* Progress Illinois…

Nearly two dozen profitable public U.S. utility companies paid no federal income taxes last year, and the utility industry overall has the lowest effective federal tax rate of any business sector, new research shows.

The “Utilities Pay Up” report from the Institute for Policy Studies (IPS) concludes that domestic utility companies “have become expert tax dodgers at the federal and state levels.” […]

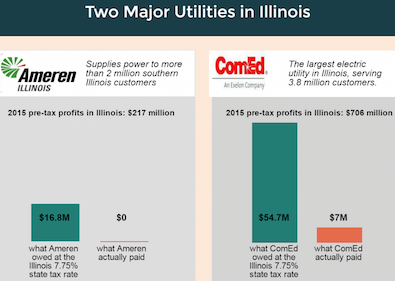

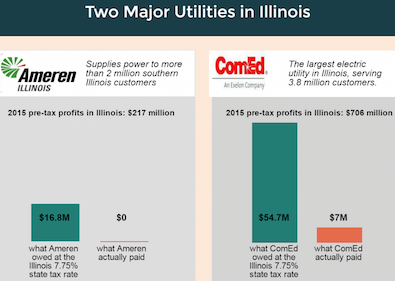

Ameren Illinois and ComEd are among the local utility companies mentioned in the report. Last year, their pre-tax profits in Illinois were $217 million and $706 million, respectively.

Illinois has a corporate income tax of 7.75 percent. Had Ameren Illinois and ComEd paid the full rate, the state government would have had an additional $65 million in revenue last year, according to IPS.

“This revenue could’ve covered the cost of weatherizing 13,800 low-income residences in single and multi-family buildings, reaching 17 percent of all low-income families in Illinois,” the report reads. “Sliced another way, the money could’ve created 1,000 jobs, 400 directly through clean energy projects and another 600 indirectly at suppliers and through economic ripple effects.”

* From the study…

- burbanite - Tuesday, Aug 2, 16 @ 3:06 pm:

Is changing this on the turnaround agenda? Yea I didn’t think so.

- 47th Ward - Tuesday, Aug 2, 16 @ 3:12 pm:

Why would profitable businesses pay taxes? Don’t they have lobbyists, lawyers and accountants for that?

Taxes are for the little people.

- Longsummer - Tuesday, Aug 2, 16 @ 3:20 pm:

Rahm’s utility tax hike idea is a good one, he just has the payor(s) wrong.

- Precinct Captain - Tuesday, Aug 2, 16 @ 3:21 pm:

This will certainly help the “Bail Us Out” campaign ComEd goes on and on about.

- anon123 - Tuesday, Aug 2, 16 @ 3:31 pm:

From what I recall, Rauner has “dozens” of companies wanting to come to Illinois to use our infrastructure and our educated workforce. All they need is assurance that they won’t have to pay for any of it. This should be on the front page of Intersect Illinois!

- Blue Bayou - Tuesday, Aug 2, 16 @ 3:32 pm:

I think we found an example of when corporations are not people.

- Lucky than Good - Tuesday, Aug 2, 16 @ 3:38 pm:

“Illinois has a corporate income tax of 7.75 percent.”

The rate reverted to 5.25 percent at the end of 2014.

- illini - Tuesday, Aug 2, 16 @ 3:43 pm:

Close to a Billion in profits ( that were reported and I assume accurate, given the loopholes available ) and only 7 Million paid in taxes.

Does anyone else see something wrong with this picture? Many of us are captive customers of these monopolies and have no choices.

- Illinois Bob - Tuesday, Aug 2, 16 @ 3:44 pm:

The study actually reads that the taxes will eventually be paid, that they were due to accelerated depreciation for investing in infrastructure. Without the accelerated depreciation, perhaps the infrastructure investment no longer makes sense and the jobs aren’t created and equipment not manufactured and purchased.

Funny thing that “Progress Illinois” chose not to mention that, and only concentrated on ways the government could’ve unproductively wasted it.

Of course no government spending is ineffective spending, is it all you big gov posters?(snark)

It may have actually saved money since if the money was spent on “clean” energy projects, it would have required government subsidies (never to be repaid like this depreciation) through perpetuity.

- Jack Retired Water - Tuesday, Aug 2, 16 @ 3:50 pm:

Yeah, I’ve read that 2/3rds of Illinois corporations pay essentially nothing in taxes. Some actually collect their employees taxes. You think the state of Illinois has a revenue problem.

- cover - Tuesday, Aug 2, 16 @ 4:05 pm:

= “Illinois has a corporate income tax of 7.75 percent.”

The rate reverted to 5.25 percent at the end of 2014. =

The 7.75% figure includes both the base 5.25% corporate tax and the 2.5% personal property replacement tax.

- Senator Clay Davis - Tuesday, Aug 2, 16 @ 4:25 pm:

ComEd paid $7 million in taxes?!?!

We better give their parent company $240 million in a ratepayer bailout to apologize.

- 4 percent - Tuesday, Aug 2, 16 @ 4:53 pm:

The companies paid no FEDERAL income tax. On the state side, Illinois uses the federal return as the basis for the state tax return.

- Last Bull Moose - Tuesday, Aug 2, 16 @ 4:54 pm:

The normal practice is to bribe companies and individuals to do what the government wants through tax incentives, and then to complain that the companies or individuals do not pay their “fair share”. For those who want greater state control this has the benefit of getting the money moved against the problem they want solved while not having the cost show up on the government books and making the evil rich individuals and corporations look like they are not playing fair. Quite a deal.

- walker - Tuesday, Aug 2, 16 @ 4:55 pm:

Well they sure spend millions to complain how badly the state is treating them.

- 4 percent - Tuesday, Aug 2, 16 @ 4:56 pm:

Plus let us not forget all of the waste, fraud and abuse in the weatherization program in Illinois.

http://dailycaller.com/2011/09/21/energy-dept-weatherization-programs-rife-with-waste-fraud-inspector-general-audits-show/

- Ron - Tuesday, Aug 2, 16 @ 5:40 pm:

Just eliminate the state corporate tax. I would be on board with a progressive personal income tax as a trade off.

- Huh? - Tuesday, Aug 2, 16 @ 7:37 pm:

“Nearly two dozen profitable public U.S. utility companies paid no federal income taxes last year…”

Two questions:

1. Are they playing by the rules?

2. Are they legally using the tax code to their advantage?

3. Did the government give the companies tax breaks to keep the companies in operation?

If the answers to the questions are all yes. My response is “So what is all the noise about?”

This pious, self righteous yammering about a profitable company not paying taxes is bloody red meat for a special interest group.

- Huh? - Tuesday, Aug 2, 16 @ 7:51 pm:

ok I can’t count, three questions. That is what I get for not self editing.

- kate from chicago - Tuesday, Aug 2, 16 @ 7:55 pm:

So, the big corporation ComEd paid 12% in taxes on their $54 million profit. How is it fair that my husband and I sold our 2 flat where we raised our kids and then used it as an income property for 10 more - and have to pay 25% of our profit?? We’re the little guys - the struggling middle class who really could use the money to pay off our kids college loans or save for retirement. Aarrgh!

- Cook County Commoner - Tuesday, Aug 2, 16 @ 9:01 pm:

Tax is an overhead item. Wouldn’t these organizations just pass the taxes to their customers?

- Ron - Tuesday, Aug 2, 16 @ 9:10 pm:

Taxes are a cost that if can be avoided will be.

- NoGifts - Wednesday, Aug 3, 16 @ 9:03 am:

The weird yin-yang of all this? How much of this stock do you think is included in your 401k’s or in the state pension investments. Reducing their costs, including taxes, makes companies more profitable and improves their performance in your portfolio.