* Crain’s…

The typical Black household in the Chicago area has nothing to fall back on, its assets and debts adding up to zero, according to a new report.

“They’re living check to check,” said Darrick Hamilton, director of the Institute on Race, Power & Political Economy at the New School in New York, which produced the report.

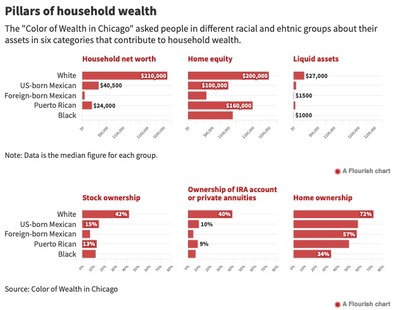

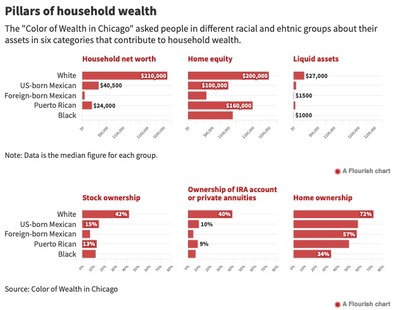

According to the institute’s research, Black households are far less likely to own stocks, individual retirement accounts and homes than most other racial and ethnic groups surveyed, and they have the least in liquid assets. […]

The median wealth of white households in the Chicago area, by comparison, is $210,000. That’s according to “Color of Wealth in Chicago,” a report the institute will release today at the Chicago Community Trust. The trust was the primary funder of the research for Hamilton’s report on Chicago, the sixth in a series covering major U.S. cities. The others were released between 2012 and 2015 and thus don’t compare directly to the Chicago report, Hamilton said, because they’re pre-pandemic and the Chicago data was collected in 2022-23.

From Crain’s…

* From the report…

Many studies focus on income, but it is wealth that better positions families (and individuals) to finance elite educations, access capital to start a business, pay for expensive medical procedures, reside in higher amenity neighborhoods, exert political influence; purchase better counsel if confronted with an expensive legal system, leave a bequest, and withstand many financial hardships resulting from any number of emergencies or shocks, including a global pandemic.

With the goal of informing policy and systems changes that reduce the racial wealth gap and move the Chicago region toward shared prosperity, our study examines the relative wealth, asset, and debt positions of Black, Mexican (born in the US and abroad), Puerto Rican and White families across 10 counties in the Chicago metropolitan area. […]

White families in Chicago have drastically better wealth outcomes than all others with over five times the amount of wealth as Mexican American families, the group with the next highest level of wealth. Black families have a net worth (or wealth) of $0, which means that at the median, Black families’ debts cancel out their assets.

Many tout education as the solution to the racial wealth gap, but often the racial wealth gap increases at higher levels of education. For example, when comparing respondents without bachelor’s degrees, White families have $135,700 more wealth than Black families. However, this gap increases to $260,000 for Black and White respondents with a bachelor’s degree. […]

Chicago’s wealth gaps are primarily driven by assets – specifically, the outsized accumulation of assets by White families. While White families in Chicago have a median asset value of $325,500, the assets of the other groups examined in our survey range from $20,000 to $128,000.

* The Grio in January…

The Wall Street Journal reported that in 2022, almost 40% of Black Americans owned stock, up from about a third in 2016, per Federal Reserve data. Similarly, a survey by Ariel Investments and Charles Schwab revealed that the growth is led by young investors under 40. Approximately 70% of the survey’s Black participants under 40 were investing, compared to 60% of their white counterparts in that same age group. […]

Despite the notable amount of Black stock buyers, the Federal Reserve’s 2022 Survey of Consumer Finances data suggests that the amount of money put into stocks is still small. As previously reported by theGrio, the median wealth for Black families increased by 60% between 2019 and 2022. Yet Black families’ median wealth is still $240,100 less than the median wealth of white families.

Though Black people may not be putting as much money into their stocks, the group’s desire to buy stocks and make good investments continues growing thanks to social media, according to the Finra Investor Education Foundation.

* Mayor Brandon Johnson today announced a $500,000 task force to study the issue…

Ahead of Juneteenth, Mayor Brandon Johnson signed Executive Order 2024-1, establishing a Reparations Task Force to develop a Black Reparations Agenda. This Task Force is an example of the Administration’s dedication to co-governance, and in partnership with members of the Aldermanic Black Caucus, the Mayor’s offices of Equity and Racial Justice and Business, Economic and Neighborhood Development, and other key City departments, will conduct a comprehensive study and examination of all policies that have harmed Black Chicagoans from the slavery era to present day and make a series of recommendations that will serve as appropriate remedies.

- Grandson of Man - Monday, Jun 17, 24 @ 1:22 pm:

“White families in Chicago have drastically better wealth outcomes than all others”

BuT DeI iS RacISt.

Being born with White skin is a big life advantage, from day one.

- 47th Ward - Monday, Jun 17, 24 @ 1:59 pm:

I think being married is a positive indicator for net worth. Not trying to make any statements about race, or the reasons why people get, remain or don’t get married, just the simple fact that two incomes are better than one.

And no, I am not saying that everyone should get married or stay married. Lots of factors go into that.

I’m curious to know how membership in a defined benefit (pension) plan factors into this. Stocks are assets, which is understandable, but DB plans guarantee income without (much) risk. Most public employees in Chicago are required to live in Chicago, so it stands to reason that there are many households that benefit from guaranteed future income that isn’t captured in net worth calculations.

- City Zen - Monday, Jun 17, 24 @ 2:06 pm:

==Being born with White skin is a big life advantage, from day one.==

We’ll never know if it’s just white skin. From the study: “Other groups, such as those who identify as Asian and Pacific Islanders, were not included.”

- Fav Human - Monday, Jun 17, 24 @ 2:36 pm:

City Zen beat me to it

I’m curious to know how membership in a defined benefit (pension) plan factors into this

There is an easy way - use the asset equivalent needed to generate that income.

So, at 4% rate of return, a 40,000 annual income equals 1 million USD.

The problem is that if you have those assets you are more flexible in accomodating a problem.

But of course, a lot of the wealth attributed to others is in 401K and house equity - one is very hard to get at, the other somewhat so (and very risky to do so).

- Demoralized - Monday, Jun 17, 24 @ 3:09 pm:

==Reparations==

Two words: absolutely not.

- Nope. - Monday, Jun 17, 24 @ 3:33 pm:

The studies have been done. 500k is “fittin to get ready.” Buy 500 tablets for the Lawndale library. I can think of 500 better ways to spend half a mil.

- 44 - Monday, Jun 17, 24 @ 3:35 pm:

Weird study. Basically all the wealth is tied up in houses, which are taxed in top ten percent in the country. Left over, $27,000! Yikes. May be vastly more on a % basis but that’s not enough for anyone to retire on. Not exactly a fat cat nest egg there. Social security and pensions more important then ever. Otherwise people are basically broke.

- Proud Papa Bear - Monday, Jun 17, 24 @ 4:07 pm:

The system works exactly as it was designed.

Whatever data is presented to show that racism is systemic, pervasive, and perpetual, white people (of which I’m one) will perform all sorts of mental contortions to explain it away.

- Amalia - Monday, Jun 17, 24 @ 4:34 pm:

should have included Asian American and other Hispanic to represent most of the population. Also wealth by income by race.

- family matters - Monday, Jun 17, 24 @ 5:59 pm:

Wow proud papa, we’re all on our feet cheering you