While they’re fighting, revenue growth slows

Wednesday, Dec 14, 2016 - Posted by Rich Miller

* This is starting to remind me of the last year or so of the Blagojevich administration, when the warring parties were too involved with their fight to notice the national trend. From The Hill…

State tax revenue growth slowed in the first several months of the new fiscal year, forcing legislators and budget officials in states across the country to slash projections and spending plans while raising concerns that the next economic recession is just around the corner.

A new report from the National Association of State Budget Officers (NASBO) found that half the states have experienced revenue shortfalls in the early months of fiscal year 2017, which began in August. The shortfalls come as sales and personal income tax growth slows and corporate income tax declines.

Those shortfalls forced 19 states to enact mid-year budget cuts in fiscal year 2016 — more than any year outside of a recession since 1990. Some budget analysts fear slowing sales and income tax growth can be a leading indicator that an economic downturn is right around the corner. […]

States expect to bring in a total of $808 billion in revenue, up 3.6 percent over the year before. But 12 states — Alaska, Delaware, Illinois, Indiana, Louisiana, Montana, New Mexico, North Dakota, Oklahoma, Texas, West Virginia and Wyoming — experienced revenue declines in 2016, and eight more expect revenues to drop this year.

The full NASBO report is here.

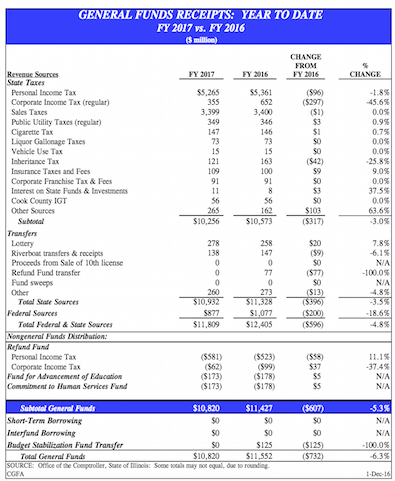

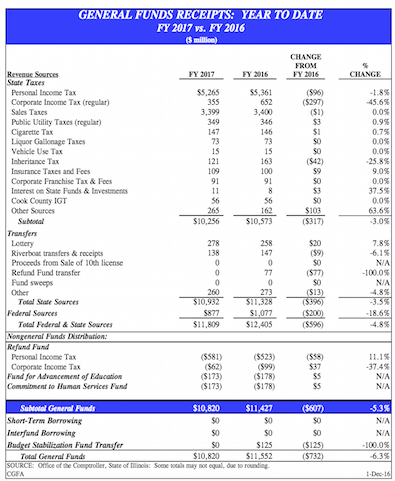

* From COGFA…

Year To Date

With almost half of the fiscal year completed, base receipts are down $607 million through November. Last month’s briefing mentioned concern with FY 2017 revenue performance—that concern continues to grow. Unfortunately, the weakness is in the largest revenue sources such as income and sales taxes, thereby limiting the State’s ability to engage in reimbursable spending, resulting in very poor federal source performance.

Gross corporate income taxes are off $297 million, or $260 million net of refunds. Gross personal income tax, despite a good November, is still down $96 million or $144 million if refunds and diversions to the education and human service funds are included. As mentioned, sales taxes are weak and have fallen $1 million. Overall transfers are down $79 million to date. Only the one-time nature of this month’s SERS repayment has allowed other sources to post a $103 million increase.

With a dramatic falloff in federal sources in November, receipts are behind last year’s dismal pace by $200 million. Growth will have to increase dramatically over the remainder of the fiscal year even to hit the Commission’s very modest projection.

And…

- Chicagonk - Wednesday, Dec 14, 16 @ 11:44 am:

Raunigan fiddles while Rome burns.

- Norseman - Wednesday, Dec 14, 16 @ 11:44 am:

No worries. Trump will have our economy so accelerated that our tax coffers will be overflowing. Believe me.

- Sir Reel - Wednesday, Dec 14, 16 @ 11:46 am:

If these findings suggest a coming recession, how will Governor All We Need is Growth balance the budget?

- Mokenavince - Wednesday, Dec 14, 16 @ 11:53 am:

Lets hope that the boat has not sailed on the economy .Though it looks very stormy for Illinois.

People are voting with their feet. We have little to grow on or hope for.

- Precinct Captain - Wednesday, Dec 14, 16 @ 12:08 pm:

I think it’s been a topic on the blog before, but a lot of states, especially ours, are not in shape to handle a recession. These are “good times” and we can’t get our act together because our recalcitrant plutocrat governor and legislative leadership that lacks vision. We can’t afford a slowdown.

- Ron - Wednesday, Dec 14, 16 @ 12:09 pm:

I still don’t understand why the state hasn’t just instituted a 20% cut in spending across the board. There is no money.

- Honeybear - Wednesday, Dec 14, 16 @ 12:11 pm:

Lack of revenue oxygen could be what causes us to lose consciousness and shut down. Add to that the fight our fiscal body is having and we’re gonna die. The body is a good metaphor. Our cardiovascular system is the workforce. For Gods sake quit messing with that system before we pass out.

- 47th Ward - Wednesday, Dec 14, 16 @ 12:27 pm:

Governor Rauner is playing a very dangerous game. I think that’s part of what makes it so appealing for a guy like that, the adrenaline rush of knowing so many people could be crushed if he (messes) up.

- NeverPoliticallyCorrect - Wednesday, Dec 14, 16 @ 12:32 pm:

God help us if enough business owner say “no more”

The signs of the apocalypse are here but the Dems just cover their eyes!

- RNUG - Wednesday, Dec 14, 16 @ 1:11 pm:

Assuming Rauner’s goal is to break the system, a recession will just help him achieve that goal.

- wordslinger - Wednesday, Dec 14, 16 @ 3:35 pm:

I understand the decline in the oil patch states like Texas, Oklahoma, Louisiana, Alaska and ND (no help from RTW, worker comp and prevailing wage, apparently).

Anything in particular to explain Illinois and Indiana?

Shouldn’t Indiana be going gangbusters with all those manufacturing jobs they’re supposedly stealing from Illinois?

- Cook County Commoner - Wednesday, Dec 14, 16 @ 3:47 pm:

Raising taxes in this economy would be like throwing gasoline on a fire. Certainly, there are many needy folks who rely on government services. But it seems we are approaching a battlefield triage situation.

- Pawn - Wednesday, Dec 14, 16 @ 4:25 pm:

Ron, are you new here? We have exhaustively covered why across the board cuts are not possible: see state and Federal laws and lawsuits that have mandated levels of service, required Maintenance of Effort matching funds, mandated pension payments, etc etc. These constraints mean that large drastic cuts and eliminating lines altogether would be needed. This is why Rauner steadfastly refuses to introduce a balanced budget based on existing revenues–the cuts would be too deep to be palatable.

- Sue - Wednesday, Dec 14, 16 @ 5:08 pm:

Tax Rates are the same during comparison period. If revenue is down it’s because Illinois is on life support in terms of the business climate BUT don’t tell that madigan. He will say you are extreme

- wordslinger - Wednesday, Dec 14, 16 @ 5:11 pm:

–Tax Rates are the same during comparison period. If revenue is down it’s because Illinois is on life support in terms of the business climate BUT don’t tell that madigan.–

So what’s the deal with Texas and Indiana? They’re coming up short, as well.

- Robert the Bruce - Thursday, Dec 15, 16 @ 9:13 am:

From the chart, federal revenue is down $200 million (19%).

I wonder how much of that is because the budget impasse has resulted in less federally-matched spending.