Pension benefits are not cut in the abstract

Tuesday, Nov 20, 2018 - Posted by Rich Miller

* Crain’s op-ed…

Not that it ever really did, but Illinois no longer has any excuse for not dealing with its pension crisis, given how Arizona has reformed its system. Arizona’s state constitutional pension protection clause was identical to Illinois’ in promising that “benefits shall not be diminished or impaired.” As in Illinois, its courts struck down, as violations of that clause, legislative reforms that would have reduced certain pension benefits.

But this month, Arizona voters passed Proposition 125 to amend the constitution to reduce benefits for two of its major pensions, covering corrections officers and elected officials. In 2016, voters passed Proposition 124 for an amendment to reduce pension benefits for police and firefighters.

The world hasn’t ended in Arizona. The working class hasn’t been destroyed. Pensioners aren’t dumpster diving. Prospects for pensioners actually getting a fair, predictable benefit have improved.

The particulars of the benefit reductions in Arizona aren’t important for now—they mostly addressed cost-of-living increases. Exactly what an Illinois amendment should say and what the resulting reforms should be are a discussion for a different day. The point for now is just that if the state constitution has to be changed to address an otherwise insurmountable pension crisis, then change it.

The actual benefit reductions are almost always “a discussion for another day.”

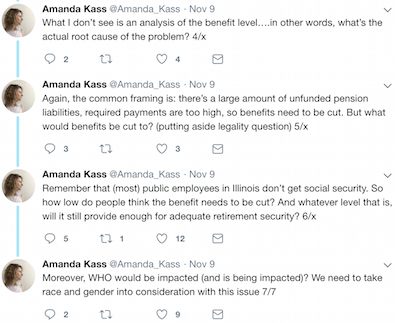

* Amanda Kass brought up a very valid point last week. How much should pensions be cut for real people?…

* Bad laws are often made during trying times because legislators can get caught up in the emotions of the moment. It goes without saying that a proposal to cut police pensions and survivor benefits wouldn’t go very far on a day like today, regardless of the fiscal need.

But it’s also important to remember that current and future pensioners are not just random entries on a spreadsheet. These are human beings.

…Adding… From the op-ed writer…

First, these are not “haircuts.” You get a haircut at a barber shop. These would be benefit cuts to real Illinoisans, something he still won’t fully admit to. How big do these cuts have to be? And who would see their benefits reduced?

And I’ve never said that the pension systems are in fine shape. That’s a complete fabrication on his part. But that’s what people like him do. Anyone who disagrees in the slightest is a “denier” who will be “held culpable in the end.” Such a tough guy.

- Arsenal - Tuesday, Nov 20, 18 @ 11:12 am:

==The world hasn’t ended in Arizona.==

The amendment was passed *this month*, Crain’s. Maybe wait for actual results before declaring success?

- Arsenal - Tuesday, Nov 20, 18 @ 11:14 am:

Like, has anyone’s benefits actually even been reduced yet?

- Benniefly2 - Tuesday, Nov 20, 18 @ 11:15 am:

Isn’t it a little early for a victory lap on this one? If the amendments seek to diminish existing folks pension benefits after the fact, won’t there be a legal challenge coming regarding the contract clause of the US Constitution? If it survives that, well… That’s another story.

- NeverPoliticallyCorrect - Tuesday, Nov 20, 18 @ 11:16 am:

There are only a few options. The state can continue to ignore and hope for multiple years of fund growth that eliminates the funding shortfall. Or it can raise taxes and fees to bring in enough money to ensure the solvency of the funds. Or it can choose to create a pension system that is fair and sustainable and as of a certain date have all new employees in that system. We’ll still have to deal with the currently employed and their obligations but it will put a cap on future concerns. Is the correct answer, “When pigs fly?”. I don’t know but the status quo won’t cut it for much longer.

- titan - Tuesday, Nov 20, 18 @ 11:17 am:

Arsenal - it looks like this week’s vote was the 2nd time:

“In 2016, voters passed Proposition 124 for an amendment to reduce pension benefits for police and firefighters.”

But it would be nice to get a sense of what reductions were made there (and whether they are in the process of being litigated).

- Rich Miller - Tuesday, Nov 20, 18 @ 11:20 am:

=== I don’t know but the status quo won’t cut it for much longer===

Then get on it and tell us who gets cut by how much.

- Trapped in the 'burbs - Tuesday, Nov 20, 18 @ 11:21 am:

People don’t realize that with the creation of Tier 2, the pension crisis needs to be framed in two parts. The Tier 2’s have significantly lower benefits that cannot be collected until age 67. This really means that the crux of the pension problem is what to do with Tier 1 recipients. For Tier 1 people, the problem is funding the benefits and the COLA’s. There are a number of ways to deal with the Tier 1’s without amending the Constitution. It requires some political courage and grown ups from both sides of the aisle to work collaboratively to impose the difficult solutions. Tier 2’s will draw comparatively diminished benefits later in life and for fewer years than their Tier 1 counterparts. Finally, the creation of Tier 3 will further tweak the benefits that state employees will earn.

- Crispy - Tuesday, Nov 20, 18 @ 11:22 am:

Plus one for both Arsenal and Benniefly2, and amending, “The world hasn’t ended *for you,* Crain’s.” I doubt it would end for higher-level pensioners such as school and university administrators, either. For groups such as teachers and other rank-and-file public workers, whose pay base is lower to start with, that remains to be seen.

- Anonymous - Tuesday, Nov 20, 18 @ 11:23 am:

Ever notice that the people who say that “blue lives matter” won’t lift a finger to help pay for them?

- Anonymous - Tuesday, Nov 20, 18 @ 11:24 am:

I’ve always said, go ahead cut my pension. It wouldn’t take too much of a cut to get me food stamps and subsidized housing and other government benefits. So pay me one way or another. Either way, when you work for the “government”, they’re paying your livlihood.

- Moby - Tuesday, Nov 20, 18 @ 11:24 am:

== Or it can choose to create a pension system that is fair and sustainable and as of a certain date have all new employees in that system. ==

Pretty sure that already happened in 2011 with Tier 2.

- Perrid - Tuesday, Nov 20, 18 @ 11:26 am:

@NeverPoliticallyCorrect “Or it can choose to create a pension system that is fair and sustainable and as of a certain date have all new employees in that system. ”

Have you heard of this nifty new thing called Tier 2? It’s so “fair” that it likely isn’t legal for employees where the state doesn’t pay Social Security, because it’s skimpier than SSA.

- DarkDante - Tuesday, Nov 20, 18 @ 11:32 am:

I think low hanging fruit would be to adjust the 3% COLA in Tier 1 to the “lesser of 3% or half of CPI” standard used in Tier 2. I don’t know that this would save the billions necessary/desired, but it can be a launching point for further discussion. The state might also think about setting caps on retirement salaries, or taxing state retirement above a certain level (create a kind of artificial ceiling). I’m not overly well versed on this topic, but, as a state employee, I can tell you it is often talked about in my hallways.

- Grandson of Man - Tuesday, Nov 20, 18 @ 11:33 am:

The world certainly won’t end if and when we right-size the tax code, so the highest incomes in Illinois are taxed at rates similar to Wisconsin, Iowa and Minnesota.

But Republicans are not change people, so Democrats may have to change the tax code themselves, which is very hard. I hope a plan is done that is sellable to a few Republicans.

State workers already took cuts: Tier II pension reform, deferring COLA’s and getting stiffed on payback for years and now no step increases and no longevity pay since sometime in 2015.

- wordslinger - Tuesday, Nov 20, 18 @ 11:33 am:

How much does Crain’s want to cut pension benefits already earned by cops today?

And how does Crain’s propose to get around Article I, Section 10 of the U.S. Constitution?

- Aldemuvs - Tuesday, Nov 20, 18 @ 11:34 am:

I believe that Proposition only lowers the COLA to a more manageable rate. I have no problem with this: “In 1998, the maximum possible increase was capped at 4 percent. The 2018 amendment’s proposed cost-of-living adjustments (COLA) was based on the inflation rate for the Metropolitan Phoenix-Mesa Consumer Price Index, with the maximum possible increase capped at 2 percent.[1][2]”

- Generic Drone - Tuesday, Nov 20, 18 @ 11:35 am:

I seriously do not understand why anyone would ever consider a career in state government outside of running for political office. With attacks coming from all sides, the constant “benefits are too generous”, pay freezes, contract disputes, blame placed in public forums, press and by legislators. I never thought wanting to assist those with disabilities would cause me and others the feeling of helplessness while others determine our fate.

- Jocko - Tuesday, Nov 20, 18 @ 11:35 am:

==Illinois no longer has any excuse for not dealing with its pension crisis==

Ever notice how Crain’s (and the ILGOP) talk of “dealing with (pensions)” sound a lot like something uttered in Goodfellas or Donnie Brasco?

- Anonymous - Tuesday, Nov 20, 18 @ 11:35 am:

In earlier discussions of this issue, some well-informed commentators (including the revered RNUG, IIRC) said that changing the constitution would not affect payments to current retirees (or even those employed before the change) because they would be protected under the US Constitution. (Presumably section 10,)

Informed views about that? How does it apply in this case? (Have the courts ruled?)

- Former Mayor - Tuesday, Nov 20, 18 @ 11:36 am:

Is there a difference between the problems in Illinois and Arizona. The primary cause of the problem in Illinois has been the failure of the State to provide their required funding and I think it has been said in a he past they took $ out. Is that the same cause in Arizona.

- CumberlandCoHick - Tuesday, Nov 20, 18 @ 11:40 am:

Dear JB, When it comes to pensions and so called reforms do not listen to the legislature or interest groups! Listen to neutral actuaries, please listen to the actuaries to avoid making the pension problem worse again. No ramps, ask ole Jim Edgar about ramps.

- Demoralized - Tuesday, Nov 20, 18 @ 11:41 am:

It’s easy to take money from other people isn’t it?

I’m with Rich. All you people who are so eager to cut public employee pensions please tell us all how much you want them cut.

And then cut your income by the same amount. That’s fair given some of the arguments we get from the anti-public employee pension crowd. We don’t get it so neither should you.

- My Button is Broke... - Tuesday, Nov 20, 18 @ 11:42 am:

==The particulars of the benefit reductions in Arizona aren’t important for now—they mostly addressed cost-of-living increases.==

Yes they are important. Arizona reduced the annual cost of living adjustment to CPI, with a maximum of 2%. Previously, it was calculated in a weird way and wasn’t proportional, it was everyone gets the same dollar level increase. This was the only benefit for current employees that was reduced. The reason the unions supported it, was because it was a reasonable change and they weren’t making a draconian cut. (The benefit reduction was passed before people voted on the constitutional amendment, so voters and unions knew what benefits were being reduced.) The law also made numerous reductions to the pensions of future employees (i.e. Tier II).

Essentially, Arizona was being reasonable with the unions and they saw the need for a slight haircut for current employees and retirees and agreed. Given the history in Illinois with certain interests trying to essentially freeze employees’ benefits at their current level and switching to a defined contribution plan, I can see why unions don’t want to play ball. Even if those interests say we just want to give you a small haircut, agree to eliminate your constitutional protections, the unions know once that happens, they will again insist that benefits be cut again and again.

- Precinct Captain - Tuesday, Nov 20, 18 @ 11:42 am:

==Anonymous - Tuesday, Nov 20, 18 @ 11:35 am:==

It’s whatever deniers and melodramatics like you don’t want.

- Demoralized - Tuesday, Nov 20, 18 @ 11:42 am:

And why does a respected publication like Crain’s let the likes of Glennon in their pages?

- tobor - Tuesday, Nov 20, 18 @ 11:43 am:

Ted Dabrowski – where he spent six years as Vice President of Policy and Spokesman at the Illinois Policy Institute.

- Duke of Normandy - Tuesday, Nov 20, 18 @ 11:47 am:

I don’t have all the data, but I don’t think too many people who receive pensions missed payments. It cracks me up how the “solution” is always to punish people who held up their end of the bargain.

- thunderspirit - Tuesday, Nov 20, 18 @ 11:47 am:

I don’t recall the State giving State employees the option to not pay the employee contribution to the pensions for any given paycheck. Maybe I missed that.

- Stones - Tuesday, Nov 20, 18 @ 11:48 am:

Wouldn’t such a change to retiree’s benefits constitute an ex post facto law?

- Nick Name - Tuesday, Nov 20, 18 @ 11:50 am:

Mark Glennon forgot one thing. “the benefits of which shall not be diminished or impaired” is not the only provision in the pension language in the Illinois Constitution. Membership in a state pension or retirement system “shall be an enforceable contractual relationship,” the constitution says.

Which protects state pensions under Article I, Section 10 of the U.S. Constitution, which prohibits states from “impairing the obligation of contracts.”

Just once, I’d like to see one of the screamers for “pension reform” tell the General Assembly to put on their big boy pants and do what they should have been doing all along: fulfill their constitutional obligation to just fund the dang pension, and pay down the debt.

- Anon324 - Tuesday, Nov 20, 18 @ 11:51 am:

A lot of the comments take aim at Crain’s, but let’s be fair–this isn’t an editorial, it’s an Op-Ed, written by Mark Glennon. Go have a read of some of his work on his website and you’ll see what you’re dealing with. He’s not interested in having an honest conversation, so much as making sure everyone knows libs and RINOs like Edgar ruined this state and keep making it worse. This may as well have been put out by Dan Proft’s “newspapers” or the IPI.

- A Jack - Tuesday, Nov 20, 18 @ 11:52 am:

The op ed author works for WirePoints. It just appeared in Crains. Crains has been fair in the pension discussions, but likely has to publish these fringe opinions. So please just beat up WirePoints instead of Crains.

- Annonin' - Tuesday, Nov 20, 18 @ 11:53 am:

Looks like AZ pols raised pension contributions by .3 % (about $150 per worker per year)

Many doubt a similar action in IL could not be used to cut benefits for anyone in the system — either worker or retiree.

- Perrid - Tuesday, Nov 20, 18 @ 11:53 am:

@Stones, don’t think it would be ex post facto. Think that’s more for criminal cases, where you make a new law criminalizing some action and then punish people who took that action before the law passed. This isn’t criminal, and there isn’t any “punishment”, just a broken promise. Not a lawyer though.

- Juice - Tuesday, Nov 20, 18 @ 11:55 am:

So without even getting into the pension particulars of Glennon’s argument. The Illinois constitution requires that 60% of those voting on the question vote “yes” for the amendment to take effect. (Or 50% of those voting in the election, which there is so much dropoff on these questions that I don‘t Know if it has ever been met.)

The amendment that was adopted in Arizona passed with 51.73% of the vote. Pretty far from the vote that would be needed to be adopted by the voters in Illinois. And that was an agreed upon amendment (I think) with a more conservative electorate.

- Chicago 20 - Tuesday, Nov 20, 18 @ 11:57 am:

More vile, brutal, biased, Koch funded propaganda with no regard to the pensioners.

What happened to Crain’s?

- Leigh John-Ella - Tuesday, Nov 20, 18 @ 12:04 pm:

Mark Glennon once again ignores the plain language of the Illinois Constitution and at least two Illinois Supreme Court decisions because they don’t fit the argument he wants to make.

An authority on retirement savings wouldn’t ignore legal rulings and laws and the constitution.

He’s not an authority. He’s just angry.

If he were devote some of that energy into constructive ideas rather than an all-out war on pensions, he might be taken seriously.

For now, he should not be taken seriously.

- Norseman - Tuesday, Nov 20, 18 @ 12:08 pm:

The biggest impediment in making the pension funding issue better is the insistence that nothing other than reducing benefits should be on the table. Everyone wants certainty and fulfillment of what they were promised.

We were told to agree to a haircut, and then everything will be fine. The problem is who defines the nature of the haircut and how many haircuts will folks be forced to take because of the incompetence of the barbers. We saw the cutters were more interested in saving a bunch of money, not ensuring folks were treated fairly.

Our constitutional protection stopped this unfair attempt to renege on the guarantees we were given.

- Fixer - Tuesday, Nov 20, 18 @ 12:08 pm:

This is why venture capitalists should stay in their lanes.

- Skeptic - Tuesday, Nov 20, 18 @ 12:11 pm:

“I can see why unions don’t want to play ball.” A pensions isn’t the union’s ball to play with. So there’s that.

- Jake From Elwood - Tuesday, Nov 20, 18 @ 12:19 pm:

And I thought former Bears QB Mike Glennon was bad…

Ideas For the fodder (Until RNUG debunks them):

1. Raise contributions on all future recipients across the board. They are based on percentages of salaries.

2. Everyone foregoes a raise one year and the difference is placed into the pension coffers for investment. Those of us in the private sector are not guaranteed salaries, some years there is no raise. Kind of the opposite of the old Blago pension holiday.

3. More steps to eliminate loathsome pension spiking (mostly executive level positions).

4. COLA reform (if you can find a way to make it constitutional of course).

5. BUT.. .above all things, do not decrease pensions that were promised to our public employees.

- Anotheretiree - Tuesday, Nov 20, 18 @ 12:22 pm:

I propose an amendment whereby all Bonds will have maturities extended by 5 years without interest. As long as the majority is selecting people to default on. I also propose a random selection where income tax refunds are cut by 50% . Those of you selected won’t mind helping out will you ? I’m no longer certain our pension benefits will survive a Supreme Court case. One more justice like Kavanagh and I think they will have an activist majority ready to reduce benefits in a bankruptcy action.

- JS Mill - Tuesday, Nov 20, 18 @ 12:22 pm:

Number one, any change to the pensions will not change the actual problem.

The problem is debt.

A change like the author would like still does not eliminate the pension debt. The debt, and not the annual cost of the pension, is the problem to the tune of $6-$7 billion per year. The annual cost is sub $2 billion and falling due to Tier 2.

The author of the article bravely pushes actual solutions on to “other people”.

=Or it can choose to create a pension system that is fair and sustainable =

no matter what some will never see any system which compensates public employees as “fair”. And no system that is not funded is sustainable.

The current system is fair. It is sustainable when funding is in place.

While the likes of Rauner will scream to the heavens about some UIC doctor making a huge pension, even the largest public pension payment is a fraction of what he is making annually in retirement.

The fact that Rauner made his money in the “private sector” (often through public money) does not mean he has any right to a $155 million per year retirement. We are not, as many mistakenly believe, a free market economy. We are a socialized economy. All one has to do is look to the bailouts of the banking and insurance industries of 2008-2009 to see full evidence.

The point is, that the idea that public employees are beholden to anyone is nonsense. The contract we agreed to cannot legally be changed unilaterally. If that is the case then no contract anywhere in Illinois is safe.

- A State Employee Guy - Tuesday, Nov 20, 18 @ 12:25 pm:

The AZ model is eminently reasonable, and reactions like Amanda’s, Rich’s, and these here comments, demonstrate how reason tends to get beaten over the head with a shovel in our wonderful state’s political discourse..

- Maximus - Tuesday, Nov 20, 18 @ 12:33 pm:

Apparently the consensus here at capitolfax is we should simply “pay up” and never consider any other option for the pension short fall? Current trajectory indicates the pension funds will continue to be less and less funded so at some point the funds wont have any money left. The article isnt a fringe opinion, it’s pointing out that one state is dealing with the pension underfunding by adjusting it’s constitution. If Illinois follows suit we do not know yet what the pension change would be, only that the constitution would no longer block lawmakers from trying to negotiate a solution.

- Huh? - Tuesday, Nov 20, 18 @ 12:34 pm:

Jake - regarding your #2, many state employees have gone 4 years without a raise because of the intransigence of 1.4%. So I am sure that idea is a nonstarter.

- Flapdoodle - Tuesday, Nov 20, 18 @ 12:35 pm:

So how does the Self-Managed Plan option figure in to all this? Serious question because I haven’t seen much discussion of the SMP with reference to pension reform.

- Ares - Tuesday, Nov 20, 18 @ 12:35 pm:

Can Crain’s be believed any more, when one of their Page 2 columns every week, is authored by the IL Policy Institute or another Rauner / Griffin / Profft front group? Propaganda masquerading as news / opinion.

- Jocko - Tuesday, Nov 20, 18 @ 12:35 pm:

==The AZ model is eminently reasonable==

Based on voting tallies, over 1 million Arizonans disagree with you.

- Huh? - Tuesday, Nov 20, 18 @ 12:37 pm:

Jake - regarding your #1 idea, why should state employees pay more when there is no assurance that the state is going to pay its share. The failure of the state to pay its contributions is what got us into this mess.

- Anon - Tuesday, Nov 20, 18 @ 12:38 pm:

1.) Tier 2 isn’t fair at the 4% contribution rate.

2.) It’s bad voodoo to decide that the best route to go after demanding services from public servants for decades without paying the full cost of those services is to stiff the public servants.

Who do y’all expect to work for you in the near future?

- Rich Miller - Tuesday, Nov 20, 18 @ 12:40 pm:

===demonstrate how reason tends to get beaten over the head with a shovel===

Another whiny victim heard from. Asking a simple, basic question is not beating someone over the head with a shovel.

- Truthteller - Tuesday, Nov 20, 18 @ 12:43 pm:

The 3% cola must end and any cola should be indexed to social security cola. As for benefit cuts, Illinois only has the problem because pension contributions were used to augment general fund spending instead of raising state income taxes. People and businesses derived a benefit from nearly 30 years and now instead of paying for it we want retirees to pay for it…no way is this even morally sound.

- Newbie Here - Tuesday, Nov 20, 18 @ 12:43 pm:

My first post so please have patience with me. I’ve always wondered why earned over time pay is calculated into State employee pensions. Is that covered by the Constitution or by Union agreements. I know in many cases it causes quite an increase in pension payments.

- JS Mill - Tuesday, Nov 20, 18 @ 12:44 pm:

=Current trajectory indicates the pension funds will continue to be less and less funded so at some point the funds wont have any money left. =

You may want to share your math on that whopper.

The current funding percentage is about the same as it was in 1970 when the constitution was written, just shy of 50 years ago. Tier 2 is actually adding equity to Tier 1 (a different problem all together).

Nice try.

- The Way I See It - Tuesday, Nov 20, 18 @ 12:44 pm:

An honest discussion on this will never happen until things like 6 figure pensions and double dipping are addressed. The typical pensioner gets what, $40K/ yr? People think that there are lots of retirees getting $200k a year.

- A State Employee Guy - Tuesday, Nov 20, 18 @ 12:49 pm:

COLAs gone across the board, would be a sensible and I think achievable goal. It’s also been suggested quite often in the last four years (at least) by those with more influence than I, so I’m not sure why you insist on plugging your ears and singing LA LA LA here, Rich.

- Arsenal - Tuesday, Nov 20, 18 @ 12:53 pm:

==Apparently the consensus here at capitolfax is we should simply “pay up” and never consider any other option for the pension short fall?==

Seems like you’re the first person to use the word “never”, but the idea that the government should have to pay up on the contracts it agreed to seems pretty banal to me.

- Robert Montgomery - Tuesday, Nov 20, 18 @ 12:54 pm:

Arizona is also governed by a Republican trifecta. So there’s that….

Glennon could also try to get a legislator to introduce a bill, but continuing to scream into the air will apparently have to do for now.

- Visitor - Tuesday, Nov 20, 18 @ 12:55 pm:

Repeal the Pension Clause, by Constitutional Amendment or other. Then, if Pritzker and the GA want to keep providing pensions, or switch to a Defined Contribution, in either way they can do whatever they want, however they want.

- RNUG - Tuesday, Nov 20, 18 @ 12:56 pm:

Quick comment before my phone battery dies. Arizona clause is similar but NOT identical.

- Demoralized - Tuesday, Nov 20, 18 @ 1:00 pm:

==Apparently the consensus here at capitolfax is we should simply “pay up” and never consider any other option for the pension short fall?==

That’s also the consensus of the Illinois Supreme court.

And the question that was asked here was how much these individuals would like to cut people’s pensions. It’s a fair question. And nobody has yet provided an answer.

==I’m not sure why you insist on plugging your ears and singing LA LA LA here, Rich==

I’d love for you to tell us where he’s done any such thing.

- Anonymous - Tuesday, Nov 20, 18 @ 1:01 pm:

It’s the DEBT, dummies.

- Not a Billionaire - Tuesday, Nov 20, 18 @ 1:01 pm:

It really is screaming in the air because it only got 51 percent. It authorizes a cola cut to 2 percent. It needs what 64 here and for a move from 3 to 2 and still may be unconstitutional. There was a previous attempt at an amendment here and it failed.

- RNUG - Tuesday, Nov 20, 18 @ 1:02 pm:

== I can see why unions don’t want to play ball. ==

Pensions are in individual right. The Union’s have no right to represent the employees in any pension changes.

- Anon324 - Tuesday, Nov 20, 18 @ 1:03 pm:

==COLAs gone across the board, would be a sensible and achievable goal==

If this comment serves to show the “reason” that gets hit over the head with a shovel, then we’re gonna need more shovels.

- Six Degrees of Separation - Tuesday, Nov 20, 18 @ 1:06 pm:

To add to JS Mill, in the hypothetical that the pension funds don’t have the balance to pay benefits, my guess is that the difference would be made up by “pay as you go” out of the GRF.

- A State Employee Guy - Tuesday, Nov 20, 18 @ 1:06 pm:

Rich: “Give is a solution.”

SOI, for the last few years: “Here’s a solution.”

Rich: “Why won’t anyone give us a solution?”

To be fair, it isn’t just Rich, although the irony of an ad hominem attack on someone pointing out how reasoned discussion on the matter has been lacking, is not lost on anyone.

- Maximus - Tuesday, Nov 20, 18 @ 1:08 pm:

JS Mill,

If the pensions being underfunded are never going to run out of money then we have no issue and we can just keep underfunding them?

- Lester Holt’s Mustache - Tuesday, Nov 20, 18 @ 1:08 pm:

Why is Crains publishing this loon’s opinion? I was told by a source that they were a bunch of collectivists…

- Not a Billionaire - Tuesday, Nov 20, 18 @ 1:08 pm:

This answers the way forward question. Bitter losers who will toss stink bombs to sow chaos. Look at what they are up to in Wisconsin.

- Anonymous - Tuesday, Nov 20, 18 @ 1:08 pm:

Do some people honestly believe that the AAI should be eliminated? It might be news to some, but teachers, for example, have no other income (social security–even if they qualify for it, it’s cut to pennies/month). It might also be news to some that many/most teachers are paid so little that they don’t have much to speak of in individual investments because there was little to nothing left to invest.

So some would like a teacher to receive the same amount of pension income at retirement that they receive when they die?

- SSL - Tuesday, Nov 20, 18 @ 1:09 pm:

The only pension change that is likely going to happen in Illinois already happened with Tier 2. You can argue about it all you want, but it isn’t going to change anything. Illinois Supreme Court ruled foolishly, but there’s nothing that can be done.

The only option for those that do want to be left with the bill for this train wreck is to leave the state as soon as you are able. Maybe the state will eventually collapse under the weight of the pension debt, but if it doesn’t, the masses are going to pay a lot more. The 1% will be long gone.

- Demoralized - Tuesday, Nov 20, 18 @ 1:11 pm:

==although the irony of an ad hominem attack==

Then stop acting like a victim.

- Anon - Tuesday, Nov 20, 18 @ 1:11 pm:

The easiest way to claw back a part of public pensions is to stop excluding retirement income from the Illinois Income Tax Base.

That way the folks that received the services without paying the full cost of them can help dig us out of the hole too.

- Ole' Nelson - Tuesday, Nov 20, 18 @ 1:12 pm:

Reasoned and Mark Glennon do not belong in the same sentence.

- Nearly Normal - Tuesday, Nov 20, 18 @ 1:12 pm:

Relieved to see that according to Twitter that Mark Glennon is “not followed by anyone you are following.”

- Demoralized - Tuesday, Nov 20, 18 @ 1:13 pm:

==SOI, for the last few years: “Here’s a solution.”==

It has to be a Constitutional solution. So, no, a real solution hasn’t been proposed.

Tell us how much you want to cut each individual pensions? Answer the question that was asked. You’re advocating taking money away from people so have the guts to tell them what you want to take away from them.

- Lester Holt’s Mustache - Tuesday, Nov 20, 18 @ 1:15 pm:

Random commenter: “Here’s a great solution”

Rich: “the Supreme Court already struck down this idea”

Random commenter: “how dare you ignore my solution?”

Rich: *facepalm*

- Demoralized - Tuesday, Nov 20, 18 @ 1:15 pm:

==Illinois Supreme Court ruled foolishly==

Yes. Heaven forbid they uphold the Constitution. How dare they.

- Anonon - Tuesday, Nov 20, 18 @ 1:15 pm:

Taxes to pay pension benefits are not increased in the abstract.

- Demoralized - Tuesday, Nov 20, 18 @ 1:16 pm:

==Taxes to pay pension benefits are not increased in the abstract.==

You want to bring that prose in for a landing?

- Perrid - Tuesday, Nov 20, 18 @ 1:20 pm:

Was there ever any kind of analysis on SB1? What kind of “haircut” that would have been? Because I gotta imagine that’s the baseline for the bare minimum that would get enacted if all the legal troubles magically went away.

- Not a Billionaire - Tuesday, Nov 20, 18 @ 1:25 pm:

SB 1 got Pat Quinn defeated and ended Dan Biss career as well. I am sure many commentators here would like the Dems to do something that pointless and stupid yet again.

- Anonymous - Tuesday, Nov 20, 18 @ 1:36 pm:

Since the ILlinois Supreme Court decided that penioners must be paid, period, is there somewhere else to take this problem? The Supremes said that there does exist a solution for paying down the debt, so……… It is wishful thinking that there is yet one more attack that will fly Meantime, the debt continues to grow. I guess for those who like this route as opposed to tackling the problem, these are the kinds of people who can’t manage their own debt at home and wishful thinking might make it go away.

- A State Employee Guy - Tuesday, Nov 20, 18 @ 1:37 pm:

Yeah, I was referring to the consideration model proposed by the Rauner admin, not the 2013 bill signed by the Quinn admin. The reason I said COLAs gone across the board is because under the consideration model, no one is going to choose to keep their COLAs, but I should have been more clear on that.

The thing is, and this is the important part, the 2013 bill was ruled unconstitutional, but the consideration model hasn’t been addressed by the courts.

- Fixer - Tuesday, Nov 20, 18 @ 1:40 pm:

State Employee Guy, contact your reps and senator then. Tell them to put it in a bill. Until then, as others have pointed out, it’s so much wasted breath.

- Demoralized - Tuesday, Nov 20, 18 @ 1:40 pm:

==I guess for those who like this route as opposed to tackling the problem, these are the kinds of people who can’t manage their own debt at home and wishful thinking might make it go away.==

Two things. You’re a victim and your argument is childish.

Yes, the Supreme Court has given guidance on what can be done but nobody wants to follow that guidance because it doesn’t necessarily involve taking money away from pensioners.

- TominChicago - Tuesday, Nov 20, 18 @ 1:41 pm:

Admittedly, I don’t know Arizona law and did not research how the recent ballot initiatives comported with the applicable law. However, I have read our supreme court’s decision in Heaton v. Quinn and it is pretty clear to me that all of the solutions that the author of this piece offers to cut pension benefits would violate that holding. For instance, you cannot cut the COLA since the ILL Supreme Court held that once a benefit has been conveyed, it cannot be impaired. Moreover, in addition to Art. I sec. 10 of the US Constitution, I think that a fair argument could be made that diminishing existing pensions would violate the due process clause of the 14th amendment since the state would be depriving its retirees of a contractual benefit without consent

- SSL - Tuesday, Nov 20, 18 @ 1:41 pm:

Ruling that benefits at time of hire could never be diminished was foolish. Doesn’t work that way in the real world and won’t work in the world of government employment. Case in point is Illinois.

Now those Supreme Court justices of Illinois wouldn’t have had any personal reason for ruling the way they did, would they? I stand by my comment that they ruled foolishly.

- lost in weeds - Tuesday, Nov 20, 18 @ 1:44 pm:

Pensions are a form of deferred compensation. Reducing pensions is theft.

When the Continental Congress would not pay wages to military officers in the American Revolution, the military officers were given a pension in lieu of wages. Pensions were born. The same happens with all pensions.

The narrative about pensions is typically about costs to the taxpayer. The narrative should include costs to the wage earner.

When will decent people of all political pursuasions or wealth status talk about greed for what it is?

Is there any morality when it comes to money today?

- Blue Dog Dem - Tuesday, Nov 20, 18 @ 1:46 pm:

I believe pension obligations need to be met. I believe higher ed, K-12, infrastructure And even social services need to be held in check until these obligations have been addressed. We all know everyone must suffer because of the misdeeds of past and present politicians.

- TaylorvilleTornado - Tuesday, Nov 20, 18 @ 1:47 pm:

I like that Mark Glennon is now claiming someone tried to hack into his Twitter account and that he’s telling Twitter.

There is the modern GOP in a nutshell. Say something stupid and then play the victim.

- Perrid - Tuesday, Nov 20, 18 @ 1:52 pm:

@SSL, “Ruling that benefits at time of hire could never be diminished was foolish.”

I think you mean the State Constitution was foolish. The ruling just reflected what the law is, not what you think the law should be.

- Sue - Tuesday, Nov 20, 18 @ 1:55 pm:

Neither Arizona nor RI((which also reformed its public pension program)has the rediculous State constitution pension impairment provisions our Illinois geniuses imposed on us. BTW for Trapped in the Burbs- please share your lawful adult suggestions for reducing Illinois Tier one liability’s. I am sure folks would love to see what you think would be approved by the Illinois S Ct

- Skeptic - Tuesday, Nov 20, 18 @ 1:55 pm:

“Then, if Pritzker and the GA want to keep providing pensions, or switch to a Defined Contribution, in either way they can do whatever they want, however they want.” You mean like the Tier 2 program started in 2011?

- Been There - Tuesday, Nov 20, 18 @ 1:56 pm:

===Apparently the consensus here at capitolfax is we should simply “pay up” and never consider any other option for the pension short fall?====

I think any discussion should include the cost shift no matter how difficult that would be. Three quarters of the pension costs and debt are atrubutle to the teachers pensions. They deserve what they have coming but the state should have never been on the hook for the school districts costs. Or least it should have been capped. Terrible vote for a legislator but the right one

- Juvenal - Tuesday, Nov 20, 18 @ 1:57 pm:

@Blue Dog

Things should not be “held in check.” We shouldcevaluate every program to figure out what its real costs are, what outcomes its delivering, and eliminate the programs that are focused on the lowest priorities, while shifting funding for the highest priorities to the approaches with the greatest return-on-investment.

- Steve - Tuesday, Nov 20, 18 @ 1:57 pm:

Rich asks a fair question. If the Illinois Constitution was changed things could be cut or taxed . Here’s what happened in Detroit…

https://www.freep.com/story/money/personal-finance/susan-tompor/2018/07/18/detroit-bankruptcy-retirees-pension/759446002/

- TominChicago - Tuesday, Nov 20, 18 @ 1:57 pm:

Ruling that benefits at time of hire could never be diminished was foolish. Doesn’t work that way in the real world and won’t work in the world of government employment. Case in point is Illinois.

That interpretation by the court was pretty much commanded by the Pension Clause of the 1970 Constitution as well as the comments leading to its enactment. The court is not free to ignore that stuff just because the legislature and the governor for years did not make required contributions to pension funds.

- ZC - Tuesday, Nov 20, 18 @ 1:59 pm:

Absolutely people who want to cut or reduce growth in pensions need to put up their math. But also politically they’ve had little incentive to do so because with the language in place what’s the political point. You can’t (except for new hires - which we’ve addressed).. Why engage in a debate that can only lose you support (except in a very elite club of pension hawks) and -still- lose, when your “reform” gets struck down.

The pension language in the Constitution may be moral, it may be immoral, but for years it’s helped kill any fruitful tough discussion of what would be the right amount of cuts or alternately the least worst. Because it took one of the most challenging fiscal political problems the state had and converted it to basically a moral talking point - do you stand with the Constitution, or against it - and here we are.

Basically every working door has been shut except enacting a progressive income tax - and were I a conservative, I’d be mad about this - but here we are, so let’s do it, finally.

- TominChicago - Tuesday, Nov 20, 18 @ 2:01 pm:

First amending the Pension Clause will not change the state’s contractual obligations to existing pensioneers or employees. They have a federally protected property interest in their pensions. Moreover Detroit was able to cut pensions because it went to bankruptcy. States cannot declare bankruptcy.

- muon - Tuesday, Nov 20, 18 @ 2:01 pm:

Sue - Arizona did have almost identical constitutional language on pensions. They used Illinois as the basis for theirs. That’s why the legislative attempt to change the benefits was struck down by their SC. However, amending the state constitution is easier in Arizona than in Illinois, so they used that method to limit certain pension benefits that were previously granted.

- Demoralized - Tuesday, Nov 20, 18 @ 2:03 pm:

==but the consideration model hasn’t been addressed by the courts.==

I would argue it has. The Court said you can’t take away something without giving something in return. Both of the “choices” in the consideration model involve giving up something.

- JS Mill - Tuesday, Nov 20, 18 @ 2:04 pm:

=If the pensions being underfunded are never going to run out of money then we have no issue and we can just keep underfunding them?=

No, I believe the state needs to follow the law and fund pensions. You can favor lawlessness if you want.

=has the rediculous State constitution pension impairment provisions our Illinois geniuses imposed on us.=

Says a welcher. It was genius because it protects us from demagogues who want to scapegoat hardworking taxpayers and public employees.

The “When the going gets tough, screw somebody” crew was foreseen 50 years ago Sue, that is how far away some people saw you coming.

= I believe higher ed, K-12, infrastructure And even social services need to be held in check until these obligations have been addressed. We all know everyone must suffer because of the misdeeds of past and present politicians.=

Brilliant. That sounds like a great plan for Illinois success. An alternative plan that is working elsewhere is to raise enough revenue to pay the bills.

Kansas or Minnesota..hmmm, which should we choose?

- Demoralized - Tuesday, Nov 20, 18 @ 2:04 pm:

== Here’s what happened in Detroit…==

Not relevant. Illinois isn’t Detroit. Are we seriously going back to the ridiculous Detroit comparisons now?

- TominChicago - Tuesday, Nov 20, 18 @ 2:06 pm:

Demoralized if I remember the compensation model, it required choosing 1 of 2 benefits that a pensioneer already had. That is not really a meaningful choice.

- muon - Tuesday, Nov 20, 18 @ 2:10 pm:

Demoralized - I agree with you that a consideration model where both choices are diminishments would likely also be unconstitutional. A consideration model based on expanding the new buyout program could be constitutional, since it leaves the existing benefit as one choice. The enacted program only applies to vested inactive members, but could be expanded to all members. It only takes 10-20% of all members to take the buyout offer for it to make a noticeable dent in the unfunded liability.

- Publius - Tuesday, Nov 20, 18 @ 2:14 pm:

There is no crisis just annually fund the cost in benefits paid plus administrative costs

Ask SERS what the ANNUAL cost to beneficiaries and admin are for the next 30 year NOT THE TOTAL, each year.

- Perrid - Tuesday, Nov 20, 18 @ 2:18 pm:

@Demoralized, personally I agree both “options” are bad, but I think there’s a half leg to stand on to say that future paid increases are not promised yet, and so they aren’t protected. If Cullerton outright said, “no pay raises whatsoever” I think it could fly. This weird distinction of “you can have a pay raise, but it doesn’t count to your pension” is probably a step too far. Like trying to have your cake and eat it too.

- SSL - Tuesday, Nov 20, 18 @ 2:19 pm:

Perrid, justices interpret the constitution, and in this case, I believe they were foolish in their interpretation. Determining that a decision to hire represented contracted benefits over the term of employment simply doesn’t make sense. Their ruling stands and must be abided by, but it doomed the state.

A recent Forbes article stated 71,000 government employees within Illinois earned $100,000 or more annually. Another 23,000 pensioners were drawing $100,000 annual pensions. Of the above, 30,000 teachers and administrators were in the $100,000 club. For all the poor mouthing, some people are doing pretty well.

- Steve - Tuesday, Nov 20, 18 @ 2:25 pm:

Bringing up Arizona isn’t all that relevant. Arizona is a much different state than Illinois. It’s easier to makes changes when your state is growing faster than the national average. Plus , no one in the Illinois State Legislature (with power) wants to change pensions via a constitutional amendment. No amendment , no changes. It’s easier to raise taxes in Illinois.

- Gracchus - Tuesday, Nov 20, 18 @ 2:26 pm:

What about reamortization as proposed by Martire?

- Old and In The Way - Tuesday, Nov 20, 18 @ 2:29 pm:

The Arizona pension clause is fundamentally different than Illinois’s. It does not confer contractual status to the pension and therefore can be modified. Illinois specifically states that the pension is a contract. As a contract it falls under the protection of the US Constitution. Good luck changing that.

Most of this dialogue and debate is laughable given the reality of the legal issues involved. Perhaps the greatest impediment to changing the pensions/contract is corporate America. From bond holders to corporations they rely on the sanctity of contracts. I can’t imagine the Supreme Court, even with the shift to the right allowing any diminisment of contracts. What would the Koch brothers say?

- P-Town Skeptic - Tuesday, Nov 20, 18 @ 2:30 pm:

Take away, or grossly change, contracted pensions and you will see one of the biggest walkouts by public employees that will make the teacher walkouts last year seem pale in comparison. We then will see how everyone who bashes pensioners will be begging for services. Good luck finding child care, providing your own public safety, and filing any sort of government forms. Cities are just as guilty of bashing pensions for local services too. You want services, you have to pay for them!

- Jocko - Tuesday, Nov 20, 18 @ 2:32 pm:

==For all the poor mouthing, some people are doing pretty well.==

Are you saying we should tax all retirees over 100K or just those who were in the public sector?

- work in progress - Tuesday, Nov 20, 18 @ 2:35 pm:

Every time this comes up people start throwing retiree COLA=cost of living allowance out there.News flash ,we do not get a cola ,we get an AAI=annual annuity increase that was paid for while we were still working. Huuuge difference,

- NoGifts - Tuesday, Nov 20, 18 @ 2:38 pm:

Teachers and many other illinois government employees don’t pay into social security and are ineligible for social security, and neither did the State of Illinois pay their percent into social security for those employees. So the state saved money there too. And those employees rely on pensions instead of social security.

- RNUG - Tuesday, Nov 20, 18 @ 2:39 pm:

Here is the relevant Arizona Constitution clauses:

C. Membership in a public retirement system is a contractual relationship that is subject to article II, section 25. (Article II, section 25 is Right to Work without union membership)

D. Public retirement system benefits shall not be diminished or impaired, except that certain adjustments to the public safety personnel retirement system may be made as provided in senate bill 1428, as enacted by the fifty-second legislature, second regular session.

E. This section preserves the authority vested in the legislature pursuant to this constitution and does not restrict the legislature’s ability to modify public retirement system benefits for prospective members of public retirement systems.

Note that these clauses are not as tightly linked as the Illinois clause and that a slight amount of wiggle room was provided to the Legislature.

I’ll further note that the change was just passed and has not been subjected to a legal challenge. The last time there was a challenge, the AZ courts ruled that the Legislature could not change the benefit formula.

- RNUG - Tuesday, Nov 20, 18 @ 2:42 pm:

== Finally, the creation of Tier 3 will further tweak the benefits that state employees will earn. ==

As I have previously explained, Tier 3 as previously proposed will cost the State more money than the current Tier 2 system.

- JS Mill - Tuesday, Nov 20, 18 @ 2:46 pm:

=A recent Forbes article stated 71,000 government employees within Illinois earned $100,000 or more annually. Another 23,000 pensioners were drawing $100,000 annual pensions. Of the above, 30,000 teachers and administrators were in the $100,000 club. For all the poor mouthing, some people are doing pretty well.=

So everyone should do poorly in retirement? Another brilliant statement.

My job requires a degree beyond a masters. That usually comes with compensation to match education and experience. I chose public service because it means more to me to do something for society than make money, but I am not doing for free. The pension is part of my compensation.

And a quick news flash, $100,000 is not big money.

Our governor made $155 million in retirement. in one year. While governor his retirement income will exceed $300 million dollars. But we should not place such a hardship on him and other like him with some additional income tax.

If he loses a few million he won’t be able to be a “job creator” by purchasing an interest in another professional sports team. /s

- RNUG - Tuesday, Nov 20, 18 @ 2:53 pm:

== think low hanging fruit would be to adjust the 3% COLA in Tier 1 to the “lesser of 3% or half of CPI” standard used in Tier 2. ==

1) based on prior court rulings, that change is not legal if applied to Tier 1

2) as I have wrote for years, the 3% AAI is the average of CPI-U over almost any 20 year or longer period since the Feds started keeping track. With the exception of one very high period in the late 70’s and 80’s, the average CPI has ran 2.9% to 3.2%.

3) The State deliberately choose a fixed AAI instead of a COLA because it was easier to budget for a fixed number than a variable one.

4) I have previously suggested that the State do a consideration offer to exchange the fixed AAI for an UNcapped trailing year CPI-U based COLA. If the State truly believed inflation will stay low, then the State wins. But the employee wins if raging inflation returns. After all, consideration requires something of value be exchanged for any change to a contract.

- Perrid - Tuesday, Nov 20, 18 @ 2:56 pm:

@SSL, try this article out

https://www.chicagobusiness.com/article/20170523/NEWS02/170529966/illinois-pensions-some-common-misconceptions

4% of public pensioners make 6 figures. You are hopping mad about 4% of the population, and ready to punish 100% of them for it.

- JB13 - Tuesday, Nov 20, 18 @ 2:56 pm:

I will look forward to all of the hand wringing over the real people who will one day soon suddenly wake up thousands of dollars poorer all to avoid making other real people somehow scrape by on less than a 3% guaranteed compounding annual COLA. I’m not saying state workers are wealthy. But I know they will come out much better at the end of all of this than me.

- Stuntman Bob's Brother - Tuesday, Nov 20, 18 @ 2:57 pm:

Forgive me if I missed someone else mentioning it, but why not just tax pension income? Mathematically, taxing a pension at 5% does the same thing as cutting it 5%, and there’s no court challenges, correct? And doing so would be one more reason to implement a graduated tax, so as not to hurt Grandma too much if her pension is small. Not taxing pension income is a nice benefit that the state can no longer afford. I think anyone who leaves the state is going to do so anyway, if only because of the too-high property tax burden.

But if we DO have to cut pensions, it would seem logical to make the largest cuts to the largest pensions, isn’t that a good starting point?

- Joe M - Tuesday, Nov 20, 18 @ 3:02 pm:

The 3% compounded annual AAI is not out of line. It is what is historically needed to keep up with inflation.

- from https://www.sj-r.com/x369946604/Robert-Rich-Committee-can-craft-real-pension-reform

The Consumer Price Index has gone from 97.6 in 1982 to 229.6 in 2012. The cost of living has more than doubled over this 30-year period. In other words, a person receiving a pension of $9,760 in 1982 would need a pension of $22,960 in 2012 to maintain the same purchasing power.

Over this same 30-year period, a person in the State University Retirement System earning a $10,000 pension is receiving $24,272.62 in 2012 under the current COLA system — a 3-percent compounded annual increase.

If a person is part of the current U.S. Social Security system and receiving a $10,000 pension in 1982, he would receive $24,175.23 in 2012, reflecting the Social Security system COLA.

However, if this same person was limited to one half of the consumer price index (the current IGPA proposal), he would be receiving a pension of $15,687.31 in 2012 and would have lost about $8,500 in purchasing power.

- RNUG - Tuesday, Nov 20, 18 @ 3:02 pm:

== think it has been said in a he past they took $ out. ==

To be clear, the State has not taken money out of the 5 funds EXCEPT to pay the pension benefits. They just never put the proper amount it. Even the Blago bond deal was a case of diverting part of the pension payment money before it got put into the funds … add diverting part of future State payments into the funds to pay off the bonds instead.

In simple English, the State always put the EMPLOYEE contributions into the funds. The State never stole EMPLOYER money deposited into the funds; they just stole it before it got to the funds

- RNUG - Tuesday, Nov 20, 18 @ 3:13 pm:

== So how does the Self-Managed Plan option figure in to all this? Serious question because I haven’t seen much discussion of the SMP with reference to pension reform. ==

A lot of opinion writers and Legislators don’t understand there are a number of variations to the State pension systems. SMP was only an option for SURS employees, so it is not that well understood.

I haven’t seen any real attempts to change it. Almost all the focus has been on reducing or eliminating the traditional pension and AAI.

- Joe M - Tuesday, Nov 20, 18 @ 3:16 pm:

Those attacking a 3% compounded AAI, that is only keeping up with historical inflation - well I guess those attackers would like to see us all on a race to the bottom.

- SAP - Tuesday, Nov 20, 18 @ 3:19 pm:

Seems like the pain could be spread around even further by giving state bond holders similar “haircuts”.

- RNUG - Tuesday, Nov 20, 18 @ 3:20 pm:

== Is that covered by the Constitution or by Union agreements. ==

Neither. It is based on State statues that,mostly, pre-date the 1970 Constitution plus some changes (primarily the AAI) since 1970.

And to clear up a mis-conception, while the union can ask / lobby for expanded pension benefits, the union has no legal authority to represent employees / retirees on pension issues. The pension contract is between each individual and the State as employer.

- RNUG - Tuesday, Nov 20, 18 @ 3:22 pm:

== COLAs gone across the board, ==

It is NOT a COLA. It is an AAI. If you don’t understand that, read my past 3 years of posts on this subject.

- RNUG - Tuesday, Nov 20, 18 @ 3:25 pm:

== Repeal the Pension Clause, by Constitutional Amendment or other. Then, if Pritzker and the GA want to keep providing pensions, or switch to a Defined Contribution, in either way they can do whatever they want, however they want. ==

But only for new employees. Just getting rid of the pension clause does not affect the current status of current pensions as a contract.

- muon - Tuesday, Nov 20, 18 @ 3:38 pm:

As RNUG says the state can do what it wants for new employees going forward whether by constitutional amendment or statute as it did for Tier 2 and 3. As I posted earlier, the biggest problem is the legacy cost due to the funding shortfall of the pension systems. Changing new employees benefits doesn’t address that unless you overcharge those new employees, which Tier 2 does to some extent. That creates the problem of new employees overpaying to cover the cots of more senior employees.

- wordslinger - Tuesday, Nov 20, 18 @ 3:38 pm:

–Perrid, justices interpret the constitution, and in this case, I believe they were foolish in their interpretation.–

Unanimous, bipartisan, from every region in the state.

The language is tight as a drum.

- Jibba - Tuesday, Nov 20, 18 @ 3:39 pm:

All the machinations needed to cheat retirees are bizarre. A totally legal method to claw back from all Illinois citizens who have been undertaxed for generations is simply to tax all retirement income. Totally legal, done by most states, spreads the burden more widely than just state employees, and can be structured to avoid large hits to lower income pensioners.

Not that I especially want to pay it, but I spent generations being undertaxed, too. Better that than crazy bankruptcy schemes or special masters, and ends the hand wringing, pearl clutching, and sky falling.

- RNUG - Tuesday, Nov 20, 18 @ 3:40 pm:

== Three quarters of the pension costs and debt are atrubutle to the teachers pensions ==

To be a bit more exact, about 48% of the pension debt can be attributed to TRS, which could, maybe, cut expenses or raise property taxes to cover any cost shift.

About 24% can be attributed to SURS. Short of more State money, their only other revenue source would be to raise tuition.

Another approximately 24% is SERS. No way for the State to cost shift this portion.

JRS and GARS are less than 2%. I guess the courts could raise filing fees to cover a cost shift. And maybe eliminate pensions for GARS, although people like State agency Directors are part of that system. Whatever. In terms of pension debt, these two don’t really count.

Bottom line is, at best, only roughly half of the pension could potentially be cost shifted … but property owners won’t be happy.

- Not a Billionaire - Tuesday, Nov 20, 18 @ 3:42 pm:

RNUG they have nothing left but their ranting . Many have reality problems in re. To the Republican annihilation evolution global warming pensions contracts…and muon t2 is paying for part of t1

- Anonymous - Tuesday, Nov 20, 18 @ 3:52 pm:

Demoralized

Addressing the debt by paying it down is hardly childish or victim-like. Mature realists address problems, not play Peter Pan and try to fly away. What are you thinking?

- Ike - Tuesday, Nov 20, 18 @ 4:06 pm:

We also need to see how many state worker take the tier 1 buy out option, though I don’t believe may would take it, since it isn’t that great of a deal

- wordslinger - Monday, Nov 26, 18 @ 8:48 am:

–The thing is, and this is the important part, the 2013 bill was ruled unconstitutional, but the consideration model hasn’t been addressed by the courts.–

If I had a pension, I’d say: “I’ve considered it. I’ll keep what I have, under my contract that cannot be diminished.”

Some of you just can’t quit that crack pipe when it comes to pensions. You’re mistaking shallow political rhetoric for big-kid reality.

That will get you a job on the tronc edit board, but that’s about all that affliction is good for.