* Fitch reduced the state’s rating to one tiny click above junk bond status, and handed a non-investment grade status to the MPEA and ISFA…

Fitch Ratings has downgraded the state of Illinois’ Issuer Default Rating (IDR) to ‘BBB-’ from ‘BBB’. Additionally, Fitch has downgraded the following ratings which are linked to or capped by the state’s IDR:

–GO bonds, downgraded to ‘BBB-’ from ‘BBB’;

–Build Illinois senior and junior obligation sales tax revenue bonds, which are linked to the state’s IDR based on state-dedicated tax analysis, downgraded to ‘BBB+’ from ‘A-’;

–Metropolitan Pier and Exposition Authority (MPEA) expansion project bonds, which are capped at appropriation risk of the state, downgraded to ‘BB+’ from ‘BBB-’;

–Illinois Sports Facilities Authority (ISFA) sports facilities (state tax-supported) bonds, which are also capped at appropriation risk of the state, downgraded to ‘BB+’ from ‘BBB-’.

The Rating Outlook is revised to Negative from Stable.

Fitch anticipates reviewing ratings within the next two weeks for Chicago motor fuel tax revenue bonds (BBB-/Stable) that may be affected by the downgrade and Outlook revision. […]

ANALYTICAL CONCLUSION

The downgrade of Illinois’ IDR and GO bond ratings to ‘BBB-’ from ‘BBB’ reflects Fitch’s anticipation of a fundamental weakening of the state’s financial resilience given its already tenuous position entering the current severe downturn. While Illinois should avoid any immediate cash flow pressures, the state’s lack of meaningful reserves and the limited nature of other fiscal-management tools at its disposal mean Illinois will be challenged to maintain its investment-grade IDR.

Illinois’ ‘BBB-’ IDR and GO bond ratings, well below the level of other states, have long reflected an ongoing pattern of weak operating performance and irresolute fiscal decision-making that has produced a credit position well below the level that the state’s broad economic base and substantial independent legal ability to control its budget would otherwise support. The ratings also reflect the state’s elevated long-term liability position, modest long-term economic and revenue growth profile and adequate expenditure flexibility.

The Outlook revision to Negative reflects the risk that the depth and duration of the downturn lead Illinois to implement nonstructural budget-management measures the state finds difficult to quickly unwind once an economic recovery finally begins to take hold.

MPEA had a great credit rating until the Rauner years, when a payment was missed…

The failed transfer prompted Standard & Poor’s to strip the agency’s $3 billion of debt of its AAA rating and Fitch Ratings to lower its AA-minus rating. Both dropped the ratings to BBB-plus, one level below the state’s A-minus rating, as they re-characterized the agency’s debt as subject to appropriation risk.

All three ratings agencies now have Illinois at the lowest possible rating and outlook before hitting junk bond territory.

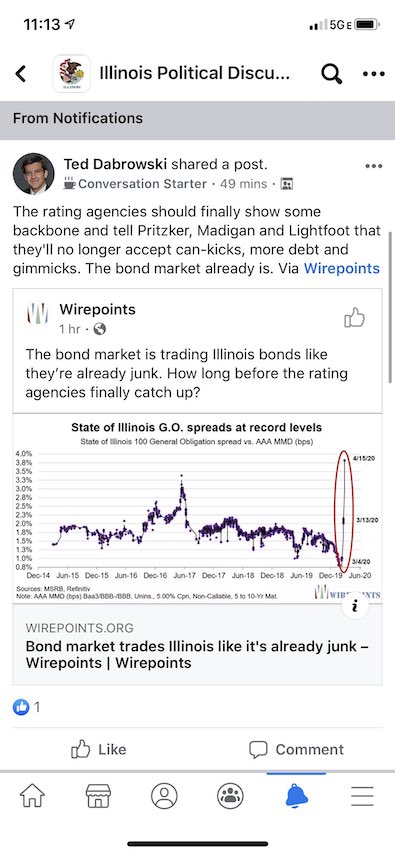

* Meanwhile, the folks at Wirepoints are all but demanding junk status…

…Adding… From the governor’s office…

The state of Illinois is committed to ensuring we work through the difficult challenges brought on by COVID-19. The state prioritizes its debt payments and will work to ensure our progress on stabilizing the state’s finances continues through this crisis. The state of Illinois’ credit remains investment grade and by working together, Illinois will get through this crisis and rebuild our economy with new resolve.

- Oswego Willy - Thursday, Apr 16, 20 @ 4:39 pm:

Wirepoints exists… to make the Illinois Policy Institute look thoughtful and knowledgeable.

If you are cheering for implosion during a pandemic that is the measure of your character you will never shake.

Wirepoints is the type of place Facebook might say… “making your *own* website is easy, here’s how”

- A Jack - Thursday, Apr 16, 20 @ 4:40 pm:

The pandemic put many corporate and municipal bonds in a squeeze. But I noticed lately that my Illinois bonds have recovered somewhat better than my corporate bonds. In fact I have a 2034 Illinois bond that is trading at a premium to par. That tells me that the bond market thinks that Illinois will be able to weather this pandemic storm.

- Donnie Elgin - Thursday, Apr 16, 20 @ 4:44 pm:

We were already ranked last of all 50 states that in terms of credit rating.. So there is that right.

- Jibba - Thursday, Apr 16, 20 @ 4:44 pm:

The ratings agencies seem to have come up against the limitations of their ratings systems. Do they actually rate Illinois below investment grade despite the ability to raise revenue and the statutory protection of bond payments, based on fears alone? If they consider impacts of the pandemic, many states will not be able to balance their budgets in the next few years. Will they al be junk? Seems unlikely.

- Anyone Remember - Thursday, Apr 16, 20 @ 4:44 pm:

Ted Dabrowski - Illinois’ Benedict Arnold.

- Precinct Captain - Thursday, Apr 16, 20 @ 4:45 pm:

I get we’re loaded to the hilt with debt, but isn’t this just kind of ghoulish? In a pandemic recession or depression, we have a broad, diverse state economy compared to say, Florida. We also have more broad and diverse revenue raising measures than compared to a state like Florida.

- Oswego Willy - Thursday, Apr 16, 20 @ 4:46 pm:

To the post,

Part and parcel of the budgetary emergency that now exists outside the usual budgetary challenges will mean Illinois, solely from the budget aspect, will be like every state stifled by the lack of revenues that are now long gone.

Illinois’ constitution will be squarely in the sights of those looking for how obligations will be met, while also seeing and grappling with the sheer charge of functioning as a state at agency levels, and obligation levels for agencies to meet their charge.

And folks wonder why I won’t let the Raunerites off the hook for the entire General Assembly (two years, mind you) without budgets.

Along with IPI and Wirepoints, Rauner himself must see these dire forecasts as “good news“.

- Ducky LaMoore - Thursday, Apr 16, 20 @ 4:48 pm:

The rating agencies should show some backbone? Pardon me, when don’t they? They aren’t some demented politician rambling about anything and everything. They are thoughtful bean counters that call them like they see them. And they are telling Illinois that things are bad, just as they should. Sorry if they don’t do it loudly or profanely as to your liking, Ted.

- MyTwoCents - Thursday, Apr 16, 20 @ 4:55 pm:

Considering the ratings agencies were ok with IL bonds until IL actually started paying pensions, even though our pension funding ratio hasn’t dramatically changed in decades I’ll take their assessments with a grain of salt. It’s like using the stock market as an indicator of the general economy, not connected to reality. I guarantee you IL will always pay their bonds in full.

- TinyDancer(FKASue) - Thursday, Apr 16, 20 @ 4:57 pm:

= They are thoughtful bean counters that call them like they see them.=

Unless, of course, they’re rating CDO or MBS.

- City Zen - Thursday, Apr 16, 20 @ 4:59 pm:

Prognosis Negative.

There will be many others.

- Oswego Willy - Thursday, Apr 16, 20 @ 5:05 pm:

I forget,

“City Zen” is another cheerleader of the doom.

The state is not only challenged with real issues and now a pandemic, the usual suspects who cheer only the bad now have the DJ playing their tunes.

Reality?

The good and truly the bad will be dictated by the constitution, statute, federal matchings, and essentials, funding levels for those items that are deemed essential… this is hard budgetary work, with even tougher budgetary decisions.

- 17% Solution - Thursday, Apr 16, 20 @ 5:53 pm:

The late wordslinger slung some words about this about a year ago.(March 5, 2019)

“Sovereign powers, exponential debt service coverage, state law, continuing appropriations and a history of never missing a bond payment.

Rauner piled on $12B in additional unpaid bills in 2.5 years — bonds got paid first, on time, in full.

It’s informative to take credit ratings as a measure of a state’s fiscal practices. But they mean nothing when it comes to paying debt service on bonds.

By any reasonable measure, every state should be AAA when it comes to their ability and track records in servicing their bonded indebtedness.

But if the rating agencies ever admitted that obvious truth, they’d be out of the business of rating states.

- Pundent - Thursday, Apr 16, 20 @ 6:50 pm:

=But if the rating agencies ever admitted that obvious truth, they’d be out of the business of rating states.=

And the yields would be lousy.

- IT Guy - Thursday, Apr 16, 20 @ 7:24 pm:

=The late wordslinger slung some words about this about a year ago.(March 5, 2019)=

During times like this I miss his insight.

- John Deere Green - Thursday, Apr 16, 20 @ 7:58 pm:

==The rating agencies … are thoughtful bean counters that call them like they see them.==

Hmm, yeah dunno about that. Their complicity in the mortgage crisis made clear they have an agenda of their own. As MyTwoCents said, grain of salt. And, always thus, Word’s valid points age well.

Sure, Teddy, all the fault of Madigan, Pritzker and Lightfoot. /s SMH. I guess Teddy and the Gaslight Gang forgot about the eight downgrades under bidnessman Baron von Carhartt. Disingenuous charlatan.

- Chicagonk - Thursday, Apr 16, 20 @ 9:31 pm:

No one said it would be easy.

- RNUG - Friday, Apr 17, 20 @ 4:47 am:

My takeaway is that the State will middle through and make all the bond payments on time, but it will require a combination of extremely tight cash management, including strategic borrowing, and a deferal of some expenditures … which may or may not include a partial shorting or deferral of both the pension funds and school payments.

In other words, pretty much business as usual … just within a tighter budget box.

- earl hickey - Friday, Apr 17, 20 @ 11:52 am:

Can the State legally send out partial pension checks along with an IOU for the balance? Same for interest payments on Bonds? Would that constitute a default?