Aetna threatens to leave, revenues down

Thursday, Jul 6, 2017 - Posted by Rich Miller

* Kristen Schorsch at Crain’s…

Aetna Better Health, which the state of Illinois owes at least $698 million, has had enough.

The subsidiary of the national insurance giant has given the state notice that it plans to terminate its Medicaid contracts, Aetna spokesman T.J. Crawford wrote today in an email.

“We have filed notices of intent to terminate our contracts but hope those terminations will ultimately be unnecessary upon resolution of the current Medicaid funding crisis,” Crawford wrote. “In other words, no final decision has been made.” […]

For Illinois Medicaid, the loss of a big insurer would mean a major shift. The roughly 235,000 low-income and disabled recipients Aetna covers would have to be moved to another health plan that might not have the same network of doctors and hospitals.

* Meanwhile, more bleak news from COGFA…

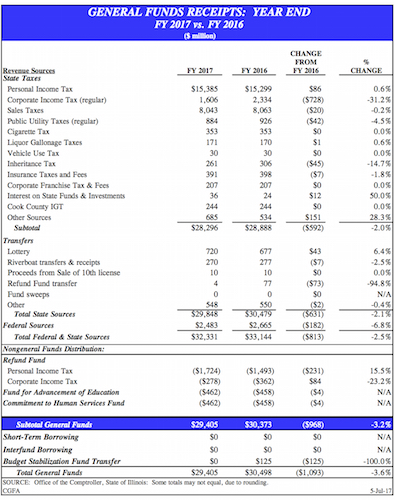

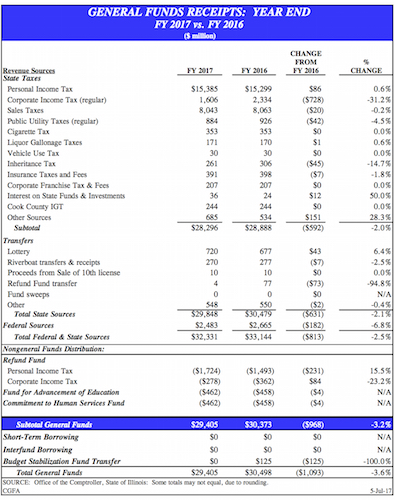

For the fiscal year, base general funds dropped $968 million or 3.2%. As discussed in earlier briefings, receipt weakness was widespread, and resulted in disappointing performances in key areas such as income and sales taxes as well as federal sources.

For the fiscal year, gross corporate income taxes were off $728 million, or $644 million net of refunds. Part of that decline was due to the IDoR now classifying pass-through withholding under the personal income tax designation rather than corporate. Because of this change, approximately $375 million gross, or $324 million net was moved from the corporate income tax line. Also significantly impacting corporate income taxes were the reconciliations made by IDoR’s during the move to their new accounting system. It is hoped that normalized receipt patterns will be reestablished as they caused significant difficulty in interpreting receipts in FY 2017. Inheritance tax, true to its volatile nature, declined $45 million. Public utility taxes were off of last year’s pace by $42 million while insurance taxes and fees dipped $7 million.

Other sources grew $151 million, in large part due to a one-time $84 million deposit of an SERS repayment. Despite being the benefactor of the previously mentioned pass through withholding designation change, gross personal income taxes returned only a gain of $86 million, but on a net basis actually fell $153 million. Public utility taxes declined $42 million for the fiscal year. Sales taxes dropped $20 million, although that total was largely the result of the IDoR diverting approximately $150 million from general funds to other local government funds that receive sales tax distributions. Insurance taxes eased $7 million in FY 2017.

Overall transfers ended down $39 million. Despite lottery transfers growing by $43 million, those gains were more than offset by a comparatively small Refund Fund transfer—down $73 million, a decline of $7 million from riverboat transfers, and a small dip of $2 million from all other miscellaneous transfers. Due to significant cash constraints throughout all of FY 2017, reimbursable spending was seriously hampered. As a result, federal sources fell $182 million for the fiscal year from the depressed level of FY 2016.

* Click on the chart for a larger view…

- Anon - Thursday, Jul 6, 17 @ 2:10 pm:

This is getting scary.

Tax receipts are already down and that is before the next few rounds of increases we are likely to see over the next decade.

5% and 7% respectively is just the first wave.

Once the pension time bomb really kicks in the state will be looking at rates approach 8% for personal and 10% corporate as there will be no other way to even come close to balancing the budget as we can’t even do it now (and the storm hasn’t hit yet).

I just fear there might not be anyone left here to pay it.

- UnionMan - Thursday, Jul 6, 17 @ 2:23 pm:

This is what happens when we cut taxes; we’ll even lose jobs. Those who whine abt paying taxes just want everything for free.

- Dunston - Thursday, Jul 6, 17 @ 2:26 pm:

flat tax rate fy16 to fy17, so…

- The Magnificent Purple Walnut - Thursday, Jul 6, 17 @ 2:26 pm:

Great. They just took over my insurance the first of the month from Cigna.

- wondering - Thursday, Jul 6, 17 @ 2:26 pm:

The trickle down is apparently not the trickle Rauner promised us.

- mare - Thursday, Jul 6, 17 @ 2:29 pm:

Just terminating Medicaid contracts it appears

- Blue Bayou - Thursday, Jul 6, 17 @ 2:29 pm:

It’s a trickle….just not of money, or jobs, or investment.

- Cubs in '16 - Thursday, Jul 6, 17 @ 2:31 pm:

===Great. They just took over my insurance the first of the month from Cigna.===

This only applies to Aetna’s Medicaid contract.

- Mike Royko - Thursday, Jul 6, 17 @ 2:32 pm:

Number of people employed in Illinois declined throughout 2016.

https://data.bls.gov/timeseries/LASST170000000000006?amp%253bdata_tool=XGtable&output_view=data&include_graphs=true

- Huh? - Thursday, Jul 6, 17 @ 2:37 pm:

That’s what happens with you don’t pay your bills. Creditors cut you off and still demand payment. What a guy, that 1.4%. Thanks buddy. /s

- Ron - Thursday, Jul 6, 17 @ 2:41 pm:

The mass exodus will only get worse with the higher tax rates.

- The Magnificent Purple Walnut - Thursday, Jul 6, 17 @ 2:42 pm:

Thank you for the clarification.

- Mama - Thursday, Jul 6, 17 @ 2:47 pm:

Pray more health insurance companies will NOT pull out of IL.

- Cubs in '16 - Thursday, Jul 6, 17 @ 2:49 pm:

You’re welcome TMPW.

- Generation X - Thursday, Jul 6, 17 @ 3:01 pm:

COGNA report isn’t terribly surprising with stagnant wages and a population decline. Going to need a whole lot more than income tax increase going forward

- Anon - Thursday, Jul 6, 17 @ 3:02 pm:

Ron

Where are individuals going to go? Most people I know are fed up due to the politics of inaction other than taxes. Raise taxes and get our house order. Its the second part that is difficult to do in Illinois

- Ducky LaMoore - Thursday, Jul 6, 17 @ 3:02 pm:

===The mass exodus will only get worse with the higher tax rates.===

We’ve lost 0.2% since the 2010 census. I’m not saying that is good. But it’s not exactly Moses leaving Egypt.

- Cook County commoner - Thursday, Jul 6, 17 @ 3:07 pm:

==Number of people employed in Illinois declined throughout 2016.==

Watch it with those facts Royko. The last thing Illinois pols want to discuss are local labor participation rates, and their likely decrease due to increased taxation. Wait until the Baby Boomers really start retiring, and the participation rates decline picks up speed.

- RNUG - Thursday, Jul 6, 17 @ 3:08 pm:

== “We have filed notices of intent to terminate our contracts but hope those terminations will ultimately be unnecessary upon resolution of the current Medicaid funding crisis,” ==

Translation: if you want us to stick around, pay what you owe us.c

- Mike Royko - Thursday, Jul 6, 17 @ 3:13 pm:

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

The Sun Also Rises by Ernest Hemingway

- WhoKnew - Thursday, Jul 6, 17 @ 3:13 pm:

The velocity of money, people.

Our economy for the last 2 years is missing 10 Billion in State funded activity.

Had that money been in play, I’m sure there would have be increases in collections for the base general funds.

- RNUG - Thursday, Jul 6, 17 @ 3:13 pm:

Take $8B or so out of the economy by not paying your bills, then scare the heck out of people about their jobs and health insurance … and people quit spending money / buying things. When the economy shrinks, tax revenues go down.

We need a cheerleader for the State, not someone who dis’s it every time they open their mouth.

- UnionMan - Thursday, Jul 6, 17 @ 3:16 pm:

The small exodus from IL is due more to instability in our political/fiscal choices than taxes. Rauner espouses a policy of destruction, masquerading as a cure.

- Oswego Willy - Thursday, Jul 6, 17 @ 3:17 pm:

- Mike Royko -

Illinois can’t go bankrupt.

States can’t go bankrupt.

- Mike Royko - Thursday, Jul 6, 17 @ 3:18 pm:

WhoKnew and RNUG have a point. I would also point out that SFY16 and SFY17 both featured no budget and therefore the state not paying bills in both years being compared. Once the state starts paying bills it will have a positive impact on income tax all else being equal.

- Cook County Commoner - Thursday, Jul 6, 17 @ 3:18 pm:

“Every truth passes through three stages before it is recognized. In the first it is ridiculed, in the second it is opposed, in the third it is regarded as self-evident.” Arthur Schopenhauer.

I suspect Illinois is in stage two regarding the trajectory of its economy.

- Oswego Willy - Thursday, Jul 6, 17 @ 3:20 pm:

Oswego Willy - Totally agree. Emphatically agree.

- Mike Royko - Thursday, Jul 6, 17 @ 3:21 pm:

Sorry Oswego Willy I accidentally used your call sign for my reply. I emphatically agree that Illinois cannot go bankrupt.

- Anotherretiree - Thursday, Jul 6, 17 @ 3:22 pm:

==Number of people employed in Illinois declined throughout 2016==

I think you may have discovered that there are 75 million baby boomers heading toward the exits…

-Ron- Shouldn’t you be loading your Uhaul ?

- Mike Royko - Thursday, Jul 6, 17 @ 3:22 pm:

The point I was trying to make with the Hemingway quote is that what was in relation to the population trend. What starts out as a slow decline gains momentum when the reason is not fixed.

- Anon - Thursday, Jul 6, 17 @ 3:24 pm:

That $8 billion that supposedly is missing from the economy never really existed anyway as the state was spending well beyond its means.

That money was no different than having whipped out a Mastercard and pretending like you got a big raise at work because it allowed you to spend as if you were making money you weren’t.

What I am interested in is how high do people think we can realistically raise taxes before an even bigger revolt happens?

The new increases don’t even balance the budget as it is, and even if the state didn’t add $1 new dollar of spending for the next 5 years (we all know how realistic that is) there will have to be another round of increases soon just to pay for the continued rise of yearly pension obligations.

People are going to have to get used to the idea that within the next 10 years we will be the highest taxed state in the nation (when accounting for sales/property/income) and we will actually see a decrease in services simultaneously because every new dollar of taxes is going to go towards pensions that don’t provide anything tangible to tax payers by way of schools/roads/services.

The scary part is that we are already one of the highest taxed states in the country when looking at the sales/property/income burden, so considering that is our starting point in the face of the continued increases we will see over the next 2 decades it is a terrifying time to be a resident of this state.

- Ron - Thursday, Jul 6, 17 @ 3:26 pm:

Wait, Illinois losing population at a faster rate than all states but West Virginia is now being brushed off?

- the Cardinal - Thursday, Jul 6, 17 @ 3:27 pm:

So Illini land is thirsty for revenue. The money pool is now a desert but for all those that remain there will be a fire hose of taxes coming to the rescue.

- Ron - Thursday, Jul 6, 17 @ 3:28 pm:

Anon, is absolutely correct. This is why we need to eliminate programs. The state simply can’t afford to do what it did in the past.

Oh, and maybe legalize pot to get some easy tax collections that don’t kill the citizens?

- Ron - Thursday, Jul 6, 17 @ 3:37 pm:

Union Man, the disturbingly high exodus of citizens out of the state is not due to lack of a budget but the fact that illinois has one of the highest state and local tax burdens in the nation.

And the fact that we will soon have the highest doesn’t help.

- Mike Royko - Thursday, Jul 6, 17 @ 3:37 pm:

Compare these two recently sold homes. CO income tax 4.63% flat. Better options for Illinois families than staying put for sure.

Naperville, IL price: $850K, prop. tax: $19K

Highlands Ranch, CO (similar to Naperville) price: $850K, prop. tax: $5K

https://www.zillow.com/homes/recently_sold/Naperville-IL/house_type/4537069_zpid/39931_rid/824975-850112_price/3085-3179_mp/globalrelevanceex_sort/41.90662,-87.931481,41.591053,-88.370934_rect/10_zm/?

https://www.zillow.com/homes/recently_sold/Highlands-Ranch-CO/house_type/13445106_zpid/38992_rid/825000-850000_price/3085-3179_mp/globalrelevanceex_sort/39.619838,-104.866391,39.456739,-105.086117_rect/11_zm/?

- VanillaMan - Thursday, Jul 6, 17 @ 3:46 pm:

See Governor, how well that tax cut from 2015 to 2017 stimulate our economy?

Nope?

Me neither. No one does.

So what’s with the panic, “the 2×4 across the forehead”, the gnashing of teeth, the sack cloth and ashes?

Oh, I thought you were serious - yeah - it’s all about you reelection and motivating fear in the minds of the foolish.

Sir, you are a persistent rascal - especially if the words “persistent” means unscrupulous, and “rascal” means shyster.

- Ducky LaMoore - Thursday, Jul 6, 17 @ 3:47 pm:

===This is why we need to eliminate programs.===

Okay Ron. Like what?

- Anon - Thursday, Jul 6, 17 @ 3:49 pm:

The property tax situation in the state is an abomination right now.

As the state government becomes more and more strapped financially, support for local schools and governments will continue to be cut to make the numbers work at the state level.

This in turn will leave local governments no choice but to keep jacking up the property tax rates to just sustain the current situation (which is already dire) much less do anything productive to make it better.

If Moody’s and the other credit rating agencies follow through on turning off the spigot by sending us to junk status there is going to be a political revolution in this state in the not too distant future.

Madigan’s smoke and mirrors approach that has worked the past 2 decades to kick the can down the road and pray not to be holding the bag when there is no more road will no longer be an option.

People are going to at some point likely revolt at the ballot box as their tax bills exponentially increase at the same time as services are cut back dramatically and schools fall further into disrepair (not to mention many folks not being able to afford the property taxes on their house).

The math dictates that things are going to change whether the folks in Springfield like it or not.

How that shakes out politically will be fascinating to see develop because we have never had to see the state operate in environment of essentially forced discipline because there was no more money available to buy people off and keep interest groups fat and happy.

- Downstate - Thursday, Jul 6, 17 @ 3:51 pm:

Friend in Cary, IL is seeing the strong rise in property taxes. Their home is worth the same that they paid for it in 1994 (23 years ago).

You can’t keep raising property taxes and think people won’t want to move. Why buy a home in an area that hasn’t shown appreciation in 23 years?

- Ducky LaMoore - Thursday, Jul 6, 17 @ 3:54 pm:

@Anon 3:49

Not going to argue with your post. But what is the solution to the problem? How high can the income tax go for a tax swap? What are the things that can/need to be cut for the state to exist in 100 years? I see many a rant and a rave that can identify the problem, but nary a solution.

- VanillaMan - Thursday, Jul 6, 17 @ 3:58 pm:

Ron

You are wrong. Please stop claiming that taxes are driving Illinoisans out of Illinois. You are wrong and your anecdotal evidence is useless.

Boomers are retiring and leaving cornfields, winters, and heading to die near beaches, mountains and deserts. I bet you know a lot of retired Boomers, so it looks like a mass exodus.

Chill. It’s the Great Circle of Life.

- Ron - Thursday, Jul 6, 17 @ 4:02 pm:

Vanilla, get your head out of the sand. Illinois is losing population faster than very state BUT West Virginia according to the US Census. Is that an anecdote?

Having one of the highest state and local tax burdens in the nation is a top reason. So is our weather, I agree. Maybe if our tax environment wasn’t so terrible people would stick it out here in spite of our weather.

- RNUG - Thursday, Jul 6, 17 @ 4:06 pm:

== It’s the Great Circle of Life. ==

-vman-, more than you think.

Literally just buried someone who had moved away for retirement but wanted laid to rest back in their hometown.

- Downstate - Thursday, Jul 6, 17 @ 4:12 pm:

Did an analysis of our community three years ago, when many high net worth individuals left for tax free environments. I have a general idea of their net worth and earnings.

To replace the state tax dollars of the departing individuals, our town needed to land a factory employing 200 people at $45k/year. The last time we had a manufacturing plant with 200 new jobs was 40 years ago.

Sadder yet is that the individuals children no longer have a tie to the state. So the inheritance will be invested and spent in another locale.

- Budget - Thursday, Jul 6, 17 @ 4:15 pm:

Moody’s had completely changed the trajectory of the state right now.

A week ago folks were celebrating how the budget would save the state and so forth.

To be told now that what many were lamenting was a harsh budget to begin with was but a drop in the ocean compared to what is needed has to have rattled lawmakers who had probably calculated that it would be back to business as usual soon.

Just speaks to the disconnect in Springfield about how dire the situation the state is facing really is.

It will certainly shape the 18 election cycle as anyone who had planned to campaign on increasing spending is going to have to wildly recalibrate their plans.

The tax increase doesn’t even cover this budget, so be weary next year of any candidate claiming they will “invest” (code word for more spending) in anything without simultaneously telling you how much taxes will have to go up in the next round of increases to pay for it.

The math just doesn’t work otherwise as this tax increase did nothing but bring us closer to balance (still not there).

- Actual Red - Thursday, Jul 6, 17 @ 4:23 pm:

-Budget–

Still though, its a choice between a possibility of junk status with the budget and a guarantee of junk status without it. Seems like a no brainer to me.

- Sue - Thursday, Jul 6, 17 @ 4:29 pm:

From Day 1 Madigan decided to wait out the Governor. The fiscal crisis isn’t caused by the lack of a budget but the lack of a budget is the symptom of the fiscal crisis. The State needs several billion of extra revenue beyond what the new taxes will generate. The reason is the State spends more then it generates and defers billions of future spending without sufficiently planning for the consequences. Don’t blame Rauner for trying to change the trajectory. The mess was on his doorstep

- Dimms own it - Thursday, Jul 6, 17 @ 4:31 pm:

LOL new budget even with new taxes is in deficit.. End of Illinois ..

- wordslinger - Thursday, Jul 6, 17 @ 4:33 pm:

–Aetna Better Health, which the state of Illinois owes at least $698 million, has had enough.–

Better get Todd Maisch to issue a “hang in there,” stat.

Seriously, a “hang in there” would go a long way to calm the nerves over $700M of deadbeatism.

Maybe Todd should pull out the stops and send his favorite former legislator, Dunk, to explain the Illinois Chamber of Commerce-version of capitalism to Aetna.

Grifter.

- Ron - Thursday, Jul 6, 17 @ 4:34 pm:

Sue, this is why we must eliminate programs. The state can’t afford to provide services it did in the past. It’s sad, we have Edgar, Blags, Madigan, etc to thank though.

- Anonymous - Thursday, Jul 6, 17 @ 4:39 pm:

“Naperville, IL price: $850K, prop. tax: $19K

Highlands Ranch, CO (similar to Naperville) price: $850K, prop. tax: $5K”

The median property tax on a home in Illinois varies from $616 in Alexander county to $6,773 in Lake County. That’s more than a 10-fold difference. You are using the worse-case scenario to make a misleading generalization about the entire state.

It should be noted that property tax rates are determined by local referendums. In those areas of the state where property taxes are higher, it’s because the majority of people voted for them.

- RNUG - Thursday, Jul 6, 17 @ 4:43 pm:

Nothing (except some consent decrees for some programs) is stopping Rauner from spending less than the budget allows.

Guess we’ll see what kind of restraint he has … or if it will be a lot of pinstripe patronage, insider software deals, and overpriced real estate.

- Mike Royko - Thursday, Jul 6, 17 @ 4:54 pm:

Anon at 4:39pm - my intention was not to mislead. I lived in Naperville 20 years ago and live near highlands ranch now and thought that they are comparable in terms of conveniences, quality of schools, and so on. so i chose a property in each that sold recently at $850K and that is what popped out. Not scientific.

I would be grateful to you to find a better comparison.

- Chicago 20 - Thursday, Jul 6, 17 @ 4:57 pm:

In FY 17 corporate income taxes are down 31.2%.

Corporate income taxes revenue amount to 10.4% of the personal income tax revenue.

For every dollar of personal income tax, Illinois collected 10.4 cents of corporate tax.

Back in 1998 Illinois collected 19.3 cents in corporate income taxes for every dollar or personal tax collected, 86% more than FY 17.

http://www.revenue.state.il.us/publications/AnnualReport/Annual-Report-2000.pdf

If we had maintained the same percentage in corporate taxes revenue collected for the FY 1998 in FY 2017 the difference would be an additional $1,363,000,000 in state revenue for FY 17.

Imagine that.

- Sue - Thursday, Jul 6, 17 @ 4:57 pm:

Vanilla Man- your contribution is laughable. Every state has boomers retiring. Unlike Illinois- those other states with a few exceptions still have overall population growth due to people moving in or their residents staying after graduation to take job opportunities which Illinois is lacking. Stop being in denial

- Anonymous - Thursday, Jul 6, 17 @ 5:01 pm:

Chicago 20, corporations like to avoid paying taxes.

So they do.

- Nicky - Thursday, Jul 6, 17 @ 7:28 pm:

Gee. I just feel real terrible for those folks with the 850k homes

How ever will they be able to pay their property taxes

- Mike Royko - Thursday, Jul 6, 17 @ 7:54 pm:

Nicky - I live in a very nice house in Colorado worth more than $850k. I could afford to pay prop tax in Illinois. But why would I?

- wordslinger - Thursday, Jul 6, 17 @ 8:00 pm:

–Nicky - I live in a very nice house in Colorado worth more than $850k. I could afford to pay prop tax in Illinois. But why would I? –

Why would you concern yourself with Illinois politics, if you live in such a nice $850K house in Colorado?

Are you all over the ins-and-outs of Rhode Island and Alabama politics, too? Just a curious wanderer?

What’s it to you?

And seriously — your handle? How did you land there? Did you think Ernest Hemingway would be too pretentious and ridiculous?

- Anonymous - Thursday, Jul 6, 17 @ 8:11 pm:

Since property taxes are based on the value of your house and you feel your taxes are too high. Buy a cheaper house

- Mike Royko - Thursday, Jul 6, 17 @ 8:14 pm:

I grew up in Chicago. Roosevelt high school 93. UIUC grad 99. I like Illinois. I left in 2001 and moved to California. Now I live in Colorado. I like Illinois. The Bears are my team. I don’t like the cubs or white sox. But my message to individuals is to do what is in their best interest and evaluate what moving from Illinois would mean for your family Your taxes are high and are on autopilot to go higher. In return you get very little services. Colorado for example has lower taxes than Illinois and spends more than Illinois per capita. Other states are similar. The grass is greener. Do what is best for you though.

- Mike Royko - Thursday, Jul 6, 17 @ 8:20 pm:

Anon. I live in Colorado. I feel my property taxes are about right. In fact I voted for a prop tax increase in the last election for education spending. Having said that my taxes would be $17,500 higher in Illinois. Not worth it.

- Anonymous - Thursday, Jul 6, 17 @ 10:11 pm:

Horrible day in Illinois history