Fun with semantics

Monday, Oct 31, 2022 - Posted by Rich Miller

* KSDK…

We can verify the passing of Amendment 1 does not guarantee a property tax increase. There is no language in the amendment regarding property taxes. […]

You may have seen the [Illinois Policy Institute’s] campaign claiming property tax could increase by $2,100 for the typical Illinois homeowner.

The IPI reached that number by taking the average property tax increase since 2010 and projected future annual property tax increases for 2023, 2024, 2025 and 2026. Those four years of increases were combined and equal around $2,100.

Bryce Hill came up with the formula.

The Verify team asked Hill why the future tax numbers wouldn’t still apply if Amendment 1 fails. The formula is based on tax averages since 2010 when Amendment 1 protections were not in place.

Hill answered, “Not necessarily…You could get a reform-minded candidate in there who wants to lower property taxes or freeze them.”

He added, “We have a much more likely scenario for property tax reform and cost of government coming down if Amendment 1 does not pass.”

Yeah, they always have a magical solution at the ready if only everyone would just do what they say.

* Technically, though, they do cover themselves. From IPI’s article entitled “Amendment 1 would guarantee $2,100 property tax hike for typical Illinois family”…

It’s election season in Illinois, and politicians are running on the promise of property tax relief as usual, including every major candidate for governor.

Illinois’ property taxes are already the second-highest in the nation and a major reason taxpayers are fleeing to lower-tax states. That problem could be made worse on Nov. 8 when voters will be asked to decide the fate of Amendment 1, a tax hike disguised as a “workers rights amendment.”

The change would prevent commonsense reforms to reduce homeowners’ tax burdens while giving government union leaders virtually limitless new ways to demand higher costs from taxpayers. If it passes, Illinois’ trend of large annual property tax increases will likely grow faster than ever. Gov. J.B. Pritzker has failed to deliver on property tax relief during his term – the average family paid $1,913 more during his administration.

Amendment 1 would guarantee that family pays at least $2,149 in higher property tax bills over the next four years, no matter which politicians win this November or how well they try to follow through on their promises.

This is a conservative estimate, assuming the rapid growth of Illinois’ property tax burden holds steady. It’s likely property taxes would grow at an even faster rate, because Amendment 1 would give Illinois government unions unprecedented bargaining powers that don’t exist in any other state. Exactly how much faster is an open question.

You have to read it closely, but, aside from the headline, they’re not saying the Workers’ Rights Amendment would in itself guarantee property tax hikes. They’re claiming it would be next to impossible to lower the historical rate of increase if Amendment 1 passes.

So, essentially, they cover themselves with the full explanation. A more honest pitch would be: “If you vote No on this thing then your property taxes might possibly if everything works out the way we hope not go up as fast,” but that probably wouldn’t be effective, or even believable. So, they stick to the shorthand with a long explanation that few will likely read.

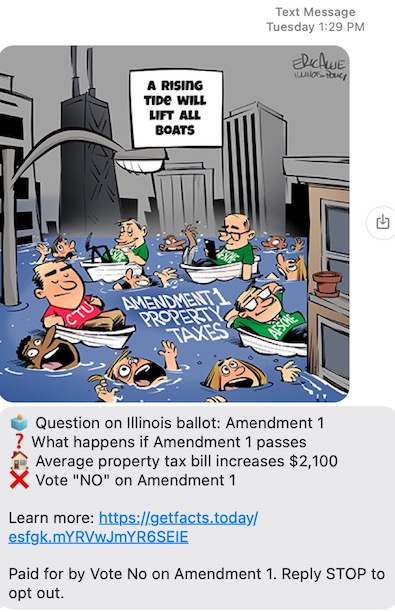

* This is one of their recent text ads…

It’s portrayed as cause and effect.

- Oswego Willy - Monday, Oct 31, 22 @ 10:43 am:

The phony about IPI is predicated on the idea of semantics…

… as IPI continually misleads to continually get grift money.

IPI lacks honesty to policy, and it’s proven IPI leaders can’t govern, let along run a governor’s office.

Semantics is like endorsing the back of checks from the foolish

- Norseman - Monday, Oct 31, 22 @ 10:47 am:

$2,149? Last I paid attention the mythical figure being bandied about was $3,000.

Sadly, a lot of folks who I consider to be intelligent are falling for the IPI/rightwing spin. They justify this as “unintended” consequence that would ensue from the amendment.

The funny thing is that I can’t vote for the amendment because I moved to a state that supposedly already has that “constitutional” protection. “Supposedly” because the MO powers that be have effectively worked around it.

- The Velvet Frog - Monday, Oct 31, 22 @ 10:48 am:

Today I saw a new online ad that made the claim that it force schools to stop screening teachers. I guess they realize that some people aren’t buying the “property tax” lie?

- Skeptic - Monday, Oct 31, 22 @ 10:49 am:

Another pitch where the word “commonsense” means “The way we want.”

- Huh? - Monday, Oct 31, 22 @ 10:51 am:

How does a union for a private company, say Starbucks, raise property taxes? It doesn’t. It us disingenuous to make that mental leap.

Allowing the right of employees to organize in their places of business promotes the health and welfare of the employees.

- Socially DIstant Watcher - Monday, Oct 31, 22 @ 10:52 am:

It amazes me that anyone gives them any credence, including the billionaires who fund them. They’re a joke, plain and simple, but they have cash, so we keep talking about them.

- Dance Band on the Titanic - Monday, Oct 31, 22 @ 11:04 am:

Applying the IPI calculation to my own property taxes over the past 4 year, the total amount I am paying due to the existing rate of growth is far less than half of the figure IPI is projecting, despite my home’s EAV being above the average.

- P. - Monday, Oct 31, 22 @ 11:10 am:

IPI is hot partisan bad faith trash yet gets pieces placed in the Daily Herald op ed and business sections, appear on WGN radio and tv stations. Wonder why they are so low rent and dishonest but get so much play start calling for some level of accountability from the (lIbErAL) media.

- Light Lifting - Monday, Oct 31, 22 @ 11:14 am:

If Amendment 1 passes could judges unionize? What about other employees of branches of government that are exempt under personnel code like senior staff of constitutional officers and GA?

- Facts Matter - Monday, Oct 31, 22 @ 11:18 am:

The methodology used by IPI in coming up with the $2100 figure is inaccurate as well. They cherry pick the components of their calculation and then apply those components in a manner that does not reflect how property taxes are actually extended under the law. Then they come up with a number that is supposed to apply generally throughout the state - which fails to take into account things like the Cook County classification system, PTELL, etc.

- Lurker - Monday, Oct 31, 22 @ 11:24 am:

The question I asked was, what percentage will my property tax increase? The answer was 0 but they claimed I was missing the point.

- sad - Monday, Oct 31, 22 @ 11:41 am:

It’s not hyperbole to say those mailers could easily lead to violence against the LGBT community.

- IL4Ever - Monday, Oct 31, 22 @ 11:59 am:

Finally, an article critiquing this absurd claim. It’s based on home price growth and property tax growth in **the last decade.** The problem? The Amendment wasn’t in place over the last decade. The portrayal as cause and effect is complete nonsense.

It’s like if you are a chain cigarette smoker for 10 years and you decide to start running 5Ks.

Bryce Hill @ the IPI: “You’re running is going to cause lung cancer.”

No, bro. It’s the smoking.

- The Velvet Frog - Monday, Oct 31, 22 @ 12:04 pm:

Not to mention that school districts already have limits on increases in place. Increasing property tax for a school district beyond those limits requires passing a referendum.

- What's the point? - Monday, Oct 31, 22 @ 12:23 pm:

=Increasing property tax for a school district beyond those limits requires passing a referendum.=

Teacher raises negotiated after amendment 1 passes are protected by the State Constitution and supersede any other law. That’s kind of the point.

- Huh? - Monday, Oct 31, 22 @ 12:27 pm:

Frog - the limit on raising property taxes applies to all agencies which levy a property tax. If I remember correctly, a property tax levy can only be increased 5% without a referendum.

- Original Rambler - Monday, Oct 31, 22 @ 12:34 pm:

Woke up this morning and had decided to vote No on Amendment 1. Read this post and am now planning on voting Yes to make my little statement against the IPI.

- illinifan - Monday, Oct 31, 22 @ 12:44 pm:

The logic train has been derailed.

- The Velvet Frog - Monday, Oct 31, 22 @ 12:48 pm:

Huh - you’re right, there are other agencies like libraries or forest preserve that have the same limit, which is tied to inflation but capped at five percent. But it doesn’t apply to villages/towns that are home rule, they don’t have a limit or require a referendum for a bigger increase.

- Demoralized - Monday, Oct 31, 22 @ 12:52 pm:

One of the arguments I’ve heard made against this amendment is that Illinois law already includes these protections. If that is the case then how can they simultaneously argue that this amendment will have any effects on anything?

- Sue - Monday, Oct 31, 22 @ 12:57 pm:

One thing you can be sure of- if the Amendment passes- the unions will be in court with cases aimed at stretching what the legislature has already afforded unions in terms of bargaining rights. Illinois already has very liberal laws protecting public sector unions. Anyone who claims this is only aimed at preventing a future legislature of Governor restricting bargaining rights s just lying about the agenda

- JS Mill - Monday, Oct 31, 22 @ 1:48 pm:

=Teacher raises negotiated after amendment 1 passes are protected by the State Constitution and supersede any other law. That’s kind of the point.=

You really should know what you are talking about before commenting, unless you think teachers would never get a raise without A 1? Then you are just goofy.

Plus a 6% cap is in place for educators.

- Demoralized - Monday, Oct 31, 22 @ 2:23 pm:

==Teacher raises negotiated after amendment 1 passes are protected by the State Constitution and supersede any other law==

Umm, if they’ve been negotiated then they are in a contract and are protected regardless of Amendment 1. You new to how contracts work?