Today’s number: 2 cents

Wednesday, Apr 13, 2016 - Posted by Rich Miller

* From IRMA…

WHERE: Illinois State Capitol

1st Floor, South Hall

301 S. 2nd Street

Springfield, IL 62707

WHEN: Thursday, April 14

Lunches available anytime between 11:30 a.m. - 1:00 p.m.

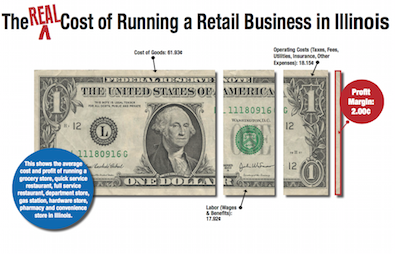

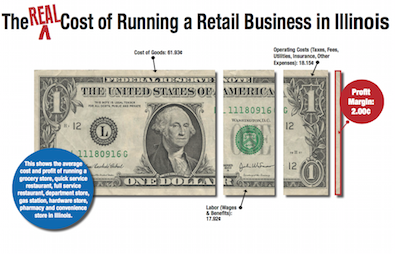

Illinois retailers launched a statewide campaign aimed at shining the spotlight on how little profit margin exists – just two cents – on every dollar spent in an Illinois retail establishment. The retailers Two Cents movement will highlight an industry increasingly burdened with a litany of cost mandates at federal, state, and local level resulting in scaling back employee hours, laying off employees and impacting overall growth. The harsh reality of today’s retail sector is that for every $1 spent in an Illinois retail establishment, only about two cents results in profit, holding true from grocery stores and gas stations, to pharmacies and hardware stores.

* This handy chart breaks everything down…

- Chicago 20 - Wednesday, Apr 13, 16 @ 10:24 am:

The graphic is a bit fuzzy, but does it claim that cost of goods represent over $1 for every dollar in sales?

- Rich Miller - Wednesday, Apr 13, 16 @ 10:25 am:

If the graphic is a bit fuzzy then click the link. And no, it obviously doesn’t. C’mon.

- Me too - Wednesday, Apr 13, 16 @ 10:27 am:

So a business owner who had gross receipts of 10 million dollars (pretty decent business if you ask me) would net just 200,000? 1 million in sales gets you 20k? Those salary and benefits include the owners I would guess. So what they’re really saying is that after paying everyone, including the owner, they only have a little bit of money to put back in the business. Okay, so pay the boss less. I know when I worked at a small business the owner’s take home was pretty much dependent on the net sales that month. I’d like to see how much of that labor, wage and benefits section is for the CEO. Then complain about 2% and try to keep a straight face.

- PublicServant - Wednesday, Apr 13, 16 @ 10:29 am:

Show your work.

- Allen D - Wednesday, Apr 13, 16 @ 10:31 am:

— Chicago 20 - Wednesday, Apr 13, 16 @ 10:24 am:

The graphic is a bit fuzzy, but does it claim that cost of goods represent over $1 for every dollar in sales?—

You obviously have not ran a business… that figure states the numbers in Cents… COGS = $61.93 Cents or to simplify $0.6193

Add them all up and it equals $ 0.98

- Allen D - Wednesday, Apr 13, 16 @ 10:33 am:

the math is easy

$ 0.6193 + 0.1792 + 0.1815 = $ 0.98

$ 0.02 is the remainder profit

- illinois manufacturer - Wednesday, Apr 13, 16 @ 10:34 am:

World wide Walmart runs a 3 % margin. Are they really gokng to show the boojs or just whine a lot and say Illinois is bad . Perhaps yoy may ask them if their bigger problem us people have enough junk from China and their stores are ugly and poorly staffed and full of stuff peopke cant want or afford because of our race to the bottom

- Earnest - Wednesday, Apr 13, 16 @ 10:34 am:

I don’t find the numbers convincing, but I’d be open to recommendations for improving the business environment for them.

- Robert the 1st - Wednesday, Apr 13, 16 @ 10:36 am:

=World wide Walmart runs a 3 % margin. Are they really going to show the books or just whine a lot and say Illinois is bad .=

So if your pay was cut by 33%, that would be just fine?

- Chicago 20 - Wednesday, Apr 13, 16 @ 10:38 am:

In 2015 Walgreen’s reported $4.1 billion in profits on $103.4 billion in sales.

That’s 3.965% or double the margin reported by IRMA.

- Not impressed - Wednesday, Apr 13, 16 @ 10:39 am:

I like how taxes are part of an 18% catchall category that also includes utilities and insurance along with “other expenses.”

But is Illinois really that much more expensive than other states? The low profit margin in retail is why Walmart has been so successful. They also exist on a razor-thin margin but the economies of scale help the corporation reap a nice overall profit. A single store run by mom and pop has a tough time competing on price against a giant that can literally afford to lose money on some items.

- Anonymous - Wednesday, Apr 13, 16 @ 10:40 am:

Is that enough “show your work” for you Public Servant?

- benniefly2 - Wednesday, Apr 13, 16 @ 10:49 am:

Retail and restaurants are a hard business due to how much competition there is out there on price. Many establishments flat out fail within the first year. That being said, I am always of the mindset that it is more informative to know the median than the average in situations like this or salary numbers or pension numbers, etc.

- ChicagoVinny - Wednesday, Apr 13, 16 @ 10:51 am:

Amazon routinely clocks in at a

- ChicagoVinny - Wednesday, Apr 13, 16 @ 10:52 am:

Hmm formatting issues…

Amazon routinely clocks in at a less than 2% profit margin.

- PublicServant - Wednesday, Apr 13, 16 @ 11:00 am:

===Is that enough “show your work” for you Public Servant?====

Uhm, No, but thanks for asking.

- Qui Tam - Wednesday, Apr 13, 16 @ 11:01 am:

Does the “other costs” category include executive pay and perks?

- Arthur Andersen - Wednesday, Apr 13, 16 @ 11:04 am:

Hey OW and word-come on down to Springfield tomorrow to catch up-I’ll get the lunch.

- Honeybear - Wednesday, Apr 13, 16 @ 11:05 am:

Look anybody who knows anything about gathering Government statistics knows that it’s just about impossible to derive the number that they did. Obviously cherry picking numbers. This is so ridiculous. C’mon

- AlabamaShake - Wednesday, Apr 13, 16 @ 11:06 am:

And, again, as others have pointed out, that $4.1B is AFTER paying out very large salaries to many, many top executives.

- burbanite - Wednesday, Apr 13, 16 @ 11:10 am:

I don’t know what retailer they got these figures from, but I used to work in the buying department of a retailer and the costs of goods sold was not over 50%, it is relative to the mark up which varies a lot based on the goods. Math is not my thing but, I am not buying this.

- Chicago 20 - Wednesday, Apr 13, 16 @ 11:28 am:

- AlabamaShake

Exactly.

- Honeybear - Wednesday, Apr 13, 16 @ 11:30 am:

That being said, I’m sure it is really really really hard for small Illinois retailers. But look to the failure of DCEO to address their needs. DCEO has done nothing for the business environment of Illinois regardless of size of co

- Anonymous - Wednesday, Apr 13, 16 @ 11:38 am:

Public Servant, I would suggest you take an introductory Finance class. That will help. Or, just start your own business and get some real life experience.

- illinois manufacturer - Wednesday, Apr 13, 16 @ 11:43 am:

Good point Honeybear but can Illinois do much for small retailers or manufacturer a when manufacturers face bad trade policy ad small retailers face predatory competition from giants ?Although it is funny to watch Amzon at zero fighting with Wal-Mart. If the national chains can’t make money in Illinois maybe they should leave. I am sure our innovative residents will come up with something despite the opression of Madigan.It is different than manuacturing where real knowledge can be lost or certain state services where people could well die.

- Wilson - Wednesday, Apr 13, 16 @ 12:07 pm:

I think the point is that the bulk of our business are small businesses and and there’s generally a pretty fine line between success or failure. Within reason, the state should “nurture” these businesses while holding them accountable. Find the right balance between accountability and a friendly business environment and our economy will grow.

- Commander Norton - Wednesday, Apr 13, 16 @ 12:09 pm:

Into what category do the lunches IRMA is providing fit?

- Almost the Weekend - Wednesday, Apr 13, 16 @ 12:25 pm:

The irony of government workers talking about how to run a business. We appreciate RNUG for his in depth understanding on pensions, because of his experience in governmenr finance. Why should it be any different for the insight in the private sector.

Maybe should look at a different perspective of a small business owner before typing a comment on your tax payer funded computer and keyboard at the office.

- Mouthy - Wednesday, Apr 13, 16 @ 12:48 pm:

I don’t buy the numbers. I’ve seen a restaurant years ago strive for food cost around the 24% range as an example. Department stores usually double the cost of an item. A shirt that cost them $20 would be priced at $40, an one hundred percent markup. Yes they have sales and markdowns but you can’t be fooled by items that are displayed as on sale items when they started out on sale. That make the “on sale” price actually the regular price.

I don’t buy figures put out by a group that has the most to gain by inflated figures. 2% profit. Give me a break…

- Hit or Miss - Wednesday, Apr 13, 16 @ 12:52 pm:

I work in a section of the retail industry in Illinois. The cost of goods sold is normally 25% to 33% of the selling price where I work. I know of a few, very few, competitors who buy their goods for as little as 10% of the selling price and have never heard of a single store where the cost of the goods exceeded 50%. The IRMA graphic looks suspect to me when it comes to the cost of goods.

Second, the ‘other’ section of the IRMA graphic, the one that includes taxes, needs to be broken down into it parts so we can see the burden posed by the state of the retail merchants.

- Anonymous - Wednesday, Apr 13, 16 @ 12:58 pm:

+1 Almost the Weekend

- Ghost - Wednesday, Apr 13, 16 @ 1:10 pm:

sorry i was driving passed the mansions and mercedes collections of the retailers owners and top officers and missed the msg.

when your company pays out millions in salaries and bonuses tour not suffering.

what is hurting retailers? online companies and cut throat competitors w/ low prices like walmart and amazon.

- Mouthy - Wednesday, Apr 13, 16 @ 1:17 pm:

- Almost the Weekend - Wednesday, Apr 13, 16 @ 12:25 pm:

“Maybe should look at a different perspective of a small business owner before typing a comment on your tax payer funded computer and keyboard at the office.”

I’m retired and at home pal so your assumptions are about as valid at the above numbers..

- illinois manufacturer - Wednesday, Apr 13, 16 @ 1:31 pm:

Almost. I have worked for both sectors and owned various size businesses of 3 million a year and under spool let me go to Hit or Miss. I don’t even know what makup it is. It used to be about double what a domestic manufacturer sold to a retailer but in this day I well some direct and base on eBay. I have no idea what the Mario on stuff from China is. Does anyone really know?

- crazybleedingheart - Wednesday, Apr 13, 16 @ 1:33 pm:

Retail requires goods, services, and overhead? WHO KNEW.

Unless they’re sad about not being able to sell nothing for something, the graphic doesn’t communicate much.

- Gordon Gecko - Wednesday, Apr 13, 16 @ 1:49 pm:

I owned and operated a convenience store for many years….2 cents is about right. My cost of goods sold was almost 70 cents (very low profit in cigs beer and lottery tickets)…good profit on fresh food like sandwiches, donuts etc….but waste will kill you…labor tried to keep at 10 cents…rent utilities insurance maintenance ate up a chunk. ..the big unknowns are shrink (theft) and bank charges for debit and credit card processing. …yes a department store has 50% COGS..and a good restaurant controls food cost…but a small to medium sized gas/grocery/convenience store nets about 2 cents BEFORE the owner gets paid!

- Lurkin' MBA - Wednesday, Apr 13, 16 @ 1:51 pm:

Seems a little low to me. YCharts.com (a fine Chicago fintech start-up) suggests Net Profit Margins for public retailers nationally are about 4%. This includes interest expense, which is a capital funding question, rather than an indication of profitability.

Retailer’s Return on Capital Employed, a better measure of the profitability, is an acceptable 20%.

- NoGifts - Wednesday, Apr 13, 16 @ 1:52 pm:

Let me see - you buy your stock, pay your rent, pay YOURSELF (pretty well) and your employees and also pay your taxes and still have 2% left over after that? 2% that can be used for expansion? That doesn’t seem too bad.

- Sulla - Wednesday, Apr 13, 16 @ 2:28 pm:

“Okay, so pay the boss less.”

Wow. Just….wow.

“Hey Mr. business owner guy - I know you risked literally everything you own as collateral for the loan you took in order to launch your business. I know you worked 80+ hour weeks for the first few years in order to keep the lights on. I know that you were the one that had to come in on holidays when your staff members all called in sick. I’m well aware that you had to wait five years before you were able to take a vacation. You’ve had to deal with all kinds of disasters and make all kinds of sacrifices over the years to get your business where it is today.

So I was thinking that you should really consider taking less of a paycheck now that your business is successful.”

- Anonymous - Wednesday, Apr 13, 16 @ 2:42 pm:

NoGifts, you will probably buy a business now, won’t you?? Easy street, on the golf course 3 times a week, great vacations at exotic places, 2-3 luxury cars.

Go for it!

- Honeybear - Wednesday, Apr 13, 16 @ 3:24 pm:

Believe it or not I was also a small retail business owner. I do have great sympathy for them. I know I pretty much operated at a loss for all 5 years I had it. But then again, I don’t think that my success or failure had anything to do with the business environment. It had to do with me not being very good at business (and in my defense I was given a crappy territory and scrap accounts from the parent company.)

- NoGifts - Wednesday, Apr 13, 16 @ 3:50 pm:

Retail profit margins are often low, and they vary a lot by type of retail. I doubt if Illinois is much different from other states in this respect. And people are still running retail businesses. I’m just saying if you can pay the bills and have a little left over you’re doing as well as anyone.

- NoGifts - Wednesday, Apr 13, 16 @ 3:54 pm:

I think this is more about a trade organization sensing some blood in the water around a sympathetic governor than any recent change in business climate.

- That Guy - Wednesday, Apr 13, 16 @ 4:44 pm:

“Into what category do the lunches IRMA is providing fit?”

Rounding error

- Liandro - Wednesday, Apr 13, 16 @ 8:01 pm:

I’d be curious to see how many of these commenters have ever run a business. I especially enjoy reading comments that use Walgreens or Walmart as the example. Because everyone who gets into business starts up at Walgreens levels, right? Sure.

- Liandro - Wednesday, Apr 13, 16 @ 8:15 pm:

To the post: margins are as various as businesses. There are plenty that are running negative numbers right now, and they might not be around tomorrow. It’s easy to point to bankruptcies and failures as poor operators, because it’s hard to prove they weren’t.

Raising your prices to increase your margins only works so far before competitors crush you (in which case the market is still served), or demand goes down too much to sustain an operation (especially in small markets or niche categories–a true loss for everyone).