* From a Rep. Tim Ozinga (R-Mokena) press release…

“There is a great injustice occurring in the state of Illinois that we have the power to fix,” said Rep. Ozinga. “The high property tax burden is suffocating families, communities, and businesses, especially in areas that are already struggling. But the extremes of property tax rates vary greatly across our state, sometimes even between towns in the same county. It’s time we ask - why are some struggling communities across our state paying four times the effective tax rate than more affluent communities?

“This crisis is why I, along with my colleague State Representative Dan Ugaste, have introduced House Bill 4866. This legislation would create the Education Property Tax Relief Fund, which would award property tax relief grants to school districts. While all areas of the state would see significant property tax relief, the hardest hit areas would see up to a 50% reduction in school district property tax rates.”

* I asked how the tax relief program would be funded. Response…

This would be funded through the Fixed Pension Payment Property Tax Relief Plan which would tie pension costs and property tax relief into a certain percentage of each year’s budget.

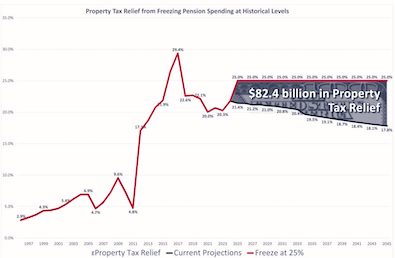

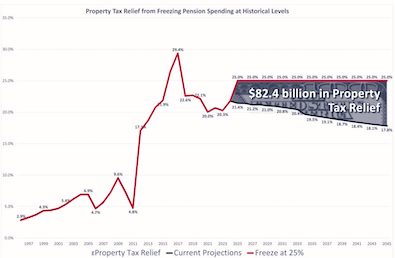

I attached a graph that demonstrates how much money would be allocated to the grant program if we freeze the pension spending at 25% of each year’s budget. With pension costs decreasing each year, the gap between the actual pension costs and the 25% budget allocation would be the funding used for this program.

* Here’s the chart. Click the pic for a larger image if you need it…

Zoom in…

You can clearly see the problem with this idea. The percentage of state spending on pensions is currently way below 25 percent and is expected to continue that decline. A rough calculation shows that this plan would cost taxpayers an extra $2 billion or so in the coming fiscal year, and more in future years if Ozinga’s chart is accurate.

* But the chart does dramatically show why you’re not hearing so much about the state pension “crisis” any longer. Again, if the projections hold up, pension costs become much more manageable as a percentage of total state spending.

Perhaps Rep. Ozinga could lock in his plan at 21 percent instead and use that extra money for property tax relief going forward. Then again, the best local property tax relief is probably the state spending more on K-12, which takes the burden off local taxpayers. This is Gov. Pritzker’s explanation earlier in the week…

When I came into office we were funding education from the state level at only 24 percent. So all the rest of it was coming, most of the rest of it coming from local property taxes. We vowed to do something about that, so evidence-based funding and funding education K-12 in general, allows us to do what I’m about to tell you which is we move from 24 percent funding to 30 percent funding. The average state is 46% funding. You can see how far behind we are, but we’re making tremendous progress. And as we move up the scale of state funding, we can lower local property taxes because this will fall more to the state than it will to local residents.

I dunno about “tremendous” progress, but the arrow is slowly pointing in the right direction for a change. And that started under Bruce Rauner, who signed evidence-based funding into law.

…Adding… From Rep. Ozinga…

“I’m fine locking in at 21% because at the end of the day, some relief is better than none. I am willing to work across the aisle for a solution to this problem, but the more relief the better. We are spending hundreds of millions, potentially billions, on new programs for non-citizens due to the crisis at the border. I think that eventually needs to go to relief as well.”

- RNUG - Thursday, Feb 15, 24 @ 1:00 pm:

Given what appears to be school district’s insatiable requests for funding, I’d want to see mandated reductions in the local property tax bills in exchange for additional state funding. Maybe something like requiring a $0.50 reduction for every new $1.00 in State funding.

- walker - Thursday, Feb 15, 24 @ 1:01 pm:

This is a version of the “Batnick Plan”, which depends on us continuing to improve our fiscal progress of the past five years in order to create the fiscal opportunities. Alternative routes toward the same objectives might include increased funding for EBF to schools, and continuing pension benefits restraints.

The question revolves around how many programmatic constraints we want put on the Executive and Legislative budget processes. It’s similar in that way to the Mendoza plan for building the Rainy Day Fund.

What’s good about this is that responsible proposals still are produced from both sides of the aisle. Another arena where our Illinois legislators outperform those in Washington.

l

- Pot calling kettle - Thursday, Feb 15, 24 @ 1:07 pm:

==the best local property tax relief is probably the state spending more on K-12, which takes the burden off local taxpayers==

As I read it, this is what the bill does, but it is a separate calculation (this bill distributes funds based on head count) from the school funding formula(s).

It’s a bad bill because K-12 funding needs are more complicated than just counting up the number of students (we went through a long, complicated process to develop the current adequacy formula). The school funding system accounts for different needs of different districts. Bypassing the current system is not necessary and would be counter-productive.

If money is added, it should be put into the current system and property taxes will go down; there is no need for a separate distribution. The question for the sponsor is pretty simple: Why not just put this into the K-12 budget?

- Route 50 Corridor - Thursday, Feb 15, 24 @ 1:11 pm:

I think you would have seen real relief with the graduated income tax, I dont think it was sold well. Should have been sold as a way to cut property taxes more than it was.

We are seeing in our area the worry about pensions subside. I think in large part because todays younger workers have a much lower chance of getting those pension because they probably are not going to state long enough to receive them.

That demographic change alone will lower the burden in the next several years in Fire, Police and IMRF.

- Numbers - Thursday, Feb 15, 24 @ 1:12 pm:

$2 billion a year is nothing to sneeze at, but if it were applied across the board (which the proposal doesn’t do, but just for math), it would be about a 5% reduction from the property taxes paid last year. However, property taxes increase each year, and this $2 billion would probably just about cover the annual increase. So it would hold property taxes flat, which is good, but the average homeowner would probably say that isn’t enough. And with this plan, the biggest relief is in year 1. The additional amount in year 2 isn’t as significant, so they would still increase in year 2.

So would this help, absolutely. But this just shows how big the property tax problem is.

- Huh? - Thursday, Feb 15, 24 @ 1:18 pm:

So how does this work? School district receives a grant, which is supposed to reduce the total amount that is levied. How does that help me? Do I get a refund?

- Huh? - Thursday, Feb 15, 24 @ 1:20 pm:

What is to stop a school district from keeping the grant and all of the property tax?

I read the bill 3 times and still don’t understand it.

- Jibba - Thursday, Feb 15, 24 @ 1:23 pm:

I’m not interested in immediately allocating all future savings available after pension pay downs toward property tax decreases. We’ve got a lot of other needs that are more pressing.

- Homebody - Thursday, Feb 15, 24 @ 1:36 pm:

==It’s time we ask - why are some struggling communities across our state paying four times the effective tax rate than more affluent communities?==

I appreciate that he makes no effort to actually answer the rhetorical question. The answer is infrastructure and salaries cost money, and places with fewer tax payers or lower value properties will end up charging more per person or higher rates to collect the necessary funds.

The only real solution to this that doesn’t end up gutting the services provided to poorer communities is to move money from wealthier places to poorer places, but I’m been told that is s o c i a l i s m.

- Dunwich Snorer - Thursday, Feb 15, 24 @ 1:39 pm:

The $350M/yr the General Assembly has been adding to the evidence-based funding formula the last few years includes $50M/yr for property tax relief. We’re also still several billion dollars away from all schools being fully-funded.

- Who else - Thursday, Feb 15, 24 @ 1:47 pm:

Agree with RNUG. The state keeps pumping money into locals via school funding, LGDF, and other locally-directed revenue sources but locals continue maxing out their levies. It might not work for everyone to halt their own property tax hikes, but there are school districts sitting on well over a reasonable amount in reserves that continue to raise property taxes on the people the districts serve. All while the state continues to kick in more. Doesn’t make any sense.

- SteveM - Thursday, Feb 15, 24 @ 2:27 pm:

The Evidence Based Funding formula already has funding and a mechanism for tax relief - the Property Tax Relief Grant. Included in that is the requirement for the districts to reduce their levies. It is not permanent however, just for two years. Maybe work on changing what is already in place and being used and look to increase funding for it rather than trying to build something similar from scratch

- Michelle Flaherty - Thursday, Feb 15, 24 @ 2:35 pm:

– “I’m fine locking in at 21% –

Is this now to be known as Rich’s Law?

- Frida’s boss - Thursday, Feb 15, 24 @ 2:40 pm:

So Tier 2 is working?

- Former Downstater - Thursday, Feb 15, 24 @ 2:41 pm:

If nothing else, it’s nice to see a Republican present a bill that is based in actual reality and can be honestly evaluated on its merits.

It’s a shame how low the bar has gotten.

- Dog Lover - Thursday, Feb 15, 24 @ 2:45 pm:

The school district where I live hasn’t reduced the levy. They only ask for more. Everyone around me had their property value increased significantly and I was told by the multi-township assessor that the state made all counties raise property values. That makes the proposal above seem disingenuous to me.

I would like to see a big increase in the state funding of schools and big decreases in property taxes. Straightforward, clear change. Not ambiguous calculations and promises followed by legislators touting that they did something for us when they didn’t.

- thechampaignlife - Thursday, Feb 15, 24 @ 3:05 pm:

===How does that help me? Do I get a refund?===

Would increasing the property tax credit be a way to accomplish that?

- TheInvisibleMan - Thursday, Feb 15, 24 @ 3:05 pm:

–why are some struggling communities across our state paying four times the effective tax rate than more affluent communities?–

Sometimes, local decision making means locals make terrible and costly decisions.

How many of these school districts are still participating with the decades-since-discredited D.A.R.E. program?

–What is to stop a school district from keeping the grant and all of the property tax?–

Nothing. And that’s the point.

Not a peep out of Mr. Ozinga about consolidating single-school districts. Despite his district having one in New Lenox.

Come back with a school district consolidation bill. Then we can talk about the money.

- Friendly Bob Adams - Thursday, Feb 15, 24 @ 4:14 pm:

Frida- yes I think that’s the largest part of the answer

- Macon Bakin - Thursday, Feb 15, 24 @ 4:36 pm:

Land Value tax>>>>>>>>>>>>>>>>>>property tax that’s my proposal

- Odysseus - Thursday, Feb 15, 24 @ 7:12 pm:

@Jibba +1

- Candy Dogood - Thursday, Feb 15, 24 @ 7:32 pm:

===So Tier 2 is working? ===

I think the answer to that really depends on what you mean by ‘working.’ The real secret to this progress is actually paying into the pension fund which is a pretty new concept for State government. Not only paying into the pension system, but also putting extra towards the pension system.

===Perhaps Rep. Ozinga could lock in his plan at 21 percent instead and use that extra money for property tax relief going forward.===

21% is a description of how much of something is a part of the budget. 21% is not the actual number of dollars and does not reflect actual expenses. Actual budgeting involves a dollar amount. I think he needs to take his proposal back to the drawing board and come up a real proposal that uses real dollar values and projects real dollar values going forward to have a real grown up conversation about public budgeting.

Also — the State is finally doing a better job at funding K-12 education, but we still have a teacher shortage, especially in our more rural counties, and we still have massive issues with competitive pay for teachers, so additional funding won’t necessarily make anyone’s property tax cheaper.

===What is to stop a school district from keeping the grant and all of the property tax?===

Elections. School boards are elected. I might by cynical, but if a school board was hoarding public dollars for education that were not necessary to pay for education I would think that there would be enough interest in stopping that it would influence an election outcome.

There’s tons of things new money towards K-12 elections can be directed to that are reasonable and appropriate expenses.

Tim just wanted to figure out a way to suggest he’s trying to lower property taxes in while increasing K-12 spending. This kind of fuzzy math is nothing new.

- JS Mill - Thursday, Feb 15, 24 @ 10:20 pm:

@RNUG, with respect…our need for funding isn’t insatiable. Our costs are 70-80% salary and benefits. Insurance costs have been rising at levels well beyond inflation for more than a decade. 8-9% is not only common, it is on the low end. And smaller districts are vulnerable to much high rates. My first year our carrier wanted a 21% increase. Same goes for wages. A 4% increase to our salary schedule base means an average of 6% increase in salaries. Some of our people were getting double digit raises due to adding education and the traditional step increase. And try to get your staff off of a salary schedule. Lots of luck.

Our other big costs are energy/fuel and transportation. Buses went up 30% thanks to a supply issue resulting from Covid. Leave or buy. Didn’t matter.

And if your buildings need work (maybe yours never wear out) good luck. A project that was bid in 2018 (but did not go forward) for $900k was completed last year for $1.3 million.

Our costs are exceeding our 4-5% levy increases and our EBF increase was $5,000 last year. And, remember that PTELL districts that reduce their levy cannot get that money back without a referendum. And many of you know the state has not been the most reliable funding source over the past 30 years. The last 5? Sure. But the vaunted EBF hasn’t done much for “middle class” districts.

The $50 million in the EBF for property tax relief is a total joke.

- Rich Miller - Thursday, Feb 15, 24 @ 10:54 pm:

===is a total joke===

Things have to be done to pass bills and get them signed into law. The private school scholarship tax credit language was also in the bill.