* Tribune…

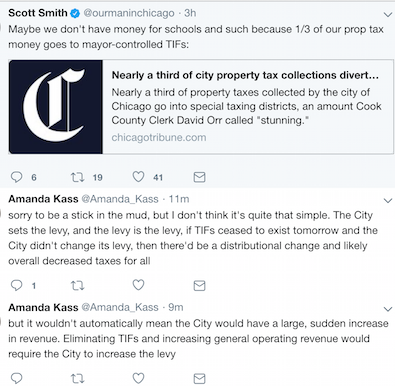

Nearly a third of property taxes now collected by City Hall go into 143 special taxing districts controlled by Mayor Rahm Emanuel and aldermen, according to a new report by Cook County Clerk David Orr.

Orr said a record-high $660 million poured into tax-increment financing funds last year, which was more than 31 percent of the $2.1 billion-plus that city government collected. The veteran clerk called the percentage “stunning.”

* And then …

- wordslinger - Wednesday, Jul 25, 18 @ 1:21 pm:

–Nearly a third of property taxes now collected by City Hall go into 143 special taxing districts controlled by Mayor Rahm Emanuel and aldermen,–

What an extraordinary coincidence.

- Roman - Wednesday, Jul 25, 18 @ 1:23 pm:

There goes that Amanda Kass again. Always muddying up arguements with pesky facts.

- 47th Ward - Wednesday, Jul 25, 18 @ 1:25 pm:

Most of the $660 million has already been spent. It’s not like this money can be diverted to other public purposes. A lot of it is paying back bonds that were sold and backed by TIF revenue. And it started long before Emanuel arrived at City Hall.

- DuPage Saint - Wednesday, Jul 25, 18 @ 1:26 pm:

This is just one big slush fund for political payoffs. I wish we had a Paul Powel back

There must be s reformer somewhere in Springfield to take this on state wide. Should be up Rauner’s alley What does J B think or propose?

- Jake From Elwood - Wednesday, Jul 25, 18 @ 1:31 pm:

TIF allows municipalities to seize property tax dollars otherwise earmarked for schools, park districts, and other taxing districts for “allowable” TIF expenditures. The expenditures are supposed to fall within statutory guidelines but the munis have great latitude. Then these same munis brag about how they do not increase the municipal property tax levy. They do not have to–they have obtained access to the tax increment that would have otherwise went to these other taxing bodies.

Does this sound fair to you?

- Juice - Wednesday, Jul 25, 18 @ 1:34 pm:

47th ward, actually very little TIF revenue is reserved for debt service. Most of the money is used for pay-as-you-go projects. Daley issued some TIF backed bonds a little over a decade ago for his school construction program, but the revenues needed to cover that debt service is a pretty tiny fraction of all TIF Revenues.

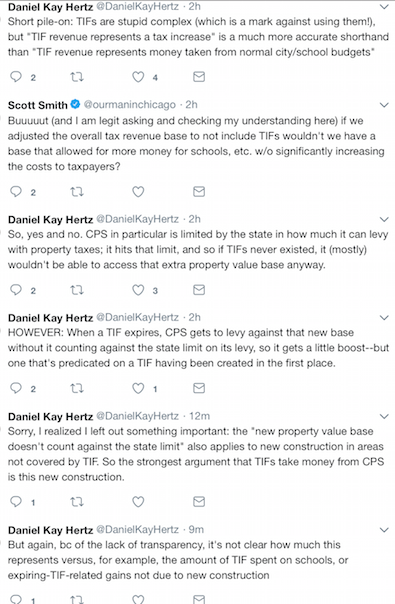

And on Amanda and Daniel’s point, because of the way PTELL and State funding works, CPS is better off with large TIF surpluses being generated annually than having access to that additional EAV.

- anon2 - Wednesday, Jul 25, 18 @ 1:54 pm:

=== the munis have wide latitude ===

Legislators who don’t like how Chicago and other munis use their wide latitude ought to narrow it. Talk is cheap.

- JS Mill - Wednesday, Jul 25, 18 @ 2:01 pm:

=TIF allows municipalities to seize property tax dollars otherwise earmarked for schools, park districts, and other taxing districts for “allowable” TIF expenditures. The expenditures are supposed to fall within statutory guidelines but the munis have great latitude. Then these same munis brag about how they do not increase the municipal property tax levy. They do not have to–they have obtained access to the tax increment that would have otherwise went to these other taxing bodies.=

Spot On.

Having been on the wrong end of TIF’s it has always amazed me that one locally elected body can forcefully change the economics of another. It just shouldn’t be that way.

Not for nothing, but to my knowledge only one TIF has ever been succesfully challenged and that one was in Burr Ridge (on the Cook County side). You can see it from I 55 at the intersection of I 55 and county line road. On the property is a swanky “downtown” development, a Marriott hotel, Lifetime fitness and more. I guess it wasn’t “blighted” after all.

- Keyrock - Wednesday, Jul 25, 18 @ 2:01 pm:

I’ve always wanted to know a lot about TIF districts. The potential for corruption is so vast.

And I learned much of this, before, from the fine work the Reader used to do.

- BlueDogDem - Wednesday, Jul 25, 18 @ 2:21 pm:

Same sentiments as Word. Darn. That hurts.

- The Captain - Wednesday, Jul 25, 18 @ 2:36 pm:

Amanda and Daniel are treasures and if you have a Twitter account they are must-follows. My favorite thing about them isn’t what they know, it’s what they’re curious about. If you follow them on Twitter you often end up going down some rabbit hole with them as they try to learn about some new topic and in most cases it’s an incredibly useful exercise.

- Arthur Andersen - Wednesday, Jul 25, 18 @ 2:37 pm:

Meanwhile, here in Springfield, $750,000 of Downtown TIF funds were used to replace the leaky roof at City Hall.

Still don’t know how that one got through.

- Jake From Elwood - Wednesday, Jul 25, 18 @ 2:44 pm:

AA, if City Hall was located within a TIF District, funds from the Springfield School District, Sanagmon County, Community College, Township, etc. can be used to improve a municipal building. It is perfect legal.

Not exactly what the taxpayers thought their school taxes were being used for, but legal.

- Leatherneck - Wednesday, Jul 25, 18 @ 2:46 pm:

And another TIF district is proposed for northeast Springfield (but within Riverton’s school district boundaries) for a lumber company that will compete directly against RP Lumber and our old friend Jason Plummer (who is quoted in opposition to TIFs in general in the SJR story below):

http://www.sj-r.com/news/20180725/riverton-schools-park-board-speak-against-lumber-lane-tif

- Mahesh - Wednesday, Jul 25, 18 @ 3:01 pm:

How to fix TIF. 1) If bonds not issued, then life of TIF district should be 5 years. 2) Don’t allow funds to move between districts. 3) Inactive TIFs should be terminated immediately.

And other stuff of course

- Precinct Captain - Wednesday, Jul 25, 18 @ 3:02 pm:

The TIF scam never ends.

- Rich Miller - Wednesday, Jul 25, 18 @ 3:03 pm:

===If bonds not issued, then life of TIF district should be 5 years===

Gee, I can’t imagine a single unintended consequence of that rule.

- sulla - Wednesday, Jul 25, 18 @ 3:25 pm:

Every nice looking building in my downtown that has redeveloped in the last 15 years has utilized TIF monies.

That brewpub that redeveloped a vacant building? TIF.

Those density-increasing second story lofts above main st which have been instrumental in attracting young urban professionals to our “dying” community? TIF.

The new 24-hour downtown gym? TIF.

Bike shop? TIF.

The health food store that recently went into that old hotel building, vacant since the 1980’s? TIF.

The black box community Theater downtown? TIF.

Those are just the first few that come to mind. None of these projects would have happened but for TIF dollars. While I’m sure that Chicago can find a way to make any economic development tool nefarious and scummy, TIF has been a godsend to my community’s downtown.

- Nieva - Wednesday, Jul 25, 18 @ 3:44 pm:

Does Chicago have a TIF just to pay for lawsuits against the police department??

- The Iceman Cometh - Wednesday, Jul 25, 18 @ 3:58 pm:

===Does Chicago have a TIF just to pay for lawsuits against the police department??===

Lol. No, but that might be better than how city hall’s paying them now.

http://www.chicagobusiness.com/article/20180706/ISSUE01/180709939/chicago-police-misconduct-settlement-costs-inflated-by-debt

- titan - Wednesday, Jul 25, 18 @ 4:16 pm:

===If bonds not issued, then life of TIF district should be 5 years===

A lot of large development projects require more than 5 years for build out.

When my old firm did redevelopment deals from the public side, we liked to trigger the spending of public money on the developer hitting certain benchmarks along the life of the project to make sure it was getting built to schedule before the public money was obligated.

- Change Agent - Wednesday, Jul 25, 18 @ 4:34 pm:

“I wish we had a Paul Powel.” [sic]

I’m no fan of TIFs, but I think even TIFs are more transparent than shoeboxes.

- Question - Wednesday, Jul 25, 18 @ 4:47 pm:

This was a surprisingly productive use of social media…

- Arthur Andersen - Wednesday, Jul 25, 18 @ 4:49 pm:

Jake, thanks. The City believed it was legal as well. That doesn’t mean it’s right, of course.

- Chicago 20 - Wednesday, Jul 25, 18 @ 8:40 pm:

The TIF district “Retail Raiding” rules prohibit businesses from moving their business to a TIF district that is less than 10 miles away from their present location. Yet time after time again businesses move into a TIF district that’s less than 10 miles away leaving a vacant building behind and burdening everyone else with their civic responsibilities with no retail raiding law enforcement.

- blue dog dem - Wednesday, Jul 25, 18 @ 10:46 pm:

TIF. Free market capitalism in Rauner-speak.

- Liandro - Thursday, Jul 26, 18 @ 9:36 am:

“The potential for corruption is so vast.”

So…exactly like the rest of government? /snark

To the post: I won’t jump into Chicago TIFs, which have their own reputation, but in rural areas TIF is the single most effective financial tool for developing a community. There are countless developments and improvements that simply would not happen if rural communities didn’t have this tool at their disposal. In the end, that damages every government, including the schools.

As for those school districts, TIFs are very rarely (from my vantage point, which DOES NOT include Chicago) used for residential development. So, new development or infrastructure comes in without directly increasing the work load on schools. In counties that have approved a school sales tax (recently to include Lee County), the districts often receive new revenue without any new residential dev.

Now, the discussion can (and should) get more complex and talk about secondary impacts (like luring new residents, and thus impacting the schools). At that point, though, we have to range wide enough to include the state funding formula, offsets, long-term tax base benefits, etc. Heck, just talking about the quality-of-life aspects is game-changing for many rural communities. That is something big-city types (and I LOVE the big city) can’t understand, simply because they may have never lived in a community where things they consider “normal” are several counties away.

Like anything complex (and TIF certainly is), it gets easy to buy into more simplified conclusions on what TIF is and does (good and bad). The vast majority of residents I talk to about TIF have no clue how it works, so a subsequent discussion of pro and cons is very difficult.