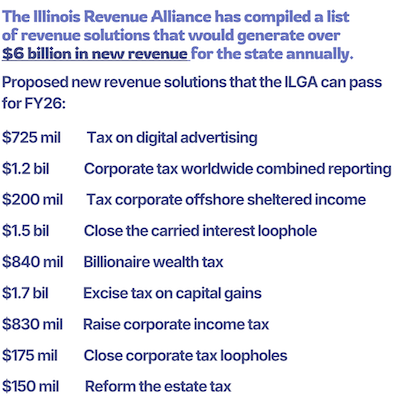

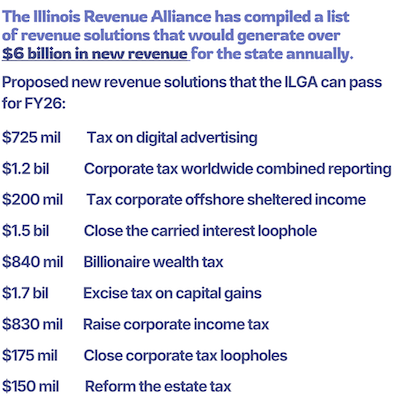

* From the Illinois Revenue Alliance…

Members include: Brighton Park Neighborhood Council, Chicago Teachers Union, Grassroots Collaborative, Healthy Illinois, Illinois Coalition for Immigrant and Refugee Rights, Jewish Council on Urban Affairs, ONE Northside, PEER Illinois, SEIU Healthcare, Shriver Center on Poverty Law, The People’s Lobby, Workers Center for Racial Justice.

* Excerpts from the more detailed page…

Proposal: Impose a 10% tax on digital advertising revenue on corporations that make over $150 million from digital ads. This tax would only impact the largest corporations profiting off of our personal data. Revenue Estimate: FY25-$775 Million, FY26-$895 Million

Proposal: Illinois should implement worldwide combined reporting worldwide combined reporting (WWCR) for corporate tax filing. This would require multinational corporations to include the income of their foreign subsidiaries when calculating Illinois’ share of their profits. Currently, six states and DC states require corporate filings to include foreign subsidiaries located in known tax haven countries. One state, Alaska, requires WWCR for oil companies. Revenue Estimate: $1.2 Billion.

Proposal: Apply Illinois’ corporate income tax and personal property replacement tax to GILTI, a 9.5% tax rate. Since the federal government only taxes 50% of GILTI, Illinois should tax the other half. This would impact large multinationals with access to offshore tax havens. Revenue Estimate: $200 Million.

Proposal: Place a 17% surcharge on all carried interest income by hedge fund and private equity executives, the percentage by which carried interest is under-taxed federally. This would eliminate these executives’ tax advantage while preserving the incentive to be a successful hedge fund manager. Revenue Estimate: $1.5 billion.

Proposal: Impose a “mark-to-market” wealth tax, which would apply Illinois’ personal income tax (4.95%) to the appreciation of billionaire’s assets. This solution was also proposed in the Biden-Harris administration’s FY 2025 budget. Revenue Estimate: $840 million

Proposal: Impose a tax of 7% on long-term capital gains on assets other than real estate over $250,000 in a given tax year. The average income of an individual being taxed under this surcharge is $4.2 million, and over 99% of the tax would be paid by people in the top 20% of income. Revenue Estimate: $1.7 billion

Proposal: Raise the Illinois corporate income tax rate from 7% to7.92%, which is the maximum increase allowed underthe IL constitution (tax limited to 8/5 of the personal income tax). Revenue Estimate: $830 million (2)

Proposal: Eliminate the remaining corporate tax loopholes identified by the governor’s administration, which include:

* Manufacturing Equipment Subsidy: Remove production-related tangible personal property from the manufacturing machinery and equipment sales tax exemption (loophole originally closed in 2008 but reopened in 2019).

* Corporate Construction Subsidy: Eliminate the add-on corporate income tax credits for construction job payroll.

* Biodiesel Sales Tax: Accelerate the expiration of the remaining sales tax exemptions for biodiesel, which is scheduled to sunset in 2030.

Revenue Estimate: $175 million

Proposal: Reduce the state estate tax exemption to $2 million, returning it to the more equitable level it was set at until 2011. Revenue Estimate: $150 million

More at the link.

Which ones do you like and which ones do you not like?

- NorthernILGuy - Tuesday, Apr 29, 25 @ 1:53 pm:

None. Cut spending.

- Rich Miller - Tuesday, Apr 29, 25 @ 1:55 pm:

Florida man heard from.

- Quibbler - Tuesday, Apr 29, 25 @ 1:56 pm:

All of them. Raise spending.

- Sue - Tuesday, Apr 29, 25 @ 1:56 pm:

Quite the wishlist- why do these folks even bother with this stuff- not one of these suggestions will become law- having just received my latest property tax bill in the mail- here is a thought- lets reduce spending to a level which matches current revenues based on existing tax sources

- Blue Bayou - Tuesday, Apr 29, 25 @ 1:58 pm:

“None. Cut spending.”

Ken Griffin? That you?

- Team America - Tuesday, Apr 29, 25 @ 1:59 pm:

=== 7% on long-term capital gains on assets other than real estate=== Are retirement funds (IRA, 401k, etc.) “assets”?

- Center Drift - Tuesday, Apr 29, 25 @ 1:59 pm:

Wealth tax is very hinky. Capital appreciation is usually unrealized gain. It is not real unless and until it is converted. Also, do you just take the value as of A certain date? Dollars to donuts this would lead to a almost certain market decline that time of year. Do you take a rolling average? Just an ill conceived money grab.

- pragmatist - Tuesday, Apr 29, 25 @ 1:59 pm:

There are some good ideas, but they cumulatively whack a small set of actors. Importantly, though, I think having CTU and Grassroots attached to anything is a death sentence. Maybe they should do more behind-the-scenes work. My two pennies.

- That Guy - Tuesday, Apr 29, 25 @ 2:00 pm:

1, 2, and 4 seem like no-brainers.

Affects only the richest schmucks who can easily afford it.

5 would be awesome as well, though I could see constitutional questions on whether or not that would be considered a progressive tax, which is constitutionally verboten in our current constitution.

- Montrose - Tuesday, Apr 29, 25 @ 2:06 pm:

I think all have merit. My question is how do they get Pritzker to reverse on his “no new taxes” public statements. Maybe this advocacy isn’t a play for this fiscal year.

- Sensible - Tuesday, Apr 29, 25 @ 2:11 pm:

Raise revenue AND reduce spending. Half and half.

- ChicagoBars - Tuesday, Apr 29, 25 @ 2:13 pm:

Did a page with a proposed financial transactions tax get stuck in their printer or did that (easily avoided) bright progressive revenue idea finally die?

- DuPage Saint - Tuesday, Apr 29, 25 @ 2:13 pm:

Tie this to a guaranteed property tax reduction that is somehow locked in and I would vote for all of them and even raise the rates. However i don’t know how tax on long term assets would work. What if asset depreciated in a given year?

- clec dcn - Tuesday, Apr 29, 25 @ 2:15 pm:

The Billionaire tax sounds good, but I really don’t know what it actually means. The problem is real estate taxes. They just took a giant leap up in Mclean County my property taxes went up $475 and $900 in the last 2 years. That is a lot and really, they say your house is worth more but if you just live it, it is not like you can say it is available money.

- Remember the Alamo II - Tuesday, Apr 29, 25 @ 2:15 pm:

Some of the verbiage used by the Illinois Revenue Alliance is confusing and needs to be clarified. For example, one of the proposals states:

“Impose a tax of 7% on long-term capital gains on assets other than real estate over $250,000 in a given tax year.”

Does this mean that the asset is over $250k or is the tax only on long term capital gains over $250k? And as another commenter asked, what is an asset for the purposes of this tax?

- Sue - Tuesday, Apr 29, 25 @ 2:18 pm:

How many billionaires live in Illinois right now?

How many will still live here if the state adds more “billionaire taxes”?

The reduction of the estate tax exemption down to $2M will ensnare many diligent savers who die early in their retirement, all the more so since once you hit the exemption, you pay the tax on the entire estate, not just the amount above the exemption. But it will definitely provide full employment for financial planners!

And I’m really surprised that it would be possible to have a higher tax rate on investment income than wage income - I thought that was prohibited just like the graduated rate was prohibited?

- Remember the Alamo II - Tuesday, Apr 29, 25 @ 2:20 pm:

Also wouldn’t some of these proposed taxes just give those the tax applies to an incentive to move out of state? A 17% tax might make it a no-brainer to move if neighboring states (or other states) are at 0%. Just saying.

- Suburban Mom - Tuesday, Apr 29, 25 @ 2:24 pm:

=== It is not real unless and until it is converted.===

The richest — like Elon Musk — do not EVER convert it, so it is not ever taxed. They borrow against it for “income.”

- Three Dimensional Checkers - Tuesday, Apr 29, 25 @ 2:25 pm:

I don’t trust CTU with the money. They’ve failed to learn from the real estate transfer tax vote. It’s not the revenue. It’s the no one trusts the spenders problem. But, if I had to choose, #2 is very feasible. Although, there is one too many “states” in their description, lol.

- Quibbler - Tuesday, Apr 29, 25 @ 2:25 pm:

== Also wouldn’t some of these proposed taxes just give those the tax applies to an incentive to move out of state? ==

This is a notion that’s often used to scaremonger against higher taxes, but there’s very little evidence that it actually happens. See: https://www.cbpp.org/sites/default/files/8-9-23sfp.pdf

- Ducky LaMoore - Tuesday, Apr 29, 25 @ 2:26 pm:

I really like #1. That is something that is not going to further drive people away from Illinois. #2 is intriguing to me, but I haven’t educated myself enough on the issue to be for or against it at this point. #3 I am not really sure either. #4 I am generally in favor of, but perhaps at a lower rate. 17% seems high to me. #5 I am completely against. I hate the idea of taxing unrealized growth. Total nonstarter for me. #6 is also a general nonstarter for me. Illinois does not tax capital gains, and I am fine with that. This is one of those big issues that could drive wealthier Illinois to other states. #7 I am neutral on. If it really came down to raising corporate income tax, I guess ok fine. But that is low on my list. #8, closing those loopholes is pretty small potatoes, and I think they are well worth the cost to keep. #9 Totally 100% against. I already think the exemption is already too low. I think it should be tied to the federal exemption. This one is very personal for me, though. We are family farmers, like 600 acres tillable. I would hate for us to have to sell land to pay a death tax.

- Henry - Tuesday, Apr 29, 25 @ 2:28 pm:

The Progressive Solution to every problem is more taxes. Unfortunately for the State too many legislators feel the same way.

- Donnie Elgin - Tuesday, Apr 29, 25 @ 2:29 pm:

Ambivalent on the 1st one. The most troubling would be the wealth tax/ mark to market - firstly, wealthy folks often invest in alternative assets that are notoriously difficult to get an accurate price/value on. Secondly, wealthy folks and even regular everyday investors have no requirement to disclose the value of unrealized capital gains, and there is no federal or national reporting required for unrealized capital gains, so good luck. Instead of all these zig and zags, this progressive group should simply lobby the Dem supermajority to raise the flat income tax from 4.95% to a higher level that would raise the income they seem to think we need.

- Sue - Tuesday, Apr 29, 25 @ 2:29 pm:

Quibler/maybe you never read about Bezos moving to Florida after WA proposed irs billionaire’s tax and when asked he specified to avoid what he called a punitive tax on success

- Remember the Alamo II - Tuesday, Apr 29, 25 @ 2:34 pm:

=== This is a notion that’s often used to scaremonger against higher taxes, but there’s very little evidence that it actually happens. ===

I would agree with that statement in cases where there is a minimal increase in state taxes, but in this case, you are proposing a 17% increase in taxes for those the tax applies to. That is a heckuva lot of money.

Also, this idea was pushed in New York, but it is contingent on a whole host of other states passing the tax as well. It would be too easy for a fund manager to move operations to a different state if this is imposed in a single location.

- Garfield Ridge Guy - Tuesday, Apr 29, 25 @ 2:54 pm:

I would accept all of these changes, together with (i) a 100% increase in politician pay, and (ii) a constitutional amendment that no county, city, or state tax in Illinois can be raised over their FY26 level for the next 25 years (other than these taxes), and that any politician who causes any tax to be raised during that 25-year period has committed a newly created felony, the punishment for which if convicted is a 10-year jail sentence and the disgorgement of all income earned (from any source) while serving as a politician since FY26.

Either these taxes will fix the problem or they won’t. If they won’t, let’s not consider them. If they will, our electeds should have skin in the game.

- Which one’s Pink - Tuesday, Apr 29, 25 @ 3:04 pm:

Many corporations pay little to no business income tax due to the Net Loss Deduction (NLD)carried forward from previous tax years. From time to time Illinois has limited this amount to $100,000. Perhaps there could be an ongoing limit to the amount of the net loss deduction (NLD) to no more than 50% of Illinois income. This could be applied to partnerships and S Corps in addition to C Corps.

- low level - Tuesday, Apr 29, 25 @ 3:08 pm:

==Unfortunately for the State too many legislators feel the same way.==

You arent from around here, are you? Practically all of this is DOA. They will be lucky to have even 1-2 of these enacted.

- Just a Citizen - Tuesday, Apr 29, 25 @ 3:08 pm:

Governments need more money, pass more taxes. I would like to see spending cuts before more taxes are passed. In a state the size of Illinois, some efficiencies can be found. The revenue alliance needs to look for those.

- City Zen - Tuesday, Apr 29, 25 @ 3:18 pm:

==This is a notion that’s often used to scaremonger against higher taxes, but there’s very little evidence that it actually happens.==

There’s zero evidence a teacher shortage is due to Tier 2 pensions yet they continually push that narrative.

The member groups certainly lack diversity. Same CTU retreads that align on every other topic. Is there really a differentiaition between One Northside and People’s Lobby?

That said, I will give them points on reading the state constitution and doing fractional math.

- Southsider - Tuesday, Apr 29, 25 @ 3:32 pm:

Another CTU front group demanding tax, tax, tax to spend, spend, spend.

- Maywood Johnny - Tuesday, Apr 29, 25 @ 3:56 pm:

Those of you citing high property tax need to wake up. Inadequate state revenue increases pressure on local property taxes— it’s a big reason why our property taxes are high.

- Benniefly2 - Tuesday, Apr 29, 25 @ 4:10 pm:

The tax on digital advertising on large firms could have the welcome side effect of having META and Google pulling out of the Illinois market rather than try to deal with the mechanics of figuring out how to pay the tax. Added bonus of companies like Roku and LG and Samsung and others forcing ads where people don’t want them will have to make decisions as well.

- TKMH - Tuesday, Apr 29, 25 @ 4:16 pm:

Illinois is a great state, and Chicago is a great town. However, it is not New York City or California. People are not clamoring to live here and will not pay a high price to do so. Illinois actually needs to compete pretty hard economically for people to move here and stay here. It would behoove progressives to maintain some humility about killing the goose that lays the golden egg.

- jim - Tuesday, Apr 29, 25 @ 4:28 pm:

a very moderate and reasonable approach. should be approved en masse.

- Old guy who mostly has his wits - Tuesday, Apr 29, 25 @ 4:32 pm:

Decreasing the exemption on estate for death taxes is just dumb and crazy. Illinois is one of less than 10 states that even tax estates. No wonder both D’s and R’s have moved to Florida and other states that do not have a death tax. Particularly hard on small farm families that have to sell land to pay the death taxes. Wonder why downstate counties want to de-annex from Illinois? This is one of the reasons.

- The Farm Grad - Tuesday, Apr 29, 25 @ 4:40 pm:

“like Elon Musk — do not EVER”

Musk paid over 11B in taxes in 2022 (probably a record), when he had to sell stocks/investments to finance his Twitter acquisition.

That said, Musk is the exception.

Ideally, we need Senator Warren’s Tax on the Oligarchy.

Without it, we have McCaskey heirs borrowing at 4%, against an asset (The Bears franchise) whose value has grown at a cagr of 11% over the last two decades.

It’s not fair or just

- Steve - Tuesday, Apr 29, 25 @ 6:00 pm:

It’s quite a list. I don’t know how viable it is though because estimating the taxes off this is quite difficult. It’s difficult to predict how many wealthy people would move to Florida. It’s darn difficult to complete with a zero state income tax state. Anyway, passing a progressive state income tax might be easier that some of the list.

- Rich Miller - Tuesday, Apr 29, 25 @ 6:29 pm:

===Anyway, passing a progressive state income tax might be easier===

lol

No. Three-fifths in both chambers and then is sent to the voters, where it must be “approved by either three-fifths of those voting on the question or a majority of those voting in the election.”

- Perrid - Wednesday, Apr 30, 25 @ 6:49 am:

Does the state NEED 10% (or more) more revenue per year? The shortfall this year is half that, right, around $3 billion?

I’d like more broad and smaller taxes than raising the rate sky high for businesses (like a small service tax that gets proposed every so often), and I’m very skeptical about trying to tax corporate income that is at least booked as being in different countries.

Closing the carried interest loophole is a good idea on its own merits, regardless of the revenue.