Lawsuit filed alleging VAP wrongdoing

Monday, Apr 4, 2022 - Posted by Rich Miller

* WBEZ…

In the past decade, a Chicago political insider’s company has raked in hundreds of millions of dollars through a state of Illinois program.

Now, a newly unsealed lawsuit alleges the company also schemed to “avoid paying Illinois income taxes” on the profits from its highly lucrative arrangement with the state.

The accusations target Vendor Assistance Program LLC, a Chicago company led by lawyer and lobbyist Brian Hynes. He got his start in politics as an aide to recently indicted former Illinois Democratic boss Michael Madigan, and Hynes also has close ties to disgraced ex-Chicago Ald. Danny Solis.

VAP has thrived as by far the biggest player in a program that allows a small group of state-certified companies to buy up debt from Illinois’ once-mountainous pile of unpaid bills.

VAP and the other companies in the program front unpaid state contractors 90% of what Springfield owes them — but later pocket late-penalty payments from the state, which pile up at a rate of 1% each month.

Hynes reached out to me today to point out, among other things, that all but two of the other companies which have participated in this program are either registered in Delaware or (one) in Minnesota. Click here for the list. Just one other company is registered in Illinois. I don’t really get this tax avoidance angle because the vast majority of these companies aren’t paying Illinois taxes anyway, and being an Illinois company is obviously not a requirement of the program. Also, most of the companies appear to be LLCs, which exist to pass corporate income through to individuals. But it’s definitely a kitchen sink story, so read the rest. Whew. Lots of threads.

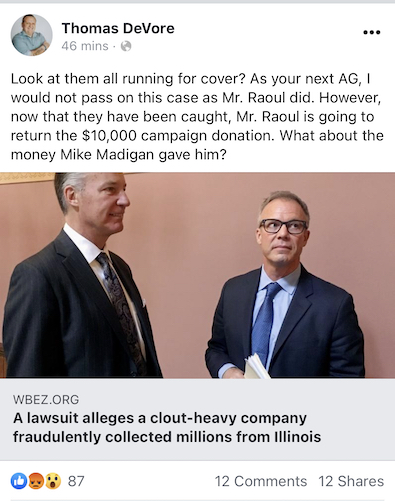

* DeVore seems awful certain that there’s a case to be made, however…

- Shytown - Monday, Apr 4, 22 @ 1:08 pm:

That story is chock full of a lot of nothing. And the lawyer whistleblower stands to make millions off this suit, so…

And if Devore is weighing in that doesn’t exactly lend much credibility to the story but he’s gotta do what he’s gotta do.

- Long time Independent - Monday, Apr 4, 22 @ 1:09 pm:

To be fair it seems like a big nothing burger. Hynes found a way to make some money and that’s what he did.

- Anyone Remember - Monday, Apr 4, 22 @ 1:16 pm:

Malcolm Weems. Trip down memory lane …

- Raising Kane - Monday, Apr 4, 22 @ 1:27 pm:

Yeah that was one messy story. Blaming an LLC for not paying corporate taxes? I’d fire that lawyer….LLC’s are by design pass through entities….that’s pretty much the point of them. After that it was just one clumsy attempted smear after another. Milihopoulas is such a disappointment.

- Three Dimensional Checkers - Monday, Apr 4, 22 @ 1:31 pm:

Pains he to say it, but Devore is right. It’s the AG’s job to make sure no one is ripping off the State from income taxes.

- Hannibal Lecter - Monday, Apr 4, 22 @ 1:35 pm:

=== Milihopoulas is such a disappointment. ===

You would actually have to have some kind of positive expectations in order to be disappointed.

- Candy Dogood - Monday, Apr 4, 22 @ 1:38 pm:

I would venture to guess that these probably aren’t single member LLCs. I really don’t know enough about income apportionment to know whether or not the income from these kinds of transactions would be considered Illinois source income.

- Lt Guv - Monday, Apr 4, 22 @ 1:59 pm:

DeVore said it? Then just noise. He has nothing valuable to say.

- NonAFSCMEStateEmployeeFromChatham - Monday, Apr 4, 22 @ 2:01 pm:

==Brian Hynes==

Is Brian Hynes related to Dan Hynes?

- Sonny - Monday, Apr 4, 22 @ 2:01 pm:

Dan cracking the lifeguard abuse story at the park district was arguably the best reporting on a singular local issue of the last few years but he’s a big “disappointment” getting for a scoop and covering a relevant lawsuit. Ok sure.

- Raising Kane - Monday, Apr 4, 22 @ 2:27 pm:

“Relevant lawsuit” you got me there….company not required to be based in Illinois is actually based in Illinois! Get him a Pulitzer stat!!

- Rich Miller - Monday, Apr 4, 22 @ 2:36 pm:

===related to Dan Hynes? ===

Just the opposite. lol

- Lincoln Lad - Monday, Apr 4, 22 @ 2:56 pm:

VAP and other qualified purchasers helped save companies from being crushed under the weight of the State not paying its bills… using a State program and at no additional cost to the State. That should be a good thing in my opinion… it was needed at the time, and only companies that wished to participate, participated. No one forced them to.

- Shytown - Monday, Apr 4, 22 @ 3:09 pm:

What Lincoln Lad said. What’s exactly illegal or wrong with all of this?

- cqiuew - Monday, Apr 4, 22 @ 3:25 pm:

If the companies selected to participate in the program had been properly vetted and the program run properly, no prob. But that is clearly not what happened here. It was wired in the way that so many programs at the state are wired. The state almost got it right by using bonding authority to make vendors whole through the Illinois Finance Authority, but by then, VAP had already sucked in millions.

- Raising Kane - Monday, Apr 4, 22 @ 3:50 pm:

I believe everyone who meets the program terms are eligible to participate. The State didn’t choose anyone. The list Rich linked to showed about 20 companies that are in the program. I agree that the state’s bonding to pay down the backlog was a prudent financial move.

- Lincoln Lad - Monday, Apr 4, 22 @ 4:07 pm:

Meet the requirements, and you were eligible to participate. Vendors owed money could work with any qualified purchaser they chose to work with. Hynes led one purchaser, Jim Edgar was a participant in another. There is no story here.

- Three Dimensional Checkers - Monday, Apr 4, 22 @ 4:08 pm:

===I agree that the state’s bonding to pay down the backlog was a prudent financial move.===

Gov. Quinn wanted to do that back in the day, but Speaker Madigan kept holding it back for whatever reason.

- Original Anon - Monday, Apr 4, 22 @ 6:34 pm:

Is there a copy of the complaint somewhere? The article never identified a false claim made to the State. Incorporating in another state for tax purposes is not a false claim. Besides, the Illinois FCA explicitly excludes violations of income tax laws.

- Burgermeister Meisterburger - Monday, Apr 4, 22 @ 7:06 pm:

@Original Anon is correct.

You cannot use the False Claims Act to go after someone for not paying Illinois taxes, if they did a lot of companies that are state vendors would be in big trouble.

This is a bogus lawsuit but unfortunately the kind of “investigative” reporting we’ve come to expect.

- Sonny - Monday, Apr 4, 22 @ 7:54 pm:

Maybe you guys can post your feelings in the judge’s comment section.

- Raising Kane - Monday, Apr 4, 22 @ 9:18 pm:

Judge’s comments. Thanks Dan…goodnight!