Today’s number: $7.1 billion

Wednesday, May 25, 2016 - Posted by Rich Miller

* Press release…

State Sen. Kyle McCarter is leading the way with a balanced budget compromise combining true budget reforms and no new taxes.

Sen. McCarter (R-Lebanon) said his plan is a balanced approach that incorporates ideas and proposals from legislators and the Governor’s office.

The “plan” is here. Almost half his savings come from pushing $1.4 billion in pension costs down the food chain to local schools and universities, which would jack up property taxes and tuition. He claims a $924 million savings by moving new hires into 401(k) plans. $700 million comes from cutting state worker pay and benefits. And $300 million would come from some apparently super drastic workers comp cuts.

Um, OK.

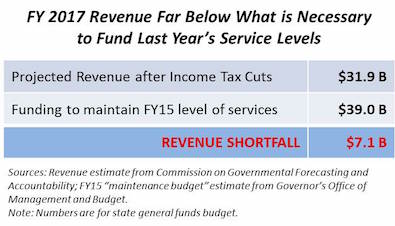

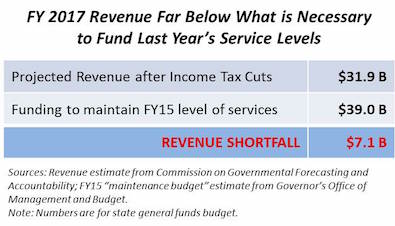

* Not to mention that the hole is larger than that. From Voices for Illinois Children…

That’s a pretty darned big hole.

* More…

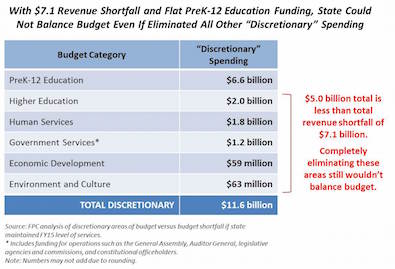

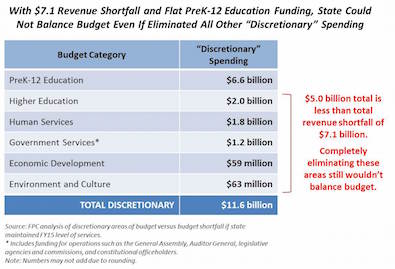

Cutting $7.1 billion from the budget wouldn’t be easy, even if it were desirable (which it isn’t). For one thing, it couldn’t be done in an across-the-board manner. That’s because roughly $27 billion (70%) of the budget can broadly be categorized as “mandatory” spending. This includes: debt service, pension contributions, transfers made according to existing state law (largely to local governments and transit systems), Medicaid costs, and spending relating to consent decrees and court orders. It’s difficult (or impossible) to cut these areas.

The remaining $11.6 billion of the general funds budget can broadly be considered “discretionary” — it doesn’t have to be spent under law. (For more details on how we calculated what is “discretionary,” click here.) This is not to say that these parts of the budget are unimportant. Far from it. This is spending on PreK-12 education, higher education, and a significant portion of human services, including areas such as homeless prevention, substance abuse and mental health treatment, and domestic violence.

* Another chart…

* And…

If lawmakers and Governor Rauner maintain (or even increase) funding for PreK-12 education, the total amount of remaining discretionary areas of the budget is less than the total revenue gap. In other words, even if the state eliminated entire sections of the state budget, it would still not balance the next state budget. Without billions of dollars in new revenue, it will be nearly impossible for the state to stop digging itself an ever-deeper financial hole. There is no getting around this.

- RNUG - Wednesday, May 25, 16 @ 10:18 am:

OK. I can see the $1.4B. I don’t see the $1.6B from the 401K (0.9B) and the worker cuts (0.7B).

- Ghost - Wednesday, May 25, 16 @ 10:19 am:

just to clarify, new workers contribute more the. they cost to the pension, so they are slowly paying down the deficit. if you put them in 401k plans it could never ever save money, in fact it would cost money as the state would have to make up the loss of their contribtuions.

also 401k plans perform more poorly, are less secure and inly benefit the invter service since they make larger fees then sefined benefit plans

- Say It Ain't So!!! - Wednesday, May 25, 16 @ 10:22 am:

How is it that they are projecting an increase in revenue from federal sources of almost $1B. Is that realistic?

- HistoryProf - Wednesday, May 25, 16 @ 10:22 am:

It’s hard not just to seem like a rank partisan. I mean the Dems have been pretty cowardly about defending government and the need for taxes — like for a generation. And not just here in Illinois.

But with apologies to the spiritual heirs of Rockefeller, shouldn’t we honestly say the modern Republican Party is crazy? This just nuts.

- wordslinger - Wednesday, May 25, 16 @ 10:23 am:

–The “plan” is here.–

And it’s still billions short.

Going for that some of the people, all of the time crowd, I take it.

- Formerly Known As... - Wednesday, May 25, 16 @ 10:24 am:

==debt service==

Bilions of dollars in debt service every year, courtesy of our wise leaders in Springfield. Thank you Blago and Madigan, for the $1.5 Bill we are sending this year alone for your pension payment bonds.

The cost-shift may eventually have to occur. Local districts negotiating a tab that is paid for with =other people’s money= has always been a recipe for spending beyond the state’s means.

- Echo The Bunnyman - Wednesday, May 25, 16 @ 10:25 am:

Madigan wanted the cost shift for teacher Pensions for a reason. Because it is the only way. And it makes sense. If you want to live in the North Shore and have boards giving huge salaries for retiring administrators, you should be on the hook for more of that burden. Why should a tax payer in Avon pay for the choices made in Wilmette? There’s the issue. Wait, I thought I was a Raunerite? Now I am a Madiganite? Or is it just that common sense is appealing and appreciated in life and rarely seen in government. Like or hate Madigan and Rauner but I believe they can work together to make the right decisions.

- DuPage - Wednesday, May 25, 16 @ 10:25 am:

$300,000,000 in state savings in WC cuts?

What would they do, just make state employees exempt from WC coverage?

- anon - Wednesday, May 25, 16 @ 10:29 am:

Apparently McCarter is clinging to the hoary GOP mantra, “This State doesn’t have a revenue problem, it has a spending problem.”

- Nothin's easy... - Wednesday, May 25, 16 @ 10:30 am:

Removing all new employees from the current pension systems would explode the unfunded liability because it would remove all future contributions the calculation now assumes. Further, if the 401(k) included an employer match, the state would increase the annual payments to two plans. It would be a budget buster. More than it is now.

- Mama - Wednesday, May 25, 16 @ 10:32 am:

Even if they fired all of the State Workers (SWs), they would need to hire contractors to perform the functions the SWs currently perform. It will not cost less than is currently being paid. How do they figure a savings of 1.8-Billion?

- Federalist - Wednesday, May 25, 16 @ 10:32 am:

The usual attack on state employees!

What else is new?

- Sue - Wednesday, May 25, 16 @ 10:32 am:

Hey- formerly- the pension bonds though not a screaming success generated more then they cost. The income exceeded interest- of course you have to repay the principal but I guess they didn’t teach that while you were at Harvard for the MBA

- Mama - Wednesday, May 25, 16 @ 10:35 am:

“He claims a $924 million savings by moving new hires into 401(k) plans.”

The state has been doing this for years so no savings there.

- PublicServant - Wednesday, May 25, 16 @ 10:35 am:

Voices for Children should have a second name: Math for McCarter.

- Juice - Wednesday, May 25, 16 @ 10:40 am:

DuPage, Workers Comp for state employees cost about $130 million a year. So McCarter’s “plan” would go a lot further than simply exempting state employees from the system.

And his DC number is pure garbage. First of all, if you are already shifting normal cost, then the State is off the hook for SURS and TRS. Plus every actuarial analysis I have seen has shown that in the short term, switching to a DC plan is going to cost billions more, not less.

- logic not emotion - Wednesday, May 25, 16 @ 10:40 am:

When I saw “balanced budget compromise”, I had hoped it was a serious, bipartisan effort with real numbers and had been well vetted. So much for that.

I wonder when a bipartisan group will step up with a serious, workable proposal… Surely, there are some among our legislators who will display some true leadership?

- thunderspirit - Wednesday, May 25, 16 @ 10:42 am:

== Apparently McCarter is clinging to the hoary GOP mantra, “This State doesn’t have a revenue problem, it has a spending problem.” ==

To be fair, the State has both a revenue problem AND a spending problem.

It would be nice to hear someone in politics admit both.

- Highland, IL - Wednesday, May 25, 16 @ 10:48 am:

Just read the comments on McCarter’s facebook page. Someone is “joking” about killing legislative leaders. They added an LOL so it’s okay I guess.

- steve schnorf - Wednesday, May 25, 16 @ 10:50 am:

Ghost, the very first part of your post is correct, but I can assure you, and you know this, the pension deficit is not being paid down

- Indochine - Wednesday, May 25, 16 @ 11:11 am:

“Kyle McCarter leading the way” is one of the funniest things I have read in a long time.

- illinois manufacturer - Wednesday, May 25, 16 @ 11:16 am:

Robert Ingram said T 2 will payoff the T 1 debt in the Winter 2015 TRS Topics

- illini - Wednesday, May 25, 16 @ 11:20 am:

I feel like I should apologize to the rest of the state for my Senator once again showing that he is oblivious to what has to be done to address our fiscal issues. Clueless!

- 47th Ward - Wednesday, May 25, 16 @ 11:22 am:

Posted this on another thread, but it fits here too:

Wouldn’t a pension holiday “save” about $7 billion next year? That’d be one way to balance the budget next year and delay the day of reckoning again. Let’s see exactly how far we can kick the can down the road.

Perhaps that would give them time to iron out some of the other issues, especially a path forward on revenue, without a complete collapse of higher education and social services.

It’s a horrible idea, but it might be the most painless in the short term.

- Political Animal - Wednesday, May 25, 16 @ 11:50 am:

Let’s just arbitrarily decide that $27 billion is off limits and then declare that there’s no way to balance the budget without reducing education spending.

Effective messaging, terrible Governing.

Every single line item needs to be on the table.

- Arthur Andersen - Wednesday, May 25, 16 @ 12:11 pm:

A few thoughts on a couple issues-

RNUG, I don’t see the “pension savings” nor the “procurement reforms.” Perhaps someone recognized the uh, ephemeral nature of these ideas.

Sue, I don’t know how this is scored any more for budget purposes, but recall that at issue, the pension funds were charged with paying back the original pension bonds, not the State. Further, they are paying back $10 billion, not the $7.3

billion net they received to actually invest. In that context, over the 13-year market cycle, the portfolio has done more than alright.

IM, Richard, not Robert, Ingram wrote, correctly, that the overfunded Tier2 will eventually cover the Normal Cost of Tier 1, not the liability. Big difference. And that assumes that the Feds won’t make the State either fix Tier 2 or

start collecting SS on Tier 2 employees. That’s why Schnorf’s post above is spot-on.

I’ve never, ever, seen a credible study, and I’ve been stirring in this sandbox for quite awhile, that could prove 401(k)s save money. Higher manager fees and lower performance are consistent issues.

Finally, 47, just remember that every dollar skipped today costs at least 7 to pay back.

- anon - Wednesday, May 25, 16 @ 12:14 pm:

=== It would be nice to hear someone in politics admit both (need for revenue increases and spending cuts). ===

Rep. Nekritz, among others, has been saying for years that we need both. I can’t think of a prominent Democrat who would deny it.

- steve schnorf - Wednesday, May 25, 16 @ 12:19 pm:

I appreciate the work the Senator has done here, a sentiment I know the majority on here don’t share.

First, getting a plan down on paper let’s people look at what different options might cost or save, and at what expense. Second, there are some valuable ideas in here. Of course their are some flaws: any proposal we see will contain some, as will the final budget adopted (if there is one).

I noticed that the Senator put on paper an idea that has been floating ephemerally for some time: apply wc changes to public employees only. That might be the kind of compromise idea that could allow some progress on the current impasse.

Shifting new normal costs for the pensions to the direct employers is something that is going to happen sooner or later. He simply takes advantage of it now.

I don’t generally like plans that pay significant base expenses with one time revenues, and I think he is very optimistic about any profits the state might receive from sale of the JRTC. He is probably optimistic that it can be done in 13 months too.

But stil. With this as a starting point a budget could be crafted that people could live with, however (sorry Sen McCarter) not without some revenue increases. The same case about a starting point could be made as to the budgeteers proposal. Work from hard numbers, make sure they’re as real as possible, and then work them to a liveable compromise with as little base expense as possible paid fro non-recurring sources.

- Norseman - Wednesday, May 25, 16 @ 1:15 pm:

AA, thank you for articulating for the folks the correct information about Tier 2’s impact on the pensions. Too often, we get folks say yea or nay without explaining themselves.

- Sgt_Schultz - Wednesday, May 25, 16 @ 1:16 pm:

I couldn’t read the ‘plan’ so maybe I am missing something. But aren’t the same Republicans that don’t support HB580 because they don’t think the legislature should have a hand in negotiations with Afscme the same people that are ‘negotiating’ away state workers pay and benefits in this budget ‘plan’?

- the Cardinal - Wednesday, May 25, 16 @ 4:26 pm:

Sgt Schultz You have to have exec authority to negotiate contract… separation of duties.

- atsuishin - Wednesday, May 25, 16 @ 4:39 pm:

==Without billions of dollars in new revenue, it will be nearly impossible for the state to stop digging itself an ever-deeper financial hole==

Rauner understands the need for new revenue and has said so many times. However there’s a complete lack of willingness from Madigan to consider the spending cuts needed to balance the budget.

Drastic spending not the typical gimmicks. McCarter proposal is a good start. The government services line should be reduced dramatically only state police spared from cuts. Illinois needs both a salary freeze and a hiring freeze. If there is $7 billion shortfall the pain shared equally with between taxpayers and government workers.

Also, tax pensions and pass a state version of the obamacare “Cadillac healthcare tax” but exempt social security. This will target the pain to the wealthier retirees.

- RNUG - Wednesday, May 25, 16 @ 6:23 pm:

== Also, tax pensions and pass a state version of the obamacare “Cadillac healthcare tax” but exempt social security. This will target the pain to the wealthier retirees. ==

Leaving SS out of the mix targets primarily teachers, who the State did not allow to participate in SS. Clearly unequal treatment of government pensioners caused by the State; definite grounds for a diminishment claim under the Pension Clause. May or may not hold up in court.

Yes, other state’s tax SS and other retirement income differently. But most other states don’t have our pension clause and / or they don’t have a class of taxpayers they prevented from participating in SS.

Better to tax all retirement income with a specific level of income exempted. We need the revenue now, not after a court tosses it out and the GA has to try to pass it a second time.