|

#PritzkerMath

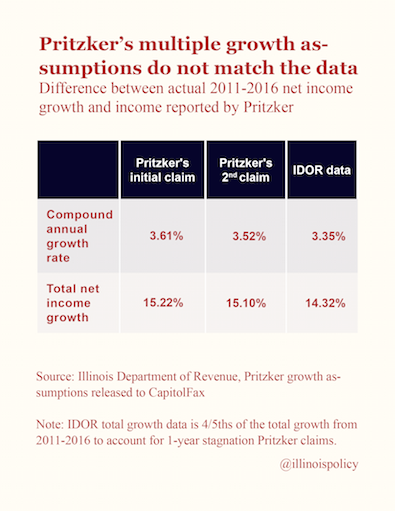

Wednesday, Mar 27, 2019 - Posted by Advertising Department [The following is a paid advertisement.] Illinois Gov. J.B. Pritzker is having a hard time getting the numbers to add up on his $3.4 billion progressive income tax hike. And the administration now is releasing details contradicting data they previously released. Despite changing their numbers, each of the figures reported by Pritzker’s team has failed to match any of the actual data. This has not only been confirmed by the Illinois Policy Institute’s analysis of both IDOR and IRS data, but by the Civic Federation’s analysis of IDOR data as well.  One problem is that the governor’s team based their growth estimates on a preliminary 2016 income number from IDOR even though a final number is available. The final number is lower by nearly $3 billion, which means their growth rates are artificially inflated.  By using outlandish projections for income growth, the administration alleges that a graduated income tax plan is capable of bringing in an additional $3.4 billion while avoiding tax hikes for 97 percent of Illinoisans. Unfortunately, because the governor’s baseline is far off, his plan will not deliver on his promise of closing the structural deficit. When his plan ultimately fails to bring in enough revenue, he will have to raise taxes on middle-class Illinoisans.

|