* US Attorney’s Office, Northern District of Illinois…

The owner of a debt collection company spent tens of thousands of dollars in an effort to corruptly influence and obtain business from court clerks in Florida and Illinois, including the Cook County Circuit Court Clerk, according to a federal indictment returned in Chicago.

DONALD DONAGHER, JR., 67, of Mechanicsburg, Pa., and Palm Beach Gardens, Fla., was the owner and Chief Executive Officer of Harrisburg, Pa.-based PENN CREDIT CORPORATION. From 2009 to 2016, Donagher and Penn Credit provided money and services to benefit the court clerks and related individuals and entities, corruptly seeking favorable treatment in the awarding of the courts’ debt collection work, the indictment states. The efforts included payments to certain clerks’ campaign committees, donations to charities supported by certain clerks, financial sponsorship of events hosted by certain clerks, and free or discounted “robocalls” made by Penn Credit on behalf of certain clerks’ campaigns, according to the indictment.

The indictment was returned Thursday in U.S. District Court in Chicago. It charges Donagher and Penn Credit with one count of conspiracy to commit federal program bribery, and five counts of federal program bribery. Arraignment in federal court in Chicago has not yet been scheduled.

The indictment was announced by John R. Lausch, Jr., United States Attorney for the Northern District of Illinois; Jeffrey S. Sallet, Special Agent-in-Charge of the Chicago office of the Federal Bureau of Investigation; Gabriel L. Grchan, Special Agent-in-Charge of the Internal Revenue Service Criminal Investigation Division in Chicago; and Patrick M. Blanchard, Cook County Inspector General. The government is represented by Assistant U.S. Attorneys Heather K. McShain and Ankur Srivastava.

According to the charges, Donagher in June 2011 caused Penn Credit to pay $5,000 to a scholarship fund named for the Cook County Circuit Court Clerk. Later that summer, Penn Credit began collecting debt for the Clerk’s Office, the indictment states. On Aug. 19, 2011 – less than three weeks after Penn Credit began its work for Cook County – Donagher sent an email to Penn Credit employees and an Illinois lobbyist, advising that Donagher had promised the Cook County Clerk “10k of ‘early’ money,” the indictment states. The following month, Donagher caused a $10,000 contribution to be made in his name “towards the fundraising efforts of Contributions to Friends of [the Cook County Circuit Court Clerk],” the indictment states. The indictment further states that, several months later, Penn Credit made hundreds of thousands of phone calls on behalf of the Cook County Circuit Court Clerk without invoicing or receiving payment from the Clerk’s campaign.

The public is reminded that an indictment is not evidence of guilt. The defendants are presumed innocent and entitled to a fair trial at which the government has the burden of proving guilt beyond a reasonable doubt.

The conspiracy charge is punishable by up to five years in prison, while the maximum sentence for federal program bribery is ten years. If convicted, the Court must impose a reasonable sentence under federal statutes and the advisory U.S. Sentencing Guidelines.

The indictment is here.

*** UPDATE *** Press release…

STATEMENT BY PENN CREDIT AND DON DONAGHER

DENYING ALL CHARGES IN FEDERAL INDICTMENT

CHICAGO, IL (March 15, 2019): The allegations against Don Donagher and Penn Credit are false and the Department of Justice should not have brought this case. Mr. Donagher and Penn Credit acted legally and in good faith, and we will prove that in court.

The indictment presents a novel and meritless theory based on conduct that allegedly occurred long ago. First, the government has charged Mr. Donagher with bribery related offenses, but it has not charged any public official or even claim that a public official was a supposed co-conspirator. Second, unlike the long line of corruption cases that have been prosecuted in Chicago, this case has none of the standard hallmarks of bribery and corruption. There are no allegations of secret cash payments. There are no allegations of concealed payments to shell companies. There are no allegations of lavish gifts or free vacations. In fact, there are no allegations that Mr. Donagher did anything to personally enrich any public official. Simply put, none of the usual indicia of corrupt activity are present in this case. Instead, the Department of Justice is attempting to criminalize entirely lawful, publicly-disclosed campaign contributions and laudatory donations to various charities, a scholarship fund and the partial sponsoring of a Women’s History Month event.

Moreover, Penn Credit never sought and never received any improper benefit from any public official. Indeed, the contracts Penn Credit received from Cook County and other government entities were awarded to it purely on the merits.

For example, regarding the Cook County contract, a county-wide committee, which included members of the State’s Attorney’s Office, objectively rated the proposals submitted by Penn Credit and its competitors, and that county-wide committee rated Penn Credit to be the most qualified company for the contract. And that superior rating was borne out by Penn Credit’s documented performance on behalf of Cook County — Penn Credit significantly increased collections and revenue for the county and dramatically outperformed its competitors by every objective measure. Thus, Penn Credit consistently received “excellent” marks for its debt collection work, not just for the Clerk’s Office, but for its superior services to all County Departments under the contract.

Mr. Donagher has a well-earned reputation for philanthropy and generosity, having donated millions of dollars to a wide variety of charitable causes around the country. The company has an unblemished record as a corporate citizen and leading employer in its community.

Theodore T. Poulos, counsel to Don Donagher and Penn Credit, said, “Donating to political campaigns and charities hoping to engender good will is not a crime. That happens every day in this country.”

Mr. Donagher and Penn Credit will enter pleas of not guilty and will vigorously defend themselves against these unsupported charges. We look forward to our day in court.

Comments Off

|

Question of the day

Friday, Mar 15, 2019 - Posted by Rich Miller

* Steve Lord at the Aurora Beacon-News…

The Fermi National Accelerator broke ground Friday on a project that takes it into the future as one of the world’s premier particle physics laboratories.

The Proton Improvement Plan II, known as PIP-II, is a brand new leading-edge superconducting linear accelerator.

“It’s a new heart for Fermilab,” said Mike Weis, the Fermilab site office manager for the U.S. Department of Energy. “That’s really what we’re doing here.”

Weis was one of 19 speakers Friday at a groundbreaking for PIP-II which included a host of dignitaries, scientists and International representatives of participants in the project.

The governor was in attendance…

* The Question: Caption?

35 Comments

|

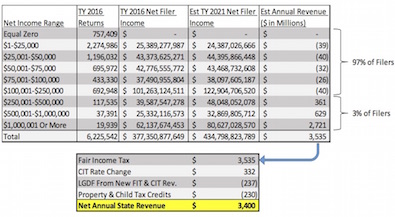

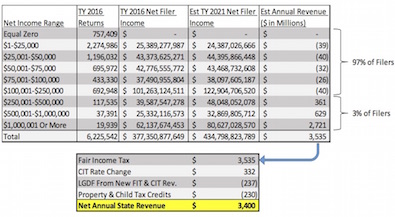

* Civic Federation…

The Governor said the new [graduated income tax] would bring in an additional $3.4 billion per year. That is exactly enough to cover an annual operating deficit estimated at $3.2 billion plus an extra $200 million—the amount recently proposed by the administration to bolster the State’s severely underfunded retirement systems. However, the Civic Federation has not been able to replicate the $3.4 billion number and the Governor’s Office has not yet provided information about the methodology used to arrive at the figure.

* I asked what result the group had come up with and was told today that their numbers crunchers hadn’t yet completed the calculations…

The Civic Federation has not published a revenue estimate because we are still working to gather complete information. We plan to complete our analysis and update our blog when we have additional information.

They were apparently waiting on the same info I was.

The Illinois Policy Institute is claiming that its own numbers crunchers found the graduated tax would yield $2.4 billion in the first full fiscal year. The group has FOIA’d the methodology info, but the governor’s office said yesterday it would need five more days to respond.

* As I noted above, I’ve been asking for the same information, and the governor’s office just sent this to me…

The Governor’s Office of Budget and Management worked with the Department of Revenue to arrive at a realistic projection for the amount generated by the fair income tax.

The team includes longtime respected experts like Deputy Governor Dan Hynes, who served as the state’s comptroller for 12 years; Department of Revenue Director David Harris, a former Republican lawmaker who served in a leadership role for many years on both the revenue and appropriations committees; GOMB Director Alexis Sturm, who has worked in government finance for more than 20 years; and GOMB Chief of Staff Cameron Mock, who has worked in government finance for nearly a decade.

A breakdown of how many tax filers are in each income bracket can be found below.

To reach the 2021 projection, the team used data from the 2016 tax year, the most recent year for which complete data is available. They assumed filers’ income for 2021 would have grown at the most recent respective 5-year compound annual growth rate (CAGR), and to ensure the estimate was conservative, included a one-year income stagnation in the event of a slowing economy.

The team assumed that local governments would receive 6 percent of the new revenue through LGDF and that $230 million of the new revenue would be used for property tax relief and child tax credits.

The team assumed that 10 percent of filers with net income more than $1 million and less than $2 million would try to capture a lower marginal rate. This is an extremely conservative assumption. In reality, only filers who have a net income between $1,000,000 and $1,009,305 would pay more in taxes than they would receive in income above $1,000,000 when the 7.95 percent rate is applied to all their income.

* Click the pic for a larger image…

22 Comments

|

* From the Illinois Human Rights Act…

Freedom from Unlawful Discrimination. To secure for all individuals within Illinois the freedom from discrimination against any individual because of his or her race, color, religion, sex, national origin, ancestry, age, order of protection status, marital status, physical or mental disability, military status, sexual orientation, pregnancy, or unfavorable discharge from military service in connection with employment, real estate transactions, access to financial credit, and the availability of public accommodations.

* HB 246…

Amends the School Code. With regard to the textbook block grant program, provides that the textbooks authorized to be purchased must include the roles and contributions of all people protected under the Illinois Human Rights Act and must be non-discriminatory as to any of the characteristics under the Act. Provides that textbooks purchased with grant funds must be non-discriminatory.

The Human Rights Act is a hugely important, hard-won law that’s been slowly expanded over the years. In my opinion, students ought to learn about the people covered by this law (and about the law itself, for that matter).

* Except…

But it is unlikely that the bill would have any immediate impact, even if it is signed into law. That’s because it only applies to textbooks purchased through the state’s textbook block grant program, which has not received any funding for the last five years, and which the State Board of Education has not requested funding for in the upcoming budget.

So much for that.

* This sentence is what set so many people off…

Provides that in public schools only, the teaching of history of the United States shall include a study of the roles and contributions of lesbian, gay, bisexual, and transgender people in the history of this country and this State.

That part has nothing to do with the textbook grant program, so it has to be taught one way or another.

* WICS…

Rep. Anna Moeller, an Elgin Democrat who’s sponsoring the bill, said the measure would help depict an accurate understanding of LGBTQ figures in the classroom.

“This exclusion has denied students the opportunity to obtain a greater and more accurate understanding of world history,” Moeller said. “It also has denied LGBT people their identity and reflection in our school curriculum.” […]

Those opposed to this bill are worried how schools would pay for another curriculum requirement.

They said school districts are already required to do too much without enough state funding.

* Um, that’s not all they said…

State Representative Darren Bailey (R-Louisville), voted no today on House Bill 246 that will mandate school books must include the teaching of the sexual identity of historical figures and that the sexual identities of lesbian, gay, bi-sexual and transgender (LGBT) must be identified.

“I am opposed to yet another mandate on our teachers,” said Rep. Darren Bailey, a former school board member. “There is nothing that prevents the teaching of the lives of historical figures including if they were known to have been homosexuals. But forcing that information on 5 year olds and elementary school children is more of an effort of indoctrination than of learning history about individuals who accomplished important discoveries in science or created great works of art.” […]

Rep. Bailey added, “I also opposed this legislation because it does not provide an ‘opt out’ option for parents who do not wish their children exposed to this kind of information for religious reasons or because their child may not be of a mature enough age to fully understand the meaning and implications of what LGBT actually is.”

* This is the current statute, except for the addition of the words “or she”…

No pupils shall be graduated from the eighth grade of any public school unless he or she has received such instruction in the history of the United States and gives evidence of having a comprehensive knowledge thereof.

It should be interesting to see how the more conservative Downstate school districts approach this if/when it becomes the law of the land.

36 Comments

|

Today’s number: 1.4 days in reserve, if that

Friday, Mar 15, 2019 - Posted by Rich Miller

* Illinois News Network…

A lesser-mentioned consequence of the budget battle between Democrats in the General Assembly and then-Gov. Bruce Rauner was the depletion of Illinois’ rainy day fund, which still sits nearly empty.

A state’s rainy day fund is used to avoid having to make cuts or tax hikes in the event of a sudden drop in revenue like what many states saw during the recession. In 2017, Illinois lawmakers voted to drain the state’s Budget Stabilization Fund and include the hundreds of millions of dollars that were in it to keep services going during the budget battle. Today, there’s less than a percentage of Illinois’ annual budget in that fund.

Justin Theal, an officer with Pew Charitable Trusts, said that goes against the national trend. Most other states have been bolstering their funds during times of higher revenue.

“The state had about $10 million in its rainy day fund, or the equivalent of just one-tenth of one day’s worth of operating cost,” he said. “Fiscal Year 2018 saw thirty-two states add nearly $10 billion to their rainy day funds. That’s largely the result of a healthy economy, robust stock market returns, specific state policy actions, and at least a portion of that was due to tax revenue growth from the recent federal tax reform package.”

Illinois also relies on its end-of-year balance, which Pew reports would cover 1.3 days, hence the headline.

Daily operating costs are based on a 365-day year.

* From Pew…

States use reserves and balances to manage budgetary uncertainty, including revenue forecasting errors, budget shortfalls during economic downturns, and other unforeseen emergencies, such as natural disasters. This financial cushion can soften the need for severe spending cuts or tax increases when states need to balance their budgets.

Because reserves and balances are vital to managing unexpected changes and maintaining fiscal health, their levels are tracked closely by bond rating agencies. For example, S&P Global Ratings downgraded Massachusetts’ debt rating in June 2017, citing its “failure to follow through on rebuilding its reserves.” A year later, Massachusetts deposited more than $492 million into its reserve fund. If left unaddressed, credit downgrades can lead to increased state borrowing costs for years to come.

Building up reserves is a sign of fiscal recovery, but there is no one-size-fits-all rule on when, how, and how much to save. States with a history of significant economic or revenue volatility may desire larger cushions. According to a report by The Pew Charitable Trusts, the optimal savings target of state rainy day funds depends on three factors: the defined purpose of funds, the volatility of a state’s tax revenue, and the level of coverage—similar to an insurance policy—that the state seeks to provide for its budget.

24 Comments

|

It’s just a bill

Friday, Mar 15, 2019 - Posted by Rich Miller

* Jerry Nowicki at Capitol News Illinois…

According to a report from the Illinois Department of Public Health, an average of 73 women in Illinois died each year from 2008 to 2016 within one year of pregnancy, 72 percent of those deaths were preventable, and 93 percent of violent pregnancy-associated deaths were preventable.

Per the report, African-American women were six times more likely to die of a pregnancy-related condition during that span.

“For African-American women in particular, we’re dying at six times the rate amongst American women, which means we’re dying at Third-World country rates,” state Sen. Toi Hutchinson, D-Olympia Fields, said.

Hutchinson and Castro have introduced, among other reforms, Senate Bill 1909, which would continue Medicaid coverage for new mothers for 12 months after giving birth – currently a mother is covered for only 60 days after a birth.

That bill would also create a pilot program to provide voluntary in-home nursing visits to low-income, first-time pregnant women; mandate quality control guidelines and hemorrhage protocols for birthing facilities; and require insurance plans to cover medically necessary treatment for postpartum complications.

* This bill has gone nowhere in the past…

Supporters are making a case for instituting a new tax on financial transactions in the state of Illinois.

The legislation would require a $1 fee on any financial transaction done in the state with the exception of securities held in a retirement account or a transaction involving a mutual fund.

“Beginning January 1, 2020, a tax is imposed on the privilege of engaging in a financial transaction on any of the following exchanges or boards of trade: the Chicago Stock Exchange; the Chicago Mercantile Exchange; the Chicago Board of Trade; or the Chicago Board Options Exchange,” according to the text of the bill. “The tax is imposed at a rate of $1 for each transaction for which the underlying asset is an agricultural product, a financial instruments contract, or an options contract. The tax shall be paid by the trading facility or, in any other case, by the purchaser involved in the transaction.”

Illinois state Rep. Mary Flowers, D-Chicago, has been the standard bearer for a state-based financial transactions tax for a number of years. She brought Matt Harrington, a self-described financial expert, to explain how the financial transactions tax “could help bring prosperity to our economy.”

* From the Anna Gazette-Democrat…

A Southern Illinois legislator earned unanimous approval from the Illinois House Judiciary Criminal Law Committee on two separate, but related pieces of legislation last week. […]

HB 2308 ensures that a defendant is prohibited from contacting victims or witnesses from jail while awaiting trial.

Windhorst says inmates awaiting trial sometimes use their phone privileges to harass victims while waiting for their court date.

“This is a victims’ rights piece of legislation,” [Rep. Patrick Windhorst, R-Metropolis] said. “HB 2308 will keep incarcerated offenders from being able to contact their victims while awaiting trial.”

HB 2309 also passed the House Judiciary Criminal Law Committee with unanimous support.

Windhorst says the legislation provides that when a petition for an emergency stalking no contact order, a civil no contact order, or an emergency order of protection is filed, the petition shall not be publicly available until the petition is served on the offending individual.

* Other bills…

* Opponents say bill could make Illinois college campuses less safe: Illinois State University receives about 20,000 applications in a given year. In 2018, Woodruff said about 150 potential students disclosed a criminal history. Of those, six were denied entry. Most of those were because of a past sex offense.

* Childcare facilities would have to hold active shooter drills under new bill: The bill was heard in committee Thursday. Committee members raised concerns about the effect such a measure would have on childcare businesses’ insurance costs, regardless of the size of the operation. Mussman promised changes to address those concerns.

* Bill would require single-occupancy bathrooms in Illinois be gender neutral: Bush said she’d bring back an amendment to change the language to clarify some aspects.

* Measure would require minimum number of women on corporate boards: The measure was heard in committee, but the committee didn’t vote on it.

20 Comments

|

Stop narrowing the tax base

Friday, Mar 15, 2019 - Posted by Rich Miller

* When you freeze assessments for one favored group of taxpayers, everybody else has to pick up the slack. So, if you want to help young homeowners, stop doing stuff like this…

The Illinois Senate is poised to take up a bill that would make it easier for some seniors to access a state program that limits property tax increases on their homes.

Under current law, people age 65 and older with incomes up to $65,000 can claim the Senior Citizens Assessment Freeze Homestead Exemption, which effectively freezes the taxable valuation of their homes so that their tax bills cannot go up simply because the market value of their home rises.

Senate Bill 1346, which cleared the Senate Revenue Committee on Wednesday, would expand that slightly, starting in the 2019 tax year, by allowing seniors to deduct from their income whatever money they spend on Medicare premiums. That would allow some people with incomes just above the $65,000 cap to claim the exemption.

Sen. Laura Ellman, a Naperville Democrat and lead sponsor of the bill, said it would benefit seniors who are “on the cusp” of the income limit, but she said she couldn’t estimate how many seniors it would benefit.

* Here’s what happened the last time the General Assembly got carried away with helping seniors on their property taxes…

When state lawmakers pushed through a trio of tax breaks in spring 2017, the idea was to ease some of the financial pain caused by Mayor Rahm Emanuel’s series of major property tax hikes on Chicago homeowners, especially senior citizens.

The changes, however, also had an unintended consequence: Thousands of homes in south suburbs such as Harvey and Park Forest fell off the tax rolls, meaning those homeowners no longer pay any property taxes at all, and an even greater number are paying less.

While that’s good news for many, it’s also resulted in tens of millions of dollars in property taxes being shifted onto remaining homeowners and businesses. They are now being hit with even higher bills in an impoverished, long-struggling, largely African-American region where an outsized property tax burden already made it difficult to attract the retail shops and industry needed to reverse economic woes made worse by the Great Recession.

49 Comments

|

Chamber president still has hope for Pritzker

Friday, Mar 15, 2019 - Posted by Rich Miller

* Dan Petrella…

With a new governor in office, Democratic lawmakers are charging ahead on legislation Republican Gov. Bruce Rauner blocked as he pursued his pro-business, union-weakening agenda. […]

With Democrats trying again on many issues Rauner prevented from becoming law, some in the business community are on edge as Pritzker also advocates for a graduated income tax plan that would raise rates on the wealthy and on corporations.

“I unfortunately do think that (the votes) are an indication of what the next four years are going to look like,” said Todd Maisch, president and CEO of the Illinois Chamber of Commerce, which was closely aligned with Rauner and opposed legislation on the smoking age, salary history and the minimum wage. “It doesn’t mean every anti-business bill is going to go ahead and pass. I do think that Gov. Pritzker really does want to be seen by the business community as somebody who understands their issues.”

However, Maisch added, “it looks like we’re going to take a few beatings.”

Hang in there, Todd. /s

On a more serious note, it’s interesting to see that Maisch retains some optimism about Gov. Pritzker’s relationship with the business community. I should probably follow up with him on that soon.

17 Comments

|

* Peoria Journal Star letters to the editor…

I know very little of JB Pritzker’s personal history but I believe I read during the recent election campaign that he is of the Jewish faith. Consequently, it seems incongruous to me that he could support the right to an abortion.

He is too young to have firsthand remembrance of the World War II holocaust but I am not. Horrific photographs of murdered, innocent Jewish men, women and children are firmly etched in my mind. […]

It is ironic that Hitler is, rightfully so, branded for all time as a monster for the extermination of millions of Jews, Christians and others for being enemies of the Third Reich. Yet Pritzker and other proponents of the extermination of millions of unborn babies are hailed as heroes under the banner of “women’s rights” or “women’s healthcare.”

How sad that abortion rights advocates now legalize extermination at any stage of the baby’s development.

You gotta wonder what goes through an editor’s mind when deciding whether to publish letters like these.

I mean, the governor helped found a Holocaust Museum, for crying out loud.

53 Comments

|

PBMs Save Illinois Patients & Payers Nearly $26 Billion

Friday, Mar 15, 2019 - Posted by Advertising Department

[The following is a paid advertisement.]

Pharmacy benefit managers (PBMs) are the primary advocate for consumers and health plans in the fight to keep prescription drugs accessible and affordable. By leveraging competition among drugmakers and drugstores, PBMs help 266 million Americans every year access needed medications. PBMs will save patients and payers $123 per brand prescription, negotiate prescription costs down nearly $26 billion in Illinois, and help prevent 100 million medication errors nationwide. That means better care for more people at a lower cost.

Think of PBMs as your advocates—they’re in your corner, clamping down on prescription drug hikes because your health is non-negotiable. Learn more at OnYourRxSide.org

Comments Off

|

* The Tennessean…

Authorities in Illinois have charged the father of the suspect in the deadly Nashville Waffle House shooting, accusing him of illegally giving his son the gun used to kill four people at the restaurant.

Jeffrey Reinking was charged Thursday with unlawful delivery of a firearm. Prosecutors said he gave his son Travis Reinking a gun — despite the fact that his son had recently been hospitalized for mental health issues.

Travis Reinking is schizophrenic, according to a medical expert who evaluated him and testified in court. Illinois prosecutors said he had been treated at the mental health unit of Methodist Medical Center of Illinois.

Illinois state law forbids people from selling or giving guns to anyone who has “been a patient in a mental institution within the past five years.”

* NBC 5…

“Mass shootings have raised public awareness regarding the need to keep firearms out of the hands of persons afflicted with mental illness,” [Tazewell County State’s Attorney Stewart Umholtz] said, noting that doing so in Illinois is a criminal offense. “While I strongly support citizens’ rights under the Second Amendment, I also strongly support holding individuals accountable for the commission of criminal offenses related to firearms.”

The older Reinking has posted bond and is scheduled for arraignment on April 25. He faces up to three years in prison and a fine, if convicted. Telephone calls to his lawyer weren’t immediately returned. […]

Travis Reinking was a onetime crane operator who moved across multiple states and suffered from delusions, sometimes talking about plans to marry singer Taylor Swift, friends and relatives told authorities. He was detained by the Secret Service in July 2017 after venturing into a forbidden area on the White House grounds and demanding to meet President Donald Trump.

* WEEK TV…

Reinking’s attorney disputed the charges.

“Jeff Reinking has not committed a criminal offense. He has been charged under an Illinois statute that prohibits the sale or gift of firearms to someone who has been in a mental institution. But Jeff didn’t sell or gift Travis the guns,” said Joel E. Brown, Reinking’s attorney in a statement to WKRN in Nashville. “The district attorney wants to pound a round peg into a square hole because of the terrible events that happened months after Travis’s weapons were returned to him. Returning Travis’s guns to Travis is not a criminal offense and we will fight it in court.”

* Peoria Journal Star…

In May 2016, a Tazewell County sheriff’s deputy met with Travis Reinking and members of his family, including his father. Travis Reinking said he believed singer Taylor Swift had been stalking him and hacking into his cellphone and Netflix account. Further, the younger Reinking said Swift had arranged to meet him at the Dairy Queen in Morton, but she only yelled at him from across the street before climbing up the side of a building and onto the roof before disappearing. Also in the meeting with the deputy, the family said Travis Reinking had been suicidal. At the end of that meeting, which also was attended by a representative of the Tazewell County Emergency Response Services, Travis Reinking agreed to go into Methodist’s Behavior Health Unit. He was there from May 26 to June 3 of 2016.

In August 2017, after Travis Reinking became a resident of Colorado, the state of Illinois revoked his Firearm Owner’s Identification Card because he was no longer a resident of Illinois. Further, a representative from the Illinois State Police confiscated the card from Travis Reinking and transferred his firearms — including a Bushmaster AR-15 — into the possession of his father. The complaint alleges a county Sheriff’s Department officer “advised” Reinking that the weapons confiscated from Travis in August 2017 and “transferred” to him “were to be kept secured and away from Travis.” […]

Jeffrey Reinking’s attorney said after the charge was filed that the statute defining the crime of giving a firearm to a person whose mental state makes him potentially dangerous does not apply in Reinking’s case.

The weapons “were neither his to sell or give. He never owned the weapons, they were his son’s” who, at the time, had a legal right to have them, said Peoria attorney Joel Brown. “The term ‘give’ is not defined in the statute.”

Jeffrey Reinking “did some research” and concluded his son was entitled to their return, Brown said.

Sheesh. What a mess. Why weren’t his guns confiscated and his FOID card revoked when he was hospitalized?

45 Comments

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|