It’s time to end this free ride

Wednesday, Jan 16, 2019 - Posted by Rich Miller

* Lots of sizzle in this graf…

But the meteoric rise of video gambling has proven to be little more than a botched money grab, according to a ProPublica Illinois investigation of a system that has gone virtually unchecked since its inception. Based on dozens of interviews, thousands of pages of state financial records and an analysis of six years of gambling data, this unprecedented examination found that, far from helping pull the state out of its financial tailspin, the legalization of video gambling accelerated it and saddled Illinois with new, unfunded regulatory and social costs.

* More…

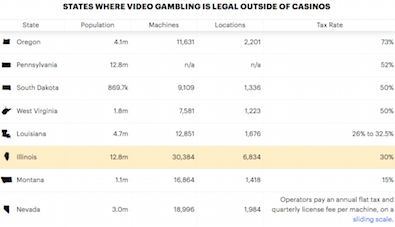

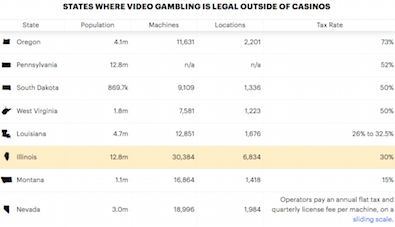

At every key point, state officials made decisions that undercut taxpayers and helped the companies that market video gambling. Lawmakers accepted a far smaller share of the profits than what’s charged in other states, giving the companies a much larger piece. They went forward with the program assuming the machines could be installed in Chicago — they couldn’t. They ignored the inevitable regulatory and social costs. And they did not anticipate the extent to which video gaming would cut into casino profits, which are taxed at a higher rate. The net effect: People in Illinois gambled a lot more, but most of the additional money ended up in the coffers of the companies behind video gambling.

* A key point…

Within months of the law’s passage, the state began borrowing hundreds of millions of dollars against the anticipated revenue. Bond documents claimed video gambling machines would raise $300 million each year to help cover the debt payments.

It wasn’t until 2017, eight years after the legalization of video gambling, that the state came close to collecting that amount. By then, video gambling had brought in less than $1 billion to pay the bond debt — $1.3 billion short of what lawmakers anticipated.

* But that shortfall is partially explained later on…

The legislature assumed video gambling would be up and running within a year of the bill’s passage, to quickly begin generating revenue. Instead, it took three years.

That’s because the Illinois Gaming Board needlessly dragged its feet to get the program up and running and the liquor industry sued over a provision in the bill which raised alcohol taxes.

Another problem that’s briefly mentioned in the piece is that Chicago has never opted in. That decision created a huge revenue hole.

* The state should’ve just given the whole program to the Lottery and let it own and install the machines. Instead, the state made huge fortunes for a handful of video gaming companies.

And it’s abundantly clear that if a new gaming bill is passed then a video gaming tax hike is in order…

The people who’ve benefited the most from video gaming are the big companies that make and install the machines and the large chains of gambling parlors. Leave the mom and pop operations alone, but those big entities ought to be coughing up a whole lot more money.

- wordslinger - Wednesday, Jan 16, 19 @ 9:52 am:

–Leave the mom and pop operations alone, but those big entities ought to be coughing up a whole lot more money.–

Agreed.

The split with the big machine providers is out of whack. There’s no reason they shouldn’t pay the same tax as the casinos.

- Hippopotamus - Wednesday, Jan 16, 19 @ 9:58 am:

And who were the lobbyists that helped get video gaming passed? We should keep an eye on them this time around.

- Not a Billionaire - Wednesday, Jan 16, 19 @ 10:01 am:

I would like them to drop the liquor licence requirement. I have a place that would be ideal but I do not want to deal with booze or the corrupt process to get one.

- JS Mill - Wednesday, Jan 16, 19 @ 10:01 am:

= Leave the mom and pop operations alone, but those big entities ought to be coughing up a whole lot more money.=

Yep.

- Conn Smythe - Wednesday, Jan 16, 19 @ 10:02 am:

All of those companies will scream “we all are mom and pop” operations, is the problem, as evidenced by how they reacted to Link and Rita’s bill last Spring. Once the parlor model went live, this thing metastatized. And at the time this was all going down, the lottery was in disarray. Part of the 09 funding bill was the privitization piece IIRC.

- anon2 - Wednesday, Jan 16, 19 @ 10:05 am:

The lobbyists for the video game industry certainly proved worth every penny of their fees. Wasn’t Joe Berrios one of them?

- OneMan - Wednesday, Jan 16, 19 @ 10:05 am:

Just going to point out a blogger pointed out the math issues with the proposal…

https://htsblog.blogspot.com/2009/06/more-poker-lets-run-some-more-numbers.html

https://htsblog.blogspot.com/2009/06/making-video-poker-numbers-work.html

If you want some more insight into the addictive properties of the machines I would suggest

Addiction By Design.

https://www.amazon.com/Addiction-Design-Machine-Gambling-Vegas/dp/0691160880

- lakeside - Wednesday, Jan 16, 19 @ 10:10 am:

Joe Berrios was very much one of them.

- wordslinger - Wednesday, Jan 16, 19 @ 10:12 am:

–All of those companies will scream “we all are mom and pop” operations, is the problem,–

Of course they will. So what? Revenues for every establishment are known. The question is where do you draw the line.

- don the legend - Wednesday, Jan 16, 19 @ 10:18 am:

It seems to me that this is low hanging fruit. Raise the tax rate.

Are the legislators afraid a future opponent will campaign that they raised taxes on gambling parlors?

- 47th Ward - Wednesday, Jan 16, 19 @ 10:19 am:

===The people who’ve benefited the most from video gaming are the big companies that make and install the machines===

Didn’t they also help write the law?

- Just the facts - Wednesday, Jan 16, 19 @ 10:24 am:

There are many flaws with this report. 1. The gaming board is flush with employees. 2. Captiol bill was a huge success, please count the jobs that were created. 3. Attendance is way down at race tracks, let’s blame video poker. Eventually everyone will be gambling on line, I assume that will be video pokers fault also.

- Merica - Wednesday, Jan 16, 19 @ 10:26 am:

Three points:

- the tax should be the same for all (casinos and video parlors,

regardless of size)

- The GA never intended this. Video gambling was sold to the GA as a way of softening the “hit” of making smoking illegal in bars. The machines were never intended to be in gas stations and non bar/restaurant establishments.

- Springfield and much of central Illinois is a visually/aesthetically challenging place. Broken sidewalks, boarded up stores, traffic lights for miles… the sprawl of video gambling into restaurants, laundromats, bars, everywhere, adds a sense of hopelessness and visual chaos to an already challenged environment. It attracts an older, lonely, and sad looking clientel. Clearly it hasn’t been good for Springfield, as the City and County finances are a mess.

- Anonymous - Wednesday, Jan 16, 19 @ 10:26 am:

Wabash Avenue in Springfield might as well be a mini Vegas strip now.

- Rich Miller - Wednesday, Jan 16, 19 @ 10:28 am:

===The machines were never intended to be in gas stations===

What? Truck stops are in the bill.

- Southside Markie - Wednesday, Jan 16, 19 @ 10:32 am:

== And who were the lobbyists that helped get video gaming passed? ==

Also Zack Stamp.

- OneMan - Wednesday, Jan 16, 19 @ 10:42 am:

You could tier it a couple of different ways.

– You could do it by site revenue. That would tend to catch the truck stops that end to have the highest revenues.

– You could do it at the machine operator level, that a machine operator have an additional tax burden (so you don’t hit the facility) when they have revenues above X (windfall tax as it were)

– You could do it by facility owner gaming revenue, that is those owners who own multiple facilities have a higher right driven by owner gaming revenue.

You couldn’t (and shouldn’t) touch the local tax revenue.

Rich is right that the Illinois Lottery should have been the machine operator, you could have then given half of the state share of the taxes to the locals (and gotten more buy in) and the state would have been ahead .

- Logan from ProPublica Illinois - Wednesday, Jan 16, 19 @ 10:51 am:

One note to add: There’s been virtually no research and little spending to understand how the rapid expansion of gambling in Illinois has affected the lives of people who live here.

If you or someone you know is struggling with video gambling, we want to hear about it. Help us understand video slot and poker addiction in Illinois by answering a few questions here: https://www.propublica.org/getinvolved/help-us-investigate-illinois-video-gambling-addiction

- anon2 - Wednesday, Jan 16, 19 @ 11:02 am:

This is a lasting part of the Quinn legacy. The Sun-Times states that the Illinois Gaming Machine Operators Association wrote the Video Gaming Today, more than 30,000 video slot and poker machines operate outside casinos here, more than any other state in the country. Yet when the General Assembly passed the Video Gaming Act, it set aside no money for additional staff or resources to implement the law and oversee the industry.

Quinn wasn’t the only one responsible. HB255, sponsored by Lou Lang and John Cullerton, provided for the biggest gambling expansion in state history. GOP leaders Cross and Radogno voted yes. The bill passed the Senate 47-12 and the House 86-30.

The article contains this quote: “The way the General Assembly constructed the capital program, by relying on video gambling revenue that failed to materialize, accelerated the state’s financial crisis,” said Laurence Msall, president of the nonpartisan Civic Federation.

- A guy - Wednesday, Jan 16, 19 @ 11:08 am:

= Leave the mom and pop operations alone, but those big entities ought to be coughing up a whole lot more money.=

I’d be OK with tapping the mom and pops a little bit more, but definitely the big operators who’ve opened all these mini-casinos all over the place should cough more than a hernia exam requires.

- Scott Cross for President - Wednesday, Jan 16, 19 @ 11:19 am:

Great article. And it explains clearly that the cost of regulation and enforcement of the Video Gaming Act needs to be shifted from the state to the video poker and slot industry.

Increase the application fee, to charge the operator for the cost of the ISP and others to perform due diligence on the operator, instead of the state bearing these costs.

Increase the annual renewal fee, to charge the operator for the cost of reviewing criminal, civil and other records to update the due diligence performed by the ISP and others.

- muon - Wednesday, Jan 16, 19 @ 11:21 am:

The Lottery would have always been a better fit to run video gaming which has thousands of locations in businesses where gambling is secondary to the main business. At the time the bill passed the Lottery had thousands of outlets, while the Gaming board only oversaw a few. Lottery outlets sold tickets as a side business while the Gaming Board had businesses that were first and foremost about gambling.

On the local side it didn’t make sense to give municipalities an all or nothing approach to video gaming. Municipalities are used to having a wide range of liquor licenses for different types of establishments with different fee schedules. Since video gaming was generally tied to liquor sales, it would have been much easier to let municipalities choose which license types had video gambling and which did not. It likely that a lot more municipalities would have said yes to limited locations rather than have to go all in if video gaming was approved.

- VegasVic - Wednesday, Jan 16, 19 @ 11:42 am:

So…Which is it?

1) The sweet & innocent GA and their staffs got Hoodwinked by those sneaky Gambling Lobbyists…

OR

2) The GA and their staffs passed legislation that benefited the Gambling Industry, their lobbyists, the GA & their staffs.

- Fav Human - Wednesday, Jan 16, 19 @ 11:54 am:

Vic, I’ll take door #2, please.

- Generic drone - Wednesday, Jan 16, 19 @ 12:05 pm:

Tax the day lights out of them like they rig the games to not pay out.

- Anonymous - Wednesday, Jan 16, 19 @ 1:34 pm:

Ugh, classic terrible governance by Illinois politicians.

- OneMan - Wednesday, Jan 16, 19 @ 2:11 pm:

Generic Drone, unless they are committing actual fraud with the reporting you can see the payout of each location.

In looking at the data in the past, the payout is about the same across the board in the state.

In fact some locations actually pay out more than they take in, it is very few, but it happens.

- Shemp - Wednesday, Jan 16, 19 @ 3:06 pm:

This. The amount of money walking out of many our communities is ridiculous. And the State has left cities with no way to regulate them other than limiting available liquor licenses.

===

- don the legend - Wednesday, Jan 16, 19 @ 10:18 am: It seems to me that this is low hanging fruit. Raise the tax rate.

Are the legislators afraid a future opponent will campaign that they raised taxes on gambling parlors?

- RJM - Wednesday, Jan 16, 19 @ 3:52 pm:

The state gets 30% of the revenue (5% of that goes to local govt.) for issuing the license, the restaurant/bar gets 35% for giving up a few square feet of space and the terminal operator takes 35% while purchasing machines (cost of $20-30k each) and providing 24 hour service/maintenance. Looks to me like the TO’s take all the risk (excepting the external costs gambling) while the locations get most of the benefits.

- Rich Miller - Wednesday, Jan 16, 19 @ 3:55 pm:

===Looks to me like the TO’s take all the risk===

You’re funny.

- wordslinger - Wednesday, Jan 16, 19 @ 4:10 pm:

–Looks to me like the TO’s take all the risk –

There’s “risk” in running slot machines? They are, literally, legally-rigged games.

- Marko the Destroyer - Wednesday, Jan 16, 19 @ 4:21 pm:

To say “there are many flaws with this report” is absurd. Do a little investigation into ProPublica and you will discover the exhaustive research that goes into their work. Jason Grotto, the author of this story, was last year’s Pulitzer Prize runner-up for his coverage of Joe Berrios. Regardless of whether you agree with them, this publication is as legitimate as it gets. They do not publish work that is full of flaws.

Here are the lobbyists for the Illinois Coin Machine Operators Association when the Video Gaming Act was passed:

Zack Stamp

Kevin McFadden

Katie Anselment

Joe Berrios

Sam Panayotovich

Tom Cullen

The original bill included a provision which prohibited any single company from controlling more than 5% of the market. That language was subsequently stripped out, and now two companies (J&J Ventures and Accel Entertainment) control 40-50% of the market. Despite this, J&J promotes itself as “family owned” in its marketing materials, which suggests even the largest companies feel they are mom-and-pop operations.

The solution is easy. Impose a progressive tax on Terminal Operators’ earnings, just like the casinos pay. What is fair for one is fair for all. Alternatively, if the largest operators do not wish to pay their fair share, then administer the entire program through the lottery. The state could increase its cut by 240% overnight (from 25% to 60%) without affecting the location owners at all.

- Rich Miller - Wednesday, Jan 16, 19 @ 5:43 pm:

===Impose a progressive tax on Terminal Operators’ earnings, just like the casinos pay.===

Agreed, and I’d add in the parlor chains.

- @misterjayem - Wednesday, Jan 16, 19 @ 7:45 pm:

“Looks to me like the TO’s take all the risk”

Trading 98 cents for a dollar isn’t over risky.

– MrJM

- Southside Markie - Wednesday, Jan 16, 19 @ 8:22 pm:

== Looks to me like the TO’s take all the risk. == Yeah. That the big machine might fall on the deliveryman’s toe while he installs it. Otherwise, not so much.

- Blue Dog Dem - Wednesday, Jan 16, 19 @ 8:31 pm:

The progressive tax idea here is brilliant.