Is a sales tax on food really regressive?

Wednesday, Feb 22, 2017 - Posted by Rich Miller

* Taxing food and medicine sales are back in the news, so the Taxpayers’ Federation of Illinois takes another look at an article it published a few years back and a new study which challenge the belief that a sales tax on food is regressive for the poor…

The theory highlighted in our article was borne out more recently in a much more rigorous academic study. The basic premise: a general sales tax exemption on groceries does not really benefit the poor because most of their food is purchased under the Supplemental Nutritional Assistance Program (“SNAP”, formerly known as food stamps) and is therefore tax exempt as a matter of federal law. In other words, the general exemption does not target the in- tended recipients and is costly in terms of tax dollars, and in administration and compliance aggravations (such as the ever-changing lists of exempt and non-exempt products).

Using SNAP data from Alabama (a full taxing jurisdiction) and New Orleans (a reduced rate jurisdiction) in conjunction with data from the 2012 Consumer Expenditure Quarterly Interview Survey (a survey on consumer’s expenditures and incomes), the authors calculate the impact of taxing food on the poor with and without accounting for the federally-mandated SNAP exemption. They find that, while the poor spend 17 percent of their total expenditures on groceries, only about 0.5 percent of those expenditures can be taxed. They show that calculating the sales tax burden without taking SNAP into account makes the sales tax look very regressive. However, once the non-taxability of SNAP purchases is taken into consideration the average tax burden based on total consumption becomes slightly progressive. Using a more traditional tax burden estimate based on income (rather than consumption), there is still a substantial decline in the tax burden on the poor once the non-taxability of SNAP purchases is accounted for, although under this analysis the burden remains regressive.

In sum, the federally-mandated sales tax exemption of SNAP purchases reduces the regressivity of a sales tax on groceries, and a sales tax on groceries may even be slightly progressive when tax burden is measured as a percent of consumption, according to this study. As the authors put it:

While there will always be some of the poor who would pay more if the food at home exemption is repealed, our work suggests that taxing food but compensating with a revenue-neutral reduction in the overall sales tax rate would provide considerable benefits to the poor and, at the same time, lead to a more rational sales tax system.

There’s a lot of stuff in this month’s “Tax Facts” publication, so go read the whole thing. The lack of a tax on retirement income is covered ($1.8 billion could’ve been collected in 2014, it projects, while 1.4 million out of 5.6 million tax returns claimed some retirement income subtraction), the state’s “archaic” franchise tax is also covered as well as a new service tax.

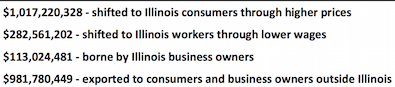

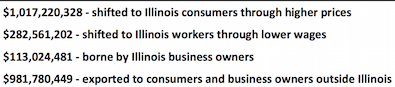

* TFI also used a Minnesota study to claim that “for fiscal year 2016, Illinois’ $2,394,586,460 in corporate income tax receipts would have been borne as follows”…

- WhoKnew - Wednesday, Feb 22, 17 @ 11:04 am:

A reasonable and responsible Tax Structure in Illinois?

BAH!!!

Let just keep using the Credit cards! /s

- NoGifts - Wednesday, Feb 22, 17 @ 11:11 am:

Many low income people do not receive SNAP benefits and would pay the tax. It is regressive based on income — LOWER income people no matter their relation to poverty pay more of their income for food than HIGHER income, so pay a higher percent of salary for the tax. It’s not just “the poor who receive benefits” we have to think about.

- Honeybear - Wednesday, Feb 22, 17 @ 11:16 am:

This study is the apex of misleading. I determine and maintain SNAP benefits every single day in my job.

1 Supplimental nutritional aid program. Supplimental! 194 a month will not meet your nutritional needs. It is a Supplimental not replacement. In addition the no income poor (which you have to be to even get as much as 194) get food from family friends and pantries. They don’t have the money to buy it. They obtain food.

2 The study assumes no income getting the full benefit. The fact of the matter is that most people are earning or getting some income. This hardly anyone gets the full u taxable benefit.

3 most people here in the metro east get far less. Most elderly because of assets only get 16 dollars.

It is without a doubt regressive and hurts the poor disabled and elderly more.

The Tax Federation should be ashamed of themselves for such poor work which harms the most vulnerable amongst us

This made me livid!

- @MisterJayEm - Wednesday, Feb 22, 17 @ 11:19 am:

“Taxing food and medicine sales are back in the news…”

Sales of newspapers and periodicals are exempt from the sales tax in Illinois. Before we tax purchasing bread and insulin, we may want to consider taxing sales of the Tribune and Hustler.

– MrJM

- Ari Shroyer - Wednesday, Feb 22, 17 @ 11:22 am:

Of course, no one thinks about the “working poor” or the many who may qualify for subsidies, but turn them down. There should never be a tax on food or medicine. These commodities are absolutely essential expenses. If you want to “go after the rich,” tax yachts and plane tickets. Think about my generation (millennials) and elderly pensioners: these expenses take up most of our “disposable” income. Why punish us for simply trying to survive in an already jobless economy, when we are often under more debt than our parents just starting out?

It’s the goal of the Left to see everyone either utterly dependent, or utterly taxed. There is a middle path and it is needed desperately for the working people of IL.

- Honeybear - Wednesday, Feb 22, 17 @ 11:23 am:

The author of the study Ryan Aprill is a lawyer for venture capitalists. I doubt he knows anything of poverty or SNAP policy

- Honeybear - Wednesday, Feb 22, 17 @ 11:31 am:

Is 194 enough to feed you for a month?

That’s why it’s called Supplimental nutritional aid program

Supplimental.

- Taxguy - Wednesday, Feb 22, 17 @ 11:35 am:

Taxing groceries is imperfect, for sure. Is it more regressive than a tax on Sugar Sweetened Beverages?

We’re way past perfect solutions given the depth of Illinois’ hole.

- BK Bro - Wednesday, Feb 22, 17 @ 11:36 am:

This is ridiculous. Not all “poor” people are on SNAP. Sales taxes in general are regressive, especially when applied to food.

- Enviro - Wednesday, Feb 22, 17 @ 11:53 am:

A sales tax on food is another way of putting still more of the tax burden on middle class workers and middle class retirees. Those who will benefit most will be the wealthy .01%.

- thechampaignlife - Wednesday, Feb 22, 17 @ 11:57 am:

An increase in the Earned Income Credit might help offset this burden for the working poor.

- @MisterJayEm - Wednesday, Feb 22, 17 @ 11:59 am:

“There should never be a tax on food or medicine. These commodities are absolutely essential expenses. If you want to ‘go after the rich,’ tax yachts and plane tickets. *** It’s the goal of the Left to see everyone either utterly dependent, or utterly taxed.”

So you think support for eliminating the food & medicine sales tax exemption is coming from THE LEFT?

– MrJM

- Ghost - Wednesday, Feb 22, 17 @ 12:10 pm:

These taxes overall have the middle class carry most of the burden.

all if these sales and consumer taxes result in the. iddle

class

paying a higher percentage of their total income to pay these taxes. Thosenwith extreme wealth pay almost nothing in overall burden. A better system is an income tax, where everyone pays the same burden. these taxing schemes are designed to save the ultra wealthy who have the most disposable income the least amount as a percentage of income. Meanwile the niddle class

pay a much parget percentage of their overall income in order to save the ultra wealthy from laying their fair burden on total income.

its a plan to punish the workers and move wealth to rich.

- A Jack - Wednesday, Feb 22, 17 @ 12:13 pm:

By this logic, we shouldn’t freeze property taxes since property taxes don’t effect SNAP people, who likely also get housing assistance.

- Foster brooks - Wednesday, Feb 22, 17 @ 12:16 pm:

How big a margin did the millionaires tax advisory referendum pass by?

- Blue dog dem - Wednesday, Feb 22, 17 @ 12:26 pm:

To the post. Absolutely regressive.

Both Democrats and Republicans know only one solution. This time. Last time. All the time. Tax the working poor and middle classes.

- pool boy - Wednesday, Feb 22, 17 @ 12:41 pm:

In 2016 the legislature eliminated the tax on feminine hygiene products because they were medically necessary for women. Food is medically necessary for everyone.

- Jimk849 - Wednesday, Feb 22, 17 @ 1:07 pm:

In Illinois there is no such thing as a bad tax.

- Last Bull Moose - Wednesday, Feb 22, 17 @ 1:10 pm:

State expenditures go primarily to the poor and disadvantaged. If you want to fund programs for autistic kids, offender diversion and transition, school aid, etc., find a way to pay for it.

The cost of medicine is so affected by insurance and subsidies that the cost to an individual is hard to estimate. I would tax it and count on the value of the programs funded to balance it out.

Much of the grocery bill goes for food preparation, not just food. Exempt canned goods, fresh fruits and vegetables, and minimally prepared grains (wheat flour, cornmeal, oatmeal), and you have exempted much of a basic diet. Tax microwaveable meals, prepared foods, snacks at a full rate.

- Amaila - Wednesday, Feb 22, 17 @ 1:42 pm:

HoneBear is on it! of course it is regressive. and for those trying to stay out of the SNAP zone, every little bit helps.

- Anonymous - Wednesday, Feb 22, 17 @ 2:31 pm:

Confounding how taxing things people need to exist at a base level is considered but taxing things that are playtime fulfillment objects (yachts, luxury items, etc.) shall not be touched. And they think we’re too dumb to figure out why. Bank robbers don’t go to food pantries you know. They’re astute enough to go where the real money is.

- Anon - Wednesday, Feb 22, 17 @ 2:40 pm:

It’s good to have someone who deals with SNAP as part of her job to critique this study and to show how it exaggerates the tax protection SNAP affords the poor.

How could an increase in sales tax on food be progressive? Someone living on $40,000 a year spends a larger proportion of her income on food than does someone living on $400,000 or $4,000,000. While the affluent may spend more on food, e.g. buying organic or expensive cuts of meat, they don’t eat more than average.

- Last Bull Moose - Wednesday, Feb 22, 17 @ 3:40 pm:

Anon. See my earlier comment. Excise taxes can usually be modified to be somewhat progressive.

- Honeybear - Wednesday, Feb 22, 17 @ 4:24 pm:

Here’s another thing. Food stamps only pay for food. The don’t pay for feminine hygiene products, laundry detergent, toiletries, toilet paper, soap etc. only food.

This is why my church has a special pantry of these items for folks. Can you imagine not having money to buy those things? I got close once. It changed my life.

One fact I always carry with me

51% of Illinois kids get free or reduced price lunch.

51%

- Anonymous - Wednesday, Feb 22, 17 @ 4:28 pm:

The federally-mandated sales tax exemption of SNAP purchases reduces the regressivity of a sales tax on groceries for poor people. Instead the sales tax burden is placed on the middle class not the most wealthy who spend proportionately less of their income on food than the middle class worker or retiree.