|

Post-campaign notebook

Thursday, Nov 10, 2022 - Posted by Rich Miller * Tribune…

Meanwhile, the AP sticks to its outdated numbers and spreads misinformation…

As another example, on election night, the AP was only reporting suburban Cook County numbers in Sen. Bill Cunningham’s race. They finally incorporated the Chicago results, but have since appear to have stopped counting. The AP claims that with “99% of precincts reporting,” Cunningham (D-Chicago) leads Christine Shanahan McGovern 53-47. He’s actually ahead 59-41. If you’re gonna set yourself up as the ultimate factual authority, then, please, put the work in, or at least run a disclaimer. * Yep…

The AP still has Sheehan ahead by 68 votes. * Speaking of mail, what DeVore fails to mention is that Donald Trump has actively discouraged mail-in ballots for years. The Illinois Republican Party pioneered mail-in voting years ago. It was jettisoned because rank-and-file voters now hate it. It’s truly hurting their party’s candidates and they need to get over themselves…  Also, with or without mail-in ballots, DeVore woulda got clobbered. I mean, c’mon. * Politico on the scramble to replace retiring House GOP Leader Jim Durkin…

Yikes. * Golden Horsehoe winner Candy Dogood in comments…

* Last February, Lake County Clerk Robin O’Connor, elected four years ago as a Democrat, announced she was switching parties to run as a Republican. She’s losing 54-46 to Democrat Anthony Vega. All countywide Democrats are winning. And only 5 of 19 seemingly victorious county board candidates are Republicans. JB Pritzker won the county with 51 percent in 2018. He’s winning the county this year with 59 percent. Pritzker won DuPage County four years ago by two points, with 48 percent. He’s winning it this year by 15 points, 56-41. Pritzker lost McHenry County four years ago by 10 points and he’s cutting his losing margin this year in half. One potential kinda/sorta bright spot for Bailey is Will County, which Pritzker won 50-44 four years ago. Pritzker’s winning by a lesser amount so far this year, 50-47. * Sen. Darren Bailey is currently leading in one Chicago ward, the 41st, way up on the city’s Northwest Side. The ward is the home to a lot of first responders. But the lead is small, 9,022-8,964, so that could get wiped out when more mail-in/provisional ballots are counted. Pritzker won the 41st Ward four years ago 51-43. * Isabel’s roundup…

* NBC 5 | ‘Ok Then’: Pritzker Details What Was Said in His Election Night Call With Bailey: “I got on the phone… I said, ‘Senator Bailey,’ he said, ‘Governor, I want to congratulate you.’ And I said, ‘Well, thank you very much. That’s very kind of you.’ And he said, ‘Okay, then.’” * Daily Herald | No red wave here: Democratic congressional candidates won big in the suburbs: Despite projections of a red wave that would push Republicans into office in Illinois and across the country, Democrats — nearly all of them incumbents — swept all eight suburban congressional seats in Tuesday’s election. * Daily Herald | Syed’s defeat of Bos in 51st House District bucked trend of incumbent victories in Northwest suburbs : “I’m feeling very, very grateful,” she said Wednesday. “I think we laid it all out there. We communicated our message. We wanted to let constituents in this district know what exactly I would fight for in the state legislature, in our suburban district and the place that I’ve called home, and a place that I was born and raised in, and I have a lot of care for this community.” * WTTW | South Side Voters Speak Up for Trees in Jackson Park and South Shore. Is Anyone Listening?: Should the city of Chicago stop cutting down trees in Jackson Park and the area surrounding the South Shore Cultural Center? […] An overwhelming number of ballots — 82% — were cast in the affirmative, according to unofficial totals from the Chicago Board of Elections. * Tribune | Progressive challenger Brandon Johnson lands another big union endorsement: An influential labor group with ties to the Chicago Teachers Union announced its endorsement of Brandon Johnson for mayor on Wednesday, adding to the list of labor organizations opting to back the Cook County commissioner over other progressives, including U.S. Rep. Jesús “Chuy” García. * Jerusalem Post | Alarming rise in American Jewish children’s complaints of antisemitism at schools: The Israeli-American Council’s (IAC) School Watch initiative reported a rise of hundreds of percent of complaints on behalf of Jewish children on antisemitism in schools, one year after the watchdog’s founding. School Watch was designed to “contribute to a safe school environment and reduce incidents of antisemitism, anti-Zionism, national origin discrimination and hate,” according to its mission statement. * The Daily Beast | The Six Biggest Takeaways From Musk’s Groveling Call With Twitter Advertisers:Amid a mass exodus of advertisers, “Chief Twit” Elon Musk took to his newly purchased social media platform on Wednesday to assure companies that Twitter will remain a safe space for their brands. In an hour-long livestream, known as a “Twitter Space,” Musk cajoled advertisers with promises of robust content moderation and account verification practices. The billionaire faces a formidable challenge: shoring up Twitter’s revenues without alienating the highly vocal band of right-wing users who initially celebrated the acquisition. * Politico | Crypto kingpin bet a fortune on Democrats. Now he’s lost it all.: Crypto megadonor Sam Bankman-Fried helped bankroll Democrats’ overperformance in the midterms. But any friends he may have had in Washington won’t be there for him as his crumbling business empire threatens to torpedo the entire digital currency market. * FiveThirtyEight | Abortion Rights Are Reshaping American Politics: Results are still pending in some key states like Arizona, but Democrats won many contests that will shape abortion access for the next few years — and in some cases, much longer. Abortion-rights supporters managed to enshrine the right to abortion in three state constitutions, including the crucial state of Michigan, where a near-total ban on abortion from 1931 has been tangled up in court battles for months. And supporters notched another consequential win in Kentucky, where a majority of the state’s voters opposed a ballot measure that would have explicitly clarified that abortion rights was not protected under the state constitution.

|

|

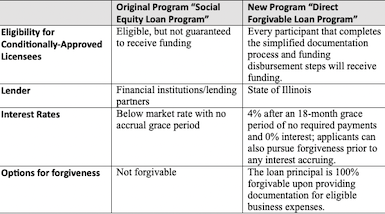

*** UPDATED x1 *** DCEO offers direct forgiveable loans for cannabis social equity participants

Thursday, Nov 10, 2022 - Posted by Rich Miller * Press release…

*** UPDATE *** Press release…

|

| « NEWER POSTS | PREVIOUS POSTS » |