* Click here to read the governor’s address. The Health Benefits for Immigrant Adults program has been eliminated, according to a senior administration official during today’s budget briefing for reporters…

“HBIA is not funded in the proposed budget. The cost for that is about $420 million a year, of which $330 approximately, would come from the General Revenue Fund.”

More on the program is here. It’s a health coverage plan for undocumented immigrants aged 42-64 and is highly controversial.

* A follow-up question during this morning’s budget briefing…

Q: What’s the thinking on [defunding HBIA]?

A: Well, I mean, this was a difficult decision. There’s no doubt about that. But I think it reflects the reality of our fiscal situation that we have flagged now for several months. And I think you will see not just with what the governor is proposing for HBIA and the [Health Benefits for Immigrant Seniors] program, but throughout the budget. It’s a reflection of difficult decisions that we had to make in order to bring the proposal into balance.

As you know, this is a budget request of the General Assembly. The General Assembly is going to start its processes today, after the governor submits his budget. And we’re happy to engage with our partners in the General Assembly for any creative solutions that they might have, not just for HBIA, but for anything else reflected in the proposal. And you know, we have always faced a challenge, some larger than others, in terms of bringing budgets into balance. But as evidenced by what we’re presenting today, those challenges have always been met by working in partnership with with the General Assembly, and this program and other programs that are not being funded in the budget this year are a reflection of the reality that we face.

The senior healthcare program remains intact, but the administrative rule barring all new enrollment will remain on the books.

The proposal also reduces Welcoming Center appropriations from $139 to $40 million.

* Excerpts from the Senate Republicans’ highlights…

· Largest budget in state history—$55.4 billion, increasing spending by $2 billion.

· Increases state budget by $15 billion or 37% since Gov. Pritzker took office.

· Includes four revenue proposals for $490 million

o $198 million - reinstates the FY 20 Delinquent Tax Payment Incentive Program

o $171 million - Pauses shift of sales taxes [to Road Fund] for one year

o $100 million- realigns the tax treatment for 15 of the 16 Illinois casinos (excluding the Chicago casino)

o $20 million - Eliminates the state-level deductions for cannabis industry businesses

* The budget briefing is here. The proposed operating budget is here. The proposed capital budget is here.

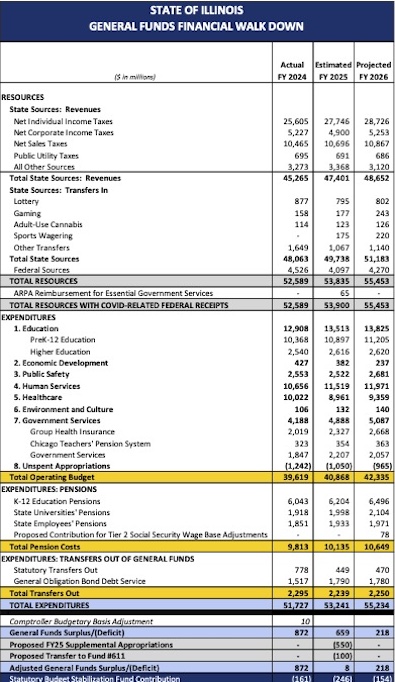

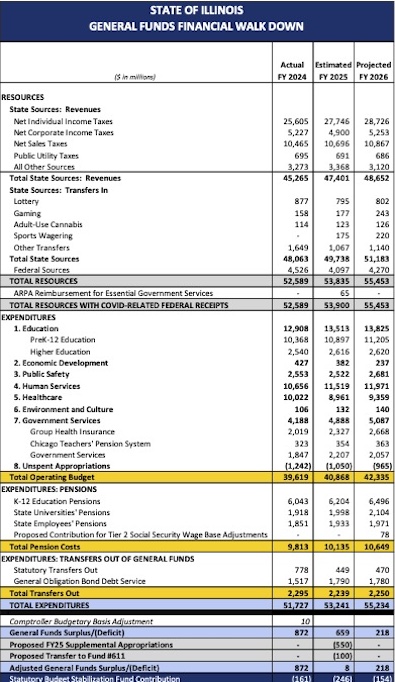

* Walkdown…

* Revenue forecast change explained…

• General Funds FY26 revenues are estimated to total $55.453 billion, a $1.553 billion, or 2.9%, increase from revised FY25 estimates.

• Base revenue growth in state sources revenues is estimated at 1.9%.

• Base revenues are approximately $1.5 billion above November preliminary estimates.

• FY26 revenue forecast benefits from several proposed revenue adjustments, including:

• Delinquent Tax Payment Incentive Program - $198 million for General Funds.

• Pause the final shift of state sales taxes on motor fuel purchases to Road Fund - $171 million.

• Realignment of tax treatment for table and electronic games at casinos - $100 million.

• With these adjustments:

• FY26 individual income taxes are forecasted to grow $980 million, or 3.5%.

• FY26 corporate income taxes are forecasted to grow $353 million, or 7.2%.

• FY26 sales tax receipts are forecasted to grow $171 million, or 1.6%.

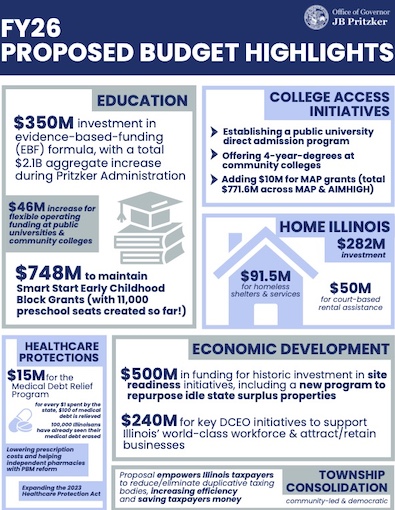

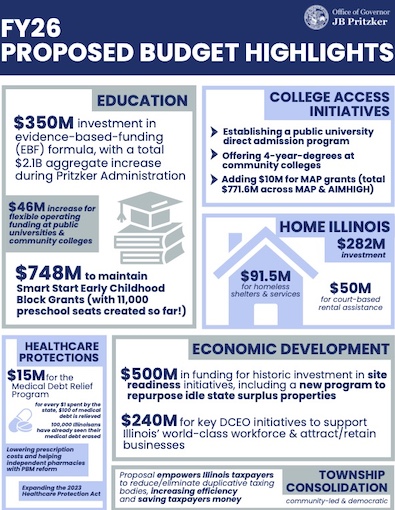

* Excerpts from a distributed document entitled “Proposed budget toplines”…

New discretionary spending is increasing by less than 1%.

The state is maintaining its commitments to mandatory spending like full pension payments, inflation on healthcare coverage, and debt pay-down.

The budget proposes cost-saving operational efficiencies to save taxpayers money, including consolidating

unnecessary segregated funds, evaluating dormant boards and commissions, and determining what state

government functions could merge to improve efficiency and savings.

Mobilizing $500 million in state capital funds to develop properties and real estate that have been sitting idle into

areas that are ripe for economic development and job creation. […]

Lowering healthcare and prescription drug costs by stopping predatory practices used by pharmacy benefit

managers;

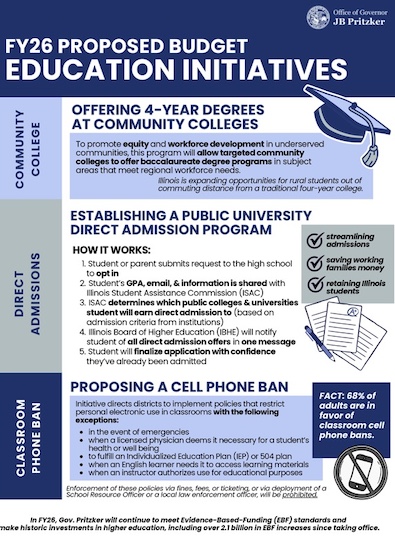

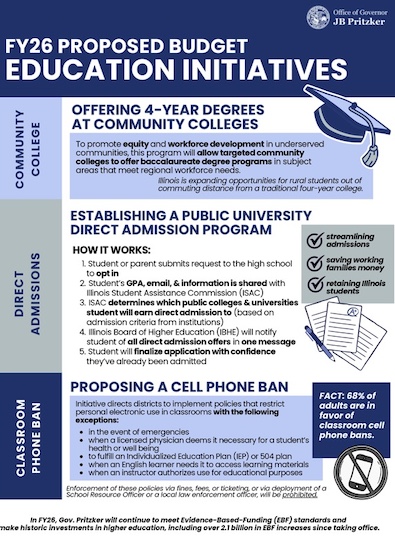

Lowering education costs, allowing community colleges to award BA degrees and streamlining public university

admissions process to reduce application fees;

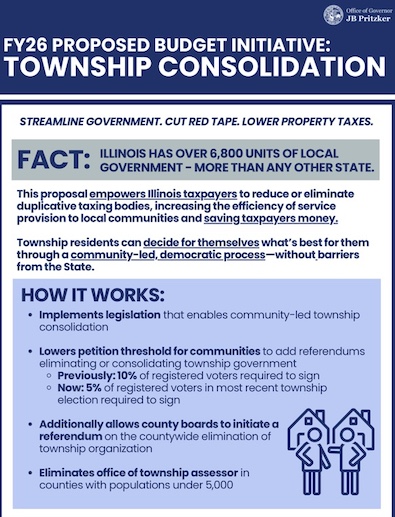

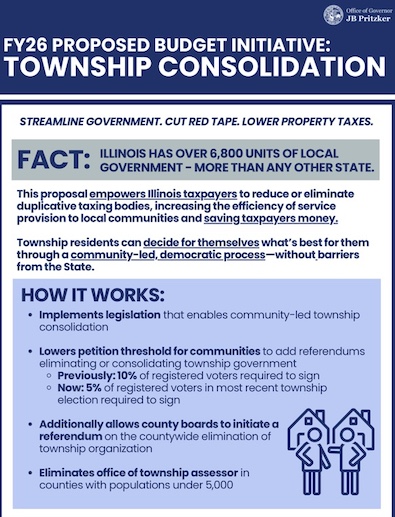

Lowering property taxes, enabling communities to decide if they want to consolidate townships or eliminate duplicative taxing bodies.

* Various one-pagers…

- Felonious Gru - Wednesday, Feb 19, 25 @ 12:23 pm:

Eliminating funding for HBIA acknowledges several realities.

The political reality of the 2024 presidential election, and Pritzker’s ambitions for 2028.

The lack of support for HBAI among suburban and Downstate Democrats.

The polling among Black and Latino voters on immigration.

Democrats would have been drowning in nonstop rhetoric from Republicans all the way up to Trump if the funds were in his budget.

Pick the fights you can win.

- DS - Wednesday, Feb 19, 25 @ 12:31 pm:

Don’t see anything in the “budget toplines” about the public transit cliff. Can’t just wish that away.

- RNUG - Wednesday, Feb 19, 25 @ 12:38 pm:

- Felonious Gru -

Pretty much my tale also. Bowing to the political realities of today.

- Donnie Elgin - Wednesday, Feb 19, 25 @ 12:40 pm:

=The Community College Baccalaureate Degree Program would enable targeted community colleges to offer four-year bachelor

degrees=

Great idea - offer lower cost commuter 4-year degree model at Community college. However, it could increase the doom loop at WIU.

- Mason County - Wednesday, Feb 19, 25 @ 12:44 pm:

Community colleges granting B.A’s?

Not their purpose and never has been nor should be. Plenty of colleges offering degrees and this has been augmented by online courses.

- Rich Miller - Wednesday, Feb 19, 25 @ 12:48 pm:

===about the public transit cliff===

That’s still being negotiated. Keep up.

- Mason County - Wednesday, Feb 19, 25 @ 12:49 pm:

=It’s a health coverage plan for undocumented immigrants aged 42-64 and is highly controversial.=

Should be eliminated except to children.

- K3 - Wednesday, Feb 19, 25 @ 12:59 pm:

Eliminating Township government, saving 5% of my tax bill, what a brave proposal JB. Way to lead.

- Friendly Bob Adams - Wednesday, Feb 19, 25 @ 12:59 pm:

Donnie- agree re: WIU enrollment

- Grimlock - Wednesday, Feb 19, 25 @ 1:11 pm:

How many working adults are there in this state who are looking to earn a four-year degree and don’t live within 30 miles of a university? I can’t imagine the number is enough to justify the expense of offering these programs.

- RNUG - Wednesday, Feb 19, 25 @ 1:32 pm:

== =It’s a health coverage plan for undocumented immigrants aged 42-64 and is highly controversial.=

Should be eliminated except to children. ==

I think they should keep vaccine programs for all ages. Herd immunity only works if most people are vaccinated against the common, easy to control diseases.

Recent outbreaks of once controlled / almost eradicated diseases point to the need.

- Mason County - Wednesday, Feb 19, 25 @ 1:34 pm:

=However, it could increase the doom loop at WIU.=

True, but they won’t be the only college or university in the state to take a hit. U of I won’t and probably not NIU or ISU- or at least not much. The rest of them will.

- Mason County - Wednesday, Feb 19, 25 @ 1:37 pm:

MAP grants to private colleges should be up for review and, in my opinion, should be eliminated.

State did this many decades ago under the idea that the public universities were so crowded that the public colleges could relieve some of that overload. Those days are long gone.

However, the private colleges have a powerful lobbying group and they are spread throughout the state. So not much is likely to happen.

- Cool Papa Bell - Wednesday, Feb 19, 25 @ 1:40 pm:

=earn a four-year degree and don’t live within 30 miles of a university=

It’s as much about cost than anything. The expense of getting a four year degree at a JUCO would be so much less than a 4 year school.

WIU’s cost per credit hour is $336

LLCC cost per credit hour is $140

Standard issue 4 year degrees at more than half off would a tremendous boost to students. Certainly not great for my alma mater WIU, but very beneficial for students.

Heck, with the ability to take JUCO classes while a high school junior and senior, you can enter as a second semester sophomore in many places and be done with a 4 year degree in about 2 years at a local JUCO.

It’s an idea worth looking deeply into.

- Leap Day William - Wednesday, Feb 19, 25 @ 1:47 pm:

== Eliminating Township government, saving 5% of my tax bill, what a brave proposal JB. Way to lead. ==

Meh. Five percent is five percent.

Republicans love to complain about Illinois having 7,000+ units of government and how wasteful it is, but seem to forget their objections once its time to act and realize their party people downstate holding the lion’s share of those offices. Roll those up into the county and be done with it.

- illinifan - Wednesday, Feb 19, 25 @ 2:30 pm:

Discontinuation of HBIA will place a further financial burden on Cook County Health since many of the folks live in Chicago and no matter what they have health needs.

- Arsenal - Wednesday, Feb 19, 25 @ 2:30 pm:

==Eliminating Township government, saving 5% of my tax bill, what a brave proposal JB. Way to lead.==

I’ll take your share if you don’t want it.

But also, it’s not clear what townships do that cities and counties couldn’t do, and I think that kind of obfuscation is ultimately bad for democratic legitimacy.

- Mason County - Wednesday, Feb 19, 25 @ 2:44 pm:

=I think they should keep vaccine programs for all ages. Herd immunity only works if most people are vaccinated against the common, easy to control diseases=

Yep, good idea for everyone’s sake.

- redrepublican65 - Wednesday, Feb 19, 25 @ 3:17 pm:

Eliminating Townships wont save you “5%” of your tax bill. Pritzker is gifting the COUNTY with nine-tenths of the dissolved townships’ tax revenue in perpetuity. Since the township portion of your tax bill = 2.5%, your annual “savings” = one-tenth of 2.5% of your tax bill. HUZZAH!

- Rich Miller - Wednesday, Feb 19, 25 @ 3:21 pm:

redrepublican65, you may be right. My own personal opinion is that the state should consolidate counties, which is where to find some big savings.

- Grimlock - Wednesday, Feb 19, 25 @ 3:28 pm:

Community colleges will need more money to offer bachelor’s degrees, they won’t be able to charge the same low tuition they do for associate’s degrees. Not unless someone else comes up with that extra money.

- RNUG - Wednesday, Feb 19, 25 @ 4:46 pm:

== My own personal opinion is that the state should consolidate counties, which is where to find some big savings. ==

There would likely be some significant savings in consolidating a lot of school districts.

But that would be like opposing motherhood and apple pie.

Towns fight tooth and nail to retain their schools. I’ve seen those fights when I lived in a small town (pop. ~ 650). The towns identity is often tied to the schools.

And I recognize there are distance / geographic limits to school consolidation. But there may still be savings if you were to consolidate the management / support infrastructure of multiple small districts. Larger cities manage to oversee a lot of schools.

- Rich Miller - Wednesday, Feb 19, 25 @ 4:52 pm:

===There would likely be some significant savings in consolidating a lot of school districts.===

That’s a given, but voters are rarely enthusiastic about it. I doubt they’d have the same attachment to counties.

- Bob Anderson - Thursday, Feb 20, 25 @ 2:24 pm:

Thank you Governor Pritzker, Townships should have been Abolished 100 years ago. Most states do NOT have township government as well 17 of Illinois’ counties. Over 90% of township revenue comes from Property taxes.

- Tinman - Friday, Feb 21, 25 @ 9:44 am:

You can promote consolidation of government. But then you do have less say and more bureaucracy. Big school districts parents have less say and they do not perform as well . Super sized counties I’m not for . Having a say in government that’s what local governments give you . Having super sized government. You get lost in the bureaucracy.