* Media advisory…

Moody’s has placed the State of Illinois’ Baa3 rating on review for possible downgrade.

The review incorporates our expectation that the Illinois House of Representatives will override Governor Rauner’s veto and implement revenue increases as part of the budget proposal. The review will assess the budget plan’s credit implications and address the likelihood of further deterioration in the state’s most pressing credit challenges:

· Pension liabilities (appx. $251 billion in FY ending June 30, 2016)

· Backlog of unpaid bills (appx. $15 billion)

Moody’s places ratings on review when a rating action may be warranted in the near term, but when further information or analysis is needed to reach a decision. A majority of reviews are concluded within 30 to 90 days.

* More…

New York, July 05, 2017 — Summary Rating Rationale

Moody’s Investors Service has placed the general obligation rating of the State of Illinois, currently Baa3, under review for possible downgrade following the state’s failure to fully enact a timely budget for the fiscal year that began July 1, and its failure to achieve broad political consensus on how to move toward balanced financial operations. The review also applies to several related state debt ratings: the Baa3 assigned to sales-tax backed Build Illinois bonds and the Ba1 ratings assigned to Illinois subject-to-appropriation bonds, the convention center bonds issued by the Metropolitan Pier and Exposition Authority and bonds issued under the state’s Civic Center program. Illinois has outstanding debt of about $32 billion, of which 82% is general obligation.

The state’s government in recent days has made legislative progress towards a fiscal recovery plan based on permanent income tax rate increases, after going through two fiscal years without a complete budget in place. The decision to place the state’s ratings under review for downgrade incorporates our expectation that the legislature will implement revenue increases, overriding the governor’s vetoes. The review will provide a limited amount of time for the Illinois General Assembly to finish voting on the measures, and for assessment of the plan’s credit implications. The review process will also address the likelihood of further deterioration in Illinois’ most pressing credit challenges: its severely underfunded pensions and a backlog of unpaid bills, which has doubled during the past year.

Despite the progress toward budget balance that the emerging fiscal plan embodies, the plan entails substantial implementation risk. The governor yesterday vetoed the plan’s revenue, spending and implementation legislation, citing a $2 billion current-year deficit and the plan’s failure to incorporate proposals in areas such as workers compensation insurance reform and caps on local property taxes. The plan’s approval relied almost entirely on Democratic party support in the state’s senate, and a vote to override the governor’s vetoes of the measures has been deferred by the state’s house of representatives. The plan therefore appears to lack broad bipartisan support, which may signal shortcomings in its effectiveness once implemented. In addition, the state’s baseline tax collections declined in fiscal 2017, suggesting that any tax increase may yield less revenue than anticipated in coming months.

So far, the plan appears to lack concrete measures that will materially improve Illinois’ long-term capacity to address its unfunded pension liabilities. A June 30 order from a federal judge that the state accelerate payments owed to Medicaid managed care organizations and service providers cast doubt on the state’s immediate ability to keep up with its statutory pension contribution schedule while also meeting obligations for debt service, payroll and school funding. The state anticipates addressing its approximately $15 billion backlog of payments owed partly through a bond offering that probably will rank among the largest in the state’s history. This component of the state’s broader fiscal plan leaves Illinois not only dependent on market access to ease liquidity pressures, but also facing a significant increase in its tax-supported debt burden. Moreover, the effectiveness of the state’s strategy to contain and reduce its deferred bills, once the backlog-financing debt has been issued, remains to be seen.

Whew. It never ends.

* By the way, the lead House Democratic budget negotiator Rep. Greg Harris told me this about a recent Tribune story claiming that the bill backlog could be reduced as much as $8 billion…

$6 billion is the total that could be authorized. Currently the revenue available would support $3 billion which could turn to $5 billion if it is used to pay down [federally] matchable Medicaid bills. Should another revenue source become available you could have another $3 billion issuance.

$5 billion is only about a third of the current backlog.

…Adding… Rep. Harris just sent me another text…

There are several other sources to pay down old bills besides bonding. There is $1.2 billion in interfund borrowing, $300 million in limited sweeps, about $800 million in EAF and CHSF and several hundred million from Drug Rebate Fund so the total resources added to the GO bonding would make about $8 billion available for backlog of bills

*** UPDATE 1 *** Just for clarity, I followed up with Moody’s and asked: “So, are you saying that Illinois could still get downgraded even if the House overrides the governor’s vetoes?” The response from Joe Mielenhausen…

Essentially, yes.

We are anticipating that the House will override the veto and the budget plan will be implemented, but essentially we’re now reviewing how the budget implementation will impact the state’s two most pressing credit challenges – pension liabilities and the backlog of unpaid bills – and whether this mitigation will be enough to avoid another downgrade.

*** UPDATE 2 *** House Democratic budget negotiator Rep. Greg Harris…

All 3 rating agencies have been clear that we must override the Governor tomorrow or we could hit junk bond status. Moody says they assume we will override and “….will provide a limited amount of time for the General Assembly to finish voting”. That time will be tomorrow afternoon. Passing a balanced budget is clearly the single most important thing we must do to start stabilizing our State.

159 Comments

|

Mrs. Rauner’s group urges budget veto override

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* Earlier today, Gov. Rauner told reporters that he would do “everything possible” to stop his budget vetoes from being overridden. He might want to check in with his wife. This press release is from Illinois Action for Children and Mrs. Rauner’s Ounce of Prevention Fund…

Over the long holiday weekend, the Illinois General Assembly worked in a bipartisan manner to end the unprecedented budget impasse, passing a full-year budget for FY2018 and the revenue increases needed to fund that budget. The governor vetoed the bills and the Senate has voted to override that veto. We strongly urge the House of Representatives to now follow the Senate in voting to override the governor’s veto.

The approved budget — the first full-year, fully-funded budget since FY2014 –provides significant funding to early childhood programs including Preschool for All and Prevention Initiative, home visiting programs, the Child Care Assistance Program, and Early Intervention.

We applaud the members of the General Assembly in both parties who took the tough vote to try to end this impasse. We hope the House can take one more important vote to move Illinois forward.

While it will take some time for early childhood programs to rebound from the impasse, with this override, we are relieved that early childhood programs will be able to shift their focus to rebuilding their programs, providing vital services for children and families, and planning for the future of those children and families they serve.

So, apparently, Diana Rauner is a Speaker Madigan “subordinate” and a supporter of our “broken” system.

Man, what a weird state this is.

…Adding… From the Ounce’s Policy Specialist…

Hoo, boy.

49 Comments

|

Something big finally shuts down

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* Not-for-profit human service groups have done their very best to continue providing services without state money. Countless private companies that provide goods and services to state facilities like prisons haven’t stopped doing their jobs. But all of a sudden road work stops? This seems a bit odd…

Road construction workers across the state were sent home Monday — or not called in at all — with the budget-related shutdown of approximately 900 transportation projects totaling $3.3 billion, according to one of the state’s largest contractor associations.

The Illinois Department of Transportation estimates 20,000 workers are affected.

“By-in-large, it’s a statewide construction shutdown. One member told me he asked people to come in, just in case there was a (budget) settlement, but he sent them home. Most asked them to stay home until there’s a resolution,” said Mike Sturino, president and CEO of the Illinois Road and Builders Association. […]

An email alert on Monday to road-association members advised the shutdown would continue, even though state lawmakers reported some progress toward a budget. Illinois entered its third fiscal year without a full-year budget on Saturday. […]

IDOT notified contractors days ahead of the start of the new fiscal year the department could no longer pay its bills as of midnight June 30 without a budget. Contractors were instructed to secure construction sites, including advisories to motorists.

29 Comments

|

* Gov. Rauner was asked today what he planned to do to stop his vetoes from being overridden…

Rauner: We are doing everything possible to make sure my veto stands and that it’s not overridden.

Reporter: Like what?

Rauner: Everything possible.

* And he more than implied that the Republicans who broke ranks were tools of the House Speaker. Here’s what he said when he was asked about the Republicans…

You know what? Speaker Madigan and his subordinates should not be working for Wall St. credit agencies, they should be working for the people of Illinois. […]

What we have is a continuing failure by elected officials in Springfield on both sides of the aisle. It’s been led by Speaker Madigan for 35 years. This is more of the same. Our system is broken.

* Asked whether he was concerned that blocking an override would hurt the state’s credit rating…

Rauner: We have to put the peoples’ concerns, what the people need and want ahead of all else. The people should come first in Illinois. Not Wall St., not special interests, not the political class, not the political insiders, not the politicians, not the folks who make money from the government.

Reporter: You don’t think people care about a junk credit rating?

Rauner: What people want is jobs. We need more jobs. What people want is lower property taxes. What people want is a political system that’s not rigged, that’s not dominated by one person, or it’s not corrupt and corroded with special insider deals. People want change, and let’s be clear, this budget is more of the same, this budget and this tax hike is what’s been going on in Illinois for the last 35 years and the system is broken and this tax hike will not fix it.

* More on Wall Street…

Don’t listen to some Wall St. firm. That’s not what matters. Listen to the people of Illinois. It’s their concern, it’s their lives… Don’t listen to Wall St., don’t listen to a bunch of politicians who want power and to stay in power like they’ve been for 35 years. Listen to the people of Illinois. People of Illinois don’t want more taxes on their lives. People of Illinois want more jobs. People of Illinois want property tax relief. People of Illinois want a better future for their kids and their grandkids. People of Illinois want a political system that works for them not for the political insiders. And term limits can help get that done. And the people of Illinois want those things.

He did say at one point that his office has been in frequent contact with credit agencies.

* The governor claimed that he’s been negotiating in good faith for “more than two years.” He claimed Madigan “wanted a crisis” to force a tax hike…

And we have got to stand against it. We’ve to to get the people to realize, Democrats, Republicans, independents, this is not about partisanship. This is about the people coming together, rising up and saying, ‘Enough. No more. No more of this system that Speaker Madigan and his loyalists have been doing to us.’

* He was then told by a reporter that he didn’t sound too concerned about a downgrade…

What I’m concerned about is the people of Illinois, so they have a better future. That’s all that matters. We’ve got to put the interests of the people ahead of all else. That means jobs, more good paying jobs. That means property tax relief. That means term limits. And that means better education funding, more education funding for all schools on an equitable basis. Not a special deal for certain politicians here in Chicago. That’s what that means.

* The Pritzker campaign was there, by the way…

…Adding… Yep…

119 Comments

|

* From November of last year…

Tyler Diers of the Illinois Chamber of Commerce, visited Highland to present the Champion of Free Enterprise Award to Rep. Charlie Meier at Windows on Broadway with Highland Chamber Members and business leaders in attendance. The award acknowledges state legislators who recognize the importance of free enterprise and who agree with pro-business legislative policies to further economic opportunities for Illinois businesses and their employees.

“With Illinois’ lackluster economic performance, there has never been a more crucial moment for our state to embrace pro-business legislators who represent the business community and support the fundamental principles of the free market system,” said Todd Maisch, president and CEO, Illinois Chamber of Commerce.

* He’s pro-life and pro-gun. But Meier is not one of those “burn it all down to save it” types. From his 2015 reelection announcement…

Meier said he will continue to advocate for the Warren G. Murray Developmental Center in Centralia. […]

Getting the state’s fiscal house in order will also be a main priority, Meier said.

* From his campaign website…

Locally Charlie is always volunteering. He has been a 4-H leader for 27 years. Charlie has been a Charter Member of the Heritage House and Museum in Okawville since 1982 helping it grow into 3 properties, one of which is on the National Register of Historic Places. Charlie has been an instrumental player in restarting the local AG and FFA program at Okawville High School. Charlie has been a Chamber member since 1992 and presently serves on the tourism tax committee. He is a life member of St. Peters U.C.C. Church, Sunday school teacher, and has served on numerous committees there.

The man has a good heart and clearly loves his community.

* Meier also campaigned against higher taxes. From his campaign site…

Charlie knows we can run Illinois with NO NEW TAXES. He has served on the Washington County Board for the last 5 years. One major project going on is the building of a new Judicial Building and preserving the historic Court House. Due to the abilities of Charlie and the board the judicial building will be built with NO TAX INCREASES. This is what we need in Springfield, someone who will not raise your taxes, but continue to move forward on improvements.

* In June, when Gov. Rauner announced the special sessions, Meier said this…

Meier is hopeful that under Rauner’s leadership, lawmakers will reach a compromise.

“Before I was elected to serve in the legislature, Governor Blagojevich called several special sessions which resulted in no action by the General Assembly,” Meier said in his statement. “I hope the outcome will be different this time due to the fact Speaker Madigan is working with a different Governor. A Governor that actually has a plan to improve our state instead of digging our state deeper into debt.”

But Rauner clearly didn’t have a viable plan. So, some House Republicans started negotiating with Democrats on a budget deal.

* And then 15 House Republicans, including Rep. Meier, voted for it. From Meier’s statement…

The fact of the matter is our state is penniless, flat out broke. Yesterday, the Illinois House voted to send Governor Rauner a budget which spends $3 billion less than if we were to continue operating without a state budget. In addition to passing a budget, the House approved a 1.25% income tax increase, a proposal I supported. The truth is, this wasn’t easy, I realize a tax increase isn’t popular. However, this was the viable option to keep our state government from shutting down and putting lives at risk.

* From today’s Belleville News-Democrat…

They’ve called him a traitor, a liar, and a Democrat.

Since voting Sunday to increase Illinois’ personal income tax rate by 32 percent, state Rep. Charlie Meier has been lambasted on social media. […]

One commenter wrote: “This is just another ‘kick the can’ exercise. I ain’t buying the statement that this was such a difficult decision. Is anybody else taking a ‘haircut’ on this besides the taxpayer?”

Another wrote: “I cannot begin to tell you how disappointed I am. You are taking food from my kid’s mouth and giving it to the Chicago Democratic Machine. Shame on you.”

And yet another wrote: “Madigan is playing chess and you’re playing checkers. You caved. If people wanted a tax-and-spend Democrat they would’ve voted for one. Oh, I guess they did.”

* And so, when I read stuff like this…

But did all of them truly break? Did the governor release pressure on some of those members in the eighth hour, knowing that a handful had solidly crossed over? That way, a budget finally passes.

I would refer them to Charlie.

63 Comments

|

Kobach Commission makes a big oops

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* The President’s Election Integrity Commission didn’t know that Illinois has a State Board of Elections…

Add Illinois to the list of states that are balking at turning over massive amounts of voter data that normally is kept private to a commission chaired by Vice President Mike Pence.

In an interview, Ken Menzel, general counsel to the Illinois State Board of Elections, said the board this morning finally received a written request from the Presidential Advisory Commission on Election Integrity. The commission says it’s trying to prevent voter fraud; Democrats say it is attempting to drive down voter turnout among progressive voters.

The request mistakenly was sent to Secretary of State Jesse White, whose office passed it on to the board.

Menzel said the matter will be researched and referred to the board for possible action. But the board doesn’t meet until Aug. 22, Menzel added, so nothing is going to be happening soon. And it’s clear that at least some requested data will not be going to the feds.

As I’ve already explained (click here) Illinois has strict rules about what the board of elections can and cannot divulge.

24 Comments

|

* This is such a weird state. The governor vetoes a budget and a tax hike and the bond markets rally because traders figure the General Assembly will ignore him…

Illinois bonds surged as the legislature moved closer to ending a record-long impasse over the budget, reducing the risk that the state’s bond rating will be cut to junk.

The rally came after the state senate overrode Governor Bruce Rauner’s veto to approve tax increases and the first full-year budget in two years, sending the measures to the House of Representatives. Without a spending plan in place, Illinois had been squeezed by chronic deficits and credit-rating companies warned that they may withdraw the state’s investment-grade rank, a step that could have prevented some investors from buying its debt.

“It does look good — it looks like the momentum is there,” said Gabriel Diederich, a portfolio manager at Wells Fargo Asset Management, which has Illinois debt among municipal bond holdings. “When you get shreds of fiscal management and fiscal prudence, even small steps have been greeted positively.”

The average price of taxable general-obligation bonds due in 2035, the most actively traded, jumped 6.5 percent to 110.5 cents on the dollar Wednesday, the highest since the end of October. That pushed the yield down to 6.36 percent from about 7 percent on July 3. The state’s bonds were the most heavily traded municipal securities Wednesday.

* Meanwhile, the Tribune editorial board makes a last-ditch effort to stop the override…

Members of the Illinois House, the decision falls to you. Will you override Gov. Bruce Rauner’s veto of a permanent, 32-percent increase in the personal income tax? Or will you instead insist, first let’s agree on the reforms that many of us promised voters would have to be part of any tax deal?

We ask because if you vote this tax increase into law and then have to admit to your constituents that accompanying “reform” bills are really just diluted eyewash, you’ll look like chumps for Speaker Michael Madigan.

At this writing, an override looks like a terrible risk for you. We say this not because we’re reflexively opposed to tax increases — we aren’t. We say it because Illinois citizens need offsetting fixes from Springfield. Otherwise you’ll own the same old state government and weak Illinois economy, but at a price you’ve just raised by 32 percent. […]

So, House members, if you’ve delivered solutions — on property taxes, on pensions, on work comp, on government bloat in Illinois — then maybe you should vote to override Rauner’s veto.

The Tribune argues that the budget chaos should continue until the governor’s reforms are enacted, but 16 Republicans specifically voted to end that insane and protracted chaos.

You’re going to see a whole lot more arguments like this before tomorrow’s expected override vote.

* Related…

* McSweeney files bill to repeal Illinois House’s permanent income tax hike

42 Comments

|

Other ways of looking at the tax hike

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* There are several ways to look at this new tax hike. You can, for instance, click here and check out the Illinois Policy Institute’s tax hike calculator. Just remember that if you deduct your state income taxes on your federal tax form you’ll have to lower that amount a bit more.

So, we now know how much this will cost you, personally as an individual. But what sort of impact will it have on the state economy as a whole? Let’s first look at the income tax hike revenue projections…

Individual: $4.453 billion

Corporate: $514 million

Total: $4.967 billion

* Let’s start with individuals. According to the Federal Reserve of St. Louis, which used US Bureau of Economic Analysis numbers, total personal income in Illinois last year was $673.983 billion.

So, the new tax will eat up 0.661 percent of total personal income in Illinois. Just for fun, add in the corporate tax projection and it’s 0.737 percent of total personal income (it wouldn’t be that high, but whatever).

* Also according to the Federal Reserve, Illinois’ 2016 Gross State Product was $791.608 billion.

So, the tax hike represents 0.627 percent of total Illinois GSP.

98 Comments

|

Where does the budget come up short?

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* Tribune…

In his Tuesday veto message, Rauner asserted that the budget package was $2 billion out of balance. His office says the legislation counts $500 million in savings on pension costs that aren’t guaranteed and fails to account for $1.5 billion in spending from the budget year that ended Saturday. That money would have to be paid out of the current budget year funds, Rauner’s team contends.

I went over the governor’s veto in detail with subscribers today, but since this is in the public domain, let’s look at it.

* If you click here, you’ll see that the Republicans’ “Capitol Compromise” plan (labeled “Brady June” in the document) booked $1.25 billion in pension savings. As we’ve discussed many times before, the governor’s first budget proposal booked a whopping $2.2 billion in immediate pension savings.

So, spare me the outrage.

* Now, on to the second point. The governor spent a ton of money without any appropriations. He signed contracts for goods and services knowing that there was no legally authorized cash to pay for them. And, now, after spending that unauthorized money, he wants the General Assembly to pay off his bills.

Despite my snark, the state does need to pay those bills. But if the governor wants that revenue, he needs to go negotiate with the leaders to generate it, or make cuts on his own. And that would’ve been much easier to do if he had used his line-item and reduction veto powers instead of vetoing the whole budget in one fell swoop.

* Meanwhile, the comptroller sent out a press release late yesterday describing her new role in life…

While Rauner’s agency directors have never named a cut they are willing to accept, this budget will force $3 billion in cuts to the state budget, finally bringing back some adult fiscal discipline. The imperfect, but thankfully, bipartisan political compromise does not solve all the problems Governor Rauner’s recklessness created, but it helps us stop the haemorrhaging and begin digging Illinois out of his pit.

The Office of the Comptroller has served as the chief trauma center for the state, trying to keep our schools, nursing homes and social service agencies alive. This legislation would lead us to being more of a recovery room, with a trauma unit to deal with the remaining bill backlog.

21 Comments

|

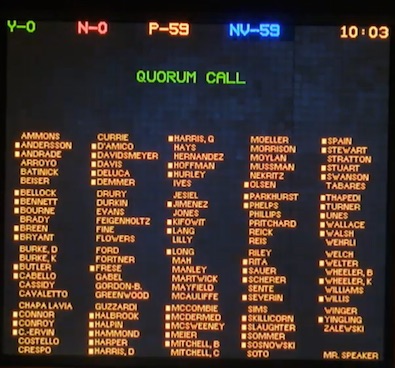

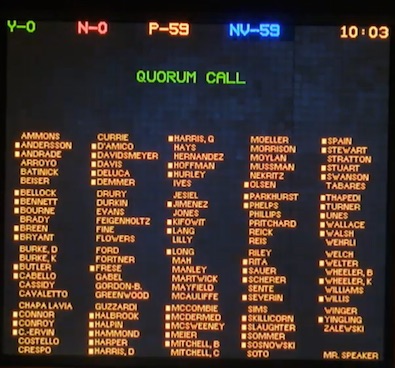

* From this morning’s House quorum call…

Notice that both leaders did not respond to the call.

The House has adjourned until tomorrow at 1:30.

* From the Speaker’s office…

The staff continues to assess members’ schedules so we can afford all the supporters of the bipartisan, compromise balanced budget plan the opportunity to vote on the override motion.

*** UPDATE 1 *** Speaker Madigan’s chief of staff just sent this e-mail to House members…

Session is set for Thurs., July 6 at 1:30 pm to consider SB override motions.

In other words, tomorrow could be the big day.

*** UPDATE 2 *** Press release…

Speaker Michael J. Madigan issued the following statement Wednesday:

“The House will hold a vote on Thursday, July 6 to override the governor’s vetoes of the balanced budget sent to him. House Democrats look forward to working with our colleagues on the other side of the aisle to begin healing the wounds of the last several years.”

74 Comments

|

How we got here

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* Not only did I forget to post my syndicated column, I also forgot to post my Crain’s Chicago Business column…

During his 2014 campaign, Bruce Rauner pledged to roll back the state income tax rate to 3 percent from 5 percent in just four years, reversing Gov. Pat Quinn’s 2011 tax increase. Rauner’s tax plan was a fantasy. He insisted that his “reforms” would create enough economic growth to mostly replace revenue lost from tax cuts.

There was some tax relief after Quinn lost to Rauner. On Jan. 1, 2015, days before Rauner was sworn in, the income tax rate automatically dropped to 3.75 percent. And while Rauner demanded that the rate be allowed to fall, the Democrats in charge of the General Assembly were the ones legally responsible. And then all heck broke loose. Since Rauner took office, state government has suffered a massive fiscal catastrophe, and state taxpayers are still waiting for the full relief he promised.

One of Rauner’s first trips as governor was to Decatur, to unveil his “right to work” plan. He demanded that the state force labor unions to allow their members to escape paying dues. It immediately poisoned any relationship he could have hoped to build with the legislative majority Democrats, who not only rely on unions for campaign help but tend to be strong supporters of union issues.

Rauner wouldn’t sign any bills to raise the income tax rate to help balance the budget, wouldn’t negotiate a budget and wouldn’t even propose a “real” budget until he got his reforms. The state was paying most of its bills in under 30 days before Rauner became governor. It’s now so fiscally impaired that Illinois government is just getting around to paying bills it incurred in October—eight months ago.

While tax revenue dropped, spending went up because state and federal judges ordered the state to pay its bills and because Rauner kept signing contracts for billions of dollars in goods and services even though he knew there was no money to pay for any of it.

So why didn’t Rauner drop “right to work” when his idea faced such fierce resistance? And, many months later, when he finally did back off, why did he insist on slashing the prevailing wage for trade union workers and tying a property tax freeze to a massive rollback of union rights?

Click here to read the rest before commenting, please. Thanks.

100 Comments

|

Radogno was one of a kind

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* Things got so busy that I forgot to post my syndicated weekly newspaper column. Here you go…

Senate Republican Leader Christine Radogno was the first ever female leader of a state legislative caucus in Illinois. That alone puts her in the history books.

But she’s also a decent human being, something that often seems in short supply around the Statehouse.

The fact that several Senate Democrats showed up for her press conference last week to announce she was resigning and then took turns hugging her after it was over demonstrated the deep well of respect and admiration she had built in the building. She even got a hug from House Speaker Michael Madigan after she told her fellow legislative leaders she was resigning in two days. Madigan isn’t the hugging type, at least not at work.

Legislative leaders, even minority leaders, have big offices, large staffs and, usually, egos to match. But Radogno was genuinely surprised at how many reporters showed up for her resignation press conference.

Her retirement was huge news because she has sparred behind the scenes with Gov. Bruce Rauner all year and reporters figured that had something to do with it. Rauner, a fellow Republican, repeatedly derailed Radogno’s efforts to devise a “grand bargain” with Senate President John Cullerton that was supposed to end the stalemate Rauner created by refusing to negotiate or even present a balanced budget. Tellingly, Radogno did not mention Rauner in her resignation letter, but she denied to reporters that her differences with the governor had anything to do with her leaving.

Gov. Rauner always treated Radogno and her Senate Republican caucus with a heavy hand. Just weeks after he was sworn into office in 2015, he met with Radogno’s Republican Senators in a back room at Springfield’s Saputo’s restaurant and delivered a couple of stern warnings.

Rauner reportedly referenced the $20 million sitting in his campaign fund at the time and said he wanted to be their partner in the upcoming session and would support those who supported him.

And then the hammer came down. Multiple credible sources told me the governor informed the Senate Republicans he would ask for their votes on 10 issues and that he absolutely needed all of their votes on all 10 items. Not five, not seven. Ten. And if anyone in the room didn’t vote for all 10, then they’d have a “(expletive that begins with an ‘F’ and ends with an ‘ing’) problem” with him.

The governor also warned his audience not to leak anything about the meeting to me. Anyone who talked, he said, would have a “(same expletive as above) problem” with him.

The Statehouse tradition is that a governor can try to influence legislators, but can’t try to control them, particularly against the wishes of their own chamber leaders. But Rauner showed right away that he wasn’t concerned with such niceties. And when Radogno started working with Cullerton, Rauner wouldn’t allow any legislation to pass without his blessing. And he didn’t bless much.

Because of Rauner, the grand bargain turned into something it was never intended to be. It was sparked last December after yet another horrible meeting with Rauner and the equally intransigent House Speaker Michael Madigan. Their idea was to find a way to get things moving after a year and a half of total governmental and legislative impasse. Radogno and Cullerton wanted to come up with a Senate-centric, bipartisan solution to Fiscal Year 2017 (which just ended on June 30th), work out some stuff on the governor’s non-budget issues like a property tax freeze and workers’ compensation reform and launch it all over to the House as a way of putting pressure on Madigan.

But the governor figured that Speaker Madigan would drastically water down anything that emerged from the Senate and he wanted the Senate to come up with a solution for Fiscal Year 2018 as well. It was simply too high of a bar. In the end, the Senate Democrats just weren’t willing to go along with the governor’s non-budget and budget demands.

The Senate Republicans elected Sen. Bill Brady, R-Bloomington, to replace Radogno. Brady ran against Rauner in the 2014 Republican gubernatorial primary, but he and the governor are fairly close. The governor probably won’t have many [expletive deleted] problems from Brady, but he has a new role now, so we’ll see.

Radogno and Cullerton had their fights, but they did their utmost to remain civil. Brady is a very likable fellow, so we’ll see how this new relationship works out.

I had an off the record dinner with Radogno after she announced her resignation. We hugged when it was over. I’m really going to miss her because she is truly one of a kind.

28 Comments

|

*** LIVE *** Overtime session coverage

Wednesday, Jul 5, 2017 - Posted by Rich Miller

* The Senate left town after overriding the governor’s vetoes yesterday, the House is in at 10 and Gov. Rauner will talk about the “Impact of Speaker Madigan’s 32% tax hike with Hegewisch community and business leaders” at 1 o’clock. So, watch whatever happens in real time with ScribbleLive…

2 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|