* Gov. Pritzker was asked today after he signed the budget if the budget process next year will be more difficult…

Mary Ann Ahern: There’s so many that say that this COVID money’s about gone… It didn’t seem like it was all that easy to get to this budget. Is it going to be way more difficult next year?

Pritzker: Well remember that the dollars that you’re referring to that came for COVID were dollars that were set aside for one time use, because we recognized that there was going to be an end to the support that was coming from the federal government as the virus was waning, right as we were getting past the pandemic. […]

And so the challenge of this budget had less to do with that than it had to do in fact, there really isn’t, the idea of the federal dollars were somehow bloating or you know, affecting the state budget. It’s true that there were people who received $1,400 checks, and they went out and spent it and there were sales tax dollars that came to every state as a result of that. But the reality is that, as you may have heard, by now, this budget that I just signed, increased spending only by 1.6%, in a world where there’s 3.2%, inflation. So just take note of that, for all the complaining that I’ve heard from people about what amounted mostly to sports betting company increase in tax on people who are already making hundreds of millions of dollars from Illinois. The reality is that this was a good budget. It did the right things toward fiscal responsibility and made the investments that we think are necessary.

Please pardon all transcription errors.

* Another question about next year…

* Isabel Miller: Some moderate House Democrats have said you should have saved some of your revenue enhancement proposals for next fiscal year when times could be tougher [due] to federal assistance and the impending mass transit fiscal cliff. Why do you disagree?

Pritzker: Well, the mass transit fiscal cliff is absolutely something that should be discussed. It isn’t just a state issue, I might add, right, where the revenue will come from, where the expenditure cuts will come from. Those are not just state issues. And we will be addressing those. But we do need, as I have said before, we need the transit agencies to come forward. We need all the best ideas to come forward, you know, question about whether we should be combining the agencies and so on. So I think that’s a little bit of a separate question.

And then again, the complaints by people that, you know, that they felt like we should have handled the budget somehow differently or saved some of these ideas or whatever. Look, we are we have balanced the budget every year. We’ve heard complaints every year after we balanced the budget: ‘Next year is going to be terrible!’ You heard that in 2021. You heard that in 2022. You heard that in 2023. You’re hearing it in 2024. People say it every year and you know what we’ve done? Balanced the budget every single year.

* Background is here if you need it. Regarding Mendoza…

Isabel: What do you make of Comptroller Mendoza’s comment that she would like to have seen across the board budget cuts during this budget?

Gov. Pritzker: Well, I want to remind all of you that across the board budget cuts, this idea is not an idea that Democrats believe in. This idea that you can just go across the board and cut 5 percent of the budget and not have a very deleterious effect on people all across the state.

I’m willing to talk with anybody about good ideas for how to tighten up our budget to make sure that we’re being efficient, and spending money well, and making cuts. Happy to talk about all that.

But you’ve got to have specific ideas. Because this idea that you’re going to cut across the board. What do you want to cut? You want to cut education by 5 percent? You want to cut health care across the board? What is it exactly that you want to cut?

So it’s easy to make these proclamations, usually Republicans make about across the board cuts.

* Background on this question is here if you need it…

Isabel: Speaking of specifics, what do you think about Rep. Crespo’s proposal for a hiring freeze and 10 percent operation cuts?

Pritzker: Again, always happy to discuss these ideas. He did not bring those ideas to the governor’s office. Remember, I introduced the budget in February. If Rep. Crespo wanted to discuss that, I’m open for business anytime to sit down and discuss with him how we might have made changes in the budget. You didn’t raise those. It was something that just got thrown out at the very end. And once again, a lot of that are talking points that really I don’t share the idea with and I don’t think most Democrats agree with.

The governor undoubtedly knows that the budgeteer process doesn’t allow people like Rep. Crespo to pitch the governor about budget matters. Everything has to go through the budgeteers and the respective leaders. And Crespo told me today that he did present his ideas to his budgeteer.

Click here to see Rep. Crespo’s actual proposal.

* On to pensions…

Amanda Vinicky: Can you speak about what happened with your pension proposal? That was part of the budget address. And you said your priorities all got passed, but that wasn’t part of it? What went on?

Pritzker: I think like everything that gets introduced in the General Assembly, you know, it has its moment. And I’ve had lots of conversations with folks in the General Assembly about that. And I expect that we will be taking up that pension reform idea, which I think is an excellent idea, and will help us to pay off our pensions to 100%, not to 90%. And to make sure that we get credit rating upgrades and that we’re being fiscally responsible. So I think it will get taken up by the General Assembly, I certainly will make sure that it gets a hearing and I expect that we’ll be able to do something that will put us in even better fiscal shape than we already are in.

* Historic preservation…

Q: When it comes to the budget, historic preservationists say that there isn’t money and admittedly have not looked through the whole thing. So maybe it’s tucked in there. But there isn’t money for some historic preservation sites that are very dilapidated, falling down. Why not support that? Once they’re gone, they’re gone.

Pritzker: Oh, I mean, let’s be clear, there are a lot of things that I would have liked to have seen done in this budget that there were only limited resources for. But I want to remind you that since I came into office, we have put more money into the Department of Natural Resources and into Historic Preservation than has been done in quite a number of years. And you’ve seen that many of those sites have already been renovated. There’s more to do for sure. And I’m sure there is somebody who would point to a site that nothing has yet been done on and needs to be done. And I would like to get to that as soon as possible. Once again, we’re, you know, always in every year you’ve got limited resources and an unlimited demand. But we’re going to do our best to get to every one of those things, because you’re right, the history of Illinois, history more broadly ought to be preserved.

16 Comments

|

Budget signing react

Wednesday, Jun 5, 2024 - Posted by Rich Miller

* Gov. Pritzker…

Today, Governor JB Pritzker and Lieutenant Governor Juliana Stratton joined Senate President Don Harmon, House Speaker Emanuel “Chris” Welch and budget leaders from each chamber to sign the FY25 state budget package. The $53.1 billion budget builds on the Pritzker administration’s initiatives to invest in early childhood, accelerate business development, and support working families.

“The FY25 budget is another demonstration of the fiscal responsibility that has guided me from Day One of my administration,” said Governor JB Pritzker. “This budget is balanced, pro-family, cuts taxes on workers, and opens up doors of opportunity for employers and employees alike. I’m proud to sign it today and look forward to working together to bring these investments to life in a healthier, more prosperous Illinois.” […]

Some highlights of the FY25 budget include:

• $198 million into the Budget Stabilization “Rainy Day” Fund.

• More than $500 million in increases for education funding across early childhood, K-12, and higher education.

• Funding to increase birth equity and eliminate black maternal mortality disparities.

• $14 million to fund creation of the new Department of Early Childhood.

• $500 million to build a world-leading quantum computing campus, attracting billions in potential private sector and federal government investment.

• Elimination of the statewide grocery tax.

• $50 million for the state’s first ever child tax credit to help working families with children under 12 who receive earned income tax credits.

• $290 million to Home Illinois to work towards ending homelessness in Illinois.

• Pay increases for Direct Support Professionals (DSP) who work in group homes and Community Care Program (CCP) in-home providers who serve seniors.

• Nearly $3 billion to serve people with intellectual and developmental disabilities, the highest-ever investment of its kind in Illinois.

• Increases in funding for safety net hospitals and nursing homes across the state.

Click here and scroll to the bottom for links to the walkdown and the highlights.

* SGOPs…

Illinois Senate Republican Leader John Curran: Pritzker’s budget grossly unfair to Illinois taxpayers

Illinois Senate Republican Leader John Curran (R-Downers Grove) released the following statement on Gov. Pritzker’s signing of the FY 25 Budget:

“In six short years, Gov. Pritzker has raised the cost of state government by over 30 percent and expanded non-citizen spending from a few million dollars per-year to nearly a billion dollars per-year today. The immense cost of Gov. Pritzker’s taxpayer-funded spending spree coupled with President Biden’s refusal to secure our nation’s border, is playing out in the budget signed today. It is grossly unfair for Gov. Pritzker to raise taxes on Illinois families and businesses to pay for the migrant crisis he created.”

* US Rep. Mary Miller had a similar take…

Today, Illinois Governor JB Pritzker signed the State Budget into law that forces Illinois families to pay more in taxes to foot the bill for the cost of living for illegal aliens. Congresswoman Mary Miller (R-IL) released the following statement:

“Governor Pritzker just signed a budget that raises taxes in order to give illegal immigrants $400 million of ‘free’ healthcare and $182 million in handouts, all paid for by hardworking Illinois families.

“Governor Pritzker is forcing you to pay the welfare, education, and healthcare costs of foreign nationals who are not American citizens.

“Joe Biden and JB Pritzker put the American people last in their desperate attempt to appease the radical left by opening our borders to mass illegal immigration, which will bankrupt our state and our nation.”

* Sen. Sims…

Sims: FY 25 budget invests in our communities

CHICAGO – Majority Caucus Appropriations Leader Senator Elgie R. Sims, Jr. (D-Chicago) released the following statement after the governor signed the Fiscal Year 2025 budget into law:

“The budget signed today builds upon our strong, smart spending decisions of recent years that have led Illinois to not just one credit upgrade – but nine.

“I am proud of the steps we took to continue Illinois on the right path. We didn’t just look at fiscal outcomes, but prioritized our most vulnerable populations – educating our young people, keeping our communities safe, creating good jobs, and growing our economy.

“Continuing our principled and disciplined approach will keep our fiscal house in order. I am committed to doing the work necessary to ensure that Illinois continues to enact responsible budgets and remains on the path toward fiscal stability, investing in and uplifting marginalized people, all while prioritizing our communities and people who need the most assistance.”

* Arne Duncan at CRED…

Thanks to lawmakers in Springfield, Chicago and Illinois are in a position to lead the nation in addressing gun violence as a public health issue. With their support we are preventing shootings, engaging with people at risk, and guiding them into the legal economy. We are deeply grateful to Governor Pritzker, President Harmon, Speaker Welch and the legislature for their courage and vision in reimagining public safety.

More budget statements have already been posted on our press release live feed, and I’ll post new releases there as they come in.

4 Comments

|

C’mon, people

Wednesday, Jun 5, 2024 - Posted by Rich Miller

* Capitol News Illinois…

Like in many other states, DraftKings and FanDuel have cornered roughly three-quarters of Illinois’ sports betting market. […]

Despite other states taking similar steps to Illinois, the companies threatened to push the nuclear button in the final days of session, with a source close to DraftKings and FanDuel telling Capitol News Illinois that “all options are on the table, including withdrawing from the state.”

Yeah, they’re gonna leave all that money behind. But if they do, then what happens, other than maybe we don’t have to watch their endless TV ads on local stations?

They basically don’t directly employ anyone in Illinois aside from lobbyists, so layoffs wouldn’t be a problem, except for the lobbyists. But they’re some of the most resilient people I know.

And if they did leave Illinois, the smaller operators could expand and/or rush in to fill the void. One thing those two huge companies definitely don’t want to see is the smaller operators gaining a foothold anywhere. If that happened, the smaller outfits might build up strength and then expand into other states, which could damage the sportsbook duopoly.

* And the Illinois tax increase is definitely tilted in favor of the smaller companies. Center Square…

The original plan would have increased the tax from 15% to 35%. A new tiered plan would tax sportsbook operators at 20% if their earnings are below $30 million, but 40% if their earnings are above $200 million.

Sports betting companies said if signed into law, higher taxes would mean worse odds and fewer promotions for users. The companies also warn the tax hike may drive all but the top three sportsbooks out of Illinois.

Wait, what? Now somebody is saying that the smaller operators are gonna leave? Which is it?

* As we’ve discussed before, perhaps the biggest issue here is tax “contagion.” Some other states have kept their tax rates low, so they’ll likely look at what happens in Illinois…

Brendan Bussmann of B Global, a consultancy serving the gaming, sports and hospitality industries, has now tabled further concerns through a note from Truist. These primarily relate to the knock-on effect the increase could have, saying further states could follow suit with similar increases.

“With Illinois the second state to increase its tax rate [after Ohio raised its rate from 10% to 20% in 2023], investors have an increased concern around contagion,” Bussmann said.

15 Comments

|

Figure it out

Wednesday, Jun 5, 2024 - Posted by Rich Miller

* Mike Miletich…

State lawmakers left Springfield last week without getting a plan to ban Delta-8 products across the finish line. A bipartisan group of lawmakers and Gov. JB Pritzker are concerned about the potential of more children and adults getting sick from the unregulated synthetic THC products over the summer.

Illinois legalized recreational cannabis in 2019 to light up the economy with the multi-billion dollar industry and invest in communities wronged by the War on Drugs. However, hemp products are still unregulated and many people sell synthetic THC products in gas stations, smoke shops and retail stores disguised as dispensaries.

“There’s no restriction on who gets it, how much they get, etc,” Pritzker said. “So, I really believe that we need to step back and ask what is in the best interest of the health of kids and adults across the state. I think regulating it is proper.”

House Bill 4293 could create a regulatory framework for hemp products and establish standards for licensing, testing and labeling. Sponsors and advocates believe that change could prevent people from getting access to Delta-8 products that could be confused with candy, chips, cookies and other common goods.

* Press release…

The following statement should be attributed to Tiffany Chappell Ingram, Executive Director of the Cannabis Business Association of Illinois, regarding the cannabis omnibus legislation (HB2911) and the Hemp Consumer Products Act (HB4293):

“We are disappointed the House failed to pass needed reforms to our state’s cannabis laws and will continue to allow synthetic hemp products that are sickening children and adults to be sold with no oversight. Despite overwhelming bipartisan support for these measures in the Senate, there is clearly more work to do to educate legislators about these important matters. We appreciate the efforts of Senate Majority Leader Kimberly A. Lightford and House Assistant Majority Leader Kam Buckner and look forward to continuing conversations in the coming months.”

* The same group sent out this release after the bill was approved in the Senate…

“The Hemp Consumer Products Act will license and regulate hemp consumer products such as CBD while banning the sale of dangerous synthetic hemp-derived intoxicants like Delta-8 that are sickening children and adults,” said Tiffany Chappell Ingram, Executive Director of the Cannabis Business Association of Illinois.

Some legit business owners were worried the legislation could put them out of business. It apparently needed more time to percolate.

* But while the legislation is percolating, things are advancing on the ground. “That’s a barrel of smokable hemp being sold at a trade show in Rosemont,” said a friend who sent me this pic yesterday…

People could buy it by the pound…

* Fox32…

The owner of an unlicensed cannabis dispensary in northwest suburban Des Plaines is facing aggravated assault charges after he allegedly racked a weapon inside the business while customers were present.

Daniel J. Nardo, 33, of Des Plaines, was charged with two counts of aggravated assault and one count of disorderly conduct in connection with the incident on Thursday, according to a statement from police.

About 1:41 p.m., officers were sent to UP Cannabis Dispensary, located at 1173 South Elmhurst Road, after a 22-year-old woman reported that Nardo, the owner and sole employee, was inside the business ingesting helium and racked what appeared to be a shotgun, the statement said.

Lovely.

10 Comments

|

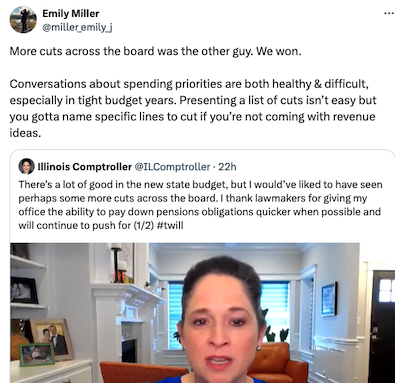

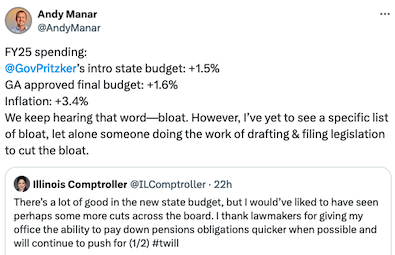

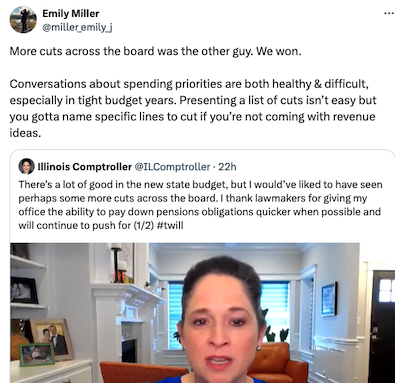

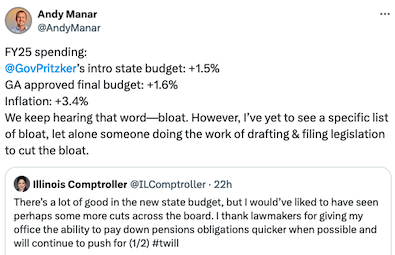

* I told subscribers about this earlier, so I’ll just leave these here for y’all. Let’s start with the comptroller…

* The governor’s policy/legislative person was not amused…

* And neither was the Deputy Governor for Budget & Economy…

The full story, entitled “Illinois comptroller pleased with ‘vanilla’ budget,” is here…

Despite being “vanilla,” Mendoza said there’s plenty she likes about the FY25 state budget, which the state House of Representatives sent to Gov. JB Pritzker’s desk May 29.

She said it does not put the progress Illinois has made cleaning its financial house at risk. Over the past several years, the state has received nine credit upgrades, resolved a $16 billion bill backlog and put $2 billion into its rainy day fund.

“There’s a lot of good things in the budget,” she said. “I would have like to seen perhaps some more cuts across the board.”

Mendoza wishes state agencies and her fellow constitutional officers looked for ways they could trim their budgets.

“Where do we have bloat? Where are we paying too much for a contract that we can get a better deal on,” she said.

* Meanwhile, Capitol News Illinois’ newsletter went out after I’d finished writing, but take a look at this…

The governor also pointed to Illinois’ recovery from the depths of the two-year budget impasse between 2015 and 2017 during then-Republican Gov. Bruce Rauner’s tenure. When Pritzker took office, he said, bills that should’ve been paid to businesses contracting with the state took 250 days and the state was paying 12 percent interest on every bill overdue by 90 days or more.

“Today, our days payable is under 15, which is very likely too fast,” he said. “But it is an effort to show the businesses that the state does business with every day that we can be responsible. And we have had it at that level for years now. So I feel like I need to tell the comptroller, ‘You can take it down to maybe 30 days payable.’”

According to Comptroller Mendoza’s office, the bill payment cycle is actually an even faster 13 days, which spokesperson Abdon Pallasch said Mendoza “takes great pride in.”

“Paying Illinois taxpayers and businesses faster than the private sector for the past three years shows the kind of stability and predictability that both attracts and lets businesses know Illinois is a good investment,” he said. “We’re always analyzing our best practices and will continue to do so.”

Thoughts?

67 Comments

|

|

Comments Off

|

Live coverage

Wednesday, Jun 5, 2024 - Posted by Rich Miller

* You can click here or here to follow breaking news. It’s the best we can do unless or until Twitter gets its act together.

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|