* From the new House Republican resolution opposing a graduated income tax…

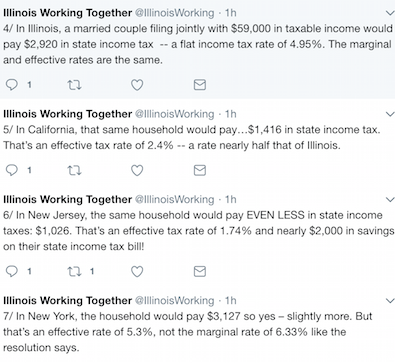

States that impose graduated income tax rates, which vary in application but number 33 in all, present a troublesome case for their residents, and would, undoubtedly, present an equally problematic case here in Illinois; looking at California, for example, which has one of the most so-called progressive income tax bracket systems, with a base rate of 1% and a top marginal rate of 13.3%, an Illinois taxpayer that is earning a median household income of approximately $59,000 would be subject to a 9.3% income tax rate under the Golden State’s model - nearly doubling the current Illinois tax; using the New York tax structure, the Illinois taxpayer would be subject to a 6.33% state tax rate; using the New Jersey model, that same Illinois taxpayer would be subjected to a 5.525% income tax rate [Emphasis added]

* IWT…

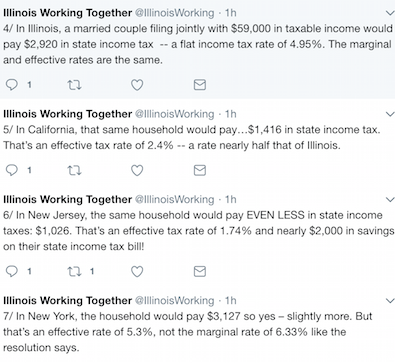

* The essential problem with the resolution, as IWT points out, is that the House GOP looks at marginal, not effective tax rates. Click here if you need an explainer…

Your marginal tax bracket, or marginal tax rate, and the actual tax rate you pay on your income are usually two different numbers. This is because you don’t pay your marginal tax rate on your entire income, thanks to deductions, exemptions, tax credits, and the way the tax brackets are structured.

* Back to Jake…

* He’s right. Here are links to the three states’ tax tables so you can see them for yourself…

* California

* New Jersey

* New York

…Adding… The Center for Tax and Budget Accountability also weighed in on this topic. Click here.

* Related…

* House GOP blasts Pritzker’s plan for graduated income tax: Pritzker spokeswoman Jordan Abudayyeh called the resolution a “political stunt” to distract from Rauner’s “failure as governor.” The Illinois individual income tax rate is a flat 4.95 percent. Although he has not specified the rates he prefers, Pritzker has suggested a higher rate for higher levels of income — the idea being that those bringing home a bigger paycheck can afford to pay more in taxes. He hasn’t suggested bringing in more revenue with the rates. But Durkin scoffed at a Democratic plan that could be revenue-neutral. “They are not going to pass a progressive tax without having more money to spend. It’s in their DNA,” Durkin said. “That’s how they operate, and giving them more ability to raise taxes on individuals at different rates is going to be a disaster.”

* House Republicans Pledge To Oppose Progressive Income Tax: Yet – a poll last year by the Paul Simon Public Policy Institute showed 72 percent of voters support changing the state constitution to allow a progressive tax. Twenty-four percent are opposed.

* Republican Leader Jim Durkin says: “Our caucus is in a good position”

* Republicans aim to make sure Pritzker’s income tax plan doesn’t progress: “First of all business owners will flood out of the state. It will lower our tax base, but more importantly in every state that puts in a graduated income tax hike, the middle class ends up paying more. The middle class gets whacked in the end,” Rauner said.

* Illinois House GOP voices opposition to progressive income tax: Rep. David Harris of Arlington Heights was the only House Republican not to sign the resolution. Harris could not be reached for comment. He was one of 10 House Republicans to split with Durkin and vote for last summer’s budget and tax package. “Taxpayers cannot afford the current increase in taxes,” Durkin said at a Statehouse news conference. “There’s no way the Democrats should even be floating an idea of the progressive tax. Both opponents and proponents know how debilitating this tax would be to Illinois taxpayers.”

* IL Policy Institute: Fifty lawmakers are taking a pledge to fight a progressive income tax in Illinois, denying progressive tax proponents the support needed to put a constitutional amendment on the ballot.

- Stark - Wednesday, Apr 11, 18 @ 11:51 am:

I have yet to hear a single argument against progressive taxation that actually makes logical or moral sense. If you don’t think it’s an American principle for those with the greatest ability to pay to pay a little more, I don’t know what to tell you.

- Ok - Wednesday, Apr 11, 18 @ 11:53 am:

Rauner and Trump proved that politics doesn’t have to be factual to achieve victory.

Now, governing on the other hand….

- Ok - Wednesday, Apr 11, 18 @ 11:56 am:

I would say the way some have talked about it over the years is pretty darn defensible from a policy perspective - creating a large set of exemptions up front to enable people to pay for basic needs, and then everybody being subject to the same rate after that set of exemptions.

And that doesn’t need a constitutional change (maybe).

But it sucks from a political perspective when people are being dishonest about it (doubling everyone’s taxes!).

- Ron - Wednesday, Apr 11, 18 @ 11:57 am:

Missouri’s top rate in it’s “progressive” tax rates starts at $9,000.

Oregon’s “progressive” tax rates are 9% from $16,900 to $249,999.

- VanillaMan - Wednesday, Apr 11, 18 @ 12:04 pm:

==. If you don’t think it’s an American principle for those with the greatest ability to pay to pay a little more, I don’t know what to tell you.==

That’s not an American principle. I don’t know what to tell you either.

- Baloneymous - Wednesday, Apr 11, 18 @ 12:06 pm:

Stark-

But Grant Wherli tweeted a compelling argument against a progressive tax just this morning. He said it was intellectually lazy.

/s

- Rich Miller - Wednesday, Apr 11, 18 @ 12:08 pm:

===That’s not an American principle===

Yes it most definitely is when it comes to income taxes.

- Michelle Flaherty - Wednesday, Apr 11, 18 @ 12:11 pm:

So the House Republicans used their state resources to attack a political candidate’s campaign position.

Interesting.

- Nacho - Wednesday, Apr 11, 18 @ 12:12 pm:

==I have yet to hear a single argument against progressive taxation that actually makes logical or moral sense.==

Same here. Arguments that don’t misunderstand (or purposely misrepresent) the difference between effective and marginal rates tend to appeal to some vague sense of “fairness” in terms of everyone paying the same rate, regardless of how much larger the actual impact of that is on those who earn less.

If the comments in yesterday’s question of the day are anything to go by, it looks like the GOP messaging against it will be to try and muddle the issues between the tax structure and the tax burden. The key for Pritzker to counter this will be to keep the response simple (”I want to lower the tax burden on working Illinoisans and have the wealthy pay their fair share” or something like that) and not try to get too much into details.

- wordslinger - Wednesday, Apr 11, 18 @ 12:14 pm:

The House GOPs marginal knowledge base makes for a less than effective argument.

- Juice - Wednesday, Apr 11, 18 @ 12:15 pm:

Ron, Oregon also doesn’t have a sales tax.

- Chicago_Downstater - Wednesday, Apr 11, 18 @ 12:16 pm:

This is the hill ILGOP wants to die on? In the middle of a populist surge in their own party and a general surge of anti-Republican-anything in the Dems? Goofy, but as a liberal I’ll take it.

I just can’t see how this stance is going to help them garner votes. But hey, I guess crazier things have happened.

- Ron - Wednesday, Apr 11, 18 @ 12:17 pm:

Juice, I would rather pay sales tax than income tax. Consumption taxes are much better, assuming food, clothing and medicine are excluded.

- regnaD kciN - Wednesday, Apr 11, 18 @ 12:20 pm:

===That’s not an American principle===

—Yes it most definitely is when it comes to income taxes.—

Help me out here Rich. A principle is a fundamental truth or policy that serves as the foundation for a system of belief or behavior or for a chain of reasoning. There are two differing opinions as to which method is “fairer” but I’m missing where it’s an American principle for those with the greatest ability to pay pay a little more.

- Rich Miller - Wednesday, Apr 11, 18 @ 12:20 pm:

===Interesting===

Yeah. You guys have never done that. lol

- 47th Ward - Wednesday, Apr 11, 18 @ 12:25 pm:

===the House GOP looks at marginal, not effective tax rates===

This helps explain why the HGOPs, as a group, are not even marginally effective.

- blue dog dem - Wednesday, Apr 11, 18 @ 12:30 pm:

Going hand in hand with a previous post. The working poor and middle classes will most certainly need to see an increase in their income taxes if.

LGDF levels are restored.

K-12 funding is increased.

Higher ed funding is increased.

Ag budget is restored.

Pension payments are made.

Debt service is played.

Social service funding is restored.

A capitol plan is launched.

Intersect Illinois is funded.

Raises to state workers.

State employee insurance is caught up.

The question is. How much?

- Cocoa Dave - Wednesday, Apr 11, 18 @ 12:30 pm:

Somehow the debt has to be paid. I don’t hear any other valid ideas on how this will be accomplished. In reality we probably need a progressive income tax that will raise more revenue and a broader tax on services and a income tax on retirement income an

- Juice - Wednesday, Apr 11, 18 @ 12:32 pm:

Ron, that’s fine to have that position even though I disagree with it (I think both income and consumption should be subject to tax). But pointing out the high marginal rates in Oregon without also acknowledging that they don’t have a sales tax, a major source of revenue here (and one of the culprits for why our system is regressive) is a disingenuous point to make.

- jdcolombo - Wednesday, Apr 11, 18 @ 12:32 pm:

Progressive rates make sense for a number of reasons. The most common argument is the “ability to pay” argument, or more precisely, the argument that the marginal utility of a dollar of income goes down as income goes up - If you make $25,000, you need every penny to buy food and shelter. If you make $25,000,000, not so much.

But one argument that is also true that one never hears is that higher income folks also benefit proportionately more from most government services. The vast majority of government spending does NOT go to the poor - it goes to services used most by the middle classes on up. Airport traffic control (and even airports themselves); roads; the court system; market regulation; even the military all benefit upper incomes more than lower incomes. It is a popular myth that most government spending benefits lower income classes. That is not correct. So progressive taxation is also justified by a simple “you use more of what government buys, so you should pay more.”

- Ron - Wednesday, Apr 11, 18 @ 12:32 pm:

Cocoa Dave, you seem to be in the majority around here. But just how high do our taxes need to go?

- titan - Wednesday, Apr 11, 18 @ 12:34 pm:

+++ - Stark - Wednesday, Apr 11, 18 @ 11:51 am: I have yet to hear a single argument against progressive taxation that actually makes logical or moral sense. If you don’t think it’s an American principle for those with the greatest ability to pay to pay a little more, I don’t know what to tell you. +++

It is not an original American value (and I’d note Karl Marx’s core slogan of “From each according to his ability, to each according to his needs” in popularizing communism).

I happen to be fine with some degree of progressiveness in rates (and a floor below which one would not pay anything), but “fair” can mean everyone is treated the same (i.e. flat rate), no floor) or people with more have to pay more (i.e. progressive rate). I do worry about how it would be implemented in Illinois if it were allowed here. I have a fear that there would be an unpleasant level of socking it to the “rich” (at least those who don’t have powerful friends) and “rich” getting defined down drastically over time

- City Zen - Wednesday, Apr 11, 18 @ 12:37 pm:

Why does the union, er, IWT, focus on “married filing jointly” tax brackets for those states when no such distinction has been proposed for Illinois?

- Union thug - Wednesday, Apr 11, 18 @ 12:39 pm:

First of a sales tax is considered regressive for a reason. The ones hit by it are the ones that can’t afford it. If the goal is to lower the burden on lower and middle income it’s the last thing to do. Basic supply demand. If they have no money they can’t provide a demand. With no demand they will not make the supply. I’ve seen businesses push out products to look good but end up broke cause nobody is buying.

- DBC - - Wednesday, Apr 11, 18 @ 12:41 pm:

@CD =Somehow the debt has to be paid.=

That’s a non-starter right there. For decades IL voters have demonstrated they will not elect someone who takes such a fiscally responsible position.

Those who run-up big tabs with no way to pay are the new fiscal conservatives.

- Hysteria - Wednesday, Apr 11, 18 @ 12:45 pm:

It is not an American principle for those who make more to pay more. It is a Christian principle that those who make more do more. So give to charity, etc. We, as a society, are expected to do that. But to pay more to a government that can then choose to do what it wants with taxpayer money, e.g., now fund abortions thanks to HB 40. That’s not American.

- Steve - Wednesday, Apr 11, 18 @ 12:46 pm:

How many people want to stay paying a 9.3% marginal tax rate on 53K or 59K ? It makes you remember the other taxes people are paying…

https://nalert.blogspot.com/2018/04/stossel-great-american-tax-ripoff.html

- Anonymous - Wednesday, Apr 11, 18 @ 12:47 pm:

@Michelle F.: Cue the Edgar County Watchdogs in 3…2…1…

- Jocko - Wednesday, Apr 11, 18 @ 12:48 pm:

To think that as recently as 1961…under Eisenhower(R)…top earners were being taxed at rates approaching 91%.

Now we have a Republican governor with nine homes arguing that the existing flat tax rate is exorbitant.

- Honeybear - Wednesday, Apr 11, 18 @ 12:50 pm:

Here’s perfidy in action.

Intentionally obfuscating

Is lying to voters

Stop the lying

- City Zen - Wednesday, Apr 11, 18 @ 12:50 pm:

If IL single filers followed the tax tables of the states below, here’s the break-even where they’d pay more in state income taxes (without deductions):

CA = $59,000

NY = $22,500

NJ = $150,000

If you make $100,000 in CA or NY, you’re paying 6.72% or 6.15%, respectively.

The question remains, who’s in JB’s crosshairs?

- Generic Drone - Wednesday, Apr 11, 18 @ 12:53 pm:

Ron. If i told you once, i have said it twice. Taxes need to go up to 50% on millionaires. Now quit asking how much.

- Cocoa Dave - Wednesday, Apr 11, 18 @ 12:53 pm:

Ron - The simple answer to how high our taxes need to go is high enough to balance our budget and service our debt. I’m all for eliminating waste, fraud and abuse but nearly everyone is for that too. We need to accept fiscal reality.

- City Zen - Wednesday, Apr 11, 18 @ 12:54 pm:

==To think that as recently as 1961…under Eisenhower(R)…top earners were being taxed at rates approaching 91%.==

I thought that meme was retired.

A study from the Congressional Research Service concludes that the effective tax rate for the top 0.01 percent of income earners during the period of 91-percent income taxes was actually 45 percent.

- Ron - Wednesday, Apr 11, 18 @ 12:57 pm:

CityZen, that’s correct about Eisenhower era taxes. There were so many more personal deductions no one paid 91% marginal rates. I have read something similar to what you quoted.

- blue dog dem - Wednesday, Apr 11, 18 @ 12:57 pm:

Fiscal reality? What exactly is that? Spend as much as you want? Over promise state workers? Do you mean freeze spending levels at a certain amount?

- Union thug - Wednesday, Apr 11, 18 @ 12:57 pm:

I also want to point out. Cali is one of the top 10 economy’s in the world and they run a budget surplus.

- Honeybear - Wednesday, Apr 11, 18 @ 12:59 pm:

Blue dog- intersect doesn’t get funding. They are a for profit corporation.

Say I’m wrong? Try to donate to it from a charitable foundation.

It doesn’t matter that Rauner created it by EO.

Also they don’t have to obey FOia requests

That’s a plus for pinstripe patronage

And edge agreements like Rivian

50 million for 35 jobs by Dec 32,2018

Thanks for putting that together Intersect Illinois

- Thomas Paine - Wednesday, Apr 11, 18 @ 1:04 pm:

@Hysteria -

i dont know what part of America y’all are from, but right here in the IL of Noise, we believe that those who make more should pay more.

It is why 80 percent of Illinois supported a millionaire tax.

80 percent of Illinois supports raising minimum wage.

67 percent of Illinois backs a progressive tax.

No corporation is running ads bragging about how they pay zero taxes.

Rauner is constantly attacking Pritzker for paying less than “his fair share.”

Back to reality:

The press conference was a big mistake, I think. It lets all of the Democrats off the hook without even a rollcall, let alone a vote. We will see.

- HistProf - Wednesday, Apr 11, 18 @ 1:04 pm:

Guys,

It IS an American principle!

The framers were concerned to preserve a “republican” society of self-governing relative equals, not beholden to bow and scrape before “aristocrats” for their living. The idea was that all white males would be self-employed or in partnership, usually on a family farm or in an artisan shop or small business. As late as 1860, Abraham Lincoln was still in this mindset when he said that in a republic, the hired hand of today was the master of tomorrow. That is, as late as 1860 north of slavery, self-employment and relative equality was what distinguished American revolutionary republicanism from British aristocracy and from the Southern “slaveocracy.”

This was a BIPARTISAN consensus. Hamilton argued for high public debt (in order to create treasury bonds which could back a banking system) funded by progressive taxes. He chose an import tariff, because only the wealthy purchased imports, and a tax on carriages, because only the wealthy had carriages.

Here is what his arch-opponent Jefferson had to say about it:

We are all the more reconciled to the tax on importations, because it falls exclusively on the rich, and with the equal partitions of interstate’s estates, constitutes the best agrarian law. In fact, the poor man in this country who uses nothing but what is made within his own farm or family, or within the United States, pays not a farthing of tax to the general government, but on his salt; and should we go into that manufacture as we ought to do, he will pay not one cent. Our revenues once liberated by the discharge of the public debt, and its surplus applied to canals, roads, schools, etc., the farmer will see his government supported, his children educated, and the face of his country made a paradise by the contributions of the rich alone, without his being called on to spare a cent from his earnings.

Thomas Jefferson to Pierre Samuel Du Pont de Nemours, 1811.

- supplied_demand - Wednesday, Apr 11, 18 @ 1:08 pm:

==A study from the Congressional Research Service concludes that the effective tax rate for the top 0.01 percent of income earners during the period of 91-percent income taxes was actually 45 percent.==

Now you are doing a reverse ILGOP. This is the effective rate, the marginal rate was actually 91% and your un-sourced quote doesn’t argue otherwise.

If anything, this proves how much higher taxes actually were because the 45% EFFECTIVE rate is still 5% more than our highest current MARGINAL rate.

- Blue dog dem - Wednesday, Apr 11, 18 @ 1:08 pm:

Honey. You are correct. I have great disdain for Intersect Illinois, and sometimes lump them with DCEO. My bad.

- Juice - Wednesday, Apr 11, 18 @ 1:09 pm:

City Zen, because the House GOP decided to use median household income, and the average household in Illinois has more than one person residing in it, therefore many would either be married, filing jointly or head of household which has the brackets that IWT used.

- Cocoa Dave - Wednesday, Apr 11, 18 @ 1:10 pm:

Blue dog - I already offered my opinion on fiscal reality. Enough revenue to balance the budget and service the debt. What expenses are incurred requiring the debt repayment are open to debate. But the reality part comes in once those expenses are incurred they need to be paid back.

- Chicago Cynic - Wednesday, Apr 11, 18 @ 1:11 pm:

The only question is whether the GOP are being dishonest or stupid? There is no third option.

- regnaD kciN - Wednesday, Apr 11, 18 @ 1:26 pm:

Tip of the cap to HistProf for excellent explanation.

- Whatever - Wednesday, Apr 11, 18 @ 1:34 pm:

The goofiest arguments against amending the constitution to allow a graduated-rate tax are that the Democrats will use this new authority to raise income taxes on everyone, or at least on a huge portion of the people. JB and other proponents may not tells us who exactly they think are the “rich” who should pay the higher rates, but you can be that the rates are not going to go up on a majority of the voters or even a minority approaching 50%. The General Assembly already has the power to raise taxes on everyone. A graduated rate tax gives them the power to raise the tax on a minority of voters, without raising the tax on the majority and even lowering the tax on a big block of voters.

- Silicon Prairie - Wednesday, Apr 11, 18 @ 1:35 pm:

Tax reform is what is needed in Illinois, not new add on or significantly higher taxes. Indiana raised their income tax but lowered property taxes 20%. In Illinois the 2 parties have never agreed on that approach bec if you raise income taxes on everyone, and lower property taxes, it really only benefits people who own homes. Somehow the tax reform needs to figure out the funding for schools which is broken. It just isnt sustainable anymore

- Anon - Wednesday, Apr 11, 18 @ 1:35 pm:

The framers also gave us the second amendment, so I’m not sure you want to go down that road of what the American principles are.

- Nacho - Wednesday, Apr 11, 18 @ 1:39 pm:

==Tax reform is what is needed in Illinois, not new add on or significantly higher taxes.==

What is changing from a flat to a progressive income tax if not reform?

- Ron - Wednesday, Apr 11, 18 @ 1:41 pm:

Nacho, that’s not reform, that’s increasing taxes.

- Louis G. Atsaves - Wednesday, Apr 11, 18 @ 1:57 pm:

‘====The only question is whether the GOP are being dishonest or stupid? There is no third option.===”

Lost in all of the above is the basic fact that if you give Democrats more money to spend, they will gladly spend it and then come back and demand more. No third option there. Just something dishonest and/or stupid.

Politics in Illinois is such fun./s

- City Zen - Wednesday, Apr 11, 18 @ 2:01 pm:

Juice - While most tax files file as married filing jointly, they comprise less than half the tax returns filed (per Tax Foundation 2003). And considering the age of those stats, that number is probably lower. Either way, the ILGOP and IWT are speaking two different tax languages, and poorly at that.

For anyone proposing a graduated tax plan, we should assume those brackets are for single filers only and will double for married filers.

- JB13 - Wednesday, Apr 11, 18 @ 2:03 pm:

In Illinois, fiscal reality is whatever the courts declare it to be.

No money? We’ll just see about that.

- Silicon Prairie - Wednesday, Apr 11, 18 @ 2:10 pm:

Nacho “What is changing from a flat to a progressive income tax if not reform? ”

Sure its called bad reform. Its not changing the way the state and local do business. My point is simply raising taxes isnt the solution. This mess is because of bad policy for the last 30 years

- wondering - Wednesday, Apr 11, 18 @ 2:13 pm:

I will say it again, 34 states have a progressive income tax, not 33. Also, D.C. and the feds. Illinois is weird not having one.

- Sands - Wednesday, Apr 11, 18 @ 2:15 pm:

-higher income folks also benefit proportionately more from most government services-

Ridiculousness

- Whatever - Wednesday, Apr 11, 18 @ 1:34 pm:

Precisely

- Ron - Wednesday, Apr 11, 18 @ 2:17 pm:

Wondering, look at the actual tax rates of those states. Many have higher rates starting at virtually no income.

- Rich Miller - Wednesday, Apr 11, 18 @ 2:20 pm:

===look at the actual tax rates of those states===

Which makes you unclear on the concept. You have to look at effective rates.

- Nacho - Wednesday, Apr 11, 18 @ 2:28 pm:

==Nacho, that’s not reform, that’s increasing taxes.==

==Sure its called bad reform. Its not changing the way the state and local do business. My point is simply raising taxes isnt the solution. This mess is because of bad policy for the last 30 years==

These are both non-answers that conflate the issue of how taxes are structured (in this case flat vs. progressive) with the amount collected.

- HistProf - Wednesday, Apr 11, 18 @ 2:34 pm:

- Anon - @ 1:35 pm:

2nd Amendment is a topic for another day. Suffice it to say for now, that precedent cuts several ways. America INVENTED progressive taxation as a way to destroy aristocracy. That’s why we had the American Revolution in the first place. We abolished primogeniture and entail in order to rid ourselves of the shackles of inherited wealth and privilege. It is literally un-American to abolish the “death tax.” American kids used to have to stand on their own two feet while kids in other countries relied on their family name and connections. That historic pattern has literally been reversed in the last 40 years.

- Cocoa Dave - Wednesday, Apr 11, 18 @ 2:41 pm:

JB13 - It’s true once the court rules and all appeals are exhausted the decision becomes fiscal reality. For me this happen when my ex-wife was awarded 40% of my pension. I don’t like it but it’s fiscal reality. I’m not at all unclear on the concept.

- Juice - Wednesday, Apr 11, 18 @ 2:41 pm:

City Zen, according to the IRS, in Illinois for 2015 (most recent data available), there were 2,943,900 single returns, 2,178,810 joint returns and 936,760 head of household returns. So there were 3.1 million returns that would fall under filed jointly brackets compared to 2.9 million who would file under the single or married filing jointly brackets in each of the States that the House GOP chose to focus on. And since the income they are using is median household income, and the median household is filing a joint or head of household return, I don’t know why the assumption should automatically be that the rates for single filers is the more important point of comparison.

I would agree with you that the language being used is imprecise, but it was Durkin who filed the resolution, and as the public official, he should probably be held to a higher standard than Jake.

- City Zen - Wednesday, Apr 11, 18 @ 2:57 pm:

==I will say it again, 34 states have a progressive income tax==

13 of those states have a lower effective tax rate at 80,000 than Illinois’ flat tax. 20 of those states set their highest tax bracket below 80,000.

What’s the plan, JB?

- anon2 - Wednesday, Apr 11, 18 @ 3:06 pm:

“Taxes should be levied according to ability to pay. That is the only American principle.” ~ FDR

Under the highly regressive state and local tax system in Illinois, those with inability to pay get socked the hardest.

- anon2 - Wednesday, Apr 11, 18 @ 3:17 pm:

Here’s what Presient Reagan said in 1985:

“We’re going to close the unproductive tax loopholes that have allowed some of the truly wealthy to avoid paying their fair share. In theory, some of those loopholes were understandable, but in practice, they sometimes made it possible for millionaires to pay nothing, while a bus driver was paying 10% of his salary, and that’s crazy. It’s time we stopped it.”

- Hysteria - Wednesday, Apr 11, 18 @ 3:29 pm:

Hysteria - I think that’s the real issue, not increasing rates. I think everyone should pay their fair share, and what’s fair is for everyone to pay the same rate. What you’ve outlined is the problem. The wealthiest can avoid paying their fair share with these loopholes.

HistProf - I’d say JB is an example of the reversal of the historic pattern! Also, the problem I have with the estate tax is that it’s taxing income that’s already been taxed.

- Juice - Wednesday, Apr 11, 18 @ 3:41 pm:

Hysteria, not by the person inheriting the estate.

- Chicago_Downstater - Wednesday, Apr 11, 18 @ 3:46 pm:

Thanks HistProf. Very cool information. I’d use exclamation points, but I believe they’re on the no-no list.

- Hysteria - Wednesday, Apr 11, 18 @ 3:52 pm:

Juice - Yes, sorry, that wasn’t clear. The decedent has already paid income taxes on the money, and then his/her estate pays estate taxes on it. To me, that’s double taxation. But yes, the beneficiaries don’t pay income tax on the inherited money.

- supplied_demand - Wednesday, Apr 11, 18 @ 3:52 pm:

==it’s taxing income that’s already been taxed. ==

This is the same stale argument we hear all the time. If a company makes “income” and uses that to pay me, an employee, then we can say that my income has already been taxed. This is nonsense because I pay tax on my income when I earn it. As such, the person receiving the gift should pay income tax on the “income” they were gifted.

- Rich Miller - Wednesday, Apr 11, 18 @ 4:00 pm:

Move away from the inheritance tax. This post is about the state’s income tax. Final warning.

- Anonymous - Wednesday, Apr 11, 18 @ 4:14 pm:

The rich should pay more, if they earn more. The American tax paying principle. Guess JB does not believe it, with all his tax avoidance methods.

- Stuntman Bob's Brother - Wednesday, Apr 11, 18 @ 4:27 pm:

I’m all in on Illinois adopting California’s tax code. But that means ALL of it, including their sales tax rate, real estate rate, and treatment of pension income and SS. I don’t know about anyone else, but my personal total tax bill wou1d drop significantly. I have to wonder what it would mean for the state as a whole - I’ve never seen a state-specific calculator that would allow one to punch in different variables and show the effect on total taxes collected.

- Last Bull Moose - Wednesday, Apr 11, 18 @ 4:34 pm:

My problem with a graduated income tax is that it lets the politicians argue for more revenue, but somebody else will pay. When the majority can take money from the minority through law, the minority must acquiesce, flee, or fight.

Excise taxes are not always regressive. It depends on how the tax is structured.

- Stuntman Bob's Brother - Wednesday, Apr 11, 18 @ 4:35 pm:

==We abolished primogeniture and entail in order to rid ourselves of the shackles of inherited wealth and privilege==

LOL, that may have been the intent, but can you tell me the names of the two frontrunners for Governor again?

- Ron - Wednesday, Apr 11, 18 @ 4:36 pm:

Stuntman, good question. Not sure how it would play out individually, but according to the Tax Foundation, CA and IL currently have the same state and local tax burden along with Wisconsin.

- Anonymous - Wednesday, Apr 11, 18 @ 5:32 pm:

FDR said try something, if it doesn’t work, try something else. We tried flat rate, doesn’t work. The people want it, be responsive to the electotate. Rauner brought this on.

- wobdering - Wednesday, Apr 11, 18 @ 5:33 pm:

sorry, 532 anon was me

- wondering - Wednesday, Apr 11, 18 @ 5:35 pm:

i am also wobering…sheesh

- Ron - Wednesday, Apr 11, 18 @ 5:35 pm:

Anonymous, why are you ignoring decades of Madigan controlled GAs and Edgar’s massive kicking of the can?