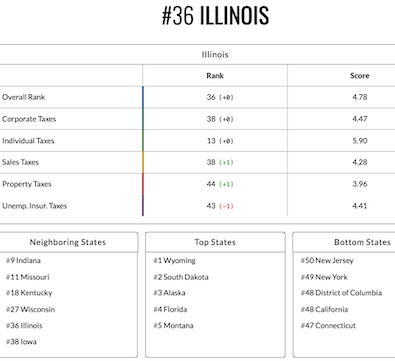

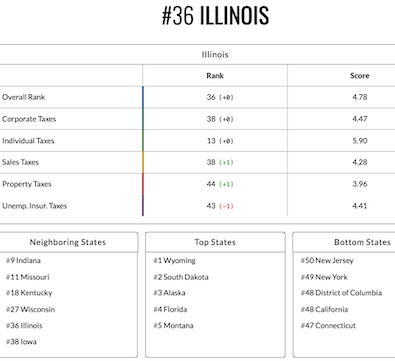

* Illinois ranks 36th for tax competitiveness, according to the Tax Foundation’s 2023 State Business Tax Climate Index…

The Tax Foundation’s State Business Tax Climate Index enables business leaders, government policymakers, and taxpayers to gauge how their states’ tax systems compare. While there are many ways to show how much is collected in taxes by state governments, the Index is designed to show how well states structure their tax systems and provides a road map for improvement. […]

The absence of a major tax is a common factor among many of the top 10 states. Property taxes and unemployment insurance taxes are levied in every state, but there are several states that do without one or more of the major taxes: the corporate income tax, the individual income tax, or the sales tax. Nevada, South Dakota, and Wyoming have no corporate or individual income tax (though Nevada imposes gross receipts taxes); Alaska has no individual income or state-level sales tax; Florida has no individual income tax; and New Hampshire and Montana have no sales tax.

This does not mean, however, that a state cannot rank in the top 10 while still levying all the major taxes. Indiana and Utah, for example, levy all the major tax types but do so with low rates on broad bases.

* At a glance…

- Lucky Pierre - Thursday, Oct 27, 22 @ 2:06 pm:

Down 7 spots since 2018

One reason for the slower economic recovery from the pandemic and 50th ranking in unemployment

44th in property taxes would be a huge improvement if true

- Travel Guy - Thursday, Oct 27, 22 @ 2:11 pm:

If you want to live in a state that has a “tax advantage,” you are free to move to one. Indiana is the closest for us collar county folks, and you get what you pay for: subpar schools and infrastructure, and so much more (less).

- Travel Guy - Thursday, Oct 27, 22 @ 2:14 pm:

Don’t forget about the lower wages and the right to work for less without union protections.

- froganon - Thursday, Oct 27, 22 @ 2:14 pm:

States with large populations, extensive infrastructure and public services charge/collect more taxes. The business community, ever on the prowl to export their costs of doing business like building/maintaining infrastructure, cleaning up their own pollution messes, providing benefits and a living wage to employees are unhappy/indignant when required to pick up the bill for problems they create and things they need to operate. No surprises here.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:25 pm:

- LP -

Since late summer I’ve been reading, looking where you have said anything positive to Illinois, as to even why you are here and you’ve yet to say to any measurable political or economic measure you find Illinois palatable.

This is a reminder that being so utterly miserable to where you live when you have 35 states with better “taxing” as you bemoan that Illinois has poor education, high property taxes, unfair practices where labor is given more than management, high corruption, high crime, high unemployment …

… why you would subjugate yourself and your family to Illinois, had you left in 2013 when Rauner came in the scene you would’ve saved 9 years in taxes, unemployment, crime, education…

You can’t say you can’t find a better job. Nope.

You can’t say you can’t find lower taxes… or better schools, or any measure you’ve decided that Illinois fails.

Today is no different. I worry for your health, it can’t be healthy being this miserable, you can’t say you aren’t miserable as, again, even since summer… your lack of Illinois positive has been absent.

Nine years of misery, and counting.

To the post,

The idea of real and honest property tax relief with education spending to K-12 where the dollars by the state can give relief while aid in elevation K-12 education would be a welcomed big step in the next term of either governor, if they could pull it off in a way that works, works within the constitution, and is workable to a legality towards a new way the system imagines education.

This ranking could look different, but to how different is speculative by me, but the way to try is up to Illinois leaders.

- notafraid - Thursday, Oct 27, 22 @ 2:26 pm:

=. Indiana is the closest for us collar county folks, and you get what you pay for: subpar schools and infrastructure, and so much more (less).

As to schools: SAT average 1073 for Indiana and 981 for Illinois. NAEP data Illinois-275 for Math and 262 for Reading; Indiana 279 for Math and 261 for Reading.

- Anthony - Thursday, Oct 27, 22 @ 2:27 pm:

–Indiana is the closest for us collar county folks, and you get what you pay for: subpar schools and infrastructure, and so much more (less).–

You don’t get that here? C’mon..

- Oswego Willy - Thursday, Oct 27, 22 @ 2:30 pm:

- notafraid -

What’s the participation percentage?

See, with ACT, in 2021

Indiana… 14% participating, 23.1 composite

Illinois?

Huh… Illinois…. 19% participating, 25.2 composite

Wonder why you forgot these numbers?

- Oswego Willy - Thursday, Oct 27, 22 @ 2:31 pm:

- notafraid -

Apologies.

Link? Sure…

shorturl.at/htyQW

- Demoralized - Thursday, Oct 27, 22 @ 2:33 pm:

OW:

The people that hate Illinois are going to latch on to whatever they can latch onto to back up their feelings of hate.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:37 pm:

- notafraid -

I’ll help you with those participation numbers.

Indiana, SAT Participation? 48%

Illinois, SAT Participation? 97%

Cite? Sure…

https://shortest.link/6JYh

- Huh? - Thursday, Oct 27, 22 @ 2:37 pm:

It is a fundamental failure to understand the function of government when it is equated to business. The foundational function of government is to spend money to provide services to the residents of the community or State. The primary purpose of business is to earn money for investors. These are mutually opposing purposes.

I like Illinois. It have been my home for over 60 years. I willingly pay the taxes to live here.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:41 pm:

- Demoralized -

Miserable people litter the path to happiness.

Be well, bud.

- notafraid - Thursday, Oct 27, 22 @ 2:41 pm:

@Oswego

Yes, that is also the reason I gave the NAEP numbers. Any questions about that?

So still not subpar, is it?

- JS Mill - Thursday, Oct 27, 22 @ 2:41 pm:

=As to schools: SAT average 1073 for Indiana and 981 for Illinois.=

Illinois has an 80% (119,000 test takers) participation rate and Indiana has a 43% (33,000 test takers)participation rate.

Makes a huge difference. But you knew that.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:43 pm:

- notafraid -

Link please?

And what an odd flex, thinking that so few taking a test gives the better measure?

Huh?

Looking at participation in, say, the ACT, Indiana is quite the failure to Illinois.

- notafraid - Thursday, Oct 27, 22 @ 2:44 pm:

@JS Mill

Sure did. That is the reason I balanced with the NAEP scores. No matter how you cut it the Indiana school performance is not subpar.

Bet you knew that.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:45 pm:

===Makes a huge difference. But you knew that.===

Prolly why the massaging and forgetting being done works on Facebook.

This ain’t Facebook.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:46 pm:

===reason I balanced===

Explain the ACT scores, lol

- Demoralized - Thursday, Oct 27, 22 @ 2:47 pm:

@notafraid:

Illinois schools aren’t subpar either. So I’m not sure what point you are trying to make here. I’m not even sure you know.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:51 pm:

- notafraid -

According to your own link?

Illinois has a school score of 237

Indiana?

Indiana has a school score of 239

… and yet can’t get students to take ACT/SAT at higher levels?

Illinois with higher lever participation passes Indiana on ACT scores?

Huh?

- notafraid - Thursday, Oct 27, 22 @ 2:52 pm:

Thanks Anonymous. I post this link but somehow it did not appear.

- Blake - Thursday, Oct 27, 22 @ 2:53 pm:

If someone wants a tax advantage these studies always look good for New Hampshire plus NH comes with high incomes.

- Oswego Willy - Thursday, Oct 27, 22 @ 2:53 pm:

Back to the post, apologies,

As - Wordslinger - would remind…

Alaska and Texas with oil, Florida with tourist, Illinois won’t be able to compete on an even field given the inherent advantages having ridiculous oil or tourism paying the bills.

- Scamp640 - Thursday, Oct 27, 22 @ 3:16 pm:

Just for fun, compare state tax competitiveness against average life expectancy be state.

https://www.cdc.gov/nchs/pressroom/sosmap/life_expectancy/life_expectancy.htm

- Chicago 20 - Thursday, Oct 27, 22 @ 3:18 pm:

I see that all the donor states are ranked poorly on this list.

I wonder if there could be some correlation? /s

- Hypocritical Oath - Thursday, Oct 27, 22 @ 3:23 pm:

=== Indiana and Utah, for example, levy all the major tax types but do so with low rates on broad bases. ===

Weird how they just conveniently leave out that Indiana and Utah tax retirement income, which shifts the tax burden off of corporations, which is why business groups argue in favor of taxing retirement.

- Stormsw7706 - Thursday, Oct 27, 22 @ 3:29 pm:

Tax Foundation. That says it. Happiness is low taxes. I think that’s in the Bible isn’t it. I’ve visited all those surrounding states in recent months. I’ll take good old Illinois any day of the week.

- Trap - Thursday, Oct 27, 22 @ 4:12 pm:

And by all means pass Amendment 1 and make it worse.

- Larry Bowa Jr. - Thursday, Oct 27, 22 @ 4:14 pm:

Wow look at those s-hole states at the bottom of these rankings: California, New York, Connecticut, DC (which is apparently now one of the 50 states).

Who will unburden the citizenry so that life in those states can be desirable again. They have so far to go to catch up with Wyoming and South Dakota.

- City Zen - Thursday, Oct 27, 22 @ 4:21 pm:

==Weird how they just conveniently leave out that Indiana and Utah tax retirement income, which shifts the tax burden off of corporations==

Actually, it shifts the burden off of workers.

But that’s what is meant about “broad bases.” Utah charges a sales tax on services but it’s overall sales tax rate is lower.

- Fivegreenleaves - Thursday, Oct 27, 22 @ 6:08 pm:

I went through Mississippi in July en route to New Orleans, and tomorrow I have to go through Indiana to get to Louisville, KY. Illinois may have higher taxes, but I’ll take my home state with higher taxes, better schools, and better infrastructure any day.

- Walker - Thursday, Oct 27, 22 @ 6:32 pm:

The tax foundation is a legit, balanced, and analytical source. Why anyone would go to IPI first is beyond me

- Hypocritical Oath - Thursday, Oct 27, 22 @ 10:56 pm:

@City Zen -

No, workers and retirees pay the same tax rate in Indiana and Utah.

In Utah, its a 4.95% tax rate on workers, 4.95% for retirees, 5% for corporations.

In Illinois, it is a 4.95% tax rate for workers, 0% for retirees, 7% for corporations.

It is pretty transparent what’s going on. This i# why the Chamber of Commerce wants to tax retirees.