[Comments now open]

* Press release…

Despite making substantial progress on Illinois’ fiscal challenges in Fiscal Year 2020, the ongoing coronavirus pandemic has resulted in unexpected and dramatic revenue losses, and Illinois will also continue to face significant financial challenges until it finds a long-term solution to its long standing structural deficit, the annual Economic and Fiscal Policy Report from the Governor’s Office of Management and Budget concludes.

As a result of these recent challenges and with the option for a graduated income tax now off the table, the Governor’s Office of Management and Budget is projecting sizeable deficits in the General Funds budget for fiscal years 2022 through 2026. Without changes to the current trajectory of the state’s finances, year-end accounts payable will continue to grow year by year, the report states.

And then it goes on.

Click here for the full report.

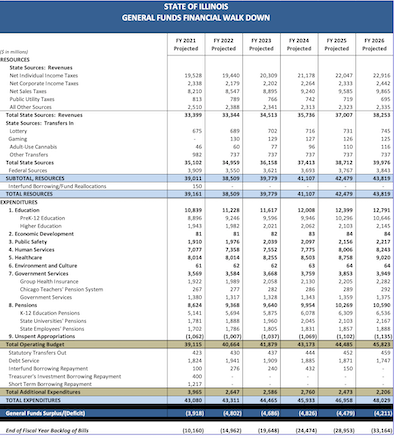

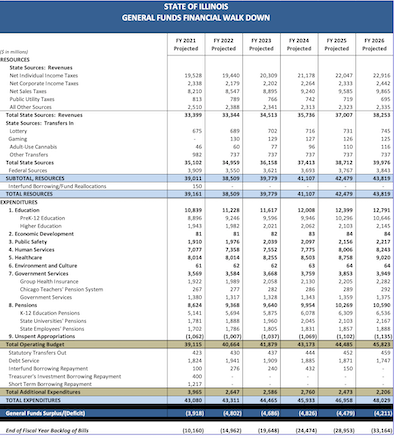

* We’ll go through it Monday, but here’s the actual projection…

So, the backlog is projected to equal 69 percent of total expenditures by FY26.

Great.

Also, nothing like dropping horrific fiscal news on a late Friday afternoon. Thanks, GOMB.

- City Zen - Monday, Nov 16, 20 @ 9:35 am:

On the plus side, the annual $350 million evidence-based funding increases for PreK-12 education ends in FY 2027.

- walker - Monday, Nov 16, 20 @ 9:42 am:

Note: The forecasts rely mainly on IHS, which is the most trusted, non-partisan, non-governmental, non-academic, economic forecaster in the world. They are relied upon by many governments, and by major corporations of all sorts. Good choice by Pritzker quants.

- thisjustinagain - Monday, Nov 16, 20 @ 9:46 am:

Oh, to live in a State with a balanced budget, and the few long-term debts paid on time every year.

Another reason Indiana looks better and better. Illinois had just barely stepped back from the edge, now it’s hanging over it again…and losing its grip.

- Oswego Willy - Monday, Nov 16, 20 @ 9:52 am:

=== Another reason Indiana looks better and better.===

You should leave and be done with it. If you’re staying here with all that angst, I would go calm you fiscally smart by jury own definitions. Go already.

To the post,

===… As a result of these recent challenges and with the option for a graduated income tax now off the table… ===

All y’all that voted against the Fair Tax to help the likes of IPI and Griffin to cause even more budgetary angst… I don’t wanna hear “why are they cutting the thing I like so much”

Odds are, they ain’t gonna just cut things to the bone, they gonna tax you for that opportunity to hurt ya too.

I can trust you’ll believe that.

- willowglen - Monday, Nov 16, 20 @ 10:02 am:

OW - Even if the Fair Tax passed, the increase in revenue would have barely put a dent in Illinois’ fiscal problems. This problem is a structural one, and has been a long time in the making. I do agree with the sentiment that if one desires to leave (there has been an exodus from the State), just do it rather than go on about it, but the numbers problem without or with a Fair Tax is an enduring and seemingly intractable one. Some might have better answers.

- Oswego Willy - Monday, Nov 16, 20 @ 10:05 am:

- willowglen -

… and yet, no one showed what cuts woulda occurred had the Fair Tax passed, so your assessment is that no cuts were coming, and that something we’ll never know.

Good try. No.

===… structural one…===

Pensions ain’t changing.

If you believe they are, maybe you should start the week over in reality.

- JS Mill - Monday, Nov 16, 20 @ 10:36 am:

=On the plus side, the annual $350 million evidence-based funding increases for PreK-12 education ends in FY 2027.=

Did you have a bad experience in school or something?

THE EBF funding will continue to rise.

- 1st Ward - Monday, Nov 16, 20 @ 11:04 am:

Is GOMB historically conservative? Actual 2019 personal income tax revenue was $22.6Bn. The above doesn’t show us getting back to that until 2026. I find this hard to believe. Further, corporate taxes were $3.0Bn the above shows only $2.7Bn in 2026 with sales taxes not fully removing until 2024. The state in total generated $43.7Bn in 2019. GOMB doesn’t expect us to get back to that until 2026? There are new sources of revenue now that we didn’t have in 2019. I find the revenue numbers hard to believe.

- striketoo - Monday, Nov 16, 20 @ 11:05 am:

Isn’t it time that we gave the voters of Illinois the government that they seem to be voting for? We are supposed to be a democracy after all. We have rejected taxing retirement income, rejected putting a higher tax rate on the very wealthy, and object to raising taxes generally, so why not try spending just the amount of revenue generated by the current tax burden. That amount seems to be the only one acceptable to to the voters, who are, in theory, in charge. Most commenters here reject the logic of this post and by so doing reject the basis of a democratic society itself. Why?

- Just Sayin' - Monday, Nov 16, 20 @ 11:12 am:

During the last 6 years, (excl 2020), our population has decreased significantly, by about 50,000 each year. When will we address cost control, pension control, and balanced budgets? You can’t just keep losing taxpayers. So for those that tell “thisjustinagain” to move already, you really can’t be so caviler in your comments.

- Oswego Willy - Monday, Nov 16, 20 @ 11:18 am:

=== pension control===

Pensions are guaranteed, can’t be diminished, and are locked in.

This is a mere talking point, not a fiscal point.

=== So for those that tell “thisjustinagain” to move already===

‘Bout that, unless the suggestions to help are real, it was - thisjustin - that talked about moving, I didn’t.

- 1st Ward - Monday, Nov 16, 20 @ 11:24 am:

Is GOMB historically conservative? Actual 2019 personal income tax revenue was $22.6Bn. The above doesn’t show us getting back to that until 2026. Further, corporate taxes were $3.0Bn in 2019 the above shows only $2.7Bn in 2026 with sales taxes not fully recovered until 2024. The state in total generated $43.7Bn in 2019. GOMB doesn’t expect us to get back to that until 2026? There are new sources of revenue now that we didn’t have in 2019.

By contrast Chicago’s projected budget shows full revenue recovery by 2023 or 2024 from 2019 numbers. Either the City or the State appear to be materially off in their assumptions. Maybe I’m missing something.