* From GateHouse…

* Sfondeles…

The largest sticking point — with negotiations still ongoing — is a Republican and Rauner-sought four-year property tax freeze paired with an income tax hike. Democrats say they’ll only approve a two-year hike due to concerns over school districts. They said the two-year timeframe was attached to the original property tax bill Illinois Senate Republican Leader Christine Radogno, R-Lemont, sponsored in January.

Radogno noted the bill didn’t reflect the most current agreement regarding discussions to protect taxpayers in a “substantial” way. She urged senators to wait for an agreement.

“We made a lot of progress since then in terms of trying to accommodate each other’s point of view on how long this freeze would be. I think we all need to remember if our taxpayers at home are watching the one thing they universally care about are property taxes,” Radogno said. “It is driving them out of their homes. They care deeply about property taxes. And a simple two-year freeze is inadequate, and there’s been some other really good ideas floated out there that again I think we can come to closure on if we gave ourselves a little more time to do it.”

Cullerton denied that the bill was “inadequate.”

“It’s a Senate bill. It can be amended in the House and let’s pass it. Let’s pass a two-year freeze. If it’s working so well and constituents clamor for it, we can come back next year and we can extend it,” Cullerton said.

According to WalletHub, Illinois has the highest combined state and local effective tax rate in the country at 14.76 percent based on national median household income. That’s a point higher than the next state. California is at 8.79 percent.

For decades, the Democratic Party has been talking about giving homeowners some relief on their property tax bills. Remember the Dawn Clark Netsch plan? These days, the Democrats barely pay lip service.

- RNUG - Thursday, May 18, 17 @ 10:23 am:

The only way you get substantial / real property tax relief is if the State increases their share of school.funding, something that will take a LOT more State taxes.

- Anonymous - Thursday, May 18, 17 @ 10:24 am:

Even the property tax freese isn’t fully about property taxes. It’s about creating pressure on local governments to have the exact same fights about union contracts that Rauner is having now.

- Anon221 - Thursday, May 18, 17 @ 10:26 am:

In the lame duck session, the two year freeze passed in the House. https://www.google.com/amp/amp.nwherald.com/articles/2017/01/10/cd5e59cd7e5e435f90e725a376bda811/

Do the doable, work on school funding to alleviate the local burden, and move on without Purvis and others throwing wrenches from the Rauner Tool Time Shop.

- Rich Miller - Thursday, May 18, 17 @ 10:28 am:

===the two year freeze passed in the House… Do the doable===

That was a permanent freeze.

- JS Mill - Thursday, May 18, 17 @ 10:28 am:

The best way to get property tax relief is:

1: What RNUG said- The state needs to increase ed funding.

2. Eliminate PTELL.

- Interim Retiree - Thursday, May 18, 17 @ 10:33 am:

Most school districts & local governmental units have seen their reserves dwindle the past several years due to the fighting in Springfield. Property taxes are a sure thing. BVR talks about how much schools are “authorized” in funding but the schools are scared of more proration or not getting categorical funding down the road. Where are the guarantees?

- SAP - Thursday, May 18, 17 @ 10:34 am:

Eliminating PTELL would make property taxes higher.

- Rich Miller - Thursday, May 18, 17 @ 10:34 am:

===Most school districts & local governmental units have seen their reserves dwindle===

The key word is “reserves.” Most have them.

- Romeo - Thursday, May 18, 17 @ 10:35 am:

Robbing Peter to pay Paul.

“We’re going to freeze your property taxes, but raise your income tax.”

- Texas Red - Thursday, May 18, 17 @ 10:35 am:

It’s about creating pressure on local governments to have the exact same fights about union contracts that Rauner is having now.

That fight is already occurring - have you see the spike in property taxes going to fund local police/firefighter pensions? Even without a freeze this is topic number one with groups like the Il Municipal league.

- Yeah - Thursday, May 18, 17 @ 10:36 am:

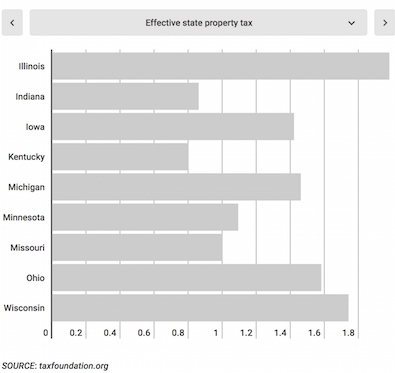

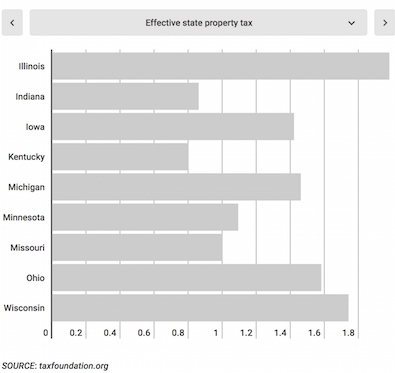

All the States listed above have significantly higher Income tax rates than Illinois.

- Rich Miller - Thursday, May 18, 17 @ 10:37 am:

===“We’re going to freeze your property taxes, but raise your income tax.”===

As Pat Quinn was fond of saying, the property tax is the only tax not based on the ability to pay it.

- Real - Thursday, May 18, 17 @ 10:37 am:

Freezing high property taxes is a duct tape solution.

- whetstone - Thursday, May 18, 17 @ 10:38 am:

The Civic Fed’s stuff on the property tax freeze seems reasonable: you can do it, but you would also have to do school-funding reform and clear a path towards local government consolidation, which is a heavy lift at a time when heavy lifts aren’t happening.

Sunsetting or not is also risky. On one hand, the income-tax sunset is a fine example of why a short-term tax change is a mess (and the other stuff to take the edge off a freeze could take awhile). On the other, it’s a risky concept and not revisiting it after a couple/few years seems like it could be a mess.

- OurMagician - Thursday, May 18, 17 @ 10:39 am:

I want 4 years! I want 2 years! Does the number 3 mean anything to either of you?

- Joe M - Thursday, May 18, 17 @ 10:41 am:

I thought Rauner, the GOP, and conservatives in general were always attacking big government and want the federal government to stay out of telling the states what to do — and the state government to stay out of telling local government what to do. Rauner himself is always saying to leave things like right to work and prevailing wages up to local government. Property taxes are totally a local tax, none of which goes to the State. So why is State government trying to tell local government how it should be running its property taxes?

As already pointed out - if the State funded schools as it constitutionally should be doing, then property taxes could go down. That should be the State’s action.

- Flapdoodle - Thursday, May 18, 17 @ 10:41 am:

I’m on a park district board in a small city with about 20% of the residents at the federal poverty level. Property taxes are our only consistently reliable revenue source, unless we want to jack up fees for *basic* services and thus exclude many residents. A property tax freeze will prevent us from completing improvements to youth athletic fields, strangle our ability to innovate special events programming that brings spending into the city, and put our facility renovation schedule on indefinite hold. By year three of a freeze, we’ll be basically a grass mowing service with most seasonal and part-time employees laid off. Them’s the facts, but I don’t see much evidence that anyone in Springfield is addressing them.

- Thoughts Matter - Thursday, May 18, 17 @ 10:45 am:

I think all the property tax items should be revised to somehow be based on your income. Your current house value is related to income you made in the past, if you have owned your house for quite a while. We are forcing retired people out of their paid off homes.

In addition, what does the home value have to really do with the line items on your property tax? You can’t really say that it costs more to throw rock/oil in front of my house than the house next door- unless you want to calculate that by how much of my property line hugs the road.

- T Sowell - Thursday, May 18, 17 @ 10:46 am:

The Dems were for a Property Tax Freeze before they were against it, and now they are sort of for it !

- City Zen - Thursday, May 18, 17 @ 10:46 am:

==All the States listed above have significantly higher Income tax rates than Illinois.==

And tax retirement income.

- Just do it - Thursday, May 18, 17 @ 10:48 am:

Just give Rauner his four year freeze and move it over to the House.

- wordslinger - Thursday, May 18, 17 @ 10:51 am:

The rhetoric from politicians pretending that they just landed on the planet gets dreary.

Illinois politicians have been talking about swapping income taxes to lower property and sales taxes for 40 years.

There’s no mystery as to how to do it, just a lack of will, as revealed in transparently lame excuses like two years isnt enough.

Anyone who won’t take half a loaf ain’t hungry.

- Yeah - Thursday, May 18, 17 @ 10:53 am:

Many counties in Indiana have a more than 2% income tax. The State collects it and passes it back to local government to fund local things, mostly their schools.

- Grandson of Man - Thursday, May 18, 17 @ 10:55 am:

Rauner wouldn’t accept a property tax freeze unless it had anti-union poison pills. Now that those pills are apparently gone, Democrats would look very bad politically, and Rauner would look reasonable, if this deal blows up because Democrats won’t accept two more years on a temporary freeze.

Doing the doable goes both ways.

- Juice - Thursday, May 18, 17 @ 10:57 am:

SAP, the point that JS Mill is making on PTELL is that taxing bodies that are capped are encouraged to increase the levy by the maximum allowable amount each year, even if they don’t need the revenue, because if there comes a time when the revenue is needed they would still be limited to inflationary increases.

Definitely a valid argument, and would be interesting to look at how the levy has changed since PTELL was adopted in districts covered under PTELL versus those who are not.

- Anonymous - Thursday, May 18, 17 @ 11:00 am:

“All the States listed above have significantly higher Income tax rates than Illinois.”

No they don’t.

- Ron - Thursday, May 18, 17 @ 11:03 am:

How do sales taxes compare?

- Judgment Day - Thursday, May 18, 17 @ 11:03 am:

“The best way to get property tax relief is:

1: What RNUG said- The state needs to increase ed funding.

2. Eliminate PTELL.”

—————

Eliminate PTELL? Really?

Maybe for the Tax Districts which are capped. But the taxpayers paying those increased RE taxes (and they will increase with no PTELL) will be savaged.

And at least in some parts of Illinois, the effects of having no PTELL in place will result in a direct negative effect on their RE market. In simple terms, less demand for homes.

It’s real simple:

1) IF no PTELL, all the ‘revaluation’ increase in assessed value gets treated as ‘Taxable Value’.

2) Tax Levies stay the same,

3) ‘Taxable Value’ vastly increases (no PTELL),

4) Tax rates may/may not stay the same,

5) There’s still a substantial increase in tax extension amounts,

6) End result: Tax Districts make out like bandits,

7) Taxpayers see substantial RE tax bill increases.

Wait for it….

8) RE taxes are a direct annual cost. If your taxes were increasing at 2% a year under PTELL, and 6%+ with no PTELL, the result is your house is going to likely be worth less in the marketplace if there is no PTELL to restrain RE taxes.

Now, there may be some areas in Chicago where property values are increasing, but most of the rest of the State of Illinois will be slaughtered. Their RE values will be headed to the downside.

Better think this through.

- 47th Ward - Thursday, May 18, 17 @ 11:05 am:

===Remember the Dawn Clark Netsch plan? These days, the Democrats barely pay lip service.===

How did that plan work out for Governor Netsch? Also, you’d need to hike the income tax well north of 6% before you could even begin to offer any real property tax relief.

So I’d say Democrats barely pay lip service to the idea precisely because they remember DCN.

- Romeo - Thursday, May 18, 17 @ 11:06 am:

@Rich==As Pat Quinn was fond of saying, the property tax is the only tax not based on the ability to pay it.==

My property taxes went up $450 this year, now sitting directly below $6,000. That’s $500 every month in property taxes alone; it’s just not sustainable.

- Rich Miller - Thursday, May 18, 17 @ 11:06 am:

===How do sales taxes compare? ===

You are one of the laziest commenters on this blog. This isn’t Google.

But just this one time, I’ll help you: Click the WalletHub link.

BTW, you’re one drive-by, trolling comment away from being permanently banned.

- Michelle Flaherty - Thursday, May 18, 17 @ 11:10 am:

Quick point for context:

We don’t have a “state” property tax.

there are local property taxes set by locally elected governments in the state of Illinois.

- Judgment Day - Thursday, May 18, 17 @ 11:16 am:

“Definitely a valid argument, and would be interesting to look at how the levy has changed since PTELL was adopted in districts covered under PTELL versus those who are not.”

————–

It’s all about the tax district budgeting process. We’d constantly see tax district levies where districts would just take the prior year’s budgeting amounts and that was their starting

point for the new RE tax year.

…. And adjust from there. No relationship at all to the prior year actual tax extension amounts.

It wasn’t uncommon at all to see a tax district’s RE tax levy amounts which were 20% to 30% higher compared to what monies were actually extended for RE taxes.

IF PTELL were to go ‘Bye Bye’, those tax districts will see a vast increase in revenue, and the RE taxpayers located in those tax districts will be slaughtered.

Great way to crush the RE market in many parts of Illinois.

- Bill - Thursday, May 18, 17 @ 11:18 am:

Our property taxes are high because our state is not adequately funding K-12. The local property tax is their only stable funding source.

- Anonymous - Thursday, May 18, 17 @ 11:37 am:

From Wallethub: All effective tax rates shown below were calculated as a percentage of the mean third quintile U.S. income of $54,286 and based on the characteristics of the Median U.S. Household*.

This makes no sense. Why would you compare a national median income to state and local taxes. At least use the state median income.

- Abe the Babe - Thursday, May 18, 17 @ 11:37 am:

Why they haven’t split the baby on this already is beyond me.

- Chicago_Downstater - Thursday, May 18, 17 @ 11:45 am:

Just give them the two extra years & be done with it. If you concede on that & they still won’t vote, then blame them until the cows come home.

I mean honestly! If it’s really going to do as much damage as my Dems say, then we can always attempt to push a repeal through. & if the damage isn’t that bad, then we can wait the additional two years for it to lapse. And if it turns out to have been beneficial, then guess what? We can renew it in 4 years.

No budget is much worst than a bad budget at this point. Just get the deal done.

- DuPage - Thursday, May 18, 17 @ 11:59 am:

Had coffee this morning with a couple small construction contractor friends. They are not happy about a new Rauner Grand Bargain tax on remodeling and repairs. They are Republicans, but they blame Rauner and his antics. They didn’t like Quinn, but he was paying down the backlog of bills with the income tax at 5%. When the smoke clears, the new Rauner income tax rate will be 4.95%. If they make $1000 profit on a $3000 job, the Rauner income tax rate will save them 50 cents, but the new sales tax will cost $180 or more, even if the particular job ends up not making any profit. Also this increases their time spent doing record keeping and paperwork, and time is money. Rauner ran on making things better for small business, but has not.

- Ghost - Thursday, May 18, 17 @ 12:07 pm:

those other states habe progressive inc tax rates that go much higher then Il. so they can do lower property taxes because they have higher income tax

- Midway Gardens - Thursday, May 18, 17 @ 12:41 pm:

DuPage, why do you think the contractors won’t pass sales tax on to their customers? Seems like that is what every business does. Might make an argument that it hurts business as it raises the overall price for a project.

- Anonymous - Thursday, May 18, 17 @ 12:47 pm:

Leave this state. Property taxes are the main muscle behind the core of corruption in Illinois. Look at the schools look at pensions look at office holders and the work they do besides being “elected officials”

Illinois is not a working class state

- Ron - Thursday, May 18, 17 @ 12:48 pm:

Midway, Plus it’s smart to show consumers the true cost of Illinois mismanaged government.

- Mordecai Brown - Thursday, May 18, 17 @ 12:52 pm:

Just want to point out a flaw in the Wallethub methodology: they use the middle rate in each state’s tax bracket to estimate effective income tax. IL is one of a small handful of states with only 1 PIT rate, so it’s not a fair comparison. (CA having the 8th lowest tax rate on the list should be a red flag). Progressive tax states generate most of their revenue from the higher brackets.

- Joe M - Thursday, May 18, 17 @ 1:20 pm:

At what point did a property tax freeze become parg of Rauner’s demands? It wasn’t part of his original turnaround agenda. His original turnaround agenda included giving more decision making to local government such as allowing them to have rtw zones and doing away with prevailing wages. Freezing property taxes does the oposite and takes away decision making from local government.

- Ron - Thursday, May 18, 17 @ 1:22 pm:

Mordecai, wallethub is nothing but click bait. The tax foundation is much better for these statistics.

- JS Mill - Thursday, May 18, 17 @ 2:34 pm:

BTW- Tip of the cap to Juice. Well done.

- JS Mill - Thursday, May 18, 17 @ 2:37 pm:

=The key word is “reserves.” Most have them. =

Fewer and fewer.

And we try to have them for good reason, see Illinois 2008 through (probably) infinity.

There is a reasonableness to them though. There is a point when it is too much.

- JS Mill - Thursday, May 18, 17 @ 2:41 pm:

=will see a vast increase in revenue=

Our district is not in a PTELL county.

So again, PTELL is in many ways a misnomer since there are maximum rates in each of the funds (except Bond IMRF/SSI rate, and Tort but they are restricted funds).

So even if PTELL was revoked there is still a ceiling that cannot be exceeded without a referendum.

Most people do not realize that so the concept of rampant and unchecked increases is a mirage that cannot happen without referendum.

- facts are stubborn things - Thursday, May 18, 17 @ 3:40 pm:

The whole reason property taxes are so high is the state does not properly fund schools. Freezing property taxes is treating the symptom and not the cause.

- RNUG - Thursday, May 18, 17 @ 4:28 pm:

-facts-, that was a perfect sound bite. Now if the D’s could just use it …

- Chicago_Downstater - Thursday, May 18, 17 @ 4:45 pm:

@Mordecai Brown

Good catch. I didn’t even think about that. Time for me to look a little closer.

Thanks!

- Anonymous - Thursday, May 18, 17 @ 5:21 pm:

If you want a property tax freeze then don’t complain when your police & fire protection, public works, art, music and sports in schools are cut.

- Anonymous - Thursday, May 18, 17 @ 6:14 pm:

Me thinks “Ron” used to be known as “Zonker”, “Arizona Bob”, and/or “Illinois Bob”.

- Tootsie - Thursday, May 18, 17 @ 7:01 pm:

How about a tax on retired State employees pensions? Certainly they enjoy the benefits provided by the taxpayers of Illinois.

Opps…sorry I forgot, they are entitled not to pay taxes

- Oswego Willy - Thursday, May 18, 17 @ 7:28 pm:

===How about a tax on retired State employees pensions? Certainly they enjoy the benefits provided by the taxpayers of Illinois.===

1) We don’t have a tax on ANY retirement income

2) They are taxpayers too.

So… You have nothing,

- Charlie Wheeler - Thursday, May 18, 17 @ 8:27 pm:

Point of Information:

In 1994, Democratic gubernatorial candidate Dawn Clark Netsch’s plan called for higher state income tax rates to pay for property tax relief and to provide additional funding to poorer school districts. Its main components ultimately were adopted by Republican Gov. Jim Edgar in 1997. Edgar’s plan would have raised income tax rates 25 percent to provide $900 million in property tax relief ($-for-$ levy abatement) and $600 million mostly targeted to property-value poor school districts. With the strong support of House Speaker Michael Madigan, a Chicago Democrat, the legislation passed the House 62-56 in May, 1997. Seven Republicans broke with their caucus leadership to join with 55 Democrats to pass the bill. The measure died when Senate President James “Pate” Philip, a Wood Dale Republican, assigned it to the Senate Revenue Committee, which rejected it on a 6-4, party-line vote, with all GOP members voting against it.

Charlie Wheeler

- JS Mill - Thursday, May 18, 17 @ 8:28 pm:

====How about a tax on retired State employees pensions? Certainly they enjoy the benefits provided by the taxpayers of Illinois.===

1) We don’t have a tax on ANY retirement income

2) They are taxpayers too.

So… You have nothing,===

Face palm…

Is it simply that they do not know that public employees are taxpayers like everyone else?

THey owe the rest of Illinois nothing but performing their job responsibilities. Once that happens the paycheck belongs to them. Just like when you go to a business and spend money, they owe you the product or service.

Sheesh.

BTW-I support taxing retirement income.

- RNUG - Thursday, May 18, 17 @ 10:20 pm:

== How about a tax on retired State employees pensions? ==

You can tax retirement income, thing

s like pensions, Social Security, annunities, IRA’’s and 401K’s. All perfectly legal if you can get it passed.

What you can’t do is tax ONLY State retiree’s pensions.