Your daily “right to work” roundup

Wednesday, May 20, 2015 - Posted by Rich Miller

* Nothing yet from the governor’s office. But here’s the AFL-CIO…

Charleston City Council rescinds the Rauner resolution it passed weeks ago.

Rock Island County unanimously passed a pro-worker resolution tonight.

Franklin County Board unanimously passes a pro-labor resolution and unanimously votes down the Rauner anti-worker resolution tonight in Benton.

* Take it off the board…

Six weeks after the original resolution was passed and two revisions later, City Council members voted down the local government relief resolution 3-2 during their meeting Tuesday.

The resolution, which was changed from “Supporting Local Government Empowerment and Reform” to “Supporting Local Government Relief and Reform,” went up for a vote after Mayor Larry Rennels opened the item to public discussion. Ultimately, Rennels and councilman Jeffrey Lahr voted in favor of the resolution while councilmen Brandon Combs, Matthew Hutti and Tim Newell voted against it.

The council reopened the resolution for discussion May 5 after a crowd packed the council chambers April 21 and addressed members concerning the measure. A different version, which removed portions of the resolution including a paragraph focused on who has control over what topics go into collective bargaining and also removed the term “prevailing wage,” was placed on file for public inspection.

The document was revised again before the final vote, this time taking out sections including a portion focused on right-to-work zones. Rennels said he wanted to focus specifically on areas of the resolution that affected Charleston. The resolution wouldn’t have enacted any changes; rather, it would send a message to Springfield that the city wants the state government to examine issues such as unfunded mandates, Rennels said.

* From RICO…

Union supporters on Tuesday cheered Rock Island County Board Democrats who issued a defiant rebuke to what they say is Gov. Bruce Rauner’s efforts to weaken organized labor.

The board voted 17-0, all Democrats, for a resolution to “protect the middle class” that opposes Gov. Rauner’s proposals to allow right-to-work zones in Illinois communities and repealing rules that protect union wage rates on public projects. The board’s six Republicans abstained. […]

Rather than oppose it, Republican members abstained with Drue Mielke, R-Coal Valley, head of the board’s Republican caucus, reading from a prepared statement.

“This resolution is partisan, and although it does not mention him by name, it is a public repudiation of the governor of the state of Illinois,” Mr. Mielke said. “We should not be taking up this resolution, nor should we be taking up a resolution that supports the governor’s agenda.”

Not exactly a ringing GOP endorsement, that.

* On to Franklin County…

The “Resolution to Protect the Middle Class” was adopted unanimously by the board at its meeting Tuesday night.

The document, which calls the labor movement “a historic cornerstone of the American middle class,” asserts that right-to-work zones are not within the authority of local governments, and that the repeal of prevailing wage requirements on construction projects will drive down wages and benefits and hurt the local economy. […]

Following the roll call vote in Benton on Tuesday night, the standing-room-only crowd in the courtroom — where the meeting had been moved because the usual county board meeting room would have been too small to hold everyone — stood and applauded.

* Related…

* Morton Grove elaborates on response to proposed state cuts: During the May 11 meeting, the board approve a resolution stating that the village would oppose any initiatives that would hurt the middle class.

58 Comments

|

SEIU blasts Rauner over contract talks

Wednesday, May 20, 2015 - Posted by Rich Miller

* Gov. Bruce Rauner’s administration is apparently playing hardball with SEIU over a union contract covering 50,000 childcare and home care workers. Negotiations began Monday, even though the contract expires June 30th. Rauner’s opening offer was pretty harsh. From a union insider…

Rauner wants to take away virtually all union benefits that have been bargained for by these employees over the years, including health care, for tens of thousands of low-wage workers. These employees don’t get state-insurance, by the way, but belong to a union-funded plan. Taking health insurance away would represent a real hardship for them.

What’s more, Rauner is demanding that his administration stop collecting dues from workers, a time-tested union-busting tactic.

He’d also cut training-which would adversely affect the quality-of-care for countless seniors and persons with disabilities.

Additionally, as if this were one of his newly-acquired private equity properties, he wants to convert these workers into “independent contractors.” He also wants to remove the state’s neutrality position on the union and make it much harder for workers and the union to communicate.

And even though the contract expires on June 30th, no further talks have been scheduled until - get this - June 23rd.

Oy.

What a summer this is gonna be.

* SEIU Healthcare Illinois Executive Vice President April Verrett, by the way, just issued a press release…

Bruce Rauner’s anti-worker efforts to eliminate bargained-for benefits and protections for home care workers and child care providers would deliberately submerge low-wage workers deeper into poverty.

What the state proposed on the governor’s behalf on Monday, May 18, has NOTHING to do with the public good or budget savings Rauner claims and everything to do with diminishing the voices of working families, punishing political opponents and gathering power. His unprecedented and hostile proposals — which include stripping health care from thousands of workers — would have a devastating impact on the tens of thousands of low-income workers and their families and put the tens of thousands seniors and children who depend on them at risk.

In addition to totally eliminating access to health coverage for workers, Rauner’s team also proposed eliminating essential training like CPR and eliminating the right of workers to have union dues deducted from their paycheck.

Let’s be clear: The people whom Gov. Rauner is willing to harm with this attack are low-wage workers, most of them women and people of color who are hovering at or in poverty. Their rights and benefits have been supported over the years by legislators and governors of BOTH parties.

What’s more, these workers fought for years for health coverage, training and professional development and the right to have a union. Gov. Rauner’s proposals set workers back and put seniors, people with disabilities, parents who depend on affordable child care and other vulnerable populations further at risk.

Refusing to collect dues and interfering with the ability of workers to communicate with their union has nothing to do with the budget and everything to do with an extreme ideology that has been rejected on a bipartisan basis.

Bruce Rauner has not brought a reasonable deal to the table and has declared war on care providers, many of them who struggle to make ends meet, and on the communities they serve.

While his ultra-wealthy donors enjoy his special protection, Bruce Rauner instead is willing to hurt the working families of Illinois and the most vulnerable among us.

I asked the governor’s office for a response a few hours ago and haven’t heard back. I’ll let you know if they say anything.

120 Comments

|

Meh

Wednesday, May 20, 2015 - Posted by Rich Miller

* AP…

A group of freshmen Republican legislators is pushing for term limits, saying gridlock in the Illinois Legislature is a sign the status quo isn’t working.

The lawmakers held a news conference Wednesday to rail on the “entrenched leadership” in Springfield.

* But…

None of the 11 lawmakers at the news conference said they’re voluntarily limiting their own time in office.

On the one hand, that’s kinda funny.

On the other hand, it’s not really hypocritical. We often see the same sort of illogical barbs aimed at those who want to see a tax increase: If you’re so concerned, how about you voluntarily send the state more money than you owe?

And, in reality, a bunch of minority party lawmakers have little to nothing to do with “entrenched” Springfield leadership. That press conference was really about the House Speaker, not rank and file members.

* I’m not a big fan of term limits, but I don’t think they would be the end of the world, either, as long as people realize that the governor would likely wind up with a whole lot more power than the office currently has. The legislative leadership has strengthened their somewhat weak constitutional position with impressive political and organizing skills (which will eventually deteriorate with turnover), creative rule-making and executive rule oversight (which hasn’t really been challenged).

I’d much rather see remap reform, but that’s not nearly as sexy in the waning days of a bitter spring legislative session.

36 Comments

|

Today’s number: $2.1 billion

Wednesday, May 20, 2015 - Posted by Rich Miller

* The problem, according to the Taxpayers’ Federation and the Center for Tax and Budget Accountability in a new report…

According to the Illinois Comptroller, the state has run a deficit in its General Fund every year since at least 1991. The causes of these annual deficits vary, as do the potential solutions, but the data make one thing clear—antiquated tax policy is one of the significant contributors to Illinois’ long term fiscal shortcomings.

* So, what to do? One route is looking at the sales tax…

For a sales tax to play its role of generating stable revenue for a fiscal system, it needs to apply broadly to most transactions that occur in the consumer economy. The reasons for this are easy to understand. First, consumer spending is the largest segment of both the nation’s and Illinois’ respective economies, accounting for nearly 70 percent of all economic activity. Second, consumer spending usually does not decline substantially—even during major economic downturns. For instance, during the Great Recession, consumer spending remained relatively constant, with real personal consumption expenditures declining by less than one percent from 2007 through 2010. Hence, if a sales tax base broadly applies to most transactions in the consumer economy, that sales tax will have the capacity to provide some stability to a state’s fiscal system, even when other more volatile/responsive revenues are declining rapidly. In addition, a broadly applicable sales tax is efficient—it does not distort consumer decision-making by exempting, and thereby favoring, one business sector over another.

* The case for the sales tax on services…

Illinois’ sales tax applies to fewer service industries than do the sales taxes in all of Illinois’ neighboring states. Nationally, Illinois ranked 45th (out of 45) in the number of service industries identified as subject to its general sales tax. Because Illinois does not apply its sales tax to most services, it has what is considered a narrow sales tax base. This is problematic because research shows that a narrow–based tax is more volatile than a broad-based one. Volatility is not desirable in a sales tax, which is supposed to generate stable revenue for a fiscal system. Hence, broadening Illinois’ sales tax base to include more services than are currently taxed should decrease this volatility. This, in turn, should enable the sales tax to do a better job of generating stable revenue for the Illinois fiscal system. […]

in 1965, the sale of services accounted for 51 percent of the total Illinois economy, while the sale of goods accounted for 41 percent. Over the next half century, the Illinois economy greatly changed. By 2012, the sale of services increased to represent 72 percent of the state’s economy, while the sale of goods declined significantly, accounting for just 17 percent of the Illinois’ economy. Put another way, the base of the Illinois’ sales tax lost more than half of its value as a share of Illinois’ economy over the last four decades. […]

By leaving the majority of the largest and fastest growing sector of the state’s economy out of its sales tax base, Illinois has effectively ensured that its sales tax cannot perform the stability function needed for its fiscal system to be sound.

* What should be avoided…

To modernize its sales tax, Illinois should expand its base to include consumer services, like pet grooming, haircuts, country club membership, health clubs, and lawn care.

The focus on consumer services is intentional. There are a number of service industries that should not be included in the state’s sales tax base for a variety of reasons. For instance, regardless of the service, business-to-business transactions should not be taxed, because taxing such transactions creates economic distortions and inefficiencies. Indeed, taxing business-to-business transactions typically results in “tax pyramiding,” which occurs when essentially one economic transaction is taxed multiple times during production and distribution, rather than just once upon final sale to the end-user. Tax pyramiding artificially increases the cost of a product or service as it flows through the economy, by taxing various stages of production.

* Bottom line…

Based on COGFA’s analysis, an estimated $2.105 billion in additional revenue could be generated if the sales tax base was expanded to include primarily consumer service industries while excluding business-to-business transactions and professional services.

Coincidentally, that’s almost the entire amount of Gov. Rauner’s phony “savings” from pension reform next fiscal year.

* Greg Hinz…

Local governments, which get at least an additional 1.25 cents on the dollar, would net another $526 million—money that would help Chicago, Oak Park, Schaumburg and other cities and towns throughout the state deal with budget problems including a proposed cut in state aid under Rauner’s budget.

The figure would be a lot higher if professional services were taxed, things such as legal and accounting fees. But the authors of the report say taxing such business-to-business charges are a bad idea. […]

Taxing construction services—such as carpentry, plumbing and painting—would net an estimated $795 million a year. Cable TV and other “program distribution” would get $11.6 million, data processing and other computer services $81 million, maintenance and janitorial services $28 million, and health clubs and tanning salons $11.3 million. A full list is at the end of the report.

To reach its $2.1 billion number, the groups took old estimates by the Commission on Government Forecasting and Accountability—the Legislature’s fiscal research unit—and adjusted them for inflation.

Thoughts?

62 Comments

|

House votes to ban “conversion therapy”

Wednesday, May 20, 2015 - Posted by Rich Miller

* From a press release…

State Representative Kelly Cassidy shepherded HB 217 to House approval Tuesday, moving Illinois closer to banning sexual orientation conversion therapy, a practice deemed disastrous for the well being of children by every prominent mental health organization.

“This archaic form of so-called treatment is based on an outdated and flawed philosophy that greatly increases the risk of suicide and mental anguish to the children who are forced to participate” Rep. Cassidy (D-Chicago) said. “I join a coalition of professional mental health organizations in applauding the passage of the bill.”

The legislation prohibits licensed mental health providers from engaging in sexual orientation change efforts, codifying the codes of ethics for mental health providers.

“The practice violates the basic Hippocratic oath of Do No Harm,” said Dr. Scott Leibowitz, Head Child and Adolescent Psychiatrist for the Gender and Sex Development Program at Ann & Robert H. Lurie Children’s Hospital of Chicago. “Promoting stigma and shame, rather than acceptance and support goes against the fundamental principles of our practice and poses a unique and serious danger to children.”

The bill passed with a vote of 68-43 and now goes to the Senate for consideration.

* Excerpt from an Equality Illinois release…

The bill passed 68 to 43, with 61 Democrats and seven Republicans voting to protect the LGBT youth of Illinois, including the House Republican leader Rep. Jim Durkin among the “yes” votes. The roll call continues the history in Illinois of all laws that advance LGBT equality succeeding due to votes from both parties.

“The fact that there was a bipartisan vote in favor of the bill in the House demonstrates that this is again not an issue based on political affiliation but on doing what is right for Illinois children. We hope that Senate Democrats and Republicans will similarly give serious consideration to supporting the bill and that Gov. Bruce Rauner will sign it.”

Equality Illinois and allied organizations have held two meetings with Gov. Rauner about the issue, and he expressed concern about the therapy’s effect on young people.

The bill prohibits licensed mental health care providers from engaging in sexual orientation change efforts with anyone under the age of 18. Sexual orientation change efforts are defined by the bill as any treatment or practice that seeks to change a person’s sexual orientation or gender identity. Such practices can negatively impact the mental and physical health of LGBT youth. For instance, LGBT youth who experience rejection and social stigmatization are more likely to have high levels of depression, more likely to engage in substance abuse, and more likely to attempt suicide.

Every major mental health organization in Illinois supports HB 217, including the Illinois Psychological Association, Illinois Psychiatric Society, American Psychoanalytic Association, Illinois Chapter of the National Association of Social Workers, and Illinois Chapter of the American Academy of Pediatrics.

The legislation does not apply to religious leaders and would not impact the ability of clergy to practice their religion. Similar legislation is now law in California, New Jersey, and the District of Columbia, and the Oregon legislature has sent a bill to the governor. Also, the U.S. Supreme Court has refused to hear a challenge to the New Jersey law.

The bill passed without debate.

* The Illinois Family Institute displayed its usual outrage…

Yesterday afternoon in an appalling disregard for children’s mental health, parental rights and religious liberty, the Illinois House voted 68 to 43 to pass HB 217, a bill to ban reparative therapy for children who suffer from unwanted same-sex attraction disorder. This bill was introduced by LBGTQ activist and State Representative Kelly Cassidy (D-Chicago). The bill received eight more votes than the sixty needed to pass!

This is an unmitigated disaster for children and families! It is a shame that not one conservative lawmaker challenged this proposal during floor debate. Not one lawmaker defended children and free speech from the tyranny of Leftists who demand we act, speak and think according to the dictates of their beliefs. Not one lawmaker reminded their colleagues that by diminishing the right to live out our faith, they are establishing the religion of secularism which the First Amendment decisively prohibits.

While a number of representatives were excused from session that afternoon, it is disappointing to report that seven Republicans sided with this pro-homosexual, anti-parental rights, anti-religious liberty legislation, including: State Representatives Dan Brady (Normal), Tim Butler (Springfield), Michael McAuliffe (Chicago), Bob Pritchard (Sycamore), Deputy “Leader” David Leitch (Peoria), and Assistant Republican “Leader” Ed Sullivan (Mundelein), who also voted to pass same-sex “marriage” in November 2013. Even Republican Minority “Leader” Jim Durkin (Burr Ridge) voted to further the devastation of families who have members struggling with the issue of unwanted same-sex attraction.

However, a number of Democrats did not support this radical agenda, including State Representatives Kate Cloonen (Kankakee), Jerry Costello (Red Bud),Anthony DeLuca (Chicago Heights), Brandon Phelps (Harrisburg), Larry Walsh Jr. (Joliet) and even Assistant Majority Leader John Bradley (Marion).

IFI is grateful for the moral clarity displayed by these and other members of the Illinois House of Representatives who opposed HB 217.

The bill now moves to the Illinois Senate, the more liberal chamber. Unless an outpouring of prayers, along with many visits and calls are made to senators’ local district offices, this bill will likely become law.

We are seeing an unprecedented attack on Illinois families, parental rights and religious liberty by the people who are repeatedly elected back into their positions of authority. Are you registered to vote? Do you vote?

If people of faith do not step out of their comfort zone and speak loudly and publicly; at the very least with their vote, we are assuredly leaving a legacy of tyranny and evil for our children and grandchildren.

* Rep. Tom Morrison explains his “No” vote…

2. By restricting counseling options, HB 217 falsely sets lawmakers up as medical experts.

This bill claims that it’s always wrong for minors to seek counseling if they’re confused about their sexual orientation.

Page 8 of the bill says that type of counseling is allowed, “under no circumstances.” That means the minor cannot turn to a professional counselor for help, even if he or she is the one who desires to talk about unwanted sexual feelings one way or another.

Many of the bill’s sponsors would argue in reproductive health care that it is not the government’s place to come between a patient and his or her doctor.

Why is this different?

* But, in reality, there may not be much activity to ban, according to the Tribune…

It’s unclear how common the practice is in Illinois. Supporters of a ban largely point to anecdotal evidence from people who have come forward to share their stories. Cassidy said she was unaware of any specific places practicing the therapy but said she has spoken to several “survivors.”

The Illinois Department of Financial and Professional Regulation, which oversees mental health providers, reported that it received one complaint related to the therapy in 2012. It was filed by the Southern Poverty Law Center, which has fought conversion therapy across the country. The state agency found no cause to discipline the therapist.

Sam Wolfe, a civil rights attorney at the law center, said it’s difficult to quantify how pervasive conversion therapy is in Illinois because conversion therapists operate through referral services and word of mouth instead of explicit advertising because of blowback in recent years.

The bill now goes to the Senate.

48 Comments

|

[The following is a paid advertisement.]

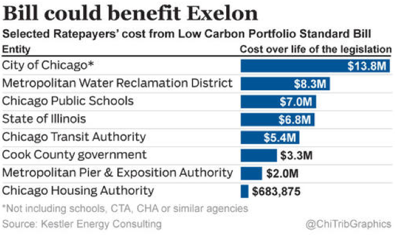

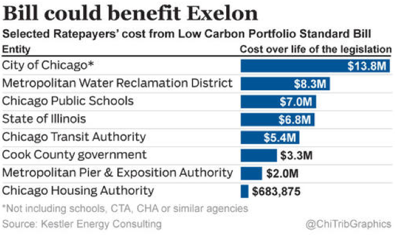

According to Moody’s, Exelon’s credit is rated (Baa2) two notches higher than Chicago (Ba1) and four notches higher than CPS (Ba3). Yet Exelon is demanding a $1.6 BILLION bailout from struggling family, business and government ratepayers including more than $20 million from Chicago and CPS. Maybe Exelon should be bailing out Chicago and CPS instead of the other way around!

“A plan to financially reward Exelon Corp. for producing no-carbon energy and potentially save three Illinois nuclear plants from closure would cost ratepayers $1.6 billion over five years and strain budgets for financially strapped businesses and municipal governments, a study released Tuesday found.” - Associated Press, 4/21/15

Chicago Tribune: “Exelon-backed legislation could cost ratepayers $1.6B, study says”

Chicago Tribune: “Exelon-backed legislation could cost ratepayers $1.6B, study says”

We simply can’t afford to pad the pockets of Exelon shareholders while governments from Chicago to Cairo are in such dire straits. Businesses and governments can learn how much the bailout would cost them at www.noexelonbailout.com/calculator.

Just say no to the Exelon bailout. Vote no on SB1585/HB3293.

BEST Coalition is a 501C4 nonprofit group of dozens of business, consumer and government groups, as well as large and small businesses. Visit www.noexelonbailout.com.

Comments Off

|

Rauner said he would do it, and he did it

Wednesday, May 20, 2015 - Posted by Rich Miller

* From a Northwest Herald editorial…

By giving every Republican member of the state House and Senate campaign cash, Rauner is no better than the special interest groups and Springfield culture he campaigned against.

When voters put Rauner into office, they did so expecting change. Not even six months into his first term, and Rauner is giving voters signs that he may be more about fitting in and conforming than mixing it up.

There’s a lot to like about Rauner’s turnaround agenda, and we’ve supported the ideas that make sense and strive to make Illinois a better place to live and do business. We don’t, however, endorse business as usual.

Using campaign dollars to attain votes is a disappointment. We expected more from the man who promised to shakeup Springfield.

* Actually, Rauner promised to do exactly what he did last week way back in December of 2013. From my syndicated newspaper column last November…

Last December, Bruce Rauner appeared on a WLS Radio talk show and revealed that he planned to form a new campaign committee to counter the power of Illinois House Speaker Michael Madigan.

“We’re gonna raise a PAC, we’re gonna raise a fund dedicated to the state legislature, members of both parties who take the tough votes,” Rauner said. “We’ve gotta protect the members who take tough votes.”

“Right now,” Rauner continued, “Madigan controls the legislature from his little pot of cash. It isn’t that much money. And he runs the whole state government out of that pot. We need a pro-business, pro-growth, pro-limited-government, pro-tax-reduction PAC down there in Springfield working with the legislature for those who take tough votes.”

Instead of one PAC, there’s two. One he controls and a “Democratic” PAC controlled by his pals.

* And from October of 2013…

“And Madigan’s never dealt with someone like me. He’s dealt with career politicians who need favors, who need money, who are worried about re-election. That ain’t me. I can stand up to him.

“And I’m also a very aggressive negotiator. I know how to leverage and advantage. And I’ve got big advantages. The power of the governorship, if you’re willing to shake it up, is hugely powerful.

“You have executive order ability like very few other governors have. You have line item veto, amendatory veto. You control the checkbook and the spending. You control the contract negotiations with the government union bosses and the suppliers.

“I can do things no career politician would think about doing. I can run the government like a business, challenge the government unions and their power, transform their deal through contract negotiations, and stand up to Madigan, because I know where his special interest groups are, and I can go after them.”

So, he’s actually toned down his promises. At least for now.

* Related…

* Local lawmakers get Rauner money, say it won’t affect their decisions: “It’s sitting on a table at home right now,” Butler said of depositing the check in his campaign account. “I think we’ve just got to see how things play out. Obviously, there’s been a lot made of the fact that he’s cut these checks, so I’m kind of evaluating it right now.”… Butler said he disagrees with the notion that he’s expected to vote in favor of the governor’s agenda because of the contribution… Poe said he got $3,000 from Rauner. “I don’t intend to probably ever cash it,” Poe said. “Give it six months, and we’ll see what happens. I didn’t think I needed it right now and probably shouldn’t cash it.”

48 Comments

|

Dems drafting their own budget

Wednesday, May 20, 2015 - Posted by Rich Miller

* Subscribers know more about this development…

House Democrats say they’re working behind the scenes to draw up their own budget plan they hope can pass before a May 31 deadline […]

“The truth is that what the governor is asking for is that we wholeheartedly accept his political ideology and agenda in exchange for a balanced budget,” Cullerton spokeswoman Rikeesha Phelon said. “The people of Illinois deserve a balanced budget with or without Gov. Rauner getting what he wants on a number of political fronts.”

Democrats aren’t saying what their budget plan would look like. If it contained a tax hike, that would play into Rauner’s hands. The governor could veto the measure and force lawmakers back to the table over the summer as he airs millions of dollars in TV ads ripping Democrats for trying to raise taxes before making other fixes.

* Reuters…

Given the Democrats’ control of the state legislature and their opposition to many proposals for spending cuts, municipal bond fund managers see little alternative for Republican Governor Bruce Rauner other than eventually agreeing to hike taxes, such as raising the state’s income tax or broadening its sales tax base. […]

“What is quite simple a solution is to raise taxes,” said Tom Metzold, senior portfolio manager at Eaton Vance Management, which has been paring down its Illinois exposure. “You’re going to have a game of chicken over who blinks first - the cutting expenditure side or raising taxes side.” […]

“It doesn’t take much of a tax increase and/or a combination of some spending cuts to solve their problems, it just takes the political will,” said Guy Davidson, director of Municipal Fixed Income at AllianceBernstein, which owns some Illinois state general obligation bonds.

While Illinois ranks 31st among the states in terms of its state business tax climate for 2015, according to the Tax Foundation research group, its flat personal income tax rate is well below many other states, particularly for higher-income earners.

Davidson is way understating the problem here. These aren’t easy peasy things.

* Meanwhile, yet another House proposal that has no chance of passage, but could likely wind up as direct mail fodder for the Democrats since it’s quite popular…

People who make more than $1 million per year would pay more in taxes after their incomes reached seven figures under a plan that lawmakers started considering today. […]

The plan would add a 3 percent tax to annual incomes over $1 million and send the money generated to Illinois schools.

Business leaders pushed back, saying the idea would be “another nail in the coffin” for businesses considering leaving Illinois. And he echoed last year’s criticisms of the 2014 referendum as a populist political move.

“It’s an easy vote to say yes to, much like being able to say: ‘Tax somebody else to take care of the problems that we face in this state,” Illinois Manufacturers Association President Greg Baise said.

The House Revenue Committee approved the measure along strictly partisan lines today.

* More…

“After New Jersey implemented its millionaires tax, the state itself came out and estimated it lost $2.4 billion of income as a direct result of tax migration,” said Todd Maisch, president and CEO of the Illinois Chamber of Commerce. “We think tax migration is going to be a very big issue.”

“In talking to our members, tax policy is indeed a driver of where they locate,” said Greg Baise, president and CEO of the Illinois Manufacturers’ Association. “This will be another nail in the coffin for job creators who want to stay in the state.”

Baise said the amendment does not address tax policy in a broad manner, something Gov. Bruce Rauner has said he wants the legislature to do this spring.

Currie, though, said the number of millionaires in New Jersey increased after the state imposed a similar tax.

It’s gonna be a heckuva summer unless they can get their acts together right away.

…Adding… Wall St. Journal…

Anti-tax advocates contend that higher taxes on the wealthy lead to millionaire flight. They say this has been seen in Maryland, Rhode Island, New Jersey and New York. The rich are mobile, they say. They can take their money, taxes and jobs wherever they are treated best.

But a new study focusing on New Jersey provides some of the most detailed evidence yet that so-called millionaire taxes have little effect on the movements of millionaires as a whole.

The study, by sociologists Cristobal Young at Stanford and Charles Varner at Princeton, studied the migration patterns of New Jersey’s millionaires before and after 2004, when the state imposed a “millionaire’s tax” that raised rates on those earning $500,000 or more to 8.97% from 6.37%.

The study found that the overall population of millionaires increased during the tax period. Some millionaires moved out, of course. But they were more than offset by the creation of new millionaires.

The study dug deeper to figure out whether the millionaires who were moving out did so because of the tax. As a control group, they used New Jersey residents who earned $200,000 to $500,000–in other words, high-earners who weren’t subject to the tax. They found that the rate of out-migration among millionaires was in line with and rate of out-migration of submillionaires. The tax rate, they concluded, had no measurable impact.

* Related…

* Expert panel criticizes medical care at Illinois prisons

* State tardy on $10 million in funding to U of I Extension

70 Comments

|

Meanwhile, in Opposite Land…

Wednesday, May 20, 2015 - Posted by Rich Miller

* California’s spending is able to rise 6 percent next fiscal year because the state previously did the fiscally responsible thing of cutting spending and raising taxes…

California Governor Jerry Brown said an expanding economy has channeled an additional $6.7 billion in revenue into state coffers, allowing him to boost proposed spending next year to a record $115 billion.

Most extra money will go to schools, Brown said Thursday at a Sacramento news conference where he released a revised budget for the year that begins July 1. Fellow members of the Democratic Party who control the legislature said he should spare some cash to augment programs for the poor. […]

Brown, 77, the longest-serving governor in California history, has steered the world’s seventh-largest economy away from deficits and turmoil. At points, it paid bills with IOUs. In the past two years, however, the three biggest bond-rating companies raised their rankings on California four times, more than any other state.

Voters increased taxes in 2012 and let lawmakers pass budgets with a simple majority instead of a two-thirds vote. Brown is capitalizing on a surge in revenue from capital-gains taxes that turned a $25 billion deficit four years ago into a surplus. […]

Brown’s new plan would provide health care to undocumented immigrants and offer an additional $2.2 billion for responding to a record drought.

Brown announced an agreement with University of California President Janet Napolitano that would freeze in-state tuition for two years by steering $436 million to the university system’s pension obligations, among other funding increases. Napolitano and Brown clashed last year when the Board of Regents granted her authority to raise tuition, inciting student protests. […]

Brown’s plan would create an earned-income tax credit to steer $380 million to 2 million low-income workers. The credit would provide an average $460 annually to households without dependents whose income falls below $6,580 and those with at least three dependents earning below $13,870.

69 Comments

|

The Democrats fire back

Wednesday, May 20, 2015 - Posted by Rich Miller

* I posted remarks at length yesterday by House Republican Leader Jim Durkin and Senate GOP Leader Christine Radogno about how the Democrats were walking away from the “working groups” process in an attempt to push the session into overtime. Here are some stories with the Democratic response. Riopell..

A spokeswoman for Senate President John Cullerton, a Chicago Democrat, criticized Republicans’ tone.

“It’s counterproductive and raises questions about the true goal of the governor’s secret meetings,” spokeswoman Rikeesha Phelon said. “We have been fully engaged in the process and continue to hope that we can arrive at a balanced and bipartisan budget.”

* Erickson…

Democrats say they are “engaged in the process,” but have warned the governor’s “Turnaround Agenda” could hurt the middle-class.

“I don’t think anybody would realistically expect the progress that working families have made in Illinois would be dismantled in a few months,” said Steve Brown, spokesman for House Speaker Michael Madigan, D-Chicago. “It’s not going the way they want. But it is what it is.” […]

A spokeswoman for Senate President John Cullerton, D-Chicago, said the Republican announcement puts a damper on the session, which is scheduled to end on May 31 with the adoption of a budget.

“Today’s press conference really does change the temperature in the building and will probably prove to be rather counterproductive,” Phelon said. […]

“Their complaints are a little curious,” Brown said. “I don’t think there is anything different happening there.”

* WCIA…

However, Illinois Representative Mike Smiddy (D-Port Byron) said Republicans are sabotaging the negotiations.

“If anything is going to get done, it’s probably going to get done by the Democrats,” Smiddy said. “And as usual the Republicans are going to be sitting on their hands come crunch time with the budget.”

Steve Brown, spokesperson for Illinois House Speaker Michael Madigan (D-Chicago), called the press conference a distraction after Republicans came under fire for taking thousands of dollars from Bruce Rauner’s campaign

* Finke…

“We have been having roll calls on the signature elements of (Rauner’s agenda),” said Steve Brown, spokesman for House Speaker Michael Madigan, D-Chicago. “I don’t know how they can justify making that kind of a claim.”

Brown also said that to the best of his knowledge, Democrats are still participating in the working groups.

Senate Democrats are also participating, said Rikeesha Phelon, spokeswoman for Senate President John Cullerton, D-Chicago. […]

She said Cullerton “is disappointed in the change in tone in Springfield today. It’s unnecessary and counterproductive when we have such a short time to produce a balanced budget. The governor is basically asking the members of the General Assembly to wholeheartedly embrace his political agenda in exchange for producing a balanced budget.”

* AP…

Steve Brown, spokesman for Democratic House Speaker Michael Madigan, fired back at Republicans for pushing an agenda he says hurts working people.

“I’m sure nobody seriously believed we’re going to dismantle decades of progress working families have made just because somebody’s showing a Power Point around the state,” Brown said, a reference to a Power Point presentation Rauner has frequently used to outline his agenda.

Oy.

43 Comments

|

[The following is a paid advertisement.]

Ben Lowers, Police Chief in Clinton, Illinois:

As Police Chief in Clinton, I know firsthand of the significant impact the Clinton Power Station has on my community. It employs nearly 700 of our friends and neighbors and funds local government services including schools, fire and emergency response through the $12.6 million it pays in taxes every year.

Outdated energy policies are forcing nuclear energy plants nationwide to close down and Clinton could be next. These closures devastate local communities. Jobs are lost. Services are cut. Last year, a Vermont town eliminated its entire police department after its local plant closed down.

Clinton cannot afford this and neither can Illinois. That is why I support a legislative proposal called the Low Carbon Portfolio Standard. This proposal is good for our state’s economic health and would help prevent plants like Clinton Power Station from closing.

I urge our legislators in Springfield to act now and vote YES on the Low Carbon Portfolio Standard - House Bill 3293 & Senate Bill 1585.

To learn more go to www.nuclearpowersillinois.com

Comments Off

|

* I tried posting this story yesterday on my phone and couldn’t get it to work right. Sorry about that. Let’s first go to the AP…

Illinois Gov. Bruce Rauner’s lawsuit over forced fees paid by non-union state workers may proceed, but without the governor participating, a federal judge ruled yesterday.

U.S. District Judge Robert Gettleman decreed that the Republican, who has tried to limit labor unions’ political influence in his short tenure, does not have sufficient interest in the matter to seek a federal opinion that so-called “fair-share” fees are unconstitutional.

And he declared Rauner cannot collect the fair-share fees and keep them in a separate account—away from the unions—until the matter is settled.

But the judge decided that three non-union Illinois workers who were added to the suit later may press the case. Mark Janus of the Department of Healthcare and Family Services, Marie Quigley of the Department of Public Health and the Transportation Department’s Brian Trygg are better positioned to show “injury” from being forced to pay the fees, but they must prove as legal action moves forward that federal intervention is justified.

Rauner was “greatly encouraged” by the decision, a spokeswoman said.

* Tribune…

In his ruling, Gettleman said Rauner lacked standing to challenge public unions in his official capacity because he had “no personal interest at stake.”

“In effect, he seeks to represent the non-member employees subject to the fair share provisions of the collective bargaining agreements,” Gettleman said of Rauner and non-union workers. “He has no standing to do so. They must do it on their own.”

In an attempt to move forward with his original lawsuit, Rauner amended it to include three non-union employees who oppose making the fair share payments. But Gettleman said Rauner lacked the authority to add the workers to his lawsuit without court permission.

Gettleman acknowledged the workers had standing to file suit to challenge the payments and agreed “in the interest of judicial economy” to allow their complaint to proceed separately. He ordered attorneys for the state’s public employee unions to respond to the suit by June 10.

* Illinois AFL-CIO react…

A federal lawsuit brought by Illinois Governor Bruce Rauner against 25 labor unions representing state employees has been dismissed by the US District Court for the Northern District of Illinois—the latest in a string of setbacks for the governor’s efforts to strip the rights of all workers to have strong union representation.

“We’re gratified that the court has rejected Governor Rauner’s latest ploy to weaken the unions that represent police officers, child protection workers, nurses and all who serve our state,” Illinois AFL-CIO president Michael T. Carrigan said. “This should be a strong signal to the governor that it’s time he treats public service workers with respect.”

Rauner filed the suit in February, at the same time he issued an executive order refusing to comply with federal and state laws that provide for fair share agreements, under which union-represented employees who choose not to join the union instead pay a proportional fair share of the cost of union representation.

Today, Judge Robert W. Gettleman granted motions by the unions and Attorney General Lisa Madigan, dismissing Rauner’s complaint for lack of standing and subject matter jurisdiction.

Judge Gettleman also denied Rauner’s request to place fair share fees in escrow.

He allowed three individual state employee plaintiffs to pursue the case in their own right.

* The full ruling is here. From the judge’s conclusion…

For the reasons explained above, the Employees’ motion to file their complaint in intervention (Doc. 91) is granted and the complaint will be treated as the operative complaint in this action. The Unions’ and Madigan’s motions to dismiss the original complaint (Docs. 40, 51) are granted. The Governor’s motion to confirm the first amended complaint (Doc. 97) and motion to dismiss defendants’ motions to dismiss as moot (Doc. 99) are denied. The first amended complaint (Doc. 102) is dismissed. The Governor’s motion to place fair share fees in escrow (Doc. 83) is denied as moot. The remaining defendants are ordered to respond to the new operative complaint on or before June 10, 2015.

89 Comments

|

[The following is a paid advertisement.]

Credit unions are dedicated to fulfilling the daily financial needs of their membership and serving the needs of their communities. The movement’s “People Helping People” philosophy also motivates credit unions to participate in meaningful and important local activities, such as honoring our veterans.

As a thank you for their ultimate sacrifice to our country, credit unions from across the state unite to sponsor wreaths to decorate the gravesites of veterans from each branch of the military during the holidays. This past year, through member donations collected at their branches and with funds directly provided by the credit unions themselves, nearly 570 gravesites were decorated with wreaths sponsored by Illinois credit unions at the Abraham Lincoln National Cemetery, as well as at Arlington National Cemetery in Washington, D.C. True to their mission, groups of volunteers from Illinois credit unions also participate in the ceremonial act of placing wreaths at the gravesites.

As not-for-profit financial cooperatives with a mantra of “People Before Profits”, credit unions are a highly valued resource by nearly 3 million Illinois consumers — and remembered for their efforts in serving their communities this Memorial holiday and every day.

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|