We’re number one!

Wednesday, Apr 27, 2016 - Posted by Rich Miller

* Oy…

Illinois has the highest median property tax rate in the nation, with various agencies and entities taking a combined 2.67 percent bite, according to a CoreLogic analysis of real estate property taxes nationwide.

Nationally, the median property tax rate is 1.31 percent, said the Irvine, Calif.-based data provider to financial services and real estate companies. That means that a home valued at $200,000 will, on average, pay annual total property taxes of $2,620.

In Illinois, that homeowner would pay $5,340. […]

After Illinois, the states with the highest median property tax rates are: New York, 2.53 percent; New Hampshire, 2.4 percent; and New Jersey, 2.37 percent. […]

Recent studies by both WalletHub, a personal finance website, and the nonprofit Tax Foundation, both based in Washington, D.C., found that Illinois had the second-highest property taxes in the nation, after New Jersey.

47 Comments

|

Today’s number: 12,330

Wednesday, Apr 27, 2016 - Posted by Rich Miller

* Greg Hinz…

A war of statistics has broken out over a proposal to institute a graduated income tax in Illinois, with varying camps presenting it as a battle between “fairness” and a potential business flight from the state.

Both sides [yesterday] offered a flood of competing facts, figures and charts—all accompanied by lots of spin—with one group contending that the plan would give Illinois the third-worst business tax climate of the 50 states. […]

At issue, as previously reported, is a pending bill by Rep. Lou Lang, D-Skokie, to revamp the state’s current 3.75 percent individual income tax. The rate in the lowest bracket would go down to 3.5 percent, enabling Lang to contend that “99.3 percent” of individual filers overall would pay less. But the rate would soar to 8.75 percent for income above $500,000 a year for individuals ($750,000 for married couples filing jointly) and a cool 9.5 percent for income above $1 million a year for individuals ($1.5 million for joint filers). […]

In a report and at a Springfield news conference, [the Tax Foundation] said owners of small businesses, who often just “pass through” their business income to their personal tax return, will be put at a huge disadvantage relative to other states. In fact, they note, since pass-through businesses also have to pay the state’s 1.5 percent corporate personal property replacement tax, the combined top rate would be 11.25 percent—higher than any other locale except California and New York City, and higher than the combined 7.75 percent paid by big C corps.

Greg thinks the truth is somewhere in the middle, but I think the Tax Foundation’s numbers make the case that a relatively tiny number of people will take a big hit.

* But the group is also misleading as heck. Check out this bit of Tax Foundation “analysis”…

Despite the more than $30 billion raised by the temporary tax increases, Illinois still has over $7.2 billion in unpaid bills

That mountain of unpaid bills was a whole lot lower before the tax hike partially expired. And it’s that high now because the tax hike expired, not “despite” the 2011 tax hike.

I mean, really. C’mon, people.

* Read on…

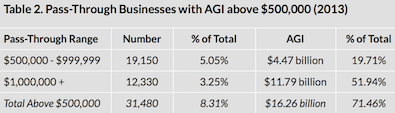

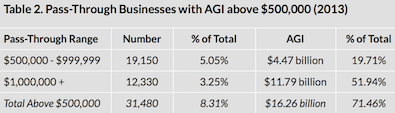

Of particular note, the companies responsible for over half of all small business income would be subject to a top marginal rate of 11.25 percent, which is significantly higher than Illinois corporate income tax rate of 7.75 percent. Even businesses with income above $500,000 but not more than $1 million would pay more as pass-through entities than they would under the corporate income tax were this plan adopted. The table below gives a sense of how many Illinois small businesses would be adversely affected by the tax increase, and the percentage of total pass-through AGI they represent.

The table…

So even the Tax Foundation admits that just 8.31 percent of pass-through business owners would pay more - and that could be way off because if those business owners are married then the tax hike wouldn’t kick in until $750,000.

* Rep. Lou Lang…

“The majority of Illinois small businesses in Illinois, 73% are pass through entities and pay the individual income tax rate and over 90% of those businesses have an adjusted gross income of $200,000 or less. All of those small businesses would get a tax cut under my plan.”

The reality is that a comparatively tiny number of pass-through business owners (12,330, according to the Tax Foundation - roughly the size of a single Springfield ward) make up a very large (51.94 percent) chunk of total adjusted gross income in this state. Those are the owners who would pay the most. They are at the center of this argument. And they are also making a whole lot of money. That’s not a bad thing. It’s just a fact.

* And speaking of which…

The small number of people who would pay more are, indeed, Illinoisans. Rep. Lang should know better.

58 Comments

|

A truly bizarre turn of events

Wednesday, Apr 27, 2016 - Posted by Rich Miller

* Some of us have been hearing for several days now that the “Individual D” in the Dennis Hastert case was none other than the brother of former House Republican Leader Tom Cross. Those rumors were confirmed today when Scott Cross testified.

So, we witnessed the bizarre spectacle of House Republican Leader Jim Durkin’s brother Tom presiding over a sentencing hearing in which the brother of Leader Durkin’s immediate predecessor testified about being molested by the defendant.

You couldn’t write this as a novel because it would be too unbelievable.

* The Tribune got to Scott Cross before anyone else…

Scott Cross, 53, said that until recently he never spoke to anyone about what happened in Yorkville High School’s locker room after wrestling practice one night when he stayed behind to try to drop some pounds before his next match. […]

Late one night after practice his senior year, Scott Cross had stayed afterward to “cut weight,” according to the prosecution’s sentencing memo. Hastert suggested a massage could “take some pounds off.” But instead Hastert removed the wrestler’s pants and performed “a sexual act” on him, according to the court filing. […]

His older brother, Tom Cross, 57, of Oswego, is the former longtime Illinois House GOP leader. Tom Cross has credited Hastert with introducing him to political life and helping him ascend to public office.

Hastert asked the former legislator earlier this year if he would write a letter of support for his sentencing, but Tom Cross by then was aware of his brother’s allegation and did not respond, according to sources.

* Former Leader Cross issued a statement today on behalf of the family…

“We are very proud of Scott for having the courage to relive this very painful part of his life in order to ensure that justice is done today. We hope his testimony will provide courage and strength to other victims of other cases of abuse to speak out and advocate for themselves. With his testimony concluded, we ask now that you respect Scott’s privacy and that of our family.”

I cannot imagine what it must’ve been like for Scott Cross to watch as his molester helped his brother scale the political heights. And imagine the crushing revulsion Tom Cross experienced when he eventually discovered that his political godfather was a monster. And then to get a request from his own brother’s molester for a kind letter to the judge?

Ugh. Just… ugh.

What a surrealistic nightmare this has become.

And, unfortunately, despite Cross’ request for privacy, I doubt that reporters will let this one go anytime soon. The whole, ugly story will eventually come out.

55 Comments

|

Rauner says he may pay for special session

Wednesday, Apr 27, 2016 - Posted by Rich Miller

* I just don’t see how he could do this without an appropriation…

Also, hasn’t he said many times that special sessions don’t work?

#Grandstanding?

* Meanwhile, the governor said last week’s higher education funding bill was “only a stopgap,” and “a short-term solution to this crisis,” adding, “It is not the only money I want us to put into for higher education.” His comments appeared to directly contradict Leader Durkin’s remarks from last week which set off Speaker Madigan.

Rauner said he wants a “long-term solution and a grand compromise” for both this and next fiscal years on higher education and everything else.

* As far as a social service stopgap spending bill, “I do believe that there might be a short-term solution there,” Rauner said. The governor said he naturally prefers not to do a short-term crisis bridge like the higher ed bill and prefers to focus on the long-term, but he left the door open for a stopgap.

Rauner also said he would negotiate reforming the state’s school funding formula, but again insisted that a K-12 appropriation be passed at the end of May if negotiations come up with nothing.

* Listen to the raw audio…

51 Comments

|

52,000 hurt by impasse in Will County

Wednesday, Apr 27, 2016 - Posted by Rich Miller

* This is crazy…

More than 52,000 clients are estimated to be affected by the Will County Health Department’s decision to suspend a handful of programs, according to a department news release.

The department — faced with a $2.1 million shortfall caused by the state’s budget impasse — announced last week it was laying off 53 employees. The agency is also suspending nine programs, including its adult psychiatric services.

Those affected include 39,000 served by a school vision and hearing program, 1,800 behavioral health clients and 4,000 clients who use HIV prevention and education services, according to the news release.

A union representative for Will County Health Department employees slated for layoffs later this month said the loss of programming will have a ripple effect on the community’s “most vulnerable citizens.”

David Delrose, president of the American Federation of State, County and Municipal Employees Local 1028, said while employees are aware of the Illinois budget crisis, the scope and immediacy of the layoffs were unexpected.

Ugh.

23 Comments

|

Opioid use soars in Metro East

Wednesday, Apr 27, 2016 - Posted by Rich Miller

* Keep in mind that we’re talking about prescription drugs here…

Madison and St. Clair County residents are buying opioid prescriptions at a rate that soars above the national average, according to new data from federal agencies.

In 2014, there were 14,367,940 oxycodone and hydrocodone pills sold in Madison County, and 9,031,240 sold in St. Clair County. That’s the most recent year that statistics were available from the federal Drug Enforcement Administration diversion program, according to the U.S. Attorney’s Office.

That’s approximately 34 pills per St. Clair County resident, and 54 pills per Madison County resident.

By comparison, the statewide average per Illinois county is 153,841 pills a year, and the national average is 182,742 pills. That translates to 1.22 pills per Illinois resident or 1.73 pills per U.S. resident — a fraction of the ratio in Madison and St. Clair County. […]

Gibbons said according to the statistics his office has compiled, only about nine pills out of every 30 prescribed are used for legitimate medical purposes. The other 21 pills end up being sold, diverted or are otherwise feeding addictions, he said.

* Related…

* An Opioid Treatment Model Spawns Imitators

30 Comments

|

* Sun-Times…

Former U.S. House Speaker Dennis Hastert arrived at the Dirksen Federal Courthouse about 7:10 a.m. Wednesday to be sentenced for violating banking laws.

The case, however, has become notorious not for that crime but for what the investigation of his financial transactions uncovered. Federal prosecutors say Hastert was paying to cover up sexual misconduct with a student years ago at Yorkville High School.

* Follow along with ScribbleLive…

90 Comments

|

* Greg Hinz…

A political consultant who has played a prominent role in the Springfield battle between Gov. Bruce Rauner and Illinois House Speaker Michael Madigan has abruptly lost a job promoting a candidate for a huge food concession at Midway International Airport in Madigan’s Southwest Side district.

Though no one involved wants to publicly say much about it, multiple inside sources report that Chicago-based Resolute Consulting, a firm headed by Greg Goldner, recently was dropped from its position as a media and marketing advisor to SSP America.

SSP is the lead company in a venture that’s expected to soon land a roughly $250 million deal selling food and retail items at the airport. But the deal has not yet closed, and could have problems with the city if it attracts political fire.

SSP dropped Goldner “because they saw him as a liability,” says one source familiar with the matter who asked not to be named. “SSP did not want to create any trouble now.”

Goldner, of course, runs IllinoisGO, which heavily backed Dunkin in his 68-32 Democratic primary loss. As part of that effort, the group paid for a million-dollar TV buy that included a nasty swipe at hizzoner.

Greg goes on to note the important fact that Midway Airport is in Madigan’s district and reports that the mayor’s office denied widespread rumors that Emanuel was personally involved in this.

56 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|