Wisconsin is not the post-Janus model

Monday, Jul 2, 2018 - Posted by Rich Miller

* The end of my Crain’s Chicago Business column about the Janus decision…

The Chicago Tribune recently published an editorial titled “Bruce Rauner has his Scott Walker moment,” and compared what happened with the Janus case to the Wisconsin governor’s “tussles with public employee unions.” But I don’t think Rauner will realize his dream of killing off public employee unions in this state. At least, not in the foreseeable future.

Public employee union membership in Wisconsin has plummeted since Walker passed what was known as Act 10, which, among other things, allowed state and local government workers to opt out of paying anything to their unions before Janus was decided.

But those “other things” were hugely important to the membership decline.

Unions were forbidden to negotiate on anything except wages, but wage increases were capped. Health insurance, pensions and other fringe benefits were taken off the negotiating table. University employees and government-funded child care and home health care workers were barred from joining unions. Most important, Wisconsin public employers couldn’t deduct union dues from worker paychecks, so workers had to pay themselves for representation that wasn’t worth much.

When Rauner talks about wanting “reforms” to allow the state, schools, universities and local governments to save money, he’s mainly talking about Wisconsin’s Act 10, which has driven down wages and benefits.

This is no secret, by the way. When the governor isn’t trying to be cagey in front of the TV cameras, he’s admitted this is his goal.

Unless Rauner is re-elected and then wins the drawing to decide who creates the new legislative maps in 2021, then picks up solid Republican majorities and enacts those Wisconsin-style “reforms,” I don’t think we’re going to see all that many government workers dumping their unions in Illinois in the near term. Their dues, deducted from their paychecks, will still produce results, unlike in Wisconsin, where dues are hand-collected and unions are toothless.

And Rauner’s anti-union rhetoric and actions have sent nonmembers flocking to unions in droves. AFSCME saw a dramatic increase in workers signing up to pay full dues since Rauner took office, and the same thing has happened with teachers unions.

Ironically, a pro-union governor like J.B. Pritzker might drive down membership over the long term as union members lose their fear and become complacent. We’ll see.

* Tribune…

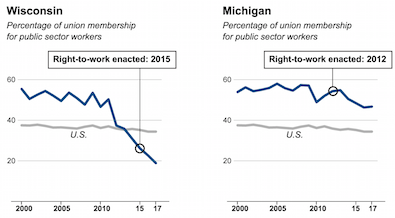

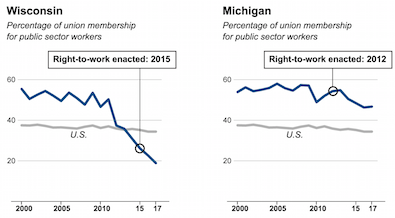

Union membership has cratered in Wisconsin since Gov. Scott Walker moved to reduce collective bargaining rights and won legislative approval for right-to-work rules. Michigan enacted right-to-work legislation in 2012, and also saw a drop, though not as dramatic. Michigan’s law went through years of court challenges before it was fully applied to public sector unions.

A recent report estimating the fallout of the Janus ruling noted a 5 to 10 percent decline in union membership following the passage of right-to-work laws. Robert Bruno, a professor of labor and employment relations from the University of Illinois, and one of the authors of that report, said the steep decline from union ranks in Wisconsin was a reflection of that state’s sweeping anti-union changes, rather than a just a change in right-to-work status.

One reason why the Wisconsin decline was so significant, Bruno said, was there were additional changes to collective bargaining and pension benefits. A better example of what could happen in Illinois could be Michigan, Bruno said, as changes there in 2012 were less far-reaching than revisions in Wisconsin.

Its accompanying graph…

* Related…

* As Supreme Court ruling threatens labor, teacher union leader says it’s been adding members: Illinois Federation of Teachers President Dan Montgomery says the union has been growing statewide and nationally despite last week’s expected Supreme Court ruling that stopped the collection of “fair share” bargaining fees from public workers who don’t want to be union members. “Our union is adding members. The AFT (American Federation of Teachers), our national union, is bigger than it’s ever been. We’re adding members here in Illinois all the time. … The graduate employees at the University of Chicago have just voted to join us,” Montgomery said Sunday on WGN AM-720.

- Anonymous - Monday, Jul 2, 18 @ 9:12 am:

People joining unions in record numbers is a logical consequence to the boss saying he wants to gut your income. What would anyone expect?

- wordslinger - Monday, Jul 2, 18 @ 9:19 am:

Don’t bother the tronclodytes with deep dives into “other things” like facts or reason. They just like to splash and yell in the shallow end of the pool.

- Raccoon Mario - Monday, Jul 2, 18 @ 9:33 am:

Since collective bargaining is now considered speech, Act 10 may find itself on the chopping block since it is a restriction of speech.

- JS Mill - Monday, Jul 2, 18 @ 9:36 am:

=which has driven down wages and benefits.

This is no secret, by the way. When the governor isn’t trying to be cagey in front of the TV cameras, he’s admitted this is his goal.=

Always has been his goal. While he can take in tens of millions in retirement the rest of the peasants need to take haircut because $100,000 a year is way too much in his head.

He has never been about economic growth other than his own.

- Fax Machine - Monday, Jul 2, 18 @ 9:41 am:

If Rauner “wins the remap” in 2021 then Republicans take the majorities in 2022 then Rauner still wouldn’t be able to push his Act 10 agenda unless he breaks his 2 term pledge and gets re-re-elected.

- Anonymous - Monday, Jul 2, 18 @ 9:41 am:

So right JS Mill. For some odd reason it’s always very wealthy people who are worried about other (lesser monied) people earning a decent living. And they can’t understand why those struggling and doing an honest days’ work resent them. It’s not their stash they resent. It’s their attitude and greed.

- Demoralized - Monday, Jul 2, 18 @ 9:41 am:

This is the kind of nonsense state employees, especially union members, are up against. Make no mistake, this editorial sums up exactly what the Governor thinks about state employees. The unions better be on their toes and fight to maintain membership.

https://www.bnd.com/opinion/editorials/article214086839.html

- Demoralized - Monday, Jul 2, 18 @ 9:44 am:

==because $100,000 a year is way too much in his head==

He rants about less money than that. He thinks a $50,000 retirement income is too generous and wants to gut healthcare benefits.

- kitty - Monday, Jul 2, 18 @ 10:04 am:

RNUG’s brilliant response from March 9, 2017 has the Rauner / wealthy investor class plan for labor: ” 1) Destroying all unions, especially government unions, starting with AFSCME

1a) Destroying the Democrat power base and removing all party leaders, 2) Preventing a graduated state income tax, 2a) Freezing or lowering property taxes, 3) Privatizing schools or, at minimum, convert all schools to a flat payment voucher system for K-12. 3a) Closing / selling off various college and university assets.

4) Busting the 5 state pension systems completely, if possible, so they are no longer an example to private sector of what everyone used to have before the bankers got greedy. 4a) If they can’t bust it, then privatize it via 401K’s so the bankers can, at least, get their hands on management fees. 5) Running the State so far into debt that it creates a SCOTUS test case for state’s to take bankruptcy 5a) In the alternative, find out how far you can stretch contract law through deliberate non-funding and misrepresentation of payment ability and terms.

5b) Leave the State so encumbered with debt that any successor will have to skyrocket taxes, ensuring that party’s defeat in the following election cycle.”

- laurafarber - Monday, Jul 2, 18 @ 10:06 am:

Horizon, c’est votre agence de communication digitale.

- JS Mill - Monday, Jul 2, 18 @ 10:14 am:

= It’s their attitude and greed.=

And more baffling is the people that are carrying a flag for them. Those who hate public employees or begrudge them a decent wage and benefits somehow have been deluded into believing that it will “save” them huge money and have no negative impact on their lives.

What Rauner dreams of would hurt the greater economy and the average citizen. And he couldn’t care less.

= He thinks a $50,000 retirement income is too generous and wants to gut healthcare benefits.=

And he believes that he is entitled to no taxes (he never met one that he didn’t like) and earning tens of millions per year.

- Whatever - Monday, Jul 2, 18 @ 10:16 am:

I’ve seen people predicting that holding that civil service labor negotiations is “political speech” will trigger lawsuits to invalidate prohibitions against negotiating on pensions, working conditions, etc. Janus may have opened the door that anti-union people should have kept closed.

- TRONCheesecurds - Monday, Jul 2, 18 @ 10:22 am:

Unlike the myth of Wisconsin labor laws flowing downstream, how about a Trib editorial about the reality of future Wisco runoff from 26 acres of Foxconn-created wetlands into Lake County’s Des Plaines flood-prone watershed?

- Grandson of Man - Monday, Jul 2, 18 @ 10:31 am:

From the BND editorial;

“Us Illinoisans earn a median salary of $32,500 a year.”

Cue the Bruce costume, pretendin’ he’s a regular guy and victim of the unions. His latest is the U of I cap.

- ajjacksson - Monday, Jul 2, 18 @ 11:13 am:

“He has never been about economic growth other than his own.”

Exactly.

- Frank Manzo IV - Monday, Jul 2, 18 @ 11:18 am:

Correct. As Professor Bruno notes, Michigan is the better recent example in the Midwest.

From 2012 (the year before Michigan enacted “right-to-work”) to 2017, public sector unionization fell from 54.3% to 46.7% - a 7.6 point drop: http://www.unionstats.com/

Professor Bruno’s and my recent study, which assessed the impact of “right-to-work” conditions in the public sector, found that the Janus decision will cause an 8.2 percentage point drop in public sector union members, on average, over time. This was based on the difference between all “right-to-work” and all collective bargaining states, controlling for other factors, and not specific to Michigan or Wisconsin.

But the Michigan example is on par with our expectations: https://illinoisepi.files.wordpress.com/2018/05/ilepi-pmcr-after-janus-final.pdf

- Annonin - Monday, Jul 2, 18 @ 11:19 am:

“Unless Rauner is re-elected and then wins the drawing to decide who creates the new legislative maps in 2021, then picks up solid Republican majorities and enacts those Wisconsin-style “reforms”.”

Did you forget GovJunk has promised to only inflict himself on us for two terms? While it is likely he currently conducting his exit interview NOW, we can be assured he be gone by the time all the mumbo jumbo you mention occurs.

- Anonymous - Monday, Jul 2, 18 @ 11:58 am:

“From the BND editorial;Us Illinoisans earn a median salary of $32,500 a year.”

BND lies again. Average full time salary in Illinois is $57,072. Median full time salary is $42,155. The median would be lower because there are more people making minimum wage in Illinois than Ken Griffins. Median is just the middle number in a long list of numbers.

https://rebootillinois.com/2017/03/29/illinois-full-time-salary-compare-tax-season/

- City Zen - Monday, Jul 2, 18 @ 12:19 pm:

Is now a good time to mention Wisconsin has one of the best pension funding percentages in the country?

- Anonymous - Monday, Jul 2, 18 @ 12:22 pm:

Also the BND editorial uses “Us” for nonunion people and “Them” for people who belong in a union. That is so nice of them. Whatever happened to “We”?

- Demoralized - Monday, Jul 2, 18 @ 1:01 pm:

==Is now a good time to mention Wisconsin has one of the best pension funding percentages in the country?==

People seem to do a lot of moaning about our problem and spend very little time on actually solving the problem. No amount of “what ifs” or “look at thems” will help. A roadmap has been given to address the problem. Nobody wants to follow the map.

- Anonymous - Monday, Jul 2, 18 @ 1:04 pm:

When/if public employees’ wages and benefits get trimmed, those public employees will be looking at the private sector. Those in the private sector should be concerned about that…….large numbers of experienced and qualified folks joining the pool of applicants.

Just sayin…….might have to move over.

- City Zen - Monday, Jul 2, 18 @ 1:07 pm:

==The AFT (American Federation of Teachers), our national union, is bigger than it’s ever been.==

Of course, Montgomery doesn’t tell you both AFT and NEA each count their merged affiliates as full members. Or that they count retirees who don’t pay dues. Or that the added Puerto Rico, but that Puerto Rico only pays a tiny fraction of what all other affiliates pay towards national dues. Nothing to see here.

https://www.aft.org/press-release/ampr-and-aft-affiliate-combat-austerity-and-fight-public-education-and

Looking at the union reports now, it seems AFT membership peaked in 2014. Plus Montgomery doesn’t mention the addition last year was Puerto Rico

- wordslinger - Monday, Jul 2, 18 @ 1:10 pm:

==Is now a good time to mention Wisconsin has one of the best pension funding percentages in the country?==

Perhaps Illinois should adopt it’s state tax model.

Crazy Eyez Walker and the GOP legislature there are quite content with it.

- Demoralized - Monday, Jul 2, 18 @ 1:10 pm:

==but overturn 40 year precedent==

I guess you can twist statistics to support any narrative you want to. Your comment and their comments are two perfect examples.

- Demoralized - Monday, Jul 2, 18 @ 1:12 pm:

Sorry. That comment above was meant to go with this:

==Nothing to see here.==

- City Zen - Monday, Jul 2, 18 @ 1:47 pm:

==Perhaps Illinois should adopt its state tax model.==

You mean tax retirement income?

- JS Mill - Monday, Jul 2, 18 @ 2:07 pm:

@CZ- now is a perfect time to mention the Wisconsin or toon funding model. Until a few years ago the Wisconsin penguins were 100% funded by the state. They were very responsible and paid into the pension plan. Now schools/teachers pay 5% and the state pays the rest.

Excellent example.

- wordslinger - Monday, Jul 2, 18 @ 2:13 pm:

==Perhaps Illinois should adopt its state tax model.==

You mean tax retirement income?–

I was thinking graduated income tax rates.

You’re the “tax retirement income” guy. Found one GA member, of the 177, who’s with you yet?

- City Zen - Monday, Jul 2, 18 @ 2:26 pm:

==I was thinking graduated income tax rates.==

Right, graduated income tax rates on retirement income. That is its state tax model you suggested we adopt. I’m down.

==now is a perfect time to mention the Wisconsin or toon funding model. Until a few years ago the Wisconsin penguins…==

Chilly Willy or Tennessee Tuxedo?

- JS Mill - Monday, Jul 2, 18 @ 2:29 pm:

Penguins- I meant pensions. Darn phone

- JS Mill - Monday, Jul 2, 18 @ 2:31 pm:

@CZ- I admire your perfect typing and, even more, when you bring something up that doesn’t work out the way you thought.

Maybe Rich will have a golden horse shoe for fewest typos? You are a shoe in!

- Sue - Monday, Jul 2, 18 @ 2:31 pm:

Time will tell but the unions are delusional to think they won’t lose 20 percent of paying individuals. As for the CTU U of C claim- those teaching assistants are about to be classified back to being students. The Obama NLRB change well settled law and the employee status won’t survive the new NLRB under Trump

- wordslinger - Monday, Jul 2, 18 @ 2:31 pm:

–Right, graduated income tax rates on retirement income. That is its state tax model you suggested we adopt. –

No, I’m suggesting graduated income tax, but not a tax on retirement income.

I’m not philosophically against a tax on some retirement income, but as a practical matter it’s such a non-starter in Illinois that there’s barely a lunatic fringe advocating it.

- City Zen - Monday, Jul 2, 18 @ 3:06 pm:

@JSMill - Also, Wisconsin teachers only accrue 1.6 points per service year (vs 2.2 here) and get 65% of final pay (vs 75% here), probably because they also participate in Social Security. This means a smaller pension and/or a longer career.

I highly doubt any IL teacher would trade for WI’s pension plans and full funding.

- City Zen - Monday, Jul 2, 18 @ 3:16 pm:

==No, I’m suggesting graduated income tax, but not a tax on retirement income.==

So Illinois will become the first state in America to have a graduated income tax but not tax retirement income? That counters every argument made about Illinois being an outlier in its current income tax policy.

- Demoralized - Monday, Jul 2, 18 @ 3:50 pm:

== This means a smaller pension and/or a longer career.==

See Tier II. We’ve already accomplished that goal here.

- Demoralized - Monday, Jul 2, 18 @ 3:50 pm:

==So Illinois will become the first state in America to have a graduated income tax but not tax retirement income? ==

Sigh. Where is it written that we have to be like every other state?

- JS Mill - Monday, Jul 2, 18 @ 4:03 pm:

@CZ- in WI the teachers/school put next to nothing into their pension and get 65%. With SSI on top of that. What isn’t to like? For nearly the entire history of the WI system the state covered the whole pension.

As a TRS member speaking only for myself, I’ll take their deal. I will earn a pension but I also contributed mightily to SSI in my first career yet loose most of that and supplement SSI bailouts to boot. If I was in WI most of my pension would have been covered by the state.

- City Zen - Monday, Jul 2, 18 @ 4:16 pm:

==We’ve already accomplished that goal here.==

So Wisconsin pensions are nearly 100% funded because of a law passed in 2011? Or is it because their pensions were a bit smaller and shorter in duration? I’m going with B.

==Where is it written that we have to be like every other state?==

It’s written in HR1025: “Of the 41 states in the country with an income tax, 33 have progressive rate structures…”

Each of those 33 states tax retirement income. So let it be written…

- vincespeegle - Monday, Jul 2, 18 @ 4:18 pm:

After exploring a number of the articles on your blog, I really appreciate your technique of blogging. I saved it to my bookmark site list and will be checking back soon. Take a look at my website too and let me know your opinion.

- Demoralized - Monday, Jul 2, 18 @ 4:21 pm:

==So Wisconsin pensions are nearly 100% funded because of a law passed in 2011? Or is it because their pensions were a bit smaller and shorter in duration? I’m going with B.=

Read what I was responding to. Teachers under Tier II will have a smaller pension and have to work longer to get it.

==It’s written in HR1025: “Of the 41 states in the country with an income tax, 33 have progressive rate structures…”==

Who cares? Again, I wasn’t aware that we have to be like everyone else.

- Demoralized - Monday, Jul 2, 18 @ 4:22 pm:

==Each of those 33 states tax retirement income.==

And for the love of pete let it go already. When you find the votes to do that come back and talk about it. You’re beating a horse that’s dead and has been run over about 300 times.

- Sue - Monday, Jul 2, 18 @ 4:24 pm:

Tier 2 is what many people would consider a Ponzi scheme. Take a lot of money from A give it to B and when A retires the pension is far less beneficial then the pensions A is being forced to fund

- Rich Miller - Monday, Jul 2, 18 @ 4:24 pm:

===Each of those 33 states tax retirement income===

Did you miss the Democratic primary where this was an issue that helped sink both of the candidates who kinda/sorta said they could back it?

- City Zen - Monday, Jul 2, 18 @ 4:51 pm:

==WI the teachers/school put next to nothing into their pension and get 65%. With SSI on top of that. ==

Right, before Act 10, the govt made the entire pension contribution. But employees had to still pay social security, so it wasn’t like nothing was coming out of their paychecks.

An IL teacher would have to work 7 years longer just to get a pension that was 12% smaller than what they currently get at full vesting. That’s 7 less years of pulling a smaller pension, which is less burden on the pension system as a whole. But there’s social security on top of that. And don’t forget the cost of all this is already baked in to salaries, and numerous sites report WI avg teacher salaries are lower than IL. If the govt is paying my pension contribution but I’m making 10% less otherwise, who’s really paying?

But to your point…would some TRS employees take that deal? No doubt, but not many.

- Illinois - Monday, Jul 2, 18 @ 7:23 pm:

Amazing: We are absorbed by Billions while the Pentagon cannot account for 21 Trillion. That is

21,000,000,000,000. Where is the money? The entire country’s money problems could be solved finding these Trillions and bringing to justice the thieves.

- ameemoynihan679 - Monday, Jul 2, 18 @ 7:58 pm:

I’ve read a few good stuff here. Certainly price bookmarking for revisiting. I surprise how a lot attempt you put to make any such magnificent informative web site.

- Anonymous - Monday, Jul 2, 18 @ 8:07 pm:

City

Should your wish come true–taxing retirement income, you will get less of what you’ve saved already. Better step up those contributions to fulfill your wishes.

- wordslinger - Monday, Jul 2, 18 @ 10:25 pm:

–I’ve read a few good stuff here. Certainly price bookmarking for revisiting. I surprise how a lot attempt you put to make any such magnificent informative web site.–

LP, back to the shop. The Kazan whiz kids missed a couple keystrokes before the reboot.

- City Zen - Monday, Jul 2, 18 @ 11:16 pm:

==Should your wish come true–taxing retirement income, you will get less of what you’ve saved already.==

Let’s do the math. $500 in higher taxes today (which is where we’re headed if we raise taxes on working wages and not retirement income) is $500 I cannot save for my retirement. In 20 years, that $500 earning 6% interest yearly would be $1,600. The tax on that $1,600 in retirement would be around $100. So if you’re asking me if I should give the state $500 now or collect $1,500 net in retirement, I chose the latter.