A collection of budget responses

Wednesday, Feb 2, 2022 - Posted by Rich Miller

* Senate President Don Harmon…

“I’m not accustomed to good news in a budget speech. This is a budget proposal unlike any I’ve seen in my time in the Senate. It speaks to the work we’ve done, together, to bring stability to our state finances. That stability allows us to invest back in our state and provide relief to those hit hardest by the pandemic and associated economic downturn. There’s a lot to like with this plan, and I look forward to working with the governor to produce a final product.”

* Speaker Chris Welch…

The governor’s budget address lays out a clear path to continue moving our state toward financial stability and surety while prioritizing hardworking Illinoisans. I could not be more proud of this state and the significant progress we’ve made in such a short amount of time.

It’s hard to imagine, but just a few years ago under the previous Republican administration we had a bill backlog of $17 billion, human service programs were decimated, our credit rating reached near junk status and Illinoisans were suffering because of it. It is thanks to hard work and responsible fiscal management that we are now in the position to discuss property tax relief, tax cuts for everyday necessities, millions in new spending for education, major investments in public safety and nearly eliminating our bill-payment backlog.

Our future is much brighter and our fiscal outlook is strong. This proposal by Governor Pritzker is an excellent starting point for our legislative budget negotiations. We cannot lose sight of the fact that we are still very much in the midst of an unprecedented pandemic and we must continue providing relief to people who are struggling. I have full confidence in Leader Greg Harris, his budget team, our appropriations committees and our Democratic Caucus to produce a final product that continues to build a better Illinois for all.

* Economic Security for Illinois…

In his State of the State budget address, Gov. Pritzker failed to include a popular proposal now up for debate in the General Assembly, which would provide 4.5 million low-income Illinoisans tax relief via an expansion to the Earned Income Credit. Shortly before the speech, the independent Center for Tax and Budget Accountability released a new report from finding the proposal would bring $1 billion in economic benefits to local economies, more than double the cost of the proposal and an overall net benefit of $600 million to the state.

“We are disappointed that the Governor’s ‘Family Relief Plan’ left low-income families behind. We are still in a pandemic, where families—particularly low-income families—continue to struggle. An expanded Earned Income Credit and new Child Tax Credit would directly benefit Illinoisans by putting cash in their hands and indirectly drive local economic investment for Illinois to build back better, ” said Harish I. Patel, Director of Economic Security for Illinois, a group which leads the Cost-of-Living Refund Coalition. “Our coalition will continue to fight alongside our partners in the General Assembly to provide permanent tax relief to Illinoisans who need it most.”

* A.J. Wilhelmi, President and CEO of the Illinois Health and Hospital Association…

“The Illinois Health and Hospital Association (IHA) echoes Gov. Pritzker’s heartfelt recognition of the extraordinary efforts undertaken by hospitals and healthcare workers around the state in the collective fight against COVID-19 over the last two years.

“The Governor’s budget proposal importantly allocates resources to begin addressing healthcare staffing shortages, which have been worsened by the pandemic. We support the Governor’s proposed funding for programs designed to help bring more workers into healthcare professions, and to help recruit and retain healthcare workers.

“Continuing to fully support our heroic, but fatigued, hospitals and healthcare workers will ensure that the Illinois hospital community remains viable and strong as they care for their patients in their time of need.

“IHA and the hospital community stand ready to work with the Governor and the General Assembly to enact a budget that ensures Illinois will emerge from this pandemic with its robust and innovative healthcare delivery system intact—and with hospitals having the necessary support to continue providing high-quality services to all Illinoisans.”

* Chicagoland Chamber…

“Between the commitment to further allocate funds to our state’s pensions, invest in workforce and economic development, increase funding for public safety, and pay down Illinois’ debt, we commend the Governor for the fiscal approach taken in this year’s proposed budget. Chicago’s business community has endured great hardship over the past several years, from an ongoing pandemic to rising property tax assessments and bills as well as violent crime that threatens every neighborhood throughout the city. The Chicagoland Chamber of Commerce stands ready to work with elected officials to ensure these proposed policies are enacted as well as to provide needed resources to our business community to both further economic growth and recovery and foster job creation and opportunity across Chicago and the state of Illinois,” said Jack Lavin, president & CEO, Chicagoland Chamber of Commerce.

* Illinois State Medical Society…

Illinois doctors are grateful that this budget commits to eliminating the reimbursement backlog for people covered under the state’s health plan. For many years medical practices serving state employees and retirees struggled as they waited months and months for reimbursement. The length of delayed reimbursement has improved in recent years and with this budget, if approved, should go away. This is good news.

In addition, ISMS appreciates the Governor’s acknowledgement of the Illinois medical community during this pandemic and his proposal to eliminate licensure fees for healthcare professionals. And we support funding the loan forgiveness programs that will help more doctors get into rural and underserved areas.

We also back the Governor’s ongoing efforts to continue to support the public health measures needed to mitigate COVID-19.

* IEC…

“The Illinois Environmental Council applauds Gov. JB Pritzker for proposing a state budget that prioritizes resources for combatting climate change, a first in Illinois history. Never before has an Illinois governor outlined such a strong budgetary commitment to climate solutions, including enactment of the Climate & Equitable Jobs Act, significant investments in electric vehicle infrastructure and support for clean energy and clean transportation manufacturing. Today’s proposal includes important first steps to rebuilding and adequately resourcing Illinois’ environmental and conservation state agencies, including increased staffing, something IEC has repeatedly called for. Finally, we are also thrilled to see the $113 million investment in replacing toxic lead service lines across the state.

“While more still needs to be done to safeguard our state’s natural resources the public health of all Illinoisans, these investments and those in the Climate & Equitable Jobs Act mark a turning point for our state, and we look forward to working with Gov. Prizkter and his administration to continue building Illinois’ nationally recognized climate leadership.”

* INA…

The Illinois Nurses Association supports Governor J.B. Pritzker’s plans to provide relief and financial support for important elements of the Illinois nursing work force. The Governor laid out his plans for Illinois in a combined State of the State and budget address today.

Nurses in Illinois have been serving patients in a pandemic that now enters its third year—nurses are stressed out, burned out, underpaid and underappreciated. We welcome the Governor’s support and are looking forward to working with him to help build the nursing workforce of the future.

INA officials also support the Governor’s efforts to ease the costs of obtaining a nursing license and his administration’s investment in nurses through the Advancement of the Healthcare Workforce Program and the Nursing Scholarship Education Program.

These programs can play an important role in recruiting new nurses to the health care workforce to help treat patients in the future.

* Illinois Hotel & Lodging Association…

“The hospitality and tourism industry, which has historically served as an anchor for Illinois’ economy, has been devastated by the pandemic – losing more than $111.8 billion in room revenue alone nationally. These losses have contributed to widespread layoffs, with many workers unable to return as recreational and business travel continues to be disrupted. Despite these struggles, Gov. J.B. Pritzker’s budget proposal neglected to offer any relief to the industry, which prior to the pandemic brought in $4 billion a year in state and local taxes and supported more than 290,000 jobs. As the governor looks for ways to support working families, we call on him to embrace our Hotel Jobs Recovery Plan, which would allocate $250 million in American Rescue Plan Act funds to hotels across the state. We urge the legislature and the Governor to support this initiative. This plan is an essential part of getting the industry, and our tourism and hospitality economy, back on stable footing and we look forward to working with the governor to make it a reality,” said Michael Jacobson, president & CEO, Illinois Hotel & Lodging Association.

* Illinois Federation of Teachers President Dan Montgomery…

“From the start of the pandemic, Governor Pritzker has steadfastly followed the science to protect our communities and move our state forward. We thank him for establishing mask and vaccine mandates that are helping keep our schools open and students and staff safe.

“The budget Governor Pritzker proposed today prioritizes the needs of students and educators and the delivery of public services to our most vulnerable Illinoisans. His proposed $350 million increase is a step toward adequately funding K-12 schools, especially in our neediest communities. But preK-12 funding is still billions of dollars short of the Evidence Based-Model funding target, which would provide the resources to educate every Illinois child well, no matter their zip code. We urge Governor Pritzker and the Illinois General Assembly to work toward fully funding the Evidence Based-Model.

“Critically, the state’s higher education system is suffering from decades of disinvestment. We are encouraged by the supplemental FY22 increase in funding for community colleges and universities that carries over to FY23. We urge the legislature to include this vital increase in higher education funding in the final budget.

“We also welcome the long-overdue recognition that the state must pay its bills – including the unfunded pension liability. The governor has proposed $500 million in pension funding over and above the required payment. This saves the state money in the long term and it’s the right thing to do.

“The pandemic will have lasting economic effects on students, educators, school staff, and communities of color. We applaud the governor for taking the necessary steps to assist in their recovery by providing some tax relief. The cuts to grocery and gas taxes and doubling the state property tax rebate will help provide the support that Illinois families need right now.

“The IFT looks forward to continuing to work with Governor Pritzker as he focuses on the state’s economic recovery from the pandemic.”

* SEIU Healthcare…

“As a union of the frontline home care, child care and healthcare workers who have experienced the direct impact of underfunded public services greatly exacerbated by a pandemic, we applaud the Governor’s continued commitment to responsible fiscal management.

“The Governor’s proposed budget is a step in the right direction, drawing upon the state’s strong economic performance and available Federal funding to pay for desperately needed rate increases for home care and child care workers as well as investment in schools, early childhood education, nursing home rate reform, mental health care, and the healthcare workforce in general.

“While the budget released today will provide crucial help to the workers and communities hardest hit by the pandemic, additional investment is still needed. We look forward to working with the Governor and the General Assembly to address the need for additional investment in crucial care services and infrastructure in communities across the state.

* Responsible Budget Coalition…

As a coalition of the state’s leading advocacy, human service, community and labor organizations, we judge any budget by these principles: It must contain adequate revenue, fairly raised, and it must avoid cuts to vital programs and services.

Sound fiscal management has put our state in a position to continue funding for many public services despite the COVID pandemic. With the state’s strong economic performance and important assistance from the federal government, we have more funds available to help all Illinoisans thrive, including those hardest hit by the ongoing pandemic.

The budget released today is a step in that direction. We are pleased with the funding increases for education as well as the focus on a number of other one time investments. However, Illinois must do more to focus on budget policies that would provide adequate revenue to support critical programs along with long-term tax relief to the lowest income people, by requiring the wealthy to pay their fair share.

We look forward to working with the Governor and the General Assembly to pass a budget that meets our moral obligation to fully fund education, health care, and human services. RBC will continue to further our mission to ensure that Illinois stays on sound financial footing as well as meeting the needs of its’ people. Working together, we can do both.

* Illinois Partners for Human Service…

Illinois Partners for Human Service, a coalition of more than 850 health and human service providers across the state of Illinois, is encouraged by Governor Pritzker’s FY23 budget proposal. We appreciate the priorities outlined in this budget for the health and human service sector and commend the significant investments proposed. Specifically, we are glad to see rate increases for many health and human services programs, including Behavioral Health, Developmental Disability Services, Childcare, the Community Care Program, and other key investments that will strengthen our sector and our communities.

Our health and human service coalition partners have been on the frontlines navigating this pandemic from the onset, and have tirelessly shouldered the burden of care for our communities. While state and federal relief dollars have been directed to our sector over the past two years, very little of this funding has addressed the systemic challenges facing the health and human services workforce. This budget is definitely a step in the right direction. At the same time, more work needs to be done to rectify the consequences of twenty years of disinvestment in the health and human service workforce in our state.

We look forward to working with the administration and our legislators to do everything possible to reduce administrative burden and ensure funding is directed to community providers. These organizations are trusted by those hardest hit by this pandemic, and their work is essential to the well-being of all Illinoisans.

* IMA…

“Facing record inflation, supply chain disruptions and workforce shortages, manufacturers across Illinois need support from policymakers to continue investing in our communities, growing our economy, and ensuring consumers receive the medicines, food and important goods they rely on. While we are encouraged by some of the priorities outlined by the Governor, including a significant investment in job training and workforce development programs, a focus on manufacturing careers, enhanced pension payment and the extension of the critical EDGE tax incentive, we must not lose sight of long-term challenges. These include policies that increase operating costs on employers and threaten job growth, such as $4.5 billion in debt plaguing the state’s Unemployment Insurance Trust Fund,” said Mark Denzler, president & CEO of the Illinois Manufacturers’ Association. “Manufacturers have time and again demonstrated our willingness to take on tough challenges and solve problems, and we remain prepared to work with the Governor and lawmakers to find solutions.”

…Adding… By Amdor’s request…

…Adding… Community colleges…

The Illinois Community College Trustees Association and the Illinois Council of Community College Presidents applaud Governor Pritzker and his administration for their planned investment in higher education through the FY 2023 budget, and support the proposed funding increases to operationalize strategies outlined in the collectively developed plan A Thriving Illinois: Higher Education Paths to Equity, Sustainability and Growth.

An unprecedented increase of $122 million in MAP funding will ensure more equitable access to higher education for all Illinois residents. This increase will also enable MAP grants to cover a greater portion of students’ tuition costs and expand funding eligibility to students pursuing short-term certificates or credentials in fields that meet essential workforce needs in our local communities, such as commercial driver’s license (CDL) and certified nursing assistant (CNA) credentials.

Illinois community colleges stand ready to partner with the Governor’s Office in the new and innovative Pipeline for the Advancement of the Healthcare (PATH) workforce program to support and expand opportunities for growing the nursing and healthcare worker pipeline. The $25 million in funding will assist community colleges with enhancing programming and wrap-around services to recruit future healthcare workers, remove barriers to entry into healthcare fields for low-income, first generation and minority students, and develop career advancement pathways for incumbent healthcare workers. These steps are essential to addressing unprecedented healthcare worker shortages and provide a ready supply of future workers.

The ongoing pandemic combined with years of near stagnant funding have strained higher education budgets, programming and services. A five percent increase to community college operational funding, and the addition of supplemental funding opportunities, will further strengthen our local institutions while easing the financial burden on local taxpayers and students.

Collectively, the proposed investments in higher education will assist the state in closing historic equity gaps and improve student outcomes for underrepresented students group, while retaining Illinois residents and creating pathways for development of a skilled workforce in key areas of the labor force to support the state’s business and industry.

Illinois community colleges are proud to work collaboratively with Governor Pritzker’s administration and our legislative leaders to maintain Illinois’ leadership as one of the most respected and progressive higher education systems in the nation, and we strongly support the proposed FY 2023 budget.

5 Comments

|

Addressing today’s top two GOP objections

Wednesday, Feb 2, 2022 - Posted by Rich Miller

* Rep. Tim Butler (R-Springfield)…

The people of this state are smart enough to see he is using one-time election-year gimmicks to cover up the fact he has gone back on his word and done nothing to change the structural problems facing our state’s finances.

This one’s pretty easy. Proposing to use revenue windfalls this year and next to put $500 million extra into pensions (which saves $1.8 billion down the road), pay off the $900 million debt that’s been carried for maybe a decade by the state employee/retiree group health insurance program, zero out the $230 million College Illinois debt that people had swept under the rug for years, stash $800 million in a previously empty rainy day fund are all part of addressing the state’s structural problems.

Is it enough? Nope. If it were up to me, I’d take all of that $1 billion tax cut and put it into paying down longterm debt, but I don’t have to run for office to keep my job. And what’s the Republican alternative? Well, the House GOPs have been a little light on details (as in, none at all), but the Senate Republicans want permanent tax cuts. Talk about making the structural problems worse.

* I’m not trying to pick on Tim, by the way. This was a common refrain today by Republicans. House GOP Leader Durkin…

The budget laid out by Governor Pritzker today is packed with gimmicks and one-time tricks, but no structural reforms.

* Rep. Dan Ugaste…

Now, without a graduated income tax, he’s painting a rosy picture of our state’s fiscal health while ignoring the structural causes of Illinois’ fiscal instability.

There were more, but you get the drift.

* Let’s move on to another objection. Rep. Avery Bourne…

When you dig into Pritzker’s budget proposal, our state revenue is projected to decrease by almost half a billion dollars next year, while spending is going up by over $2 billion. This kind of spending growth is irresponsible and unsustainable.

It’s not quite that simple. From GOMB…

That shows expenditures will fall by $1.6 billion.

* Here’s Sen. Win Stoller…

In fact, this budget increases spending. It creates new and permanent spending of $2.5 billion, potentially leaving us in a precarious financial position once our temporary federal revenue is exhausted

* From the Senate Republicans…

The Republicans are certain that revenues will crash in the future and fear that Pritzker would lock them in to spending hikes. The governor’s office thinks we’re heading back to more “normal” revenue growth after this next year.

* Anyway, I asked the governor’s office about this and was told: “We balanced a budget with realistic revenue for next year. Not fantasy revenue. And if we have to make cuts because revenue goes down lower we will. Because we’ve done it before. We believe in balanced budgets.”

49 Comments

|

* Aside from the usual complaining from the usual types who all seem to be using the same words in their objections to the new budget proposal, there are some legit critiques by folks who actually have an influence over the legislative process. For instance, this was sent today by Operating Engineers Local 150. Subscribers saw it earlier this week…

While Local 150 supports the Governor’s plan to seek tax relief for families during these difficult times, providing that relief by raiding $135 million from Illinois’ road fund is not a responsible option.

Only a week ago, we saw a bridge collapse in Pennsylvania, and there are currently more than 2,000 structurally deficient bridges in Illinois. Our state is only beginning to make progress on this, and now is not the time to start writing IOU’s for our critical infrastructure.

When 80 percent of Illinois voters passed the Safe Roads Amendment in 2016, they made clear their opposition to political interference with the road fund. Investing in the safety of our infrastructure is popular with voters of every political stripe in Illinois, and voters overwhelmingly disapprove of diverting money from the road fund.

There are ways for the Governor to accomplish his goal without short-changing the road fund, and we look forward to engaging in a meaningful dialogue with his office in the days to come to find solutions that provide relief without compromising safety or economic competitiveness.

* The co-chairs of this group are the director of the Chicago Laborers District Council and a top exec with the Illinois Asphalt Pavement Association…

The Transportation for Illinois Coalition, an umbrella organization of business, labor and infrastructure groups that advocates for federal and state transportation funding, today issued the following statement in response to Gov. Pritzker’s proposed Fiscal Year 2023 budget plan:

“We are concerned about the Governor’s proposal to skip the expected small increase in the state’s motor fuel tax this summer, as part of his plan to provide tax relief in the upcoming budget year.

We understand the desire to address drivers’ concerns with current high gas prices. But this change – skipping an expected increase of 2.2 cents per gallon scheduled for July 1 – will save the average driver a maximum of less than $1 per fill up.

While those savings will take a long time to make a difference in the daily commute for drivers, the $135 million in revenue loss to the state’s Road Fund will be more significant and long lasting.

For many years, Illinois diverted money intended for road and bridge construction into other needs and allowed revenues to fall short of inflation, creating a huge backlog of billions of dollars in infrastructure needs. In 2019, we worked with the Legislature and Gov. Pritzker to increase the state’s motor fuel tax to begin to address the backlog, and to tie the tax in the future to a cost-of-living increase each summer to keep up with increasing construction costs.

Taking $135 million out of the planned construction program now will have a more significant impact over several years, as projects that could be planned with those funds will be delayed. At the same time, revenues will not keep up with rising inflation-driven construction costs. It also could create a political temptation to skip future scheduled small tax increases that will worsen our funding problem.

We encourage the Governor and Legislature to carefully consider this change and weigh whether the small relief for consumers will be worth the larger costs to the state’s infrastructure system – costs that we all pay.”

* The Illinois Chamber chimed in with its support for organized labor’s position…

We support the Governor’s proposals that will temporarily lessen the tax burden on Illinois taxpayers, but we believe that his proposed array of tax cuts needs to be revised. Of greatest concern is the Governor’s call to disregard a bipartisan commitment to adequately fund our vital transportation infrastructure. We join our friends in labor in expressing our concern that the Governor’s proposal on the gas tax is an end run around the transportation lockbox amendment.

* Statement by Jordan Abudayyeh earlier this week…

The Governor looks forward to presenting a fiscally responsible balanced budget that uses one time revenue to ease the unique burden of inflation on working families. The road fund is incredibly healthy with projects moving forward on time and on budget and the FY23 budget proposal will not be a hindrance on projects moving forward this year.

21 Comments

|

Campaign notebook

Wednesday, Feb 2, 2022 - Posted by Rich Miller

* I told you in December that Newman’s payments to Chehade totaled about $29K. They’ve continued, according to the Daily Beast…

The scandal enveloping congresswoman Marie Newman—who is accused of signing and then reneging on a contract to pay a political rival not to run against her—has taken a shocking new turn. Federal campaign records show that after striking a secret settlement with the rival, the Illinois Democrat did, in fact, put the man on her campaign payroll.

In October 2018, Newman allegedly signed a contract with Iymen Chehade promising him a cozy six-figure salary on her congressional staff in exchange for his political support, according to the Office of Congressional Ethics (OCE). When Newman ultimately didn’t hire Chehade after she won her 2020 election, he sued.

The two reached an undisclosed settlement over the summer. But, it turns out, that’s not the end of the story.

Newman’s latest FEC filings show she did hire Chehade as a foreign policy adviser—only instead of being paid through her congressional office, Chehade was hired through Newman’s campaign.

Chehade has received a total of $54,000 since the second half of 2021, mostly in salary installments of $7,500 a month, but sometimes with additional $2,000 payments. According to the FEC filings, the disbursements to Chehade began on July 1, 2021, just two days after both sides reached a deal to resolve the lawsuit.

* And here’s Rolling Stone…

The ethics complaint against Newman had been filed by the Foundation for Accountability and Trust, a right-wing group founded by Matthew Whittaker, who served as President Donald Trump’s former acting attorney general. A Republican operative described the group as “a chop shop of fake ethics complaints” to New York in 2018. But it’s not just right-wingers questioning Newman’s account. Her main contention is that she hired Chehade not to keep him out of the race, but because she needed his foreign policy expertise — particularly on Palestinian issues. It’s an assertion that multiple sources called inaccurate. “It strikes me as a complete fabrication that there weren’t Palestinian voices she consulted who are smart and educated on these issues,” says a source close to the Newman campaign.

Newman said she had sought out Chehade because he had “very specific knowledge around Palestine and Israel that I needed,” she said in an interview with ethics investigators last fall. “We had looked for Palestinian advisors and we could never find one.” Newman had also told investigators that she never discussed Chehade’s interest or intentions to run in the Illinois 3rd primary — only a potential run for state senate or alderman instead. She disclosed to ethics investigators that Chehade had briefly mentioned flirting with a congressional campaign when the two first met in May 2018, but he’d wanted to help her build her Israel-Palestine platform, instead.

But when Newman began mapping out her 2020 run, she had expressed concern about Chehade entering the race, according to a former Newman ally familiar with her thinking at the time. They recall her mentioning Chehade in the context of running, not as an advisor. “Marie never mentioned she’d asked Chehade to be an advisor,” the source said. Sources also suggest Newman overstates the necessity of bringing in Chehade to advise on Israel-Palestine issues, claiming she was already well-connected with experts and community leaders on both sides of the conflict. (The sources spoke with Rolling Stone on the condition of anonymity in order to discuss sensitive political topics without fear of personal retribution.)

* But some of her enemies have decided to invent oppo, which in this case is truly stupid because they’re funneling money to a convicted felon…

* Thread!…

Yep. Checks out.

* Sullivan’s Tribune op-ed…

Despite what we’re told, this is not some unavoidable nationwide rise. This is the direct result of anti-police, anti-accountability policies pushed by Gov. J.B. Pritzker, Chicago Mayor Lori Lightfoot and Cook County State’s Attorney Kim Foxx. In partnership with the House Democratic Caucus, they have crippled our law enforcement with policies that are unwise and that threaten the safety of every resident in this state — most importantly, our kids.

It is time for bold action. I recently released my Safe Streets action plan, calling for three concrete steps to save Illinois: First, we must enforce our laws. Second, we must honor and defend our heroes in law enforcement. Third, we must restore accountability, by taking criminals off the streets and by keeping the most violent offenders behind bars.

But that’s not all. Foxx, who releases violent criminals on the streets, must be recalled. I will lead the charge to recall or defeat Foxx for violating her oath of office and her obligation to Cook County and Chicago residents to uphold the rule of law.

Lightfoot has become the leader of the anti-police movement in Illinois and in its largest city. I am committed to working with the principled, commonsense problem solver who can defeat her in 2023.

Local violence is part of a national trend. And this whole idea of a leader picking huge political fights to the death with other elected officials didn’t work out so well for our former governor or the city’s current mayor.

* Made me chuckle…

* Bailey’s running-mate…

Republican lieutenant governor candidate Stephanie Trussell says it’s no surprise in an election year that Gov. Pritzker wants to freeze taxes. She says Pritzker is why the taxes are high and he wants to make himself look like a savior.

28 Comments

|

Republicans angry!

Wednesday, Feb 2, 2022 - Posted by Rich Miller

* ILGOP…

There is an adage in politics that says the worse the internal poll numbers are, the more gimmicky a candidate’s campaign proposals become. For Governor JB Pritzker, 2022 is shaping up to be a bad year for his electoral hopes as crime, corruption, and high taxes continue running roughshod over Illinois families.

He needs a pick-me-up and this year’s joint budget and State of the State address is his latest attempt at distracting Illinoisans from his disastrous leadership and well documented record of asking us to pay more for a state government that doesn’t work.

Despite today’s election year gimmicks, Pritzker has a consistent record of supporting tax hikes. Sometimes he was successful in enacting them, and sometimes he was not. Let’s check the tape:

• Pritzker spent $58 million of his own money to try and convince Illinoisans to change the state constitution allowing for a massive income tax hike and the ability for Springfield lawmakers to increase middle class taxes whenever they want. Luckily, Illinois families said no to the largest tax hike in state history.

• Failing to pass the largest tax hike in Illinois history, Pritzker then turned to small businesses, increasing taxes by over $600 million on job creators across the state.

• When the federal bailout disappears and Pritzker’s out-of-control spending sends us even deeper into debt, Pritzker’s already telegraphed what he will do next: raise the income tax by 20%.

“Pritzker has never once pursued true property tax relief for Illinois families despite billions of dollars in federal bailout money flowing to our state, complete Democrat control at the capitol, and three years to get it done,” said ILGOP Chairman Don Tracy. “And now he has the audacity to trot out these campaign gimmicks that pale in comparison to the $5.2 billion in tax and fee hikes he has already imposed on us? Pritzker is a proven tax-hiker, and that’s why we need a Governor who will provide permanent property tax relief, spend within our means, and lower taxes.”

Most of those tax and fee hikes were approved in 2019 and included Republican votes. He didn’t impose anything.

…Adding… Gary Rabine sent out this press release 18 minutes before the governor was set to start speaking…

“Today we witnessed how out of touch our billionaire Governor, JB Pritzker, is with the people of Illinois. In his State of the State/Budget address, he described the State of Illinois in terms that only someone who spends his days in the cocoon of a North-side mansion or private jet could use.”

“JB Pritzker has not done one thing to improve the fundamental fiscal trajectory of the state. Biden paid off JB’s Illinois credit cards last year, but we are still in a fiscal death spiral. A one-time bailout from the federal government does not equate with sound fiscal management. Millions of dollars spent on TV and digital ads doesn’t turn fantasy into reality either.”

“The truth is that Illinois, outside of the Astor Street Mansion, is far different than what JB described. Chicago and its suburbs are the crime capitols of the country. Our unfunded public pension liability is at $130 billion – the worst in the nation. Our state has lost hundreds of thousands of jobs due to JB’s heavy handed, unilateral decision to shut down the state’s economy. We are the highest taxed state in the country and more people left Illinois in the last decade than any other state.”

“All might be well with the wine and cheese crowd but for the rest of us, it’s time for a new direction in Illinois.”

…Adding… Richard Irvin…

“It is no surprise that the Tax-Hiker-In-Chief is attempting to rewrite history today to mislead Illinois voters in an election year with gimmicks that rely on a disappearing federal bailout. This is the same governor who pushed for the largest tax hike in our state’s history on Illinois families and businesses, and we know he plans to raise billions more in taxes when the federal money runs out. The only way to stop Pritzker’s permanent tax hike campaign is at the ballot box in November.”

…Adding… House GOP Leader Durkin…

“The governor’s budget address is always a wish-list, and this year it’s clear that the governor wishes to be reelected. The budget laid out by Governor Pritzker today is packed with gimmicks and one-time tricks, but no structural reforms. The people of Illinois deserve a governor who will be honest and work to actually fix things like property taxes and out-of-control crime.”

* Politico…

House Speaker Emanuel “Chris” Welch will be listening for comments on Covid relief: “The surge we had in December and January reminds us that we’re still in the midst of a global pandemic and there’s more relief needed, and so I’m looking forward to hearing the governor’s ideas on that,” Welch said in an interview.

Senate President Don Harmon hopes to hear Pritzker “make a serious investment in public safety. in building up the ranks of our state police, and ensuring local governments have the resources to add and train local police officers and give them the equipment that they need.”

Republicans aren’t wowed by Pritzker’s plan for temporary tax cuts and property tax rebates, seeing it as an election-year gimmick.

State Rep. Blaine Wilhour, who represents part of southern Illinois, hopes the governor might defend what rights parents have to make decisions about their child’s health and having their kids vaccinated. “Parents need more rights and respect than what they get,” he told Playbook.

And in a statement, Senate Minority Leader Dan McConchie said instead of “short-term, one-time relief,” what Illinois families “really need are long-lasting solutions that make it affordable to live here.”

* Speaking of the budget…

Snow storm stiff arm: Pritzker to deliver State of State from Old State Capitol after House cancels session

[…] Pritzker’s closest aides scrambled to find a backup venue after a severe snow storm forecast forced the House and Senate to send their members home and cancel the week of scheduled legislative session. Without an invitation from the House, the governor had no grand stage to deliver his speech, and state law required him to deliver his budget address on the first Wednesday in February this year.

Um, no. Almost immediately after the decision to cancel session was made by the three Democratic leaders (including the governor) Monday evening, the governor’s people were telling me they wanted Pritzker to give his State of the State/budget address at the Old State Capitol. They only “scrambled” because they were unsure at first if the venue would be available. But the place was ideal for them because, unlike the House chamber, the Old State Capitol has a smallish chamber and they envisioned a smallish audience in attendance (including, as it now turns out, GOMB staffers who’ve never personally witnessed a budget address before, which is pretty cool). Also, state law only requires the governor to submit his budget plan to the General Assembly. He could’ve just sent them the text of his speech and his proposed legislation.

* But, just to be on the safe side, I reached out to House Speaker Chris Welch’s spokesperson Jaclyn Driscoll for comment…

We never disinvited the governor. And I am confident in saying we would have worked with him if he wanted to deliver the speech in the chamber. There were so many ideas discussed [Monday], but it came down to what the Governor wanted to do. The Speaker is fairly close with the Governor and he’s not trying to ’stiff arm’ him.

Driscoll added later that the House has no rules which would’ve prohibited the governor from using the House chamber for his address.

28 Comments

|

* Background is here and here if you need it. Darren Bailey talking on Facebook…

I’ve been blessed to be able to do these lives with you. I think I’ve been very consistent in my messaging and my purpose. Yesterday, fake liberal news somehow or another assumed that I was calling one of my opponents the devil. [laughs] Just go back and watch it and you make your own decision. I am honored and blessed that that fake liberal media is actually listening. Maybe some of this truth of God’s word will penetrate to their hearts and change change their lives and they’ll start reporting on truth. And wouldn’t that be awesome?

Lying is a sin.

* Speaking of which, before we get into the rest of his remarks, let’s do a bit of basic education…

What is a levy?

The amount of money a school district and/or local government (taxing districts) certifies to be raised from property tax.

* Back to Bailey…

I’m just going to share a little bit of this with you because there’s a lot of it. I ran for state Representative for the 2018 election, I ran against a tax hiker. And I was met with the full force and fury of my own people, my own party who wanted to keep me away because they wanted to keep a yes person. They wanted to keep people in that would raise taxes, would raise gas taxes. And we’ve got some of those people are running, actually, as in Lieutenant Governor positions, people who have raised your gas taxes by 20%. Do your education on these people.

But anyway, just a little bit of what’s going on. Many of your social media outlets were flooded yesterday with posts that Darren Bailey taxed elderly people out of their homes. And as a matter of fact, one of the most egregious fake news outlets and fake news reporters even came down and, and reported such a story. And I would appreciate if you just listen, if you see that story, just listen to it and dig deep into it and really listen to what you’re hearing, because what you’re hearing is not what this person is saying.

How many school board members do we have out there how many people who have served on an on a township board and and on a local community board and from time to time have have passed levies to keep your schools open, to keep certain particular interest open? You know that when you deal with a levy, that you’re not creating a burden, some tax that taxes people out of their homes ,that taxes the elderly, many of you know this and if you don’t go to your go to your county assessor and go and start talking about this, start getting yourself educated on how this works.

Many times the purpose of a levy is to fulfill what has not been promised temporarily and that’s what happened many times on the North Clay School Board. And and I was so honored and blessed by serving with the boards that I serve, we did an amazing job of communicating to the people and let giving them the option. And not just once, not trying to hide it, not trying to hide a tax increase or a levy to say that, you know, the next day people wake up and see this. Now we literally many times every time let people know how much exactly per household, you know, per 100 on your on your assessed value that this was going to cost during my term as they on those days. You can also look back and you will see the real reason why property taxes escalated all over the state. When I got on the North Clay School Board. We were one of the lowest taxed school districts in the state. When I got off, we were still well in the bottom third, but we were doing some amazing things that we were up to the 50% pay range on paying where we paid our teachers and what we were doing. We had an amazing school district but sadly enough, my state representative at the time and state government were failing to give the schools their money, you know, they have the education budgets and and many times at the end of the year, you realize that you didn’t get 200,000, 400,000 and on and there were delays. So the purpose of the levy is to fill that void.

So here’s what I went through, the 2018 election and here’s why, some of the same players are at play. And a little bit later I’m going to begin you know, letting you know who those are because they are players that are sitting in positions of power in the Illinois House of Representatives on the Republican side and they’re doing the exact same thing that they did five years ago and four years ago to try to keep me off.

Our mailboxes were full, I don’t even know which one to start with. [Holds up mailer.] ‘Darren Bailey taxed seniors out of their house 14 times when he was on the school board ,brought to you by the Illinois Republican Party.’ That’s where your money is going. [Holds up mailer.] Gosh, ‘Cash King farm subsidy Darrin Bailey, corporate welfare king.’ Think about these messages that we’ve just heard with the PPP money, with the the USDA assistance from for what you know for farms with and now that we’re taxing people. I mean, it’s endless. I got, here’s another one. Millions of dollars were spent on fliers when I was serving as, as running for this position [Holds up mailer] ‘Bought and paid for by Chicago.’ Gosh, friends, this is what we’re up against. And I asked you to get yourself educated, get yourself informed, please share these messages, push this out. This is how we’re going to do this to where, you know, until this is how we’re going to grow this movement.

Lots of words.

Please pardon all transcription errors.

…Adding… Funny and accurate…

36 Comments

|

Budget briefing live coverage

Wednesday, Feb 2, 2022 - Posted by Rich Miller

…Adding… Very handy links…

* Full budget briefing [Fixed file]

* Operating budget proposal

* Capital budget proposal

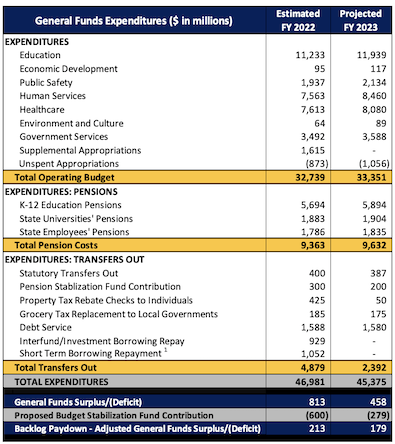

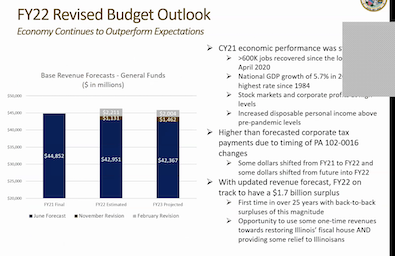

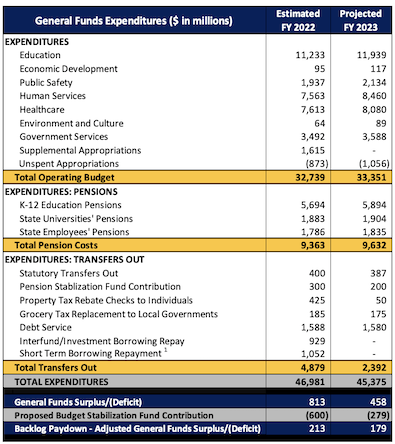

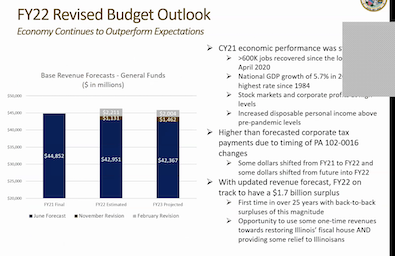

* The governor’s office has taken the embargo off of this morning’s budget briefing. They’ve revised the surplus upward for this fiscal year and next…

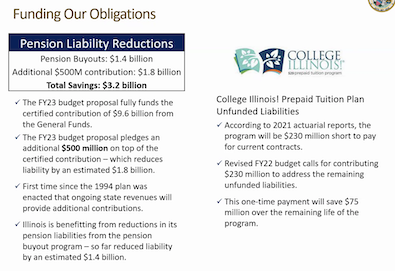

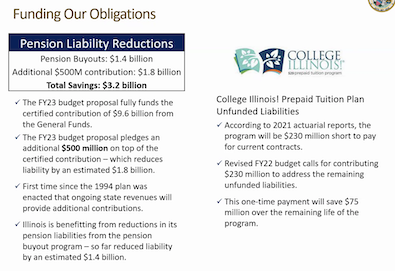

* As I told subscribers earlier, this is huge. An extra $500 million will be put into the pension systems…

* More…

* There was a problem with the screen earlier, so these are from yesterday’s briefing that I shared with subscribers…

* Revenues and spending…

* Education…

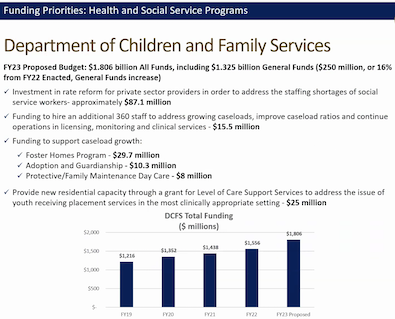

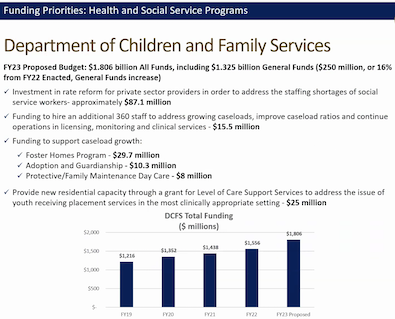

* DCFS…

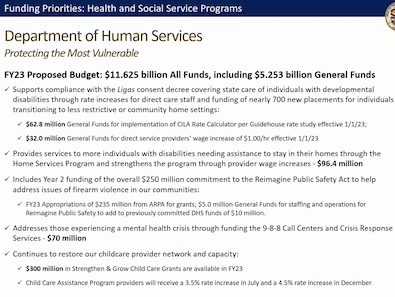

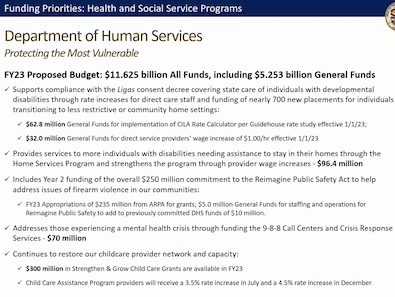

* DHS…

* Public safety and violence prevention…

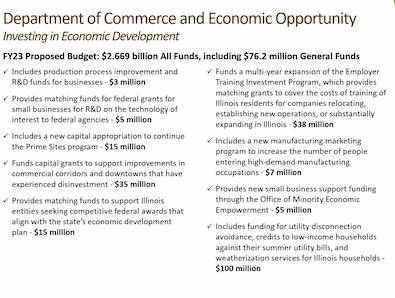

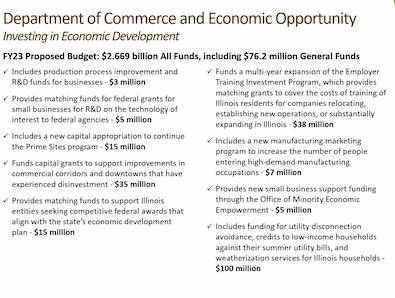

* DCEO…

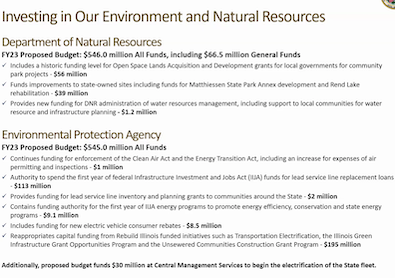

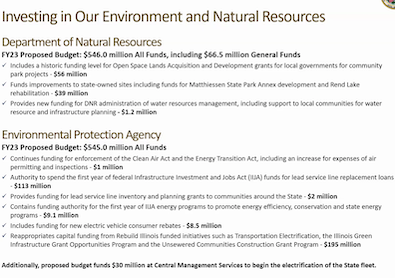

* IDNR and IEPA…

* Covid money…

* Capital…

I missed some stuff, but hopefully I’ll be able to link to a briefing book.

* Question about surpluses…

The surplus that we’re on track for in FY 22 is $1.7 billion, that is what is going to then be directed into some of our debt pay-down or Budget Stabilization Fund, and then a part of the tax relief proposal. The the surplus that’s left is the number that’s going into the accounts payable reduction.

* Any change in income tax revenue sharing with local governments? No.

* What about the unemployment insurance trust fund? Negotiations still ongoing through agreed bill process. Planning legislation by April adjournment.

* What percent of homeowners would see property tax relief? About 2 million people claim the income tax credit.

* Can you point to something that repairs a structural budget imbalance? Key part is aligning revenues with expenditures. The $500 million extra pension infusion will get the state funds to the “tread water” point, so that funding is actually paying down the debt. The massive state employee/retiree group health insurance backlog of nearly $900 million that has been around for years will be paid off if the budget is enacted.

* Do you have a Plan B for how to give drivers relief if Local 150 ends up killing your gas tax proposal? Long answer short: Not that I could discern.

31 Comments

|

Open thread

Wednesday, Feb 2, 2022 - Posted by Rich Miller

* We’re riding out tonight to case the Promised Land.

36 Comments

|

|

Comments Off

|

|

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|