|

*** UPDATED x1 *** Hold on tight because the economy is in for a very rough ride

Friday, Mar 20, 2020 - Posted by Rich Miller * It ain’t gonna be pretty…

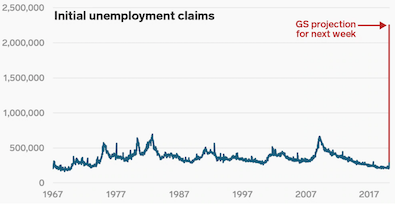

Using Goldman Sachs’ original forecast and finding a middle ground between it and two forecasts from Deutsche Bank and JP Morgan, the Economic Policy Institute projected 206,648 lost jobs in Illinois alone. Deutsche Bank and JP Morgan predicted a 14 percent GDP decline. The middle point used by the EPI was somewhere around 10 percent. Goldman Sachs is now at 24 percent. The new middle point between those two is now a 19 percent contraction. So, maybe double that originally projected 206.6K Illinois job loss? The latest figures from the Bureau of Labor Statistics has Illinois employment at 6.19 million with a 3.5 percent unemployment rate. *** UPDATE *** A striking visualization of the Goldman Sachs projection…

|

- Nick - Friday, Mar 20, 20 @ 2:05 pm:

I don’t think people are prepared for the speed at which this is going to get worse than 2008. The only silver-lining is that the recovery, if we’re lucky, will be much stronger and much quicker. But frankly I’m not sure if the assumptions which underline strong growth in Q3 or Q4 are safe right now.

- OpentoDiscussion - Friday, Mar 20, 20 @ 2:05 pm:

And the dollar is gaining strength as the ‘best of the worst.’

That will only hurt any remaining U.S. exports and will do real damage to the AG sector which is important in Illinois.

- Southern Skeptic - Friday, Mar 20, 20 @ 2:06 pm:

Thank God we have a flush rainy day fund. /s

Seriously though, this is going to be a very scary time. I hope everyone stays safe and stays employed. Good luck everyone.

- Nick - Friday, Mar 20, 20 @ 2:09 pm:

To put it into perspective, while the rise in unemployment claims was gradual, the highest they ever reached even at the height of the 2008 financial crisis was 600K. Goldman Sachs is now estimating they’ll hit 2.2 million this week.

GDP falling at an annualized rate of even just 10% in Q2 would be the steepest fall in quarterly GDP since demobilization following World War II. 24 percent? That’s the sort of decline you *probably* saw at the *height* of the great depression.

- Coach Bag - Friday, Mar 20, 20 @ 2:15 pm:

Nationally it will be very painful.

In Illinois it will devastating.

We are just not financially prepared for this at all as a state.

- Six Degrees of Separation - Friday, Mar 20, 20 @ 2:18 pm:

My grandmother noted two things about the Great Depression that I remember. One was that there were fat cats with a lot of money who flouted it, even though much of the population was suffering. The other was that, before the fall, money was very easy to borrow, and lenders went out of their way to get people hooked. This one feels different as we had essentially full employment before COVID-19 and there are some sectors who are still busier than ever. Some of my friends in the logistics business say they have never been busier.

- SSL - Friday, Mar 20, 20 @ 2:26 pm:

I don’t doubt the bad numbers, but I don’t think there will be any kind of a bounce back. There will be many businesses that never reopen after the shutdown. Too many operated on razor thin margins and won’t survive. Then the ripple effect will start and next thing you know, you’ve got yourself another great recession.

- Penny - Friday, Mar 20, 20 @ 2:32 pm:

This does not have to happen.

- Joe Bidenopolous - Friday, Mar 20, 20 @ 2:37 pm:

So Penny, what’s the solution?

- McLincoln - Friday, Mar 20, 20 @ 2:40 pm:

-“ We are just not financially prepared for this at all as a state”

Agreed. Thus far, JB has proven he is capable.

- Ducky LaMoore - Friday, Mar 20, 20 @ 2:50 pm:

The estimates vary widely on how much the economy will contract. Median estimates are about half as bad as this one. Nonetheless, there will be a lot of pain.

- Huh? - Friday, Mar 20, 20 @ 2:53 pm:

Disagree that recovery will be fast. The small business owners that line Main Street who are being hit the hardest won’t have the resources to rebuild their businesses. Gearing up big business will take longer. When this ends, we will still be practicing social distancing for fear of the corona virus.

This isn’t going to end nicely.

- Ok - Friday, Mar 20, 20 @ 2:56 pm:

There is going to be quite the wallop of company earnings reports.

But the real pain will be the small companies that can’t ride through on investor cash and debt, and two weeks is more than they can absorb. Let alone 2 months.

- Lucky Pierre - Friday, Mar 20, 20 @ 2:59 pm:

In January Goldman Sachs declared the economy recession proof so I would take their forecasts with a grain of salt

https://www.cnbc.com/2020/03/14/goldman-thought-economy-was-recession-proof-in-january—it-wasnt.html

- CharlieKratos - Friday, Mar 20, 20 @ 2:59 pm:

It’s times like these that make me mourn the ban on the exclamation mark.

- Nick - Friday, Mar 20, 20 @ 3:05 pm:

Lucky Pierre,

In January no one was envisioning that we’d be forcefully shutting down entire sector of our economy. I think we can all attest to the fact that things have changed since then.

- West Town TB - Friday, Mar 20, 20 @ 3:10 pm:

In the spirit of irrational optimism, maybe the silver lining here is that the feds will give Illinois a needed bailout and help us to be on sound financial footing after this mess? No more pension ramp up?

A man can dream….

- Three Dimensional Checkers - Friday, Mar 20, 20 @ 3:11 pm:

Not surprising, just look outside and see for yourself. No one is spending money anywhere. How much money can we all spend on food, household goods, and health care (god forbid)? Should make it clear that consumer spending and not investment or anything else is the real core of the economy.

- Hamlet's Ghost - Friday, Mar 20, 20 @ 3:14 pm:

Paging Andrew Yang

This calls for universal basic income

- SSL - Friday, Mar 20, 20 @ 3:15 pm:

States that are the hardest hit face the very real possibility of losing a significant amount of businesses, and the people that go with them. Awful.

- Southern Skeptic - Friday, Mar 20, 20 @ 3:21 pm:

Public Service Announcement. When you see this kind of silliness, just ignore.

“This does not have to happen.”

- City Zen - Friday, Mar 20, 20 @ 3:49 pm:

==Paging Andrew Yang==

Should’ve paged MSNBC/CNN/NYT/DNC first.

- Huh? - Friday, Mar 20, 20 @ 3:52 pm:

“This calls for universal basic income”

A lot of good it will do if stuck in house and can’t spend any money.

- OK Boomer - Friday, Mar 20, 20 @ 3:57 pm:

I saw a poll that our President still has a high approval rating. How is this possible? This administration has been so inept and the consequences are now catastrophic. 2008 was bad and that happened under the watchful eye of our last GOP administration. I always considered myself an independent but I am not sure I will ever vote Republican again.

- Anonymous - Friday, Mar 20, 20 @ 4:15 pm:

Some experts are projecting a depression, not just a recession. The last time Illinois saw a depression, the State postponed the collection of real estate taxes by a year. That created havoc with the local public bodies who relied on real estate taxes — and the same havoc would ensue this time. As the State sees its pension liabilities skyrocket by 30% due the market crash, and sees its revenues plummet due to a steep decline in sales tax and income tax revenue, and sees an escalating demand for public benefits (Medicaid, TANF, etc.) that require the State to spend more money to serve its most vulnerable, the State will be hard pressed to maintain even level funding for local governments, including school districts. And if a lot of people don’t pay their real estate taxes (a not unlikely scenario, taking into account unemployment and underemployment), or if the State allows people to defer their real estate taxes, school districts and other locals are going to be in big trouble. IMO, this thing is going to get a lot more ugly before it starts to look less ugly, and it could a long time before it starts to look pretty.

- Because I said so.... - Friday, Mar 20, 20 @ 4:26 pm:

I am trying hard not to panic and my attempts at being optimistic are failing fast. I worry about the health and well-being of myself and family but also frightened that so much of my retirement investments are likely gone. I’m coming to the realization that life as we knew it, and the life I had planned in the future is not going to be what I had hoped.

- Dybalaton - Friday, Mar 20, 20 @ 4:40 pm:

The economy will certainly shrink by shockingly large amounts. But business will almost certainly bounce back quickly. China is already seeing production increase as the crisis subsides there. Of course Illinois as a state will likely get decimated due to our financial mismanagement.