* Moments after I hit the “Publish” button on that post below about how everyone needs to try and remain calm, this press release landed in my in-box…

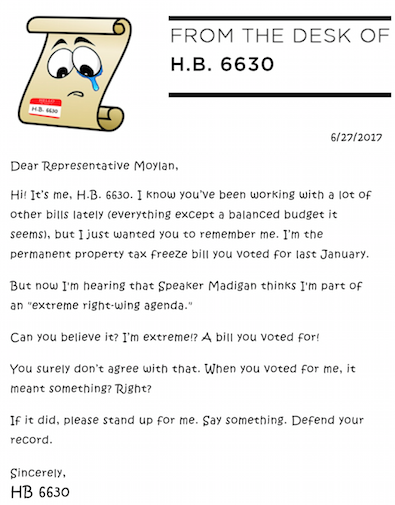

Extra! Extra! This morning 27 House Democrats received personalized letters highlighting their vote this January to permanently freeze property taxes.

Unfortunately, the tax freeze bill died in the Senate. But Democrats in the General Assembly now have a chance to make good on their pledge and pass real property tax relief.

As Politico Illinois notes - the current proposed Democratic property tax freeze has major gaps, including exemptions for the City of Chicago and CPS. It’s simply not real relief as drafted.

The following Democrats received letters this morning:

HD 15 John D’Amico

HD 44 Fred Crespo

HD 46 Deb Conroy

HD 55 Marty Moylan

HD 56 Michelle Mussman

HD 59 Carol Sente

HD 62 Sam Yingling

HD 98 Natalie Manley

HD 96 Sue Scherer

HD 111 Dan Beiser

HD 116 Jerry Costello

HD 118 Brandon Phelps

HD 40 Jaime Andrade, Jr.

HD 3 Luis Arroyo

HD 83 Linda Chapa LaVia

HD 58 Scott Drury

HD 12 Sara Feigenholtz

HD 31 Mary Flowers

HD 24 Elizabeth Hernandez

HD 113 Jay Hoffman

HD 78 Camille Lilly

HD 60 Rita Mayfield

HD 21 Silvana Tabares

HD 67 Litesa Wallace

HD 11 Ann Williams

HD 77 Kathleen Willis

HD 22 Speaker Madigan

* The hand-delivered letter…

As I’ve already told subscribers, the House Republican Leader has informed Speaker Madigan that he could be for a freeze plan that exempted the city. The state party and the governor who funds it need to back the heck off and let the House negotiate.

- illini97 - Tuesday, Jun 27, 17 @ 9:58 am:

Republicans still use Comic Sans? How awful!

- City Zen - Tuesday, Jun 27, 17 @ 10:01 am:

How could anyone resist a face like that?!

- Annonin' - Tuesday, Jun 27, 17 @ 10:02 am:

Hmmm…lookin’ more like Gov “Happy” Junk is windin’ up the big kill the deal play. Reports Durkie feelin’ strung out.

- Oswego Willy - Tuesday, Jun 27, 17 @ 10:07 am:

===The state party and the governor who funds it need to back the heck off and let the House negotiate.===

Bruce Rauner, and Diana Rauner, have funded the ILGOP, and Bruce had staffed the ILGOP, and orchestrated everything “ILGOP”…

… Am I suppose to believe Rauner and his Crew is oblivious to what’s going on, and further, are on their own right now doing this?

Hmm.

Rauner put $20 million in his account at jump street telling GOP GA members he (Rauner) wanted no $&@#% problems… now, Rauner, this?

- Amalia - Tuesday, Jun 27, 17 @ 10:08 am:

ripe for John Oliver and “I’m just a bill” with the bill itself smoking cigarettes, homeless, in danger, and more. cartoons equals I’m not taking it seriously.

- @MisterJayEm - Tuesday, Jun 27, 17 @ 10:10 am:

The No True Scotsman fallacy involves discounting evidence that would refute a proposition, concluding that it hasn’t been falsified when in fact it has.

For example:

The No True Scotsman fallacy is a way of reinterpreting evidence in order to prevent the refutation of one’s position. Proposed counter-examples to a theory are dismissed as irrelevant solely because they are counter-examples, but purportedly because they are not what the theory is about.

– MrJM

- CCP Hostage - Tuesday, Jun 27, 17 @ 10:11 am:

Gov. Happy Junk. lol

- FearTheTree - Tuesday, Jun 27, 17 @ 10:14 am:

Property Tax Freeze that exempts Chicago and CPS???!!!

Isn’t that like being a little bit pregnant?

Meanwhile, the City of Chicago Public School System pays an annualized rate of 6.39% for 90-day money to make payroll.

How much does a corporation pay for 90-day money in the commercial paper market?

1.16%

- GA Watcher - Tuesday, Jun 27, 17 @ 10:16 am:

It was mentioned in Committee that Chicago and Cook County were exempted in response to critics that their property taxes are too low compared to other parts of the Chicago region. The argument was made that the exemption will allow the County and City to catch up.

- Joe M - Tuesday, Jun 27, 17 @ 10:17 am:

As was pointed out on another thread, folks are always complaining that Chicago doesn’t pay high enough property taxes. And a lot (if not most) of those complaining are GOP conservatives. So what is their beef now with not freezing Chicago property taxes, if they think Chicago isn’t paying its fair share?

- Not It - Tuesday, Jun 27, 17 @ 10:19 am:

No! Cook County citizens need tax relief as well. We have already seen what happens when we have property tax policy for Cook and a separate policy for everyone else. I’m tired of the State assuming that just because I live in Cook I’m tolerant of more taxes.

- Shark Sandwich - Tuesday, Jun 27, 17 @ 10:20 am:

Now, illini97, that’s no accusation to be levelled lightly, it’s an egregious offense that no one should commit. That said, that font is not Comic Sans. I am not saying it is a good font, but it is not the Hitler of fonts, either.

- wordslinger - Tuesday, Jun 27, 17 @ 10:26 am:

I think it’s swell that the ILGOP is providing daycare and arts and crafts fun for the kids when they’re out of school.

This is some exceptional rounded scissors and paste work.

- MickJ - Tuesday, Jun 27, 17 @ 10:38 am:

Perfidy!

- ChicagoVinny - Tuesday, Jun 27, 17 @ 10:49 am:

That font may not be Comic Sans, but it is definitely Comic Sans-curious

- Longtime Buddy - Tuesday, Jun 27, 17 @ 10:49 am:

Thanks for the Hattip, Rich!

This is a fine example of what I meant by the two men’s negotiating styles.

“The fox knows many things , but the hedgehog knows one big thing .”

Rauner keeps trying to outfox Madigan, but he can’t, because Madigan is actually a hedgehog.

- Bothanspy - Tuesday, Jun 27, 17 @ 10:56 am:

I’m sure I’m preaching to the choir or at least to many of you and I do agree that spending cuts and tax increases are needed. However, I’m not sure continuing to bump property tax rates beyond the astronomical rate they already are is the solution. Demand for property ownership will just continue to fall.

We have got to implement a progressive tax system. Taxing internet tv services reeks of desperation, grasping at any revenue source. There are easier solutions that the populous would accept and would allow for the sunset of some of these silly taxes.

- walker - Tuesday, Jun 27, 17 @ 11:17 am:

When is a “sham bill” no longer a sham?

- VanillaMan - Tuesday, Jun 27, 17 @ 11:33 am:

Propterty Tax Freezes are not conservative governing. It is an abuse perpetrated by state politicians againgst smaller governments closer and more responsive to citizen’s needs.

No one in Lincolnshire, Barrington or Lake Bluff are suffering. They just don’t want their wealth going to people they consider beneath them.

Freezing their property taxes still leaves their municipal governments with more than they need.

- Ron - Tuesday, Jun 27, 17 @ 11:45 am:

I’m with Bothanspy. Massive spending cuts. Start at 10% across the board and institute a progressive income tax and eliminate government employee benefit protection. Workers comp reform is a must. Illinois is bleeding manufacturing jobs while our neighbors are seeing growth.

- Longtime Buddy - Tuesday, Jun 27, 17 @ 11:50 am:

As Rich has pointed out time and again, there is wide variation in effective residenial property tax rates in Illinois.

While many in Cook complain about property taxes, the rate is much higher in many other places.

In fact, it’s exhorbitant property taxes in Lake and DuPage — the state’s third and second-largest counties — that make Illinois the second-highest property-taxed state in the nation.

Democrats are right to push for a more nuanced bill, rather than a one-size-fits-all solution.

Of course, this might be more about Rauner trying to effectively kill Chicago/CPS at all costs, even if that means destroying more than a few Republican counties/towns/schools along the way.

If that remains his true agenda, we are just spinning our wheels until we get a new governor.

- My New Handle - Tuesday, Jun 27, 17 @ 12:51 pm:

Does anyone here really believe, not hope but believe, Illinois will have a budget by the end of this month? Rauner does not want one. His lackeys in the General Assembly don’t want one. So there will not be one. Every Rauner-paid ad, every letter with ill-intent tells me so. No amount of “insider” intelligence or analysis even gives me hope.

- Demoralized - Tuesday, Jun 27, 17 @ 1:00 pm:

==Massive spending cuts.==

I think both the Dem and Republican budgets include $3B - $4B in spending cuts.

==institute a progressive income tax==

Probably a good idea but you couldn’t do it soon enough to solve the current problem. You’d still need a tax increase right now.

==eliminate government employee benefit protection==

Also does not fix the problem now or any of the liability currently owed now. Again, no matter how much you stomp your feet about public employee benefits it is what it is.

- Anonymous - Tuesday, Jun 27, 17 @ 1:07 pm:

“I think both the Dem and Republican budgets include $3B - $4B in spending cuts.”

Good, more of that please.

“You’d still need a tax increase right now”

I never said otherwise.

“Also does not fix the problem now or any of the liability currently owed now. Again, no matter how much you stomp your feet about public employee benefits it is what it is.”

Never said it did, just want to save future Illinoisans (if there are any) from a potential catastrophe in the future.

- anon2 - Tuesday, Jun 27, 17 @ 1:26 pm:

I’m no fan of the Governor. On the other hand, why isn’t it fair to ask legislators if they still support what they voted for a few months ago? If not, either they changed their minds, or they never really favored it in the first place.

- City Zen - Tuesday, Jun 27, 17 @ 1:28 pm:

==No one in Lincolnshire, Barrington or Lake Bluff are suffering. They just don’t want their wealth going to people they consider beneath them.==

Barrington and Lincolnshire school districts get 90% and 97% of their education funding from property taxes. Considering their substantial state income tax dollars aren’t coming back to their local schools, their wealth is already going to people they consider beneath them, as you say.

- Anonymous - Tuesday, Jun 27, 17 @ 4:39 pm:

Homeowners in Cook County are assessed at 22% of their homes’ values after application of the State Multiplier.

Those of us outside of Cook County are assessed at 33% of what we could sell our homes for.

I hear a parody of “Don’t Cry for Me, Argentina” coming on.

- Ron - Tuesday, Jun 27, 17 @ 4:52 pm:

Last I checked Chicago has the second largest office district in the nation. I think that is the reason our residential real estate is taxed less. Thank goodness.