|

The new gilded age

Thursday, Jul 19, 2018 - Posted by Rich Miller * Some Illinois numbers from the Economic Policy Institute…

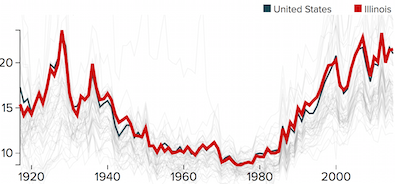

* Historical look at share of income by top 1 percent…  The all-time high of 23.9 percent was reached in 1928. The EPI reports that five states, 30 metro areas and 78 counties have now topped that number. The most “equal” town in Illinois is Johnson, in the deep south. Its average income for the top 1 percent is $279,021, while the average for everyone else is $36,881, giving it a top-to-bottom ratio of 7.6. County data is here, municipal data is here. Hat tip to Jake, who notes the obvious: In Illinois, the top 1% take home more than 21% of all the income in the state…but pay the same state income tax rate.

|

- wordslinger - Thursday, Jul 19, 18 @ 12:50 pm:

Those nostalgic for the days of a strong middle class, there it is, between 1945 and 1980.

Post New Deal security measures, union protections, GI Bill, revolution in homeownership with FHA and Fannie opening up the world of capital to working people, massive road building, etc.

It’s been done.

- Honeybear - Thursday, Jul 19, 18 @ 12:56 pm:

Only unions actual fight

for better wages and benefits

for the 99%.

Most politicians are feckless

Or in the pockets

Of the 1%

Organize

- Montrose - Thursday, Jul 19, 18 @ 12:56 pm:

Its not like anything bad happened after 1928, so I see no reason to worry.

- Put the fun in unfunded - Thursday, Jul 19, 18 @ 12:57 pm:

So per Jake, the top 1% are paying 21% of all income tax to the state. What percent should it be?

- Honeybear - Thursday, Jul 19, 18 @ 1:03 pm:

“Scorn to take the crumbs they drop us

All is ours by right.

Forward now, all hell can’t stop us

Crush the Raunerite

(With apologies to Ralph Chaplin)

- Put the fun in unfunded - Thursday, Jul 19, 18 @ 1:07 pm:

BTW Rich I think it is “gilded”

- Anon1234 - Thursday, Jul 19, 18 @ 1:19 pm:

I’ve heard there is a way to move the bottom 99 percent into the top 1 percent.

- Anonymous - Thursday, Jul 19, 18 @ 1:21 pm:

Put the Fun is exactly correct. They pay the same % but in actual dollars they pay waaaaaaaay more than everybody else.

- 47th Ward - Thursday, Jul 19, 18 @ 1:23 pm:

Employment is at a nearly all-time high, and yet the number of Americans relying on food stamps hasn’t dipped from the recession years.

https://www.bloomberg.com/news/articles/2018-07-19/food-stamp-use-still-above-recession-era-despite-u-s-job-gains

Once again, the taxpayers are subsidizing Walmart, Amazon and so many other “job creators” by providing SNAP, Medicaid, etc. And the GOP boot-lickers in Congress continue to insist that Americans work in exchange for public aid. Next they’ll require that poor people work two jobs or they’ll cut food stamps again.

But even now, as I type this, the Republicans in Congress are trying to cut taxes again.

It’s simple math. When are people going to wake up?

- JS Mill - Thursday, Jul 19, 18 @ 1:24 pm:

=So per Jake, the top 1% are paying 21% of all income tax to the state. What percent should it be?=

More than 21%.

- Big Jer - Thursday, Jul 19, 18 @ 1:25 pm:

Put the fun in unfunded

====So per Jake, the top 1% are paying 21% of all income tax to the state. What percent should it be?===

Read it again. The 1% make 21% of the INCOME in the state, but pay the same income tax RATE as those at the lower income brackets.

- Actual Red - Thursday, Jul 19, 18 @ 1:32 pm:

Top earners pay the same rate as everyone else on income, but because of things like sales and property taxes, tend to actually pay a substantially lower percentage of their overall income in taxes than middle and low earners. Thus, they should pay a higher income tax rate to compensate.

- lost in the weeds - Thursday, Jul 19, 18 @ 1:36 pm:

The 1 percent obtain their wealth from government and the 99 percent. They also get things like roads, police protection, legal system, environmental protection and weather forecasts. They need more of those things to protect their wealth than the 99 percent.

- Grandson of Man - Thursday, Jul 19, 18 @ 1:50 pm:

It’s way past time that the highest incomes are taxed at higher state rates in Illinois, ballpark to Wisconsin, Iowa and Minnesota. Voters support it, but not one Republican would consider it.

Rauner is fighting with all his might and spending millions to not pay his fair share, and to gouge workers. It’s ironic that he’s spending tens of millions to save a lot less that he would pay with a tax hike. Clever by half, a trait of zealots.

Is there not one Republican who is willing to work with her or his fellow legislators and craft a proposal that will raise taxes on people like Rauner and Pritzker and cut them on the majority or large majority of earners?

Pritzker owes his supporters, and all state residents, a plan that raises taxes on the super-rich and cuts them on many others.

- Not a Billionaire - Thursday, Jul 19, 18 @ 1:50 pm:

They are not paying 21 % of taxes they make 21% of All income.the top 4 make 35% of All income. That is those over 200000. That is why we have financial problems and ridiculously regressive taxes like property and sales.

- blue dog dem - Thursday, Jul 19, 18 @ 1:58 pm:

1945 to 1980. The good old days of American manufacturing and fair trade agreements.

- NeverPoliticallyCorrect - Thursday, Jul 19, 18 @ 2:01 pm:

So what. https://www.nationalreview.com/2018/07/income-inequality-millennials-wrong-thing-to-be-worried-about/ This is not automatically a bad thing.

- anon2 - Thursday, Jul 19, 18 @ 2:05 pm:

When it comes to taxation, I agree with FDR: “Taxes should be levied according to ability to pay. That is the only American principle.”

This venerable principle goes back to 1776 and Adam Smith, the father of capitalism. In The Wealth of Nations, Smith posited that a fair tax in a capitalist economy should “remedy inequality of riches as much as possible, by relieving the poor and burdening the rich.”

- Soccermom - Thursday, Jul 19, 18 @ 3:10 pm:

Lost is correct. The top 1% should pay a higher percentage because they receive a higher percentage of government services.

I mean, if the SEC were only protecting my stock investments, they could pretty much work a 40-second work week…

- City Zen - Thursday, Jul 19, 18 @ 3:11 pm:

==In Illinois, the top 1% take home more than 21% of all the income in the state…but pay the same state income tax rate.==

As they do in Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, Wyoming, Colorado, Indiana, Massachusetts, Michigan, North Carolina, Pennsylvania, and Utah.

- ughh - Thursday, Jul 19, 18 @ 3:15 pm:

–Read it again. The 1% make 21% of the INCOME in the state, but pay the same income tax RATE as those at the lower income brackets.–

Does that mean they pay 21% of the income taxes also?

- City Zen - Thursday, Jul 19, 18 @ 3:24 pm:

==Does that mean they pay 21% of the income taxes also?==

According to the Civic Federation, yes.

https://www.civicfed.org/sites/default/files/further_agi_stratification_feb_16_2018.pdf

- SAP - Thursday, Jul 19, 18 @ 3:25 pm:

All sounds like a good argument for raising the (federal) minimum wage. If the bottom tier of the 99% makes more money, it will require fewer government services while paying more income tax. The tax cut for the wealthy should leave employers in a position to pay higher wages.

- Dead Head - Thursday, Jul 19, 18 @ 4:01 pm:

Couldn’t help but notice the date of 1928. Seems like something big happened right after that.

- Da Big Bad Wolf - Thursday, Jul 19, 18 @ 4:23 pm:

==Couldn’t help but notice the date of 1928. Seems like something big happened right after that.==

Seems like the original gilded age happened before that. As they say, karma’s a witch.

- Last Bull Moose - Thursday, Jul 19, 18 @ 5:24 pm:

Is 21% of income the same as 21% of taxable income? I think not as Social Security and pensions are not taxed. Those are not a large percentage of income for the top tax %.

I am not sure how property taxes break out. Chicago seems to underpay compared to the rest of the state. In my neighborhood the higher value homes pay much more in property taxes. Another wrinkle is how property taxes are built into rental units. Particularly with the new tax law, property taxes on commercial property are tax deductible. Property taxes are not deductible for individuals to who do not itemize and of limited value to those who do.

Do the rich disproportionately benefit from roads, police, prisons, DCFS, DHS, and public teacher pensions? If yes it is not proportionate to their income.

Progressive taxation may be the right method, but the math is not as simple as it seems.

- Another Miller - Friday, Jul 20, 18 @ 3:31 pm:

Plot Madigan’s reign on that chart…and he is supposedly “for the people”?