*** UPDATED x1 *** Question of the day

Friday, Apr 27, 2018 - Posted by Rich Miller

* Sen. Tom Cullerton’s SJRCA21…

Proposes to amend the Finance Article of the Illinois Constitution. Provides that in no fiscal year shall the rate of growth of General Revenue Fund appropriations over the preceding fiscal year exceed the rate of growth of the Illinois economy.

Provides that if the General Assembly by adoption of a resolution approved by a record vote of a majority of the members of each house finds that an emergency exists and identifies the nature of the emergency, the General Assembly may provide for appropriations in excess of the amount authorized.

Rate of economic growth is defined as the “average annual growth rate of per capita gross domestic product in the State over the preceding ten calendar years, using data reported by the federal Bureau of Economic Analysis, or its successor agency, before December 31 immediately preceding the beginning of the fiscal year.”

* The DuPage County Democrat has been working with the Illinois Policy Institute on his proposal…

Illinois Policy Institute’s Adam Schuster said changing the constitution to cap state spending to the rate of growth in Illinois’ economy is needed.

“We see this from states ranging from California, to Texas, to Florida, so you could see that this is not a partisan measure, it’s not an ideological measure,” Schuster said. “It’s a good government, common sense way to control the rate of spending.”

* The Question: Should the state limit budgetary spending increases to the state’s rate of economic growth? Don’t forget to explain your answer in comments, please.

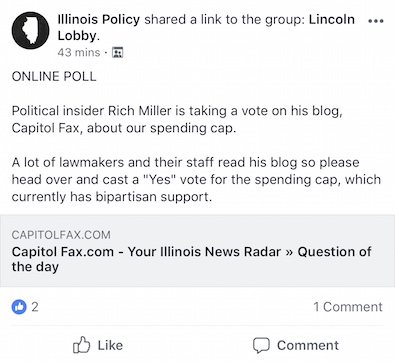

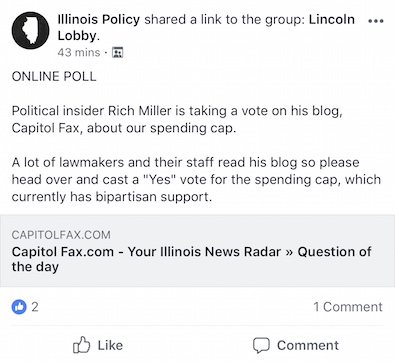

*** UPDATE *** The poll is being Freeped so I deleted it…

Continue on in comments, however.

- Stark - Friday, Apr 27, 18 @ 11:23 am:

Things that drive economic growth: Strong infrastructure, well-funded university systems, investment in robust social services to get people back to contributing to the economy.

Things you can’t fund properly as the population grows unless you increase spending: All of the above.

- Nick Name - Friday, Apr 27, 18 @ 11:24 am:

Voted no. Show me a causal relationship between the rate of economic growth and state appropriations.

- cover - Friday, Apr 27, 18 @ 11:25 am:

This amendment would not achieve the stated goal of the poll question. If it were to pass, the budgeteers would find ways to divert revenues and costs from the General Revenue Fund (GRF) onto other funds to circumvent the letter of the law.

- cdog - Friday, Apr 27, 18 @ 11:27 am:

We spend too much already, have weak results, and somebody wants more? uh, no. lol.

- wordslinger - Friday, Apr 27, 18 @ 11:28 am:

No. Too blunt a weapon for the Constitution.

- Leave a Light on George - Friday, Apr 27, 18 @ 11:30 am:

Sounds like another way to justify not making a full pension payment.

- Ron - Friday, Apr 27, 18 @ 11:32 am:

At a minimum, yes. We actually need to not increase spending at all for at least 5 years. Direct money to the massive pension obligations in the meantime.

- Anonni - Friday, Apr 27, 18 @ 11:34 am:

When the state has a weak economy, that’s when government needs to increase spending. This is the entire purpose of stimulus packages.

Not to mention that if Illinoisans are out of work or in low-wage jobs, they will need better access to public assistance, not less support.

- HistProf - Friday, Apr 27, 18 @ 11:35 am:

What Stark says. Sometimes you have to prime the pump.

- Not a Billionaire - Friday, Apr 27, 18 @ 11:36 am:

Health care spending has risen faster than growth for a long time and most of our budget is health care and education.

- Ron - Friday, Apr 27, 18 @ 11:40 am:

Um, illinois can’t prime the pump like. Anational government. It doesn’t print money. We have declining population due to a massive tax but rden that prodces very little for the vast majority of the state’s population. It’s great for government workers though.

- Demoralized - Friday, Apr 27, 18 @ 11:47 am:

==prodces very little for the vast majority of the state’s population==

You continue to peddle this and it’s absolute nonsense.

- Stark - Friday, Apr 27, 18 @ 11:47 am:

We have a declining population more so because of the fact it’s warmer in Arizona, California, and Florida rather than Illinois’ tax structure. If you wanted to make a tax change that would bring families back, try a progressive tax so schoolteachers and Bruce Rauner don’t pay the same percentage of their grossly different incomes.

- jze - Friday, Apr 27, 18 @ 11:48 am:

Mistake to have procyclical economics be constitutionally mandated.

- Just Me - Friday, Apr 27, 18 @ 11:55 am:

If increased tax revenue were directly tied to increased economic growth, then all the politicians wringing their hands trying to squeeze blood out of a turnip would instead be trying to find ways to increase jobs, which would solve so many of our state’s problems.

- Tony - Friday, Apr 27, 18 @ 12:05 pm:

I agree with Nick. One does not necessary tie directly to the other. And this could be like PTELL where it’s a good idea at the time but handicaps government going through growth fluctuations.

- Ron - Friday, Apr 27, 18 @ 12:09 pm:

It’s true demoralized. The state of Illinois provides very little for it’s massive tax burden.

- Flapdoodle - Friday, Apr 27, 18 @ 12:10 pm:

Agree with those who have pointed out that (1) economic growth is not correlated with budgetary needs and (2) periods of low economic growth often entail greater budgetary needs. Understand the impulse to impose a seemingly solid cap on budget increases, but writing it into the state constitution is dangerous — this is an instance when the law of unintended consequences really needs to be considered.

- UIC Guy - Friday, Apr 27, 18 @ 12:16 pm:

No. The things that state and local governments buy are primarily education, law enforcement, and health care (also road maintenance, etc.). Unfortunately the costs of these things go up faster than prices as a whole, because for those things (unlike computers, cars, anything that can be imported, and a whole range of services that computers are making cheaper) labor productivity goes up slowly, or not at all. (Google ‘Baumol’).

So, over time, providing the same services is going to take a larger share of the state’s GDP. We see all around us, in this state and many others, the costs of trying to pretend this isn’t so, but it is.

Sorry about that, but better to face the fact.

- d.p.gumby - Friday, Apr 27, 18 @ 12:18 pm:

Creates political song and dance over meaninglessness. “Emergency” is in the eye of the beholder as is “rate of growth”. Another distraction from the GA inability to seriously address honest budgeting and fiscal/tax policy.

- Smitty Irving - Friday, Apr 27, 18 @ 12:19 pm:

No. Other than Jerry Brown pulling a rabbit out of a hat in 2011 on, California adopted this after Prop 13 and it was non-stop dysfunction thereafter.

- Chicago_Downstater - Friday, Apr 27, 18 @ 12:22 pm:

It warms my heart to see all these comments against pro-cyclical economics. There’s plenty of research that shows that spending during a recession and saving during the good years (aka counter-cyclical economics) is the best way to go. And this bill would lock us into the opposite economic policy where the people of Illinois wouldn’t be able to find relief from either the public or private sector in the lean years.

Here’s a somewhat snappish article that lays out some of the reasons why pro-cyclical policies (like the one this bill would likely create) are bad, m’kay: https://www.economist.com/blogs/democracyinamerica/2010/03/deficit_spending

- wondering - Friday, Apr 27, 18 @ 12:30 pm:

No, the good Senator has been watching the sheriff in Blazing Saddles. “Don’t make me shoot (myself). Wide open loop hole, constitutional clause for crafting excuses….settle down and do the hard choices, Senator.

- Lucky Pierre - Friday, Apr 27, 18 @ 12:42 pm:

When exactly has Illinois “saved” during the good years?

- Langhorne - Friday, Apr 27, 18 @ 12:44 pm:

Feel good nonsense. We don’t need a 10 yr avg. The constitution is fine. Step 1: estimate revenue. Step 2: don’t spend above that level.

- Roman - Friday, Apr 27, 18 @ 12:44 pm:

Good politics, bad policy. Maybe pass a law tying budget growth to CPI for several year…but locking it into the constitution is a mistake.

- Ron - Friday, Apr 27, 18 @ 12:56 pm:

Roman, probably right. But certainly not a bigger mistake than constitutional public employee benefit protection.

- Ron - Friday, Apr 27, 18 @ 12:57 pm:

LP, obviously never.

- wordslinger - Friday, Apr 27, 18 @ 1:02 pm:

–When exactly has Illinois “saved” during the good years?–

Ask your boss. He got a $5 billion tax bump this year but wants a supplemental appropriation.

- Dublin - Friday, Apr 27, 18 @ 1:05 pm:

IPI ruins everything. Even Rauner’s messaging.

- wondering - Friday, Apr 27, 18 @ 1:16 pm:

Ron, what are you? A master of the old bait and switch?

- Demoralized - Friday, Apr 27, 18 @ 1:18 pm:

== The state of Illinois provides very little ==

That sort of nonsensical commentary is why nobody takes you seriously.

- VanillaMan - Friday, Apr 27, 18 @ 1:25 pm:

Simple minded proposal for a complicated set of problems.

Won’t work in real world.

- Demoralized - Friday, Apr 27, 18 @ 1:35 pm:

==Provides that if the General Assembly by adoption of a resolution approved by a record vote of a majority of the members of each house finds that an emergency exists and identifies the nature of the emergency, the General Assembly may provide for appropriations in excess of the amount authorized.==

This makes it easy to ignore it by only requiring a simple majority.

- 47th Ward - Friday, Apr 27, 18 @ 2:06 pm:

Absolutely not. It’s at times of economic trouble that state services are most in need. See “Global Financial Collapse” for more info.

Just as state revenues plummeted, people needed extended unemployment benefits, job training, more returned to college putting pressure on MAP grants, Medicaid enrollment surged as families lost health insurance along with their jobs, etc.

Governments often need to spend more precisely because of economic downturns. Limiting spending in those cases would cripple the state’s ability to help its citizens at a huge time of need for many.

I guess that’s why IPI supports it. But why does Tom Cullerton?

- Stark - Friday, Apr 27, 18 @ 2:11 pm:

Leave it to IPI to ruin the party.

- Lucky Pierre - Friday, Apr 27, 18 @ 2:34 pm:

Because Tom Cullerton is in a swing district (50.7% to 49.3% in 2016) that is concerned about fiscal responsibility and he is pitching himself as a bipartisan, responsible legislator

Good policy and good politics, they can go together 47th

- walker - Friday, Apr 27, 18 @ 2:38 pm:

Not a constitutional issue; a legislative one.

- 47th Ward - Friday, Apr 27, 18 @ 3:38 pm:

===Good policy and good politics, they can go together 47th===

Except this is terrible policy, but good politics. This kind of thinking is why we continue to dig the hole deeper instead of finding a way out.

- Lucky Pierre - Friday, Apr 27, 18 @ 3:41 pm:

Dig a hole deeper by having a budget cap?

More spending will not lower the debt

More spending will dig a deeper hole