|

Comments Off

|

*** UPDATED x1 *** Campaign notebook

Thursday, Jul 7, 2022 - Posted by Rich Miller

* Sen. Bailey tries to walk back his “move on and celebrate” comments shortly after the Highland Park shooting…

…Adding… This Bailey campaign is a mess, man. Not only did the candidate mistakenly invent a mythical community (Edgefield Park), but the bible verse he quoted today was not Psalm 112. It was Colossians 3:12.

* Greg Hinz…

Bailey also appears to have decided to keep Illinois GOP Chairman Don Tracy on the job instead of moving to dump him for his own candidate, as often happens. Tracy was in Effingham for Bailey’s election night party and the gesture was noted. “If he’ll work with us, we’ll work with him,” says one insider.

* This will likely receive more coverage as the campaign year progresses…

Saying Illinois workers need a constitutional guarantee of their right to organize and bargain—and reminding workers of the war former right-wing Republican Gov. Bruce Rauner waged against them—leaders of the Illinois AFL-CIO and legislative allies began their drive for voters to pass a proposed pro-collective bargaining constitutional amendment this November.

If approved, the measure would be one of four such guarantees enshrined in the 50 state constitutions. To win, it needs either 60% of the votes on the initiative itself, or an absolute majority–50% + 1–of all votes cast in the election. […]

“We’re getting ready for the inevitable attacks” from the corporate class, Drea told the Peoria crowd. “To counter the attacks, we have to blunt the lies we expect” from those interests. One of the few Republicans to oppose the amendment during last year’s debate, State Rep. Blaine Wilhour, R-Altamont, called it “special interest legislation” designed to “draw campaign contributions.”

The state fed’s campaign for the amendment will include radio and TV ads, plus mailers but will rely on person-to-person contact, Drea said.

* Personal PAC endorsed Judge Rochford’s opponent in the Democratic primary, but Rochford won by 16 points…

The Personal PAC Board of Directors is extremely proud to endorse pro-choice Liz Rochford for the Illinois Supreme Court in the 2nd district, which includes Lake, Kane, Kendall, McHenry and Dekalb counties.

We believe Rochford respects the fundamental right to privacy in reproductive decision-making. The November 8th election could not be more important to the future of reproductive rights in Illinois and across the entire Midwest for the 56 million women who will depend on us being here into the next decade and beyond as a result of the U.S. Supreme Court overturning Roe v. Wade.

Rochford’s opponent, Mark Curran, has been endorsed by the most extreme factions of the anti-choice movement seeking to make abortion illegal in Illinois, even in cases of rape and incest. For this reason Curran has the full support of “Illinois Right To Life,” the political arm of the anti-choice movement. From Curran’s Supreme Court campaign website: “Person of Faith-Devout Roman Catholic and follower of Christ, he founded Bibles, Badges and Business…”

* This is not a very fair take. Pritzker released two statements, one of which was consoling, before issuing the statement highlighted in this WaPo piece…

President Biden took the stage at an Independence Day barbecue just a few hours after the latest horrific shooting to upend an American city — but at his first opportunity to address the nation in person about the Highland Park killings, he did so only obliquely.

“You all heard what happened today,” Biden said. “Things will get better still, but not without more hard work together.”

It was not until about two hours later, after singer Andy Grammer finished an acoustic version of “Give Love,” that the president returned to the stage and attempted to respond to the tragedy more fully, calling for a moment of silence and decrying the spate of mass shootings. “We’ve got a lot more work to do,” Biden said, reiterating some of what he had said in a written statement earlier in the day. “We’ve got to get this under control.”

In contrast, J.B. Pritzker, Illinois’ Democratic governor, delivered a fiery response that took direct aim at those blocking gun control legislation. “If you are angry today, I’m here to tell you to be angry,” he said, seething while Biden was consoling. “I’m furious. I’m furious that yet more innocent lives were taken by gun violence.”

* Illinois Family Action…

Illinois conservatives face serious challenges in the gubernatorial race.

In 2014, Bruce “The Deceiver” Rauner beat Pat Quinn in the race for governor by about 140,000 votes. Quinn won only one county: Cook County. Rauner won in large measure by deceiving Illinoisans–including many conservatives–with his dishonest campaign promises. By the time he ran for reelection in 2018, Rauner had been found out and, as a consequence, had little support. He received nearly 58,000 fewer votes in the 2018 election and was trounced by J. B. Pritzker.

Because of his promotion of all sorts of evil, Pritzker was able to energize the Democrat base, thereby beating Rauner by over 700,000 votes in the 2018 race. While Quinn won only one county in 2014, Pritzker won at least 16 counties in 2018 (of 102 total counties in Illinois).

Here was the key for Pritzker over Rauner: He won Cook County by 836,138 votes. Fifty-one percent of his total votes came from just Cook County alone! If you throw in the following 6 counties: DuPage, Will, Lake, Kane, Champaign, and St. Clair counties, Pritzker received more votes than Rauner did statewide. In fact, Pritzker could have given the 611,791 votes he received in the rest of Illinois and donated them to Rauner and still won.

In the 2020 presidential election, Donald J. Trump received 260,608 more votes than Rauner did in those 7 counties. Of course, in a presidential election, the voter turnout is much higher which may account for the discrepancy. However, what is interesting is that in a non-presidential election year, Pritzker still received 32,855 more votes in those 7 counties than Trump did.

Therefore, two things must happen if GOP nominee Senator Darren Bailey is to beat Pritzker. He must get as many votes as Trump did and hope that the turnout for Democrats decreases by 5 percent or more or to make up the rest of the difference downstate. This will be a challenge for Bailey.

To say the least. Also, turnout across the board is always much higher in a presidential year. Bailey matching the Trump numbers would take a political hurricane and a perfect campaign run by Bailey. Trump received over 2.4 million statewide votes in 2020, while Pritzker took about 2.5 million and Bruce Rauner and Sam McCann combined received less than 2 million votes in 2018.

* Speaking of turnout, here’s the Chicago Board of Elections…

Updated Voter Turnout: 338,402 – 22.58% of registered voters in Chicago (1,498,813)

Democratic Turnout: 302,605 (89.42%)

Republican Turnout: 34,769 (10.27%)

Libertarian Turnout: 1,022 (0.30%)

Nonpartisan Turnout: 6 (0.001%)

32,461 additional votes have been counted and added to this total since the last summary report I sent on 7/1/22 , with 30,101 new Vote By Mail ballots included (received on Election Day 6/28/22 up through Tuesday 7/5/22). In total, 90,431 Vote By Mail ballots were returned and counted so far for the June 28th Primary Election.

So far, 173,571 Chicago voters chose to Early Vote or Vote By Mail (51.3% of voters), and 164,831 Chicago voters chose to vote on Election Day (48.7%).

These results will remain unofficial until the July 19th Proclamation of Results. The Board will now begin to process and count 3,662 Provisional Ballots, and will continue to count properly postmarked Vote By Mail Ballots sent to our office through July 12th. There are 34,154 Vote By Mail ballots that were sent and not returned (though we do not expect most of these will be returned with the proper postmark).

All updated results and ward by precinct totals are live on our website here: https://www.chicagoelections.gov/en/election-results.html

Four years ago, which featured hotly contested gubernatorial primaries in both parties, 452,529 voters chose Democratic ballots and 31,535 Chicagoans chose GOP ballots. So, Republican turnout was up this year by about 10 percent and Dem turnout dropped by 33 percent. Also, Chicago voter registration has fallen ever so slightly (0.3 percent). That lack of Democratic enthusiasm is being pointed to by some as a possible warning sign for the Pritzker campaign, but if Darren Bailey doesn’t right his ship soon, he’s gonna deflate his momentum in a hurry.

* And speaking of Chicago, here’s Fran Spielman…

Former Chicago Public Schools CEO Paul Vallas dropped $836,500 into his mayoral campaign fund on Wednesday in the first significant fundraising report filed by any of the seven candidates vying to unseat Mayor Lori Lightfoot. […]

They include $500,000 from prominent Republican donor and golf course magnate Michael Keiser; $100,000 apiece from John Canning and James Perry of Madison Dearborn Partners; $50,000 from Noel Moore, managing partner of Endurance Asset Management; and $25,000 from Edgar Bachrach of Bader Clothing.

Vallas also reported receiving $10,000 contributions from Petco Petroleum’s Jay Bergman; the O’Donnell Family LLC; and Edward J. Wehmer, president and CEO of Wintrust Financial.

After a first-quarter fundraising frenzy — her best since taking office — Lightfoot still had just $1.7 million in cash in her primary political account.

…Adding… Kendall County Republicans…

We are selling raffle tickets for four popular firearms (one raffle per firearm). Cost is $20 per ticket. Click a link below to buy a ticket for that firearm. The drawing (and last date to buy tickets) will be on July 24th at 2 PM at Mike & Denise’s in Yorkville.

To be eligible to buy a raffle ticket, you must be a FOID card holder, at least 21 years old, and legally allowed to own a gun.

• Smith & Wesson 642 38 Special

• Smith & Wesson 5.56/.223

• Glock G19 G5 9MM

• Viper G2 Silver 28 Gauge

*** UPDATE *** That Smith & Wesson 5.56/.223 being auctioned by the Kendall County Republicans is very similar to and the same caliber as the Smith & Wesson M&P15 that was used in the Highland Park shooting. Great move, folks. Sheesh.

…Adding… Edgefield Park is the new Lincoln County?…

…Adding… Heh…

…Adding… Press release…

Mayor Lori E. Lightfoot’s reelection campaign announced today that it raised more than $1.25 million for the second quarter of 2022, ending the quarter with $2.5 million cash on hand.

“I’m so grateful to the supporters who are Ridin’ with Lori and have joined our reelection campaign,” said Mayor Lori E. Lightfoot. “When I announced my reelection bid last month, I promised to never back down from the tough fights that lie ahead. I will continue to tackle our biggest problems head on, like continuing to bring down violent crime, standing up for women’s bodily autonomy and access to high quality reproductive care, helping bridge the financial burdens that too many Chicagoans face and continuing investments in neighborhoods that have been neglected for decades. Change doesn’t happen overnight, but we are seeing what happens when we join together and focus on making a difference in people’s lives. I am honored by the support of so many Chicagoans and I will keep fighting everyday for you.”

85 Comments

|

Question of the day

Thursday, Jul 7, 2022 - Posted by Rich Miller

* Synopsis of Rep. Daniel Didech’s HB888…

Amends the Firearm Owners Identification Card Act. Provides that the Department of State Police shall conduct a search of the purchasers’ social media accounts available to the public to determine if there is any information that would disqualify the person from obtaining or require revocation of a currently valid Firearm Owner’s Identification Card. Provides that each applicant for a Firearm Owner’s Identification Card shall furnish to the Department of State Police a list of every social media account.

The bill was filed in 2019 and went nowhere. A total of 3,575 people submitted electronic witness slips against the bill, compared to just 29 in support. Rep. Didech said his staff was inundated with communications from angry opponents.

* Rep. Andrew Chesney (R-Freeport) said Didech’s proposal would “create unnecessary bureaucracy, unacceptable delays and is an outrageous infringement on law-abiding citizens exercising both their Second and First Amendment rights” at the time.

A gun shop owner told WAND back then he was against the bill and was wondering, “Who’s going to make that judgement? What’s the parameter? What are they looking for?”

“It seems much more likely to end in profiling of people, rather than catching a possible school shooter,” Rebecca Glenberg, a senior staff attorney for the ACLU of Illinois, told CNN.

* But the sponsor said this…

In an increasingly online world, we must have an open discussion about the tools law enforcement may use to keep our communities safe, and my intention is to continue that discussion so we can find the right balance that respects the Second Amendment rights of law-abiding gun owners while at the same time keeping our children safe from gun violence.

And today, in the wake of the Highland Park massacre, Sen. Darren Bailey seemed to at least endorse the concept of the Illinois State Police proactively monitoring gun owners’ social media accounts.

* The Question: Do you support the concept of police agencies proactively monitoring social media accounts of Illinois gun owners? Take the poll and then explain your answer in comments, please.

100 Comments

|

State loses big court round over managed care

Thursday, Jul 7, 2022 - Posted by Rich Miller

* David Jackson at the Better Government Association…

Since 2011, Illinois lawmakers have promised to save taxpayer dollars, improve care for low-income patients and give them more choices when selecting doctors and clinics by privatizing its Medicaid program, which was completed in 2018.

Before then, the state paid each doctor, clinic or hospital a fee for every Medicaid service rendered. Now, the state contracts with private insurance companies to make reimbursement decisions.

Under their current contracts with the state, four for-profit MCOs are supposed to quickly reimburse practitioners who care for Medicaid patients. Medicaid rules say the MCOs must pay 90% of providers’ uncontested claims within 30 days and 99% within 90 days.

But Saint Anthony Hospital, a safety net hospital on Chicago’s Southwest Side, and many providers allege the MCOs deploy bureaucratic dodges and opaque billing error codes to skirt the federal rule, make partial payments, pay years late or deny claims without explanation.

* But a federal appellate court has stepped in…

The U.S. Court of Appeals for the 7th Circuit ruled Saint Anthony Hospital “alleged a viable claim for relief” when it sued state officials for not adequately overseeing the insurance companies they contracted as managed care organizations.

The panel overturned a lower court decision to toss out the case and underscored widespread claims from hospitals and caregivers who say they have been driven to near bankruptcy by the failure to reimburse them fairly. […]

The appeals court panel overturned a district court judge who ruled the hospital could have first arbitrated each billing claim against the insurance companies individually — a task providers said is costly, cumbersome and unachievable.

* From the decision…

The State has tools available to remedy systemic slow payment problems—problems alleged to be so serious that they threaten the viability of a major hospital and even of the managed‐care Medicaid program as administered in Illinois. If Saint Anthony can prove its claims, the chief state official could be ordered to use some of those tools to remedy systemic problems that threaten this literally vital health care program. We therefore reverse in part the dismissal of the case and remand for further proceedings.

The state essentially claimed a loophole in the definition of the term “health care providers” that allowed it to delay payments to hospitals but not to physicians. The court pointed to ample evidence to the contrary…

Given this evidence, it would seem odd to construe a provision Congress intended to assure timeliness of provider payment as not applying to many providers, as HFS advocates. That would appear to defeat the statute’s evident purpose in most cases. We decline to read the text in such a manner.

The court was split 2-1. According to the article, the state hasn’t decided on its next move.

18 Comments

|

Unclear on the concept

Thursday, Jul 7, 2022 - Posted by Rich Miller

* From the Firearms Restraining Order Act…

“Firearms restraining order” means an order issued by the court, prohibiting and enjoining a named person from having in his or her custody or control, purchasing, possessing, or receiving any firearms or ammunition, or removing firearm parts that could be assembled to make an operable firearm. […]

“Petitioner” means:

(1) a family member of the respondent as defined in this Act; or

(2) a law enforcement officer who files a petition alleging that the respondent poses a danger of causing personal injury to himself, herself, or another by having in his or her custody or control, purchasing, possessing, or receiving a firearm.

* From Sen. Darren Bailey’s press conference today regarding the Highland Park massacre and gun violence…

Let’s be clear, Governor Pritzker, this happened on your watch. You’ve got more gun control laws than almost anywhere else in America. Our problems are more complex than just more restrictive gun laws on law abiding citizens.

The Firearms Restraining Act would have prevented the tragedy on the Fourth, but you buried it. You left it moldering in some bureaucratic basement somewhere. Your watch, Governor. It’s not enough to pass laws. You have to do the hard work to make sure that the laws do what they were intended to do. Gun owners, let’s get real. The Firearms Restraining Act exists and we need to stop pretending that it doesn’t. If we have to amend it to make sure that it protects our constitutional rights, let’s take a look at that. But for Pete’s sake, let’s use it. […]

I’m telling the people that the law is on the books and it was ignored. We didn’t know one government, starting at the top with government, Governor Pritzker ignored it. It wasn’t used, and if it would have been used, it could have prevented this. And that’s why I’m calling for special session. […]

The FOID card system is simply to pilfer money from people’s pockets. That’s all it does. We have the federal firearm background check. We have age limits. We have waiting periods. We have the Firearms Restraining Act, which was passed to take care of this very issue. It’s not working, the FOID card’s not working and it needs to go. […]

I want to find out why government didn’t enact this and it starts at the top. Governor Pritzker failed in enacting this Firearms Restriction Act. […]

We have a law on the books, the Firearm Restraint Act. And as far as I can tell, that bill looks like it should have caught it, but it’s not being used. It’s another law. People come here to Springfield. They want to pass more laws. They think passing laws is the solution. That time is wasted if we don’t have a leader that holds people can hold these laws accountable and make sure that they work, thats where the system messed up at.

Following Bailey’s logic, every time cops are called by third parties regarding an alleged threat that family witnesses denied ever happened (as was the case with the Highland Park shooter in 2019), the Illinois State Police should go to court and petition a judge to force the alleged offender to surrender their firearms. And if the person doesn’t own or possess any firearms (as was also the case with the Highland Park shooter in 2019), then… what?

* Back to Bailey…

The Highland Park shooter was posting violent videos with an intent to attack. The shooter could have been stopped and would have been stopped if Governor Pritzker and the government were living up to their true duty to protect the innocent

OK, so Sen. Bailey wants the Illinois State Police to monitor all social media at all times to see if Illinois residents and gun owners are posting any violent videos online, like, I dunno, perhaps, posting a video of shooting a printed Illinois state budget with a high-powered rifle, or defiantly proclaiming a willingness to “die on my porch before I give up my guns,” or repeatedly raffling off weapons of war to help fund a political campaign, and then take every single incidence of that to a county judge?

See how that works, Darren?

If the ISP had received a tip or otherwise stumbled across the fact that the Highland Park shooter was posting videos threatening to kill certain people or shoot up an event and didn’t do anything about it, then that’s most definitely on the ISP. Otherwise, what Bailey is proposing is a huge government overreach and intrusion with almost unlimited potential for abuse.

…Adding… The Firearms Restraining Order Act was expanded last year. Sen. Bailey voted “No.”

58 Comments

|

ISP goes deeper in its explanation

Thursday, Jul 7, 2022 - Posted by Rich Miller

* ISP…

In the ongoing investigation into the shooting in Highland Park on July 4, 2022, the Illinois State Police (ISP) continue to provide information to the public.

Clear and Present Danger reporting was established by Illinois law in 1990 and expanded incrementally to include school administrators and law enforcement. This law is distinct from the Firearms Restraining Order which became law in 2019. Clear and Present Danger is a mechanism used by the ISP to revoke or deny a Firearm Owner Identification Card (FOID). On the other hand, the Firearms Restraining Order is a court ordered restriction on firearms possession. Clear and Present Danger status is only one of many factors that can result in the revocation and denial of a FOID card. Other factors can include criminal records, mental health prohibitors, and other orders of protection.

Upon receipt of a Clear and Present danger report submitted to ISP, officers determine if the subject of the report has a FOID card or a pending FOID application and review all information submitted by the local reporting police department.

For a Clear and Present Danger determination, the legal standard for review ISP must meet is a preponderance of the evidence, which is a higher legal burden than probable cause. Granting a Firearms Restraining Order has an even higher burden of proof requiring “clear and convincing” evidence.

If the reviewing officer determines there is sufficient evidence to establish a clear and present danger posed by the subject of the report, then the subject’s FOID is revoked, or a pending FOID application is denied. If there is insufficient evidence, the status of the FOID or pending application is unaffected.

For the individual charged in the Highland Park shooting, in September 2019 ISP officers confirmed the individual did not have a FOID card or pending application. According to the report submitted, the threat of violence allegedly made by the individual was reported to Highland Park Police second hand. When police went to the house, both the individual and his mother disputed the threat of violence. The individual told police he did not feel like hurting himself or others and was offered mental health resources. Additionally, the report indicated the knives did not belong to the individual and were ultimately turned over to the father who claimed they were his. As stated by Highland Park Police, there was no probable cause to arrest. Upon review of the report at that time, the reviewing officer concluded there was insufficient information for a Clear and Present Danger determination.

In December of 2019 the individual applied for a FOID card. The application included a parental legal guardian affidavit signed by the father of the individual applying.

Illinois law dictates that the Illinois State Police shall issue a FOID card to an applicant who meets the statutory requirements and who has no firearms prohibitor. At the time of FOID application approval for the individual in question there was no new information to establish a clear and present danger, no arrests, no prohibiting criminal records, no mental health prohibitors, no orders of protection, no other disqualifying prohibitors and no Firearms Restraining Order. The available evidence would have been insufficient for law enforcement to seek a Firearms Restraining Order from a court.

Much of the reporting so far has focused on the Firearms Restraining Order law, but, as indicated above, that misses the point.

* I guess my next question is, did the local police ever report the alleged suicide attempt/threat to ISP?…

Officials said cops were called to Crimo’s home in April 2019 after receiving a report that he had attempted suicide a week earlier.

Officers spoke to Crimo and his parents, but the matter was handled by mental-health professionals at time, said at a news conference.

“There was no law-enforcement action to be taken. It was a mental-health issue handled by those professionals,” Covelli said.

And…

[Lake County Major Crime Task Force spokesman Christopher Covelli] said in April 2019, an individual contacted Highland Park Police after learning that Crimo had attempted to commit suicide. Police responded to his home but the situation was already being handled by mental health professionals and was not deemed a police matter at the time.

That report happened several months before the report of the alleged threat of violence.

Perhaps the “preponderance of the evidence” requirement could be eased by the General Assembly.

19 Comments

|

* Coalition partner list is here. Press release…

On behalf of the members of Illinois Latino Agenda 2.0 and our respective organizations, we are once again grief-stricken and outraged by the gun violence epidemic shattering the lives of families and crippling our communities with fear.

Our thoughts and prayers are with the families of the victims and survivors of the awful Fourth of July mass shooting in Highland Park.

Celebrating Independence Day is a welcomed tradition of time spent making memories with family enjoying music, cookouts, fireworks, parades, and other festivities. It is also a day of reflection to contemplate what freedom means to us as members of this beautiful quilt of blended cultures united by the American flag, embracing American values.

Now the images of young and old smiling faces lining the streets of Highland Park to cheer floats and marching bands that quickly turned to looks of horror and screams of terror are unfortunately part of July Fourth memories.

The downrush of gun violence that has become frighteningly commonplace in America continues to deny us freedom of assembly, freedom to enjoy and have productive lives in our society, and freedom to live.

This weekend in Chicago, where living in violence is sadly commonplace, eight people were killed and 68 wounded, a reduction of 18 dead and 92 shot in 2021. But the Summer has just started, and we are bracing for the number of victims to soar.

As Highland Park joins Buffalo, Uvalde, and other communities forever broken by mass shootings and national attention again focuses on our country’s unique gun problem, we demand better.

We demand a special legislative session in Springfield for lawmakers to immediately address:

● Ban assault weapons, high-capacity magazines.

● Create an assault weapons registry.

● Demand mandatory fingerprinting on FOID cards.

It is time to bring about policies to keep all our communities safe from gun violence. Once again, we have proved that guns and assault weapons in the wrong hands are lethal and have no geographical boundaries, and do not discriminate

While Congress tried to develop a landmark bipartisan bill addressing gun violence after 26 years, our concerns were barely met.

The killing of seven people and 37 wounded in Highland Park are sadly part of the prevalent gun violence culture in the U.S. We are disheartened to learn that among the victims are the grandfather and the boyfriend of health volunteers at the non-profit Mano a Mano.

After 2 1/2 years of Covid19, the isolation, violence, and gun violence have increased, and it is also cause for immediate action in our cities and state’s mental health services.

ILA 2.0 is compelled to DEMAND better self-monitoring of platforms that, while enjoying their success, should fully embrace the responsibility that comes with their growth and how it affects vulnerable minds and people searching for a place and ideology to fit in. It can not only be about profits…it’s about lives.

We once again urge our local governments and philanthropy to increase resources for mental health services so that no person who needs it goes without. A number of our organizations provide mental health services– with language and cultural competence– to victims of crime and potential perpetrators. The evidence overwhelmingly supports the value of reducing crime through trauma-informed services.

The members of the ILA 2.0 are dedicated to making impactful change. By supporting common-sense gun measures, greater access to mental health services, and holistic youth programming, we aim to ensure that all recently lost are remembered through collective action.

The state significantly increased mental health funding this year and enacted a big mental health omnibus bill, which appears to be tacitly acknowledged in the release since they’re calling on local governments and philanthropy groups to step up.

…Adding… The Gun Violence Prevention PAC has also been calling for inclusion of specific issues during any upcoming special session…

Specifically, we call upon them to act quickly to regulate weapons of war that make mass shootings like today’s in Highland Park more deadly, including registration of assault rifles and semi-automatic handguns as well as limiting high capacity ammunition magazines.

35 Comments

|

Open thread

Thursday, Jul 7, 2022 - Posted by Rich Miller

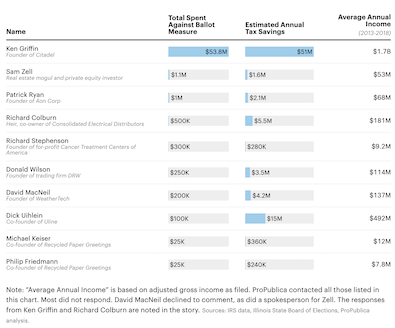

* Coming a day late to this, and it would’ve been a strong addition to yesterday’s Ken Griffin post, but here you go anyway…

Anyway, talk about whatever you want, as long as it’s Illinois-centric.

14 Comments

|

LIVE COVERAGE

Thursday, Jul 7, 2022 - Posted by Rich Miller

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|