Our sorry state

Friday, May 3, 2019 - Posted by Rich Miller

* COGFA looks at the ramp…

If the State continues funding according to Public Act 88-0593, the projected accrued liabilities of the State retirement systems will increase from $229.3 billion at the end of FY 2019 to $331.0 billion at the end of FY 2045. At the same time, the projected actuarial value of assets is projected to increase from $92.5 billion to $297.9 billion. Consequently, the projected unfunded liabilities are projected to decrease from $136.8 billion at the end of FY 2019 to $33.1 billion at the end of FY 2045, and the projected funded ratio is expected to increase from 40.3% in FY 2019 to 90.0% by the end of FY 2045. All of the projected figures in this paragraph come from the various systems’ actuaries and are predicated upon the State making the necessary contributions as required by law.

Remember that last sentence.

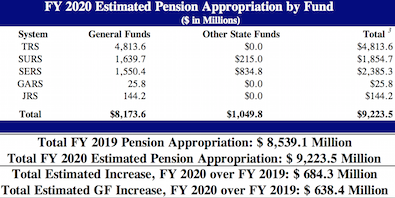

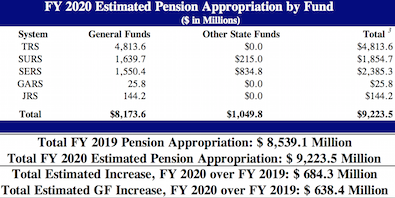

* This is based on current statutory requirements…

The governor has proposed lowering that FY20 payment by almost $900 million, but Amanda Kass puts the actual figure at about $1.1 billion. And this is every year for seven years.

* According to COGFA, the pension funds currently have assets totaling $89.8 billion. But…

Over the last 24 years [since fiscal year 1995], the State of Illinois has appropriated $91.8 billion to the five retirement systems

So, the pension funds currently have $2 billion less than the state has put in, and we most definitely didn’t start at zero in 1995.

Ugh.

* And while the unfunded liability percentage dropped a tiny bit over the past fiscal year, the dollar amount increased…

Despite a roaring stock market, combined unfunded liabilities in the state’s five pension funds rose again and hit a record $133.5 billion in the year ended June 30. […]

According to the Commission on Government Forecasting and Accountability, the difference between what the state has set aside for retirement benefits and what it has committed to pay (the unfunded liability) rose $4.8 billion in fiscal 2018, up 3.7 percent from the prior year. […]

There are some small bits of good news in the report.

One is that the funded ratio of the funds actually ticked up from 39.8 percent to 40.2 percent. But it’s still below what it was in 2011, with huge gains in the equity markets since then.

Another dollop of good news is that the amount being paid out by funds in benefits seems to be leveling off. But it’s not clear whether that will continue.

- lakeside - Friday, May 3, 19 @ 1:36 pm:

==the pension funds currently have $2 billion less than the state has put in==

Welp. Have a great weekend guys. I’m going to… think about anything else for a while.

(JB - please don’t do your terrible plan. Thanks)

- Dan Johnson - Friday, May 3, 19 @ 1:42 pm:

Can we please tax retirement income and put that almost $2B/year into the pension funds?

Makes sense, right?

- wordslinger - Friday, May 3, 19 @ 1:50 pm:

–Despite a roaring stock market,–

The DJIA has been pretty flat since Jan. 2018, when it hit 26,616.71.

But it’s definitely been roaring, since March 2009, when it was at 7,223.98.

- Steve - Friday, May 3, 19 @ 2:08 pm:

Since benefits can’t be cut. Taxes will have to go higher. Sacrifices have to be made , the pension clause isn’t going to be changed.

- Simple Simon - Friday, May 3, 19 @ 2:13 pm:

==Can we please tax retirement income and put that almost $2B/year into the pension funds?===

As a pensioner, I agree, with a very large exemption (like 50K or so). But be warned, that includes all pension income, not just state retirements.

We need to claw back from folks who earned when the tax rate was not high enough to support the government services being provided at the time..

- AndyIllini - Friday, May 3, 19 @ 2:29 pm:

That fact that we’ve had one of the longest bull markets in history, and are at near full employment, and the funding level hasn’t increased is pretty alarming, at least to me as an outsider. It makes you wonder what funding levels would be like if that overdue recession or a big market correction happened.

- Robert the Bruce - Friday, May 3, 19 @ 2:30 pm:

==And this is every year for seven years==

Honest question: if the progressive income tax passes, will it still be seven years of lowering the pension payment?

- Cook County Commoner - Friday, May 3, 19 @ 2:31 pm:

“Since benefits can’t be cut. Taxes will have to go higher. Sacrifices have to be made….”

Sacrifices by whom?

- Sue - Friday, May 3, 19 @ 2:33 pm:

This post confirms what I have said a dozen times. The management of the State funds in terms of investment performance has been abysmal. Just think how much better the taxpayers and pension participants would have been had the funds attained market returns since 09. Achieving the 8 percent hurdle rate over 10 years and claiming victory is rediculous. If Pritzker does anything during his time in office to professionalize the investment staffs and force our lay boards to retain firms like Blackrock or Goldman to oversee investment decision making he will be doing Illinois the biggest service he can imagine. Why allow these non professional Boards to administer the State’s single largest liability is a question which Pritzker should should address sooner then later

- wordslinger - Friday, May 3, 19 @ 2:38 pm:

–Over the last 24 years [since fiscal year 1995], the State of Illinois has appropriated $91.8 billion to the five retirement systems

So, the pension funds currently have $2 billion less than the state has put in, and we most definitely didn’t start at zero in 1995.–

If I’m reading that correctly, over the last 24 years, state contributions and earnings have covered pension payments, save for $2 billion.

- wordslinger - Friday, May 3, 19 @ 2:41 pm:

–Consequently, the projected unfunded liabilities are projected to decrease from $136.8 billion at the end of FY 2019 to $33.1 billion at the end of FY 2045, and the projected funded ratio is expected to increase from 40.3% in FY 2019 to 90.0% by the end of FY 2045. All of the projected figures in this paragraph come from the various systems’ actuaries and are predicated upon the State making the necessary contributions as required by law.–

Any whiz kids out there with the ciphering skills to calculate what the projected fund ratio would be in 2045 under Pritzker’s plan? I certainly do not have them.

- Donnie Elgin - Friday, May 3, 19 @ 3:02 pm:

“Can we please tax retirement income”

seniors/retirees strike fear into the hearts of elected officials as they vote in huge numbers. No chance IL pols will vote to taxing retirement income.

- Davos - Friday, May 3, 19 @ 3:02 pm:

=Why allow these non professional Boards to administer the State’s single largest liability is a question which Pritzker should should address sooner then later=

If you review the published investment return data, you would see that the returns of the Systems mirror that of the global financial markets. The systems are utilizing such worldclass firms in the management of their portfolios. The reason unfunded liability continues to grow is primarily driven by the structural inadequacies of current statutory funding formula. Take a look at the annual CAFR of each system, such documents track the growth in unfunded liability.

- Jibba - Friday, May 3, 19 @ 3:18 pm:

The recent Pew report also mentions private management fees as a problem inhibiting returns of public pension funds, to the tune of billions of dollars. Rauner made his money how, again?

- RNUG - Friday, May 3, 19 @ 3:27 pm:

Given how deep the hole is, that really is decent news.

But Rich is right about that last sentence.

I’m not home to run any numbers … but a swag of missing $2B a year for 7 years would be an additional difference of $30B to $50B at the end.

- Sue - Friday, May 3, 19 @ 3:40 pm:

Davis- you are misinformed. The funds haven’t achieved upper quintile performance in years. You have to compare performance to other similarly sized public plans. Try reading Pension and Investments. The Illinois funds are lagging and lagging significantly

- striketoo - Friday, May 3, 19 @ 3:53 pm:

It is inevitable that at some point in the future pensions will be reduced whether it is legal to do so or not. The legislative and executive branches will simply challenge the courts ability to intervene.

- Popeye - Friday, May 3, 19 @ 4:05 pm:

Striketoo

WHAT??? They are called co-equal branches of government contrary to what you are hearing and seeing on tv. The decision was already made by the Illinois Supremes…be careful of what you wish for the 1% LOVE hearing that talk, can you say oligarchs