* CBPP…

As states revisit their spending plans for the 2021 budget year, which began July 1 in most states, they are making deep budget cuts to offset huge revenue shortfalls triggered by COVID-19 and the worst economic downturn since the Great Depression. The initial state and local cuts enacted in spring and early summer caused sizable harm through layoffs, furloughs, and cuts to vital public services. Unless federal policymakers provide a new round of flexible fiscal aid, the harm will only worsen.

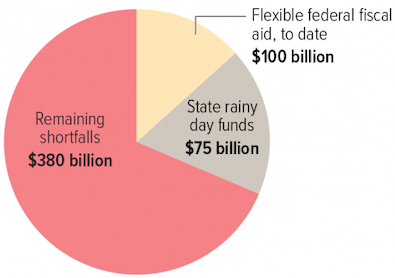

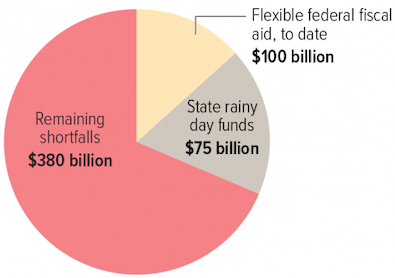

With business closures and layoffs sharply reducing state income and sales taxes, we estimate that state shortfalls will total about $555 billion through 2022. That’s a sharper drop than even in the worst three years of the Great Recession and its aftermath of a decade ago, and it doesn’t include the added state and local costs to confront the virus, such as more testing centers and hospital capacity. States must balance their budgets even in recessions, so state policymakers face enormous pressure to fill these shortfalls however they can, including with damaging cuts. […]

Some states have found ways to shield K-12 public schools or health services from their initial cuts, but that’s likely unsustainable. Policymakers will find it nearly impossible to protect these programs entirely over time, since education and health make up more than half of state spending nationwide. Indeed, several states have already slashed crucial health programs, such as substance use treatment and prevention.

More federal aid would enable states to reverse many of these cuts and minimize further cuts next year, when revenues likely will still be significantly depressed. That would limit further damage from the crisis, which has especially hurt people of color and economically struggling communities. It also would help lay the groundwork for state and local economies to recover more strongly.

The current crisis is simply too large for states to handle on their own. Federal aid in the Families First Act and CARES Act, both enacted in March, helped, but only about $100 billion of it is flexible enough for states to use to offset revenue shortfalls and limit cuts in services. Even after accounting for states’ “rainy day” reserves, which were a historically high $75 billion when the crisis started, about $380 billion in potential shortfalls remains through 2022.

Chart…

Note: Illinois’ rainy day fund is about 85 cents.

- 47th Ward - Wednesday, Jul 22, 20 @ 2:52 pm:

That’s some deep yogurt right there. The federal government is going to have to bail states out of this. It’s the only entity that can print money. Plus, what’s another half trillion in debt at this point? 5%?

- Norseman - Wednesday, Jul 22, 20 @ 2:58 pm:

=== Note: Illinois’ rainy day fund is about 85 cents. ===

Pick the snark of your choice:

1. It’s a start.

2. Better than nothing.

3. Can’t wait to calculate the interest.

4. I can double that with a donation of the change in my pants.

End with Sad Face Emoji

- Grandson of Man - Wednesday, Jul 22, 20 @ 3:03 pm:

“they are making deep budget cuts”

Katrina and the Trib editorial board, the IPI and others live for this, even without the COVID-19 crisis.

States need massive financial assistance. To the GOP, close your eyes and pretend it’s tax cuts to your richest donors.

- Ducky LaMoore - Wednesday, Jul 22, 20 @ 3:09 pm:

I’m so conflicted. I feel like we are going to destroy the US Dollar. But then again, if we are going to essentially suspend free market capitalism to prop up the value of publicly traded markets, then why not pay up to the entities that are fighting the pandemic?

- Oswego Willy - Wednesday, Jul 22, 20 @ 3:10 pm:

There will be state bailouts.

The only questions are;

How much? Where the monies can go?

- Michelle Flaherty - Wednesday, Jul 22, 20 @ 3:18 pm:

Regarding “rainy day funds”

State government isn’t a “for-profit” entity.

If state government collects more money than it needs for operations, it should return the excess to the taxpayers to stash in their own rainy day funds or to put to active use in the economy.

Government rainy day funds are a bureaucratic bean counter’s concoction.

And how can one justify establishing an Illinois rainy day fund prior to 2046? If there’s extra money, put it toward a debt.

- DuPage Saint - Wednesday, Jul 22, 20 @ 3:26 pm:

Michelle Flaherty is absolutely right. Rainy day fund she be returned to tax payer. Please send me my fair share of the 85 cents

- Friend of the Family - Wednesday, Jul 22, 20 @ 3:27 pm:

I can see that Social Services will take a beating, as they always do when budgets are cut. DCFS in Illinois will as usual, bear the burden of cuts when affected families lose the safety net that keeps them functioning. Schools will continue to run their pools, climbing walls, after school manga clubs, travel to chess tournaments, buy new equipment. Schools will definitely be ok.

- 1st Ward - Wednesday, Jul 22, 20 @ 3:31 pm:

Agree with OW.

@Ducky Lamore. We are $26.5TN in debt and your concern is over up to $555B of which a percentage would be recouped through federal taxes as less state employees are laid off. The concern is further deflation when debt loads are this high decreasing consumption, employment, and tax receipts more.

Structural deficit needs to be dealt with in the medium term. Not today.

- Cassie - Wednesday, Jul 22, 20 @ 3:43 pm:

A major reason it took ten years to not-quite-fully recover from the Great Recession is that state and local governments were forced into austerity. They drove a huge amount of unemployment, limited procurement, weren’t able to invest (in things like infrastructure, healthcare systems, public systems like Unemployment Insurance…).

Let’s definitely try that again? But more?

Or, with the cost of capital at historic lows, the federal government could provide significant grants. Let’s go beyond just filling the gap to actually catalyze investments in the systems and infrastructure the entire country has been ignoring for far too long. We can come out of this *stronger*.

- Angry Republican - Wednesday, Jul 22, 20 @ 4:41 pm:

At risk of deletion, I’m sure Trump will gladly bailout states in exchange for their electoral votes.

- Candy Dogood - Wednesday, Jul 22, 20 @ 4:48 pm:

Don’t worry folks, congress did the important thing by making hundreds of billions of dollars available to for profit companies.

Why prioritize K-12?

Fortune 500 companies will provide great new employee training programs for the job skills they need.

- RNUG - Wednesday, Jul 22, 20 @ 4:58 pm:

== Note: Illinois’ rainy day fund is about 85 cents. ==

While painting today, I found 72 cents on the shelf by the washing machine.

- Last Bull Moose - Wednesday, Jul 22, 20 @ 8:25 pm:

My back of the envelope calculations during the Great Recession was that state expenditure cuts added one percentage point to the unemployment rate. It cut muscle and bone more than fat.

My preferred plan distributes money as grants, not loans. Distribute to state governments 50% on population and 50% on taxes paid to the federal government by residents of the state. Keep it simple and roughly fair.