Memorial Day on social media

Monday, May 29, 2017 - Posted by Rich Miller

* Gov. Rauner…

* Gubernatorial candidates…

The CAIR tweet was retweeted by Ameya Pawar.

* And one more from my side of the equation…

15 Comments

|

It’s just a bill

Monday, May 29, 2017 - Posted by Rich Miller

* But it’s a good one…

The Illinois House unanimously passed Senate Bill 1933 to create automatic voter registration (AVR) on Monday, to applause from backers in the Just Democracy Illinois coalition of civic and voting rights groups.

“We are thrilled that automatic voter registration passed the House today with broad, bipartisan support,” said Andy Kang, Legal Director at Asian Americans Advancing Justice Chicago, and a Co-Coordinator of Just Democracy Illinois. “We urge Governor Rauner to sign automatic voter registration into law and create a more modern, secure, and accurate voter registration system for Illinois.”

SB1933 reforms current registration laws so that whenever an eligible Illinois resident applies for, updates or renews a driver’s license or state ID, he or she will be automatically registered to vote or have their registration updated, unless they opt out. It also creates a similar program for other state agencies, such as the Department of Human Services and Department of Natural Resources.

The achievement of bipartisan agreement on legislation dealing with elections is remarkable in the midst of partisan tension in Springfield. The legislation passed the Senate on May 5th with a 48-0 vote, with 22 Republicans and 26 Democrats voting in favor. In the House, the AVR bill was cosponsored by members of both parties, and passed 115-0. Representative Mike Fortner (R-West Chicago) was a Chief Co-Sponsor and sponsored the final amendment to the bill.

“Automatic voter registration, as passed this year, will allow technology to help make our elections more secure, more efficient, and more open to all citizens of Illinois,” said Rep. Fortner. “This bill will create a seamless process for citizens to register and keep their registration up-to-date as they move. At the same time, it respects the privacy of those in the system and those who choose not to participate.”

* From the Paulick Report…

The Illinois Senate passed a wide-ranging gambling bill, SB7, earlier this year. It would allow for six new full-scale casinos, including one in the city of Chicago. It tosses a meatless bone to racetracks, permitting them to finally conduct what every corner bar in the state now enjoys: video gaming.

The measure is too little, too late to help breathe life into a once-proud industry. Where racing once had to fight casinos with both hands tied behind their back, it now would have one hand freed if this bill is passed by the House in the next few days. That’s not enough.

Only by permitting Illinois racetracks to compete freely and openly, with slots and table games, will the state’s racing and breeding industries come back to life – with thousands of additional jobs and millions of dollars in purses and tax revenue to the state.

* Press release…

It’s not the most provocative topic at the Statehouse, but the process for determining how new laws will be implemented by state agencies briefly took center stage in the Senate Thursday afternoon.

Legislation sponsored by Senator Don Harmon (D-Oak Park) seeks to correct a few problems that have arisen in the General Assembly’s bipartisan rule-making review process, which is carried out by a 12-lawmaker panel known as the Joint Commission on Administration Rules – or JCAR.

Harmon is a co-chairman of the commission. He said the legislation is a response to actual problems the commission has encountered, not a backdoor attempt to hamstring any governor – an accusation levied by at least one senator.

But Harmon added that the commission wants to demand accountability of state agencies and increase efficiency and transparency in the rule-making review process.

“There is nothing saucy here. These are ministerial and mundane things. This is simply an attempt to help us maintain balance between the executive and legislative branches,” Harmon said.

* From the Illinois Policy Institute’s totally unbiased news service…

A bill likely to land on the governor’s desk within the next few days would prohibit the establishment of right-to-work zones, a blow for those who believe such zones could help recoup thousands of jobs lost to neighboring states in recent years.

A veto also is likely, as right-to-work, or “empowerment” zones, are a concept that Gov. Bruce Rauner has championed since taking office in 2015.

As Illinois’ Republican governor and Democrat-controlled House and Senate continue to spar over the best way to kick start jobs growth and pull the state back from its multibillion dollar budget deficit, the state’s black community suffers with the highest unemployment rate of the nation. New Bureau of Labor Statistics data show Illinois tied with Nevada at 12.7 percent for black unemployment.

3 Comments

|

Get in the game or go home

Monday, May 29, 2017 - Posted by Rich Miller

* Unless these superintendents demand a tax increase to fund their programs and/or tell legislators what programs should be slashed to pay for all this, they should just stay home…

Illinois school chiefs are pressing lawmakers to pass a budget that fully funds schools before the legislative session draws to a close this week.

School district superintendents from across the state will convene at the state Capitol on the General Assembly’s Wednesday deadline to urge lawmakers to produce the state’s first complete budget in two years.

The coalition is calling on Gov. Bruce Rauner and legislative leaders to pay schools the $1.1 billion they say the state owes them for programs like special education and transportation. Payments have lagged amid the state’s historic budget impasse.

The 440 superintendents represent two-thirds of Illinois school children.

Demanding “a budget” misses the point. This fight isn’t about the “budget,” it’s about the governor’s non-budget demands tied to a tax hike.

These superintendents have some sway back home. They need to finally step up and tell their own constituents what needs to be done.

* I wrote much the same thing in my subscriber edition today. One superintendent had the guts to respond…

* Related…

* Responsible Budget Coalition: Illinois needs revenue to thrive

25 Comments

|

* The bill passed by a vote of 114-0. From Speaker Madigan’s office…

Speaker Michael J. Madigan issued the following statement Monday after the House voted to pass Senate Bill 8, a package of reforms negotiated by Gov. Bruce Rauner to help streamline acquisition of goods and services, reducing costs to the state:

“Today’s passage of a procurement reform package requested by Governor Rauner is another instance in which House Democrats have followed through on our commitment to work cooperatively with the governor to reduce the cost of government and address the issues facing our state.

“This bill is the result of negotiation between legislators and the administration. In January, I directed the House State Government Administration Committee to thoroughly evaluate the governor’s procurement proposal, and that committee approved the governor’s plan with bipartisan support.

“The biggest issue facing Illinois remains the state budget. As the governor continues to hold other aspects of his agenda as pre-conditions to his cooperation on a full balanced budget, I renew my request that the governor immediately focus on working with House Democrats to find common ground and pass a budget for our state. Today’s agreement is proof that House Democrats are willing to make compromises to move Illinois forward.”

The bill is SB 8.

*** UPDATE 1 *** From Eleni Demertzis in the governor’s office…

Tiny, incremental steps to change our broken system are better than nothing, but what the House passed today is far from what is needed.

While Speaker Madigan’s Democrats continue to argue over how big of a tax hike to impose on the people of Illinois, the governor remains focused on enacting real and lasting property tax relief.

The governor has previously said that his procurement reforms could save a half-billion dollars a year. I’ve asked for some clarification.

*** UPDATE 2 *** The answer to my question…

Because they’ve removed the most important structural changes from the bill, we can’t give any estimate on savings but we know it won’t be anywhere near that number.

*** UPDATE 3 *** From Steve Brown…

If the Governor is saying the differences between the Senate bill and the House amendment won’t result in savings, here’s the list of changes. None of these should reduce the number, and there was a claim SB8 as it passed the House would save $70M a year [the same claim made in the Senate].

* The House amendment requires agencies to submit a list of exempt contracts to the CPO. The purpose of this is to increase transparency and establish one location where members and the public can find information about exempt contracts. This was not included in the bill as it passed the Senate.

* As it passed the Senate, the bill exempted from the Procurement Code (1) public private partnerships, and (2) food purchased for commercial resale by public universities. This is not included in the House amendment.

* As it passed the Senate, the bill removes the 90-day cap on emergency procurements for construction at the request of Capital Development Board. This is not included in the House amendment.

* As it passed the Senate, the bill gives agencies authority to use master contracts, interpreted without CPO oversight. The House amendment clarifies the CPO has authority and allows a CPO to void, ratify, or affirm a joint purchase that was in violation of the law under the Governmental Joint Purchasing Act. This language was initially requested by House GOP members.

* As it passed the Senate, the bill repeals the procurement reporting requirement. The House amendment clarifies this language, but does not repeal it.

* As it passed the Senate, the bill creates a Special Committee to review procurement laws and recommend improvements in (i) efficiency, (ii) minority, female, and veterans contracting, and (iii) Illinois preference purchasing. The House amendment does not remove the General Assembly from procurement discussions, but does includes a committee solely focused on minority, female, and veterans contracting.

* As it passed the Senate, the bill allows universities to enter a lease for 30 years if the lessor has to make more than $100K in improvements. This is not included in the House amendment.

* As it passed the Senate, the bill includes the use of prequalified pools for all areas of procurement. This is not included in the House amendment.

* As it passed the Senate, the bill allows universities to directly contract, without CPO oversight, with the Midwest Higher Education Cooperation Act for computer and technology equipment, or services, and insurance. The House amendment allows these purchases with CPO oversight.

* As it passed the Senate, the bill changes the Small Business Act to allow the state to count contractors and sub-contractors toward the goal of awarding 10% of total contract dollars to small businesses. This makes it easier to meet the 10% goal. The House amendment does not include subcontractors and moves the current requirements of the Small Business Act into the Procurement Code. The intent is to urge the State to enter into a greater number of contracts with small businesses.

19 Comments

|

This Is Illinois

Monday, May 29, 2017 - Posted by Rich Miller

* SJ-R…

Farmers in Illinois are one step closer to being allowed to grow industrial hemp.

A bill sponsored by Sen. Toi Hutchinson, D-Olympia Fields, passed unanimously in the Senate this month and now goes to the House.

While the state currently allows universities offering four-year agricultural science degrees to grow hemp, this new legislation would expand that to all farmers.

According to the Illinois Stewardship Alliance, there are at least 25,000 different products that could be made from hemp, ranging from plastic alternatives, to food, cosmetics, rope and clothing. […]

“One of the most important things that we need to do is make people and farmers understand that what we’re suggesting with industrial hemp has nothing to do with cannabis or marijuana,” [Rob Davies, marketing director for the Illinois Farmers Union] said. “It’s a multipurpose commodity that we’re presently importing in enormous quantities into our own country to do jobs that we can take care of ourselves.”

The article doesn’t mention it, but the bill is stuck in the House.

The House sponsor, Rep. Larry Walsh, has a huge medical marijuana facility in his district so the med-mar lobsters were able to tie it up. The Stewardship Alliance, Sen. Hutchinson and several House members have complained bitterly about the way this bill got jammed up in the House, but the med-mar people deny they were a problem, even though they were demanding things like a 4-mile setback from their facilities (which seems ridiculously excessive for indoor grow facilities, so they eventually settled at a quarter mile). Rep. Walsh has flatly denied allegations that he was a “hostile sponsor,” claiming that he was just trying to settle differences among various interest groups.

And then all of a sudden the lieutenant governor’s office intervened. The LG runs the Rural Affairs Council, so that gave her some skin in the game. It now looks like veto session at the earliest.

The med-mar people have interests to protect. I get that. But this was starting to look to me like the days when the casinos worked against video poker machines.

Nothing’s ever easy in this state.

* Semi-related…

* Odds against Springfield casino after amendment blocked: Chances of a Springfield casino took a major hit Sunday when a House committee blocked an amendment to add the casino to an omnibus gambling expansion bill.

Comments Off

|

Unclear on the concept

Monday, May 29, 2017 - Posted by Rich Miller

* Sun-Times…

[House Republican Leader Jim Durkin] said his members are “not interested in doing a repeat of 2011, a tax increase that was thrust upon Illinoisans with no strings attached that did not pay one bill.” [Emphasis added.]

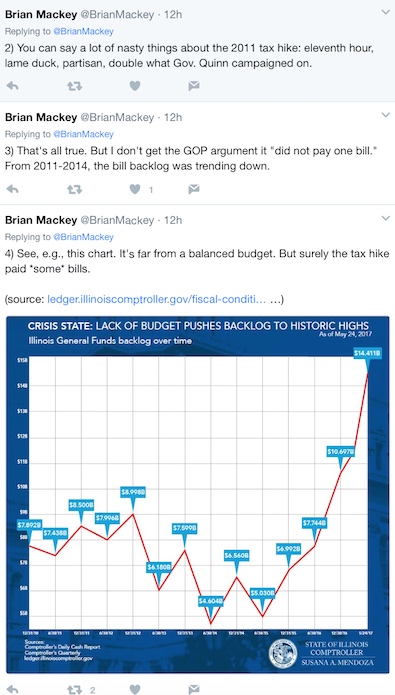

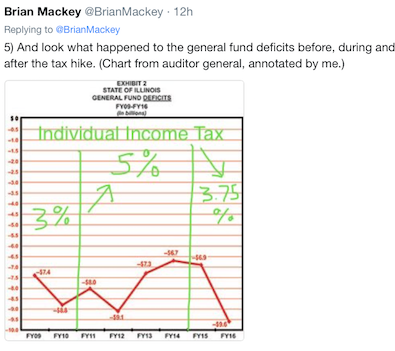

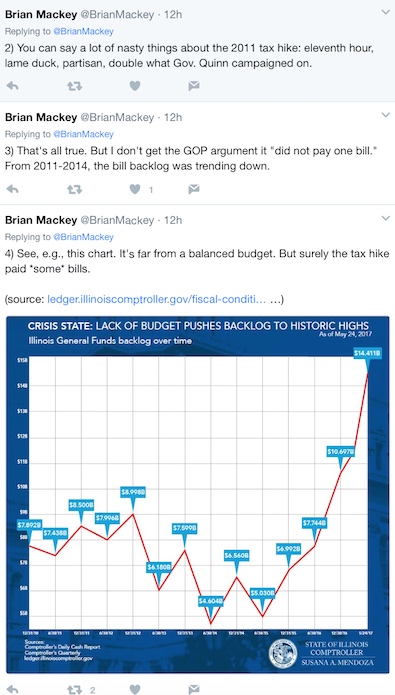

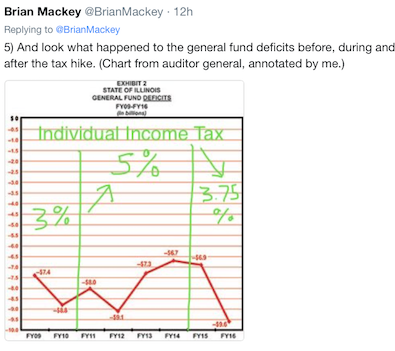

* Brian Mackey debunks…

The bill payment cycle was down to under 30 days when Rauner took office - that’s a “normal” cycle. Now, it’s something like 6 months.

25 Comments

|

Today’s number: $484.5 million

Monday, May 29, 2017 - Posted by Rich Miller

* That number is the payment backlog in the state’s Public Transportation Fund…

The RTA has resorted to short-term borrowing to stay current in its subsidy payments to the three transit agencies.

“We have maxed out our temporary short-term borrowing capacity,” Redden said.

CTA, Metra and Pace all have cash reserves, but the reserves are intended only as a stop-gap. Redden said all three agencies are looking at options that could include service cuts and fare hikes, which may be needed sometime in the coming quarter.

CTA and Pace have in place 2017 budgets that did not cut service or raise fares; in fact, Pace has augmented service, particularly on its expressway and tollway corridor services. Metra raised fares in February, with the intention of setting aside the additional revenues generated to help pay the local share of federally-funded projects.

…Adding… From the Senate President’s office…

The Senate President spoke at an Elmhurst College event a few weeks ago. His speech included this …

My friend Kirk Dillard, the former DuPage County state senator, is now chairman of the RTA. The state owes that agency about $400 million. The agency borrows to cover the shortfall.

Here’s the catch.

The state doesn’t pay the RTA interest on the money that’s late, but the RTA has to pay interest on the borrowing to cover the state money.

The agency ends up losing about $2 million a year because of this.

That’s enough to buy five new METRA cars or rehab three train stations, which are far better uses of the dollars than paying loan interest.

So, if you use METRA and you think the train cars are too crowded or too old or your local train station is rundown and needs updated, the state’s failure to pay its bills is to blame.

4 Comments

|

* From the Illinois Policy Institute’s news service…

Testifying before the House Appropriations-General Services Committee on Sunday, officials from the Illinois State Board of Elections said Senate Bill 6 provides the department with $20.5 million.

But Elections board Chairman Charles Schultz said the appropriation doesn’t account for implementing proposed Automatic Voter Registration legislation because it would take additional funds to update hardware and software.

Schultz also said the elections board’s voting infrastructure would be threatened as its information technology and cyber security vendors, who are already waiting on payment for work that’s been done, could [not] go further without payment.

Board officials also said if there is no agreed-upon budget, they’d have to turn their internet off to maintain network security. The state’s election board suffered a breach last summer where intruders were able to capture some personal voter information, but not signatures or histories, nor was anything changed within the system, the board said.

* AP…

The consequences were again hammered home earlier Sunday in testimony before the House General Services Appropriations Committee. Kevin Turner, director of information technology for the Illinois State Board of Elections, said the agency does not have enough computers to quickly dispatch with candidates filing nominating petitions late this fall for the 2018 election. There’s been no money for replacing obsolete work stations and without $25,000 for new ones, lines will be long, Turner said.

“We may be doing it in the parking lot using abacuses,” Turner joked.

Turner added that the board, which suffered a breach of election data by a foreign hacker last summer, is two years behind on paying as much as $9,000 for online antivirus protection and if it doesn’t catch up this fall, “we would have to unplug our agency from the internet.”

Um, if they can’t find a way to move around $9,000, then I don’t know what to tell them.

9 Comments

|

* From Lawrence Msall of the Civic Federation…

The Tribune’s editorial “Illinois lawmakers should focus not just on taxes but on major spending reforms” is a disappointment. In its criticism of the Civic Committee of the Commercial Club of Chicago’s recent report, it fails to recognize the enormous costs of the state not having a budget for two years.

While the Editorial Board has championed reforms for pensions, Medicaid and other areas of government in the past, the Civic Committee’s report rightly points out that policy fights must not delay the process of balancing Illinois’ budget. Until the state has a budget, savings proposed by the Editorial Board or anyone else are unlikely to occur.

The Tribune’s position not only does harm to our state’s most vulnerable citizens, but also to our state’s reputation and credit rating. The greatest savings our state could realize would be by passing a comprehensive budget and thereby not being subjected to an exorbitant premium on delayed bill payments and not having a near-junk credit rating that is costing us hundreds of millions of dollars in borrowing costs.

Amen to that.

* Let’s revisit the words of Rep. Steve Andersson before he backtracked yesterday…

“I think we all recognize that we are letting the state burn. We’ve destroyed our social-service safety net. In my opinion, at this point, there’s not enough reform to counter the damage we’ve done to the state in the past two years. and so for me, the biggest win is to create stability in this state. I want the [Turnaround Agenda] reforms. I agree with the governor that there are things in there we need to do. But the number one reform in my world is predictability and sustainability. Because people will stay [in the state] if they know what the rules of the game are.”

The one thing this state government has sorely lacked since 2003 is “predictability and sustainability.” Blagojevich was completely unpredictable and refused to do the hard work of governing, which meant the state never got to sustainability. Quinn signed a temporary tax hike into law which undermined both predictability and sustainability. And now Gov. Rauner is demanding yet another temporary tax hike coupled with a temporary property tax freeze.

This needs to end.

The House has already passed a permanent property tax freeze. Maybe they should crank it out again with some reasonable caveats.

14 Comments

|

HDems take tax hike bill away from Rep. Ives

Monday, May 29, 2017 - Posted by Rich Miller

* From the Illinois Policy Institute’s news service…

State Rep. Jeanne Ives on Sunday blasted her Democrat colleagues in the Illinois House for removing her as chief sponsor of a Senate bill that would increase taxes on Illinoisans by more than $5 billion.

Democrats, Ives said, “used a procedural move to take this bill from me, which must mean their only intent is a massive tax hike of over $5.4 billion on the hardworking folks in Illinois.” […]

Ives, an opponent of tax increases, filed to be chief sponsor of the bill in the House.

Earlier Sunday, Sen. Toi Hutchinson, D-Olympia Fields, requested that Ives, R-Wheaton, be removed as the primary sponsor in the House. Hutchinson, who carried the tax hike bill in the Senate, requested state Rep. Will Davis, D-Homewood, be assigned as the primary sponsor.

On the House floor, Ives said taking the tax hike bill away from her was a partisan move to prevent a bipartisan conversation on taxes from taking place. She said Democrats ignore the state’s poor business climate.

Rep. Ives filed an amendment (click here) which stripped out all the Senate Democrats’ tax hikes and left intact the tax credits and tax reductions. The Senate sponsor wasn’t pleased and filed her motion to remove Ives as a sponsor and add Rep. Davis.

The House Democrats had been saying they didn’t want to make Ives a martyr by taking the bill away from her, but then she started amending the bill and they received a formal request for a sponsorship change. So, they went ahead and did it anyway.

* The Senate sponsor wasn’t the only one who expressed displeasure…

“It’s no time to be playing games with people’s bills, especially this budget bill,” State Rep. Linda Chapa Lavia (D – Aurora) said during Sunday’s meeting of lawmakers.

Republicans responded to those statements, saying that Democrats have no interest in forging any bipartisan consensus on a bill.

“Democrats are not interested in bipartisan support on what we should be doing with taxes,” State Rep. Jeanne Ives (R – Wheaton) said.

That would be more believable if Rep. Ives was interested in working out the differences. But as the Illinois Policy Institute notes, she’s “an opponent of tax increases.”

* But, whatever. It’s not like the House Democrats are interested in passing that Senate tax hike/revenue package anyway…

[Rep. Greg Harris] said there is concern about some of the things used by the Senate to come up with a balanced budget. That includes estimating $1.25 billion from changes to state employee pensions, $435 million from changes to state employee group health insurance and $300 million from the sale of the James R. Thompson Center in Chicago.

Harris said it is too early to count on savings from pension changes and that the health insurance savings has to be negotiated with unions. The Thompson Center is a one-time revenue, he said.

“I think if we are looking at the Senate and House budget, there’s about $1.6 billion to $1.8 billion worth of difference between them,” Harris said. “We’re not sure you can really book some of the revenues that the Senate booked.”

8 Comments

|

A closer look at the GOMB memo

Monday, May 29, 2017 - Posted by Rich Miller

* AP…

The House has committee hearings scheduled Monday to continue reviewing the $37 billion budget plan the Senate approved. It includes $5.4 billion in revenue raised mostly by a 32 percent increase in the personal income tax rate from 3.75 percent to 4.95 percent.

The Senate sent the plan to the House last week. It also includes $3 billion in spending reductions.

* Tribune…

As Democrats were behind closed doors, Rauner budget director Scott Harry sent a letter to House members warning the governor would veto the Senate plan should it make it to his desk. Harry estimated the budget and tax plan was at least $435 million out of balance, and said it does nothing to pay down the bill backlog or put in place economic changes the governor has pushed such as a property tax freeze.

* Here’s that memo. I’ve added paragraph numbers so we can more easily dissect it…

From: Scott Harry, Director, Governor’s Office of Management and Budget To: Members of the Illinois House of Representatives

Date: May 28, 2017

Re: GOMB Analysis of SB 6

1) The Senate Democrats’ budget bill (SB 6) proposes to spend $5 billion more than the state’s fiscal year 2018 revenue forecast of $32 billion. Notably, Senate Democrats also passed a large tax increase to accompany SB 6 without any significant changes to our broken system – no real and lasting property tax relief and no economic reforms to grow the economy.

2) Drafted and voted upon without bipartisan support, SB 6 fails to make substantial spending cuts and has no real and hard spending cap beyond fiscal year 2018. If SB 6 were enacted, government spending would likely continue to explode, driving our state deeper into debt.

3) The Governor’s budget office estimates that even if the House enacted the Democrat-only tax hike proposal accompanying SB 6, the budget would be out of balance by at least $435 million in fiscal year 2018 (due to the lack of implementing legislation to achieve savings in the group health insurance program) and roughly $1 billion in fiscal year 2019. Furthermore, SB 6 takes no action to meaningfully pay down the bill backlog – concealing an even higher planned income tax rate than the Senate already passed.

4) From a technical drafting perspective, the FY17 appropriations in SB 6 were not drafted to address the true obligations of the state and fully cover commitments from FY16 and FY17. Other problems are caused by the drafting approach to structure the FY17 appropriations around spending authority that the Comptroller has established for consent decrees, court orders and continuing appropriations.

5) In sum, the House is considering a broken budget contingent on a large tax hike without any meaningful property tax relief or job creating reforms – which even if enacted would not even balance the budget. SB 6 is a lose-lose for taxpayers. If this bad deal for taxpayers comes to the Governor’s desk, he will veto it.

1) Oh, please. That is so misleading. Unlike the governor and his budget office, the Senate Democrats cut spending from the GOMB forecast and then added revenues. And that “large tax increase” was supported by the governor during negotiations.

2) The proposal didn’t receive GOP votes, but it most definitely received lots of Republican input. It makes billions of dollars more spending cuts than Gov. Rauner and his budget office proposed in February. And while there is no spending cap beyond FY 18, one can be enacted for FY 19 and beyond in the future. The governor could also simply propose a budget that has a spending cap.

…Adding… As mentioned in comments, Gov. Rauner’s agency directors all said during appropriations committee hearings that they couldn’t enumerate any cuts and that any cuts would be bad, yet Gov. Rauner’s budget director expects the Senate to find them anyway. Nice one.

3) The governor’s proposal to reduce spending on group health insurance requires changes to collective bargaining laws - something that Senate President Cullerton has completely ruled out. The Senate proposed the same reduction as Rauner did, but they put it on Rauner to achieve his spending reductions via the collective bargaining process and/or the courts.

And, seriously, they’re worried about a possible budget deficit in Fiscal Year 2019 that doesn’t even end for two more years? Really? Rauner can’t propose a solution to this alleged problem next February? From the Senate Democrats…

How much of his job is the governor expecting the Senate to do?

Exactly right.

I agree that it’s a copout for the Senate Democrats to punt on the bill backlog, among other things. No doubt about it. But Rauner did the exact same thing in his own budget proposal. From a May 9th report…

The Civic Federation’s Institute for Illinois’ Fiscal Suitability is not able to support Governor Rauner’s recommended FY2018 budget because it has an operating deficit of at least $4.6 billion, presents an insufficiently detailed plan for closing the gap and does not address Illinois’ massive backlog of bills.

And from the Senate Democrats…

Two weeks ago, the Senate came within 3 votes of passing a budget that cut deeper while also refinancing that debt, and I don’t recall the governor rounding up votes to try to help get it passed.

4) “Technical drafting” errors are fixable.

5) If this is a “broken budget,” then why doesn’t the governor’s budget office propose a real one?

* Also, here’s an important point from Rep. Greg Harris (D-Chicago)…

Harris said the whole budget discussion is taking place while Rauner is making public appearances and airing ads that attack the Democrats’ plan.

“They (Senate Democrats) actually passed a lot of the revenue ideas he’s been championing since he became governor,” Harris said. “He’s on social media and on paid advertising and on robocalls attacking people for doing the things he’s been suggesting.”

19 Comments

|

* NBC 5…

State legislators are meeting this holiday weekend in Springfield as they try to come to an agreement on a new budget, but one of the Democrats’ key initiatives is reportedly in big trouble.

According to NBC 5, , Democrats held a caucus on Sunday night in Springfield, and only 46 representatives are planning to vote for a tax hike that the Senate passed last week. In order to pass the legislation out of the House, 60 votes would be needed, leaving Democrats well short of that mark.

* Tribune…

Rank-and-file members were divided: some were reluctant to vote to raise taxes knowing Rauner is likely to veto the plan and try to score political points ahead of his 2018 re-election bid, while others wanted to vote for a budget plan given they expect to be attacked either way.

“We could potentially do the right thing, have the governor veto it, potentially try to push it past him, and have him still come out and say, ‘Well, I still didn’t want this. I get all the benefits of having a budget, but none of the political pain,’” said Rep. Christian Mitchell, D-Chicago. “I think there’s real reluctance to do that.”

Mitchell said House Democrats also were spooked by what they saw happen in the Senate, where Democrats decided to go on their own following months of negotiations with Republicans.

“So mimicking that experience in the House, I don’t think appeals to a lot of people,” Mitchell said.

* Sun-Times…

House Deputy Majority Leader Lou Lang, D-Skokie, on Sunday night said Democrats are discussing the Senate bills, but he noted there’s discussion of “some new items and different ways of looking at things.”

“I think it’s premature. Some might say well, ‘We’re three days away from May 31, how can it be premature?’ ” Lang said. “I think we know that in the life of the General Assembly, three days is a lifetime.”

Um, it’s only a “lifetime” if everyone is pulling in the same direction.

* SJ-R…

In a hearing on higher education spending, Rep. Sara Wojcicki Jimenez, R-Leland Grove, expressed frustration with another hearing that covered the same ground.

“I respectfully request that instead of asking the universities to continue to come in and tell us how bad things have been operating without a budget, I think it’s time for our committee to come up with a bipartisan solution,” she said. “With all due respect, it’s our turn.”

Rep. Greg Harris has said he invited the House Republicans to participate in drafting a budget. They declined.

12 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|