How did we get here?

Tuesday, Apr 17, 2018 - Posted by Rich Miller

* The Civic Federation is hosting a conference on pensions today. Greg Hinz wrote a preview yesterday and here’s part of it…

Under a long-term plan approved when Jim Edgar was governor—he’s among the speakers at [today’s] conference—spending on pensions was to slowly ramp up, starting in 1995, so that funding would hit the 90 percent level by 2045. According to retirement system reports combined and passed on to me by former state CFO John Filan, unfunded liabilities were expected to rise from just under $20 billion in 1995 to $70 billion in 2034, before then dropping sharply in the next few years:

Reality has been far different than those original circa-1995 forecasts. The actual 2016 unfunded liability of $123.8 billion is two and a half times the predicted $50 billion under the Edgar ramp. And with another 17 years to go before the ramp is scheduled to peak, the spread between prediction and reality is only going to grow—a lot.

Why the bad projections? There are lots of reasons, but Filan puts a number on two of the largest: Assuming a return on investments of an overly peppy 8.5 percent a year—the retirement systems since generally have ratcheted that expectation down to 7 percent—has driven up unfunded liability $35 billion, according to Filan. And another $35 billion came when lawmakers failed to follow the ramp and instead spent money that should have gone toward pensions for other, more popular items. One instance of that came during Filan’s tenure, when the state issued $10 billion in pension-obligation bonds but used those proceeds to replace normal pension contributions, which were spent on other items.

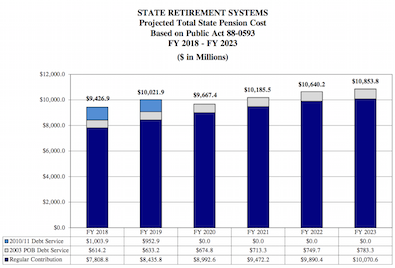

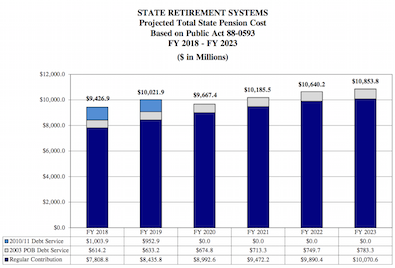

* The next five years, via COGFA…

- Angry Republican - Tuesday, Apr 17, 18 @ 12:31 pm:

For even more bad news, read the Pew report on state pensions (http://www.pewtrusts.org/en/research-and-analysis/issue-briefs/2018/04/the-state-pension-funding-gap-2016) and the IPI story about unfunded health care (https://www.illinoispolicy.org/reports/taxpayers-on-the-hook-for-billions-in-hidden-government-worker-health-care-costs/).

Neither one of these reports shows the debt as percentage of Gross State Product, which would help in measuring the size of the problem.

- wordslinger - Tuesday, Apr 17, 18 @ 12:32 pm:

–Assuming a return on investments of an overly peppy 8.5 percent a year—the retirement systems since generally have ratcheted that expectation down to 7 percent—has driven up unfunded liability $35 billion, according to Filan.–

Was 8.5% “overly peppy?”

In the link below, the DJIA calculator will show an average annual return of 8.3% from 1995 to date.

Perhaps Stu and the gang made some choices in investments for reasons other than ROI to the funds?

https://dqydj.com/dow-jones-return-calculator/

- Ole General - Tuesday, Apr 17, 18 @ 12:47 pm:

- Wordslinger -

Was the retirement system invested in Index funds with an expense ratio of 0.05% or what it likely held by some broad fund who returned less than the index and charged 2&20?

I’ll let you guess.

- City Zen - Tuesday, Apr 17, 18 @ 12:49 pm:

==Was 8.5% “overly peppy?”==

Yes, because it was the same rate used for the discount rate.

- Occam - Tuesday, Apr 17, 18 @ 12:57 pm:

*** Perhaps Stu and the gang made some choices in investments for reasons other than ROI to the funds?***

No, they wouldn’t have parked hundreds of millions of dollars of fund balance with fund managers whose primary qualifications were their political connections or their inclusion in some favored special interest group as opposed to their qualifications in successfully investing money. Right???

- Chicago Cynic - Tuesday, Apr 17, 18 @ 12:59 pm:

At the conference. Really depressing. No good answers yet but other states have made headway with bipartisan cooperation. It’s possible to solve this problem.

- Ok - Tuesday, Apr 17, 18 @ 1:01 pm:

You should include a graphic of the ramp from 2009-2013 that was in the original 1995 plan.

It was an intentional underfunding for 15 years, and then a rapid increase when “inflation” would take care of it all.

Increase the annual payment by billions over the course of just a couple years. That was the plan. It made the original tax hike inevitable and permanent.

- Name/Nickname/Anon - Tuesday, Apr 17, 18 @ 1:05 pm:

There was also an Early Retirement Incentive which didn’t help anything.

- Lucky Pierre - Tuesday, Apr 17, 18 @ 1:08 pm:

Total FY 2018 Pension Appropriation: $ 7,996.7 Million

Total FY 2019 Estimated Pension Appropriation: $ 8,539.1 Million

Total Estimated Increase, FY 2019 over FY 2018: $ 542.4 Million

Total Estimated GRF Increase, FY 2019 over FY 2018: $ 493.9 Million

Revenues were just over 29 billion dollars last year, and that state has a huge backlog and unfunded liability for health insurance in addition to the pensions.

Yet the democratic candidate for Governor is proposing huge increases in new spending

At the rate we are going, Illinois state government will soon be just a pension fund and a health insurance company for retired state employees with little money left over for core state services because of our self serving politicians

- Reality Check - Tuesday, Apr 17, 18 @ 1:10 pm:

Check out the chart on page 35 of the COGFA report. It shows that the normal cost (that is,the cost of benefits earned in a given year) is just $3.5 billion for the five state-funded systems in 2018. It also shows that this normal cost is going down every year as a percent of payroll.

The difficulty is the other $6 billion being paid this year, which is debt run up in the past. That amount cannot be reduced and must be paid - on that point the Constitution and the courts have been crystal clear. Nor would an ex post facto change constitutional amendment change this amount.

Policymakers need to figure out the best schedule to pay the debt, raise the revenue to do it and stick to an ironclad plan.

- blue dog dem - Tuesday, Apr 17, 18 @ 1:14 pm:

If those overseeing a pension fund were 100% invested in equities, I would be looking for a new fund manager..immediately.

- City Zen - Tuesday, Apr 17, 18 @ 1:15 pm:

==There was also an Early Retirement Incentive which didn’t help anything.==

It never does.

- Arthur Andersen - Tuesday, Apr 17, 18 @ 1:15 pm:

word, TRS reported a 30 year return of 9.7% the other day in its member newsletter, so I don’t think investment performance has been the long-term problem, all due respect to Director Filan. The last 20 years ( the period studied by COGFA) has been brutal on pension fund returns. Bond crash, tech bubble, WorldCom/Enron, global recession-all of these affected the 20 year return bigtime.

The pension funds would also have billions more in assets had they not had to pay the debt service on Filan’s pet project, the 2004 Pension Obliglation Bonds, as noted above.

- Morty - Tuesday, Apr 17, 18 @ 1:20 pm:

-No good answers yet but other states have made headway with bipartisan cooperation.

That happened. The result was Tier 2.

The problem was decades in the making, as will the solution implementation

- Sue - Tuesday, Apr 17, 18 @ 1:22 pm:

AA- the pension systems actually had a positive arbitrage on the Pension bond Blago put thru. The State though took a pension holiday until Quinn came in. I am not a big fan of the concept in that the market performance can be brutal in terms of timing but at TRS had a positive I’ve return even factoring in the interest carry

- Juice - Tuesday, Apr 17, 18 @ 1:28 pm:

In defense of Filan (hoo boy), not sure if the “overly peppy” is a direct quote or Greg’s interpretation of what Filan said.

But it is unquestionable (regardless of whether you think it was the right decision or not) that the funds’ decisions since 2009 to lower the assumed rate of return and the discount rate has increased the unfunded liability by billions of dollars.

- Reality Check - Tuesday, Apr 17, 18 @ 1:33 pm:

the funds’ decisions since 2009 to lower the assumed rate of return and the discount rate has increased the unfunded liability by billions of dollars

Correct. We’re not in a markedly different position than before, it’s just being measured differently.

And, to repeat, the COGFA report shows that the normal cost is already going down, owing to Tier II.

- Anonymous - Tuesday, Apr 17, 18 @ 1:48 pm:

Unfunded liability, unappropriated funds for state worker‘s contracts - same crap different flavor.

- A Jack - Tuesday, Apr 17, 18 @ 1:49 pm:

How about a Late retirement incentive? The later someone retires, the less AAI and benefits the state has to pay. A voluntary incentive would be constitutional. You keep them on the payroll longer, but they are also contributing more toward their health insurance and state taxes.

- Anonymous - Tuesday, Apr 17, 18 @ 1:53 pm:

==Check out the chart on page 35 of the COGFA report…It also shows that this normal cost is going down every year as a percent of payroll.==

But do projections ever come to fruition? Here’s the employer normal cost projections for 2018 per the:

2008 COGFA report:

TRS = $1B

SERS = $514M

2017 COGFA report:

TRS = $2B

SERS = $900M

The 2017 report has 6 years worth of Tier II participants yet is almost double what was projected. So I wouldn’t put much stock in any long-term projections.

- Just Saying - Tuesday, Apr 17, 18 @ 1:56 pm:

Gee, sure sounds like they are saying that the state employees are not the problem. If everyone would just quit blaming them and work on a solution instead of trying to figure out how to not pay what is owed. There is already a pension reform called Tier II. This article needs to be on the front page of every newspaper. Had there been no pension holidays and all the funds left in the system to generate interest, there would be no issue. The system is quite sustainable if they just run it as intended. Over a 30 year period, about 8.5% rate is what is needed to make the system 100% funded. Many years the rate was around 13%, so technically, the state of Illinois should not be having this issue with pensions. Blame the legislators and not state employees.

- Anon - Tuesday, Apr 17, 18 @ 1:58 pm:

The frightening thing is that despite an almost unheard of 10 year economic expansion the fiscal outlook is dire.

Illinois is one good recession away from being borderline ungovernable right now as the percentage of the general fund designated for pensions is only going to increase even under the rosiest of assumptions.

We are already one of the highest taxed states in the country factoring in income/sales/property and we are riding an economic expansion and yet we still are no where near balancing the budget now or in the future.

People have no idea how dire the situation is going to get.

- wordslinger - Tuesday, Apr 17, 18 @ 2:02 pm:

–At the rate we are going, Illinois state government will soon be just a pension fund and a health insurance company for retired state employees with little money left over for core state services because of our self serving politicians–

Sounds like you’ve done the math. What’s your month/year ETA?

- My Button is Broke... - Tuesday, Apr 17, 18 @ 2:27 pm:

-But do projections ever come to fruition? Here’s the employer normal cost projections for 2018 per the:-

The 2008 numbers you are looking at are the employer normal cost, and the 2018 numbers you are citing are the total normal cost. TRS FY2018 employer normal cost is $1.054 billion and SERS is $678 million. So they aren’t too far off the 2008 projections (but there was Tier II).

- Shemp - Tuesday, Apr 17, 18 @ 2:51 pm:

Yes wordslinger, 8.5% was overly peppy… by a lot. As noted, there are brokerage/asset manager fees for one, but also, the investment policy of pension funds, whether it’s Harvey or the State, mixes public equities with fixed income and other investments from real estate to private equity.

- City Zen - Tuesday, Apr 17, 18 @ 2:54 pm:

==TRS FY2018 employer normal cost is $1.054 billion and SERS is $678 million.==

Thanks for the clarification. The reports don’t flow very well from year to year, even more so in 9 year gaps.

That said, the 2011 COGFA forecast an employer normal cost of $796M for TRS and $428M for SERS. That’s about 33%/50% off the numbers you quooted. So I stand by my original statement, albeit less so.

http://cgfa.ilga.gov/Upload/FinCondILStateRetirementSysFY%202011Mar2012.pdf

- Nick - Tuesday, Apr 17, 18 @ 3:20 pm:

A Jack

Late retirement incentive. Ha

This administration is doing nothing but incentivizing early retirement

The older more senior tier 1 employees can’t get out the door fast enough

No raises. Constantly Insulted by the governor and the public constant threats to their health insurance and pensions etc. passed over for promotions in favor of younger. Special employees

Why would anyone stay once they are eligible to leave

- Arthur Andersen - Tuesday, Apr 17, 18 @ 3:30 pm:

Juice, spot on. About $15-20 billion depending upon where you start counting the reductions.

Sue, you’re missing the point. Yes, we’ve made money on the POBs. There’s a chart on it in the COGFA report; about 7.3-7.8% per year since the 2004 sale. The point is, the pensions would have a lot more assets if they weren’t paying down the debt on the POBs through lowered State contributions. Interest paid on the POBs drops that 7.5%ish return down to about 2.5%ish.

- SSL - Tuesday, Apr 17, 18 @ 3:46 pm:

I can almost hear Don Meredith signing now. Turn out the lights, the party’s over…

- supplied_demand - Tuesday, Apr 17, 18 @ 3:50 pm:

==Revenues were just over 29 billion dollars last year, and that state has a huge backlog and unfunded liability for health insurance in addition to the pensions.

Yet the democratic candidate for Governor is proposing huge increases in new spending==

Meanwhile, the Republican candidate is telling us he will somehow lower our income taxes. His budget stalemate is also where the “huge backlog” came from. Still supporting him?

- Oswego Willy - Tuesday, Apr 17, 18 @ 3:54 pm:

===Total FY 2018 Pension Appropriation: $ 7,996.7 Million

Total FY 2019 Estimated Pension Appropriation: $ 8,539.1 Million

Total Estimated Increase, FY 2019 over FY 2018: $ 542.4 Million

Total Estimated GRF Increase, FY 2019 over FY 2018: $ 493.9 Million

Revenues were just over 29 billion dollars last year, and that state has a huge backlog and unfunded liability for health insurance in addition to the pensions.

Yet the democratic candidate for Governor is proposing huge increases in new spending===

The incumbent sitting governor of Illinois…

… has YET… to sign a full fiscal year budget since taking the oath.

“Lucky Pierre”,

You can’t claim “facts”, when the fact remains…

… Rauner has YET… to sign a full fiscal year budget.

Bruce Rauner failed Illinois.

===At the rate we are going, Illinois state government will soon be just a pension fund and a health insurance company for retired state employees with little money left over for core state services because of our self serving politicians===

Rauner’s second term?

- Anonymous - Tuesday, Apr 17, 18 @ 3:54 pm:

As a state retiree, I would reluctantly favor taxing retirement income and dedicating that additional revenue to pension obligation reduction. It would not solve the entire shortfall, but it would help.

- CivilSpk - Tuesday, Apr 17, 18 @ 4:26 pm:

TRS reported average returns under 6% for the last twenty years. A 42% annual compounded shortfall compared to 8.5% plan. Ouch. Combine that with the restrictions on investment instruments and low interest rates the market would need to average over 10% forever. Yeah that’s realistic. Can we hire Bernie Madoff to handle our accounts?

2017 trs report 10 year annualized return 4.8%

2008 trs report 10 year annualized return 6.9%

- Generic Drone - Tuesday, Apr 17, 18 @ 4:30 pm:

As a future state retiree, I would not favor a tax on retirement as it is becoming painfully clear I will not be taking home enough to have any to spare. Im just one of those front line employees.

- filmmaker prof - Tuesday, Apr 17, 18 @ 5:41 pm:

I think taxing retirement income over $100K would be fair. It wouldn’t solve all the problems, but it would help.

- anon2 - Tuesday, Apr 17, 18 @ 6:52 pm:

=== Late retirement incentive. ===

School districts wouldn’t like that, given how their contracts are based upon years of service. They give early retirement incentives because a new teacher gets paid half or less of the retiree.

- Just A Dude - Tuesday, Apr 17, 18 @ 7:08 pm:

As has been mentioned many times there is no way to make cuts to benefits based on the ISC ruling. Hopefully, this Civic Federation discussion leads to some new ideas that are realistically possible. They argue that the Cullerton plan should be found constitutional.

Consider offering additional options for current tier 1 employees: For instance, to buy service years at a premium as opposed to what was offered in the last 2002 ERI. Example, SERS employees currently pay 4%, the additional years could be offered at 6% or more. This could be offered to younger tier 1 employees that still would not be eligible for retirement even with the purchase. I think you would get more takers than with the current consideration model as it is currently written. Probably reduce the states obligation more than the current proposal. Older workers won’t take it and I doubt there are that many younger tier 1s that would stick around to make that much of a difference. For think tank types to decide I suppose.

- Arthur Andersen - Tuesday, Apr 17, 18 @ 7:51 pm:

CivilSpk, since that 20 year return for TRS was not quite peppy enough to meet the (now unrealistic) 8.5% return assumption, aren’t we fortunate that the 30 year return was a very peppy 9.7% per annum, as I noted above?

Are you another one like “Sue” who couldn’t get a job at a pension system and endlessly distorts the facts about them?

- Arthur Andersen - Tuesday, Apr 17, 18 @ 8:10 pm:

And another thing while I’m a little grouchy-Filan tries to lay off the funding situation on investment underperformance, let’s examine his record, why don’t we?

2003-Sells POBs, sends pensions the payment book. Takes nearly $3 billion of bond proceeds to pay “issuance costs” (remember Individual K and his $800k fee that went to Rezko?) and 15 months of regular pension contributions, hosing pension funds out of over $2 billion.

2004-Attempts to cut $150 million from pension approps by “taking future pension reform savings” in advance. That dog didn’t hunt.

2005-06-Whacks pensions by $1 billion per year “to fund education” in FY 06 and 07 budgets. Deleted 10-year payback requirements for State ERI and TRS formula change, adding billions to unfunded.

2007-Attempts to tie unspecified increases in pension funding to ill-fated gross receipts tax proposal. DOA.

2008-Gave up.

COGFA oughta add a line in their “Causes of Unfunded Growth” labeled “Filan Bad Ideas.”

- Future Pensioneer - Tuesday, Apr 17, 18 @ 8:59 pm:

Correct me if I am wrong but was not Mr. Filan one of the masterminds behind Blago’s Pension Holidays and pooling of funds so he could be a populist?

- CivilSpk - Tuesday, Apr 17, 18 @ 10:06 pm:

Arthur—

It is a combination issues. Salaries jumped dramatically in the late 90’s and beyond. People were contributing based on significantly lower dollar amounts. At retirement with all of the creative bumps they ended up making more in retirement. So during the period of accelerating wages we had declining returns. Look at the assets under management for 1990, 2010, and now. What we need is 1980’s high interest rates to get back to those returns. I remember a 14% rate loan then.

- Ron - Wednesday, Apr 18, 18 @ 8:27 am:

Civil, agreed high inflation is basically the only hope. High debtors need high inflation. Why do you think Trump is stoking a trade war? You want inflation? Artificially force prices to increase.

- Wow said I - Wednesday, Apr 18, 18 @ 9:25 am:

A better report, instead of rehashing the same thing over and over, is a review of proposed legislation that sweetens current pensions.