Question of the day

Thursday, Mar 23, 2023 - Posted by Rich Miller

* Press release…

The Illinois Freedom Caucus today held a press conference to discuss some of the majority party’s misguided legislative priorities as the legislative session moves closer to adjournment.

Some of the measures not considered before the Committee deadline include:

• House Resolution 51 – Mandates a forensic audit of state spending, hiring, procurement and contracting

• House Bill 2178 – Repeals the Climate and Equitable Jobs Act (CEJA) directly contributing to higher energy prices

• House Bill 1575 – Lowers the gas tax to 19 cents per gallon

• House 2979 – Increases the standard income tax deduction to $150,000

• House Bill 2599 – Reduces the individual income tax rate from 4.95% to 3.75% and the corporate tax rate from 7% to 6%

• HB3625 – Bans Tik Tok on State Devices

• House Bill 2986 – Prevents the rate of growth of general fund spending from exceeding the rate of growth of the Illinois median household income.

• House Bill 1640 – Creates the Efficient School District Commission to make recommendations on where reorganization and realignment of school districts into unit districts would be beneficial.

• House Bill 2136 – Ends the legislative pension system for new members

• House Bill 3825 – Allows for resident tuition at local non-Chicago school districts within ¼ Mile of district line

• House Bill 1600 – Protects Firearm ownership for tenants

• House Bill 2610 – Allows children at daycare facilities to be exempt from vaccine mandates on the basis of religious exemptions

“We recognize we are in the minority and the likelihood of our bills getting passed is slim to none, but the ideas we are presenting are substantive and should at least merit a discussion,” said State Representative Chris Miller (R-Oakland). “Illinois is in the bottom five in unemployment, and we lost more than 100,000 residents last year. We have former legislators facing federal indictments and a culture of corruption that is legendary. We need to focus on the real problems facing our state, which is what our legislative agenda seeks to do.”

* The Question: Do you support any of these bills? Explain.

45 Comments

|

Afternoon roundup

Thursday, Mar 23, 2023 - Posted by Rich Miller

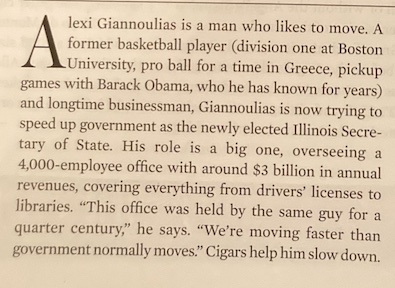

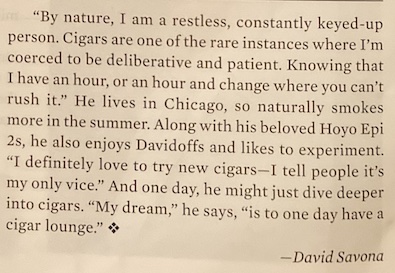

* Crain’s…

Illinois risks a “catastrophic” security breach of highly confidential personal data on millions of residents unless it soon upgrades outmoded computer systems based on 1980s technology.

That’s the bottom line of a report from newly installed Illinois Secretary of State Alexi Giannoulias that takes a hard look at the status of Common Business Oriented Language, or COBOL, systems his office now uses to store and process Illinoisans’ data, including their home addresses, vehicle registrations, Social Security numbers and organ donor information. […]

A Giannoulias spokeswoman said security concerns prevent her from discussing any actual attack, but Dave Drucker, spokesman for longtime Secretary of State Jesse White, who retired in January, said there, indeed, have been “many” such attempted hacks.

“No records were broken into, but there were numerous efforts to do so” in recent years, Druker said. “We applaud the Giannoulias administration for pushing security.

* IDES…

The Illinois Department of Employment Security (IDES) announced today that the unemployment rate was unchanged at 4.5 percent, while nonfarm payrolls increased by +10,700 in February, based on preliminary data provided by the U.S. Bureau of Labor Statistics (BLS) and released by IDES. The January monthly change in payrolls was revised from the preliminary report, from +14,300 to +12,300 jobs. The January revised unemployment rate was 4.5 percent, unchanged from the preliminary January unemployment rate. The February payroll jobs estimate and unemployment rate reflect activity for the week including the 12th.

In February, the industry sectors with the largest over-the-month gains in employment included: Government (+5,900), Leisure and Hospitality (+5,100), and Trade, Transportation and Utilities (+2,700). The industry sectors with the largest monthly payroll declines included: Professional and Business Services (-3,000), Information (-3,000), and Construction (-1,100). […]

The state’s unemployment rate was +0.9 percentage point higher than the national unemployment rate reported for February, which was 3.6 percent, up +0.2 percentage point from the previous month. The Illinois unemployment rate was down -0.1 percentage point from a year ago when it was at 4.6 percent.

* Tribune ComEd 4 trial coverage…

And in the wake of Republican Gov. Bruce Rauner’s election in November 2014, some of [now vice president of external affairs for ComEd Keisha Parker’s] colleagues wondered wondered whether there had been a power shift in Springfield. “I just asked Em if Madigan is still in the driver’s seat? I mean what about Rauner???” a colleague asked in one email shown to the jury.

Parker responded: “You know Daddy is in charge. (Rauner) who??!!”

Parker testified that by “Daddy,” she meant Madigan.

* Press release…

Attorney General Kwame Raoul presented the proposed budget for the Attorney General’s office for next fiscal year to lawmakers today in Springfield. Raoul announced to a legislative committee that his office collected nearly $1.6 billion in revenue on behalf of the state through litigation and collection efforts in 2022. The revenue collected for the state by the Attorney General’s office shows that for every dollar of taxpayer funding the office received in Fiscal Year 2022, it generated $39.52 for the state. […]

In 2022, the Attorney General’s office was able to bring in $304 million through collections litigation, including cases involving the collection of funds for damage to state property, child support enforcement, fines and penalties. The Attorney General’s office also collected more than $807 million through tobacco litigation and more than $456 million in estate tax revenues.

In addition to recoveries for the state, the Attorney General’s Consumer Fraud Bureau mediated more than 20,000 complaints in 2022. The bureau provided more than $8 million in mediated savings for Illinois consumers and secured more than $207 million through enforcement actions.

* ALPLM…

The Abraham Lincoln Presidential Library and Museum opened a major new exhibit Thursday that explores the elusive idea of “home” and the many different ways Illinoisans have made this state their home over the centuries.

“Here I Have Lived: Home in Illinois” will also introduce visitors to

• Black Hawk, the Sauk leader who refused to be driven away from the land where he grew up

• Oscar Micheaux, a farm boy who broke barriers for Black artists in Hollywood

• Michelle Obama, who started out in a Chicago bungalow and wound up in the White House

• Louisa Phifer, who ran a farm and raised seven children while her husband served in the Civil War.

“Here I Have Lived” features multiple people from Springfield, including a forward-thinking socialite, an immigrant friend of the Lincolns and a witness to the racial violence of 1908.

The exhibit runs through Jan. 21, 2024, in the museum’s Illinois Gallery, a space used for highlighting Illinois history as part of the ALPLM’s role as the state historical library. The exhibit is free with regular museum admission.

* The McLean County GOP throws in everything but the kitchen sink…

Dear [Redacted],

If you don’t think that CRT (critical race theory) and DEI (diversity, equity, inclusion) policies and practices are impacting kids in Illinois public schools, then consider the following facts:

1. Time is being pulled from critical areas of education to make room for CRT and DEI, and recent school report cards show it.

2. Standards are being eliminated, so no child feels excluded or left behind.

3. Gender-affirming behaviors are practiced and promoted in the classroom, and traditional Christian values are being forcefully rejected.

4. The most explicit form of sex education is being introduced to children at the most tender ages.

5. Children whose parents remove them from objectionable lessons and activities are “punished” with excess workloads while others attend thought- and behavior-influencing events.

6. Kids are routinely calling each other “racist” for the slightest slip of the tongue.

These are just a few instances where social radicals are erasing our children’s innocence and indoctrinating a generation of children in our public school systems. How long will it be before our children are forced to attend “drag queen” story hour or an “adult cabaret” performance for the sake of tolerance? Wokeism is poisoning the brains of youth, and their childhoods are being stolen.

Suppose we don’t act to stop forced conformity by electing good school board members in the April 4th election. In that case, it won’t be long before parents are accused of crimes against society, and our children report us to school authorities for various “undesirable” social behaviors such as child discipline and gun ownership.

Parents – indeed, all citizens – need to understand and think clearly about the political, economic, and moral issues of our day. Each of us must show courage and fortitude in protecting children.

Parents must be informed about the nature of CRT and DEI and how they impact children. Join the Republican Party of McLean County this Saturday morning in learning more about these evil influences. Attend our Critical Race Theory brunch on March 18 from 9-11 AM. Education Specialist Jonathan Butcher of The Heritage Foundation will speak on the “Critical Race Theory” issue as it impacts our schools and our children.

And they have a list of preferred candidates.

* Speaking of…

Since UpRising Bakery & Cafe owner Corinna Sac announced plans to close the Lake in the Hills store by the end of the month, online donors have raised more than $34,000.

While the infusion of cash could keep her open, doing so by donation “is not sustainable” in the long run, and she is weighing her options, Sac said.

[…]

As of Wednesday, Sac said she was considering a few options: staying open in Lake in the Hills; moving to a smaller, accepting location; or closing.

If she closes, Sac said, she would ask the fundraiser creator to either return the online donations or ask if donors are OK with her using some funds to pay off final bills, Sac said.

That would be up to her, [Anti-Defamation League Midwest Regional Director David Goldenberg] said, noting the donations did not come with any ties.

* Isabel’s roundup…

* Reuters | Union workers can’t sue under Illinois biometric law, court rules: The Illinois Supreme Court unanimously held that campus security workers at Roosevelt University in Chicago must bring claims that the school used their fingerprints for timekeeping without their consent in union arbitration rather than court.

* Pantagraph | Cooperating ex-guard gets 6 years in Illinois inmate’s death: A contrite Willie Hedden, the last of three ex-correctional officers convicted in the beating death of an Illinois prison inmate, was sentenced Wednesday to six years in federal prison after pleading guilty to civil rights violations and obstruction and testifying against his codefendants.

* Sun-Times | 4 Chicago cops placed on desk duty amid allegations seized guns were mishandled: Ephraim Eaddy, first deputy of the Civilian Office of Police Accountability, said the oversight agency is “actively investigating the actions of the involved officers and made a recommendation to the Chicago Police Department to relieve the officers of their police powers.”

* Crain’s | Biden budget may ease CTA, Metra fiscal pain — but only a bit: At issue is the roughly $350 million a year the three agencies collectively get annually from the federal government in what is known as Section 5307 Urbanized Formula Funds. The money has been earmarked solely for transit capital and capital maintenance programs under terms of a law adopted during the Reagan presidency that banned their use for fuel, pay for vehicle drivers and other operational costs. But Biden wants to loosen that provision.

* Sun-Times | DuPage County’s new tool in fighting domestic abuse: a QR code that points to help: The idea came from John Caldwell, a fire medic with the Lisle-Woodridge Fire Protection District. Caldwell said paramedics often are called to treat people they suspect have been injured by an abuser. They try to give the victim a “tear sheet” that lists agencies that can help them.

* Sun-Times | Sen. Duckworth joins bipartisan call for stronger rail safety measures: Senate Commerce Committee grills Norfolk Southern CEO on safety enhancements that can be implemented to prevent derailments like the one in East Palestine, Ohio.

* Daily Herald | Proposal for marijuana shop near Buffalo Grove High School faces opposition: But it will need a zoning variance from the village board, since it falls short of the minimum 1,000-foot distance from schools required under village code. The distance from the building to the high school’s property line is 918 feet. Buffalo Grove trustees Monday barely approved sending the application to the planning and zoning commission for further consideration, with trustees Eric Smith, Joanne Johnson and Gregory Pike voting in favor and Andrew Stein and David Weidenfeld opposed.

* SJ-R | Redpath Feger is no stranger to working on political campaigns but this time it’s her own: Former Springfield Mayor Karen Hasara has endorsed her as have former State Sen. Larry Bomke, Sangamon County Clerk Don Gray, Sangamon County Sheriff Jack Campbell and former sheriff Neil Williamson. Redpath Feger has gotten the backing of the Sangamon County Republicans.

* Tribune | Paul Vallas’ and Brandon Johnson’s 100-day plans for Chicago: More beat cops vs. ‘Treatment Not Trauma’: Johnson, a Cook County commissioner, said he will double youth employment and vowed to pass “Treatment Not Trauma,” a City Council ordinance to repurpose vacant police salaries to send social workers and medical specialists to nonviolent mental health crises calls, and “Bring Chicago Home,” a plan to raise the real estate transfer tax on properties above $1 million to fund homelessness services. Vallas, the former Chicago Public Schools CEO, said he would place more Chicago police officers on local beats, “address this issue” of recently incarcerated citizens and open school campuses through the dinner hours, weekends and holidays for community programming and services.

* Chicago Reader | The ladies who sing from the back: These Chicago background vocalists have helped the likes of Aretha Franklin, Stevie Wonder, and Otis Clay sound their best. Here their own voices take center stage.

* WCIA | Barbecue sauce, drug incinerator, moon habitat, radar face off in Illinois Maker’s Madness: “The diversity of products that have made it to this final round demonstrate the dynamic nature of our state’s manufacturing sector, as well as the versatility of the women and men who work on our factory floors,” Mark Denzler, president and CEO of the Illinois Manufacturers’ Association said. “Whether it’s delicious sauces created by a champion pitmaster, housing for astronauts on the moon, a portable drug incinerator to fight narcotics abuse, or a compact sensor to assist drivers and improve road safety, voters have a great field to choose from.”

9 Comments

|

It’s just a bill

Thursday, Mar 23, 2023 - Posted by Isabel Miller

* ACLU of Illinois…

Thank you for asking about the ACLU of Illinois’ position on HB2123, which creates civil liability for “digital forgeries” (deepfakes). While we acknowledge the real harm that is caused by deepfakes, particularly those of a sexual nature, this bill language creates a sweeping new cause of action against a relatively new form of communication that will have the real impact of chilling or silencing vast amounts of protected speech.

House Floor Amendment 1 does make improvements to the original bill language, but does not address the core of our concerns. With the exception of sexually explicit deepfakes, which cause a unique harm, these cases can and should be brought under existing tort law, including defamation and false light. Existing tort laws include decades of precedent and First Amendment protections for political speech, parody, and artistic expression that a new civil remedy fails to provide. Political speech, in particular, is considered highly protected speech and would be actionable under this legislation. This should be a concern to all of us.

Lastly, the remedies, which include temporary restraining orders and immediate takedown of speech prior to a final verdict, are, as drafted, an unconstitutional prior restraint (judicial suppression of material without first determining if it is unlawful). The First Amendment severely limits the ability of the government to do this.

We have been in conversations with the sponsors and proponents and have suggested alternative language options, including to specifically address the unique harms caused by deepfakes of a sexual nature. We hope that we can continue those conversations to address harmful deepfakes within the boundaries of the First Amendment.

Newly adopted House Amendment 3, we’re told, does not change the organization’s position.

* Sen. Robert Peters…

“Individuals sentenced to probation should be afforded the same liberties as ordinary citizens, as long as the liberties are unrelated to the circumstances that landed them on probation,” said Peters (D-Chicago). “Alleviating restrictions on cannabis drug use under supervision for those on probation is a positive step toward true reform.”

Currently, a court can order a person on probation to refrain from using drugs, including substances such as alcohol and cannabis that are legal in Illinois.

Senate Bill 1886 stipulates a court cannot order that a person on probation, conditional discharge, or supervision refrain from having cannabis or alcohol in his or her body unless the presence of an intoxicating compound is an element of the offense charged or the person is participating in a Problem-Solving Court.

“By definition, probation means a person is released for good behavior under supervision,” said Peters. “A person who has demonstrated good behavior shouldn’t be punished for engaging in legal activities.”

Senate Bill 1886 passed the Senate Executive Committee and will now head to the Senate floor for further consideration.

* SB2260, also from Sen. Peters, is heading to the Senate Floor…

With the intention to expand upon domestic violence laws, State Senator Robert Peters passed a measure through committee on Wednesday to protect victims of gender-based violence.

“Current domestic violence laws unfortunately have loopholes that can cause incarcerated survivors to get their resentencing request dismissed,” said Peters (D-Chicago). “Expanding upon current domestic violence laws and including protections for victims of gender-based violence helps survivors during their fight for freedom.”

Under current law, relief from judgement following a domestic violence incident is applied when the survivor’s offense was related to having previously having been a victim of domestic violence.

Senate Bill 2260 expands the relief from judgment process for resentencing to include certain offenses committed by a victim of gender-based violence who was unable to present evidence of gender-based violence at trial.

“Supporting survivors of gender-based violence advances true social justice,” said Peters. “Incarcerated survivors should be given a clear path to request resentencing.”

Senate Bill 2260 passed the Senate Special Committee on Criminal Law and Public Safety and will now head to the Senate floor for further consideration.

* Bills passed by Gen Z legislators…

Two of the youngest members in state legislature history had their first bills pass in the Illinois House this week.

Reps. Brad Fritts and Nabeela Syd, both 23 years old, had bills move to the Senate. House Bill 2963 from Fritts, R-Dixon, passed unanimously on Tuesday and pertains to his hometown’s park district authority to install and operate solar panels at its facilities.

Syed, D-Palatine, received bipartisan support for House Bill 3643 on Wednesday. The bill establishes that students 17 years or older will have their individualized education program plans tailored to promote voter registration. IEP plans are for students ages 3 to 21 who have been diagnosed with disabilities or developmental delays, according to the state board of education.

Some House Republicans expressed concern about involving educators in voter registration. The majority, including Coffey, did support the bill.

* Sen. Tom Bennett advances his bill to remove roadblocks for teachers…

The Illinois Senate Education Committee voted unanimously to advance legislation from State Senator Tom Bennett (R-Gibson City) that would remove one of the biggest issues stopping prospective teachers from making it to the classroom. His legislation would suspend the current edTPA requirement, a much-criticized evaluation program that has regularly been cited as a major factor in the worsening teacher shortage. […]

Under current law, prospective teachers are required to pass the edTPA requirement to complete their education program. The edTPA standard has been criticized for being difficult, inaccurate in predicting future performance, expensive for education students, and for taking too much time away from in-classroom training. The requirement has also been blamed for keeping diverse teachers out of classrooms.

Senate Bill 1488, filed by Bennett, would waive the edTPA requirement through August 31, 2025. The legislation would also create the Teacher Performance Assessment Task Force, which would be tasked with developing a new evaluation system for teaching students. The task force would be required to present its findings no later than August 1, 2024.

* Rep. Manley…

* This bill is in the Rules Committee. Press release…

KIDS TOO, commonly known as the Me Too movement for kids, announced today that they are joining forces with other child advocacy organizations to demand that Illinois Legislators pass HB 3290. This legislation, sponsored by Representatives Katie Stuart, Jehan Gordon-Booth, Amy Elik and Michelle Mussman, is designed to criminalize educators who commit a sexual act toward students ages 18-22 attending classes at a public or nonpublic secondary school.

Educator sexual abuse is pervasive in schools across America, with 1 in 10 children experiencing sexual misconduct by a school official before graduating from high school, according to the US Department of Education. Illinois made news headlines in 2018 regarding its largest school district, Chicago Public Schools, when the high volume of sexual abuse cases and misconduct by educators in CPS was revealed.

The Office of the Inspector General (OIG) was created to serve as an independent oversight body for Chicago’s public, contract and charter schools. Among other focus areas, OIG investigates allegations of sexual misconduct, releasing annual reports with insights on allegations, handling of cases and outcomes. In addition, Faith’s Law legislation and its trailer bill, signed by Illinois Governor Pritzker in 2021, ensures training for educators about grooming tactics and allows school districts to request and receive more in-depth educator employment histories.

In Faith’s Law, however, one loophole for predatory educators did not get closed and still remains: Current Illinois law allows sex between teachers and students older than 17. HB 3290 seeks to close this loophole; last week, however, HB 3290 was assigned to the Rules and Regulations Committee, often known in lawmaking circles as the place where bills are sent to never see the light of day.

* Rep. Canty…

Members of law enforcement, firefighters, and correctional officers who sustain a catastrophic injury in the line of duty will be able to select any health insurance plan provided by their employer under a bill passed by state Rep. Mary Beth Canty, D-Arlington Heights.

“Our first responders put themselves in harm’s way every day to keep our communities and our families safe. When the worst happens, we are morally obligated to support these heroes to the greatest possible extent,” Canty said. “This bill helps first responders who’ve suffered catastrophic or fatal injuries in the line of duty pay for the health care and treatment they need.”

Currently, under the Public Safety Employee Benefits Act, local governments are only required to pay premiums for “basic” health insurance plans, even if it is not the most favorable plan for the injured, and even if the injured was on a different, more expensive plan at the time of injury. House Bill 3249 would require public employers to offer employees eligible for health insurance benefits under the Public Safety Employee Benefits Act who face a catastrophic injury the choice of any health insurance plan available to currently-employed full-time law enforcement, correctional or correctional probation officers, or firefighters.

“This bill is a common sense solution that treats our first responders with the dignity and respect they deserve,” Canty said. “I thank my colleagues on both sides of the aisle for supporting this essential legislation, and I urge the Senate to pass this bill and support first responders across Illinois.”

House Bill 3249 passed the House with no opposition, and now heads to the Senate for consideration.

3 Comments

|

* New poll…

In the latest poll conducted by Victory Research on March 20-22, Paul Vallas saw his lead over Brandon Johnson shrink from six points to two, 46.3% to 44.2%, from the previous poll conducted March 6-9. […]

While nearly 10% of voters remain undecided, 15.5% say they could still change their mind.

More here, but some trends outside of the 3.45 MoE are emerging as voters get to know the two candidates better.

By far the most important trend is that even after several high-profile endorsements by Black leaders, Vallas’ support among Black voters has dropped by 13 points since the last poll taken March 6-9. Johnson’s Black support is up by 11 points.

Johnson’s support is rising among women (up 4 points), men (up 6 points), age 46-60 (up 5.5 points), and progressives (up 11 points). Again, at least some of this is because people are just finding out who he is (and are overcoming their anger/disappointment that their first round candidate lost).

Vallas is up among men (4 points), White voters (10 points), Latino voters (6 points) and conservatives (10 points). His support among women is essentially unchanged, which is not a good sign.

And undecideds are down from 16 to 10.

…Adding… I chatted last night with an elected official who said the same exact thing, but I didn’t check all three of the pollster’s results today. Vallas is in the mid 40s, where he has been pretty much the whole time. Is 45-46 a Vallas ceiling? The elected thought it was and that Johnson would overcome it. We’ll see…

* Eric Zorn makes a good point today that Johnson’s endorsements are almost all expected in one way or another. Vallas’ backing, however, has included some shockers, including Jesse White. Whether it does him any good or not is yet to be seen.

* Oh, for Pete’s sake…

* The Cook County Democratic Women’s PAC was shut down by the Illinois State Board of Elections way back in 2014 after it was deemed inactive. The committee faced multiple fines. Press release…

Mayoral candidate Paul Vallas will be endorsed Thursday by leaders of Cook County Democratic Women, a grass-roots organization that works to ensure that women have a presence and a strong voice in national and local elections.

* And now let’s look at Senate Bill 2339, which was introduced back in 2018…

Provides that if a law enforcement officer detains a minor for an act that if committed by an adult would constitute vehicular hijacking, aggravated vehicular hijacking, or possession of a stolen motor vehicle, the officer shall deliver the minor to the nearest juvenile officer as provided under the Act. … Provides that should the court order detention, the minor shall be detained, pending the results of a court-ordered psychological evaluation to determine if the minor is a risk to himself, herself, or others.

The bill was sponsored by then Sen. Tony Muñoz. It was amended in the House and then died in the Senate. Brandon Johnson weighed in at the time…

Today from the Vallas campaign…

Chicago is dealing with a major spike in carjackings, with the Chicago Tribune recently reporting that vehicle thefts are up 55% since last year, the largest increase of any U.S. city. But when the state senate unanimously passed a bill to remove loopholes that allowed carjacking suspects to be immediately released with little penalty, Brandon Johnson spoke out against it.

Johnson’s opposition to this common sense public safety measure, coupled with his embrace of the extreme “defund the police” movement, raises significant questions about whether he can be trusted to make Chicago safer according to State Senator Antonio Munoz, who was the lead sponsor of the car theft legislation. Senator Munoz is announcing his endorsement of Paul Vallas for Mayor.

“Chicago has a serious crime problem and we need a Mayor who will side with the victims, not with the perpetrators like Brandon Johnson has done over and over again,” said Senator Munoz. “Brandon Johnson’s approach of defunding the police and opposing stricter penalties for carjacking is the last thing Chicago needs, and that’s why I’m supporting Paul Vallas for Mayor.”

Senator Munoz will be available for comment, if you would like to schedule an interview please contact xxx@xxxxxx.com.

Johnson’s extreme position on crime is clearly out of the mainstream in Chicago, with numerous public opinion polls showing that public safety is the number one issue and residents want more police presence in their neighborhoods.

“Carjacking is an epidemic in our city and it’s shocking that Brandon Johnson tried to stop legislation to ensure that car thieves are held accountable,” said Vallas. “I’m proud to have Senator Munoz’s support because he has a real record of making our community safer, and Brandon Johnson has proven that he can’t be trusted to reduce crime.”

* Moving right along, notice anything missing from this story?…

Separately, Johnson’s campaign has manufactured an endorsement and claimed it’s Vallas’.

Context: Oppo research revealed Vallas on a conservative radio show a few years ago claiming Gov. JB Pritzker and Mayor Lori Lightfoot “act like dictators” for their pandemic executive orders.

The oppo prompted Republican Darren Bailey to talk about it on his Facebook live page, which Johnson’s team is calling an endorsement for Vallas. Bailey didn’t endorse anyone.

Johnson’s team isn’t giving up on pinning the Republican label on Vallas, who was officially endorsed Wednesday by former Democratic Gov. Pat Quinn. Vallas was Quinn’s running mate in his failed 2013 race against Bruce Rauner. Though Vallas’ more recent stumble might be spending too much time on conservative talk shows.

It’s right that Bailey didn’t endorse Vallas, as we discussed yesterday. But Bailey didn’t just “talk about” Brandon Johnson. Bailey said that if Johnson was elected, “it’s going to be a dark day.”

Also, it’s not just that Vallas spent a lot of time on talk radio shows, for crying out loud, it’s what he said on those shows and in other venues. For instance…

And somebody dug up this little quote from Vallas on Jeanne Ives’ podcast last year…

Vallas: Pritzker of course just announced that he’s lifting the mask mandate. You know, the science, it’s like, it’s more political science.

“Political science” was a common phrase used by covid deniers. Just sayin.

* An excerpt from the Sun-Times story on Johnson’s meeting with the Crain’s editorial board…

“Of course, we need the support of Springfield and the City Council [for things like the transaction tax]. … Yes, there’ll be some push and pull on this,” Johnson said.

“That’s why I’m best suited for this position. … I am collaborative. I have relationships in Springfield. My opponent has to figure out how he’s going to convince Democrats to work with him.”

He noted he “used to work” for Illinois Senate President Don Harmon and that Johnson’s three kids “grew up together” with Speaker Chris Welch’s children.

Johnson contrasted his relationship-building approach to Paul Vallas, whose Republican supporters condemned Gov. J.B. Pritzker for his stay-at-home orders during the pandemic.

“You certainly can’t expect the governor to respond to someone who calls him a dictator,” he said.

Johnson could probably offer to babysit the Speaker’s kids for free anytime, anywhere and he still couldn’t pass that transaction tax. It’s folly. But, yeah, decent point about Vallas. A case can be made that New York City’s mayor hurt the Democratic Party last year by focusing on their soft on crime ways. Vallas could be much, much worse.

* Isabel’s roundup…

* Chalkbeat | Chicago school leaders foresee declining revenue but promise more investments: A district report last fall noted the city has shifted costs onto the district and could offload more expenses amid a transition from mayoral control to an elected school board. The report described the district’s financial outlook as “fragile” and warned of a potential $628 million deficit by 2026, which represents about 6% of this year’s $9.5 billion budget.

* Sun-Times | Johnson won’t identify ‘plan B’ for revenue if City Council, legislature resist tax hikes: Johnson’s plan to help bankroll an array of new social programs is the cornerstone of his anti-violence strategy. It initially included a “Metra city surcharge” to raise $40 million “from the suburbs.” It still includes taxes on high-end home sales and financial transactions; a revived employee head tax; increased taxes on jet fuel and hotel rooms; and “new user fees for high-end commercial districts frequented by the wealthy, suburbanites, tourists and business travelers.”

* Block Club | Will Retired Cops Return To CPD? Would More Detectives Curb Crime? Vallas, Johnson Spar Over Public Safety Platforms: Vallas also blamed Johnson and Chicago Teachers Union leadership for extended school closures during the COVID-19 pandemic. Johnson is a former CTU organizer and the union is one of his largest donors.

* ABC Chicago | Vallas, Johnson spar over Kim Foxx’s performance and policing in schools: “She has led with an incredible amount of integrity. She’s been part of the type of reform that’s needed,” Johnson said. But, Vallas voiced his concerns about Foxx. “She has not been aggressive at keeping dangerous criminals off the street, and the data clearly states it,” Vallas said. … “He remains a paid employee from the Chicago Teachers Union. At the end of the day, what has he run? What has he managed? He’s voted on budgets. He’s never managed a budget,” Vallas said. “We all know someone like Paul who has failed over and over again and continues to be allowed to fail up,” Johnson said.

* CBS Chicago | Johnson, Vallas get heated in attacks on each other’s positions in roundtable forum: One question raised at the forum to which the candidates’ positions has not made headlines before was whether Cook County State’s Attorney Kim Foxx has made Chicago safer. Neither Johnson nor Vallas directly answered the question, but their responses did not suggest they are on the same page about Foxx.

* CBS Chicago | What would Vallas, Johnson do to reverse downtown retail exodus? Both are short on specifics: “Michigan Avenue may have a vision for how they can revitalize – but yet the city regulatory department seems to be an obstacle,” Vallas said. Is Vallas short on specifics? Yes. But so is Johnson. “I’ve thought about this a lot,” Johnson said at a mayoral question-and-answer session earlier this week. “This is really about attracting innovative corporations to the city of Chicago.”

* The Crusader | Coalition of women in ‘spirit of Mayor Washington’ endorses Johnson: Among the scores of women attending a press conference at Rainbow PUSH Coalition headquarters in support of Johnson, was Dr. Jacqueline Jackson, wife of Reverend Jesse Jackson. She told the Chicago Crusader, “We intend to win with Brandon because he’s the best man for the job and I’ve always been for the very best.”

* Read Paul Vallas’ answers to Crain’s candidates’ questionnaire : “From the outside, from information that is publicly available, one might reactively advance proposals for spending and program cuts. But that would make proposals and prioritize solely on the basis of the portion of the iceberg that is above the surface, knowing that the greater mass warranting consideration is beneath the surface. This is further complicated by the fact that the city data is routinely flawed or fluffed, that most portions of the city operate without data-driven program and policy performance metrics and milestones, and more at the margin but not inconsiderable, a practice we came to learn in the last cycle of budget hearings of funds appropriated for specific purpose which the administration did not allow expenditure and implementation.”

* Tribune | Public safety and environmental concerns are at the forefront in 10th Ward runoff: Chico and Guajardo made the April 4 runoff out of the five candidates in the Feb. 28 general election. None of the five won a majority of the vote, forcing the runoff between the top two vote-getters. Chico garnered 40.5% of the vote in February while Guajardo got 26.5%, or about 1,000 fewer votes than Chico, but she’s been steadily beating Chico in fundraising.

* The Hill | Chicago mayoral race underscores city’s racial divisions: “Chicago has always been a city that has been very explicitly divided by racial politics,” explained Twyla Blackmond Larnell, associate professor of political science at Loyola University Chicago and faculty affiliate for the school’s Institute for Racial Justice. “Race is definitely one of the major cornerstones of how politics gets done in the city,” she continued. “Power is divvied up according to racial groups, but also you have to account for who in those groups has access to the social, economic and political resources that are needed to win elections as well.”

* The Triibe | What anti-CTU rhetoric in the mayoral runoff election reveals about Chicago: According to several people who spoke to The TRiiBE, anti-CTU rhetoric during the election is grounded in a perceived fear that if Johnson becomes mayor, the issues that CTU has been organizing around for more than a decade, such as education, housing, and healthcare, would lead to the disruption of the city’s status quo and the interests of Chicago’s elite.

* Block Club | Chicago Schools Poised To Vote On Keeping Police On Campuses: There are 59 police officers stationed across 40 Chicago public schools. Each school will convene a safety committee before local school councils vote by June 2 on keeping officers in schools, officials said.

* Block Club | 36th Ward Candidates To Debate Northwest Side Ward’s Issues Thursday In Ukrainian Village: Villegas is headed to a runoff April 4 after failing to garner a majority of the votes to secure reelection to his third City Council term. As alderperson, the retired marine has pushed for a universal basic income program and to reinstate the City Council’s Office of Veterans Affairs. He’s also endorsed a plan to reopen the closed 13th Police District in West Town, which was closed in 2012 as part of a citywide consolidation of police resources.

* Lynn Osmond, Larita Clark | Don’t forget tourism in the economic development equation: We all agree that Chicago is a great destination to live, work and play. As we look to the future, we want to work with the next mayor to continue to build a positive narrative about Chicago. This does not mean ignoring our challenges; rather, it is about recognizing our strengths while working to address our weaknesses. We need to share the positive stories about the city we love and talk about why Chicago is a great place to visit.

* Block Club | Tickets, Signs Not Stopping Illegal Parking In Bike Lanes Where 2 Cyclists Killed, Northwest Siders Say: The 3800 block of North Milwaukee Avenue near North Kilbourn Avenue — which has seen two cyclists killed since 2019, car crashes, illegal parking and ongoing construction — has been set to receive concrete curb barriers since the second half of 2022 as part of the city’s bike safety upgrade to the area — but less than half of the Milwaukee stretch has completed barriers.

45 Comments

|

* Subscribers were given more info earlier today. Press release…

Today, the Democratic Party of Illinois (DPI) has released details of its unprecedented effort to prevent extremist conservatives from implementing regressive platforms on school and library boards throughout the state. As national groups continue to funnel dark money into Illinois to prop up fringe candidates, DPI is fighting back to defend its values of diversity, equity and inclusion that make our education system stronger for our children.

“Illinoisans deserve to know the truth about candidates’ ideologies before they head to the ballot box, and DPI will make sure voters have the resources they need to make their decision,” DPI Chair Lisa Hernandez said. “As conservative groups attempt to mask their radical agenda behind supposedly nonpartisan candidates, DPI is committed to supporting credible candidates who will oppose efforts to ban books, revise history, and limit reasonable sex education. We can’t afford to sit back while kids and families are at risk.”

Following an extensive analysis of over 500 districts, DPI has identified 84 recommended and 74 opposed candidates in school and library board races across the state. Opposed candidates include those affiliated with extreme national conservative groups as well as those aiming to implement anti-equality, anti-truth agendas in their districts. Some of their radical political platforms include banning books, teaching revisionist history, ignoring common sense public health measures, and blocking comprehensive sex education.

This unprecedented plan will include mail and digital advertising sent to a base of Democratic voters in target districts, reaching hundreds of thousands of individuals and households in Illinois. The paid communications program will highlight extremists on the ballot, support credible community advocates that DPI recommends, and direct voters to DefendOurSchoolsIL.com, where they can find additional information about races in their districts. In addition, the Party is supporting direct voter contact efforts through consultation and candidate training led by DPI’s Regional Political Organizers. DPI will invest nearly $300,000 statewide to support recommended candidates and expose fringe candidates.

“We’re providing organizing support alongside direct mail and digital communications to make sure we reach voters where they are, especially in these typically low-information races. Many extreme national groups know that they can hide their regressive agendas behind so-called nonpartisan candidates due to a lack of access to clear and accurate information about the names appearing on ballots,” DPI Executive Director Ben Hardin said. “We’re proud to implement this innovative program to make sure voters everywhere can support candidates who align with their own values despite efforts from right wing groups to disguise their real platform and take over our school boards.”

This initiative is launching as DPI implements a new party building directive under the leadership of Chair Hernandez to provide year round support to Democrats through grassroots organizing and continuous voter engagement.

* Meanwhile, from the Tribune…

The Illinois House on Wednesday approved a measure that would allow the Illinois secretary of state’s office to deny grant funding to public and school libraries if they ban books or fail to devise policies against removing titles from their stacks.

The 69-39 party-line vote in the Democratic-led House reflected the partisan divide on the book-banning issue both in the state and nationally. The bill will now move to the Senate for consideration.

Illinois has not seen as many cases of book bans or attempted bans as states that lean more Republican, according to some research. But according to the secretary of state’s office, citing figures from the Chicago-based American Library Association, there were 67 attempts to ban books in Illinois in 2022, up from 41 the year before.

Democrats say book bans often discriminate against the LGBTQ community and other marginalized groups, while Republicans have argued that some titles need to be out of the reach of children if they contain pornography or obscene imagery.

* Center Square…

During debate between state Rep. C.D. Davidsmeyer, R-Jacksonville, and Stava-Murray, the question of parental rights was raised.

“Could you ask if that they not be taken to the library,” Stava-Murray said.

“I don’t think they should be completely kept from the library because there may be one or two books, I think they should be able to go to the library like every other kid,” Davidsmeyer said.

“And you’re not confident that your parenting has instilled in your children their own ability to choose their own books?” Stava-Murray said as Republicans booed.

“I know for a fact that my parenting will allow my children to pick the right book,” Davidsmeyer said.

Huh. For some reason, they left out Rep. Stava-Murray’s retort…

“I know for a fact that my parenting will allow my children to pick the right book,” he said.

“So then let the other children read the books too,” Stava-Murray replied.

Zing.

27 Comments

|

* Sun-Times…

Illinois Secretary of State Alexi Giannoulias on Thursday plans to announce $21 million in grants to police departments and task forces across the state in an effort to tamp down on a three-year surge in armed carjackings.

More than half of that funding is earmarked for the Illinois State Police and the Chicago Police Department as the city grapples with some of its highest numbers of carjackings in at least a generation.

“It’s destroying communities,” Giannoulias told the Sun-Times ahead of the grant announcement. “It’s causing people to leave the state, making people second-guess putting their kids in the backseat. It can happen at 10 in the morning or 2 in the afternoon.

“We want to give law enforcement every resource we can to help identify and prosecute these criminals,” said Giannoulias, the first-term Democrat elected last year to replace the long-serving former Secretary of State Jesse White.

* Press release…

In an effort to combat the surge of carjackings and motor vehicle thefts in Illinois, Secretary of State Alexi Giannoulias is awarding grants totaling more than $21 million to six police organizations.

The funding originates from the Illinois Vehicle Hijacking and Motor Vehicle Theft Prevention and Insurance Verification Council, which is overseen by Secretary Giannoulias’ office. The Secretary of State’s office convenes regular meetings of council members and awards funding to assist law enforcement entities – including the Secretary of State Police – to combat carjackings and prevent motor vehicle thefts.

“There is no single solution, but these grants give law enforcement needed financial resources, which will provide a greater sense of focus and effort to recover stolen vehicles and prevent carjackings that have been occurring all too frequently throughout our state,” said Giannoulias. “People doing something so routine as getting in their car and driving shouldn’t have to fear that they’ll be robbed of their vehicle at gunpoint. Working together, we will continue to not only make our roads safer but also our communities, neighborhoods and business districts.”

“ISP’s expressway safety enforcement effort brings together the full force of patrol, investigations, license plate readers, air operations, and other assets,” said ISP Director Brendan F. Kelly. “These grant funds will energize and sustain those efforts to pursue violent offenders and keep reducing violence.”

“Partnership is essential as we work to prevent and investigate vehicular hijackings and motor vehicle thefts,” said Interim CPD Superintendent Eric M. Carter. “This grant funding will help us bolster these efforts and create a safer Chicago.”

“The Illinois Statewide Auto Theft Taskforce (ISATT) will use this money to expand our investigations into crimes related to vehicular hijacking, auto theft, insurance fraud, rogue tow operators and recyclable metal left,” said Secretary of State Police Lieutenant Adam Broshous, Director of ISATT. Lieutenant Broshous noted that nine of the 22 sworn officers that make up ISATT are part of the Illinois Secretary of State Police.

In 2022, there were 1,655 reported carjackings in Chicago, more than triple the amount in 2012, according to city figures. Meanwhile, the National Insurance Crime Bureau (NICB) reports that Chicago saw auto thefts rise 55% in 2022, an increase greater than every other city in the nation. In 2021, the NICB reported there were 13,856 auto thefts in the city, which increased to 21,516 auto thefts in 2022. Statewide, vehicle thefts rose from 28,557 in 2021 to 40,505 in 2022, according to NICB’s most recent data.

Over the course of the next several weeks, Giannoulias will provide the police organizations the below grants. These initial funds are earmarked for use in the upcoming year, and organizations can request full or partial grant renewals over the next three years to continue efforts to prevent carjackings and motor vehicle thefts:

Expressway Safety Enforcement Group (ESEG) $10,264,503

Illinois Statewide Auto Theft Task Force (ISATT) $3,381,759

Metro East Auto Theft Task Force (MEATTF) $2,456,527

Greater Peoria Auto Crimes Task Force (GPACT) $2,150,700

Tri-County Auto Theft Task Force (TCAT) $1,841,000

Chicago Major Auto Theft Investigations (CPD) $1,451,011

[Total] $21,545,500

The Secretary of State’s office collects an annual $1 assessment on automobile insurance policies from the insurance industry to fund grant awards. In addition, the Illinois General Assembly appropriated an additional infusion of $30 million last year to combat statewide carjacking and motor vehicle theft.

The council is made up of 11 members who discuss strategies to prevent carjackings, motor vehicle theft and recyclable metal theft. This council fell under the jurisdiction of the Illinois Criminal Justice Information Authority from 1991-2017. Since 2018, the council’s work has led to 4,726 recovered vehicles valued at $92 million.

*** UPDATE *** From the governor’s office…

Today, Governor Pritzker and the Illinois Emergency Management Agency (IEMA) announced $20 million in grants have been awarded to 116 non-profit organizations across the state through the 2022 Nonprofit Security Grant Program (NSGP). The funding will be used to help organizations strengthen efforts to protect against public safety and security threats. Many of the grantees are places of worship, reproductive health providers, cultural institutions, and education centers who were deemed at high-risk of a terrorist attack.

“As Governor, my top priority has always been—and will continue to be—keeping Illinoisans safe,” said Governor JB Pritzker. “This $20 million investment will provide grantees—from mosques and synagogues to education centers and cultural institutions—the resources they need to enhance safety measures amidst the rising tide of extremism. From Skokie to Peoria, Illinoisans deserve to be able to congregate safely with their communities, and that’s exactly what the Nonprofit Security Grant Program achieves.”

“When the nonprofits that provide spaces to worship, create, and educate are secure, our communities grow and thrive,” said Lt. Governor Juliana Stratton. “In Illinois, we stand against extremism and hate. These statewide grants are part of our sustained commitment to help broaden protective measures so all Illinoisans can feel safe and well.”

Funds must be used for target-hardening activities, which include active shooter trainings, the purchase/installation of security equipment on property owned or leased by the not-for-profit organization, and the hiring of contracted security personnel. Security enhancements must be for the locations that the not-for-profit occupies at the time of the application, and the projects must be fully completed during the three-year (36 month) performance period.

“At a time when threats against cultural and religious institutions have occurred in record numbers, this critical security funding is particularly important,” said State Rep. Bob Morgan (D-Deerfield). “I am grateful to Governor Pritzker and IEMA for getting these resources to the places they are needed most.”

“Though we have taken historic steps to make Illinois the most welcoming state in the nation, there has been a rise in anti-Semitism, anti-Asian American hate, anti-immigrant rhetoric, and hate crimes,” said State Senator Ram Villivalam (D-Chicago). “We must stay vigilant and provide as many tools in the toolbox as possible to root out hate. In that vein, I am grateful to the advocates and the work that was done to allocate resources to organizations in our communities to protect our constituents from harm.”

“The 116 non-profit groups will be able to immediately purchase and implement safety measures at their facilities,” said IEMA Director Alicia Tate-Nadeau. “Security equipment, facility hardening, and other operational actions are just some ways these groups are increasing safety measures for their organizations.”

The Illinois Emergency Management Agency and the IEMA Office of Homeland Security will continue to identify all expanding threats and work collaboratively with partners to monitor all enhancements and document proven successes.

10 Comments

|

Defense cross-examines former top ComEd lawyer

Thursday, Mar 23, 2023 - Posted by Rich Miller

* We talked yesterday about prosecution witness Tom O’Neill’s testimony against the ComEd Four. Today, let’s look at his cross-examination. Tribune…

“Did Mike McClain ever tell you that Speaker Madigan was guaranteed to support ComEd’s legislation?” McClain’s attorney, Patrick Cotter, asked at one point. O’Neill responded no.

To my eyes, that kinda plays in to the prosecution’s case. The feds claim the reason for the alleged bribery scheme was to make sure a sometimes hostile Madigan did what the defendants wanted.

* ABC 7…

On cross-examination, O’Neill admitted that at no time during the years he was General Counsel did anyone at ComEd suggest that Madigan would do as they wanted in the Assembly because he was being given contracts and jobs for his political allies.

Yeah, but he may not have been in that particular loop.

* Sun-Times…

ComEd’s former top lawyer confirmed Wednesday that he — not ComEd executive Anne Pramaggiore — made the decision in 2011 to hire a law firm with political ties to Michael Madigan as ComEd tried to pass a key bill in Springfield.

So given that Pramaggiore is now on trial for an alleged bribery conspiracy revolving around Madigan, her defense attorney sarcastically asked Thomas O’Neill whether he then went to Pramaggiore, confessed and said, “I lost my head and I just bribed Mike Madigan.”

O’Neill confirmed he did not. […]

And when asked by Doherty defense attorney Gabrielle Sansonetti whether O’Neill believed the effort to hire Reyes Kurson “was connected to legislation,” O’Neill told jurors, “No, I did not.” […]

The [Reyes Kurson] contract was originally signed in 2011, one day before the Illinois General Assembly overrode a veto by then-Gov. Pat Quinn to pass EIMA. But O’Neill said he didn’t believe the bill was in danger.

Legislative leaders were committed to overriding Quinn, he said.

It may not have been bribery to O’Neill’s eyes at the time, but he wasn’t part of the alleged cabal.

* Crain’s…

After getting O’Neill to agree that McClain could be “a bit of a pest,” McClain attorney Patrick Cotter on cross-examination said to O’Neill, “At the end of the day, you did what you wanted to do with Reyes Kurson. You cut their hours.” “Yes,” O’Neill responded.

“Did you intend to bribe Mr. Madigan by hiring Reyes Kurson?” Cotter asked. “I did not,” O’Neill said. […]

In cross-examination, Pramaggiore attorney Scott Lassar, a former U.S. attorney for Illinois’ Northern District, pointed out that [Juan Ochoa’s appointment to ComEd’s board] was being pushed by Madigan as a favor to other politicians. U.S. Rep. Luis Gutierrez wanted Madigan’s help in getting Ochoa appointed. Chicago Mayor Rahm Emanuel also went to bat for Ochoa with ComEd, Lassar said.

Likewise, Joe Dominguez, who was ComEd’s CEO at the time (Pramaggiore had been promoted to CEO of all Exelon-owned utility companies and was Dominguez’s boss), had met with Ochoa and backed the appointment, Lassar said. “That was my understanding, yes,” O’Neill replied.

Exelon CEO Chris Crane also sided with Pramaggiore.

* More from the Tribune…

“There are fights you pick and fights you don’t. … I thought it was something we could handle,” O’Neill answered [when questioned by prosecutors “couldn’t you have said no” to the contract].

On cross-examination, Lassar and Cotter both zeroed in on whether O’Neill felt that the hiring of Reyes’ firm was a bribe.

When Cotter asked if O’Neill had “a corrupt intent” when he hired the firm, prosecutors objected and O’Neill did not answer. Cotter then asked, “Did you hire Reyes to bribe Michael Madigan?”

“I did not,” O’Neill answered.

* Capitol News Illinois…

Although a “due diligence” background check conducted on Ochoa also pulled up items from Ochoa’s past – including a property he owned that was foreclosed upon after he’d stopped paying the mortgage – O’Neill said those concerns weren’t top of mind.

O’Neill said he was more concerned with a person close to Madigan having access to exclusive information about ComEd that the utility’s executives only disclosed to board members in their quarterly meetings.

But in a call with Pramaggiore and the CEO of ComEd’s parent company, Exelon, O’Neill said Pramaggiore acknowledged “the Madigan connection,” and said she was “for that.”

“She wanted to go forward (with Ochoa’s appointment),” O’Neill said. “She thought it was important.

* Isabel’s coverage roundup…

* Sun-Times | Defense tries to flip the script in ComEd bribery trial, casting corruption charges as ‘classic, honest, legal lobbying’: When O’Neill took the witness stand Tuesday, prosecutors sought to link the contract for Reyes Kurson to legislation that then passed and drastically improved ComEd’s financial position. Defense attorneys did not get a chance to cross-examine O’Neill until Wednesday, though. Once they did, they tried to offer jurors a different perspective that revolved around “classic, honest, legal lobbying,” a multi-year campaign to pass legislation, and personal connections.

* Tribune | Ex-ComEd lawyer testifies request to put Juan Ochoa on utility’s board came from Michael Madigan: In one of the central allegations in the government’s case, Tom O’Neill, ComEd’s former chief lawyer, testified that Madigan wanted former McPier chief Juan Ochoa to get placed in a rare vacant seat on the company’s board in late 2017 and that CEO Anne Pramaggiore was behind the move because Ochoa’s resume came from Madigan. “I did discuss that I had some concerns about someone (recommended by) the speaker’s office being on the ComEd board,” O’Neill said of a conversation with Pramaggiore where he cited “optics” and the possibility that an ally of the speaker would have access to exclusive company information that could go before the board.

* Crain’s | Trial covers flurry of anguished emails over ComEd contract with Madigan ally: ComEd’s legal department, which O’Neill ran, had concluded it didn’t have much work Reyes Kurson was equipped to do and sought to cut back the firm’s hours under its contract with ComEd. McClain, through many emails, negotiated on Reyes’ behalf, addressing detailed items like renewal options and fees. O’Neill, in his second day on the witness stand in a trial that’s expected to last another six or seven weeks, said he was surprised at what a headache the relatively low-priority contract became.

* Bloomberg Law | Ex-Exelon Counsel Testifies About ‘Pressure’ in ComEd Four Trial: McClain was pestering O’Neill and arguing with him over the minutia of the terms of the firm’s contract, and O’Neill said he didn’t understand why the speaker would be so interested in ComEd’s contract with the Reyes Kurson law firm. “I started to wonder if he was using speaker’s name for impact,” O’Neill said.

* ABC Chicago | Prosecutors try to connect Mike Madigan to various utility contracts, hirings: “I’m sure you know how valuable Victor is to our Friend,” McClain wrote in an email to Pramaggiore dated January 20th, 2016. He added that: “I know the drill and so do you. If you do not get involved and resolve this issue of 850 hours for his law firm per year then he will go to our Friend. Our Friend will call me and then I will call you. Is this a drill we must go through?” “Our Friend” is, according to the indictment, one of the ways McClain often referred to Mike Madigan, who in 2017 appears to have exercised his influence with the utility once again.

* Telephone conversation between Michael McClain and Michael Madigan | ComEd Exhibit 92-T: Michael McClain speaks to Speaker Michael Madigan about moving state Rep. Lou Lang “to the dark side, that’s what I call lobbying.”

* Telephone conversation between Michael McClain and Michael Madigan | ComEd Exhibit 99-T : A brief conversation between Speaker Michael Madigan and Michael McClain.

* Telephone conversation between Michael McClain and Michael Madigan | ComEd Exhibit 101-T: MCCLAIN: So, Michael, the reason why I called ya, is I want to let ya know I have (unintelligible) Lou Lang and, um, (unintelligible) long discussion (unintelligible) fight it, he just doesn’t like it, right? MADIGAN: Mhm.

* Telephone conversation between Michael McClain and Michael Madigan | ComEd Exhibit 102-T: Speaker Michael Madigan and Michael McClain have a brief conversation about state Rep. Lou Lang.

12 Comments

|

|

Comments Off

|

|

Comments Off

|

Open thread

Thursday, Mar 23, 2023 - Posted by Isabel Miller

* Good morning! What’s shakin’ in Illinois today?

10 Comments

|

Isabel’s morning briefing

Thursday, Mar 23, 2023 - Posted by Isabel Miller

* Here you go…

* NBC | ‘Blue wall’ Democrats urge the White House to give Chicago the 2024 DNC convention: A band of governors, members of Congress and mayors from Illinois to Minnesota to Kentucky signed a letter Wednesday that was first made available to NBC News, calling on both the White House and Democratic National Committee Chair Jaime Harrison to choose Chicago.

* Sun-Times | A quarter of a century after Giannoulias was carjacked, new SOS doles out $21 million in grants to fight current surge: Chicago carjacking reports hit an apex of 1,849 in 2021. The Illinois secretary of state said it’s also personal for him, after being carjacked with high school basketball teammates in 1998. “It leaves a scar you never forget,” he said. “I hate the thought of anyone else going through that.”

* Daily Herald | Des Plaines District 62 board member says schools shouldn’t celebrate Columbus Day: “In our district, no way in hell is it going to be called Columbus Day again,” Tina Garrett said during a joint video interview with other candidates and the Daily Herald. “Not happening.”

* Sun-Times | Defense tries to flip the script in ComEd bribery trial, casting corruption charges as ‘classic, honest, legal lobbying’: Defense attorneys did not get a chance to cross-examine O’Neill until Wednesday, though. Once they did, they tried to offer jurors a different perspective that revolved around “classic, honest, legal lobbying,” a multi-year campaign to pass legislation, and personal connections.

* SJ-R | Illinois House passes more than 100 bills including book ban policy for public libraries: On its 52-page agenda were 205 bills listed in third reading – the last hurdle a bill has to clear to make it to the Senate for debate. A total of 101 passed with 41 bills passing on Tuesday.

* Chalkbeat | Chicago schools poised to vote on keeping police on campuses: There are 59 police officers stationed across 40 Chicago Public Schools. Each school will convene a safety committee of administrators, staff, parents, and students before Local School Councils vote by June 2, Chou said.

* WAND | Construction to begin on center for youth in custody in Lincoln: The new center, which was originally announced in February of 2021, will be located at the site of the former Lincoln Developmental Center. Two cottages for housing youth will be renovated with additional cottages for programming and administrative use. A new 27,000 square foot building will serve educational, recreational, and dietary needs.

* WTVO | Illinois organization helping adults become teachers, but they need the state’s help: The Illinois Golden Apple Foundation has two programs that help people become teachers, but the group said that it needs state money to get those programs to grow.

* Northwest Herald | Legislative action doesn’t always represent the finish line: Some actions, while technically laws, generally stipulate how government operates itself. Often this involves creating a task force responsible for producing a study and perhaps recommendations for further action. It’s impossible to complete the journey without the initial steps, but we don’t celebrate everyone who simply starts the marathon. There are too many examples of task forces that missed reporting deadlines or generated proposals with no chance of passage.

* Tribune | Chicago Sky’s Elizabeth Williams joins earthquake relief effort with her Turkish club: ‘It’s just so close to home’: The disaster elicited an immediate flood of concerned calls and messages from friends and family worried for Williams’ safety. Updates from teammates in Turkey quickly followed with more stark news: The death toll included Turkish basketball player Nilay Aydoğan, who played for Çankaya Üniversitesi.

* AP | Musicians fight threat of Tennessee anti-LGBTQ, drag bills: Love Rising, a concert held on Monday in Nashville, featured Grammy-winning artists like Sheryl Crow, Jason Isbell, Maren Morris, Hayley Williams and Brittany Howard alongside drag performers and trans and queer singer-songwriters. The following night, the effort continued with a second show, We Will Always Be, featuring a showcase of LGBTQ artists in collaboration with Black Opry.

* CNN | DeSantis administration moves to extend prohibition on teaching sexual orientation and gender identity to all grades: The Florida Department of Education approved the proposed rule on March 9 and it was published in the Florida Administrative Register for review on March 16. The State Board of Education is scheduled to take it up on April 19.

* Crain’s | United to start air-taxi service to O’Hare in 2025: United is partnering with Archer Aviation, a maker of electric vertical takeoff and landing craft, to provide the service from Vertiport Chicago, a helipad at the Chicago Medical District campus just west of downtown. Pricing details weren’t announced, but United executives have previously said the cost will be similar to Uber’s Black Car service, or about $100 to $150 at rush hour.

* The Atlantic | How Ivermectin Became a Belief System: Since fall 2021, Daniel Lemoi has been a central figure in the online community dedicated to experimental use of the antiparasitic drug ivermectin. “You guys all know I’m not a doctor,” he often reminded them. “I’m a guy that grew up on a farm. I ran equipment all my life. I live on a dirt road and I drive an old truck—a 30-year-old truck. I’m just one of you.” Lemoi’s folksy Rhode Island accent, his avowed regular-guy-ness, and his refusal to take any money in exchange for his advice made him into an alt-wellness influencer and a personal hero for those who followed him. He joked about his tell-it-like-it-is style and liberal use of curse words: “If you don’t like my mouth, go pray to God, because he’s the one that chose me for this mission.”

14 Comments

|

Live coverage

Thursday, Mar 23, 2023 - Posted by Isabel Miller

Comments Off

|

|

Support CapitolFax.com

Support CapitolFax.com

Visit our advertisers...

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

...............

|

|

Hosted by MCS |

SUBSCRIBE to Capitol Fax |

Advertise Here |

Mobile Version |

Contact Rich Miller

|