|

Comments Off

|

* Press release…

The House and Senate Redistricting Committees today released an updated version of the proposed congressional map that accounts for public feedback while improving minority influence.

“These new proposed congressional boundaries are historic and reflect the great diversity present throughout the state,” said Rep. Lisa Hernandez, Chair of the House Redistricting Committee. “The proposal ensures minorities, as well as the rest of Illinoisans, have an equitable voice in representation in Washington. I want to thank everyone who has participated in helping our bipartisan redistricting committee collect feedback, and I look forward to additional hearings next week.”

“The changes made in this updated congressional map will help ensure the diversity of Illinois is reflected in Washington,” said Sen. Omar Aquino, Chair of the Senate Redistricting Committee. “We appreciate the many advocacy groups and individuals that continue to guide our work with passion and dedication, as we remain focused on the creation of a fair map that will provide equal representation for all.”

This amended version of the proposed congressional boundaries reflects changes based on testimony received in previous hearings. For example, the map keeps the Round Lakes area together in one Congressional District. This proposal also creates a new coalition district to enhance minority influence.

The proposal can be viewed at www.ilhousedems.com/redistricting and www.ilsenateredistricting.com. The public is encouraged to provide feedback during additional hearings next week.

Tentative Hearing Schedule:

· House Hearing: Tuesday, October 26 (Time/Location TBD)

· Senate Hearing: Wednesday, October 27 (Time/Location TBD)

Details on the hearing schedule will be forthcoming as times and locations are finalized. These will be hybrid hearings with the opportunity for in-person and virtual testimony. Those wishing to provide testimony, submit electronic testimony or submit electronic witness slips can do so in advance of the hearing via the General Assembly website www.ilga.gov or through email at redistrictingcommittee@hds.ilga.gov and redistrictingcommittee@senatedem.ilga.gov.

The House and Senate Redistricting Committees also encourage the public to utilize the map making portal. This tool allows residents to draw and submit proposed boundaries for lawmakers to consider. The portal can be accessed at www.ilhousedems.com/redistricting or www.ilsenatedems.com/redistricting. While the portal will remain open for the duration of these redistricting efforts, residents are encouraged to submit their proposals as soon as possible. Returning users that have previously used the portal do not need to create a new account.

The General Assembly is expected to vote on new congressional boundaries by the end of the scheduled fall veto session.

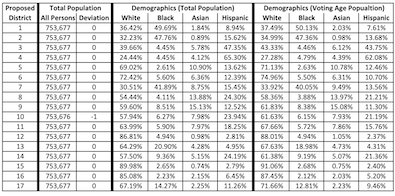

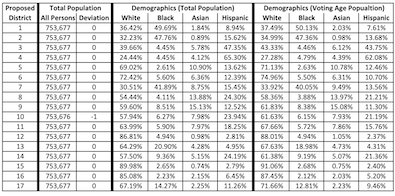

* The proposed map has a majority Latino voting age population district (currently represented by Chuy Garcia) and a Latino influenced VAP district (the 3rd District, which has no current incumbent). Click the chart for a larger view…

The first draft map had a solid Latino district and no significantly Latino influenced district.

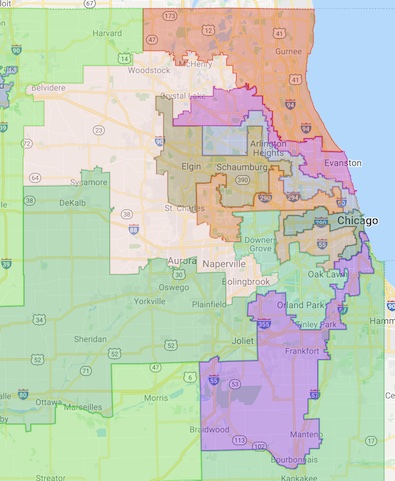

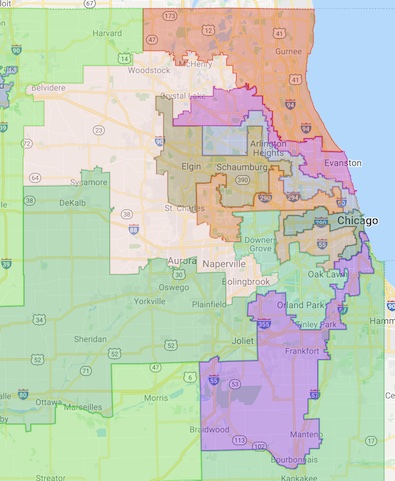

* Democratic US Reps. Marie Newman and Sean Casten are mapped together in the 6th CD. Former US Rep. Dan Lipinski is also in the 6th.

*** UPDATE *** Republican US Reps. Darin LaHood and Adam Kinzinger are in the same district (16). And Republicans Mike Bost and Mary Miller are in the same district (12).

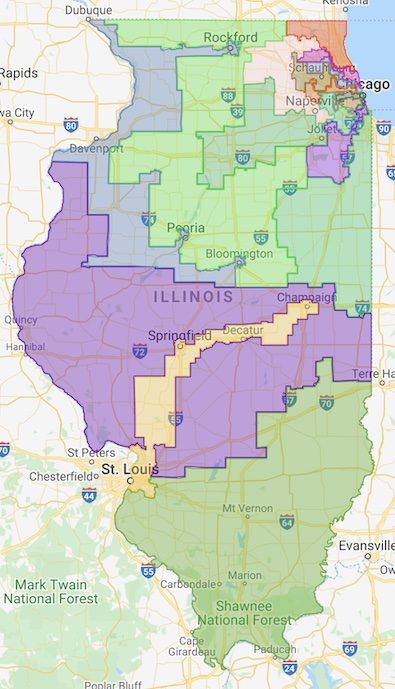

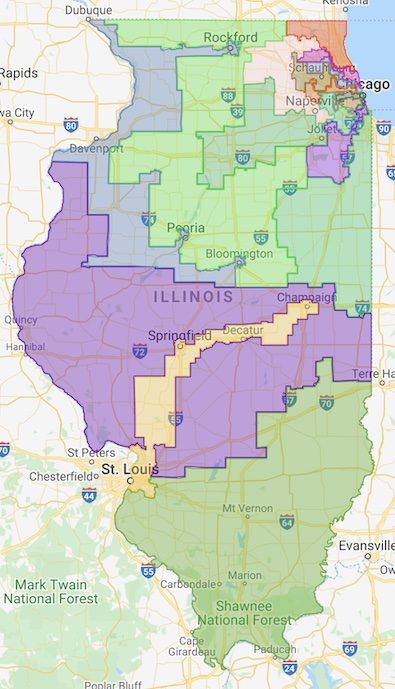

* Here are the maps…

* Rodney Davis’ district is the 15th, the purple one above which runs from western Illinois, over to eastern Illinois and then back down to near the Metro East.

* Lauren Underwood’s 14th District runs from Joliet out to LaSalle County and up to DeKalb.

* Here are the incumbents and their respective districts…

Bobby Rush: 1

Robin Kelly: 2

VACANT (Latino influenced): 3

Chuy Garcia: 4

Mike Quigley: 5

Marie Newman: 6

Sean Casten: 6

Danny Davis: 7

Raja Krishnamoorthi: 8

Jan Schakowsky: 9

Brad Schneider: 10

Bill Foster: 11

Mike Bost: 12

Mary Miller: 12

VACANT (Nikki Budzinski): 13

Lauren Underwood: 14

Rodney Davis: 15

Darin LaHood: 16

Adam Kinzinger: 16

VACANT (Dem-leaning - Rockford, QC, Peoria, Bloomington): 17

…Adding… I should probably remind you that there is no guarantee that this is the final map. Do not automatically assume that there will be no further changes.

…Adding… Also, there’s some misinformation out there from supposed map expert Dave Wasserman. This is really easy to check. Click here for the 2020 candidate list with home addresses. Then copy and paste those addresses into the search function on the map district page.

…Adding… Here you go…

12 Comments

|

* Jade Yan at the Tribune…

Nearly a week a later, Dixmoor is still without reliable running water as Cook County officials met Thursday with representatives of the south suburb and the town of Harvey.

Homes in Dixmoor are still experiencing “a spectrum” of problems ranging from no water to a trickle, Cook County Board President Toni Preckwinkle said at a news conference Thursday morning in Dixmoor. […]

Barnes said that officials are “still unsure” what the problem is, and that it’s been difficult to diagnose because the pipes are underground and “the way you diagnose is through process of elimination.”

The problem has been isolated to a stretch of water main that runs under Wood Street, he added. Dixmoor has experienced further issues with its turbines, also known as pumps, one of which still needs to be repaired.

Water may be cut off for residences near where work is being done, said John Yonan, an engineer and Cook County’s bureau chief of asset management. Yonan was unable to provide a timeline for when the problems will be fixed.

* ABC 7…

More than 800 students in West Harvey-Dixmoor Public School District have been sitting home all week, impacted by the village’s lack of water pressure. Laptops and hotspots were handed out to waiting parents at Dixmoor’s MLK Elementary School Thursday, as one of three district schools prepares to teach remotely Monday. […]

Harvey Village officials have kept quiet throughout the week, even though they supply Dixmoor with its water.

Harvey is where it is believed the problem originally occurred SaturdAy morning after a water main broke. Several more pipe breaks have popped up since then.

“They need some technical kind of expertise to diagnose what they said is a clog in one of their feeder mains,” said John Yonan, Cook County Bureau of Asset Management.

It’s a cascading problem because their pipes are a century old. Something breaks and that causes other things to break down the line. It’s a mess. Meanwhile, people are going without water.

…Adding… According to a Tribune study a few years ago, “Dixmoor’s water bill is higher than 152 of the 162 towns [which use Lake Michigan water] that provided information.”

25 Comments

|

* Background is here if you need it. Gov. Pritzker was asked today about attorney Tom DeVore’s handling of a lawsuit against 145 school districts over the mask mandate…

Well, you know, he’s a grifter who is taking money from parents who are being taken advantage of. This is, we are trying to keep kids and parents and grandparents and teachers and everybody that’s in the community of the school safe. That’s my job as governor, that’s our job as elected officials.

And I have to say that, you know that going around and suing school districts and the governor and the Attorney General and everybody else in order to keep people less safe, that makes zero sense to me. So we’re gonna push back as hard as we can, certainly we’ll be in court.

The Attorney General, I just want to praise him and his staff. He has done an amazing job. You don’t want to spend all your time doing this, there are an awful lot of things that the Attorney General’s Office does to protect consumers out there. But the more you have to send lawyers out to fight these ridiculous lawsuits that are frankly making people less safe, that are harming our children, then you know, the less you can do to really lift up the entire state.

So I hope that the, you know, the reign of grifting and terror that he is trying to bring about in the school districts will come to and end.

*** UPDATE *** You knew this would happen…

After Pritzker’s “grifter” comments, DeVore said Thursday afternoon he’s hired an attorney and will sue the governor for defamation for being called a thief.

“That’s an insult to each and every one of my clients that are trying to protect their children,” DeVore said in an interview. “Not only is it defamation against my character and my profession, it is an insult against every one of those parents who are trying to protect their children.”

Illinois Supreme Court, Blair v. Walker, 1976…

We hold that the Governor is protected from actions for civil defamation by an absolute privilege when issuing statements which are legitimately related to matters committed to his responsibility. […]

We emphasize that today’s decision is not an endorsement of either the tenor or the content of the defendant’s statements concerning the plaintiffs. The Governor’s position could undoubtedly have been expressed to the people with language less calculated to injure the plaintiffs’ personal and professional reputations. While it is unfortunate that the application of executive immunity may occasionally deny relief to a deserving individual, the sacrifice is justified by the public’s need for free and unfettered action by its representatives.

77 Comments

|

* Background…

The Illinois Supreme Court this year will decide whether a Cook County tax on firearms and ammunition is unconstitutional on grounds taxes can’t be levied on items that allow people to exercise their “fundamental” rights.

The state’s high court last week heard arguments on a case where Cook County has twice been victorious in lower courts.

In 2012, the Cook County Board of Commissioners passed a $25 tax on firearms, followed a few years later by a per-cartridge tax on centerfire and rimfire ammunition.

The plaintiff in the case, “Guns Save Life”, a non-profit best known for erecting pro-gun signs on the side of highways, argues the intent of the tax was to make it more difficult for Illinoisans to purchase guns and violates their Second Amendment protections.

* The Illinois Supreme Court voted 6-0 to toss it out with Justice Anne Burke not taking part in the decision…

The uniformity clause provides that, “[i]n any law classifying the subjects or objects of non-property taxes or fees, the classes shall be reasonable and the subjects and objects within each class shall be taxed uniformly. Exemptions, deductions, credits, refunds and other allowances shall be reasonable.” Ill. Const. 1970, art. IX, § 2.

Generally, to survive scrutiny, a nonproperty tax classification must (1) be based on a real and substantial difference between the people taxed and those not taxed and (2) bear some reasonable relationship to the object of the legislation or to public policy. Arangold Corp. v. Zehnder, 204 Ill. 2d 142, 147 (2003). Before this court, plaintiffs have abandoned their argument based on differences between tax classifications for centerfire and rimfire ammunition, distinctions between in- county and out-of-county purchasers, and any distinction between retail purchasers and those exempt from the tax, including law enforcement. Instead, the inquiry is primarily focused on the second prong, whether the taxing classification at issue— a special tax on the retail purchases of firearms and firearm ammunition—bears some reasonable relationship to the object of the legislation or to public policy.

This second prong is typically a narrow inquiry. While a municipality must “produce a justification” for its classification, we normally uphold a taxing classification as long as “a set of facts ‘can be reasonably conceived that would sustain it.’ ” Empress Casino Joliet Corp. v. Giannoulias, 231 Ill. 2d 62, 73 (2008) (quoting Geja’s Cafe v. Metropolitan Pier & Exposition Authority, 153 Ill. 2d 239, 248 (1992)). Once the municipality produces a justification, the plaintiff then has the burden to persuade the court that the explanation is insufficient as a matter of law or unsupported by the facts. Arangold, 204 Ill. 2d at 156. […]

Relying primarily on Boynton v. Kusper, 112 Ill. 2d 356 (1986), plaintiffs assert that the ordinances may not single out the exercise of a fundamental right for special taxation to raise revenue for the general welfare. Plaintiffs further argue that the firearm tax merely funds the general revenue fund and that neither the firearm nor the ammunition tax is specifically directed at gun violence prevention measures.

We agree that the ordinances impose a burden on the exercise of a fundamental right protected by the second amendment. At its core, the second amendment protects the right of law-abiding citizens to keep and bear arms for self-defense in the home. District of Columbia v. Heller, 554 U.S. 570, 635 (2008). In McDonald v. City of Chicago, 561 U.S. 742, 778 (2010), the United States Supreme Court stated that “it is clear that the Framers and ratifiers of the Fourteenth Amendment counted the right to keep and bear arms among those fundamental rights necessary to our system of ordered liberty.” See also Johnson v. Department of State Police, 2020 IL 124213, ¶ 37 (“the second amendment right recognized in Heller is a personal liberty guaranteed by the United States Constitution and the fourteenth amendment” (citing McDonald, 561 U.S. at 791)).

While the taxes do not directly burden a law-abiding citizen’s right to use a firearm for self-defense, they do directly burden a law-abiding citizen’s right to acquire a firearm and the necessary ammunition for self-defense. See Illinois Ass’n of Firearm Retailers v. City of Chicago, 961 F. Supp. 2d 928, 938 (2014) (noting that the acquisition of firearms is a fundamental prerequisite to legal gun ownership); Jackson v. City & County of San Francisco, 746 F.3d 953, 967 (9th Cir. 2014) (the right to possess a firearm for self-defense implies a corresponding right to acquire the ammunition necessary to use them for self-defense).

This court has not yet considered the analytical framework for addressing a tax classification that bears on a fundamental right in the context of a uniformity clause challenge. Thus, we look to other contexts for guidance. In Boynton, we struck down a tax imposed upon those who applied for marriage licenses as violative of the due process clause. The statute required that $10 of the fee collected for issuing a marriage license must be directed into the Domestic Violence Shelter and Service Fund (see Ill. Rev. Stat. 1983, ch. 40, ¶¶ 2403, 2403.1). Boynton, 112 Ill. 2d at 359-60. The plaintiffs challenged that portion of the license fee as an unconstitutional tax violative of due process and the uniformity clause. Id. at 360. […]

Under the plain language of the ordinances, the revenue generated from the firearm tax is not directed to any fund or program specifically related to curbing the cost of gun violence. Additionally, nothing in the ordinance indicates that the proceeds generated from the ammunition tax must be specifically directed to initiatives aimed at reducing gun violence. Thus, we hold the tax ordinances are unconstitutional under the uniformity clause.

Since our holding disposes of this case, we need not address plaintiffs’ additional challenges to the ordinances.

…Adding… Sun-Times…

In a statement, a spokesman for Cook County Board President Toni Preckwinkle said the county is “disappointed” in the Illinois Supreme Court’s recent decision.

“We intend to meet with our legal counsel and determine any next steps that may be warranted,” the spokesman said. “It is no secret that gun violence continues to be an epidemic in our region. … Addressing societal costs of gun violence in Cook County is substantial and an important governmental objective.

“We continue to maintain that the cost of a bullet should reflect, even if just a little bit, the cost of the violence that ultimately is not possible without the bullet. We are committed to protecting County residents from the plague of gun violence with or without this tax.”

32 Comments

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS

SUBSCRIBE to Capitol Fax

Advertise Here

Mobile Version

Contact Rich Miller

|