on discussions with more than 400 local superintendents and statewide town halls involving parents and educators.

The new bill includes the following improvements to SB 16:

Regionalization: Considers regional differences when determining state aid for districts. The new legislation uses the National Center for Education Statistics’ Comparable Wage Index to measure variation in salaries and cost of living from district to district.

Low-income calculation: Calculates the low-income population of a district based on the number of students receiving services from the Illinois Department of Human Services (generally students below 200 percent of the poverty line). This replaces the number used under SB 16, which was based on the number of students receiving free and reduced lunch (generally students below 185 percent of the poverty line).

Adequacy study: Expedites a study that will analyze the adequate amount of funding for education and develop a base level funding for adequate student growth. The study will consider how student characteristics, tax rates and preschool expansion should be factored into the funding formula.

Adequacy grants: Provides additional funding for districts that are collecting taxes at or above state averages but are spending below a calculated adequacy target— the Education Funding Advisory Board’s adequacy recommendation weighted for each district. This would protect underfunded districts from losses under SB1.

ELL reporting: Requires school districts receiving state funding for English Language Learner (ELL) programs to report their revenues and costs related to bilingual education.

Special education flexibility: Ensures that districts with above average special education needs will be funded based on their number of special education students, rather than the statewide rate of 13.8 percent.

***Projections from the Illinois State Board of Education will be distributed when they become available. ***

37 Comments

|

Credit Union (noun) – an essential financial cooperative

Tuesday, Feb 3, 2015 - Posted by Advertising Department

[The following is a paid advertisement.]

Cooperatives can be formed to support producers such as farmers, purchasers such as independent business owners, and consumers such as electric coops and credit unions. Their primary purpose is to meet members’ needs through affordable goods and services of high quality. Cooperatives such as credit unions may look like other businesses in their operations and, like other businesses, can range in size. However, the cooperative structure is distinctively different regardless of size. As not-for-profit financial cooperatives, credit unions serve individuals with a common goal or interest. They are owned and democratically controlled by the people who use their services. Their board of directors consists of unpaid volunteers, elected by and from the membership. Members are owners who pool funds to help other members. After expenses and reserve requirements are met, net revenue is returned to members via lower loan and higher savings rates, lower costs and fees for services. It is the structure of credit unions, not their size or range of services that is the reason for their tax exempt status - and the reason why almost three million Illinois residents are now among 100 million Americans who count on their local credit union every day to reach their financial goals.

Comments Off

|

AFSCME fires back

Tuesday, Feb 3, 2015 - Posted by Rich Miller

* Council 31’s spokesman Anders Lindall responds to Gov. Bruce Rauner’s anti-union memo to lawmakers…

It’s bizarre and outrageous for Bruce Rauner to suggest that public employees aren’t ‘working families’. He’s wrong to vilify workers who serve the public, earn middle-class wages and have a right to a voice through their union.

And it’s especially offensive for Rauner to criticize prison and highway workers who risk their lives to do some of our state’s most dangerous work.

His false attacks seem designed to distract from real problems, like tax loopholes for big corporations and giveaways to wealthy individuals who funded Rauner’s political campaign.

The governor spoke often about closing corporate tax loopholes during the campaign. Not much since, however.

I’m told the governor’s State of the State address will focus on solutions and not on the state’s problems. It’s about freaking time.

156 Comments

|

* A whole bunch of people sent me a link to this WaPo story about Congressman Aaron Schock’s newly renovated DC office…

Bright red walls. A gold-colored wall sconce with black candles. A Federal-style bull’s-eye mirror with an eagle perched on top. And this is just the Illinois Republican’s outer office.

“It’s actually based off of the red room in ‘Downton Abbey,’ ” said the woman behind the front desk, comparing it to the luxurious set piece at the heart of the British period drama. […]

She introduced herself as Annie Brahler, the interior decorator whose company is called Euro Trash. She guided me to Schock’s private office, revealing another dramatic red room. This one with a drippy crystal chandelier, a table propped up by two eagles, a bust of Abraham Lincoln and massive arrangements of pheasant feathers.

Then, my phone rang.

It was Schock’s communications director, Benjamin Cole.

“Are you taking pictures of the office?” he asked. “Who told you you could do that? . . . Okay, stay where you are. You’ve created a bit of a crisis in the office.”

What? They thought nobody would find out? It’s a public office, for crying out loud. I mean, yeah, some of it was donated by the designer and Schock paid for the rest, but it’s still in the Rayburn Building.

* A pic…

You really should go read the whole thing.

*** UPDATE *** Uh-Oh…

House rules prohibit Members of Congress from accepting most gifts valued at $50 or more — including “gifts of services, training, transportation, lodging, and meals, whether provided in kind, by purchase of a ticket, payment in advance, or reimbursement after the expense has been incurred.”

Stephen Spaulding, policy counsel for the non-partisan Common Cause, told ThinkProgress that this donation of services from a professional decorator could well violate both the spirit and letter of the House gift rules: “It certainly raises plenty of questions that I think [Schock] needs to answer.”

182 Comments

|

S&P settles with feds, states

Tuesday, Feb 3, 2015 - Posted by Rich Miller

* From a press release…

Attorney General Lisa Madigan today announced a $1.375 billion settlement with Standard & Poor’s to resolve allegations that the credit ratings agency compromised its independence and objectivity in assigning its highest ratings to risky mortgage-backed securities in the lead up to the 2008 economic collapse.

Illinois will receive $52.5 million under the joint state-federal settlement forged by the U.S. Department of Justice (DOJ), Madigan and 19 other attorneys general and S&P, a subsidiary of McGraw-Hill Companies, that is one of the nation’s largest credit ratings agencies responsible for independently rating risk on behalf of clients and investors.

In 2012, Madigan was one of the first attorneys general in the country to file a lawsuit against S&P for its misconduct that contributed to the 2008 collapse. Madigan’s lawsuit alleged S&P compromised its independence as a ratings agency by doling out high ratings to unworthy, risky investments to increase its profits, while its misrepresentations spurred investors, including Illinois’ pension funds, to purchase securities that were far riskier than their ratings indicated.

“Standard & Poor’s deliberately exploited its trusted reputation as an independent analyst to maximize profits and gain market share, and in the process, S&P became a key enabler of the economic meltdown,” Attorney General Madigan said. “Were it not for S&P abandoning its core principles, these securities, made up of unsustainable mortgages destined for default, could never and would never have been purchased by many investors.”

According to the settlement, S&P consistently made misrepresentations about the processes it used to assign credit ratings to mortgage-backed securities. While publicly promising independent, objective analyses, the company privately relaxed its ratings criteria and manipulated subprime mortgage data to ensure its clients’ mortgage-backed securities would achieve higher ratings than the actual quality of the assets supported. These tactics were part of an overarching corporate strategy intended to retain clients and increase market share, according to the settlement agreement.

Mortgage-backed securities are financial products made up of a pool of mortgages that are bundled together and sold as a security. The assets are backed by residential mortgages, including subprime mortgages. The performance of these investment products have significant, real-world implications for Illinois institutional investors, such as pension funds and 401(k) managers that make decisions about whether, and which, of these securities are appropriate investments. It was the misrepresentation of the true risk of these mortgage securities that helped the housing market skyrocket and ultimately led to its collapse in 2008.

Under today’s settlement, S&P will pay a $1.375 billion penalty, which exceeds the company’s profits earned for rating mortgage-backed securities from 2002-2007. The majority of the relief awarded to Illinois will be distributed to the state’s pension systems. Further, S&P has agreed to a statement of facts acknowledging conduct related to its analysis of structured finance securities. S&P also agreed to comply with all applicable state laws and will cooperate with requests for information from states that may express concern over a possible violation of state law. The states have also retained authority to enforce their laws – the same laws used to bring these cases – if S&P engages in similar conduct in the future.

25 Comments

|

Medicaid costs skyrocketing

Tuesday, Feb 3, 2015 - Posted by Rich Miller

* The Tribune reports that far more people have signed up for Medicaid than expected and costs per person are skyrocketing…

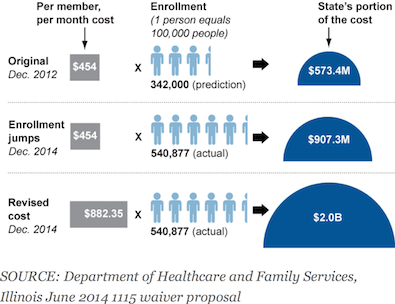

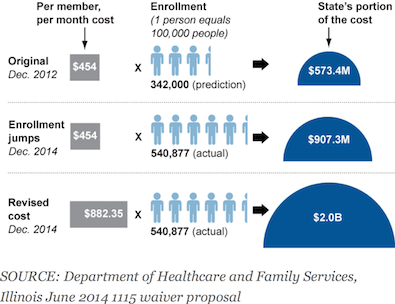

Starting in 2017, Illinois and other states that also expanded their programs are required to start paying a small portion of the bill, rising to no more than 10 percent of the total tab. State health officials estimated in 2012 that Illinois’ portion of the expansion would cost $573 million from 2017 through 2020.

But far more people signed up in 2014, the expansion’s first year, than the state expected. Based on multiple interviews and a Tribune analysis of government data, Illinois will pay at least $907 million from 2017 through 2020 because of those new members. The tab could surge even higher, though.

A document sent by Quinn’s office to the federal government over the summer significantly raised the per-person estimated cost, bumping the state’s total outlay to $2 billion, using 2014 enrollment numbers, more than three times the original estimate. […]

Original projections anticipated that 199,000 residents would sign up in 2014, potentially rising to no more than 342,000. State officials estimated a monthly, per person cost of $454, and revised that number upward to $882 in the document sent to in June to federal officials.

But through December, 540,877 joined Medicaid’s ranks. State officials said thousands more likely signed up through January.

Oy.

* A chart…

* The Tribune editorial board wants the state to impose fees…

Gov. Mike Pence of Indiana in recent days announced an expansion of Medicaid, with a twist. The Republican governor secured the approval of the Obama administration to require that Medicaid enrollees chip in a small contribution — up to around $26 a month for a single adult — for their health care premiums. If people fail to make the payments, they could be denied coverage for six months.

The deal also discourages unnecessary trips to the emergency room — an expensive item in every Medicaid budget — by imposing copays of up to $25 for patients who make unnecessary trips.

Pence’s plan will provide health care to as many as 350,000 people, and set a new model for responsible use of that health care.

Discuss.

36 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|